- Home

- »

- Clinical Diagnostics

- »

-

Non Invasive Prenatal Testing Market Size Report, 2030GVR Report cover

![Non Invasive Prenatal Testing Market Size, Share & Trends Report]()

Non Invasive Prenatal Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Gestation Period, By Pregnancy Risk, By Method, By Technology, By Product, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-310-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Non Invasive Prenatal Testing Market Summary

The global non invasive prenatal testing market size was estimated at USD 4.21 billion in 2023 and is projected to reach USD 8.16 billion by 2030, growing at a CAGR of 10.06% from 2024 to 2030. The increasing demand for non invasive prenatal testing (NIPT), rising collaborations & licensing agreements, and improvements in the reimbursement scenario are some of the key factors estimated to fuel market growth.

Key Market Trends & Insights

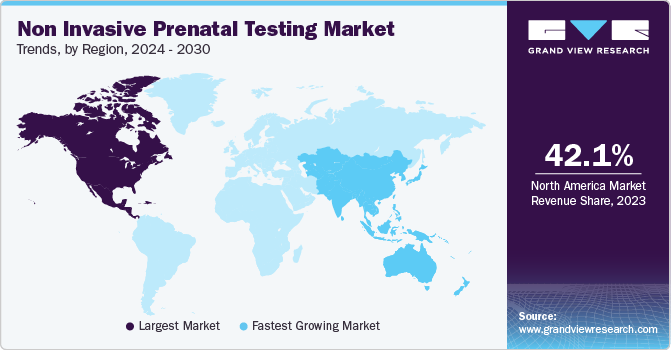

- North America led the global non invasive prenatal testing market with a revenue share of 42.08% in 2023.

- By gestation period, the 13-24 weeks segment led the market, with a revenue share of 51.5% in 2023.

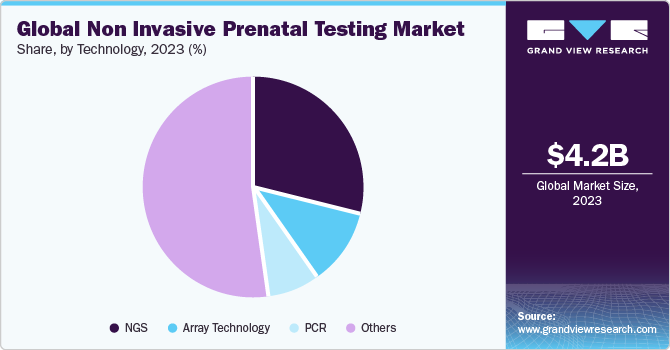

- By technology, the Next-generation Sequencing (NGS) led the market, with a revenue share of 29.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.21 Billion

- 2030 Projected Market Size: USD 8.16 Billion

- CAGR (2024-2030): 10.06%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Further, the proliferating incidence of chromosomal abnormalities is expected to accelerate market growth. The market was slightly impacted by the COVID-19 pandemic. Several manufacturing companies maintained regular communication with the U.S. FDA to keep themselves informed of any supply chain disruptions.

Of all the countries, there is a substantial opportunity in China for noninvasive prenatal screening, with nearly 14.65 Million annual births and an increasing number of high-risk pregnancies. In addition, India has a heavy burden of genetic diseases. Various studies suggested that chromosomal abnormalities are found with a frequency of 1 in 166 newborns in the country, while trisomy 21 (Down syndrome) has a high incidence rate of 1 in 800 births, resulting in the birth of 32,000 newborns with Down syndrome every year. Families can benefit from accurate and early screening using NIPT to know about their baby's genetic issue.

Furthermore, key manufacturers are undertaking several efforts to provide advanced products in the market. Test manufacturers offer other testing options such as tests for copy number variants, rarer trisomies, and microdeletions, including 11q deletion (Jacobsen syndrome), 22q11.2 deletions (DiGeorge syndrome), 15q deletion (Prader–Willi and Angelman syndromes), 15p deletion (cri-du-chat syndrome), and 4p deletion (Wolf–Hirschhorn syndrome. For instance, in May 2022, ARUP Laboratories launched a new cfDNA test with higher sensitivity and specificity compared to other NIPTs. The test is approved for screening pregnant women carrying a single fetus, and it can be performed as early as 10 weeks of pregnancy.

The market is highly saturated with existing key players operating in the NIPT market. Companies are forming partnerships and collaborations to maintain a stable position in the market. For instance, in January 2022, QIAGEN and Atila BioSystems collaborated to provide NIPT solutions to boost the application portfolio of its digital PCR platform QIAcuity. Moreover, in June 2021, Illumina entered into a strategic collaboration with Next Generation Genomic to introduce a CE-IVD, NGS-based NIPT test, VeriSeq NIPT Solution v2 in Thailand. With this initiative, Illumina aimed to have greater patient access to NIPT's next-generation sequencing.

Furthermore, these entities allow cross-selling of NIPTs with an array of other procedures, including carrier screening and preimplantation screening for in vitro fertilization. To provide the aforementioned services, players are collaborating with entities operating in parallel markets and other laboratories to gain significant market share. For instance, in August 2022, LGC Clinical Diagnostics extended and expanded its partnership with the Stanford University Department of Obstetrics and Gynecology for NIPT reference materials.

Market Dynamics

Improving reimbursement policies for average and low-risk pregnancies is expected to drive the adoption of noninvasive prenatal screening tests. For instance, in the U.S., Medicaid programs cover noninvasive prenatal tests for high-risk patients after first-trimester screening. NIPT is covered by insurers for around 114 Million women with average-risk singleton pregnancies in the U.S. Moreover, Australia & many European countries cover NIPT for average-risk women for primary screening. Such initiatives are anticipated to increase the adoption rate of NIPT procedures. Furthermore, improvement in reimbursement policies and the inclusion of NIPT in national health programs across the globe are encouraging market players to conduct R&D activities to develop novel tests.

NIPTs have been in the market for a long time now and there is continuous pressure on upcoming products concerning affordability and accessibility. This is adding pressure on R&D to create more effective & affordable products. Mature players are investing more in R&D to develop novel and precise diagnostics and they are focusing on delivering economic value to customers and healthcare professionals. Whereas emerging players focus on receiving funding support from government bodies and healthcare organizations, rising inclination on developing PoC products and strengthening the supply chain to deliver products to the large pool of end-users.

NIPT is morally unacceptable because of the involvement of unnatural creation and destruction of human embryos post-sex determination in certain regions of the globe. Application of NIPT for sex selection on non-medical backgrounds is prohibited, which is expected to restrain market growth in certain countries where sex-based abortions are prevalent. Additional policy guidance is needed for clinicians to address these issues and reduce the impact of this restraint over the forecast period.

Gestation Period Insights

The 13-24 weeks segment held the largest share of over 51.5% of the non invasive prenatal testing market in 2023. This can be attributed to the fact that maximum non-invasive prenatal procedures are carried out in the second trimester of pregnancy, and these tests also cover major complementary tests, such as ultrasound & serum screening for alpha-fetoprotein.The rapid adoption of cell-free DNA tests performed in the second trimester or after 10 weeks of pregnancy is one of the major factors propelling the segment. Post 10 weeks of pregnancy, there should be enough fetal DNA in the patient’s bloodstream, which can increase the adoption of cfDNA NIPTs in the second trimester of the pregnancy.

The 0 to 12 weeks gestation period segment accounted for a considerable revenue share in 2023. Prenatal Cell-free DNA (cfDNA) screening is expected to gain a considerable share over the forecast period. It is recommended for women who are pregnant for at least 10 weeks. Key players are focusing on cfDNA analysis from the maternal blood sample collected in the first trimester to develop reliable and accurate NIPTs. For instance, in May 2022, ARUP Laboratories introduced a cfDNA sequencing assay with enhanced sensitivity and specificity for customers considering NIPT

Technology Insights

Next-generation Sequencing (NGS) accounted for the largest revenue share of market in 2023. With the increase in NGS popularity, the market is becoming fiercely competitive. Illumina, Inc., Ariosa Diagnostics, Inc.; Verinata Health, Inc.; Natera; Sequenom, Inc.; Berry Genomics Co.; BGI; GENNET; and LifeCodexx AG are among the key companies that offer NGS-based NIPT testing for common chromosomal conditions. In addition, a 2021 NCBI article on a study based on 13,607 cases concluded that NGS NTP offers high sensitivities and specificities of more than 98.89%, and the failure rate is less than 0.72% in aneuploidy conditions such as trisomy 21, trisomy 18, trisomy 21 + 13, trisomy 13, & monosomy X.

The adoption of Polymerase Chain Reaction (PCR) for NIPT has increased with the commercial launch of Eurofins LifeCodexx—one of the world's first quantitative real-time PCR NIPT assays to detect fetal trisomy 21 (qNIPT). This novel PCR-based quantitative NIPT assay offers enhanced speed and lower costs as compared to classical NIPT methods. Additionally, the higher multiplexing capabilities of ddPCR further simplify the detection process of ddPCR-based NIPT and improve its reliability. Researchers have used universal locked nucleic acid probes to develop a multiplex ddPCR assay to detect fetal aneuploidies.

Pregnancy Risk Insights

The high and average risk segment accounted for the largest revenue shareof the market in 2023. This can be attributed to the growing adoption of these tests in high-risk cases and pregnancies in women 35 years and above. The market is well-penetrated for high-risk pregnancy tests. However, few payors do not have favorable medical coverage for average risk testing. Average risk guideline inclusion in the reimbursement for NIPT procedures is expected to serve as a high-impact rendering driver for this vertical in the coming years.

The low-risk segment is expected to register the fastest CAGR from 2024 to 2030. increasing recommendations for NIPT tests for all pregnant women, including low-risk pregnancies, are further anticipated to boost the segment over the forecast period. For instance, in August 2020, new guidelines set by the American College of Obstetricians and Gynecologists (ACOG) recommended NIPTs for all pregnant women in the U.S. Key health insurers follow ACOG guidelines to determine their coverage, which can increase the inclusion of NIPT tests in private insurance for low-risk pregnancies.

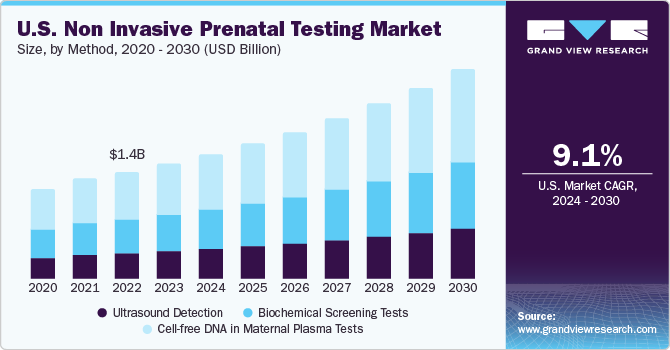

Method Insights

The cell-free DNA in maternal plasma tests segment accounted for the largest revenue share of the market in 2023. Technological advancements have expanded the range of testing to whole genome sequencing, and they can detect many additional chromosomal anomalies, such as microdeletions & sex chromosomal abnormalities. For instance, the Panorama prenatal test by Natera Inc. helps detect sex chromosomal abnormalities, microdeletions, and triploidy. Moreover, this segment is anticipated to witness lucrative growth owing to a high number of product launches and the increasing adoption rate due to improving reimbursement scenarios.

Ultrasound detection is deployed as complementary to the Cell-free DNA-based NIPT test, resulting in a lower share of this segment. However, with the rise in technological advancement, companies are developing solutions compatible with homecare settings and point-of-care testing. For instance, in May 2022, General Electric Company (GE Healthcare) invested around USD 50 million in Pulsenmore, an Israeli startup. This allows expectant parents to chart their pregnancies at home and perform self-scans. This shift from traditional testing facilities to home care testing is expected to provide a lucrative opportunity for segment growth.

Application Insights

Trisomy led the market in 2023 owing to the rising incidence of chromosomal abnormalities. Technological advancements have expanded the range of testing to whole-genome sequencing as they can detect many additional chromosomal anomalies, such as microdeletions and sex chromosomal abnormalities.

The microdeletion syndrome segment is anticipated to grow at the fastest rate over the forecast period. Factors such as increasing incidence of microdeletion syndromes, raising awareness among people about chromosomal abnormalities, and technological advancements in screening tests to include microdeletion syndromes screening in standard NIPT tests.

Product Insights

The consumables and reagents segment dominated the market in 2023 owing to the presence of major players offering a wide range of consumables and reagents for NIPT. For instance, in November 2022, Juno Diagnostics launched the Hazel fingerprick-based prenatal genetic screening test to reduce the barriers to accessing NIPTs. In addition, the company introduced at-home sample collection services to conduct NIPTs.

The instruments segment is expected to grow at a lucrative rate over the forecast period owing to continuous efforts undertaken by instrument manufacturers to develop advanced platforms. PerkinElmer, Inc. offers Vanadis NIPT System—an automated instrument to overcome the limitations associated with cost, complexity, and capacity of other NIPT technologies for screening of aneuploidy. The system is the only NIPT screening platform that enables analysis of the targeted cfDNA without PCR or next-generation sequencing.

End-use Insights

The diagnostic laboratories segment held the largest revenue share of the market in 2023. Well-drafted laboratory standards for NIPT in developed economies, coupled with a large volume of NIPT tests conducted in diagnostic laboratories, can be attributed to the largest revenue share of the diagnostic laboratories segment. Efforts taken by key diagnostic laboratories to expand their customer reach are also anticipated to propel segment growth. Major merger acquisitions in the recent past, such as the acquisition of Sequenom by Laboratory Corporation of America Holdings (LabCorp), are likely to boost segment growth.

The presence of public and private hospitals that offer NIPT across the globe is fueling the growth of the hospitals and clinics segment. In addition, the rise in research studies in hospitals is expected to increase testing rates in hospital settings.

Regional Insights

North America dominated the market with a revenue share of 42.08% in 2023, followed by Europe. The rapid development of next-generation sequencing and reproductive genetics is a key factor driving regional growth. Testing programs have been widely implemented across the country, resulting in a larger revenue share of the region in the global market. Furthermore, the increasing number of domestic and global companies receiving U.S. patents for commercializing NIPT tests is driving the revenue in the region. Furthermore, significant technological advancements, an increasing number of FDA approvals for NIPTs, and competition among biotechnology companies are projected to boost market growth over the forecast period.

Asia Pacific is expected to exhibit the fastest growth over the forecast period owing to the rising maternal age, which contributes to the growing incidence of chromosomal aneuploidies in babies, leading to a rise in the potential customer base. Significant developments in China and Japan, technological integration of NGS procedures, and improving healthcare infrastructure are expected to boost regional growth.

Key Companies & Market Share Insights

Key players in the NIPT market are undertaking various strategies in order to strengthen their geographic presence and provide services across the globe.

-

In September 2023, Yourgene Health plc unveiled the Yourgene MagBench Automated DNA Extraction Instrument and Kit. The MagBench solution, accessible to Sage customers in Asia-Pacific and the Middle East, offers a simplified, rapid, and cost-effective bench-top robotic workstation for cell-free DNA extraction, tailored for Yourgene’s Sage 32 NIPT Workflow. This comprehensive solution empowered clinical laboratories to deliver precise and competitive non-invasive prenatal testing (NIPT) services, ensuring efficiency from sample to report.

-

In August 2022, at the Canaccord Genuity 42nd Annual Growth Conference in Boston, Natera, Inc. announced that it had proactively initiated the FDA pre-submission process for its Panorama non-invasive prenatal test (NIPT) through the Q-Sub process. The filing, made in June 2022, specifically addresses fetal chromosomal aneuploidies and targets 22q11.2 deletion syndrome. This proactive move underscored Natera's commitment to navigating regulatory channels and seeking approval for its advanced Panorama NIPT, showcasing dedication to enhancing prenatal testing options.

Key Non Invasive Prenatal Testing Companies:

- Genesis Genetics (CooperSurgical, Inc.)

- Natera, Inc.

- Eurofins LifeCodexx GmbH

- Illumina, Inc. (Verinata Health, Inc.)

- Centogene N.V.

- MedGenome Labs Ltd.

- Myriad Women’s Health, Inc. (Counsyl, Inc.)

- F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics)

- Qiagen

- Laboratory Corp. of America Holdings

- Progenity, Inc.

- Quest Diagnostics, Inc.

Non Invasive Prenatal Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.59 billion

Revenue forecast in 2030

USD 8.16 billion

Growth rate

CAGR of 10.06% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gestation period, pregnancy risk, method, technology, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina, South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Genesis Genetics (CooperSurgical; Inc.); Natera, Inc.; Centogene N.V.; Illumina, Inc. (Verinata Health, Inc.); Eurofins LifeCodexx GmbH; MedGenome Labs Ltd.; F. Hoffmann-La Roche Ltd.; (Ariosa Diagnostics); Myriad Women’s Health, Inc. (Counsyl; Inc.); QIAGEN; Laboratory Corp. of America Holdings; Progenity, Inc.; Quest Diagnostics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Non Invasive Prenatal Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non invasive prenatal testing market report based on gestation period, pregnancy risk, method, technology, product, application, end-use, and region:

-

Gestation Period Outlook (Revenue, USD Million, 2018 - 2030)

-

0-12 Weeks

-

13-24 Weeks

-

25-36 Weeks

-

-

Pregnancy Risk Outlook (Revenue, USD Million, 2018 - 2030)

-

High & Average Risk

-

Low Risk

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrasound Detection

-

Biochemical Screening Tests

-

Cell-free DNA in Maternal Plasma Tests

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

NGS

-

Array Technology

-

PCR

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables & Reagents

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trisomy

-

Microdeletion Syndrome

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global non invasive prenatal testing market size was estimated at USD 4.21 billion in 2023 and is expected to reach USD 4.59 billion in 2024.

b. The global non invasive prenatal testing market is expected to grow at a compound annual growth rate of 10.06% from 2024 to 2030 to reach USD 8.16 billion by 2030.

b. NIPT for high & average risk type dominated the non-invasive prenatal testing market with a share of 76.37% in 2023. This is attributable to the presence of the favorable payor reimbursement coupled with increasing awareness on the prevention of chromosomal anomalies such as Downs Syndrome.

b. Some key players operating in the non invasive prenatal testing market include Sequenom, Roche (Ariosa Diagnostics); Natera, LabCorp, BGI Genomics; Quest Diagnostics, Illumina, and Berry Genomics among others.

b. Key factors that are driving the non invasive prenatal testing market growth include increasing demand for early and non-invasive prenatal testing procedures to prevent the occurrence of chronic illness in the offspring and improving reimbursement scenarios in the space.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.