- Home

- »

- Pharmaceuticals

- »

-

Analgesics Market Size, Share And Growth Report, 2030GVR Report cover

![Analgesics Market Size, Share & Trends Report]()

Analgesics Market (2023 - 2030) Size, Share & Trends Analysis Report By Drug Type (Opioid, Non-opioid, Compound Medication), By Route Of Administration, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-079-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Analgesics Market Summary

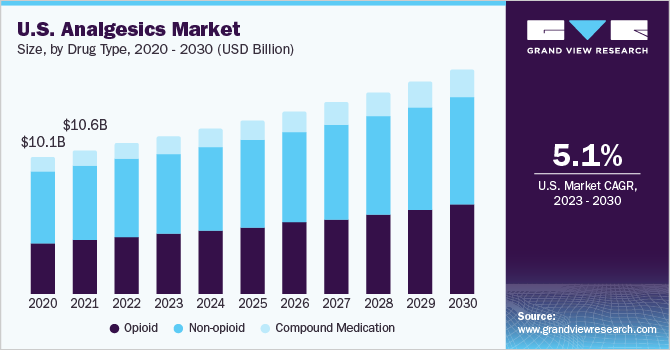

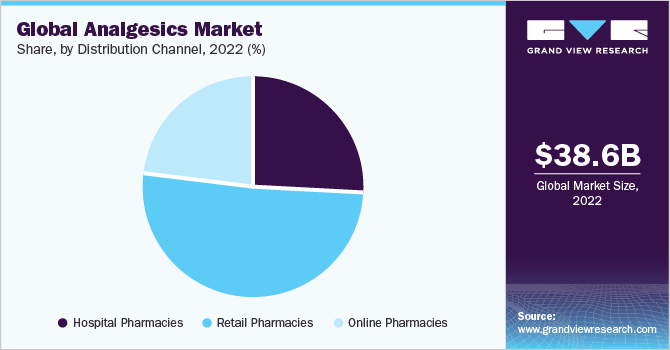

The global analgesics market size was valued at USD 38.60 billion in 2022 and is projected to reach USD 61.39 billion by 2030, growing at a CAGR of 6.02% from 2023 to 2030. Increasing incidences of arthritis & osteoarthritis, neuropathic diseases, and cancer are expected to boost market growth during the forecast period.

Key Market Trends & Insights

- In 2022, North America led the global market for analgesics with a revenue share of 31.76%.

- By drug type, the non-opioid segment dominated the market for analgesics, with a share of 52.01% in 2022.

- By route of administration, the oral segment dominated the market for analgesics, with a share of 47.88% in 2022.

- By application, the surgical & trauma segment led the analgesics market with a share of 22.71% in 2022.

- By distribution channel, the retail pharmacies segment dominated the analgesics market, with a revenue share of 50.96% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 38.60 Billion

- 2030 Projected Market Size: USD 61.39 Billion

- CAGR (2023-2030): 6.02%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Moreover, the increasing efforts of pharmaceutical companies to develop novel analgesics to manage pain and related disorders are expected to offer lucrative growth opportunities. For instance, as of October 2022, in the U.S., there were 17 novel pain relief drugs in development phases; out of these, 16 were in phase 3 clinical trials. In May 2020, Assertio Holdings, Inc. merged with Zyla Life Sciences to strengthen its pain management product portfolio.

The increasing prevalence of targeted diseases is expected to drive market growth over the forecast period. For instance, according to the CDC, around 1 in 4 U.S. adults (23.7%) i.e., about 58.5 million people, are diagnosed with arthritis. Arthritis is more prevalent in women as compared to men and its prevalence increases with age.

Osteoarthritis is a leading form of arthritis; fibromyalgia and gout are some of the common rheumatic conditions. Some of the common analgesics used in managing arthritis are celecoxib, naproxen, ibuprofen, diclofenac, and etodolac, among others. Thus, the surge in the prevalence of arthritis is a major driving factor in the market for analgesics.

The increasing number of surgeries performed worldwide is likely to create positive demand for analgesics in the coming years. For instance, according to the NCBI, around 310 million major surgeries are reported annually; out of these, 40-50 million are performed in the U.S. and around 20 million in Europe. In addition, according to Australian Commission on Safety and Quality in Health Care, more than 2.5 million people undergo surgeries in private and public hospitals in Australia annually.

Globally, governments and regulatory bodies are taking steps to promote the development of non-addictive alternatives to opioids for pain management. For instance, in February 2022, the U.S. FDA undertook certain steps for the development of non-addictive alternatives for opioids to manage pain and reduce exposure to opioids in order to combat new addiction. Similarly, in April 2022, ACSQHC formulated a new standard of care for the appropriate use of opioid analgesics in emergency departments after surgical procedures.

The increasing demand for safe and effective drugs for pain management is pushing regulatory bodies for product approvals of novel and safe analgesic preparations. Ongoing R&D activities have aimed to develop effective pain relief drugs that have a low risk of addiction and overdose. In September 2022, Lupin Limited received U.S. FDA approval for its ANDA diclofenac sodium USP 2% w/w. Similarly, in May 2020, Dr. Reddy’s Laboratories announced U.S. FDA approval for its ELYXYB, for the management of migraine with or without aura in adult patients.

Furthermore, the higher demand for analgesics in the target population and smooth approvals are encouraging several manufacturers to introduce their products in lucrative markets for higher revenue generation. For instance, in August 2021, Dr. Reddy’s Laboratories relaunched the OTC version of naproxen sodium tablets, a brand equivalent of Bayer’s Aleve, in the U.S. The company relaunched the product owing to its higher sales in previous quarters.

Drug Type Insights

The non-opioid segment dominated the market for analgesics, with a share of 52.01% in 2022. This is due to the increasing demand for non-opioid analgesics owing to the lower risk of adverse effects, strong availability of generic preparations, and various initiatives taken by private organizations and governments for the use of non-opioid preparations in pain management. The growth is also aided by the satisfactory results shown by non-opioid medicines in clinical trials. For instance, in March 2022, Vertex Pharmaceuticals announced a positive result for its non-opioid candidate VX-548 in phase II trials.

The compound medication segment is expected to show the fastest growth over the forecast period. Increasing adoption of combination drugs, the high effectiveness of opioid-combined analgesics with minimal side effects, and increasing awareness regarding the safe use of analgesics are expected to fuel segment growth through 2030. For instance, in October 2021, ESTEVE received U.S. FDA approval for its SEGLENTIS (celecoxib and tramadol hydrochloride) proprietary product, indicated for acute pain management in adults.

Route Of Administration Insights

The oral segment dominated the market for analgesics, with a share of 47.88% in 2022. Factors such as the convenient administration of analgesic preparation by oral route and its non-invasive nature are key factors contributing to the segment share. Moreover, increasing R&D efforts by pharmaceutical companies to develop novel oral analgesics with fewer side effects and lower risk of drug overdose are poised to drive segment growth through 2030. For instance, in December 2022, Tris Pharma’s Phase 2b clinical study of its cebranopadol showed that it was significantly less addictive compared to opioids.

The parenteral route of administration held the second-largest market share and is anticipated to expand at a lucrative growth rate during the projected period. High hospitalization rates due to certain chronic disorders & surgeries, rapid onset of action, and better bioavailability of administered products are some of the key factors fueling the demand for parenteral administration of analgesics. In addition, the high demand for parenteral analgesics in critical care settings & cancer care centers is also expected to spur segment growth.

Application Insights

The surgical & trauma segment led the analgesics market with a share of 22.71% in 2022. The high market share of the segment is due to the increasing demand for painkillers during & after surgeries, increasing incidences of traumatic injuries, and various initiatives undertaken for the management of traumatic events. Programs such as Global Emergency and Trauma Care Initiative, National Child Traumatic Stress Initiative, and others are expected to drive segment growth over the forecast period.

According to the Government of NSW, around 200,000 elective surgery procedures are performed in NSW public hospitals every year. Analgesics such as opioids and non-opioids are being used during and after the surgeries to subside pain incidences. Some of the common painkillers used during surgeries are fentanyl, morphine, hydromorphone, alfentanil, dexmedetomidine, ketamine, ketorolac, and others.

The neuropathic segment is expected to exhibit a lucrative CAGR throughout the forecast period. Factors such as the increasing incidence of neuropathic pain and the increase in demand for analgesics for the treatment of neuropathic disorders are the major factors driving segment growth. Moreover, increasing R&D activities to develop novel, effective analgesics for neuropathic pain are further expected to drive segment growth. For instance, as of 2022, most investigational analgesics are being investigated for neuralgia, back pain, and muscle pain.

Distribution Channel Insights

The retail pharmacies segment dominated the analgesics market, with a revenue share of 50.96% in 2022. The growth of the retail pharmacies segment is attributed to the rising availability of OTC prescriptions, high generic penetration, and the increasing number of analgesics prescriptions due to the increasing incidence rate of pain, injuries, etc. In addition, the surge in OTC drug launches is another factor fueling segment growth. For instance, analgesics such as, diclofenac, ibuprofen, ketorolac have been recently launched as OTC drugs.

The online pharmacies segment is anticipated to grow at the fastest rate during the coming years, owing to factors such as high internet penetration, increasing adoption of e-commerce, growing awareness about online pharmacies, and extra discounts available on online medicines. Moreover, the increasing adoption of telemedicine across the globe is further anticipated to drive segment growth during the projection period.

Regional Insights

In 2022, North America led the global market for analgesics with a revenue share of 31.76%. This is due to the presence of several leading players undertaking various strategic initiatives, and high investments in analgesics-focused R&D in the region. The growth is also governed by the high prevalence of target diseases such as musculoskeletal disorders and chronic pain, among others, coupled with the cost of analgesics in the region.

In addition, the increasing number of surgeries and various government initiatives to safeguard the use of analgesics is also expected to fuel regional expansion during the forecast period. For instance, in 2022, the CDC introduced updated opioid prescribing guidelines to use opioids in a more cautious manner, also reflecting the increasing need for novel analgesics drugs in pain management.

The Asia Pacific market is projected to witness the fastest growth rate over the forecast period. The high prevalence of chronic diseases, coupled with the increasing geriatric population and the growing economies in the region, are some of the primary factors that are expected to drive market growth over the forecast period. Moreover, the high unmet needs of the patient population and rising investments by key market players in the region are anticipated to augment industry growth during the projected period.

Key Companies & Market Share Insights

Key market players are adopting strategies such as new product development, mergers & acquisitions, and partnerships to increase their market share. For instance, in March 2023, Pfizer Inc. receive U.S. FDA approval for its ZAVZPRET, the first CGRP receptor antagonist nasal spray for treating acute migraine in adults. Such initiatives are expected to drive market growth over the forecast period. Some prominent players in the global analgesics market include:

-

Bayer AG

-

Endo International plc

-

Assertio Holdings, Inc.

-

Janssen Global Services, LLC

-

GSK plc

-

AbbVie Inc.

-

Novartis AG

-

Viatris Inc.

-

Teva Pharmaceutical Industries Ltd.

Analgesics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 40.77 billion

Revenue forecast in 2030

USD 61.39 billion

Growth rate

CAGR of 6.02% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, route of administration, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain;Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Bayer AG; Endo International plc; Assertio Holdings, Inc.; Janssen Global Services, LLC; GSK plc; AbbVie Inc.; Novartis AG; Viatris Inc.; Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Analgesics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global analgesics market report based on drug type, route of administration, application, distribution channel, and region:

-

Drug Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Opioid

-

Non-opioid

-

Compound Medication

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Parenteral

-

Transdermal

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Musculoskeletal

-

Surgical and Trauma

-

Cancer

-

Neuropathic

-

Migraine

-

Obstetrical

-

Fibromyalgia

-

Pain Due to Burns

-

Dental/Facial

-

Pediatric

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The analgesics market size was estimated at USD 38.60 billion in 2022 and is expected to reach USD 40.77 billion in 2023.

b. The analgesics market is expected to grow at a compound annual growth rate of 6.02% from 2023 to 2030 and is expected to reach USD 61.39 billion by 2030.

b. The non-opioid segment is expected to dominate the analgesics market with a share of 52.01% in 2022 due to the high adoption rate of non-opioid analgesics coupled with less adverse effects and a large number products available in the market.

b. Some key players operating in the analgesics market include Bayer AG, Endo International plc, Assertio Holdings, Inc., Janssen Global Services, LLC, GSK plc., AbbVie Inc., Dr. Reddy’s Laboratories Ltd., Novartis AG, Viatris Inc., and Teva Pharmaceutical Industries Ltd. among others.

b. Increasing prevalence of chronic diseases, increasing rate of hospitalization, and surgery & trauma cases are the major factors driving the analgesics market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.