- Home

- »

- Biotechnology

- »

-

Analytical Instrumentation Market Size, Industry Report 2033GVR Report cover

![Analytical Instrumentation Market Size, Share & Trends Report]()

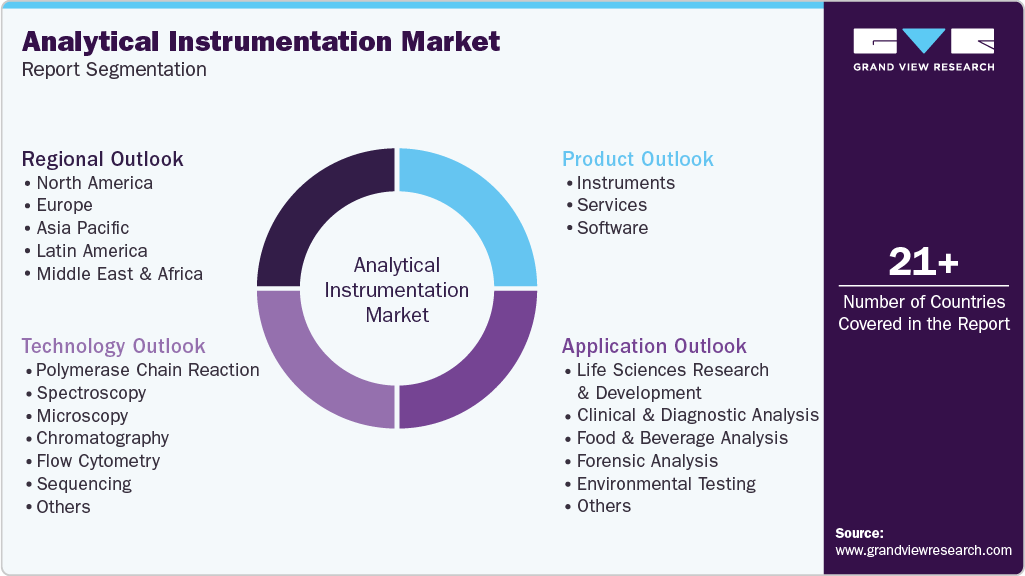

Analytical Instrumentation Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Services, Software), By Technology (Polymerase Chain Reaction, Spectroscopy, Microscopy), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-028-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Analytical Instrumentation Market Summary

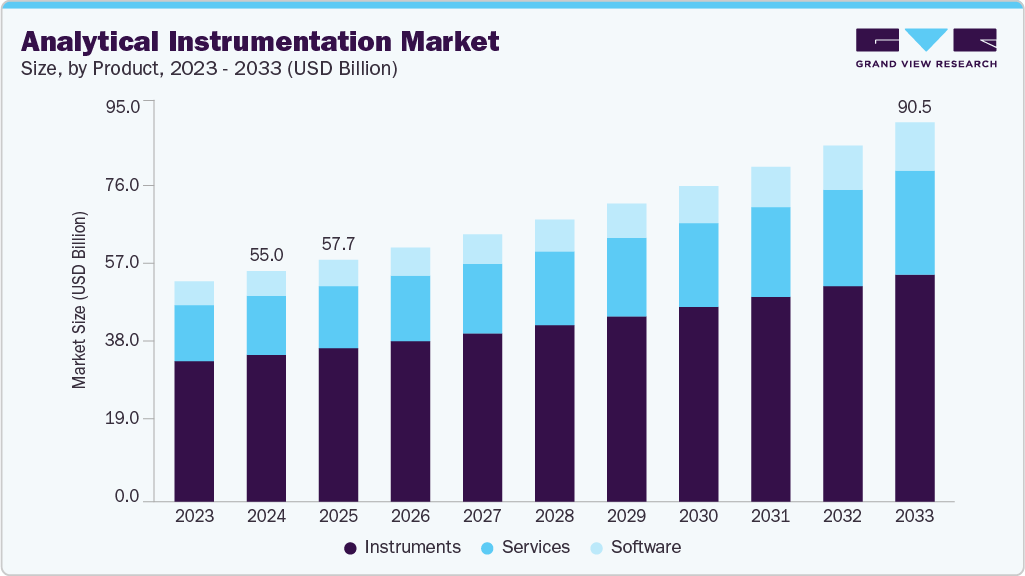

The global analytical instrumentation market size was estimated at USD 55.00 billion in 2024 and is anticipated to reach USD 90.48 billion by 2033, growing at a CAGR of 5.79% from 2025 to 2033. Rising requirements for accurate quality assurance, ongoing innovations in research and development, stricter regulatory standards, and broader usage across sectors such as pharmaceuticals, environmental monitoring, food safety, and chemicals primarily fuel the market expansion.

Key Market Trends & Insights

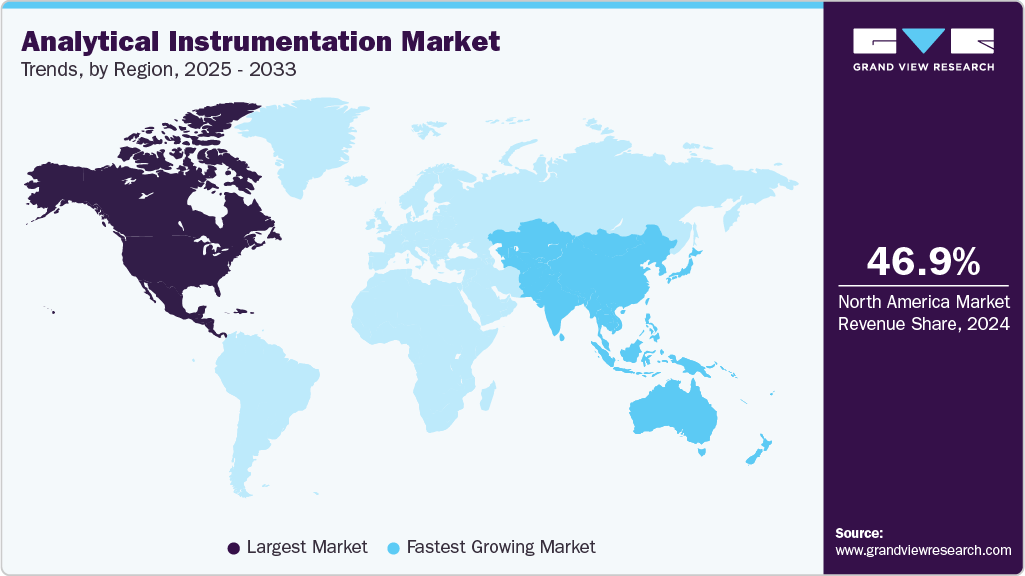

- The North America analytical instrumentation market held the largest share of 46.95% of the global market in 2024.

- The analytical instrumentation industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the instruments segment held the largest market share of 63.66% in 2024.

- Based on technology, the polymerase chain reaction (PCR) segment held the highest market share in 2024.

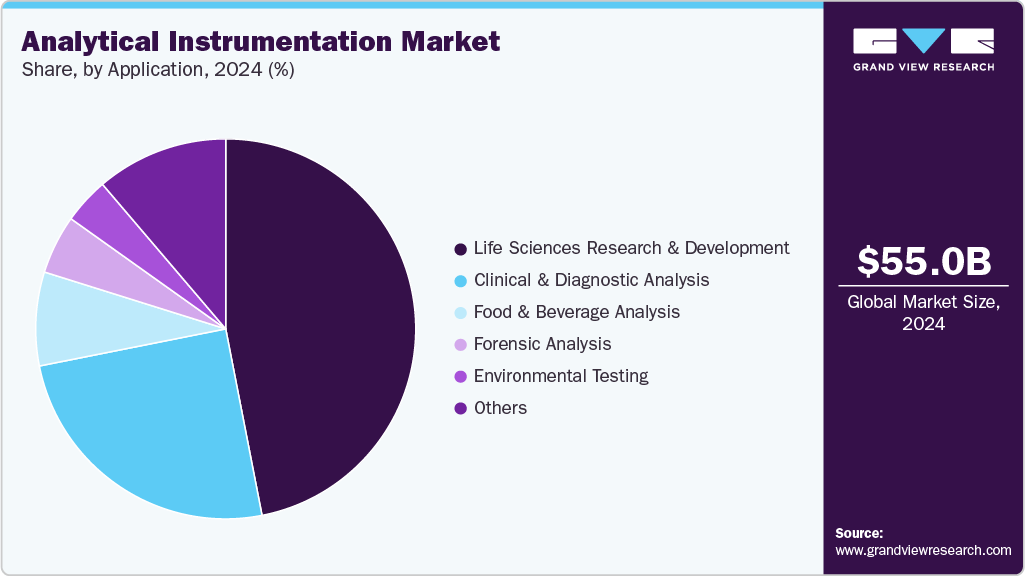

- By application, the life sciences research & development companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 55.00 Billion

- 2033 Projected Market Size: USD 90.48 Billion

- CAGR (2025-2033): 5.79%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological Innovation

Technological innovation is a major driver of growth in the global analytical instrumentation industry. Advances in chromatography, mass spectrometry, spectroscopy, and nuclear magnetic resonance (NMR) have significantly enhanced analytical instruments' accuracy, sensitivity, and efficiency. For instance, in February 2024, Thermo Fisher Scientific launched its Dionex Inuvion ion chromatography system in the United States. The reconfigurable instrument streamlined ionic and small polar compound analysis across diverse laboratory sectors. These improvements enable faster and more precise detection of chemical and biological compounds, which are critical in applications ranging from drug development and clinical diagnostics to environmental testing and food quality assurance. As industries demand more detailed and reliable analytical results, the push for cutting-edge technologies continues to grow.

Moreover, the integration of emerging technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) has revolutionized the capabilities of analytical systems. These innovations support automation, real-time data analysis, remote monitoring, and predictive maintenance, greatly improving operational efficiency and reducing human error. The trend toward miniaturization and developing portable analytical instruments is also expanding the market by making advanced analysis accessible in field settings, such as remote healthcare facilities, environmental sites, and food safety inspections. Together, these advancements drive broader adoption and open new growth opportunities across various industries.

Rising emphasis on quality control and safety

The rising emphasis on quality control and safety across multiple industries is a significant driver of demand for analytical instrumentation. In sectors such as pharmaceuticals, biotechnology, food and beverages, chemicals, and cosmetics, ensuring product purity, consistency, and compliance with safety standards is not just a competitive advantage but a legal necessity. Regulatory bodies such as the FDA (U.S. Food and Drug Administration), EMA (European Medicines Agency), and other global organizations enforce strict guidelines for product testing, manufacturing processes, and batch validation. Analytical instruments are essential in meeting these requirements, offering precise measurement of active ingredients, detection of contaminants, and verification of chemical composition.

Moreover, the increasing complexity of products, especially in pharmaceuticals and biologics, requires more sophisticated analysis to ensure efficacy and patient safety. For instance, in November 2024, PerkinElmer advanced battery science in North America, enhancing analytical tools and recycling processes to improve battery chemistries, boosted performance, and optimize recycling efficiency across industry applications. Maintaining consistent quality is critical for product performance and operational safety in the chemicals and materials sectors. Analytical instruments help companies comply with regulatory standards, minimize risks, reduce product recalls, and build consumer trust, making them an indispensable part of modern industrial operations and a key driver of market growth.

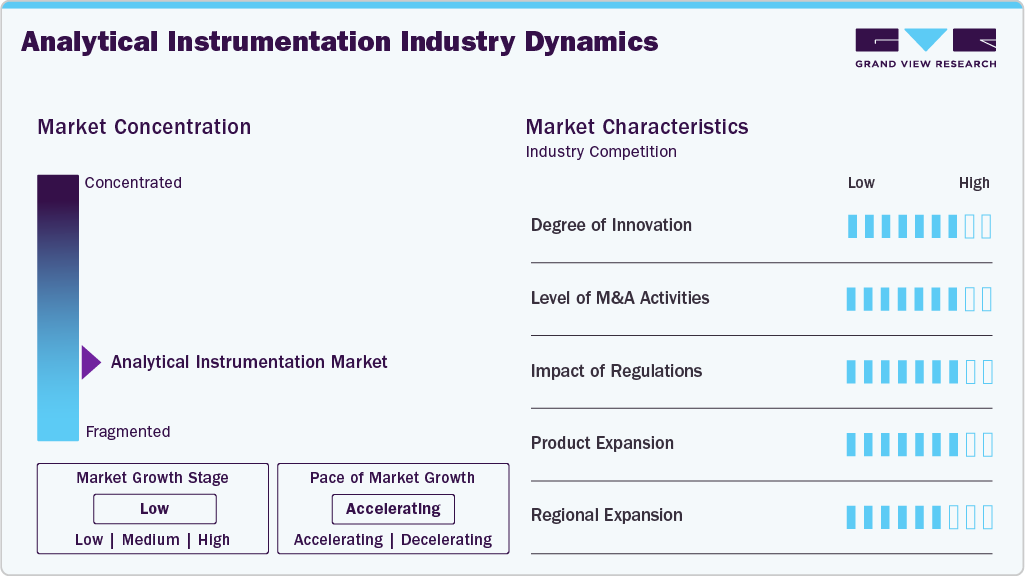

Market Concentration & Characteristics

The analytical instrumentation industry exhibits high innovation, driven by the growing demand for faster, more accurate, and versatile analytical solutions across sectors. Technological advancements in core methods such as chromatography, mass spectrometry, and spectroscopy continually enhance detection limits, sensitivity, and data quality. At the same time, integrating AI, machine learning, and IoT transforms instruments into smart, automated systems capable of real-time monitoring and predictive analysis. For instance, in March 2024, Japan-based HORIBA launched three high-speed analytical instruments at Pittcon in the United States: the PoliSpectra Rapid Raman Plate Reader for ultra-fast 96-well screening, the Veloci BioPharma Analyzer employing A-TEEM fluorescence for rapid biomolecule fingerprinting, and the SignatureSPM, a multimodal system combining AFM, Raman, and photoluminescence. These innovations aimed to accelerate pharmaceutical research and streamline drug development and bioprocessing workflows. This strong pace of innovation positions the market as highly dynamic and technology-intensive.

The analytical instrumentation industry has seen a moderate-to-high level of M&A activity in recent years, driven by the need for companies to expand their technological capabilities, product portfolios, and global reach. For instance, in March 2025, Advanced Instruments, a subsidiary of Sweden's Investor AB, announced plans to acquire Nova Biomedical in a USD 2.2 billion deal. These strategic acquisitions also help consolidate market share, improve economies of scale, and accelerate innovation. Moreover, cross-sector M&A deals involving companies in life sciences, diagnostics, and environmental monitoring reflect the growing convergence of technologies and end-user applications within the analytical instrumentation space.

Regulations are crucial in shaping the analytical instrumentation industry by driving demand for precise, reliable, and compliant testing solutions. Stringent regulatory frameworks imposed by agencies such as the FDA, EMA, EPA, and other global bodies require industries, particularly pharmaceuticals, food and beverages, environmental monitoring, and chemicals, to adhere to strict quality and safety standards. These regulations mandate rigorous testing protocols for product development, manufacturing, and environmental compliance, fueling the adoption of advanced analytical instruments. Evolving and increasingly stringent regulations are a significant growth catalyst for the market, encouraging continuous innovation and widespread implementation of sophisticated analytical technologies.

Product expansion is increasingly becoming a key growth driver in the analytical instrumentation industry as companies strive to offer comprehensive solutions beyond just selling equipment. Many manufacturers and third-party providers are broadening their service portfolios to include instrument installation, calibration, maintenance, repair, training, and software support. For instance, in March 2025, BrightSpec unveiled the first commercial Molecular Rotational Resonance (MRR) instruments in over 50 years at PittCon 2025 in Boston, USA. Their product suite includes the spectraMRR, isoMRR, and nanoMRR platforms, designed to provide high-precision molecular analysis without extensive sample preparation. This shift helps customers optimize instrument performance, extend equipment lifespan, and comply with regulatory standards more efficiently. By providing end-to-end services, companies not only enhance customer satisfaction and loyalty but also generate recurring revenue streams, thereby strengthening their market position in a highly competitive landscape.

Regional expansion is a significant growth driver in the analytical instrumentation industry as companies increasingly target emerging economies in Asia-Pacific, Latin America, and the Middle East. These regions are experiencing rapid industrialization, increased pharmaceutical investments, environmental monitoring, food safety, and strengthening regulatory frameworks, all boosting demand for advanced analytical instruments. Moreover, growing research and development activities and expanding healthcare infrastructure in these markets create new vendor opportunities. Companies can better address region-specific needs, reduce costs, and improve customer support by establishing local manufacturing facilities, sales offices, and service centers. This strategic regional focus helps players capture untapped markets and diversify their global footprint.

Product Insights

The instruments segment held the largest share, 63.66%, of the overall revenue in 2024, owing to many companies offering different types of analytical instruments, such as mass spectrometers, chromatographs, sequencers, and microscopes. Moreover, key players are expanding their instrumentation portfolio by adding new products. For instance, in May 2025, the United States launched an enhanced three‑phase, integrated lifecycle approach to the analytical instrument and system qualification, updating USP General and expanding the analytical instrumentations globally.

The software segment is anticipated to grow at the fastest CAGR of 7.95% during the forecast years. Software is commonly used for data analysis and interpretation of results in analytical procedures in various areas, such as academic research and clinical diagnosis. For instance, in July 2021, the Waters Corporation launched TRIOS AutoPilot software for TA Instruments, automating thermal analysis workflows, accelerating SOP creation by 25%, reducing errors, and enhancing laboratory efficiency globally. Such software capabilities are likely to boost segment growth over the forecast period.

Technology Insights

The polymerase chain reaction (PCR) segment held the largest revenue share of 24.98% in 2024. Technology offers several benefits, such as rapid amplification, the requirement of a small sample, and utility for detecting various diseases. PCR enables higher amplification of specific sequences and more sensitive detection in less time than other traditional methods, making the technique significantly useful for basic & commercial purposes, including forensics, genetic identity testing, in vitro diagnostics, and industrial quality control. For instance, in February 2025, bioMérieux launched the GENE UP TYPER real-time PCR solution, combining automated assays with machine learning strain typing to pinpoint pathogen contamination root causes, initially targeting Listeria monocytogenes, and launched globally. Moreover, real-time PCR offers various benefits in clinical laboratories, such as simultaneous analysis of multiple genes, lower reagent costs, internal controls, and preserving samples for tumor profiling.

The sequencing segment is projected to grow at the fastest CAGR of 8.87% over the forecast period. Sequencing technology can determine the order of nucleotides in small, targeted entire genomes or genomic regions. The key sequencing methods are DNA sequencing, RNA sequencing, high-throughput sequencing, and methylation sequencing. Sequencing technology has a variety of applications in cancer research, microbiology research, complex disease research, and reproductive health. For instance, in June 2022, a study published in the Journal of Clinical Microbiology demonstrated how advanced sequencing technologies enhanced pathogen identification and genomic analysis, improving diagnostic accuracy and treatment strategies in clinical microbiology. Hence, extensive applications of sequencing in multiple areas are boosting segment growth.

Application Insights

The life sciences research & development segment captured the largest revenue share of 46.94% of the overall revenue in 2024. The increasing prevalence of chronic and infectious diseases is the key factor leading to increased R&D activities by various life sciences industries to develop and manufacture novel biologics, such as monoclonal antibodies, vaccines, and therapeutic proteins. Analytical tools, such as liquid chromatography, mass spectroscopy, and UV-Vis spectroscopy are used to characterize antibodies. Moreover, therapeutic proteins require an extensive chemical composition analysis, which can be performed using analytical instrumentation, such as HPLC, capillary electrophoresis, and mass spectroscopy. Such analytical instrumentation applications in life sciences research & development are driving the segment growth.

The clinical & diagnostics analysis segment is anticipated to grow at the fastest CAGR of 6.94% throughout the forecast period. The increasing incidence of cancer and chronic diseases has resulted in a high demand for diagnostic tests, which, in turn, is likely to increase the demand for analytical instrumentation products, such as flow cytometers, for clinical testing. For instance, in March 2025, illumination technologies introduced advanced fluorescence, transitioning from traditional xenon and halogen lamps to LEDs and lasers. These innovations enhanced precision, sensitivity, and efficiency in medical diagnostics and surgical visualization. Integrating AI and closed-loop feedback systems enabled real-time guidance and automated diagnostics, significantly improving patient care and scientific research outcomes.

Regional Insights

North America analytical instrumentation market held the largest share of 46.95% of the overall revenue in 2024. This large share can be attributed to the region's well-established healthcare system and pharmaceutical industry, which has created a significant demand for analytical instrumentation for clinical and research purposes. Extensive R&D initiatives for developing vaccines & therapeutics for various diseases and increasing public-private investments in cancer research have also fueled the need for these tools.

U.S Analytical Instrumentation Market Trends

The U.S. analytical instrumentation industry has grown significantly in recent years. It benefits from a strong pharmaceutical and biotechnology sector, leading research institutions, and significant R&D investments. The presence of stringent regulatory bodies like the FDA ensures high demand for precise, reliable analytical solutions. For instance, in June 2024, PerkinElmer unveiled its next-generation thermal analysis instruments, the DSC 9, TGA 9, STA 9, and NEXION 1100, enhancing polymer and inorganic material analysis. These advancements offer expanded temperature ranges, improved baseline stability, and interchangeable components, facilitating seamless upgrades and integration. The instruments support hyphenated techniques, enabling comprehensive analyses in polymer and pharmaceutical laboratories.

Europe Analytical Instrumentation Market Trends

Europe analytical instrumentation industry is expected to grow steadily during the forecast period. The region benefits from well-established pharmaceutical, chemical, and environmental sectors and stringent regulatory frameworks such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). Strong government support for research and innovation and a growing emphasis on sustainability and environmental monitoring further drive demand for sophisticated analytical tools. The region's focus on precision medicine and biotechnology also fosters the continuous adoption of cutting-edge instruments in life sciences and healthcare industries.

The UK's analytical instrumentation industry is driven by a strong life sciences and pharmaceutical industry, supported by world-class research infrastructure. For instance, in September 2024, the University of Nottingham partnered with Asynt Ltd to provide advanced analytical services. This collaboration combines Asynt's expertise in scientific equipment with Nottingham Analytical's advanced instrumentation, including NMR, mass spectrometry, and chromatography. The partnership aims to support R&D across various industries by offering precise, reliable results and sustainable laboratory solutions, further driving the demand in the country's analytical instrumentation industry.

The analytical instrumentation industry in Germany is expected to grow over the forecast period, owing to its strong industrial base, especially in chemicals, pharmaceuticals, and manufacturing. The country’s emphasis on quality control, strict regulatory standards, and extensive R&D activities support continuous demand. Germany is also a leader in engineering and automation, encouraging the adoption of advanced, integrated analytical solutions.

Asia Pacific Analytical Instrumentation Market Trends

The Asia-Pacific analytical instrumentation industry is anticipated to witness the fastest CAGR of 7.23% from 2025 to 2033, fueled by industrial expansion, increasing R&D investments, and growing regulatory compliance requirements. Countries like China, India, Japan, and South Korea are major contributors, driven by booming pharmaceutical manufacturing. For instance, in November 2024, the Central Analytical Instrumentation Facility (CAIF) was inaugurated at the Manipal Institute of Technology (MIT), part of the Manipal Academy of Higher Education (MAHE), in Manipal, Karnataka, India. The facility aims to foster interdisciplinary research and innovation across various scientific domains. Moreover, the region's governments promote local manufacturing and innovation through favorable policies, creating significant opportunities for market players.

China analytical instrumentation industry is rapidly expanding driven by fast industrialization, increased healthcare spending, and growing development in the analytical instrumentation industry. For instance, in December 2024, Shimadzu Corporation inaugurated its fourth manufacturing facility in Suzhou, China, enhancing production capacity by 2.4 times. The expanded plant now produces high-end analytical instruments, including LC-MS, GC-MS, gas chromatographs, and energy-dispersive X-ray fluorescence spectrometers, to support the domestic demand and further expansion.

The analytical instrumentation industry in Japan is expected to witness significant growth over the forecast period, driven by advanced technology adoption and strong pharmaceutical and cross-border expansion of domestic companies. For instance, in September 2024, Japan-based Shimadzu Corporation commenced operations of its subsidiary, Shimadzu Mexico. This strategic move enables localized sales and service for analytical and measuring instruments and medical systems, enhancing regional support and accessibility. Moreover, the country's growing population fuels healthcare demand, while strict regulatory oversight ensures high-quality product standards, supporting growth in clinical diagnostics and environmental monitoring.

Middle East & Africa Analytical Instrumentation Market Trends

The MEA analytical instrumentation industry is an emerging market, with increasing regulatory standards encouraging adoption. Healthcare infrastructure development and rising public health concerns boost diagnostic and pharmaceutical analysis investments. Moreover, ongoing industrialization, government initiatives for sustainable development, and international collaborations are expected to accelerate growth in the forecast period.

Kuwait analytical instrumentation industry is still in the early stages of development, but shows potential due to rising investments in scientific research and healthcare modernization. The government’s efforts to diversify the economy and build a knowledge-based sector have increased interest in genomics, precision medicine, and biotechnology. Partnerships with international research organizations and universities are helping introduce advanced technologies, including analytical instrumentation, into Kuwait’s healthcare and research ecosystems.

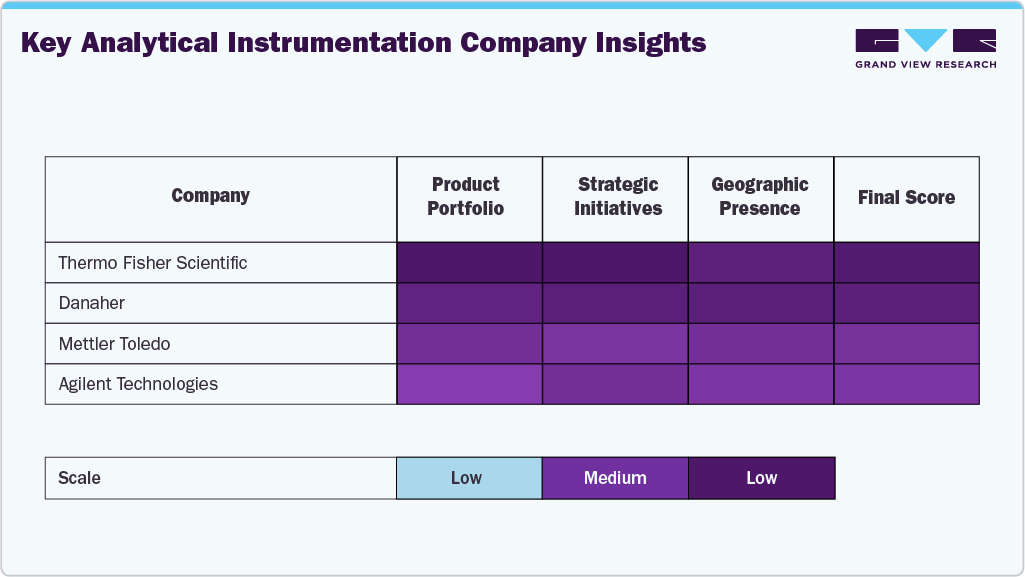

Key Analytical Instrumentation Company Insights

The analytical instrumentation industry is dominated by established global leaders known for their broad product ranges, cutting-edge technologies, and strong foothold in the industry. Companies such as Thermo Fisher Scientific, Waters Corporation, Shimadzu Corporation, Danaher, Agilent Technologies, Bruker Corporation, and PerkinElmer hold a significant share by continuously investing in research and development and offering solutions across various sectors, including pharmaceuticals, environmental analysis, food safety, and clinical diagnostics. Companies like LGC Biosearch Technologies, Quintara Biosciences, GenScript, and IBA Lifesciences GmbH are expanding their presence by offering innovative solutions and customized analytical instrumentation services that cater to the growing needs of research institutions, pharmaceutical companies, and synthetic biology enterprises.

Prominent players such as Mettler Toledo, Zeiss Group, Bio-Rad Laboratories, Illumina, Eppendorf SE, F. Hoffmann-La Roche AG, Sartorius AG, and Avantor, Inc. further enrich the competitive environment by providing specialized instruments, integrated systems, and value-added services designed to meet specific customer requirements. These firms prioritize advancements in automation, enhanced sensitivity, and user-friendly platforms that streamline complex processes in research and industrial settings.

These companies sustain their leadership positions by harnessing technological innovation, forming strategic alliances, and leveraging extensive global distribution networks. With increasing demand for precise analysis in fields such as gene sequencing, drug discovery, synthetic biology, and personalized medicine, these market leaders are well equipped to drive future growth. Their dedication to improving accuracy, efficiency, and sustainability is shaping the ongoing evolution of the analytical instrumentation industry.

Key Analytical Instrumentation Companies:

The following are the leading companies in the analytical instrumentation market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Waters Corp.

- Shimadzu Corp.

- Danaher

- Agilent Technologies, Inc

- Bruker Corp.

- PerkinElmer, Inc.

- Mettler Toledo

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc.

Recent Developments

-

In June 2025, Bruker Corporation announced the acquisition of Biocrates Life Sciences AG, a leading provider of mass spectrometry-based quantitative metabolomics solutions headquartered in Innsbruck, Austria. Financial terms were not disclosed. This strategic acquisition enhances Bruker's multi-omics capabilities by integrating Biocrates' standardized metabolite and lipid analysis kits, assays, software, and services into its portfolio. Biocrates' offerings include the MxP Quant 1000 kit, which quantifies up to 1,881 biomarkers from minimal sample volumes, facilitating advanced analysis across various biological matrices.

-

In June 2025, ABB Robotics and METTLER TOLEDO in Switzerland signed an MOU to integrate ABB’s collaborative robots with METTLER TOLEDO’s LabX software. This collaboration aimed to enhance flexible, efficient lab automation, boosting productivity and data management across industries while addressing labor shortages.

-

In May 2025, Waters Corporation acquired Halo Labs, enhancing its capabilities in biological analysis. Halo Labs' Aura platform offers advanced imaging technologies for detecting and analyzing particles in therapeutic products, such as cell, protein, and gene therapies. This acquisition complements Waters' existing Wyatt Technology portfolio, enabling comprehensive particle analysis and supporting the development and quality control of large molecule therapies.

-

In January 2025, ABB Robotics and Agilent Technologies announced a strategic collaboration to advance laboratory automation. This partnership aims to integrate Agilent's advanced analytical instruments and software with ABB's robotics technology to automate repetitive tasks such as sample handling, testing, and data processing.

-

In October 2024, Thermo Fisher Scientific launched the iCAP MX Series ICP-MS instruments, comprising the single quadrupole iCAP MSX and triple quadrupole iCAP MTX models. Designed for environmental, food safety, industrial, and research laboratories, these instruments offer high sensitivity and precision in analyzing trace elements across complex matrices. The iCAP MSX provides robust performance without compromising sensitivity, while the iCAP MTX delivers interference-free analysis, which is ideal for challenging samples. Both models feature advanced argon gas dilution and cone design to extend maintenance intervals, enhancing laboratory productivity and ensuring reliable results.

Analytical Instrumentation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 57.67 billion

Revenue forecast in 2033

USD 90.48 billion

Growth rate

CAGR of 5.79% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Waters Corp.; Shimadzu Corp.; Danaher Corp.; Agilent Technologies, Inc.; Bruker Corp.; PerkinElmer, Inc.; Mettler Toledo; Zeiss Group; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Eppendorf SE; F. Hoffmann-La Roche AG; Sartorius AG; Avantor, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Analytical Instrumentation Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global analytical instrumentation market report on the basis of product, technology, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Services

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Polymerase Chain Reaction

-

Spectroscopy

-

Microscopy

-

Chromatography

-

Flow Cytometry

-

Sequencing

-

Microarray

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Life Sciences Research & Development

-

Clinical & Diagnostic Analysis

-

Food & Beverage Analysis

-

Forensic Analysis

-

Environmental Testing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global analytical instrumentation market size was estimated at USD 55.00 billion in 2024 and is expected to reach USD 57.67 billion in 2025.

b. The global analytical instrumentation market is expected to grow at a compound annual growth rate of 5.79% from 2025 to 2033 to reach USD 90.48 billion by 2033.

b. North America dominated the analytical instrumentation market with a share of 46.95% in 2024. This is attributable to the increasing research and development activities coupled with the presence of established companies such as Thermo Fisher Scientific, Inc., Danaher Corporation, and others in the region.

b. Some key players operating in the analytical instrumentation market include Thermo Fisher Scientific, Inc.; Waters Corporation; Shimadzu Corporation; Danaher Corporation; Agilent Technologies, Inc.; Bruker Corporation; PerkinElmer, Inc.; Mettler Toledo; Zeiss Group; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Eppendorf SE; F. Hoffmann-La Roche AG; Sartorius AG; and Avantor, Inc.

b. The increasing R&D activities and continuously growing investments & funding in the life sciences domain are driving the demand for efficient analytical tools, thereby boosting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.