- Home

- »

- Clinical Diagnostics

- »

-

Anatomic Pathology Market Size, Industry Report, 2033GVR Report cover

![Anatomic Pathology Market Size, Share & Trends Report]()

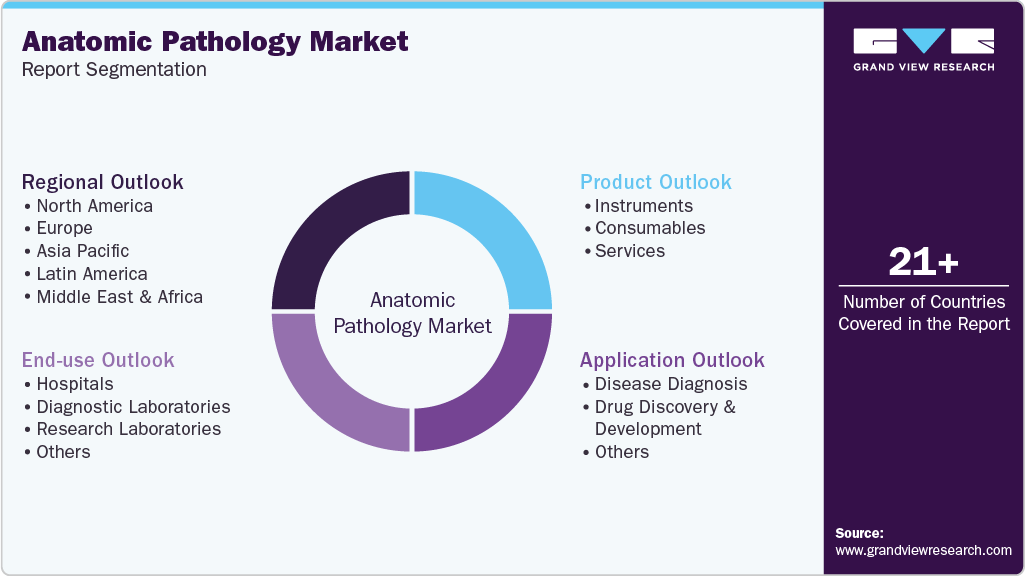

Anatomic Pathology Market (2026 - 2033) Size, Share & Trends Analysis Report By Product & Service (Instruments, Consumables), By Application (Disease Diagnosis), By End Use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-318-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anatomic Pathology Market Summary

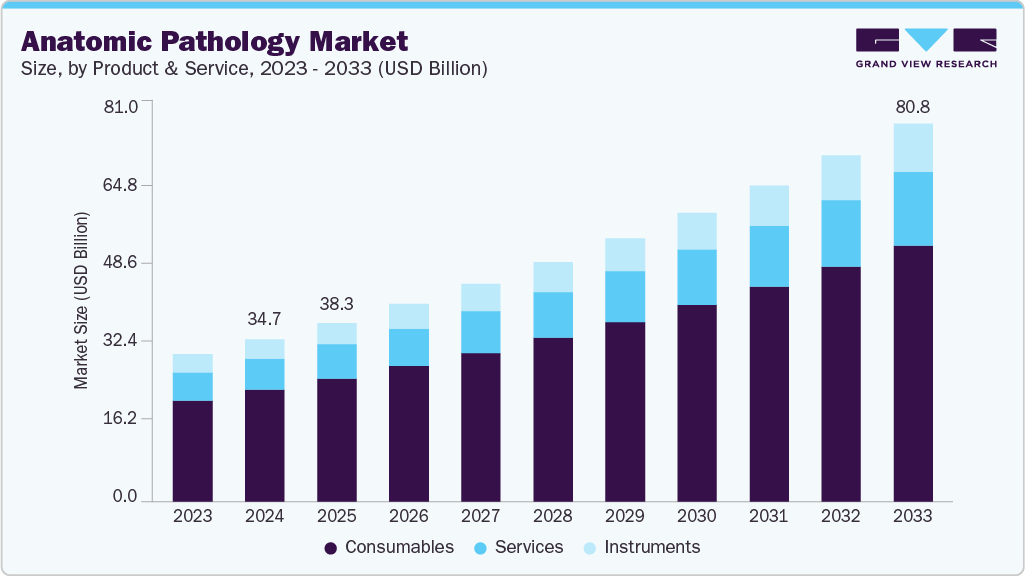

The global anatomic pathology market size was estimated at USD 38.27 billion in 2025 and is projected to reach USD 80.77 billion by 2033, growing at a CAGR of 9.73% from 2026 to 2033. Some of the major factors driving the market are rising global cancer and chronic disease burden, growing adoption of precision and personalized medicine, and digital pathology and artificial intelligence (AI) advancements.

Key Market Trends & Insights

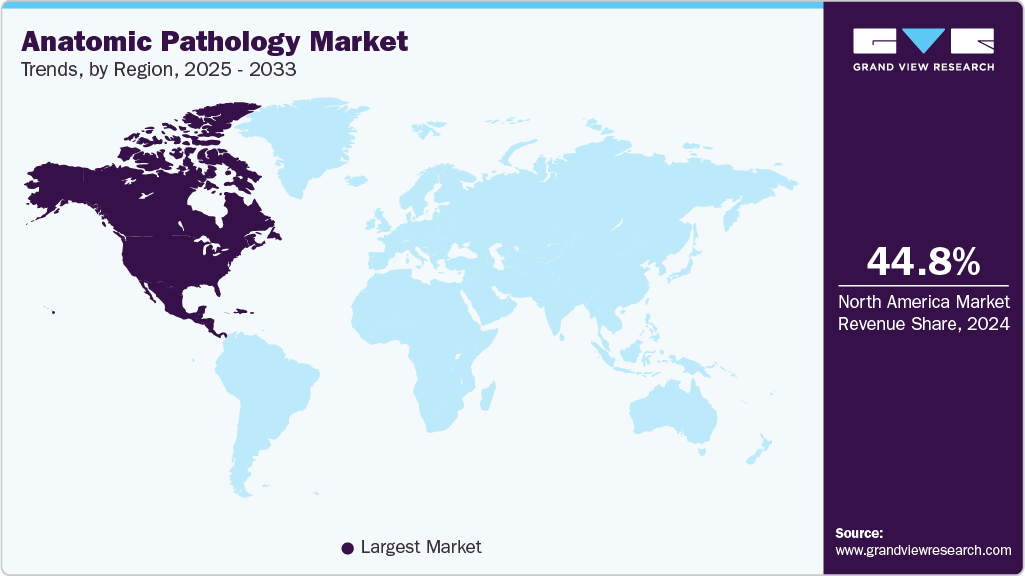

- North America anatomic pathology industry dominated the global market and accounted for the largest revenue share of 44.27% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- By product & service, the consumables segment dominated the global market.

- By application, the disease diagnosis segment held the largest revenue share of 59.7% in 2025.

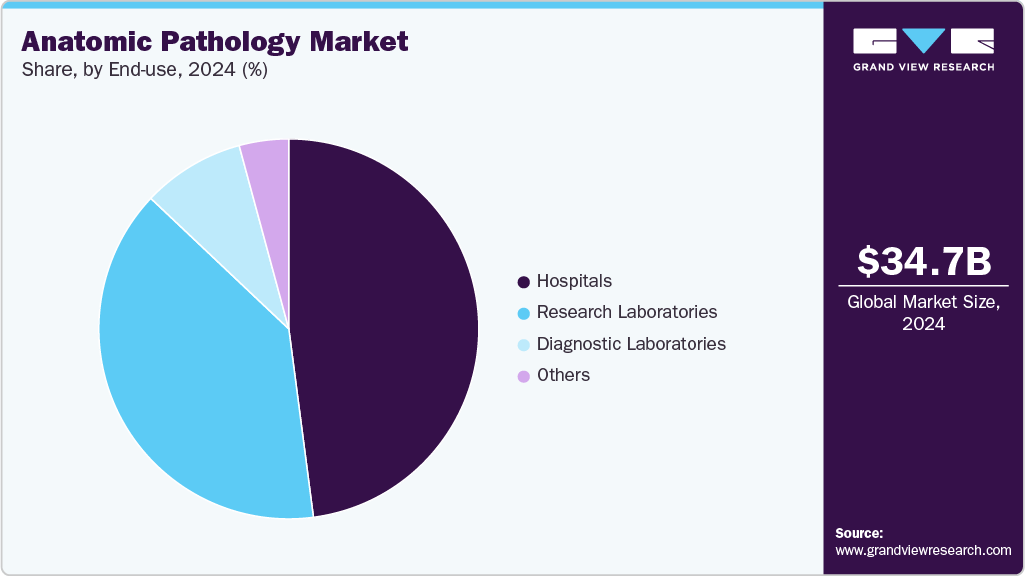

- By end use, the hospitalssegment held the largest revenue share of 47.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 38.27 Billion

- 2033 Projected Market Size: USD 80.77 Billion

- CAGR (2026-2033): 9.73%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

For instance, in July 2025, PathAI (U.S.) launched the Precision Pathology Network (PPN), a first-of-its-kind network of digital anatomic pathology laboratories powered by PathAI's AISight 1 Image Management System (IMS).The PPN is intended to provide early access to the most recent AI-powered pathology solutions developed by PathAI in collaboration with the biopharma industry, to allow participating laboratories to monetize real-world pathology data, to support biopharma-sponsored evidence generation studies, and to enable novel clinical development strategies that leverage AI-pathology. Furthermore, an aging population and rising healthcare expenditure fuel the growth of the global anatomic pathology industry. As per the World Population Prospects 2024, the world's population is expected to keep growing for another 50 or 60 years, peaking at around 10.3 billion in the mid-2080s, up from 8.2 billion in 2024.

The growth of molecular pathology and companion diagnostics (CDx) is significantly increasing the global market for anatomic pathology by allowing for more precise, personalized, and targeted approaches to disease diagnosis and treatment. Molecular pathology detects genetic, molecular, and cellular changes associated with specific diseases, most notably cancer, allowing for earlier and more accurate diagnoses. Companion diagnostics help guide the use of targeted therapies by identifying patients who are most likely to benefit from specific treatments. This combination of diagnostics and therapeutics is increasingly being used in oncology and other fields of medicine, driving demand for advanced pathology services. As pharmaceutical companies continue to invest in personalized medicine and regulatory agencies encourage the incorporation of CDx into drug development pipelines, the role of anatomic pathology is expanding beyond traditional histology to include molecular insights, accelerating market growth and innovation.

In addition to rising disease burdens and technological advancements, several other factors are driving the global anatomic pathology industry. The growing awareness and education of patients and healthcare providers about the importance of early and accurate diagnosis is driving up demand for pathological services. The growing number of biopsy procedures, driven by routine health screenings and preventive care programs, is increasing the demand for pathology analysis. Furthermore, the transition from hospital-based care to outpatient and specialized diagnostic centers improves pathology services' accessibility and efficiency. Favorable reimbursement policies in developed countries, as well as supportive government initiatives to strengthen diagnostic infrastructure in emerging economies, are further driving market growth.

Furthermore, strategic collaborations, mergers, and acquisitions between diagnostic labs, hospitals, and technology companies are fostering innovation and expanding service offerings across regions.

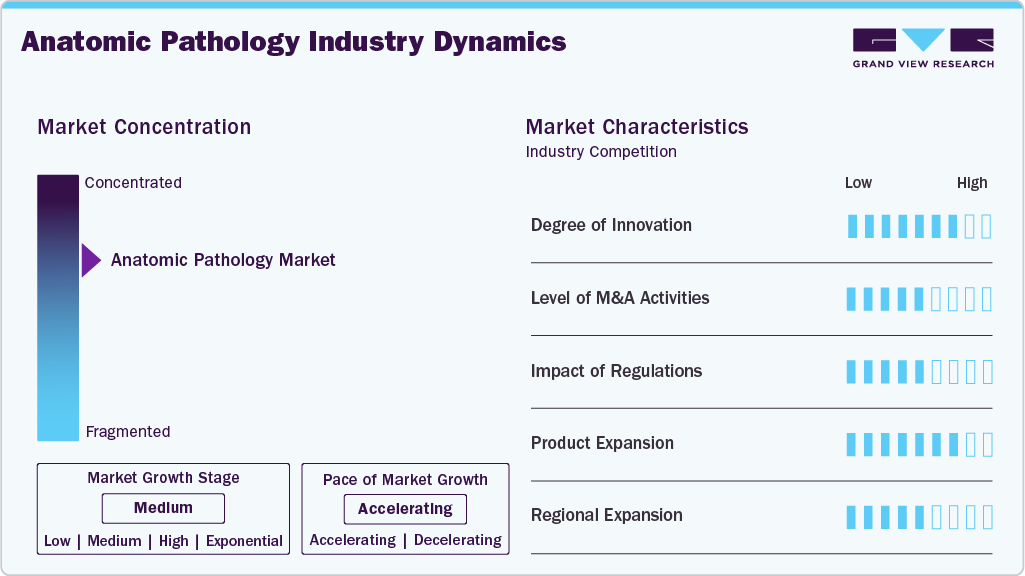

Market Concentration & Characteristics

The anatomic pathology industry is currently experiencing a high level of innovation, which is primarily driven by advances in digital pathology, artificial intelligence (AI), and molecular diagnosis. Companies increasingly incorporate AI-powered image analysis, automated workflows, and cloud-based platforms to boost diagnostic accuracy and efficiency. For instance, in September 2025, Leica Biosystems debuted cutting-edge digital pathology software at ECP 2025, expanding its extensive suite of solutions. Furthermore, Aperio HALO AP, the new clinical image management software, includes a full suite of enterprise-grade digital pathology diagnostic workflows for on-screen diagnosis, multidisciplinary team meetings, consultations, and more. Moreover, the combination of molecular pathology and anatomic enables more personalized and targeted treatment approaches. These innovations are reshaping traditional pathology practices, and they are expected to accelerate even more as R&D investments and collaborations between diagnostics and biopharma companies grow.

Mergers and acquisitions (M&A) in the anatomic pathology industry are moderate, with key players aiming to expand their technological capabilities, geographical footprint, and market share. Moreover, while not as common or large-scale as in other healthcare sectors, recent M&A have focused on bringing together AI startups, digital imaging firms, and specialized pathology labs to broaden service offerings. These activities help companies stay competitive and meet growing demand, but the market is still somewhat fragmented, particularly in emerging markets, limiting the full impact of M&A for the time being.

The regulatory environment for anatomic pathology has a moderate influence on the market. Regulatory bodies such as the FDA, EMA, and other regional agencies play an important role in approving and overseeing diagnostic devices, AI algorithms, and laboratory practices. While widespread support for innovation exists, particularly in digital and companion diagnostics, regulatory pathways can be complicated and time-consuming, particularly for AI-powered tools. Efforts are being made globally to modernize diagnostic regulations and provide more straightforward guidelines for digital pathology, which may increase this impact in the future.

The anatomic pathology industry is rapidly expanding due to increased demand for specialized diagnostic tools, reagents, and integrated systems. Manufacturers are constantly introducing new staining kits, digital scanners, AI-powered software, and biomarker tests to meet the increasing complexity of disease diagnostics. The emphasis on developing solutions for personalized medicine and faster diagnostic turnaround is encouraging businesses to diversify their portfolios. Furthermore, the proliferation of cloud-based platforms and laboratory automation tools is improving pathology services' scalability and efficiency.

The market is expanding moderately across regions, with Asia-Pacific, Latin America, the Middle East, and Africa leading. Furthermore, while North America and Europe continue to be dominant markets due to advanced infrastructure and widespread adoption of digital tools, companies are increasingly looking to emerging markets to capitalize on rising healthcare investments, expanding diagnostic capacity, and unmet medical needs. However, barriers such as limited infrastructure, reimbursement issues, and labor shortages in some areas slow adoption and expansion.

Product & Service Insights

Based on product & service, the market is segmented into instruments, consumables, and services. The consumables segment dominated the market with a 69.7% share in 2025 because of its critical and recurring role in diagnostic workflows. Consumables such as reagents, stains, antibodies, fixation solutions, embedding materials, and slides are required for all pathology procedures, making them indispensable in routine and advanced diagnostic tests.

Unlike capital equipment, which requires a one-time investment, consumables are used daily, resulting in consistent and high demand in hospitals, diagnostic labs, and research facilities. The growing number of biopsy and histopathology procedures, driven by the rising incidence of cancer and chronic diseases, drives demand for these products. Furthermore, the growing use of automated staining systems and immunohistochemistry (IHC) techniques has boosted demand for specialized reagents and antibodies, reinforcing the consumables segment's market leadership. Furthermore, the growing use of automated staining systems and immunohistochemistry (IHC) techniques has increased demand for specialized reagents and antibodies, bolstering the consumables segment's market dominance.

The instruments segment is expected to be the fastest-growing segment over the forecast period, owing to rising demand for automation, digitalization, and high-throughput diagnostic capabilities. For instance, in September 2025, StatLab Leads Pathology innovation with the U.S. Diapath equipment launch. Moreover, this milestone fulfills the strategic vision behind StatLab’s 2024 acquisition of Diapath to bring differentiated histology instrumentation to U.S. laboratories and deliver a comprehensive end-to-end pathology workflow solution.

Application Insights

Disease diagnosis accounted for 59.7% of revenue in 2025, owing to the growing global burden of chronic diseases, cancer prevalence, and increased demand for early and precise diagnostic testing. Hospitals and diagnostic centers are increasingly implementing advanced pathology technologies, such as digital pathology and molecular diagnostics, to improve disease detection accuracy and speed. Furthermore, the growing emphasis on personalized medicine, as well as the integration of AI-driven diagnostic tools, are strengthening this segment's dominance. The ongoing demand for routine tissue and organ analysis for disease confirmation ensures that this category generates consistent revenue.

Moreover, drug discovery and development is expected to be the fastest-growing segment over the forecast period, owing to the increasing use of pathology techniques in pharmaceutical and biotechnology research. The increase in R&D investments in novel therapeutics and precision oncology has increased the demand for tissue-based studies and biomarker analysis. Anatomic pathology is critical in identifying disease mechanisms, validating drug targets, and assessing treatment efficacy during the preclinical and clinical stages. Furthermore, advancements in digital imaging, automation, and AI-assisted analysis are increasing efficiency, hastening the growth of this segment within the larger market. For instance, in April 2024, PathAI partnered with google cloud to transform drug discovery and precision medicine through AI-powered pathology to help biopharma companies and anatomic pathology (AP) labs accelerate the adoption of AI and digital pathology.

End Use Insights

Hospitals accounted for 47.8% revenue share in 2025, due to their high patient footfall, comprehensive diagnostic infrastructure, and integration of multidisciplinary services. They serve as primary centers for disease diagnosis, surgical pathology, and cancer screening, driving consistent demand for pathological examinations. The availability of advanced laboratory facilities, skilled pathologists, and access to cutting-edge technologies such as immunohistochemistry and molecular pathology further enhances their diagnostic capabilities. Additionally, hospitals are investing in digital pathology to expand the digital pathology. For instance, In September 2025, HSE revealed plans to establish a USD 52.27 million digital pathology solution in 22 hospitals nationally. Moreover, the technology was introduced in 22 histopathology laboratories, including eight HSE centers of excellence and 14 general hospital laboratory centers.

Furthermore, diagnostic laboratories are projected to be the fastest-growing segment over the forecast period owing to the increasing trend of outsourcing pathology tests to specialized labs and the rapid adoption of automation and digital pathology systems. These laboratories offer high throughput testing capabilities, faster turnaround times, and cost-effective services, attracting both patients and healthcare providers. The rise in independent pathology labs, coupled with advancements in AI-driven image analysis and remote diagnostics, has expanded their reach and efficiency. Furthermore, the growing healthcare demand in emerging economies and the shift toward decentralized diagnostic models are fueling the rapid growth of this segment.

Regional Insights

North America anatomic pathology industry is the leading region globally, holding a revenue share of 44.27% in 2025, owing to several key factors. The area benefits from a well-established healthcare infrastructure with widespread availability of advanced diagnostic laboratories and state-of-the-art pathology equipment. High healthcare expenditure and strong government support for cancer screening and chronic disease management programs drive consistent demand for pathological services. Additionally, North America is a hub for technological innovation, rapidly adopting digital pathology, AI-powered diagnostic tools, and molecular pathology techniques. The presence of significant market players, robust R&D activities, and favorable reimbursement policies further fuel market growth. Moreover, increasing awareness among patients and healthcare professionals about the importance of early diagnosis and personalized medicine continues to boost the region's demand for anatomic pathology solutions.

U.S. Anatomic Pathology Market Trends

The anatomic pathology industry in the U.S. is driven by rising allergy prevalence, greater healthcare spending, and a strong emphasis on early and precise diagnosis. The presence of advanced healthcare infrastructure, significant R&D investments, and a high clinical awareness all contribute to rapid market expansion. For instance, in August 2025, Agilent Technologies Inc. launched of its Dako Omnis family of instruments with three new models-Agilent Dako Omnis 110, 165, and 165 Duo-designed to meet the evolving needs of pathology laboratories of all sizes. These new instruments give labs the ability to tailor their staining solutions based on volume, workflow, and diagnostic needs. Favorable payment schemes and the rapid adoption of new technology, such as molecular diagnostics and biologic drugs, drive demand even higher. Furthermore, FDA regulations help enable faster product approvals and market entry. The rising emphasis on tailored treatment and preventive care creates new opportunities for targeted allergy therapies. These factors make the U.S. a global leader in developing and applying allergy tests and therapies.

Europe Anatomic Pathology Market Trends

The Europe anatomic pathology industry growth is driven by the rising cancer rates, more investments in healthcare infrastructure, and the expanding use of AI and digital pathology technologies. Across Europe, countries are prioritizing precision medicine and early disease detection with the help of strong government initiatives and favorable reimbursement policies. The area is also well known for the extensive collaborations that pathology labs and pharmaceutical companies have established to speed up the development of biomarkers and diagnostics. However, regulatory complexity and national healthcare system differences impede consistent market growth. Despite these challenges, advances in molecular pathology and heightened patient and clinician awareness are driving an increase in the demand for advanced diagnostic services.

The anatomic pathology industry in the UK is evolving, with a focus on combining AI and digital pathology to enhance patient outcomes and diagnostic workflows. Innovative pathology solutions are being actively promoted by the National Health Service (NHS) to enhance cancer diagnosis and control the rising burden of chronic illnesses. Personalized medicine initiatives and increased government funding are propelling the use of companion and molecular diagnostics. For instance, in September 2023, the Data to Early Diagnosis and Precision Medicine initiative is a USD 281.00 million investment that aims to advance precision medicine, allowing for earlier diagnosis and more effective treatment of major diseases. The program had already committed all funding and assisted UK businesses and academia in harnessing research and health data to drive innovation, improve health outcomes, and stimulate economic growth. UK Research and Innovation (UKRI) led the initiative, with Innovate UK as the primary delivery partner. A highly qualified workforce and a reputable research ecosystem that supports clinical trials and translational studies are additional advantages for the UK market. Rapid expansion, however, might be hampered by financial limitations and the requirement for infrastructure improvements in some places.

Germany anatomic pathology industry is a significant force in Europe, as it is the largest healthcare market in Europe, because of its high healthcare expenditures and sophisticated medical infrastructure. Automated pathology tools and AI-powered digital platforms are being used more frequently to satisfy the nation's expanding diagnostic needs, especially in oncology. Robust regulatory frameworks and reimbursement support for innovative diagnostics encourage molecular pathology innovation and adoption. Another significant contribution is made by Germany's thriving biopharmaceutical sector, which collaborates with diagnostic labs on clinical validation studies and biomarker research. Also propelling market expansion are the aging population and the growing incidence of diseases linked to a sedentary lifestyle.

Asia Pacific Anatomic Pathology Market Trends

Asia Pacific anatomic pathology industry is anticipated to one of the fastest growing market in the world, driven by the growing incidence of cancer, the expansion of healthcare infrastructure, and the growing use of advanced diagnostic technologies. Significant investments are being made by nations like China, Japan, India, and South Korea to update pathology labs and incorporate AI and digital pathology. The scope of diagnostic services is being extended outside of urban areas by government initiatives to increase healthcare affordability and accessibility. But issues like a lack of qualified pathologists and inconsistent reimbursement practices still exist. Notwithstanding these obstacles, the need for supplies, equipment, and molecular diagnostic testing is being driven by rising interest in early detection and personalized medicine.

Japan's anatomic pathology industry is distinguished by its developed healthcare system, which places a premium on R&D. Because of government incentives and innovative regulatory frameworks, the country is aggressively deploying AI and digital pathology to improve diagnostic efficiency and accuracy. For instance, in August 2024, BostonGene, a leading provider of AI-driven molecular and immune profiling solutions, showcased its AI-powered multiomics platform at the 22nd Annual Meeting of the Japanese Society of Digital Pathology at Meio University in Nago, Japan. Two of the company's abstracts were accepted for presentation at the event, highlighting BostonGene's ongoing efforts to advance precision diagnostics through the integration of AI and multiomics technologies. Japan's high cancer incidence and rapidly aging population drive the country's ongoing demand for pathology services. Moreover, clinical practice is increasingly reliant on the integration of companion and molecular diagnostics, particularly for targeted therapies. Partnerships between pharmaceutical companies and diagnostic labs not only advance precision medicine but also strengthen Japan's position as a significant regional market.

China's anatomic pathology industry is rapidly expanding, fostering by rising cancer rates, government initiatives to modernize diagnostic infrastructure, and increased healthcare spending. Also, China is seeing an increase in the use of digital pathology, artificial intelligence based diagnostic tools, and molecular pathology to aid personalized medicine. Efforts to improve rural healthcare access as well as insurance coverage are driving demand away from major cities. Moreover, local manufacturing of pathology instruments and consumables is also becoming more popular, lowering costs and increasing accessibility. Also, challenges such as a lack of skilled pathologists and regulatory complexities may stymie expansion. Overall, China remains a high-potential market with exciting growth prospects.

Latin America Anatomic Pathology Market Trends

The Latin American anatomic pathology industry is gradually expanding, owing to rising cancer and chronic disease prevalence, as well as increased healthcare investment in countries such as Brazil, Mexico and Argentina. Adoption of digital pathology and automation is growing, albeit at a slower pace than in developed regions due to infrastructure and economic constraints. Government initiatives aimed at improving diagnostic services and broadening insurance coverage are generating new opportunities. Collaborations between local labs and international companies also help to facilitate technology transfer and skill development. Despite challenges such as limited reimbursement and labor shortages, rising disease awareness and healthcare modernization efforts are expected to drive consistent market growth.

Middle East and Africa Anatomic Pathology Market Trends

The Middle East and Africa anatomic pathology industry is driven by rising cancer incidence, increased government focus on non-communicable diseases, and growing healthcare infrastructure investments. Furthermore, countries like the Saudi Arabia, UAE, Egypt, and South Africa are investing in modern diagnostic facilities and adopting digital pathology platforms to improve service delivery.

However, the region faces challenges such as limited trained pathology personnel, varying regulatory environments, and budget constraints in some areas. Apart from these challenges, collaborations and initiatives aimed at capacity building are enhancing market prospects. Growing awareness of early diagnosis as well as the adoption of personalized medicine approaches are further supporting the market’s upward trajectory.

Key Anatomic Pathology Company Insights

The anatomic pathology industry is highly competitive, and market players are involved in activities such as strategic collaborations, new product launches, acquisitions, technological advancements, and regional expansion.

Key Anatomic Pathology Companies:

The following are the leading companies in the anatomic pathology market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- PHC Holdings Corporation

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche AG

- Agilent Technologies, Inc.

- Sakura Finetek USA, Inc.

- NeoGenomics Laboratories, Inc.

- BioGenex

- Bio SB

Recent Development

-

In September 2025, Labcorp collaborated with Roche to advance digital pathology capabilities. The investment enables pathologists to diagnose patients using digital images and supports future artificial intelligence (AI) integration. Moreover, Labcorp is committed to advancing its diagnostic capabilities by adopting innovative technologies.

-

In May 2024, Quest Diagnostics and PathAI, collaborated to accelerate the adoption of digital and AI pathology innovations to improve quality, speed and efficiency in diagnosing cancer and other diseases. Quest licensed PathAI's AISight digital pathology image management system to support its pathology laboratories and customer sites in the US. The two companies may also look into ways for Quest to help PathAI develop its algorithm products, leveraging Quest's extensive pathology expertise.

-

In September 2022, PathAI (U.S.) launched the Precision Pathology Network (PPN), a first-of-its-kind network of digital anatomic pathology laboratories powered by PathAI’s AISight 1 Image Management System (IMS). The PPN is designed to provide early access to PathAI's most recent AI-powered pathology solutions developed in collaboration with the biopharma industry, to allow participating laboratories to monetize real-world pathology data, to support biopharma-sponsored evidence generation studies, and to enable novel clinical development strategies that leverage AI pathology.

Anatomic Pathology Market Report Scope

Report Attribute

Details

Market size in 2026

USD 42.18 billion

Revenue forecast in 2033

USD 80.77 billion

Growth rate

CAGR of 9.73% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Danaher; PHC Holdings Corporation; Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; F. Hoffmann-La Roche AG; Agilent Technologies, Inc.; Sakura Finetek USA, Inc.; NeoGenomics Laboratories, Inc.; BioGenex; Bio SB

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anatomic Pathology Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the anatomic pathology market report based on product & service, application, end use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Microtomes & Cryostat

-

Tissue Processors

-

Automatic Stainers

-

Whole Slide Imaging (WSI) Scanners

-

Other Products

-

-

Consumables

-

Reagents & Antibodies

-

Probes & Kits

-

Others

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Disease Diagnosis

-

Drug Discovery and Development

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Laboratories

-

Research Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anatomic pathology market size was estimated at USD 38.27 billion in 2025 and is expected to reach USD 42.1 billion in 2026.

b. The global anatomic pathology market is expected to grow at a compound annual growth rate of 9.7% from 2026 to 2033 to reach USD 80.77 billion by 2033.

b. Some of the key players in this industry are Danaher, PHC Holdings Corporation, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, F. Hoffmann-La Roche AG, Agilent Technologies, Inc., Sakura Finetek USA, Inc., NeoGenomics Laboratories, Inc., BioGenex, and Bio SB.

b. Some of the major factors driving the market are rising global cancer and chronic disease burden, growing adoption of precision and personalized medicine, and digital pathology and artificial intelligence (AI) advancements.

b. The growth of molecular pathology and companion diagnostics (CDx) is significantly increasing the global anatomic pathology market by allowing for more precise, personalized, and targeted approaches to disease diagnosis and treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.