- Home

- »

- Pharmaceuticals

- »

-

Anemia Supplements Market Size, Industry Report, 2033GVR Report cover

![Anemia Supplements Market Size, Share & Trends Report]()

Anemia Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Ferrous Fumarate, Ferrous Gluconate), By Form (Tablets, Capsules), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-793-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anemia Supplements Market Summary

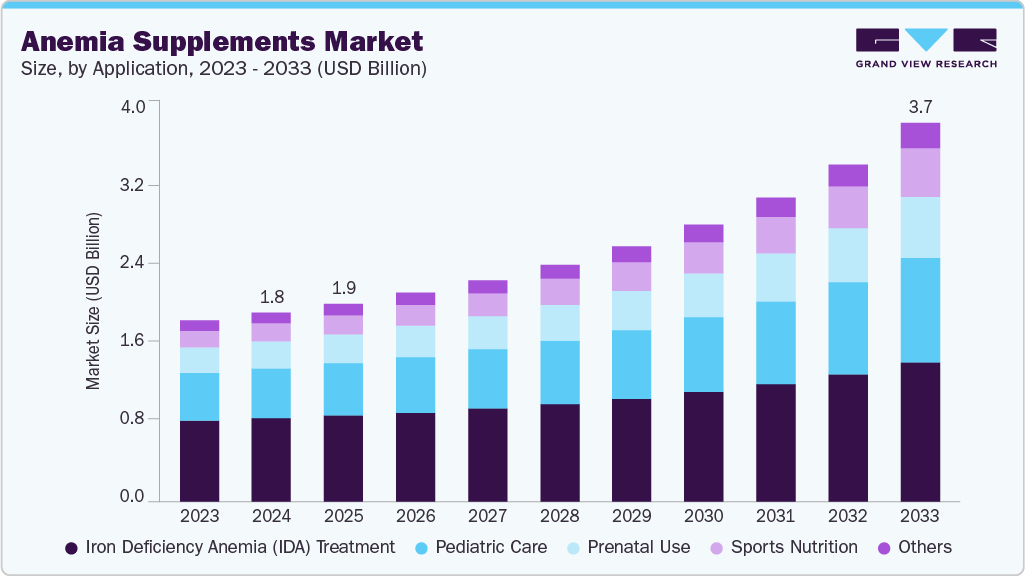

The global anemia supplements market size was estimated at USD 1.85 billion in 2024 and is projected to reach USD 3.71 billion by 2033, growing at a CAGR of 8.44% from 2025 to 2033. Market expansion is driven by the rising global prevalence of iron deficiency anemia, the increasing adoption of preventive nutrition, and the growing demand for prenatal and pediatric supplements.

Key Market Trends & Insights

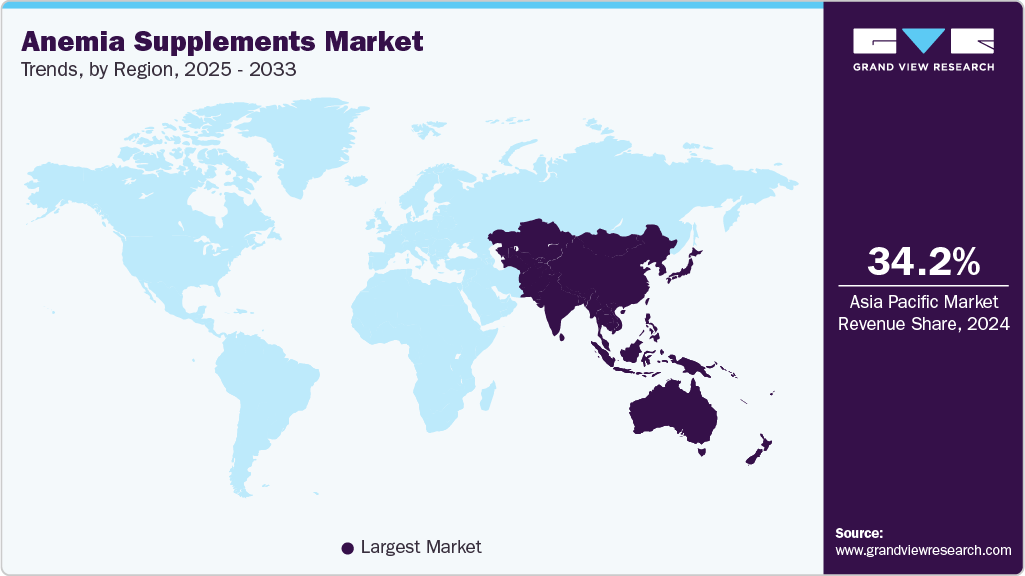

- Asia Pacific dominated the anemia market with the largest revenue share of 34.19% in 2024.

- The anemia industry in China accounted for the largest market revenue share in Asia Pacific in 2024.

- By product, the ferrous fumarate segment accounted for the largest market revenue share in 2024.

- Based on form, the tablets segment led the market with the largest revenue share of 40.64% in 2024.

- By application, the iron deficiency anemia (IDA) treatment segment led the market with the largest revenue share of 44.22% in 2024.

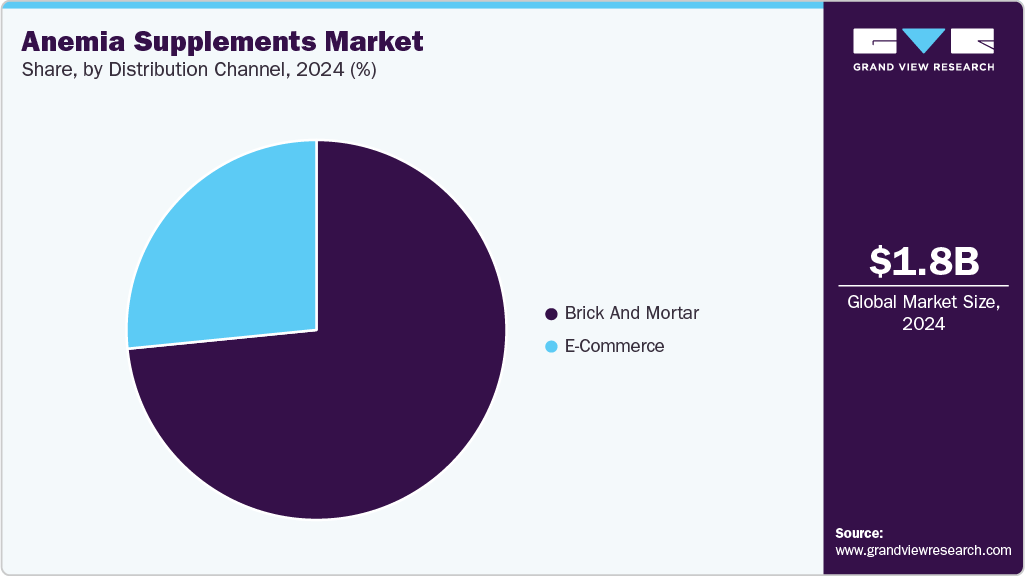

- Based on distribution channel, the brick and mortar segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.85 Billion

- 2033 Projected Market Size: USD 3.71 Billion

- CAGR (2025-2033): 8.44%

- Asia Pacific: Largest market in 2024

Advancements in bioavailable iron formulations, combined with expanding distribution through e-commerce and retail pharmacy channels, further support growth. The anemia supplements industry is experiencing a notable shift toward clean-label, vegan, and plant-based formulations as consumers increasingly prioritize natural, transparent, and ethically sourced nutrition solutions. Growing awareness surrounding ingredient safety, avoidance of synthetic additives, and rising intolerance to conventional iron salts have amplified interest in plant-derived and gentle iron alternatives such as iron bisglycinate, organic ferrous mineral complexes, and fruit- and vegetable-based extracts. In addition, marketing initiatives emphasizing purity, sustainability, and digestive comfort have helped brands differentiate their offerings and strengthen appeal among informed health-conscious buyers.Demand growth is further fueled by the expanding vegan and vegetarian population, alongside a broader consumer base adopting flexitarian lifestyle focused on nutrient-dense plant foods. This demographic is particularly susceptible to iron deficiency, contributing to increased reliance on supplementation to address nutritional gaps associated with plant-dominant diets. Consequently, supplement manufacturers are strategically developing cruelty-free and allergen-friendly formulations reinforced with vitamin C, natural bioenhancers, and botanical extracts to improve iron absorption and clinical outcomes. These advancements position plant-based iron products as credible alternatives to traditional heme-iron supplements, widening market penetration across diverse consumer segments.

Clean-label preferences also align with rising scrutiny around product traceability, sustainable sourcing, and environmentally responsible manufacturing. Regulatory focus on consumer transparency and heightened sensitivity toward chemical excipients are encouraging companies to adopt naturally derived binders, organic fillers, and minimal processing methods. Innovative delivery formats such as gummies, liquid tonics, and plant-based capsules are gaining momentum, improving palatability and compliance among pediatric, elderly, and general wellness consumers. Partnerships between nutraceutical manufacturers, organic raw-material suppliers, and digital wellness platforms further support accelerated product development and distribution innovation.

Looking ahead, the clean-label and plant-based trend is expected to drive significant product diversification within the anemia supplements landscape, encouraging brands to strengthen R&D capabilities and incorporate naturally functional ingredients like moringa, spirulina, beetroot, and amla for enhanced nutrient synergy. Increasing influence of influencers, prenatal awareness campaigns, and lifestyle-focused marketing will continue shaping buyer preferences, particularly across urban populations and emerging digital-first markets. As competition intensifies, companies prioritizing regulatory certification, transparent labeling, sustainable packaging, and science-backed claims are positioned to capture greater consumer loyalty and secure long-term growth within this evolving segment of the anemia supplements industry.

Rising Burden of Iron Deficiency Anemia

The global anemia supplements industry continues to expand due to the escalating prevalence of iron deficiency anemia (IDA) across women, children, and elderly populations. Women of reproductive age, particularly pregnant and lactating mothers, remain the most vulnerable segment due to increased physiological iron requirements, menstrual blood loss, and nutritional gaps. Governments and healthcare organizations are increasingly prioritizing maternal nutrition programs and anemia screening campaigns to address this public health challenge, accelerating both diagnosis rates and supplement adoption. In addition, awareness campaigns around maternal well-being, early childhood development, and micronutrient sufficiency are strengthening consumer engagement with preventive iron supplementation.

Children and adolescents represent another key consumer group, as iron deficiency remains one of the most common nutritional deficiencies affecting developmental health, cognitive performance, and immune resilience. Pediatricians and nutrition specialists increasingly recommend iron supplementation, fortified foods, and gentle liquid formulations to support healthy growth and neurodevelopment, particularly in regions with high malnutrition incidence. School-based nutrition initiatives, fortified meal programs, and parental preference for safe and palatable pediatric supplements are contributing to sustained product uptake, expanding the market’s reach within early-life nutrition channels. As urbanization and lifestyle transitions drive dietary imbalance, supplement penetration is rising steadily across middle-income households and digital commerce ecosystems.

Elderly consumers also play a significant role in market expansion, as aging populations face heightened anemia risks due to chronic illnesses, reduced dietary iron absorption, and medication interactions. Geriatric care providers increasingly emphasize iron status monitoring and supplementation as part of broader wellness routines. This demographic shift, combined with expanding healthcare access and longer life expectancy, strengthens market demand for bioavailable iron formulations designed for sensitive gastrointestinal systems. Together, rising disease awareness, improved diagnostic practices, targeted nutrition policies, and an expanding base of health-conscious consumers are reinforcing the importance of anemia management, positioning iron supplementation as an essential component of global public health and preventive nutrition strategies.

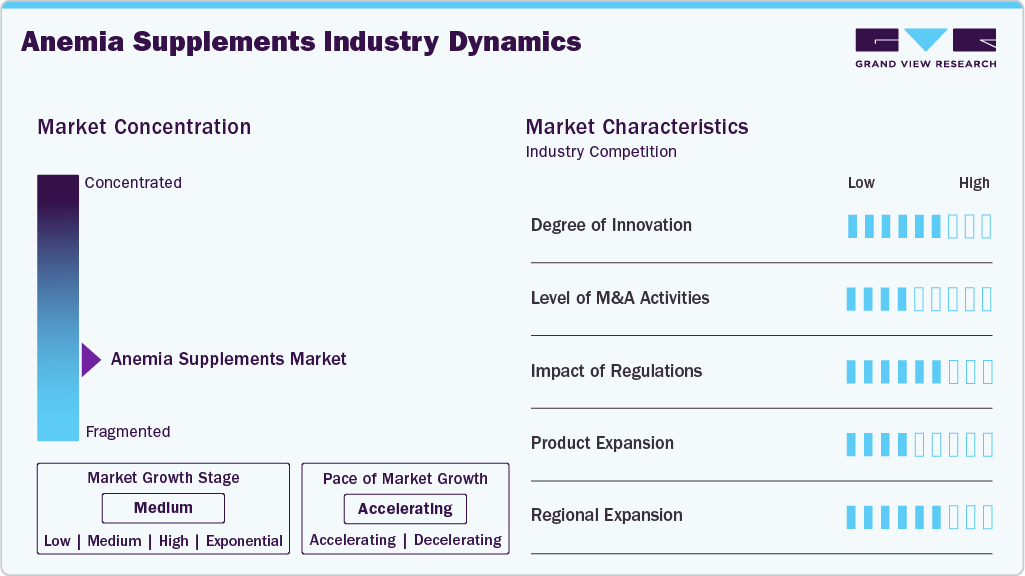

Market Concentration & Characteristics

The anemia supplements industry exhibits a competitive landscape characterized by the presence of established nutraceutical brands, specialized iron supplement manufacturers, and emerging clean-label and plant-based formulators. Companies focus on product innovation, enhanced bioavailability, and improved gastrointestinal tolerance to strengthen customer loyalty and address compliance challenges. Strategic initiatives such as partnerships with healthcare professionals, expansion across e-commerce platforms, and region-specific nutrition programs further support market positioning. In addition, investments in research-backed formulations and targeted marketing campaigns enhance differentiation in a growing consumer-driven market.

The anemia supplements industry reflects moderate M&A activities, driven by increasing demand for clinically backed and high-absorption iron formulations, as well as the expansion of nutraceutical portfolios among established healthcare and wellness companies. Strategic acquisitions target innovative plant-based, pediatric, and gentle-iron brands to diversify offerings, enhance distribution networks, and accelerate entry into fast-growing regional markets, particularly across Asia Pacific and North America.

Regulations play a crucial role in the anemia supplements industry by ensuring product safety, quality, and accurate labeling, thereby strengthening consumer trust and compliance with health standards. Authorities enforce guidelines on permissible ingredients, claims, dosage limits, and manufacturing practices to prevent misinformation and safeguard public health. In addition, regulatory oversight encourages transparency, clinical validation, and adherence to Good Manufacturing Practices, shaping industry competitiveness and fostering innovation in safe and effective iron supplementation solutions.

Product expansion in the anemia supplements industry is driven by rising consumer demand for diverse and convenient formulations, including liquid supplements, gummies, soft gels, and chewables that enhance compliance and palatability. Companies are increasingly investing in innovative delivery mechanisms, bioavailable iron complexes, and supportive nutrient blends such as vitamin C and folate to improve absorption and efficacy. In addition, clean-label, plant-based, and pediatric-focused variants continue to broaden the product landscape and cater to evolving consumer preferences.

Regional expansion in the anemia supplements industry is driven by rising anemia prevalence across emerging economies, increasing healthcare spending, and government-led nutrition programs aimed at reducing micronutrient deficiencies. Companies are strengthening their footprint through localized manufacturing, strategic distribution partnerships, and tailored product portfolios to address regional dietary patterns and regulatory requirements. Growing e-commerce penetration, urbanization, and awareness campaigns further facilitate market entry and accelerate adoption across Asia Pacific, Latin America, and the Middle East & Africa.

Product Insights

The ferrous fumarate segment led the market with the largest revenue share of 37.55% in 2024, owing to its high elemental iron content, favorable absorption profile, and cost-effectiveness compared to alternative formulations. Its widespread use in both prescription and over-the-counter supplements, along with strong clinical evidence supporting its efficacy in treating iron deficiency anemia, further strengthened its adoption. In addition, availability in multiple delivery formats, including tablets, capsules, and fortified foods, contributed to its broad market penetration.

The iron bisglycinate segment is expected to grow at the fastest CAGR of 10.85% during the forecast period. This is driven by its superior bioavailability, reduced gastrointestinal side effects, and suitability for individuals with sensitive digestive systems compared to traditional iron salts. Increasing consumer preference for gentle, clinically validated, and well-tolerated formulations, alongside rising demand for clean-label and premium nutritional products, is further accelerating segment adoption across adult, prenatal, and pediatric populations.

Form Insights

The tablets segment led the market with the largest revenue share of 40.63% in 2024. This is attributed to their cost-effectiveness, ease of storage, longer shelf life, and widespread availability across retail pharmacies and hospital channels. Tablets remain a preferred choice in clinical settings due to standardized dosing and proven efficacy. In addition, strong consumer familiarity and extensive use in government and public health anemia programs further reinforced tablet adoption across major global markets. These factors are expected to support the continued dominance of tablets during the forecast period.

The other segment is expected to grow at the fastest CAGR of 10.51% during the forecast period. This is owing to rising consumer preference for innovative formats such as gummies, powders, chewables, and effervescent tablets that enhance convenience, palatability, and compliance. Increasing adoption among pediatric and geriatric consumers, along with strong online availability and clean-label product launches, further supports segment momentum.

Application Insights

The iron deficiency anemia (IDA) treatment segment led the market with the largest revenue share of 44.22% in 2024. This dominance is driven by the high global prevalence of IDA, especially among women, children, and individuals with nutrient-poor diets, coupled with growing screening programs and physician preference for iron-based therapies. Increasing awareness about early diagnosis, availability of diverse iron supplements (oral and IV), and rising initiatives to address nutritional deficiencies further strengthen this segment’s leadership in the anemia supplements industry. These factors are expected to sustain the segment’s leading position during the forecast period.

The sports nutrition segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing focus on endurance, muscle recovery, and optimal oxygen utilization among athletes and fitness enthusiasts. Rising participation in recreational sports, awareness of iron deficiency’s impact on performance, and growing adoption of iron and vitamin-rich supplements in training regimes further fuel demand worldwide. These factors are expected to support robust market expansion and sustained growth during 2025 to 2033.

Distribution Channel Insights

The brick and mortar companies segment accounted for the largest market revenue share in 2024,supported by strong customer trust in physical pharmacies and retail outlets, where buyers can receive in‐person guidance and verify product authenticity before purchase. In addition, well‐established distribution networks, wide product availability, and physician referrals to nearby pharmacies enhanced sales. The growing preference among older consumers for face‐to‐face interactions and immediate product access, combined with promotional programs run by healthcare retailers, further reinforced this segment’s leadership.

The e-commerce segment is projected to grow at the fastest CAGR during the forecast period, driven by rising internet penetration, convenient home delivery, wider product variety, and increasing consumer preference for online health and wellness purchases. Competitive pricing, subscription models, and digital marketing strategies further accelerate adoption. This trend is expected to strengthen as consumers increasingly shift to digital purchasing channels. These factors are expected to drive sustained growth from 2025 to 2033.

Regional Insights

The North America anemia supplements market held a significant market share in 2024, driven by the rising prevalence of iron deficiency anemia, growing awareness regarding nutritional deficiencies, and wider availability of advanced supplement formulations. Strong healthcare infrastructure, supportive reimbursement policies, and physician recommendations further strengthened product adoption. In addition, an increase in self-care trends and higher consumer spending on health and wellness supported market expansion. The market is anticipated to maintain steady growth as preventive nutrition and personalized supplement use continue to rise across the region.

U.S Anemia Supplements Market Trends

The anemia supplements market in U.S. is a key contributor to the North American region, driven by high prevalence of iron-deficiency anemia, strong consumer awareness, and wide availability of advanced supplement formulations across retail and e-commerce channels. Supportive healthcare programs, increasing adoption of personalized nutrition, and rising demand from women and aging populations further strengthen market growth.

Europe Anemia Supplements Market Trends

The anemia supplements market in Europe is witnessing steady growth, driven by increasing incidence of anemia among women, aging populations, and individuals with chronic diseases. Strong clinical guidelines promoting preventive nutrition, rising adoption of fortified foods, and expanded availability of high-quality iron formulations are enhancing market demand. Government-led nutritional programs and heightened consumer preference for clean-label supplements are further contributing to industry expansion. The region is expected to continue its growth trajectory as healthcare systems emphasize early diagnosis and dietary intervention for anemia management.

The UK anemia supplements market is experiencing steady growth, supported by strong government focus on nutritional health, high awareness of iron deficiency among women and children, and increasing adoption of fortified and vegan supplement products. The expansion of retail and online distribution channels, combined with a rising consumer preference for clinically backed and clean-label formulations, continues to reinforce market growth.

The anemia supplements market in Germany is witnessing consistent growth, driven by increasing prevalence of iron deficiency among women and aging populations, strong emphasis on preventive healthcare, and high adoption of premium iron formulations such as iron bisglycinate. In addition, robust pharmaceutical manufacturing capabilities, expanding OTC supplements category, and growing consumer preference for clinically validated and clean-label products are further supporting market expansion.

Asia Pacific Anemia Supplements Market Trends

Asia Pacific dominated the anemia supplements market with the largest revenue share of 34.19% in 2024, and is expected to witness at the fastest CAGR during the forecast period. This dominance is attributed to a high prevalence of iron deficiency among women and children, as well as the expansion of healthcare access and increased awareness about preventive nutrition. Government-led anemia control programs, coupled with rising consumption of dietary supplements across developing economies such as India and China, are supporting market expansion. Growing investment by global nutraceutical brands and lifestyle changes driven by urbanization will continue to fuel regional demand. These factors are expected to sustain robust growth in the Asia Pacific market.

The anemia supplements market in China is growing rapidly, fueled by a high prevalence of iron deficiency among women and children, rising health awareness, and increasing adoption of dietary supplements among urban consumers. In addition, government maternal and infant health programs, the expansion of e-commerce penetration, and the growing demand for premium, plant-based, and clinically backed iron formulations are accelerating market expansion, making China one of the fastest-growing markets globally.

The Japan anemia supplements market is expanding steadily, supported by increasing consumer focus on preventive health and higher awareness of iron deficiency among women and aging populations. Growing adoption of premium, easy-to-absorb iron formulations and strong confidence in domestic nutraceutical brands further strengthens market development.

Middle East & Africa Anemia Supplements Market Trends

The anemia supplements market in Middle East and Africa is emerging, driven by the rising prevalence of anemia, increasing awareness of nutritional deficiencies, and efforts by governments and NGOs to improve maternal and child health. The growing availability of affordable supplement products and the expansion of pharmacy and retail networks are further supporting market demand. In addition, increasing investment in healthcare infrastructure and preventive care initiatives is strengthening market penetration. As awareness and purchasing power rise, the region is likely to present strong long-term growth opportunities.

The Kuwait anemia supplements market is experiencing steady growth, driven by rising awareness of nutritional deficiencies, increasing concerns among women, and growing demand for premium iron supplements. In addition, improving healthcare access and growing retail pharmacy networks are further contributing to sustained market adoption.

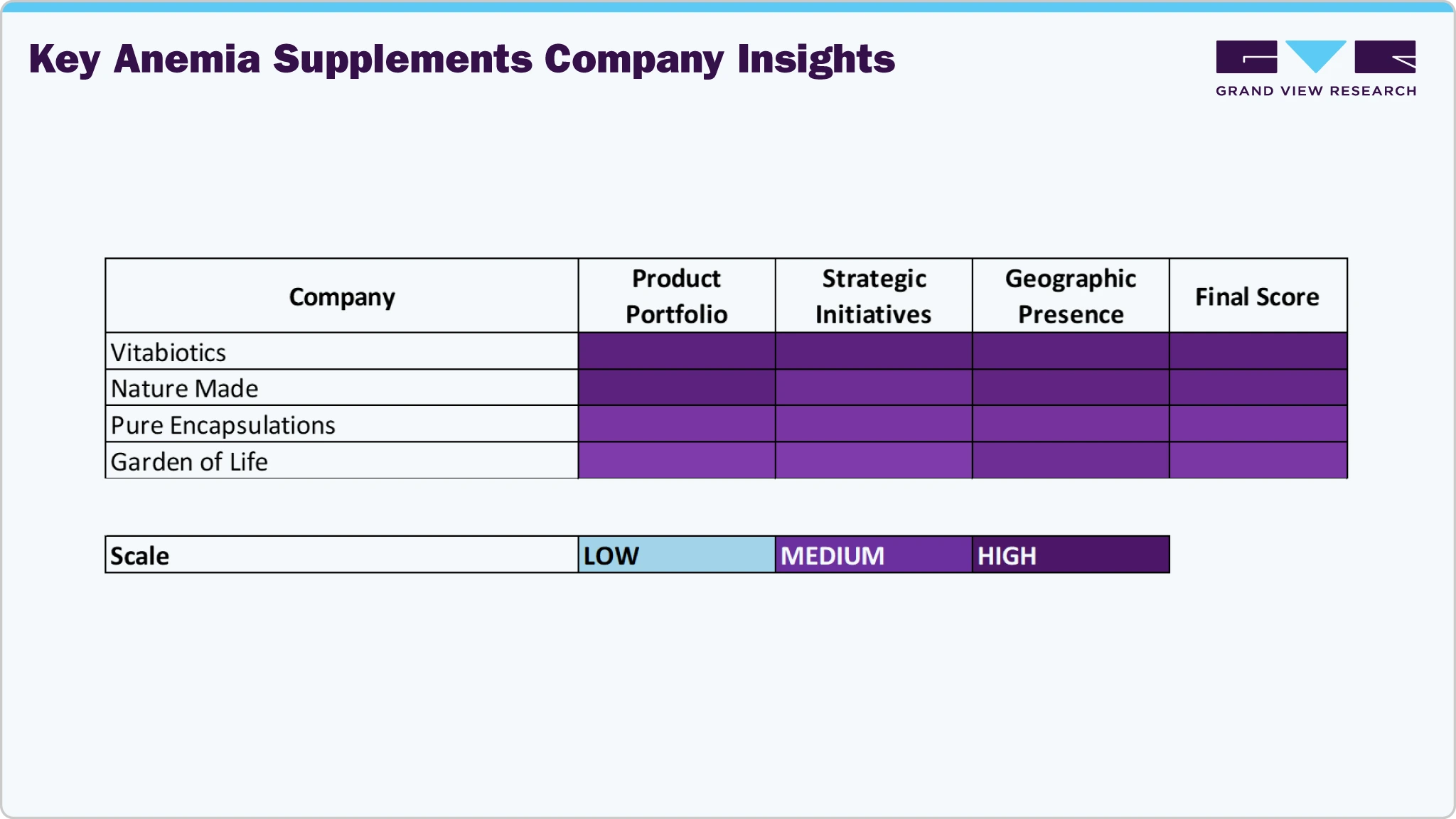

Key Anemia Supplements Company Insights

The global anemia supplements industry is moderately fragmented, comprising a mix of established multinational nutraceutical companies, pharmaceutical firms, and emerging specialized brands. Leading players focus on strong product portfolios spanning ferrous salts, chelated iron, multivitamin blends, and plant-based formulations. Market leadership is primarily defined by brand recognition, retail and pharmacy penetration, clinical validation, and physician recommendation networks. Companies with established OTC supplement lines and multi-channel distribution structures continue to capture the largest revenue share.

Product innovation and formulation advancement remain key competitive strategies among top players. Manufacturers are increasingly introducing gentle-on-stomach, high-absorption formats, such as iron bisglycinate, liposomal iron, and micro-encapsulated iron supplements. There is a noticeable shift from traditional ferrous sulfate products toward differentiated offerings that reduce gastric discomfort while improving bioavailability. Many brands are also expanding their clean-label and vegan portfolios to target health-focused consumers, pregnant women, and pediatric users. Beyond ingredient innovation, players are investing in improved dosage forms, including gummies, chewable tablets, sachets, and liquid formulations to enhance compliance and broaden appeal.

Strategic partnerships, e-commerce expansion, and global branding initiatives are shaping the industry’s competitive landscape. Companies are leveraging digital platforms, influencer partnerships, subscription-based nutrition delivery services, and targeted marketing to strengthen direct-to-consumer reach. Retail pharmacy collaborations and physician-driven recommendation programs remain critical in markets with a traditional preference for medical guidance in supplement adoption, particularly in North America, Europe, and parts of Asia.

Mergers and acquisitions within the market are focused on strengthening product portfolios, geographic expansion, and entry into niche categories such as prenatal, pediatric, and sports nutrition-focused anemia supplements. Private-label brands from large pharmacy chains and online retailers are also gaining traction, offering cost-competitive alternatives and increasing price pressure on global supplement players. Meanwhile, premium brands continue to emphasize clinically backed formulations, traceable sourcing, and third-party certifications to retain consumer trust and command higher price points.

Key companies operating in the global anemia supplements industry include Garden of Life, Nature Made, Solgar, NOW Foods, Olly Nutrition, Walgreens, GNC, Vitabiotics, Twinlab, and NovaFerrum. These companies are expected to continue prioritizing R&D, consumer education, and formulation science to maintain market competitiveness. As awareness surrounding iron deficiency continues to improve and demand rises across maternal health, pediatrics, and elderly nutrition segments, market leaders will remain focused on expanding their specialty offerings, regional footprints, and personalized nutrition solutions to sustain long-term growth.

Key Anemia Supplements Companies:

The following are the leading companies in the anemia supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Vitabiotics

- Nature Made

- NovaFerrum

- Floradix

- Feosol

- Ferro-Sequels

- Vitron-C

- Solgar

- Pure Encapsulations

- Garden of Life

Recent Developments

-

In June 2025, Wanbury Limited launched its new iron supplement, Wanbury Cred, aimed at addressing the widespread prevalence of iron deficiency and anemia, marking a strategic expansion of its nutritional healthcare portfolio.

-

In November 2024, Cadila Pharmaceuticals introduced Militol, an advanced iron supplement formulated to deliver an optimized blend of nutrients aimed at improving iron absorption and enhancing gastrointestinal tolerance, effectively supporting iron deficiency management.

-

In January 2024, Dr. Reddy's acquired MenoLabs, a women's health and dietary supplements brand portfolio, strengthening its position in the nutritional supplements market and expanding its product range to include targeted formulations addressing key female health needs, including conditions often associated with iron deficiency.

Anemia Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.94 billion

Revenue forecast in 2033

USD 3.71 billion

Growth rate

CAGR of 8.44% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Vitabiotics; Nature Made; NovaFerrum; Floradix; Feosol; Ferro-Sequels; Vitron-C; Solgar; Pure Encapsulations; Garden of Life

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anemia Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global anemia supplements market report based on the product, form, application, distribution channel, and region

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Ferrous Fumarate

-

Ferrous Gluconate

-

Ferrous Sulfate

-

Iron Bisglycinate

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Iron Deficiency Anemia (IDA) Treatment

-

Pediatric Care

-

Prenatal Use

-

Sports Nutrition

-

Others

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Brick and Mortar

-

Direct Selling

-

Chemists/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

-

E-Commerce

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anemia supplements market size was estimated at USD 1.85 billion in 2024 and is expected to reach USD 1.94 billion in 2025.

b. The global anemia supplements market is projected to grow at a compound annual growth rate (CAGR) of 8.44% from 2025 to 2033, reaching USD 3.71 billion by 2033.

b. The Asia Pacific dominated the anemia supplements market, accounting for a 34.19% share in 2024. This is attributable to the presence of a large patient pool, rising prevalence of nutritional deficiencies, and expanding access to affordable supplementation programs.

b. Some key players operating in the anemia supplements market include Vitabiotics; Nature Made; NovaFerrum; Floradix; Feosol; Ferro-Sequels; Vitron-C; Solgar; Pure Encapsulations; and Garden of Life among others.

b. Key factors driving market growth include the rising prevalence of iron deficiency and anemia across emerging and developed economies, coupled with increasing awareness of preventive healthcare and nutritional management. Growing government initiatives and public health programs aimed at reducing anemia, especially among women and children, are further accelerating product uptake. Additionally, the expansion of retail and e-commerce distribution channels, as well as the introduction of advanced formulations with improved bioavailability, is supporting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.