- Home

- »

- Pharmaceuticals

- »

-

Angina Pectoris Drugs Market Size And Share Report, 2030GVR Report cover

![Angina Pectoris Drugs Market Size, Share & Trends Report]()

Angina Pectoris Drugs Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Stable Angina, Unstable Angina), By Drug Class (Beta Blockers, Anticoagulants), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-045-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Angina Pectoris Drugs Market Summary

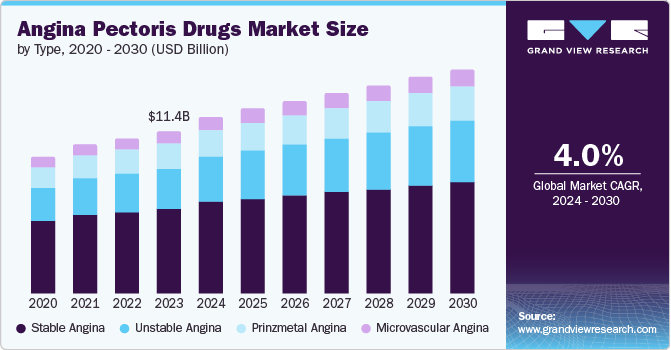

The global angina pectoris drugs market size was estimated at USD 11.37 billion in 2023 and is projected to reach USD 15.71 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. Advancements in personalized cardiovascular medicine and novel drug delivery systems are driving market expansion.

Key Market Trends & Insights

- North America dominated the global angina pectoris drugs market with a revenue share of over 40.0% in 2023.

- The angina pectoris drugs market in the U.S. is poised to experience substantial growth during the forecast period.

- By type, the stable angina segment dominated the angina pectoris drug market with a revenue share of 52.2% in 2023.

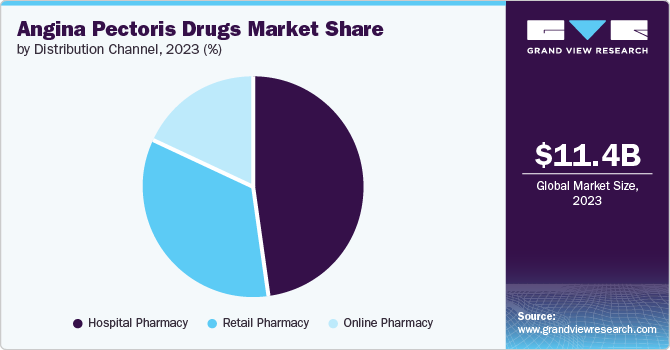

- By distribution channel, hospital pharmacies dominate the angina pectoris drugs market with a revenue share of 48.5% in 2023.

- By drug class, beta blockers dominated the angina pectoris market in 2023 with a revenue share of 38.8%.

Market Size & Forecast

- 2023 Market Size: USD 11.37 Billion

- 2030 Projected Market Size: USD 15.71 Billion

- CAGR (2024-2030): 4.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, worldwide market growth is fueled by the escalating prevalence of cardiac disorders, including coronary heart disease. Pharmaceutical companies are investing heavily in clinical trials to develop innovative treatments with improved efficacy, further propelling market growth. These developments are expected to significantly contribute to the market’s continued expansion.

The global angina pectoris drugs market is driven by a combination of factors, including the increasing occurrence of cardiovascular diseases worldwide. The growing demand for effective treatments is driven by the fact that cardiovascular diseases are a leading contributor to global mortality rates. Advances in drug delivery systems, such as transdermal patches and sustained-release formulations, are also boosting the efficiency and patient compliance of angina pectoris medications.

The growing geriatric population is another key driver of the market, as the elderly are more susceptible to cardiovascular diseases. This demographic shift presents an opportunity for pharmaceutical companies to develop targeted therapies that address the unique needs of older adults and improve their quality of life. Strategic partnerships and collaborations between pharmaceutical companies and research institutions are also driving market growth by advancing the development of innovative drug formulations and accelerating drug discovery.

Advancements in cardiology treatment, ongoing research and development efforts, and growing number of drug approvals from regulatory bodies such as the FDA are also driving market growth. The rise in retail pharmacies and patient preference for purchasing angina drugs through these channels is creating market opportunities. As the global population continues to age, there will be an increasing demand for effective treatments for angina pectoris, presenting an opportunity for pharmaceutical companies to develop and market new products that address this growing need.

Type Insights

The stable angina segment dominated the angina pectoris drug market with a revenue share of 52.2% in 2023. The number of patients suffering from chronic stable angina is rising, and almost half of these patients have it as the initial sign of ischemic heart disease. Factors such as cold weather or physical exertion can trigger stable angina, contributing to the expansion of this particular group. The dominance of the stable angina segment can be attributed to many factors, such as research and development, public awareness, and effective treatment options.

The unstable angina segment is expected to experience the fastest growth of 5.5% over the forecast period. The growing geriatric population, along with lifestyle choices such as smoking, poor eating habits, and lack of physical activity, are key factors contributing to the increasing prevalence of cardiovascular diseases (CVDs). This rise in CVD cases has led to a higher demand for angina pectoris medications, especially for unstable angina, a more severe form of the condition. With improved healthcare infrastructure, advancements in diagnostic tools, and increased awareness about CVDs, unstable angina is now being diagnosed at an earlier stage. This early detection enables timely treatment, which supports market growth.

Distribution Channel Insights

Hospital pharmacies dominate the angina pectoris drugs market with a revenue share of 48.5% in 2023. This can be attributed to the fact that hospitals equipped with advanced infrastructure and suitable facilities are witnessing a rise in the number of patients seeking treatment for angina pectoris disorders. In addition, the expansion of hospitals, tied with effective policies, is also playing a significant role in driving the growth of this particular segment.

The online pharmacy segment is projected to grow at the fastest CAGR of 5.7% over the forecast period. Online pharmacies have emerged as a convenient solution for acquiring angina pectoris medications. These platforms enable patients to order medicines from the comfort of their homes, offering a diverse range of options, including customized treatments for angina pectoris. Competitive pricing and home delivery services further facilitate medication access, particularly for patients with mobility limitations.

Drug Class Insights

Beta blockers dominated the angina pectoris market in 2023 with a revenue share of 38.8%. Segment growth is primarily driven by its increasing adoption as a first-line therapy for angina pectoris. The aging population and strategic market developments among players to enhance commercial availability of beta blockers also contribute to this growth. These medications reduce heart rate and weaken heart muscle contractions, making them a crucial treatment option for an increasingly aging population.

The anticoagulants segment is expected to grow at a significant rate over the forecast period. The surge in cases of angina pectoris is propelling the expansion of the anticoagulant drug market, as these medications are frequently prescribed to prevent blood clots and subsequent cardiovascular complications in patients with this condition. The introduction of novel oral anticoagulants (NOACs) has revolutionized the market by offering safer and more effective alternatives to traditional warfarin, thereby driving market growth.

Regional Insights

North America angina pectoris drugs market dominated the global angina pectoris drugs market with a revenue share of over 40.0% in 2023. The increasing demand for minimally invasive procedures is expected to drive the market’s growth in the forecast period. In addition, the market is also being driven by factors such as unhealthy lifestyles, favorable regulatory actions, and a rise in cardiac diseases.

U.S. Angina Pectoris Drugs Market Trends

The angina pectoris drugs market in the U.S. is poised to experience substantial growth during the forecast period, driven by increasing awareness about the condition, improved accessibility of treatments, and favorable insurance coverage. As a result, patients in the U.S. are opting for prescribed therapies, thereby driving the market’s expansion.

Europe Angina Pectoris Drugs Market Trends

Europe angina pectoris drugs market was identified as a lucrative region in this industry. Market growth in the region is aided by the increasing number of patients with cardiovascular diseases, technological advancements, awareness, government initiatives, and hospital research on the angina pectoris drug. In addition, the rising geriatric population is one factor driving market growth.

The angina pectoris drugs market in Germany is anticipated to experience rapid growth during the forecast period, driven by the increasing prevalence of cardiovascular diseases among the elderly. Factors such as a sedentary lifestyle, smoking, and other unhealthy habits are contributing to the rise in cardiovascular diseases, leading to a greater demand for angina pectoris treatments in Germany.

The UK angina pectoris drugs market is showing significant growth in the forecast period. Rising awareness about angina pectoris and its risk factors, combined with public health programs designed to educate about cardiovascular health, is expected to fuel the need for angina pectoris medications in the UK.

Asia Pacific Angina Pectoris Drugs Market Trends

Angina pectoris drugs market in Asia Pacific is expected the fastest growth in the global angina pectoris drugs market with a CAGR of 5.5%. The rise in urbanization, changing lifestyles, and the increasing occurrence of risk factors such as cardiovascular diseases have driven the need for angina pectoris drugs in countries such as China, India, and Japan. As healthcare expenditures continue to rise and the emphasis on preventive care grows, the demand for these medications is on the rise.

China angina pectoris drugs market is projected to experience significant growth during the forecast period, primarily driven by the country’s rapidly aging population and rising prevalence of unhealthy dietary habits. The growing incidence of cardiovascular diseases among the elderly population, coupled with a lack of awareness about healthy lifestyles, is expected to fuel the demand for angina pectoris treatments in China.

The angina pectoris drugs market in India is anticipated to witness significant growth in the forecast period as increased awareness of cardiovascular diseases and the importance of early checkups and treatment lead more individuals to get medical consultations. In addition, government initiatives and awareness programs drive the market growth.

Key Angina Pectoris Drugs Company Insights

The global angina pectoris drugs market is characterized by a competitive landscape featuring established pharmaceutical giants and emerging biotechnology firms, such as Amgen Inc.; Bayer AG; Eli Lilly and Company.; Gilead Sciences, Inc.; and Merck & Co., Inc. Strategic collaborations, partnerships, and licensing agreements drive innovation, while mergers and acquisitions consolidate resources to accelerate drug development and commercialization efforts.

-

Amgen Inc. utilizes living cells to create biologic medicines. These medicines play a crucial role in treating grave illnesses and cater to diseases that have a restricted number of treatment options available. By concentrating on areas with substantial unmet medical needs.

-

Gilead Sciences manufactures medications for serious illnesses. The company places a significant emphasis on scientific research.

Key Angina Pectoris Drugs Companies:

The following are the leading companies in the angina pectoris drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Bayer AG

- AstraZeneca

- Gilead Sciences

- Novartis AG

- GlaxoSmithKline Plc.

- Merck & Co., Inc.

- Amgen Inc.

- Eli Lilly and Company

- Otsuka Pharmaceutical Co., Ltd.

- Sanofi S.A.

- Boehringer Ingelheim International GmbH

Recent Developments

-

In May 2024, Novartis and AC Health entered a partnership for integrated cardiovascular and cancer care, with the objective of expanding access to innovative medicines in the areas of cancer, cholesterol, and heart failure, as well as empowering patients through this collaborative effort.

-

In July 2023, Riparian Pharmaceuticals partnered with Pfizer to advance novel cardiovascular programs, granting Pfizer exclusive rights to a preclinical program to support Riparian’s efforts to discover further drug targets for vasoprotection.

Angina Pectoris Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.43 billion

Revenue forecast in 2030

USD 15.71 billion

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pfizer Inc.; Bayer AG; AstraZeneca; Gilead Sciences; Novartis AG; GlaxoSmithKline Plc.; Merck & Co., Inc.; Amgen Inc.; Eli Lilly and Company; Otsuka Pharmaceutical Co., Ltd.; Sanofi S.A.; Boehringer Ingelheim International GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Angina Pectoris Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global angina pectoris drugs market report based on type, drug class, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stable Angina

-

Unstable Angina

-

Microvascular Angina

-

Prinzmetal Angina

-

-

Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beta Blockers

-

Calcium Antagonists

-

Nitrates

-

Anticoagulants

-

Anti-Platelets

-

Other Drug Classes

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.