- Home

- »

- Pharmaceuticals

- »

-

Anticoagulants Market Size & Share, Industry Report, 2033GVR Report cover

![Anticoagulants Market Size, Share & Trends Report]()

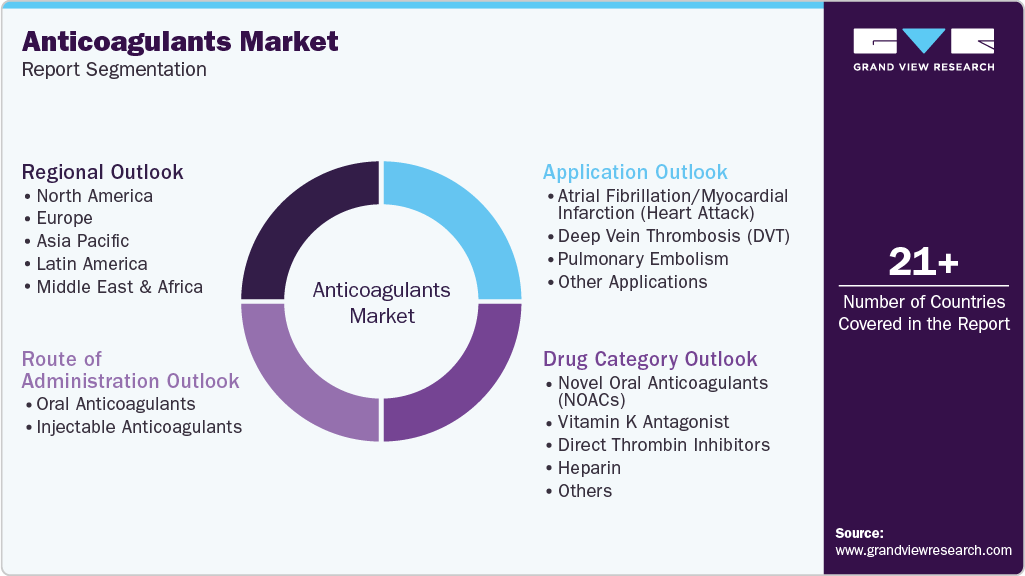

Anticoagulants Market (2026 - 2033) Size, Share & Trends Analysis Report By Drug Category (Novel Oral Anticoagulants, Direct Thrombin Inhibitors, Heparin), By Route of Administration, By Application (Deep Vein Thrombosis (DVT)), Pulmonary Embolism), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anticoagulants Market Summary

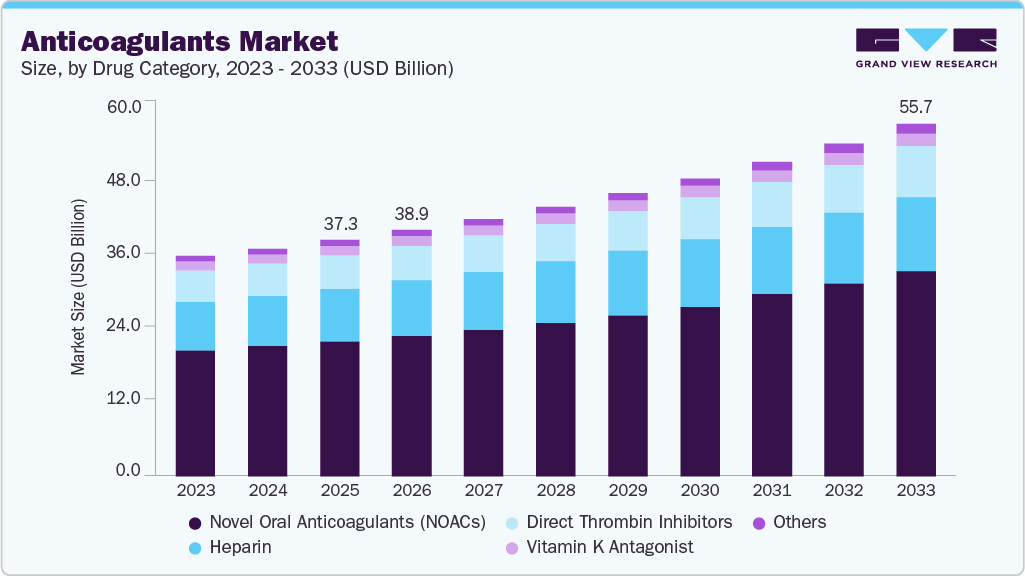

The global anticoagulants market size was estimated at USD 37.35 billion in 2025 and is projected to reach USD 55.72 billion by 2033, growing at a CAGR of 5.26% from 2026 to 2033. The rising prevalence of cardiovascular diseases, such as Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), and Atrial Fibrillation (AF), is expected to drive demand for anticoagulants.

Key Market Trends & Insights

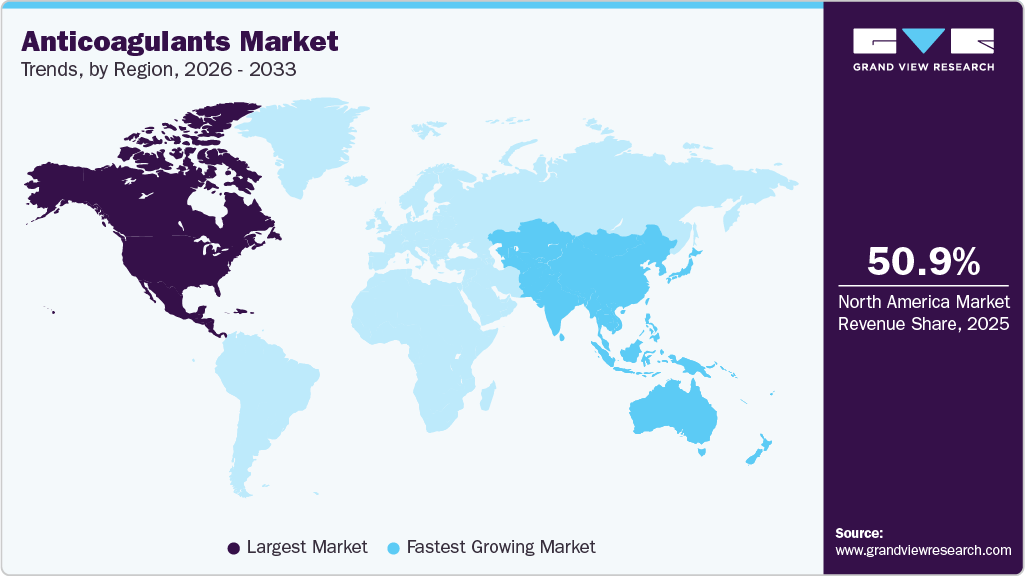

- The North America anticoagulants market held the largest global revenue share of 50.98% in 2025.

- The U.S. anticoagulants industry is expected to grow significantly from 2026 to 2033.

- By drug category, the novel oral anticoagulants (NOACs) segment held the highest market share of 57.11% in 2025.

- By route of administration, the oral anticoagulants segment held the highest market share in 2025.

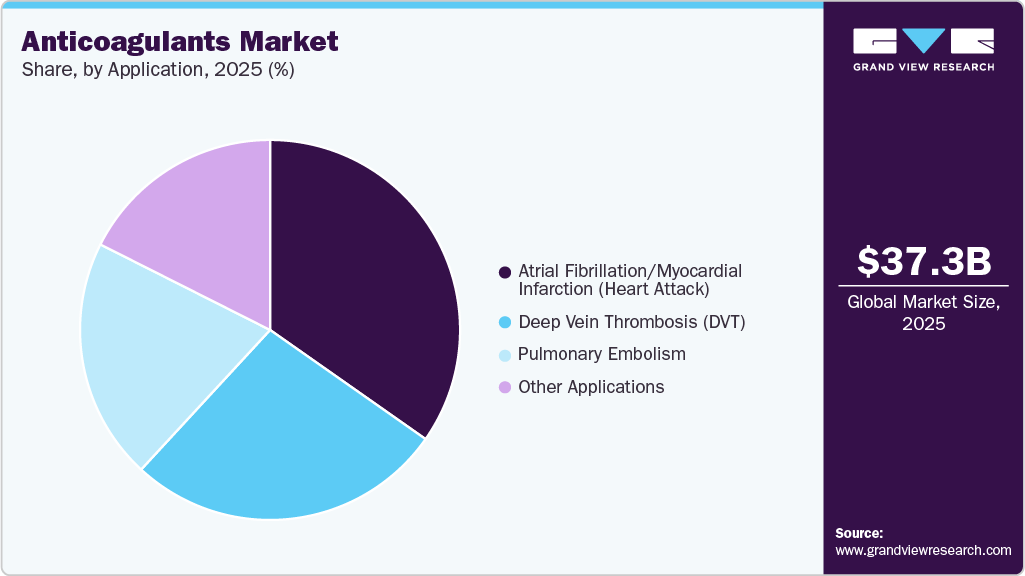

- By application, the atrial fibrillation/myocardial infarction (Heart Attack) segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 37.35 Billion

- 2033 Projected Market Size: USD 55.72 Billion

- CAGR (2026-2033): 5.26%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

In recent years, a rise in venous thromboembolism (VTE) has been reported across various regions. According to the U.S. Centers for Disease Control and Prevention (CDC), in the U.S., up to 900,000 individuals are affected by it each year. CDC also states that nearly 60,000-100,000 fatalities are caused by venous thromboembolism (VTE) every year. Health professionals prefer using anticoagulants to prevent thromboembolic events and complications such as strokes. These aspects are likely to generate significant growth in demand in the anticoagulants industry.

A sedentary lifestyle, increasing urbanization, changing dietary preferences, and a lack of physical activity have contributed to the growing number of individuals experiencing cardiovascular diseases. VTE is also linked with multiple other conditions, including cancer, complicated surgeries, pregnancy, and others. According to the CDC, VTE is one of the leading causes of preventable hospital deaths in the U.S. Such aspects are expected to result in continuous growth in the adoption of anticoagulants.

Recent advancements in healthcare technology related to anticoagulants are anticipated to assist the market in growing. For instance, in February 2024, Roche (F. Hoffmann-La Roche Ltd.) launched novel Factor Xa inhibitor coagulation tests designed to facilitate clinical decisions regarding the prescription of direct oral anticoagulants, primarily for stroke prevention. Furthermore, the increasing incidence of stroke is projected to propel the market growth during the forecast period. Blood thinners are used for stroke prevention in individuals at risk due to various conditions, such as atrial fibrillation, certain heart valve disorders, and previous strokes. As per the CDC, over 795,000 individuals in the U.S. experience stroke every year, out of which approximately 610,000 are first-time or new strokes.

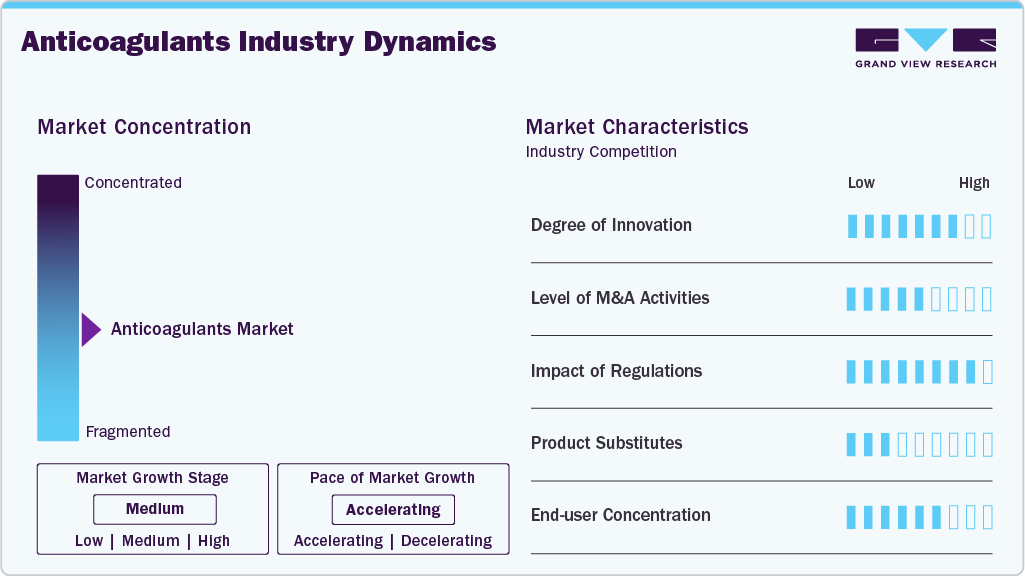

Market Concentration & Characteristics

The anticoagulants market growth stage is moderate, and the pace of growth is accelerating. The market experiences a high degree of innovation driven by advancements in multiple areas of the healthcare industry. For example, advances in pharmacogenomics allow for more personalized anticoagulant therapy. The increasing availability and access to point-of-care diagnostic devices and home monitoring kits have enabled patients to conveniently monitor their coagulation status. The emergence of modern technologies, such as AI, and their integration with medical devices has also led to significant advancements in the detection and analysis of blood clotting.

Pharmaceutical companies engage in M&A activities to expand their product portfolios and enter new therapeutic areas. Acquiring or merging with companies with novel drug candidates or established products can be a strategic move to diversify offerings. Companies pursue M&A to access innovative technologies for anticoagulant development, formulation, or drug delivery. This can enhance their research and development capabilities, potentially leading to the introduction of more advanced anticoagulant therapies. For instance, in February 2025, Novartis announced that it had agreed to acquire Anthos Therapeutics, Inc., a clinical-stage biopharmaceutical company based in Boston, U.S. Anthos has been developing abelacimab, a late-stage drug designed for preventing stroke and systemic embolism, particularly in patients with atrial fibrillation.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national regulatory bodies, have set stringent standards for the approval and registration of anticoagulant drugs. The regulatory process involves extensive preclinical and clinical trials to demonstrate the safety and efficacy of new anticoagulant therapies. Hospitals are major end users of anticoagulant therapies, particularly for acute conditions such as DVT, pulmonary embolism, and post-surgical prophylaxis. Ambulatory care centers, including specialized anticoagulation clinics, contribute to end-user concentration by providing targeted anticoagulation management services. These centers often focus on monitoring and adjusting anticoagulant therapy, ensuring patient adherence, and preventing complications.

Drug Category Insights

The Novel Oral Anticoagulants (NOACs) segment dominated the global anticoagulants industry, accounting for a revenue share of 57.11% in 2025. The growing awareness of the benefits associated with the adoption of NOACs is primarily driving growth. Benefits of NOACs include minimal drug interaction, a broader therapeutic window, fixed daily doses, and others. The growth is also attributed to the rising adoption of NOACs in developing countries as the preferred option over warfarin, owing to their effectiveness and safety.

New drug approvals, product launches, and research-driven product developments are expected to significantly influence the market's growth during the forecast period. For instance, in February 2025, TRIASTEK announced it had received Investigational New Drug (IND) clearance for T20G. In 2024, T20G, a proprietary 3D-printed non-vitamin K antagonist oral anticoagulant (NOAC) product by TRIASTEK, was given IND clearance by China's National Medical Products Administration (NMPA)-the role of anticoagulation therapy in therapeutic interventions linked with stroke prevention in cases related to atrial fibrillation.

The heparin segment is projected to experience significant growth over the forecast period. The indications for heparin and Low Molecular Weight Heparin (LMWH) are expanding to include acute treatment, as well as prevention in high-risk patients, such as those undergoing major surgery or experiencing prolonged immobilization. The increasing prevalence of thrombotic events fuels the demand for heparin and LMWH. Furthermore, heparin and LMWH are often considered cost-effective anticoagulant options, especially in resource-limited healthcare settings. The affordability and effectiveness of these agents make them attractive choices in various healthcare systems globally.

Route of Administration Insights

Oral anticoagulants led the anticoagulants market, accounting for the largest revenue share of 67.70% in 2025. The segment’s growth is primarily driven by the increasing adoption of Novel Oral Anticoagulants (NOACs), ease of use, and growing availability. Oral anticoagulants offer a convenient and patient-friendly alternative to traditional injectable forms. This is particularly crucial for long-term therapy, where patient adherence to the prescribed treatment regimen is essential. The ease of administration contributes significantly to the overall preference for oral anticoagulants among healthcare providers and patients. Increasing research and development activities, driven by the exploration of novel anticoagulants that target Factor XI and FXIa, are expected to generate lucrative growth. These efforts aim to prevent thrombosis while minimizing the negative impact on hemostasis.

The injectable anticoagulants segment is anticipated to experience significant growth from 2026 to 2033. The segment's growth is attributed to its increasing use in treating various medical conditions, including deep vein thrombosis, pulmonary embolism, and atrial fibrillation. These anticoagulants are administered through injections and have a quicker onset of action than oral anticoagulants. Additionally, the prevalence of chronic conditions such as atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE) is increasing globally. These conditions require anticoagulant therapy to prevent blood clots, which can lead to serious complications such as stroke and heart attack. These factors are expected to support the injectable anticoagulants segment in the forecast years.

Application Insights

The Atrial Fibrillation/Myocardial Infarction (Heart Attack) segment dominated the global anticoagulants industry, accounting for a revenue share of34.74% in 2025. Atrial fibrillation is a common heart condition that can lead to blood clots and stroke, and anticoagulants are an effective treatment option for reducing the risk of these complications. New product launches and recent approvals by regulatory authorities are also expected to drive the growth of this segment. For instance, in February 2025, the Central Drugs Standard Control Organization, a regulatory authority in India, approved Edoxaban 15, 30, and 60 mg tablets for the prevention of systemic embolism and stroke in adult patients with Non-Valvular Atrial Fibrillation (NVAF). Such developments are expected to generate greater adoption in cases of patients having more than one risk factor, such as Transient Ischaemic Attack (Tia), hypertension, Congestive Heart Failure, and others.

Deep Vein Thrombosis (DVT) is anticipated to experience significant growth over the forecast period. The growth of this segment is mainly driven by the rising prevalence of DVT and the increasing geriatric population that is more prone to DVT. The use of anticoagulants helps patients slow the growth of existing blood clots and prevent the formation of new ones. Anticoagulants enable the fibrinolytic system and support the dissolution of blood clots. Significantly growing incidence of DVT across multiple regions is expected to drive the growth of this segment.

Regional Insights

The North America anticoagulants market held the largest share of 50.98% in 2025, due to a high prevalence of cardiovascular diseases such as atrial fibrillation and venous thromboembolism. Advanced healthcare infrastructure supports widespread adoption of novel oral anticoagulants, offering patients safer and more convenient treatment options. A strong presence of major pharmaceutical companies and continuous innovations in drugs help maintain leadership in new anticoagulant therapies. High patient awareness and proactive preventive care for thrombosis and stroke contribute to consistent demand. The trend of shifting from older vitamin K antagonists to newer direct oral anticoagulants further strengthens the market.

U.S. Anticoagulants Market Trends

The U.S. dominates North America’s anticoagulant consumption due to the high prevalence of cardiovascular and clotting disorders, especially among aging and higher-risk populations. The sophisticated healthcare ecosystem, combined with multiple anticoagulant manufacturers and extensive market penetration of novel therapies, fuels growth. Clinicians in the U.S. increasingly prescribe direct oral anticoagulants due to their convenience and reduced monitoring requirements. The large patient base with co‑morbidities such as obesity and hypertension raises demand for long-term anticoagulation therapy. Frequent new product launches and strong distribution networks ensure the wide availability of anticoagulant drugs. Overall demand remains high, as clinicians emphasize the importance of stroke and thrombosis prevention across various risk groups.

Europe Anticoagulants Market Trends

Europe represents a mature anticoagulants industry, with a substantial share, owing to the widespread cardiovascular disease burden and an aging population. Well-developed healthcare systems ensure broad access to modern anticoagulant therapies and high adoption of direct oral anticoagulants over older therapies. The growing incidence of lifestyle-related disorders, such as obesity and sedentary habits, increases the need for anticoagulation to prevent thromboembolic events. Orthopedic surgeries and post-surgical thrombosis prevention also drive demand for anticoagulants in many European countries. Strong clinical research activity and medical guideline support encourage physicians to follow best practices in anticoagulation therapy. The stable economic environment and health expenditure support consistent uptake of both oral and injectable anticoagulants.

The UK anticoagulants market contributes significantly to Europe’s growth, supported by the widespread adoption of modern anticoagulant therapies and a growing number of patients with cardiovascular disorders that require long-term management. Healthcare providers in the UK are increasingly favoring direct oral anticoagulants due to their ease of use and lower monitoring burden compared to traditional therapies. The rising incidence of thromboembolic events among elderly populations and patients undergoing surgeries increases demand for preventative anticoagulation. The UK market benefits from strong clinical guidelines and established prescribing practices, which help standardize treatment for atrial fibrillation and deep vein thrombosis. Increasing awareness among patients about the risks of clot-related conditions encourages early diagnosis and the initiation of appropriate therapy. These factors together sustain steady market growth in the UK.

The anticoagulants market in Germany stands out within Europe due to the country's high burden of cardiovascular diseases and robust health infrastructure, which supports advanced care. Patients often receive early diagnosis and timely anticoagulation for conditions like atrial fibrillation and deep vein thrombosis, boosting consumption. Medical practices in Germany increasingly favour direct oral anticoagulants for outpatient management, given their convenience and safety profile. The presence of leading pharmaceutical companies and ongoing clinical research facilitates the introduction of newer anticoagulant options and ensures a stable supply. Demand is further driven by the rising number of surgical procedures, such as orthopedic operations, that require prophylactic anticoagulation. This combination of medical need, infrastructure, and innovation maintains Germany’s significant role in the regional market.

The France anticoagulants market contributes to Europe’s anticoagulants consumption through a consistent incidence of thromboembolic and cardiovascular disorders, requiring long-term anticoagulation therapy. Physicians in France are increasingly adopting newer anticoagulants due to their efficacy and fewer dietary or monitoring constraints, which supports market expansion. The healthcare infrastructure supports broad access to both oral and injectable medications, including anticoagulants used post-surgery to prevent thrombosis. An aging population and rising rates of lifestyle-related health issues, such as hypertension and obesity, amplify the need for preventive care using anticoagulation therapy. Steady pharmaceutical innovation and supply of anticoagulant drugs maintain availability and support uptake. As a result, France remains a stable contributor to the regional market growth.

Asia Pacific Anticoagulants Market Trends

The Asia Pacific anticoagulants industry is expected to register the fastest CAGR of 6.6% over the forecast period, driven by the rising prevalence of cardiovascular diseases and increased thromboembolic risk due to aging populations and lifestyle changes. The expansion of healthcare infrastructure and increased access to modern therapies are supporting the rise in demand across major countries. Growing patient awareness about clot-related conditions and improved diagnosis rates encourage the use of anticoagulant therapies, including direct oral anticoagulants. The large and growing population base in countries such as China, Japan, and India creates a substantial potential patient pool. Rapid economic development and rising per capita income support the affordability and uptake of advanced anticoagulant treatments. Together, these factors position Asia Pacific as a major growth engine for the global market.

The Japan anticoagulants market is expected to grow over the forecast period. In Japan, anticoagulant demand is rising due to the increasing incidence of atrial fibrillation and other cardiovascular and thromboembolic conditions among the aging population. Physicians in Japan increasingly prescribe newer oral anticoagulants for outpatient management, reflecting global adoption trends. Improved awareness about stroke and clot prevention supports patient demand and earlier initiation of therapy. Healthcare infrastructure and pharmaceutical supply chains ensure the availability of both branded and generic anticoagulants for long-term management of these conditions. Regular diagnostic screening for cardiovascular disorders contributes to early detection and treatment, supporting stable growth. The combination of demographic trends, evolving clinical practices, and access to modern therapies sustains growth in Japan’s market.

The anticoagulants market in China is among the fastest-growing in Asia Pacific. The country is experiencing a surge in demand due to the increasing prevalence of cardiovascular disorders and venous thromboembolism associated with lifestyle changes. The rapid expansion of healthcare infrastructure and improved patient access in urban and some semi-urban areas support the wider adoption of modern anticoagulants. Growing awareness among patients and physicians about the risks of thrombosis and stroke fosters increased therapy uptake. Rising disposable incomes and a growing middle-class population enable the affordability of newer anticoagulant treatments. Pharmaceutical companies expanding their footprint in China contribute to broader drug availability and competitive pricing. These dynamics suggest China will continue to exhibit strong growth in anticoagulant usage.

Latin America Anticoagulants Market Trends

Latin America’s anticoagulants industry is gradually growing due to the rising incidence of cardiovascular diseases and increasing recognition of thromboembolic conditions requiring treatment. Urbanization and the improvement of healthcare infrastructure in key countries support increased access to anticoagulant therapies. Major urban hospitals are beginning to transition from traditional anticoagulants to newer therapies, providing better safety and convenience for patients. Increased awareness among physicians and patients about clot-related risks encourages diagnosis and treatment initiation. Nevertheless, overall market penetration remains lower compared to developed regions, leaving room for growth as healthcare access expands. The rising burden of heart disease and strokes in the region underlines the potential for further market development.

The Brazil anticoagulants market is projected to grow over the forecast period. In Brazil, demand for anticoagulants is driven by increasing cardiovascular disease prevalence and growing numbers of patients with thromboembolic disorders requiring long-term therapy. Expanding healthcare infrastructure in urban centers enables better access to both oral and injectable anticoagulant therapies. Physicians in Brazil are gradually adopting modern anticoagulants, which offer improved safety and fewer monitoring constraints over older treatments. Enhanced disease awareness among patients leads to more frequent diagnosis and initiation of therapy for atrial fibrillation, deep vein thrombosis, and other clot-related conditions. As public and private healthcare systems expand coverage, the uptake of anticoagulants is expected to rise. Collectively, these factors support a stable yet growing market for anticoagulants in Brazil.

Middle East & Africa (MEA) Anticoagulants Market Trends

Middle East & Africa is experiencing moderate growth in anticoagulant consumption, driven by the rising incidence of cardiovascular diseases and venous thromboembolism, which increases demand for effective clot-prevention therapies. Uptake remains concentrated in major urban and tertiary care hospitals with limited penetration in rural or underserved areas. Growing awareness of thromboembolic risks and increased healthcare spending in some countries support a gradual rise in the adoption of anticoagulant drugs. Pharmaceutical companies are gradually expanding distribution networks in key MEA markets to improve access. However, inconsistent healthcare access and economic diversity across countries limit overall market penetration. Ongoing demographic changes and increasing disease burden provide potential for future market growth as infrastructure improves.

In the Saudi Arabia anticoagulants market, the demand is rising due to the growing rates of cardiovascular diseases, including atrial fibrillation and deep vein thrombosis, prompting the need for long-term blood-thinning therapy. Urbanization and the increasing incidence of risk factors such as obesity and sedentary lifestyles contribute to a higher clotting disease burden. Access to modern healthcare facilities in major cities enables the use of newer anticoagulant therapies, improving patient treatment options. Physicians are increasingly prescribing advanced oral anticoagulants to manage thrombosis risk among high-risk populations. As healthcare infrastructure and patient awareness improve, the adoption of anticoagulants is likely to increase further. These factors collectively support the market growth.

Key Anticoagulants Company Insights

Some of the key companies operating in the global anticoagulants industry are Aspen Holdings, Pfizer Inc., Sanofi, Bristol-Myers Squibb Company, and Bayer AG. Major market participants have been embracing strategies such as new product development, innovation-based product launches, improved investment in research, and collaborations with other organizations.

-

Aspen Holdings is a pharmaceutical company specializing in marketing and manufacturing a wide range of post-patent, branded medicines. It offers injectable products, prescriptions, and OTC medicines. Its product range linked with thrombosis includes Arixtra, Fraxiparine, Fraxodi, and others.

-

Pfizer Inc., one of the major market participants in the biopharmaceuticals industry, offers a variety of anticoagulation products, including a novel oral anticoagulant (NOAC), Eliquis (apixaban). It also provides Heparin Sodium Injection in various forms, including IV bags, vials, and syringes.

Key Anticoagulants Companies:

The following are the leading companies in the anticoagulants market. These companies collectively hold the largest market share and dictate industry trends.

- Aspen Holdings

- Pfizer Inc.

- Bristol-Myers Squibb Company

- GSK plc

- Sanofi

- Bayer AG

- Boehringer Ingelheim International GmbH

- DAIICHI SANKYO COMPANY, LIMITED

- Johnson & Johnson Services, Inc.

- Eisai Co., Ltd.

Recent Developments

-

In December 2024, Novo Nordisk announced its Alhemo (concizumab-mtci) injection had received approval from the U.S. Food and Drug Administration (FDA). The approval is expected to strengthen its portfolio and further its commitment to offering solutions for rare bleeding disorders.

-

In October 2024, Pfizer Inc. announced that it had received U.S. FDA approval for its HYMPAVZI (marstacimab-hncq), developed for treating Hemophilia A or B without inhibitors. It is a once-weekly subcutaneous prophylactic treatment.

-

In November 2023, Pharmascience Canada announced the launch of the generic drug (Pr) pms-RIVAROXABAN. This medicine belongs to the anticoagulant (blood thinner) group and helps prevent blood clots by directly blocking the activity of Factor Xa.

-

In July 2023, Endo International plc. launched bivalirudin injection in ready-to-use (RTU) vials in the U.S. with the collaboration of Gland Pharma Limited, India, and MAIA Pharmaceuticals, Inc. The new RTU vials of bivalirudin are expected to be more convenient and efficient for healthcare professionals.

Anticoagulation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 38.92 billion

Revenue forecast in 2033

USD 55.72 billion

Growth rate

CAGR of 5.26% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug category, route of administration, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Aspen Holdings; Pfizer Inc.; Bristol-Myers Squibb Company; GSK plc; Sanofi; Bayer AG; Boehringer Ingelheim International GmbH; DAIICHI SANKYO COMPANY, LIMITED; Johnson & Johnson Services, Inc.; Eisai Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anticoagulants Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the anticoagulants market report based on drug category, route of administration, application, and region:

-

Drug Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Novel Oral Anticoagulants (NOACs)

-

Eliquis

-

Xarelto

-

Savaysa & lixiana

-

Pradaxa

-

-

Vitamin K Antagonist

-

Direct Thrombin Inhibitors

-

Heparin

-

Type

-

Low Molecular Weight Heparin

-

Ultra-low Molecular Weight Heparin

-

Unfractionated Heparin

-

-

Source

-

Porcine

-

Bovine

-

Others

-

-

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral Anticoagulants

-

Injectable Anticoagulants

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Atrial Fibrillation/Myocardial Infarction (Heart Attack)

-

Deep Vein Thrombosis (DVT)

-

Pulmonary Embolism

-

Other Applications

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anticoagulants market size was valued at USD 37.34 billion in 2025 and is expected to reach USD 38.91 billion in 2026.

b. The global anticoagulants market is expected to expand at a compound annual growth rate (CAGR) of 5.26% from 2026 to 2033 to reach USD 55.71 billion by 2033.

b. Novel oral anticoagulants (NOACs) segment dominated the anticoagulants market with a revenue share of 57.11% in 2025. The growth of the segment is attributed to the rising adoption of NOACs in developing countries as the preferred option over warfarin owing to its effectiveness and safety.

b. Some key players operating in the anticoagulants market include Aspen Holdings; Pfizer Inc.; Bristol-Myers Squibb Company; GSK plc; Sanofi, Bayer AG; Boehringer Ingelheim International GmbH; DAIICHI SANKYO COMPANY, LIMITED; Johnson & Johnson Services Inc.; Eisai Co., Ltd.

b. Key factors that are driving the market growth include the rising prevalence of cardiovascular diseases, such as deep vein thrombosis, pulmonary embolism, and atrial fibrillation, aided by the growing aging population, who are more prone to conditions that require anticoagulant therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.