- Home

- »

- Animal Health

- »

-

Animal Disinfectant Market Size, Share, Growth Report, 2030GVR Report cover

![Animal Disinfectant Market Size, Share & Trends Report]()

Animal Disinfectant Market Size, Share & Trends Analysis Report By Product (Alcohol-based Disinfectant, Iodine-containing Disinfectant), By Form (Liquid, Powder), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-277-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Animal Disinfectant Market Size & Trends

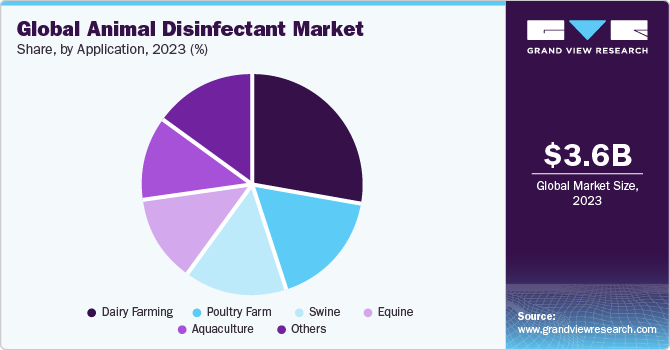

The global animal disinfectant market size was estimated at USD 3.56 billion in 2023 and is projected to grow at a CAGR of 7.50% from 2024 to 2030. Rising prevalence of infectious diseases in animals, high demand for meat and dairy products, and focus on the development of sustainable animal disinfectants are some of the key factors driving the growth of this market.

According to the World Organization for Animal Health (OIE), in 2023, some of the most common animal diseases outbreaks included avian influenza (AI), with ongoing outbreaks reported in various countries, leading to significant losses in domestic poultry and wild birds. Similarly, zoonotic diseases such as salmonellosis, brucellosis, and tuberculosis continue to pose a threat, with instances of human infections linked to contact with animals and animal products. Animal disinfectants play a crucial role in preventing spread of diseases and infections in livestock and poultry farming.

Additionally, the growing development and launch of innovative animal disinfectants is expected to significantly drive the animal disinfectant market’s growth . For instance, in April 2023, Virox Technologies has introduced Rescue Refill Wipe pouches, containing eco-friendly disinfectant chemistries, with 90% less plastic than traditional canisters. Designed for insertion into existing wipe canisters, they enable reuse, reducing single-use plastic waste in veterinary clinics and animal hospitals where large volumes of wipes are used daily.

With a growing emphasis on animal welfare and disease prevention, there is increased awareness among farmers and animal owners about the importance of maintaining clean and hygienic environments for their animals. This drives demand for effective disinfectant products to control and prevent spread of diseases in livestock and companion animals.

Market Concentration & Characteristics

The market for animal disinfectants is currently in a phase of rapid and accelerating growth, marked by a high level of innovation. This is attributed to continuous development of more advanced and effective disinfectants aimed at addressing outbreaks of animal diseases. Additionally, continuous R&D investments to develop and manufacturer potent disinfection solution for a wide range of animal species is expected to boost the market growth. Developing innovative and more effective disinfectant allows companies to stay competitive and meet evolving needs of veterinarians and pet owners.

The market is highly fragmented and competitive. Market players are involved in implementation of various strategic initiatives, such as product launch, partnerships and collaborations, mergers and acquisitions, and regional expansion to capture a larger market share. For instance, in July 2023, Solenis, a major specialty chemicals manufacturer for water-intensive industries, has acquired Diversey Holdings, Ltd. in an all-cash deal worth around $4.6 billion. Diversey, specializes for its offerings in hygiene, infection prevention, and cleaning solutions, adds significant value to Solenis' portfolio.

The entry of human disinfectant manufacturing companies into animal disinfectant market with large product portfolio is expected to further intensify competition. For instance, In November 2023, Virox Technologies Inc. has partnered with Diversey to bring its patented Citr-IQ disinfectant technology to various sectors, including healthcare. This collaboration aims to enhance disinfection standards and provide safer and more environmentally friendly alternatives in the market.

Product Insights

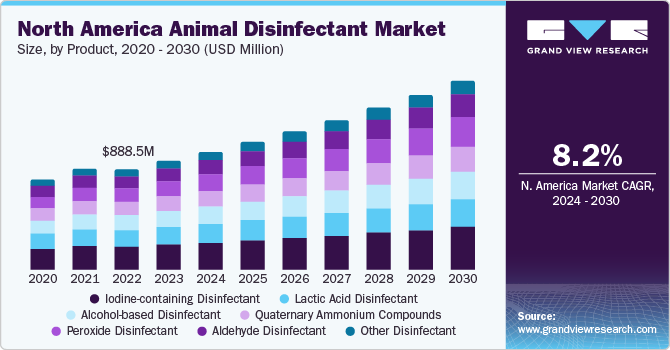

The iodine-containing disinfectant segment dominated the market with a revenue share of more than 23.05% in 2023. Iodine-containing animal disinfectants are more in demand due to their effectiveness in killing a broad range of microorganisms, including bacteria, viruses, and some spores. Compared to some other disinfectants, iodine-based products may have a lower likelihood of microbial resistance development. This characteristic enhances their long-term effectiveness in controlling pathogens.

The quaternary ammonium compounds segment is anticipated to grow at the fastest CAGR from 2024 to 2030. Quaternary Ammonium (QA)-based disinfectants typically have fast-acting properties, allowing for rapid disinfection of surfaces. Additionally, they often dry quickly, minimizing downtime and allowing for faster turnover of animal housing areas. With an increasing focus on biosecurity measures to prevent disease outbreaks in animal populations, QA-based disinfectants play a crucial role in maintaining a clean and hygienic environment. Their effectiveness against a broad range of pathogens aligns with biosecurity objectives, driving their demand in animal sector.

Form Insights

The liquid forms segment accounted for the largest revenue share of 49.42% in 2023. The liquid animal disinfectants are mainly used in various applications due to their many properties, such as their soluble nature and simplicity of availability. They are especially efficient against numerous pathogenic diseases. Moreover, liquid disinfectants are user-friendly and versatile, making them suitable for a variety of applications in animal facilities. Additionally, their ability to efficiently penetrate surfaces ensures comprehensive disinfection, playing a crucial role in sustaining a sanitary and hygienic environment in animal housing.

The others segment is expected to register the fastest CAGR from 2024 to 2030. The other forms include disinfecting wipes and sprays. Increasing development and introduction of disinfecting wipes are fueling growth of the market. These wipes offer convenience and ease of use, providing a simple solution for disinfecting surfaces in animal facilities. These innovative products offer convenience and ease of use, catering to evolving needs of animal owners and caregivers. With their quick and efficient application, disinfecting wipes and sprays are gaining popularity across various animal facilities, including veterinary clinics, shelters, grooming salons, and households.

Application Insights

The dairy farming segment held the highest revenue share of 28.22% in 2023. Disinfectants are used to maintain high levels of hygiene on farms, prevent the spread of infections and diseases in livestock, and protect animals during birth, breeding, and feeding in dairy farms. Dairy farms are susceptible to various infectious diseases that can affect both health of animals and quality of milk production. Disinfectants are crucial in preventing and controlling spread of diseases within the herd. They help eliminate or reduce microbial load on surfaces, equipment, and facilities, minimizing risk of infections. Similarly, dairy farms are subject to strict regulations related to milk quality and safety. Use of approved disinfectants helps farmers comply with regulatory standards, ensuring that milk produced meets hygiene and safety requirements for human consumption.

The others application segment is estimated to grow at the fastest CAGR from 2024 to 2030. Other applications include disinfectants used for pets and small animals. Pet owners are increasingly being aware of the importance of maintaining health and hygiene of their pets to prevent diseases and ensure their well-being. This awareness drives the demand for pet disinfectants to sanitize living areas, pet bedding, toys, and other surfaces frequented by pets. Occasional outbreaks of infectious diseases in pets, such as canine parvovirus and feline calicivirus highlights the importance of effective disinfection to control disease spread. These outbreaks can lead to increased awareness and demand for pet disinfectants among pet owners and veterinary professionals.

Regional Insights

North America dominated the global market with a revenue share of 27.19% in 2023, attributed to the rising concerns about zoonotic diseases, importance of biosecurity measures, the ongoing advancements in disinfectant formulations and application technologies, rising consumer preference for high-quality disinfectants, and a ban on antibiotics in animal feed. Innovations such as improved efficacy, reduced environmental impact, and enhanced safety profiles contribute to adoption of disinfectant products in animal industry.

U.S. Animal Disinfectant Market Trends

The animal disinfectant market in the U.S. is poised to grow at a significant CAGR over the forecast period. The outbreaks of diseases such as avian influenza, porcine epidemic diarrhea virus (PEDv), and African swine fever (ASF) pose significant threats to animal populations in the U.S. To mitigate risk of disease transmission and control outbreaks, there is a growing need for effective disinfectants in animal production facilities. Additionally, growing pet ownership is also driving the demand for animal disinfectants. Pet owners are increasingly showing concern over the health and hygiene of their pets, leading to a greater demand for disinfectant products tailored for household use.

Europe Animal Disinfectant Market Trends

The animal disinfectant market in Europe held the second-largest revenue share in 2023. During 2023, as per the World Health Organization (WHO), Europe encountered a significant epidemic of A(H5N1) viruses affecting birds, with incidences observed in domestic birds, wild birds, and mammals across 24 nations. Increasing epidemic of A(H5N1) viruses in animals across Europe is expected to drive a surge in demand for animal disinfectants. As the outbreaks affect both domestic and wild birds, as well as mammals, there is an increased emphasis on implementing stringent biosecurity measures in animal-related facilities. This includes the need for effective disinfectants to sanitize environments, equipment, and surfaces, playing a crucial role in preventing the spread of the virus among animal populations. Growing awareness of the importance of biosecurity and disease control is likely to stimulate the demand for high-quality animal disinfectants in Europe as a proactive measure to safeguard animal health and curb the spread of A(H5N1) viruses. Europe has stringent regulations and standards for animal health and welfare, necessitating the use of high-quality disinfectants.

The animal disinfectant market in Germany is expected to witness growth over the forecast period. In Brandenburg, Germany, 3,007 cases of African swine fever (ASF) have been confirmed in wild boar, posing challenges for containment due to the large wild boar population and their extensive movement. Additionally, another case of ASF was reported in farm pigs in Brandenburg, prompting the precautionary slaughter of 11 animals. These outbreaks have led to bans on German pigmeat imports by countries like China. Rising incidents of ASF highlight the urgent requirement for robust biosecurity measures in livestock farming to curb disease transmission. Disinfectants are integral to these measures, as they sanitize facilities and equipment. As concerns about disease outbreaks grow, there's a probable increase in demand for high-quality disinfectant products as farmers prioritize protecting their livestock and adhering to regulations, ultimately ensuring animal and consumer health and safety.

The UK animal disinfectant market is projected to grow in the forthcoming years. Rising number of animal disinfectant approvals by the Department for Environment, Food & Rural Affairs (Defra) in UK is significantly contributing to the market growth. With Defra's approval, these disinfectants gain official recognition for their effectiveness and safety in combating pathogens in animal environments. With Defra's approval, farmers gain access to a wider range of approved disinfectant products, ensuring effectiveness and compliance with regulations. This leads to increased adoption of disinfectants among farmers, driving market growth as they prioritize disease prevention and animal welfare. Moreover, growing emphasis on biosecurity measures by Defra underscores importance of disinfection in livestock farming, further fueling demand for approved disinfectant products in UK.

Asia Pacific Animal Disinfectant Market Trends

Asia Pacific is anticipated to witness significant growth during the forecast period. APAC is home to some of the world's largest livestock industries, including poultry, swine, and cattle. With increasing demand for meat, dairy, and other animal products driven by population growth and rising incomes, there is a parallel increase in the need for surface disinfectants to maintain biosecurity and prevent disease outbreaks in intensive animal production systems. Increasing awareness of zoonotic diseases, which can be transmitted between animals and humans, is prompting greater emphasis on disease prevention and control in animal husbandry. This awareness drives the adoption of disinfectants to minimize the risk of disease transmission and safeguard public health.

The India animal disinfectant market is expected to grow during the forecast period. This growth is driven by the rising awareness and emphasis on animal health and hygiene in agriculture and livestock sector. With an increasing focus on preventing the disease transmission among animals, farmers and livestock owners are adopting rigorous biosecurity measures, creating a demand for effective and efficient animal disinfectant products. Increasing product launches of pet disinfectants by Indian players present significant growth opportunities in India. As more domestic companies introduce specialized products catering to pet hygiene, it not only addresses the rising awareness of pet health but also expands the overall market scope. This trend can lead to a diversified range of animal disinfectant offerings, tailored for different species and purposes.

Latin America Animal Disinfectant Market Trends

The growing demand for meat and dairy products is boosting livestock farming across the region, thus increasing the need for effective disinfection solutions to maintain animal health and productivity. Furthermore, increasing outbreaks of animal diseases such as foot-and-mouth disease and avian influenza have increased awareness about biosecurity measures. This leads to more use of disinfectants to prevent and control infections. Thus growing livestock animal population and awareness about effective animal disinfectant are expected to contribute to the market growth.

The animal disinfectant market in Mexico is growing as the country ranks among the top 10 global chicken meat producers, faced a bird flu outbreak in 2023, emphasizing critical need for enhanced biosecurity measures in poultry industry. The incident is expected to drive demand for animal disinfectants in Mexico as authorities, led by Senascia, encourage farmers to prioritize biosecurity protocols to safeguard national poultry production.

MEA Animal Disinfectant Market Trends

The animal disinfectant market in Middle East & Africa is experiencing steady growth, due to increasing concerns about animal health and welfare, along with the growing demand for meat, dairy, and poultry products across the region. Moreover, the poultry and livestock sectors are significant contributors to the region's agricultural output. As these industries expand to meet the growing demand for animal products, the need for effective disinfection solutions becomes more popular, thus contributing to market growth.

The South Africa animal disinfectant market is anticipated to witness growth from 2024 to 2030. In 2023, South Africa faced multiple outbreaks of highly contagious avian influenza (H5N1) in various poultry farms, resulting in the removal of approximately 7.5 million chickens to contain the spread. These outbreaks posed a threat of egg and poultry shortages for consumers, prompting import restrictions and extensive culling within the poultry industry. The South African Poultry Association confirmed the implementation of various precautionary measures on affected farms, including isolation, culling of infected birds, and thorough disinfection of facilities and equipment. Reduced livestock production due to disease outbreaks is anticipated to drive demand for animal disinfectants in South Africa.

Key Animal Disinfectant Company Insights

The market is dominated by key players such as Neogen Corp.; Virox Technologies Inc.; GEA Group Aktiengesellschaft; KERSIA GROUP; LANXESS AG; Sanosil Ltd.; Diversey Inc.; and Zoetis Inc. Developing effective and safe disinfectant compounds for animal use requires extensive R&D efforts, and companies are investing in R&D activities to enhance their product offerings. Companies are also focusing on expanding their production facilities by launching new products due to extensive research and development (R&D) initiatives. Moreover, key players differentiate their products by offering sustainable and eco-friendly options, which are becoming increasingly important to customers.

Key Animal Disinfectant Companies:

The following are the leading companies in the animal disinfectant market. These companies collectively hold the largest market share and dictate industry trends.

- Neogen Corporation

- Zoetis Inc.

- Solvay Group

- Kersia Group

- Steroplast Healthcare Limited

- GEA Group

- Albert Kerbel GMBH

- PCC Group

- G Sheperdanimal Health

- Sanosil Ag

- Delaval Inc

- Stepan Company

- Fink Tech Gmbh

Recent Developments

-

In January 2023, Planet Pets, a company specialized pet-care product, has launched Zap Kennel Wash, India's first disinfectant designed specifically for pet owners to combat odor issues and prevent spread of deadly viruses among pets. This product is suitable for use in veterinary clinics, hospitals, and households with pets.

-

In November 2022, Neogen Corporation has introduced its well-established Synergize disinfectant in European, Middle Eastern, and African markets. Synergize, a trusted solution in North America for over two decades, is recognized for its effectiveness in biosecurity and research practices. It is relied upon by industries such as swine, poultry, cattle, equine, and companion animals to prevent spread of diseases proactively.

-

In 2022, Byotrol, a specialist infection prevention and control company, launched next-generation ANIGENE range into animal health sector. Launch of ANIGENE is part of Byotrol's strategy to expand its product portfolio and address growing demand for effective infection control solutions in various sectors, including animal health.

Animal Disinfectant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.82 billion

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 7.50% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, form, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Neogen Corporation; Zoetis Inc.; Solvay Group; Kersia Group; Steroplast Healthcare Limited; GEA Group; Albert Kerbel GMBH; PCC Group; G Sheperdanimal Health; Sanosil Ag; Delaval Inc.; Stepan Company; Fink Tech GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Disinfectant Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global animal disinfectant market report based on product, animal type, form, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcohol-based Disinfectant

-

Iodine-containing Disinfectant

-

Aldehyde Disinfectant

-

Peroxide Disinfectant

-

Quaternary Ammonium Compounds

-

Lactic Acid Disinfectant

-

Other Disinfectant

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Livestock Animal

-

Companion Animal

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Farming

-

Poultry Farm

-

Aquaculture

-

Swine

-

Equine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global animal disinfectant market size was estimated at USD 3.56 billion in 2023 and is expected to reach USD 3.82 billion in 2024.

b. The global animal disinfectant market is expected to grow at a compound annual growth rate of 7.50% from 2024 to 2030 to reach USD 5.90 billion by 2030.

b. Europe dominated the animal disinfectant market with a share of 39.88% in 2023. This is attributable to the rising prevalence of several animal diseases and growing awareness of the importance of biosecurity and disease control.

b. Some key players operating in the animal disinfectant market include Neogen Corporation; Zoetis Inc.; Solvay Group; Kersia Group; Steroplast Healthcare Limited; GEA Group; Albert Kerbel GMBH; PCC Group; G Sheperdanimal Health; Sanosil Ag; Delaval Inc; Stepan Company; Fink Tech Gmbh.

b. Key factors that are driving the market growth include rising prevalence of infectious diseases in animals, increasing demand for meat and dairy products, and growing focus on the development of sustainable animal disinfectants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."