- Home

- »

- Disinfectants & Preservatives

- »

-

Surface Disinfectant Market Size, Share, Growth Report 2030GVR Report cover

![Surface Disinfectant Market Size, Share & Trends Report]()

Surface Disinfectant Market (2024 - 2030) Size, Share & Trends Analysis Report By Composition (Chemical, Biobased), By Form (Liquid, Wipes), By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-721-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surface Disinfectant Market Summary

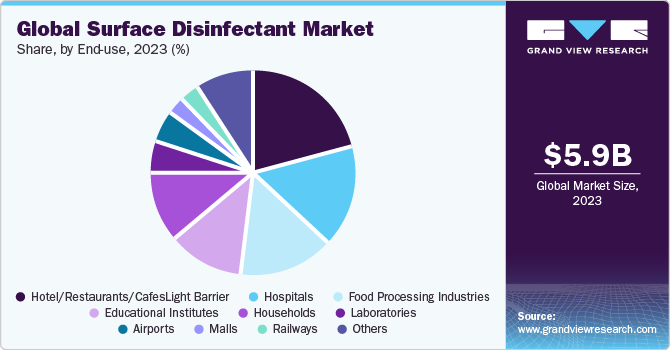

The global surface disinfectant market size was estimated at USD 5.85 billion in 2023 and is projected to reach USD 9.49 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030. The growth is attributed to several factors such as changing lifestyles in developing economies and the rising awareness among livestock farmers concerning animal diseases and disinfections in livestock farms.

Key Market Trends & Insights

- North America region dominated the surface disinfectant market with a revenue share of more than 33.0% in 2023.

- By composition, the chemical segment dominated the surface disinfectant market with a high revenue share of more than 90.0% in 2023.

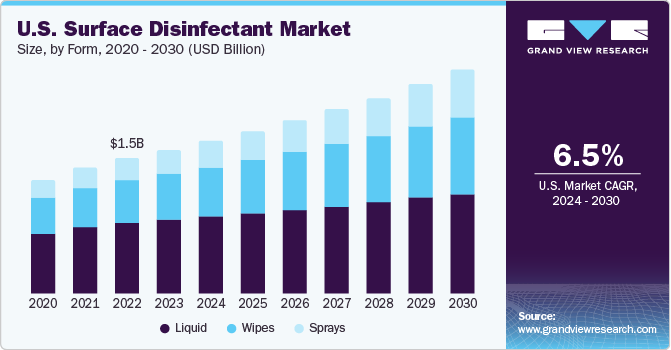

- By form, the liquid segment dominated the global surface disinfectants market with a high revenue share of more than 62.0% in 2023.

- By application, the in house segment dominated the surface disinfectant market with a revenue share of over 68.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.85 Billion

- 2030 Projected Market Size: USD 9.49 Billion

- CAGR (2024-2030): 7.2%

- North America: Largest market in 2023

There has been a significant rise in demand for cleaning products, sanitizers, and disinfectants as surface disinfectant market is experiencing a resurgence globally, fueled by a heightened awareness of hygiene and sanitation post-pandemic. This has led to a surge in demand for products that combat germs and viruses on surfaces, positively impacting market growth.The raw materials used in the production of surface disinfectants are primarily the by-products of the petroleum sector. Local manufacturers in the developed economies of Europe, North America, and China mainly source these raw material ingredients. Recently, the industry observed a shift in the trend toward the usage of biodegradable surface disinfectants for preventing chemical-related toxicity. The raw materials required for biodegradable surface disinfectants are cheaper in comparison to chemicals and are easily available. As a result, bio-based surface disinfectant demand is expected to overtake conventional petroleum-based surface disinfectants in the coming future.

Surface disinfectant products market has witnessed a low to moderate rise in prices post pandemic. Sudden upsurge in demand for surface disinfectants post COVID-19 and rising prevalence of chronic diseases, prevalence of HAIs, encouraging government initiatives, and stringent regulations on disinfection and sterilization. These factors have led to a rise in demand for the product especially in developed economies of North America and Europe.

Surface disinfectants have various chemical substances. When used as per guidelines yield magnificent results. They help prevent the occurrence and transmission of various diseases. However, these substances can be harmful to humans and animals and ultimately leads to environmental problems. Incomplete knowledge regarding the proper use of surface disinfectants and the health hazards associated with these products can pose a potential threat to the market growth.

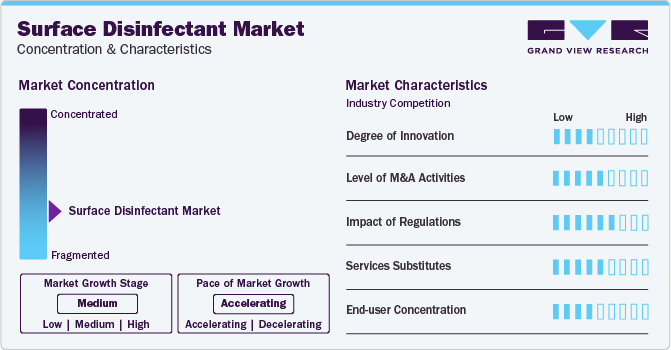

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The market is characterized by increasing awareness among consumers about hygiene and preventive healthcare. The market is also characterized by a high level of merger and acquisition activity by leading manufacturers to consolidate market share. Emerging players resort to long-term agreements and collaboration in a competitive environment. The competitive nature of the market encourages companies to explore synergies and target players with innovative technologies and complementary products.

The market is also heavily influenced by stringent rules & regulations. Regulations pertaining to product safety, environmental impact, and production standards. Further, companies have to be compliant with regulatory requirements in end-use sectors, such as food & healthcare industry, that have a negative impact on the market. Key players are concentrating on using advanced technologies and adopting new marketing strategies to strengthen their base to generate more revenue in the near future.

Increasing awareness among consumers regarding the toxicity of chemical-based products, coupled with the growing disposable incomes of majority of population in developed economies, has compelled several manufacturers to produce biobased surface disinfectants. This poses challenge for surface disinfectant products & services. Therefore, industry players focused on optimizing and managing supply efficiency and being competitive in the market by enhancing their operational efficiency, increasing productivity, and reducing lead time. Also, differentiate their products by highlighting unique features with respect to their applications.

Composition Insights

Chemical products dominated the surface disinfectant market with a high revenue share of more than 90.0% in 2023.This is attributed to the rising utilization of hydrogen peroxide in industries such as food packaging, and in hospitals to disinfect various surfaces. Also, the rising utilization of quaternary ammonium compounds, as well as alcohols is anticipated to have a positive impact on the market growth.

Chemical surface disinfectants are primarily classified into two types, oxidizing and non-oxidizing disinfectants. Non-oxidizing disinfectants comprise aldehydes, amphoteric phenolics, alcohol, and quaternary ammonium compounds (QACs). These disinfectants are majorly segmented into three types which are, low level (QAC, Phenolic), intermediate level (iodine, alcohols, iodophore, hypochlorites), and high-level (ortho-phthalaldehyde, hydrogen peroxide, peracetic acid, formaldehyde, glutaraldehyde) disinfectants.

Biobased surface disinfectants are viewed as alternatives to chemical surface disinfectants owing to their non-toxic, biodegradable, and environment-friendly characteristics. The FDA approval to use biobased products in commercialization and formulations of surface disinfectants is expected to create huge opportunities for market participants. Also, the increasing application scope of biobased surface disinfectants along with a high potential to replace chemical surface disinfectants at economical levels is anticipated to create lucrative opportunities for existing as well as new market participants.

Form Insights

Liquid form dominated the global surface disinfectants market with a high revenue share of more than 62.0% in 2023. This high share is attributed to their variety of applications in industrial as well as household usage like kitchen fixtures, glazed ceramic tile, windows, plastics, exterior surfaces of applications, vinyl, and glass.

Liquid surface disinfectants are found in liquids and gels forms with minimum viscosity. Liquid disinfectants are toxic antimicrobial or biocidal, strong chemicals that can be used on contaminated surfaces. Biobased surface disinfectants are generally used in liquid form. Sodium hypochlorite is one of the commonly used liquid disinfectants in the livestock industry. It is an aqueous solution, which is not affected by water hardness. Such liquid disinfectants are used to omit the risk of several diseases as well as treat livestock infections.

Furthermore, wipes are moistened pieces of plastic or cloth. Surface disinfectant wipes are anticipated to witness growth because of their minimum probabilities of cross-contamination, convenience, and nil water consumption. Wipes are used for disinfecting equipment, especially in hospitals, where the use of liquids and sprays is not that easy.

Application Insights

In house application dominated the surface disinfectant market with a revenue share of over 68.0% in 2023.Its high share is attributable to the sharp increase in the product demand for regular cleaning activities and disinfecting the interior of houses, especially after the ongoing pandemic situation.

In-house surface applications include industrial, commercial, and household surfaces. The Centers for Disease Control and Prevention (CDC) has laid some regulations and recommendations for the disinfecting and cleaning processes to be followed. This process does not necessarily kill or clean all germs but lowers the risk of spreading diseases and infections caused by viruses, fungi, and bacteria.

Other applications of surface disinfectants include transportation and outdoor disinfection. The product demand from these applications has increased significantly. Chemical-based surface disinfectants are most likely to dominate the market as they are easy to apply, economical, and widely available.

End-use Insights

Hotel/Restaurants/Cafes dominated the surface disinfectant market with a revenue share of more than 20.0% in 2023. Its high share is attributable to the growing need to sanitize and disinfect the common areas, swimming pools, bedrooms, and lobbies to maintain hygiene.

Hospitals are also one of the important end-users as they are the most vulnerable to infections caused by viruses, bacteria, and fungi. Regular and periodic disinfection of equipment, surfaces, and PPE kits are on top priority in hospitals, and this acts as a major factor for driving the market.

Air travel plays a crucial role in spreading infectious diseases. A high number of passengers from all over the globe come together in an enclosed area with comparatively high contact rates with chances of leading to more risk of infections. An infected person can easily spread the pathogens to co-passengers and airport staff through luggage, direct contact, and by touching several places at the airport. Thus, airports need to be disinfected by spraying disinfectants at the common places, airport lounge, jet bridge, and gates.

Regional Insights

North America region dominated the surface disinfectant market with a revenue share of more than 33.0% in 2023. This is attributed to the number of approvals by regulatory authorities such as Health Canada and the U.S. Environmental Protection Agency (EPA) to use these disinfectant products in their own countries. In North America, the ever-evolving regulations, healthcare spending, hygiene and health-related awareness, and increased R&D activities across surface disinfectant formulators, raw material manufacturers, and end-users are expected to continue driving the growth of the industry.

Europe witnessed a severe surge in the demand amid the ongoing pandemic spread. Many big international companies are constantly expanding their presence by setting up multiple production and manufacturing facilities in the region, so as to meet the rising demand and serve the European healthcare facilities locally. Technological and R&D advancement in terms of production technologies have further advanced the market in the region.

Consumption of surface disinfectants in Asia Pacific is highly benefitted from its heightened demand, especially since the COVID-19 pandemic. The availability of cost-effective active ingredients for the market has accelerated market growth at the domestic as well as international level. China is expected to be the prominent value shareholder throughout the forecast period, driven by the spread of COVID-19 across the country.

India Surface Disinfectant Market: Surface disinfectant market in India is expected to witness significant growth owing to its rising hygiene standards, massive population, and growing awareness of health and hygiene in urban & rural areas of the country.

Key Surface Disinfectant Market Company Insights

Some of the key players operating in the market include Proctor & Gamble, Clorox Company, The 3M Company, and Ecolab Inc.

-

Proctor & Gamble is a global manufacturer of consumer goods and a service provider for janitorial cleaning, buildings, restaurants, hospitality, healthcare, drug retail, and education. It provides solutions for cleaning & disinfection of bathrooms, carpets, kitchen & dishes, laundry & linen, and surface & air. Spic Span, Swiffer, Febreze, Bounty, P&G Proline. Comet, and Safeguard are some of the company’s prominent product brands. It further focuses on product innovation, advanced formulations, addressing emerging pathogens, and R&D for product efficiency.

-

3M provides solutions for cleaning & disinfection of bathrooms, carpets, kitchen & dishes, laundry & linen, and surface & air. Spic Span, Swiffer, Febreze, Bounty, P&G Proline. Comet, and Safeguard are some of the company’s prominent product brands. Technology, manufacturing, global expansion and brand value are the key strengths of the company. It operates via 80 manufacturing facilities located across the U.S. and 125 manufacturing facilities outside the U.S. with sales in around 200 countries globally.

-

BODE Chemie GmbH and Star Brands Ltd are some of the emerging market participants in surface disinfectant market.

-

Star Brands Ltd is a company that produces a wide variety of household cleaning products. It offers products such as laundry detergent, dish soap, stain removers, and others. The company sells its products under the brands named the pink stuff and star drops. The pink stuff utilizes 100% natural cleaning particles for effective cleaning. It has an employee strength of more than 110.

-

BODE Chemie GmbH is a company that manufactures disinfection, skin protection, and hygiene products. It has a presence in the Americas, Europe, Asia, Africa, and the Middle East. The company manufactures more than 400 products in Germany at the Hamburg-Stellingen site. The products are sold in more than 50 countries. It offers five product categories namely hands, skin, instruments, surface, and equipment.

Key Surface Disinfectant Companies:

The following are the leading companies in the surface disinfectant market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these surface disinfectant companies are analyzed to map the supply network.

- PDI, Inc.

- GOJO Industries, Inc.

- W.M. Barr

- Spartan Chemical Company, Inc.

- W.W. Grainger, Inc.

- Carenowmedical

- Reckitt Benckiser Group PLC

- PaxChem Ltd.

- BODE Chemie GmbH

- Star Brands Ltd.

- The 3M Company

- Ecolab

- Procter & Gamble

- The Clorox Company

- Whiteley Corporation

- Lonza

- SC Johnson Professional

- BASF SE

- Evonik Industries AG

- Kimberley-Clark Corporation (KCWW)

- Medline Industries, Inc.

Recent Developments

-

In June 2023, Lysol, a Reckitt Benckiser Group PLC brand announced the launch of Lysol air sanitizer in U.S. It is the first air sanitizer spray that is being approved by U.S. Environmental Protection Agency (EPA).

-

In March 2022, PDI launched Sani-24® Germicidal Disposable Wipe, Sani-HyPerCide® Germicidal Disposable Wipe, and Sani-HyPerCide® Germicidal Spray. The disinfectants are designed to empower infection prevention professionals in their efforts to combat the escalating rates of healthcare-associated infections (HAIs) and effectively address the challenges posed by COVID-19 in healthcare settings.

-

In February 2022, SC Johnson Professional introduced the Quaternary Disinfectant Cleaner, featuring an innovative, easy-to-measure, squeeze, and pour bottle design. This product streamlines cleaning processes by offering one-stop solution for cleaning, disinfecting, and deodorizing, effectively reducing labor time and effort previously spent on measuring and diluting concentrated chemistry.

Global Surface Disinfectant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.25 billion

Revenue forecast in 2030

USD 9.49 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Composition, Form, Application, End-use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, UK, France, Spain, Italy, China, India, Japan, Australia, Brazil, Mexico, GCC Countries, South Africa

Key companies profiled

PDI, Inc., GOJO Industries, Inc., W.M. Barr, Spartan Chemical Company, Inc., W.W. Grainger, Inc., Carenowmedical, Reckitt Benckiser Group PLC, PaxChem Ltd., BODE Chemie GmbH, Star Brands Ltd., The 3M Company, Ecolab, Procter & Gamble, The Clorox Company, Whiteley Corporation, Lonza, SC Johnson Professional, BASF SE, Evonik Industries AG, Kimberley-Clark Corporation (KCWW), Medline Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Surface Disinfectant Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surface disinfectant market report based on composition, form, application, end-use, and region:

-

Composition Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Alcohol

-

Ammonium Compounds

-

Oxidizing Agents

-

Phenolics

-

Aldehydes

-

Others

-

-

Biobased

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Wipes

-

Sprays

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

In House

-

Instruments

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Households

-

Hotel/Restaurants/Cafes

-

Educational Institutes

-

Malls

-

Railways

-

Airports

-

Food Processing Industries

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface disinfectant market size was estimated at USD 5.49 billion in 2022 and is expected to reach USD 5.85 billion in 2023.

b. The global surface disinfectant market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 9.49 billion by 2030.

b. The chemical product type segment dominated the global surface disinfectant market with a revenue share of 91.37% in 2022.

b. The liquid form segment led the global surface disinfectant market and accounted for the largest revenue share of 64.54% in 2022.

b. The in-house application segment dominated the global surface disinfectant market and accounted for the largest revenue share of 25.98% in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.