- Home

- »

- Organic Chemicals

- »

-

Surface Disinfectant Market Size, Industry Report, 2033GVR Report cover

![Surface Disinfectant Market Size, Share & Trends Report]()

Surface Disinfectant Market (2026 - 2033) Size, Share & Trends Analysis Report By Composition (Chemical, Bio-based), By Form (Liquid, Wipes, Sprays), By Application (In House, Instruments), By End Use (Hospitals, Laboratories, Households), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-721-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surface Disinfectant Market Summary

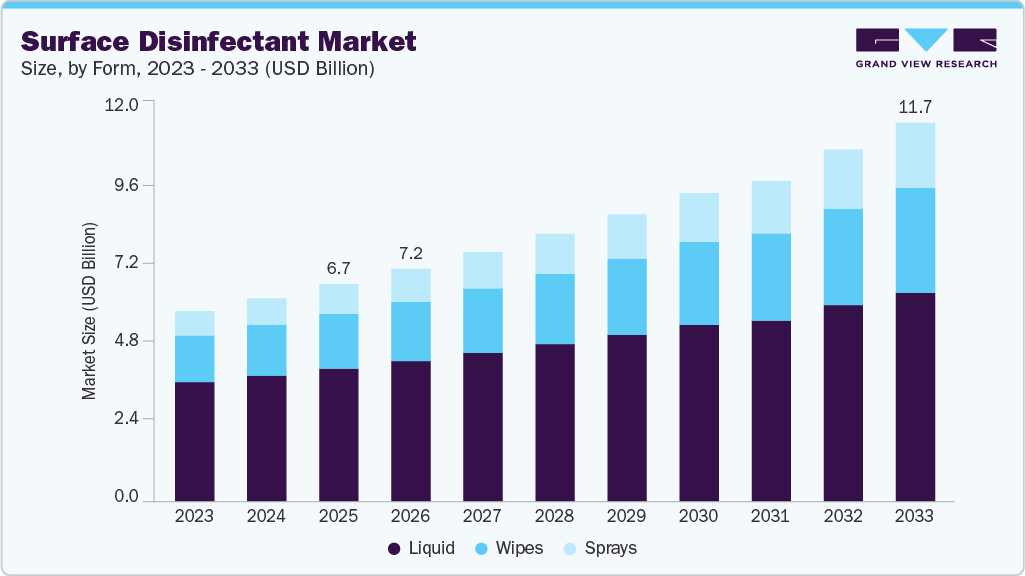

The global surface disinfectant market size was estimated at USD 6.68 billion in 2025 and is projected to reach USD 11.66 billion by 2033, growing at a CAGR of 7.2% from 2026 to 2033. The market is primarily driven by stringent infection prevention and control (IPC) protocols across hospitals, laboratories, food processing facilities, and public infrastructure, supported by regulatory mandates from health and food safety authorities.

Key Market Trends & Insights

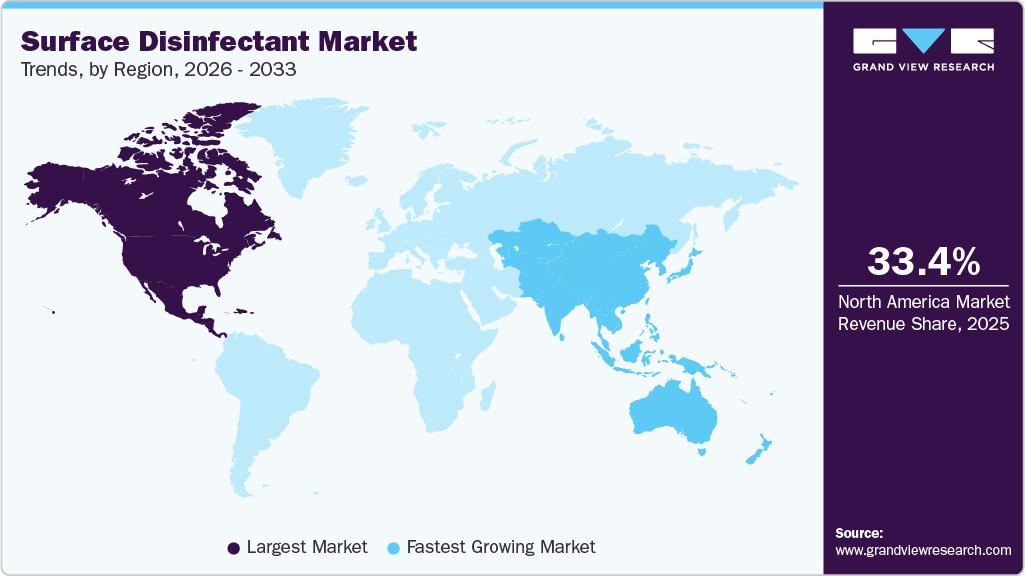

- North America dominated the surface disinfectant market with the largest revenue share of 33.4% in 2025.

- The market in China is expected to grow at the fastest CAGR of 8.6% from 2026 to 2033 in terms of revenue.

- By composition, the bio-based segment is expected to grow at the fastest CAGR of 12.7% from 2026 to 2033 in terms of revenue.

- By form, the liquid segment held the largest revenue share of 61.1% in 2025 in terms of value.

- By end use, the Hotel/Restaurant/Café (HORECA) segment held the largest revenue share of 21.3% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 6.68 Billion

- 2033 Projected Market Size: USD 11.66 Billion

- CAGR (2026-2033): 7.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Rising awareness of healthcare-associated infections (HAIs), coupled with the expansion of healthcare infrastructure, increased diagnostic testing, and sustained hygiene standards in transportation hubs and commercial spaces, continues to underpin high-volume, repeat demand for surface disinfectants across both institutional and consumer end uses.The market presents strong opportunities through the growing shift toward low-toxicity, biobased, and environmentally compliant formulations, particularly in households, food-contact surfaces, and hospitality settings.

The rapid growth in disinfectant wipes and ready-to-use formats, driven by convenience, compliance, and labor efficiency, is enabling manufacturers to capture higher margins and stronger brand loyalty, while increasing public investment in sanitation across railways, airports, and smart cities in emerging economies is creating long-term institutional procurement opportunities.Key challenges include intensifying regulatory scrutiny on chemical compositions, particularly concerning toxicity, VOC emissions, and occupational safety, which is increasing formulation costs and approval timelines. Furthermore, pricing pressure and product commoditization in liquid disinfectants, combined with fluctuating raw material costs for alcohols and chemical actives, are compressing margins, while maintaining efficacy, material compatibility, and sustainability simultaneously remains a critical formulation and differentiation challenge for market participants.

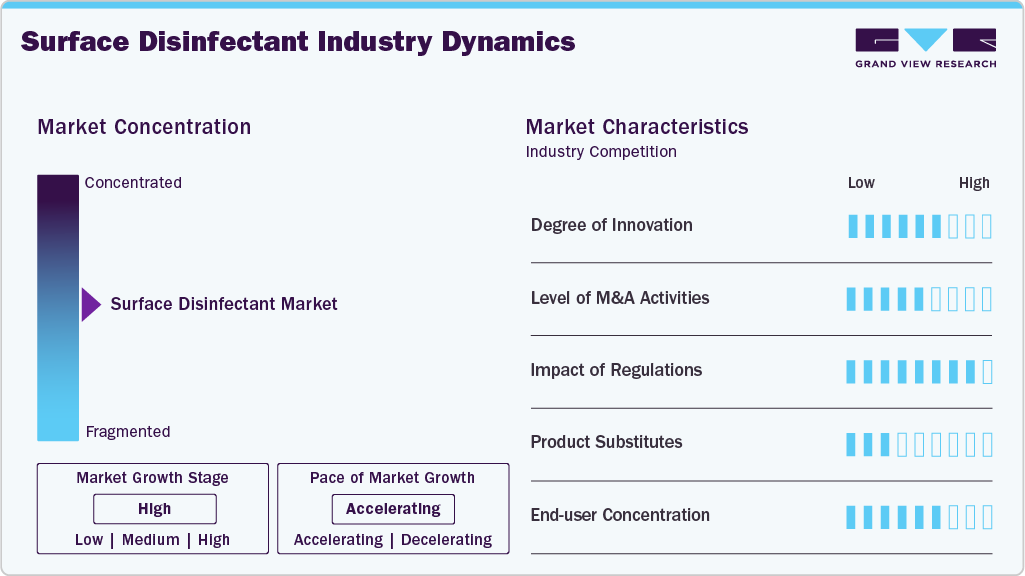

Market Concentration & Characteristics

The global surface disinfectant market is moderately fragmented, characterized by the presence of multinational hygiene solution providers, consumer product leaders, specialty chemical manufacturers, and regional institutional suppliers. Large players such as Ecolab, 3M Company, The Clorox Company, Procter & Gamble, Kimberly-Clark, and Lonza hold a strong competitive position due to their broad product portfolios, regulatory-compliant formulations, strong brand equity, and long-term contracts with healthcare and institutional buyers. These companies benefit from global distribution networks, established relationships with hospitals and food processing facilities, and continuous product innovation, particularly in wipes, ready-to-use disinfectants, and low-toxicity formulations.

Competition is increasingly shaped by product differentiation, compliance capability, and end-use specialization, rather than price alone. Mid-sized and regional players such as PDI, Whiteley Corporation, BODE Chemie, Spartan Chemical, GOJO Industries, and W.M. Barr compete by offering application-specific solutions, private-label manufacturing, and strong regional footprints, while chemical suppliers such as BASF and Evonik play a critical upstream role by supplying active ingredients and enabling formulation innovation. Strategic priorities across the landscape include portfolio expansion into biobased disinfectants, investments in sustainable chemistries, acquisitions to strengthen healthcare exposure, and partnerships to secure institutional contracts, reinforcing competition in both regulated and high-volume segments.

Composition Insights

The chemical segment dominated the global surface disinfectant market with the largest revenue share of 89.7% in 2025, driven by its proven broad-spectrum antimicrobial efficacy, rapid kill time, and widespread regulatory acceptance across critical end use industries. Chemical disinfectants, particularly alcohols, quaternary ammonium compounds, and oxidizing agents, are deeply embedded in hospital infection control protocols, laboratory sanitation standards, food processing compliance frameworks, and public infrastructure cleaning programs, where performance reliability and consistency are non-negotiable. Their cost-effectiveness at scale, ease of formulation into liquids, wipes, and sprays, and compatibility with high-volume institutional procurement further reinforced their dominance, while phenolics and aldehydes continued to serve niche, high-risk medical and laboratory applications requiring high-level disinfection.

In contrast, the biobased segment, while still accounting for a smaller share of overall revenue, is gaining strategic importance due to increasing regulatory scrutiny on chemical toxicity, growing sustainability mandates, and rising end-user preference for safer, low-residue formulations. Biobased disinfectants are witnessing stronger adoption in households, hospitality, educational institutions, and food-contact surface applications, where environmental impact and user safety are key decision factors. However, higher formulation costs, narrower efficacy spectrum, and limited acceptance in critical healthcare settings currently constrain large-scale substitution, positioning biobased solutions as a complementary growth segment rather than a direct replacement for chemical disinfectants in the near to medium term.

Form Insights

The liquid segment captured the largest revenue share of 61.1% in 2025, primarily due to its widespread use across hospitals, laboratories, food processing facilities, and public infrastructure, where high-volume, routine surface sanitation is required. Liquid disinfectants offer cost efficiency, formulation flexibility, and ease of dilution, making them the preferred choice for institutional buyers and centralized cleaning operations. Their compatibility with multiple application methods, such as mopping, spraying, and wiping, along with strong regulatory acceptance for critical infection control, has reinforced their dominance, particularly in healthcare and industrial end use environments.

Wipes and sprays are gaining momentum as convenience-driven and compliance-friendly formats, supporting faster growth from a smaller base. Disinfectant wipes are increasingly adopted in healthcare and commercial settings due to controlled dosing, reduced cross-contamination risk, and ease of use on high-touch surfaces, enabling higher value realization per unit. Sprays, on the other hand, continue to see strong demand in households, hospitality, retail, and light commercial applications, driven by portability and ease of application. Together, these formats are reshaping competition by allowing manufacturers to differentiate through ready-to-use solutions, premium positioning, and brand-led sales, while liquids remain the backbone of bulk institutional consumption.

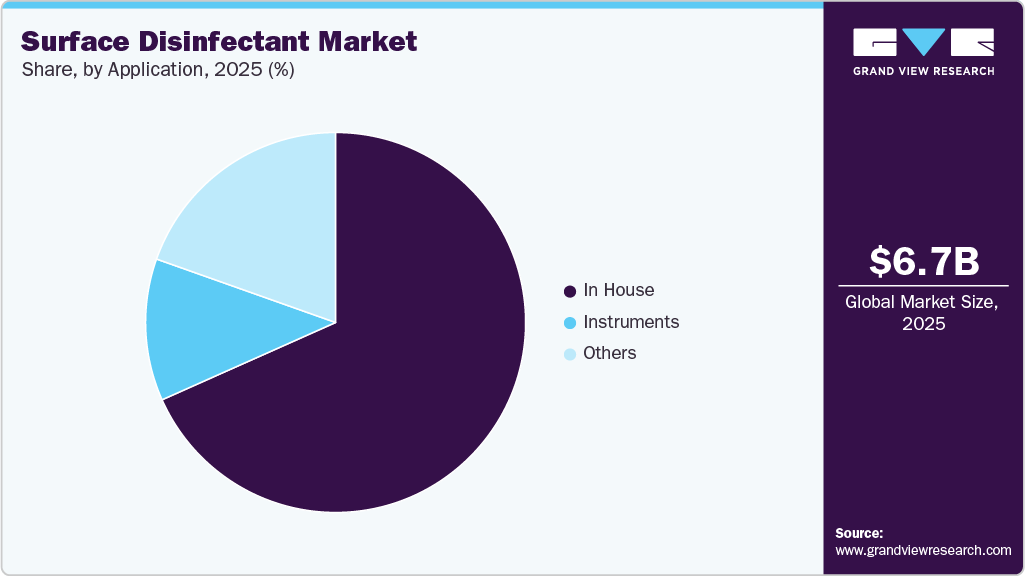

Application Insights

In-house application segment held the largest revenue share of 68.4% in 2025, driven by the high frequency and volume of surface disinfection required for routine sanitation of high-touch areas across hospitals, laboratories, households, commercial buildings, and public infrastructure. In-house applications include floors, walls, work surfaces, furniture, and frequently contacted points such as door handles and counters, creating continuous, repeat demand for liquid disinfectants and wipes. The segment’s dominance is further supported by institutional hygiene protocols, regulatory compliance requirements, and standardized cleaning schedules, which favor cost-effective, broad-spectrum disinfectants capable of being deployed at scale.

The Instruments segment represents a smaller but higher-value application area, where disinfectants must meet stringent efficacy, material compatibility, and low-corrosion requirements for medical devices, diagnostic equipment, and laboratory instruments. This segment is driven by growth in healthcare diagnostics, surgical procedures, and laboratory testing, supporting demand for alcohol-based and specialized chemical formulations. Other applications, including transportation assets, industrial surfaces, retail environments, and food-contact areas, are expanding steadily due to increased sanitation standards in public spaces and commercial facilities, positioning these applications as an important contributor to incremental market growth alongside the dominant in-house segment.

End Use Insights

The Hotel/Restaurant/Café (HORECA) segment dominated the global surface disinfectant market with the largest revenue share of 21.3% in 2025, driven by the high frequency of cleaning cycles, strict food safety regulations, and sustained hygiene expectations among consumers. HORECA facilities require continuous disinfection of food-contact surfaces, dining areas, kitchens, restrooms, and high-touch points, resulting in large-volume and repeat consumption of surface disinfectants across liquids, wipes, and sprays. The recovery of the global hospitality sector, coupled with regulatory inspections and brand reputation risks associated with hygiene lapses, has reinforced consistent procurement of professional-grade disinfectants within this end use segment.

Hospitals and laboratories continue to represent highly regulated and specification-driven end uses, demanding broad-spectrum, fast-acting, and compliant disinfectants for infection control and instrument safety, while households contribute significantly through volume-driven, brand-led consumption, particularly in urban markets. Educational institutes, malls, railways, and airports are emerging as important demand centers due to government-backed sanitation programs and public health mandates, supporting steady institutional purchasing. Meanwhile, food processing industries maintain strong demand due to stringent contamination control and audit requirements, and other end uses, including industrial and municipal facilities, add incremental growth, collectively reinforcing the diversified and resilient demand structure of the surface disinfectant market.

Regional Insights

North America surface disinfectant market accounted for 33.4% of the global surface disinfectant market in 2025, supported by stringent infection control regulations, high healthcare expenditure, and strong institutional hygiene compliance across hospitals, laboratories, food processing, and public infrastructure. The region benefits from well-established procurement frameworks, high penetration of professional cleaning services, and early adoption of premium formats such as disinfectant wipes and ready-to-use solutions, reinforcing stable, high-value demand across healthcare, HORECA, and transportation end uses.

U.S. Surface Disinfectant Market Trends

The U.S. dominated the North American market with an 82.1% share in 2025, driven by its large healthcare infrastructure, strict FDA and EPA regulations, and high awareness of healthcare-associated infections (HAIs). Strong presence of leading manufacturers, widespread adoption of institutional-grade disinfectants, and sustained demand from hospitals, food processing, airports, and public facilities continue to position the U.S. as the primary revenue contributor within the region.

Europe Surface Disinfectant Market Trends

Europe held a 27.7% market share in 2025, underpinned by robust regulatory frameworks, high hygiene standards, and strong emphasis on occupational safety and environmental compliance. Demand is driven by healthcare systems, food and beverage processing, and public transportation networks, while the region is also witnessing increased traction for low-toxicity and sustainable disinfectant formulations, influencing product innovation and portfolio shifts among manufacturers.

Surface disinfectant market in Germany accounted for 24.2% of the European surface disinfectant market in 2025, supported by its advanced healthcare infrastructure, strong pharmaceutical and medical device industries, and strict sanitation regulations. The country’s focus on quality, compliance, and eco-friendly chemical solutions has driven consistent demand for high-performance disinfectants across hospitals, laboratories, food processing facilities, and industrial environments.

Asia Pacific Surface Disinfectant Market Trends

Asia Pacific captured 26.5% of the global market in 2025, driven by rapid urbanization, expanding healthcare capacity, rising hygiene awareness, and increased government investment in public sanitation. Growth is supported by large population bases, improving regulatory enforcement, and expanding HORECA and transportation sectors, positioning the region as one of the fastest-growing markets despite price sensitivity in certain countries.

Surface disinfectant market in China dominated the Asia Pacific market with a 45.6% share in 2025, fueled by large-scale healthcare infrastructure, strong domestic manufacturing capacity, and government-led sanitation initiatives. High demand from hospitals, public transport systems, food processing industries, and commercial facilities, combined with cost-competitive local production, continues to drive volume-led growth in the country.

Middle East & Africa Surface Disinfectant Market Trends

The Middle East & Africa market is driven by rising healthcare investments, expanding hospitality infrastructure, and increasing focus on public hygiene standards, particularly in Gulf countries. Demand is supported by hospital expansions, airport and metro development, and food safety regulations, while market growth remains uneven due to varying regulatory maturity and budget constraints across different countries.

Latin America Surface Disinfectant Market Trends

Latin America represents a steady-growth market, supported by improving healthcare access, rising awareness of sanitation standards, and growing adoption of disinfectants in food processing and commercial facilities. Countries such as Brazil and Mexico are key demand centers, while price sensitivity and fragmented distribution networks continue to shape competitive dynamics and product positioning across the region.

Key Surface Disinfectant Company Insights

Key players, such as PDI, Inc., GOJO Industries, Inc., W.M. Barr, Spartan Chemical Company, Inc. , W.W. Grainger, Inc. , and BASF SE are dominating the market.

BASF SE

-

BASF SE is a key upstream participant in the global surface disinfectant market, leveraging its strong capabilities in specialty chemicals, active ingredients, and formulation support rather than finished disinfectant brands. The company supplies critical disinfectant actives and intermediates, including alcohols, oxidizing agents, and performance-enhancing formulation chemicals, to institutional hygiene product manufacturers serving healthcare, food processing, and commercial sanitation markets. BASF’s competitive strength lies in its global manufacturing footprint, regulatory expertise, and focus on sustainable and low-toxicity chemistries, enabling customers to develop compliant, high-performance disinfectant solutions aligned with evolving environmental and occupational safety standards.

Key Surface Disinfectant Companies:

The following key companies have been profiled for this study on the surface disinfectant market

- PDI, Inc.

- GOJO Industries, Inc.

- W.M. Barr

- Spartan Chemical Company, Inc.

- W.W. Grainger, Inc.

- BASF SE

- Evonik Industries AG

- Kimberley-Clark Corporation (KCWW)

- BODE Chemie GmbH

- Evonik Industries AG

- BASF SE

- Ecolab

- Procter & Gamble

- The Clorox Company

- Whiteley Corporation

Recent Developments

-

In September 2025, GOJO Industries, Inc. continued expansion of its PURELL surface disinfectant range, including broad-spectrum surface disinfecting wipes and sprays tailored for healthcare and professional settings; the company is also exploring strategic options including a potential sale or minority stake transaction to accelerate growth and unlock shareholder value.

Surface Disinfectant Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.15 billion

Revenue forecast in 2033

USD 11.66 billion

Growth rate

CAGR of 7.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Composition, form, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Brazil; Mexico; South Africa; GCC

Key companies profiled

PDI, Inc.; GOJO Industries, Inc.; W.M. Barr; Spartan Chemical Company, Inc.; W.W. Grainger, Inc.; BASF SE; Evonik Industries AG; Kimberley-Clark Corporation (KCWW); BODE Chemie GmbH; Evonik Industries AG; BASF SE; Ecolab; Procter & Gamble; The Clorox Company; Whiteley Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surface Disinfectant Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global surface disinfectant market report based on composition, form, application, end use, and region.

-

Composition Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Chemical

-

Alcohol

-

Ammonium Compounds

-

Oxidizing Agents

-

Phenolics

-

Aldehydes

-

Other Chemical Compositions

-

-

Bio-based

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Liquid

-

Wipes

-

Sprays

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

In House

-

Instruments

-

Other Applications

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Hospitals

-

Laboratories

-

Households

-

Hotel/Restaurants/Cafes

-

Educational Institutes

-

Malls

-

Railways

-

Airports

-

Food Processing Industries

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Latin America

-

Brazil

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The global surface disinfectant market size was estimated at USD 6.68 billion in 2025 and is expected to reach USD 7.15 billion in 2026.

b. The surface disinfectant market is expected to grow at a compound annual growth rate of 7.2% from 2026 to 2033 to reach USD 11.66 billion by 2033.

b. The chemical segment dominated the surface disinfectant market with the largest revenue share of 89.7% in 2025 due to its proven broad-spectrum antimicrobial efficacy, rapid action, and strong regulatory acceptance across healthcare, food processing, and institutional end uses. The cost efficiency, scalability, and compatibility with high-volume liquid and wipe formulations reinforced its widespread adoption in routine and critical sanitation applications.

b. Some of the key players operating in the surface disinfectant market include PDI, Inc., GOJO Industries, Inc., W.M. Barr, Spartan Chemical Company, Inc., W.W. Grainger, Inc., BASF SE, Evonik Industries AG, Kimberley-Clark Corporation (KCWW), BODE Chemie GmbH, Evonik Industries AG, BASF SE, Ecolab, Procter & Gamble, The Clorox Company, and Whiteley Corporation

b. The surface disinfectant market is driven by stringent infection control regulations, rising awareness of healthcare-associated infections, and sustained hygiene protocols across healthcare, food processing, hospitality, and public infrastructure. The expansion of healthcare facilities, growth in HORECA and transportation hubs, and increased institutional sanitation spending continue to support steady, repeat demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.