- Home

- »

- Next Generation Technologies

- »

-

Anime Merchandising Market Size, Industry Report, 2033GVR Report cover

![Anime Merchandising Market Size, Share & Trends Report]()

Anime Merchandising Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Figurine, Clothing, Books, Board Games & Toys, Posters), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-084-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anime Merchandising Market Summary

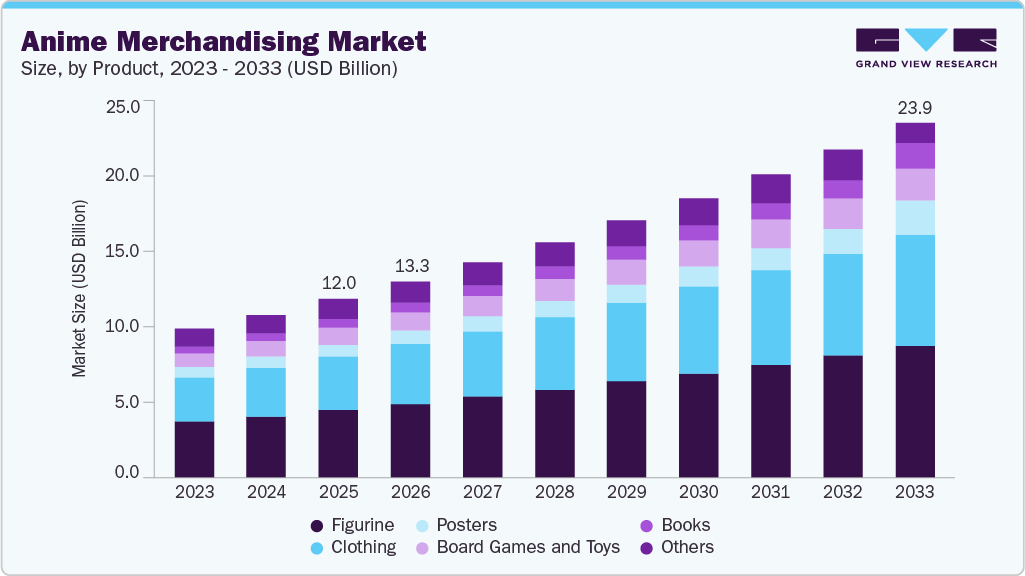

The global anime merchandising market size is estimated at USD 12,038.9 million in 2025 and is projected to reach USD 23,942.4 million by 2033, growing at a CAGR of 8.8% from 2026 to 2033. This expansion is largely fueled by the increasing global popularity of anime and the rise of digital streaming platforms.

Key Market Trends & Insights

- The Asia Pacific anime merchandising industry accounted for the revenue share of over 19.3% in 2025.

- Japan dominated the global anime merchandising market with the largest revenue share of over 59.0% in 2025.

- By product, the figurine segment accounted for the largest market share of over 37.0% in 2025.

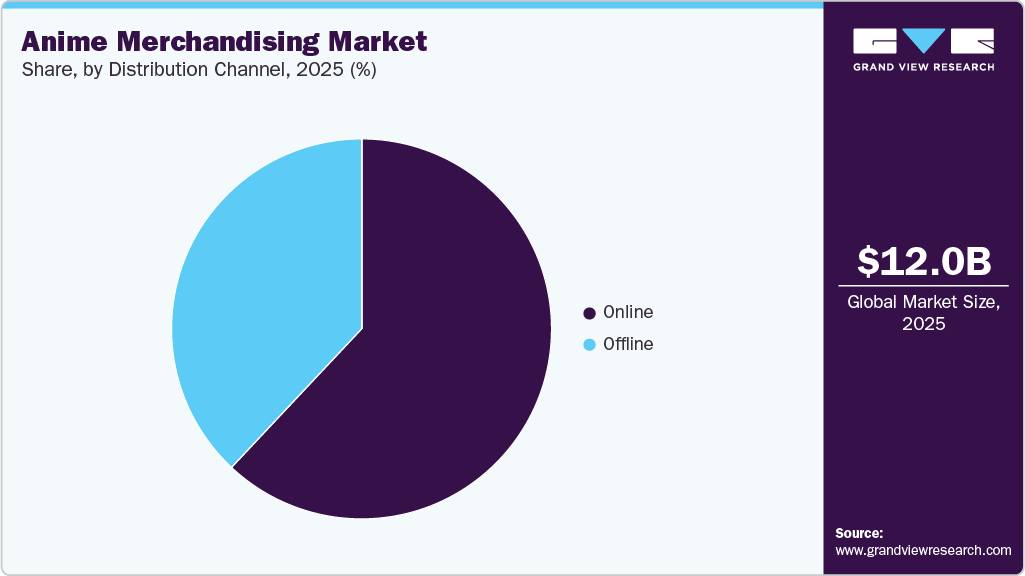

- By distribution channel, the online segment is expected to grow at the fastest CAGR of over 10.0% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 12,038.9 Million

- 2033 Projected Market Size: USD 23,942.4 Million

- CAGR (2026-2033): 8.8%

- Japan: Largest Market in 2025

- North America: Fastest Growing Market

Digital streaming platforms have made anime more accessible to diverse audiences, subsequently creating a demand for merchandise that allows fans to engage with their favorite series and characters. This surge in viewership has led to a booming market for products ranging from action figures and apparel to home decor and collectibles, which is expected to present significant growth opportunities for the anime merchandising industry in the coming years.The growing advancements in e-commerce and digital platforms have facilitated the accessibility of anime-related products, allowing fans to easily discover and purchase merchandise online. Strategic marketing efforts by industry stakeholders, combined with collaborations between anime producers and merchandisers, have enhanced brand visibility and expanded product offerings. The convergence of these factors has led to a dynamic and expanding anime merchandising industry, characterized by sustained growth.

Additionally, the rise in limited-edition and specialty items has created a sense of exclusivity, driving heightened demand among collectors. The market is also evidenced by a growing focus on sustainability, with eco-friendly and ethically sourced merchandise gaining popularity. The continued diversification and global expansion of the anime fanbase are expected to significantly influence the growth of the anime merchandising industry in the coming years.

Social media and influencer marketing have become powerful tools for promoting anime merchandise, facilitating the sale of limited edition and exclusive items that create urgency and drive consumer demand. Additionally, there is a notable diversification of merchandise beyond traditional figures and plushies, including lifestyle and fashion items. Collaborations between anime franchises and fashion brands have also attracted a wider audience.

Moreover, the rapid advancements in sensor technologies and connectivity have played a pivotal role in the anime merchandising industry. With the development of low-cost, high-performance sensors and improved connectivity networks (such as 5G and low-power wide-area networks), farmers can collect real-time data from their fields and livestock. This data can then be used to monitor soil health, weather conditions, irrigation levels, and crop growth, helping farmers make informed decisions. The continuous improvement of these technologies enhances efficiency, reduces operational costs, and improves farm management. This trend is expected to drive the expansion of the anime merchandising industry in the coming years.

Product Insights

The figurine segment led the anime merchandising market, accounting for the largest revenue share of over 37.0% in 2025. This growth is driven by the rising popularity of anime series and the growing collector culture among fans. As anime gains mainstream recognition, successful series often lead to a diverse range of collectible figures that cater to various age groups and interests. Additionally, limited edition releases and collaborations with renowned artists or studios create a sense of exclusivity, further boosting demand. The rise of online platforms and social media has facilitated global access to these products, enabling fans worldwide to easily purchase figurines, thereby enhancing the segment's growth.

The posters segment is projected to register a significant CAGR of around 10.0% from 2026 to 2033. The segmental growth propelled by the rise of social media has enhanced fan engagement, allowing for community interactions and discussions that further promote merchandise. Additionally, collaborations between anime franchises and global brands have resulted in unique, limited-edition products that appeal to diverse consumer bases.

Distribution Channel Insights

The online segment led the anime merchandising industry, accounting for the largest revenue share in 2025. This growth is primarily driven by the convenience and accessibility offered by digital platforms. Online platforms enable fans to easily access a wide range of products, from figurines to apparel, often featuring exclusive items not available in physical stores. Additionally, social media campaigns allow for direct engagement with consumers, generating excitement around new product launches and fostering a robust online community that encourages merchandise purchases.

The offline segment is projected to register a significant CAGR from 2026 to 2033. Anime conventions, pop-up shops, and dedicated retail stores offer fans the chance to interact with their favorite franchises in person, fostering a sense of belonging within the community. These events often feature exclusive merchandise and limited-edition items, creating a sense of urgency among consumers to make purchases. Furthermore, the tactile experience of shopping in-store allows fans to appreciate the quality and craftsmanship of products firsthand, enhancing their connection to the merchandise. The established brand loyalty among long-time fans also drives sales in offline channels, as consumers prefer purchasing from trusted retailers that offer authentic products related to their beloved series.

Regional Insights

North America's anime merchandising market is expected to grow at the fastest CAGR of over 17.0% from 2026 to 2033. This expansion is largely driven by the localization of anime content and the proliferation of streaming platforms, which have made anime more accessible to a wider audience. The U.S. has a strong consumer culture and a vibrant pop culture industry that has helped mainstream anime and its associated merchandise. Additionally, the presence of numerous anime conventions and dedicated retail stores across the region supports the growth of the market by providing fans with opportunities to purchase licensed merchandise and engage with their favorite franchises.

U.S. Anime Merchandising Market Trends

The U.S. anime merchandising industry held a dominant position in 2025. The U.S. market is characterized by a diverse range of products, including apparel, toys, figurines, and electronic accessories. The rise of e-commerce has significantly impacted how consumers purchase anime merchandise, with online platforms becoming increasingly popular for both official and fan-made products.

Europe Anime Merchandising Market Trends

The Europe anime merchandising industry is expected to grow at a CAGR of over 11.0% from 2026 to 2033. This growth is driven by several factors, including the expanding fanbase and communities, the rise of digital streaming platforms, and improved localization efforts that make anime more accessible to diverse audiences. The increasing influence of anime on European media and its cross-cultural appeal further contribute to the market's expansion. Additionally, the popularity of anime conventions and fan gatherings fosters community engagement and drives merchandise sales. In contrast, collaborations between anime franchises and mainstream brands create excitement and broaden the audience base.

The UK anime merchandising market is expected to grow at a significant CAGR in the coming years. In the UK, the rise of anime culture is marked by a growing interest from younger generations who view anime as a form of entertainment and escapism. The expansion of digital platforms, such as Crunchyroll and Netflix, has made it easier for fans to access a wide range of anime titles, leading to increased merchandise sales. Additionally, collaborations between popular anime series and mainstream brands have resulted in limited-edition products that appeal to both collectors and casual fans alike.

The anime merchandising market in Germany is expected to grow, driven by a strong local fanbase and an increasing number of anime-related events that promote community engagement. The country's commitment to supporting creative industries has led to a flourishing market for anime products, with local companies investing in high-quality merchandise that resonates with fans.

Asia Pacific Anime Merchandising Market Trends

The Asia Pacific anime merchandising industry accounted for the revenue share of over 19.3% in 2025. The increasing popularity of Japanese anime worldwide has significantly expanded the fan base, leading to heightened demand for related merchandise in the region. Anime has become a mainstream cultural phenomenon, integrating into various aspects of pop culture, including fashion and gaming. This integration presents opportunities for growth and collaboration between the anime industry and other sectors, further propelling market expansion.

The China anime merchandising market is experiencing rapid expansion due to the country's growing acceptance of Japanese pop culture and significant investments in local anime production. The increasing popularity of streaming services has introduced anime to a wider audience, resulting in heightened demand for related merchandise. Additionally, the Chinese government's support for creative industries has fostered an environment conducive to the growth of anime-related products. With a large youth population that possesses growing disposable income, there is a strong appetite for collectibles, apparel, and other merchandise associated with popular anime series, further propelling market dynamics.

Japan Anime Merchandising Market Trends

Japan dominated the global anime merchandising industry with a revenue share of over 59.0% in 2025. The market is characterized by its rich history of animation and a vibrant otaku culture that drives strong consumer demand. The country's unique consumer behavior fosters brand loyalty among fans who are willing to invest in high-quality merchandise from their favorite franchises. Moreover, Japanese companies are increasingly collaborating with international brands to create exclusive merchandise that appeals to both domestic and global audiences, thereby expanding their market reach and solidifying Japan's position as a leader in the anime merchandising landscape.

Key Anime Merchandising Company Insights

Some of the key players operating in the market include Crunchyroll (Sony Pictures Entertainment, Inc.) and The Walt Disney Company.

-

Crunchyroll (Sony Pictures Entertainment Inc.) is a joint venture that operates independently, formed by U.S.-based Sony Pictures Entertainment, Inc. and Japan’s Aniplex, which is a subsidiary of Sony Music Entertainment (Japan) Inc. The company offers a streaming platform that specializes in anime, manga, and Asian media, primarily targeting the U.S. market. The platform offers a vast library of titles, including simulcasts of popular series, which allows fans to watch episodes and enhances fan engagement through exclusive merchandise offerings, further solidifying its position in the competitive landscape of anime-related products.

-

The Walt Disney Company is a global entertainment conglomerate known for its three core business segments, including Disney Entertainment, ESPN, and Disney Experiences. The company has been investing significantly in original anime productions and collaborating with Japanese creators to attract existing anime fans and to introduce new audiences. The company offers a variety of anime-inspired merchandise, including apparel and collectibles featuring iconic characters reimagined in anime style.

Some of the emerging players in the anime merchandising market include Atomic Flare and Good Smile Company, Inc.

-

Atomic Flare is a company dedicated to providing hard-to-find video games, anime, and pop culture merchandise at affordable prices. The company offers a diverse range of officially licensed products from popular franchises, including Final Fantasy, Pokémon, and My Hero Academia, among others. The company emphasizes local shipping and personalized customer service, ensuring a memorable shopping experience.

-

Good Smile Company, Inc. is a prominent Japanese firm dedicated to the planning, development, production, and sale of figures, toys, and related goods. The company has expanded its operations internationally, including establishing locations in the USA, which allows it to better cater to local fans and collectors. By collaborating with various animation studios and creators, the company aims to promote popular anime franchises and to support the creators behind them, ensuring that their work reaches a broader audience.

Key Anime Merchandising Companies:

The following are the leading companies in the anime merchandising market. These companies collectively hold the largest market share and dictate industry trends.

- Studio Ghibli, Inc.

- Bandai Namco Filmworks Inc.

- Crunchyroll (Sony Pictures Entertainment Inc.)

- Good Smile Company, Inc.

- Sentai Holdings, LLC (AMC Networks)

- Ufotable Co., Ltd.

- Atomic Flare

- MegaHouse (Bandai Namco Filmworks Inc.)

- MAX FACTORY, INC.

- Alter Co., Ltd.

- BANDAI SPIRITS CO., LTD.

- Bioworld Merchandising, Inc.

- Stronger Co., Ltd.

- Aniplex Inc. (Sony Pictures Entertainment Inc.)

- Medicom Toy Co., Ltd.

Recent Developments

-

In April 2025, Bandai Namco Filmworks Inc. announced its participation in Middle East Film & Comic Con (MEFCC) 2025, where it showcased an expanded lineup of popular collectibles, including Ichiban Kuji lotteries and merchandise from major franchises such as One Piece, Naruto, Demon Slayer, and Jujutsu Kaisen.

-

In January 2025, Crunchyroll (Sony Pictures Entertainment, Inc.) launched a new manga app called "Crunchyroll Manga" 2025 as a premium add-on for subscribers, which complements their anime offerings and existing merchandise in the Crunchyroll Store. The app, announced at CES 2025, aims to provide fans access to a vast library of manga titles, enhancing the value of a Crunchyroll membership that already includes anime, games, and merchandise.

-

In October 2024, Crunchyroll (Sony Pictures Entertainment, Inc.) announced its plan to launch on YouTube Primetime Channels, distributing over 40 anime titles across the U.S., UK, Germany, and Australia by the end of the year. This new service will feature popular series such as Dragon Ball Daima, One Piece, BLUE LOCK, Re:Zero, and Shangri-La Frontier Season 2.

Anime Merchandising Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 13,253.7 million

Revenue forecast in 2033

USD 23,942.4 million

Growth rate

CAGR of 8.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa; Japan

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Studio Ghibli, Inc.; Bandai Namco Filmworks Inc.; Crunchyroll (Sony Pictures Entertainment Inc.); Good Smile Company, Inc.; Sentai Holdings, LLC (AMC Networks); Ufotable Co., Ltd.; Atomic Flare; MegaHouse (Bandai Namco Filmworks Inc.); MAX FACTORY, INC.; Alter Co., Ltd.; BANDAI SPIRITS CO., LTD.; Bioworld Merchandising, Inc.; Stronger Co., Ltd.; Aniplex Inc. (Sony Pictures Entertainment Inc.); Medicom Toy Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anime Merchandising Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global anime merchandising market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Figurine

-

Clothing

-

Books

-

Board Games & Toys

-

Posters

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Japan

-

Frequently Asked Questions About This Report

b. Some key players operating in the anime merchandising market include Studio Ghibli, Inc., Bandai Namco Filmworks Inc., Crunchyroll (Sony Pictures Entertainment Inc.), Good Smile Company, Inc., Sentai Holdings, LLC (AMC Networks), Ufotable Co., Ltd., Atomic Flare, MegaHouse (Bandai Namco Filmworks Inc.), MAX FACTORY, INC., Alter Co., Ltd., BANDAI SPIRITS CO., LTD., Bioworld Merchandising, Inc., Stronger Co., Ltd., Aniplex Inc. (Sony Pictures Entertainment Inc.), and Medicom Toy Co., Ltd

b. The significant growth of the anime merchandising market is attributed to the increasing global popularity of anime, the rise of digital streaming platforms, which have made anime more accessible to diverse audiences, and the subsequent demand for merchandise that allows fans to engage with their favorite series and characters

b. The global anime merchandising market is expected to grow at a compound annual growth rate of 8.8% from 2026 to 2033 to reach USD 23,942.4 million by 2033.

b. The figurine segment dominated the anime merchandising market with a share of over 37% in 2025. This is attributable to the rising popularity of anime series and the growing collector culture among fans.

b. The global anime merchandising market size was valued at USD 12,038.9 million in 2025 and is expected to reach USD 13,253.7 million in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.