Anthrax Treatment Market Size & Trends

The global anthrax treatment market size was valued at USD 361.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.95% from 2023 to 2030. The anthrax treatment market is anticipated to witness significant growth due to the rising number of novel and innovative developments aimed at providing more effective treatments for anthrax.

The growing concern over potential exposure to Bacillus anthracis in both civilian populations and military forces has spurred a surge in the development of novel therapies. Thus, the necessity to protect both civilian populations and military forces from the potential consequences of anthrax bioterrorism underscores the significance of bioterrorism preparedness as a driving force in the anthrax treatment market.

In addition, the emergence of fresh anthrax cases in animals holds significance for the market, especially as the disease can be transmitted to humans through animal spores. For instance, as per Sierra Leone government-issued public notice in May 2022, new anthrax cases were reported among animals in the northern district of Port Loko, West Africa. This development is likely to elevate the risk of transmission to humans and subsequently boost the demand for anthrax treatment, thus contributing to market growth.

Furthermore, advancements in research significantly drive the anthrax treatment market by providing a deeper understanding of anthrax, its pathogenic mechanisms, and potential treatment targets. As new insights emerge, they foster the development of more effective treatments and prophylactic measures, driving innovation in the market. Medical research advancements not only enhance the efficacy of anthrax treatments but also pave the way for more targeted therapies, improved diagnostics, and preventive strategies, positioning them as key catalysts for growth in the Anthrax Treatment market.

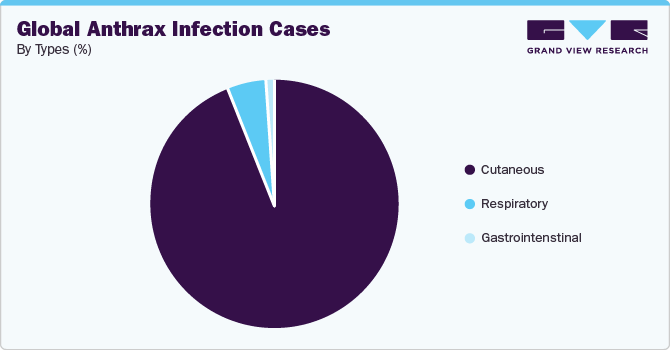

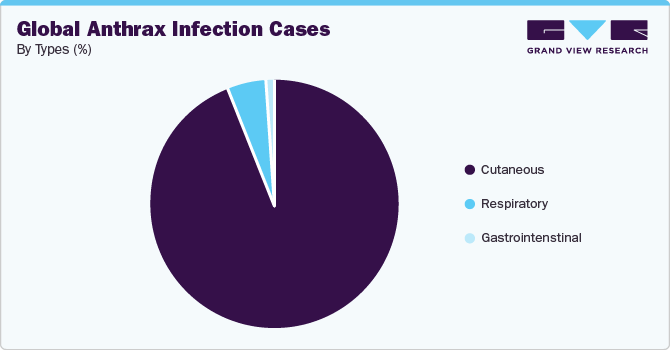

Anthrax Type Insights

On the basis of type, the market is segmented into inhalation anthrax, cutaneous anthrax, gastrointestinal anthrax, and injection anthrax. The inhalation anthrax segment held the largest market share in 2022 due to its exceptionally high lethality and potential for use as a bioterrorism agent. The aerosolized spores in inhalation anthrax pose a grave risk to public safety, prompting governments and healthcare organizations to prioritize the development of targeted treatments and vaccines specific to this form. On the other hand, cutaneous anthrax is expected to witness lucrative growth over the forecast period.

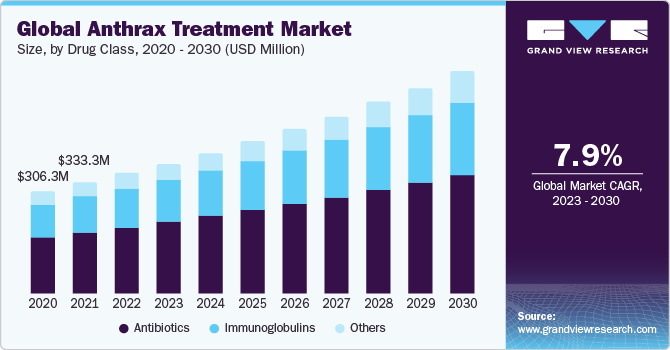

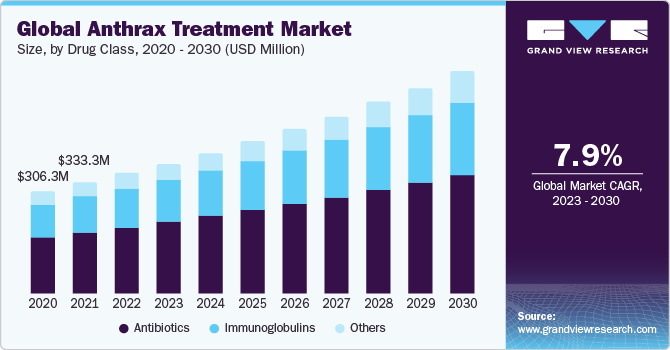

Drug Class Insights

On the basis of drug class, the market is segmented into antibiotics, immunoglobulins, and others. The antibiotics segment held the largest market share in 2022 as they are the primary and most effective form of treatment for anthrax infections. Anthrax is caused by the bacterium Bacillus anthracis, and antibiotics, such as ciprofloxacin, doxycycline, and penicillin, are highly effective in targeting and killing the bacteria responsible for the infection. Timely administration of antibiotics, particularly in the early stages of infection, can significantly improve patient outcomes by preventing the bacteria from further spreading and producing deadly toxins.

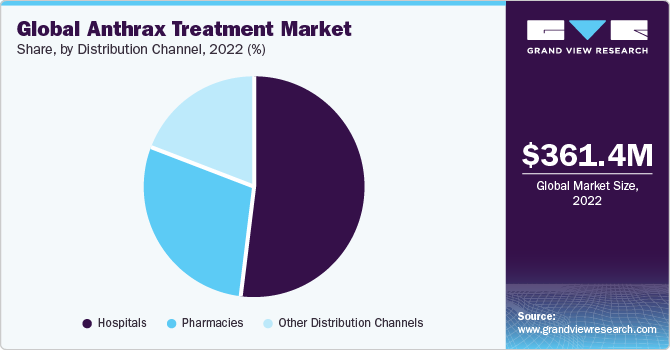

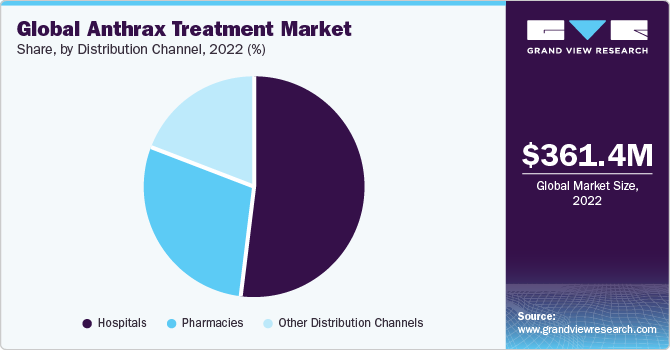

Distribution Channel Insights

On the basis of distribution channels, the market is segmented into hospitals, pharmacies, and others. The hospital segment held the largest market share in 2022, primarily as anthrax is a serious and potentially life-threatening condition that requires immediate medical attention and a controlled environment for treatment. Hospitals are equipped with the necessary medical infrastructure, expertise, and resources to diagnose, treat, and manage anthrax cases effectively. They provide critical care, isolation facilities, and pharmaceutical supplies required to address anthrax cases, particularly inhalation anthrax. On the other hand, the pharmacy distribution channel is expected to witness lucrative growth over the forecast period.

Regional Insights

North America dominated the market in 2022. The region has a robust healthcare infrastructure, advanced research and development capabilities, and a strong focus on bioterrorism preparedness, making it well-equipped to address anthrax-related challenges. Additionally, North America has a high level of healthcare expenditure, encouraging research, innovation, and the availability of advanced treatments, which, in turn, fuels the dominance of the region in the Anthrax Treatment market. On the other hand, Asia Pacific is expected to witness lucrative growth over the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are Almirall, LLC, Nighthawk Biosciences, Inc., Emergent, Paratek Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, Pfizer Inc., GSK plc, and Bayer AG.

In April 2022, NightHawk Biosciences successfully finalized its acquisition of Elusys Therapeutics, Inc., a company focused on biodefense with a proven track record in the development of ANTHIM (obiltoxaximab), a treatment specifically designed for inhalation anthrax.