- Home

- »

- Plastics, Polymers & Resins

- »

-

Anti-corrosion Coatings Market Size, Share, Industry Report, 2027GVR Report cover

![Anti-corrosion Coatings Market Size, Share & Trends Report]()

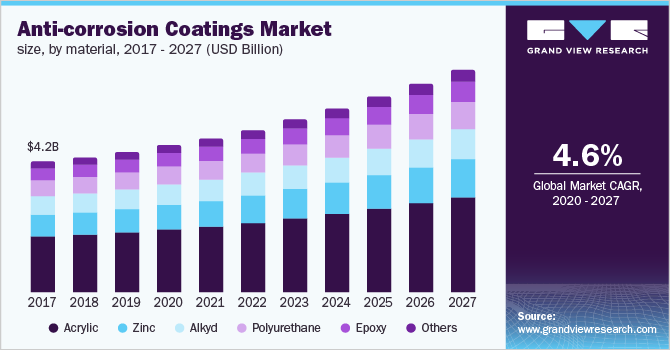

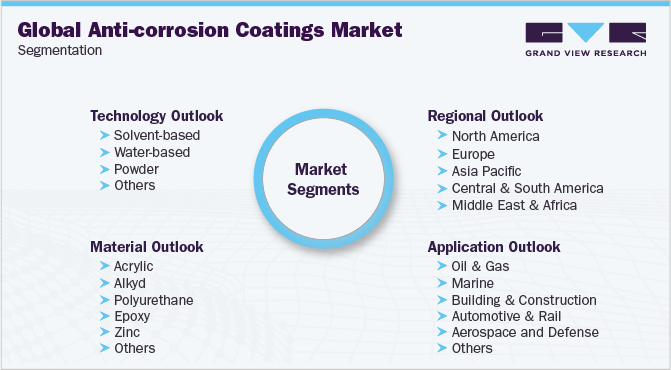

Anti-corrosion Coatings Market Size, Share & Trends Analysis Report By Material (Acrylic, Polyurethane), By Technology (Solvent-based, Powder), By Application (Marine, Oil & Gas), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-128-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The global anti-corrosion coatings market size to be valued at USD 38.6 billion by 2027 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% during the forecast period. The rising demand for thin-walled durable metallic components in the manufacturing of lightweight products, which are used in various industries including building & construction, automotive, marine, and oil & gas is expected to propel the market growth over the forecast period. Amid the global COVID-19 pandemic, the demand for anti-corrosion coatings has increased primarily in the oil & gas and marine application industries owing to the reduced exploration and marine operation. The machines & equipment, which are not in operations need maintenance to avoid the degradation and rusting as such equipment has crude oil residual, water, salt, and other chemicals, which cause corrosion.

According to the report published by the Executive Office of the President of the United States, the U.S. federal government is planning to invest USD 2 trillion over a period of 10 years for infrastructure development. The country is characterized by a low-risk environment, a stable economy pre-COVID, and a robust financial sector.

These factors have provided a multitude of opportunities for investors in recent years, which are likely to trigger the infrastructure spending that includes both new infrastructure projects and redevelopment of existing buildings in the country. This, in turn, is projected to have a positive effect on the demand for anti-corrosion coatings in the U.S. construction industry.

Anti-corrosion Coatings Market Trends

The expansions and renovations in the infrastructure industry such as roads constitute, rails, bridges, and buildings are observed to perform rapidly for the market. For instance, rapid industrial production and construction activities in developing regions such as the Asia Pacific and Africa are bolstering the industry’s growth. This has thus increased the global demand for architectural metals like lead, tin, zinc, copper, aluminum, and iron along with metal alloys including brass, bronze, nickel silver, and others, that are used in various construction activities. The majority of these metals tend to corrade establishing a huge need for anti-corrode products for corrosion mitigation thereby, increasing the demand of the market.

The imposed regulation for Volatile Organic Compounds (VOC) is impeding the market growth. Industrial coating operations, paints, gasoline-powered lawn and garden equipment, and others are some of the sources of VOC emissions. Therefore, the anti-corrosion coating products comply to meet the level of stringency. For instance, The U.S. EPA (Environmental Protection Agency) regulates VOCs at the federal level for product segments such as aerosol coatings, architectural coatings, automobile refinish coatings, and consumer products.

However, the development of environmentally friendly coating products is certain to act as a growth opportunity in the coming future. Anti-corrosion technology such as waterborne epoxy (WEP) coatings is receiving significant attention owing to their lower VOC emission. In addition, it improved the barrier property of WEP coating to increase their anti-corrosion ability, further supporting the market growth.

Technology Insights

The solvent-based technology segment led the market and accounted for more than 46% share of the global revenue in 2019. This high share is attributable to the rising demand for industrial tanks, manufacturing machines, pipes, ballast tanks, chemical storage tanks, gas ducts, cooling towers, smokestacks, etc. In addition, solvent-based corrosion protection coating requires less drying time, exhibits improved temperature, humidity, and abrasion resistance.

With the rising stringent environmental regulation, water-based coatings are gaining demand and are often used in household appliances as it reduces VOC emissions. The water-based coating offers properties, such as excellent chemical resistance, cold-resistant, non-flammable and non-explosive, and non-toxic in nature. Water-based coatings are commonly used in metal components, machinery equipment, axles, transmission shafts, gearboxes, and others.

Powder coatings are commonly used with materials including epoxy, polyester, polyurethane, and acrylic. Powder anti-corrosion coatings have a negligible amount of VOC emissions and low flammability at the time of application. In addition, powder coatings offer properties, such as enhanced surface finish, uniform thickness, and have low operating cost compared to other technology.

Material Insights

The acrylic material segment led the market and accounted for more than 43% share of the global revenue in 2019. This high share is attributable to the excellent properties of acrylic materials, such as resistance to weathering and oxidation. Acrylic coatings are primarily water-based, which offer ease of handling and superior performance in a wide range of applications, such as wall coating, roof coating, and low price compared to other materials.

Epoxy material is commonly used in the powder form for corrosion protection applications. These are often used in piping systems in both commercial and residential purposes. In addition, corrosion protection coatings are used in mining, architectural, municipal, and medical, IT industries, and food & beverage industries.

Zinc coatings are comprised of zinc metal pigment ranging from 85 to 92%. Zinc corrosion protection coating provides cathodic protection and thickness ranging from 6 to 125 microns. Zinc-based corrosion protection coatings are used in building & construction and marine applications for pipelines, bridges, containers, and other metallic products.

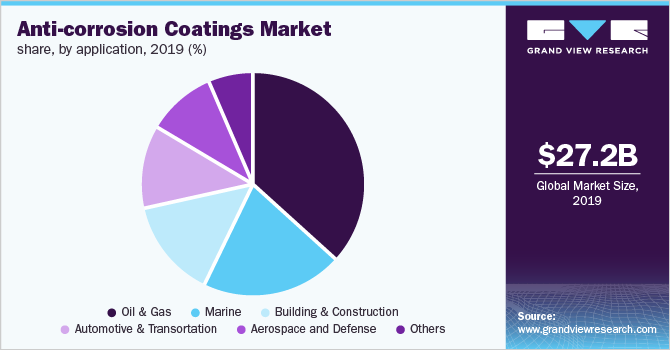

Application Insights

The oil & gas application segment led the market and accounted for more than 36% share of the global revenue in 2019. This high share is attributable to the extensive usage of corrosion protection coating in this sector. In addition, the anti-corrosion coating minimizes the risk of microbes and improves abrasion resistance & surface finish. The Anti-corrosion coating also finds applications in hospitals, care homes, and drop-in centers for the product including floors, handles, beds, walls, and ceiling paints.

Corrosion protection coating is used in flooring, shelving, kitchen mats, storage containers, water coolers, and water hydration systems in the food & beverage industry. The growth of the food & beverage industry on account of the increasing population and changing lifestyles is expected to drive the product demand in this application segment over the forecast period.

The aerospace & defense application segment accounted for more than a 9% share of the global revenue in 2019. Rising defense expenditure as security threats among the countries has intensified post the emergence of the COVID-19 pandemic is driving the demand. In addition, the growth of the commercial aviation industry has plunged downwards owing to travel restriction to tackle the COVID-19 pandemic. These factors are boosting the product demand in the aerospace & defense application segment.

Amid the global COVID-19 pandemic, the marine industry had a negative impact as the demand for goods from China has reduced. According to the reports published by Vessels Value Ltd., the demand for goods from Japan and South Korea is increasing and the demand for goods from China is still witnessing a downfall. This trend is expected to continue as various companies operating in the electrical & electronics, building & construction, and aerospace & defense sectors are exploring new geographies for establishing there manufacturing facilities outside China. This, in turn, is expected to drive the product demand over the forecast period.

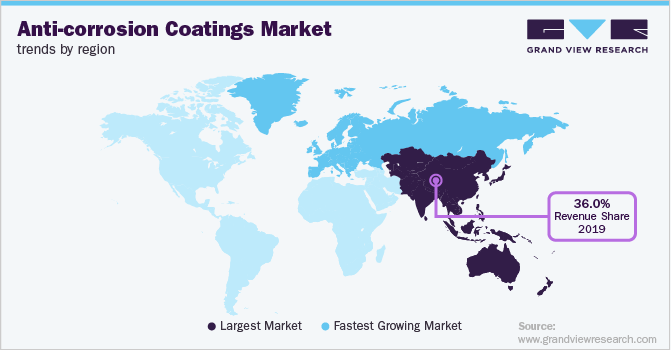

Regional Insights

The Asia Pacific led the market and accounted for over 36% share of global revenue in 2019. This high share is attributable to the rising demand for Electric Vehicles (EVs) in countries, such as China, India, and Japan. In addition, the presence of various automotive manufacturers, which are involved in research & development activities in the region including Tata Motors, Mahindra & Mahindra Ltd, and Bajaj Auto Ltd., will propel industry expansion over the forecast period.

The growth of the construction industry in emerging economies, such as Brazil, China, India, and Mexico, are expected to drive the product demand in the protection of components, such as insulation, fixtures, structural lumber, windows, fences, and others, over the forecast period. The demand for anti-corrosion coatings in the building & construction market can be attributed to increased foreign investment in the construction industry of these countries as a result of the rising number of redevelopment projects of public and industrial infrastructure.

Europe ranks second, in terms of revenue. The regional market is driven by the growth of the major application sectors, such as oil & gas and marine applications. According to Eni S.p.A., the European oil & gas industry has registered a decline of approximately 40% in the profit of first-quarter 2020 compared to 2019.

In addition, the automotive & rail application segment is expected to witness considerable growth owing to increasing demand for smart EVs in the region, which requires lightweight and durable components to improve the vehicular efficiency.

Key Companies & Market Share Insights

The market is segmented in nature owing to the presence of a large number of manufacturers across the value chain. Major players focus on the expansion of their manufacturing and R&D facilities, infrastructural development, and seeking opportunities to vertically integrate across the value chain. Amid the global COVID-19 pandemic, fluctuating prices of basic raw materials, crude oil, and natural gas, which are used in the production of acrylic, alkyd, polyurethane, epoxy, and others, are expected to be the major factors restraining market growth, as they result in higher production costs, thereby reducing the profit margin. However, recovering production and operations of various industries from the COVID-19 pandemic is anticipated to drive the market growth.

Recent Developments

-

In January 2022, Applied Graphene Materials (AGM) launched its range of industrial anti-corrosion primers — Genable Epoxy Primer and Genable HC Primer. Alongside, extending its Genable 3000 dispersion series, the company also introduced a range of non-metal, active anti-corrosion graphene additives.

-

In March 2022, United Metallurgical Company (OMK), a Russian manufacturer of high-speed railway wheels, launched a new production line for wheel protective coatings.

-

In November 2021, IGL Coatings launched Ecoclear Aegis a clear anti-corrosion coating. The product is the company’s first graphene-reinforced anti-corrosion clear coating.

-

In September 2021, Axalta Coating Systems a global supplier of liquid and powder coatings acquired U-POL Holdings Limited a leading supplier of protective coatings and paints.

-

In June 2021, Greenkote launched the Greenkote G5k coating an advanced product to the company’s line of corrosion protection.

-

In May 2020, U.S.-based specialty chemicals company, Gabriel Performance Products launched a high molecular weight polymer PHENOXY PK-ZN40, that can be used as an additive for anti-corrosive coatings.

Some of the prominent players in the anti-corrosion coatings market include:

-

Akzo Nobel N.V.

-

Ashland

-

Axalta Coating Systems, LLC

-

BASF SE

-

Hempel A/S

-

Jotun

-

Kansai Paint Co., Ltd.

-

PPG Industries, Inc.

-

RPM INTERNATIONAL INC.

-

The Sherwin-Williams Company

Anti-corrosion Coatings Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 28.2 billion

Revenue forecast in 2027

USD 38.6 billion

Growth Rate

CAGR of 4.6% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, material, application, region

Regional scope

North America; Europe; Asia Pacific; Southeast Asia; Central & South America; Middle East & Africa

Country Scope

The U.S.; Canada; Mexico; Germany; The U.K.; France; Italy; China; India; Japan; Malaysia; Indonesia; Thailand; Brazil; Saudi Arabia

Key companies profiled

PPG Industries, Inc.; Akzo Nobel N.V.; The Sherwin-Williams Company; Axalta Coating Systems, LLC; BASF SE; Hempel A/S; Ashland; Jotun; RPM INTERNATIONAL INC.; Kansai Paint Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-corrosion Coatings Market SegmentationThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global anti-corrosion coatings market report on the basis of technology, material, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Solvent-based

-

Water-based

-

Powder

-

Others

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Acrylic

-

Alkyd

-

Polyurethane

-

Epoxy

-

Zinc

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Oil & Gas

-

Marine

-

Building & Construction

-

Automotive & Rail

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Key factors driving the anti-corrosion coatings market growth include laws & regulations enforced by governments, increasing awareness regarding sustainable VOC emissions, and reduction in environmental impact from plastic production.

b. The global anti-corrosion coatings market size was estimated at USD 27.2 million in 2019 and is expected to reach USD 28.2 billion in 2020.

b. The global anti-corrosion coatings market is expected to grow at a compound annual growth rate of 4.6% from 2020 to 2027 to reach USD 38.6 billion by 2027.

b. Asia Pacific dominated the anti-corrosion coatings market with a share of 36.2% in 2019. This is attributable to the rising demand for sustainable building & construction components used in a wide range of infrastructure development projects in residential, commercial, and industrial purposes.

b. Some of the key players operating in the anti-corrosion coatings market include PPG Industries, Inc., Akzo Nobel N.V., The Sherwin-Williams Company, Axalta Coating Systems, LLC, BASF SE, Hempel A/S, Ashland, Jotun, RPM INTERNATIONAL INC., and Kansai Paint Co., Ltd.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."