- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Powder Coatings Market Size, Share & Trends Report, 2030GVR Report cover

![Powder Coatings Market Size, Share & Trends Report]()

Powder Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin (Epoxy, Polyester, Acrylic, Other Resins), By Application (Architectural, Automotive, Consumer Goods), By Region, And Segment Forecasts

- Report ID: 978-1-68038-112-2

- Number of Report Pages: 131

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Powder Coatings Market Summary

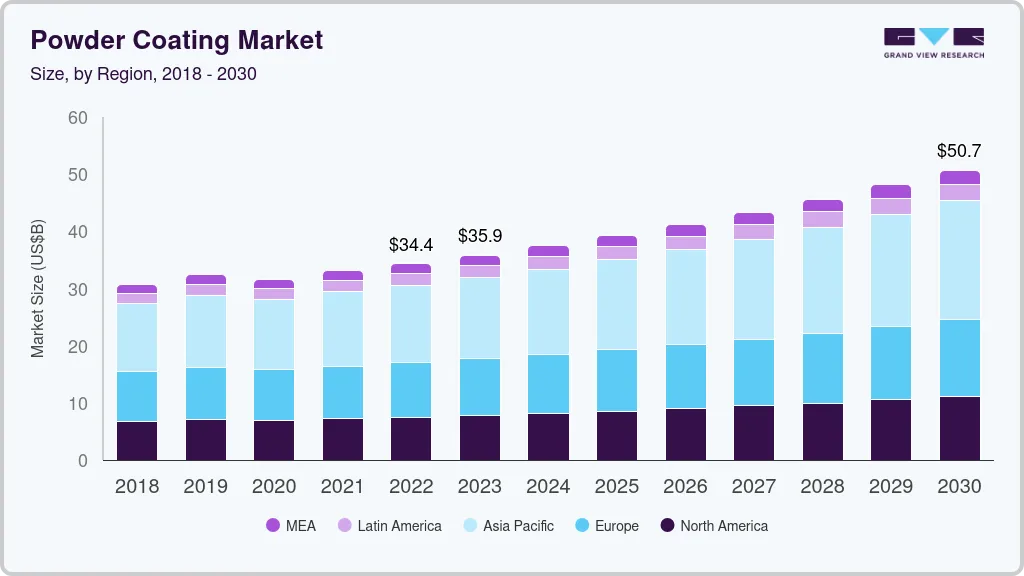

The global powder coatings market size was estimated at USD 10.39 billion in 2023 and is projected to reach USD 15.34 billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. This growth can be attributed to their widespread usage in diverse sectors such as appliances, automotive, infrastructure, and general industrial, among others.

Key Market Trends & Insights

- Asia Pacific powder coatings market dominated globally in 2023 with a revenue share of 37.7%.

- The powder coatings market in the U.S. is estimated to grow at a significant CAGR from 2024 to 2030.

- By application, consumer goods segment dominated the market with a revenue share of 24.1% in 2023.

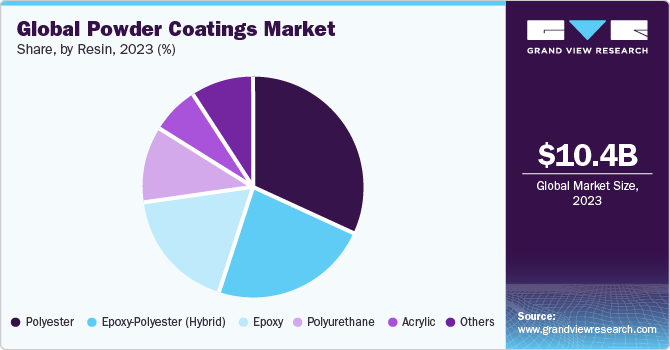

- By resin, polyester segment dominated the market with a revenue share of 26.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.39 billion

- 2030 Projected Market Size: USD 15.34 billion

- CAGR (2024-2030): 5.8%

- Asia Pacific: Largest market in 2023

Advantages offered by powder coatings over other paints and coatings, such as uniform thickness, superior appearance, and high resistance to heat and impaction, have made them a preferred option for applications around the world.

Coatings find usage in a variety of end user industries such as chemicals, architecture, automobile and others. Architectural coatings play a critical role in safeguarding and enhancing the surfaces of residential and commercial buildings. These coatings are specifically formulated to provide a wide array of benefits, including protection against weathering, UV radiation, and the growth of mildew. Within the architectural segment, a diverse range of products, such as paints, varnishes, stains, and sealants, serve various purposes in the construction and maintenance of buildings.

Powder coatings lack solvents, giving way to negligible volatile organic compound (VOC) emission into the atmosphere and reducing the risk of combustion during their usage and storage process. In addition, the powder can be easily washed when exposed to human skin, which reduces the risk of health problems for operators. Nominal wastage is another factor contributing to the growth of the powder coatings industry as the excessive powder is collected by the extraction system and recycled. In certain cases, the excessive powder is collected and reused immediately. In addition, developing these products that can be cured at lower temperatures has led to lower energy utilization. This helps release less heat into the atmosphere, thus maintaining the temperature of the surrounding atmosphere.

Powder coatings have numerous environmental advantages over others owing to lower carbon dioxide (CO2) emission, low levels of VOC emission, and less wastage, which are a few factors contributing to a greener environment. In addition, the technological advantage and simplicity of application have resulted in powder coatings being a preferred coating method over other methods.

Development in the chemical composition of resins, additives, coloring agents, equipment, and application methods is expected to drive market growth. Newer resins, which require very low curing temperatures, are expected to help lower energy consumption and reduce energy expenditure. The development of powders for high-temperature applications, such as charcoal grills, engine exhaust components, and fireplace inserts, is expected to increase the application segments for the market. In addition, equipment development is expected to help improve powder utilization and reduce wastage and consumption.

Market Concentration & Characteristics

The global powder coatings industry can be characterized as moderately fragmented, with a significant share of the market being held by multiple players. This level of fragmentation is indicative of a market where the market share is divided amongst a host of competing players, leading to a competitive landscape with fierce competition exerted by these players. This fragmentation is driven by several factors, including the level of innovation required, research and development costs, as well as strict regulatory environment.

Innovation plays a crucial role in the market, driving the development of new products, processes, and technologies. The industry is undergoing continuous evolution, fostering innovative formulations and solutions that cater to the diverse needs of end use industries. Notably, there is a growing emphasis on environmentally friendly solutions, with a focus on sustainable powder coating formulations, including low-VOC products and recycling programs. This emphasis on innovation aligns with the broader industry trend towards sustainability and environmental responsibility.

The global powder coating industry faces the potential impact of product substitutes, particularly in the context of evolving consumer preferences and technological advancements. As the industry continues to innovate, the emergence of alternative coating technologies or materials could present competitive challenges. In addition, the market's response to the harmful environmental impact of solvent-borne products suggests a potential shift towards alternative products that align with stricter environmental regulations and sustainability parameters.

Application Insights

Consumer goods dominated the market with a revenue share of 24.1% in 2023. Powder coatings have found widespread application in various consumer goods due to their versatility, durability, and environmentally friendly properties. One of the significant areas where they are extensively used is in household appliances. Refrigerators, washing machines, ovens, and other kitchen appliances are coated with these layers to provide a smooth and visually appealing finish. Moreover, they offer excellent protection against scratches, corrosion, and wear, ensuring the longevity and aesthetic appeal of these consumer goods.

Powder coatings play a crucial role in the automotive industry. One of the most common uses is coating wheels. Powder-coated wheels offer exceptional durability, scratch resistance, and protection against road debris and harsh weather conditions, making them an attractive choice for functional and aesthetic purposes. In addition, they are extensively applied to automotive bumpers and exterior trim. They provide superior impact resistance, safeguarding the vehicle from minor collisions and stone chips. Moreover, they exhibit excellent resistance to UV rays and weathering, ensuring the longevity and appearance of these exterior components.

In industrial applications, they are used on machinery exposed to high temperatures, corrosive fluids, and gases that can deteriorate them. They provide equipment with improved impact and abrasion resistance as these products are impermeable. In the automotive and transportation sectors, coatings are used for external and internal components of automobiles, such as hood, fenders, and other body parts, to retain the color and gloss. They are also used to coat engines and turbochargers to increase thermal resistance.

Resin Insights

Polyester dominated the market with a revenue share of 26.4% in 2023. Polyester coatings find application as reinforced linings, thus effectively safeguarding trenches, foundations, and concrete floors from the corrosive effects of pickling acids. In addition, polyester powder protective products are well-suited for coating complex shapes and are highly effective in extreme environments such as coastal buildings and chlorine-rich surroundings. These are gaining popularity due to their VOC-free composition and low wastage, further contributing to their significant market share.

Epoxy resins are synthetic thermosetting polymers containing an epoxide group. They are extensively used in various industries, such as construction, shipbuilding, and wastewater treatment. These resins offer outstanding properties, including resistance to stains, cracking, extreme temperatures, and blistering. They are also utilized in floor toppings, grouts, crack injections, and adhesives.

Epoxy-polyester coatings are commonly used general-purpose powders with limited tolerance to sunlight exposure. They offer exceptional hardness and have the highest chemical and corrosion resistance among powder coatings. Their ease of application makes them convenient to use. When applied to metals, epoxies exhibit excellent adhesion, especially with pre-treatments like phosphate and sandblasting.

Regional Insights

The powder coatings market in North Americawas the second-largest regional market in 2023. North America is a prominent region due to various end use industries, including automobile and construction, in countries such as the U.S., Canada, and Mexico, which, in turn, is driving the demand in the region.

U.S. Powder Coatings Market Trends

The powder coatings market in the U.S. is estimated to grow at a significant CAGR from 2024 to 2030. The Affordable Healthcare Act (reform law enacted in March 2010 by the U.S. Department of Health & Human Services) incentivizes the construction of a larger number of hospitals and healthcare units, which, in turn, is expected to boost the country's demand over the forecast period.

Asia Pacific Powder Coatings Market Trends

Asia Pacific powder coatings market dominated globally in 2023 with a revenue share of 37.7%. The demand for powder coatings in Asia Pacific is driven by several factors, such as the rapid industrialization and urbanization in countries like China, India, and Southeast Asia. This has increased the need for protective and decorative equipment in various industries. Automotive, construction, and industrial goods industries have been mainly instrumental in driving the demand due to their durability, versatility, and environmental benefits.

The powder coatings market in China held the largest share in Asia Pacific in 2023. China's construction sector has recently undergone substantial expansion. As reported by the National Bureau of Statistics of China, the construction output in China reached a remarkable value of around CNY 31 trillion (~USD 421.57 billion) in 2023, which is expected to further aid the market in the country.

Europe Powder Coatings Market Trends

The power coatings market in Europe is expected to grow at a significant rate from 2024 to 2030. The demand for these products in Europe has witnessed consistent growth, driven by various factors and industry-specific developments. One of the primary catalysts is the increasing demand for environmentally friendly coating solutions.

The Germany powder coatings market held the largest revenue share of the Europe market in 2023. Increasing sustainability awareness and adherence to stricter regulations have further propelled the demand across various sectors, including automotive, architecture, furniture, and appliances in the country.

The powder coatings market in the UK is expected to grow at a significant CAGR from 2024 to 2030. Powder coatings, renowned for their low VOC content and absence of hazardous air pollutants, have become the preferred choice for industries striving to minimize their environmental impact in the country.

Central & South America Powder Coatings Market Trends

The powder coatings market in Central & South America is anticipated to witness significant growth from 2024 to 2030. The increasing disposable income of consumers has surged the demand for automobiles, which is expected to augment the product demand over the forecast period.

The Brazil powder coatings market is estimated to grow at a significant CAGR over the forecast period. The government is focusing on improving and expanding the public infrastructure. Surging investments in the development of infrastructure amenities are anticipated to fuel the adoption of the product.

Middle East & Africa Powder Coatings Market Trends

The powder coatings market in MEA is driven by rapid industrialization and urbanization. For instance, the government of UAE plans to increase the contribution of the manufacturing industry to its economy by diversifying its investments in other industries, highlighting the potential for growth in the regional market.

The Saudi Arabia powder coatings market is expected to grow significantly due to recent improvements. Initiatives such as Vision 2030 and substantial investments in housing and infrastructure development are opening new opportunities for the country to adopt powder coatings.

Key Powder Coatings Company Insights

The competitive landscape of the global powder coatings industry is characterized by intense competition among a host of different players, technological advancements, and strategic initiatives aimed at maintaining industry leadership and driving innovation. Some major firms, such as Akzo Nobel N.V., The Sherwin-Williams Company, and Nippon Paint Holdings Co., Ltd., are prominent players in the industry, with established brand identities and considerable market penetration. These companies have a strong presence in the overall global coatings industry, leveraging their brand reputation to maintain market share and drive growth.

Some of the key players operating in the market include

-

BASF SE is a leading player in the market, offering a wide range of products in segments such as petrochemicals, intermediates, performance materials, monomers, dispersion and resins, performance chemicals, catalysts, coatings, care chemicals, nutrition and health, and agricultural solutions.

-

The Sherwin-Williams Company is a major player in the industry. The company caters to the demand from industrial, retail, commercial, and professional sectors. It offers powder coating solutions under its portfolio's performance coatings product segment.

Arkema and JOTUN are some of the emerging players in the global powder coatings industry.

-

Arkema is an emerging player in the market. The powdered coating solutions by the company are provided under the coating solutions product segment.

-

Jotun is a notable emerging player in the global industry. The company caters to the demand from the hospitality, commercial, infrastructure, healthcare, education, and residential sectors and maintains a presence in over 100 countries worldwide.

Key Powder Coatings Companies:

The following are the leading companies in the powder coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- BASF SE

- Arkema

- JOTUN

- Nippon Paint Holdings Co., Ltd.

- RPM International, Inc.

Recent Developments

-

In July 2023, BASF SE entered a partnership with Zhejiang Guanghua Technology Co., Ltd. (KHUA), which states that BASF SE will supply KHUA with Neopentyl Glycol (NPG). KHUA manufactures polyester resins used for powder coatings. The partnership is expected to help meet the growing demand from China and other Asia Pacific countries.

-

In May 2023, PPG Industries, Inc. announced an investment of USD 44 million in five powder coating manufacturing facilities in Latin America and the U.S. The project is in line with the company’s strategic initiative to increase powder coating production and strengthen its product portfolio to cater to growing demand.

Powder Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10,927.9 million

Revenue forecast in 2030

USD 15.34 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Benelux; Turkey; Switzerland; Sweden; Poland; Austria; Norway; Denmark; Finland; Portugal; Czech Republic; Slovenia; China; Japan; India; South Korea; Thailand; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Akzo Nobel N.V.; The Sherwin-Williams Company; PPG Industries, Inc.; BASF SE; Arkema; JOTUN; Nippon Paint Holdings Co., Ltd.; RPM International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powder Coatings Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global powder coatings market report based on resin, application, and region.

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyester

-

Epoxy-Polyester (Hybrid)

-

Acrylic

-

Polyurethane

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Consumer Goods

-

Architectural

-

Automotive

-

General Industries

-

Furniture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Benelux

-

Turkey

-

Switzerland

-

Sweden

-

Poland

-

Austria

-

Norway

-

Denmark

-

Finland

-

Portugal

-

Czech Republic

-

Slovenia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global powder coatings market size was estimated at USD 10.39 billion in 2023 and is expected to reach USD 10,927.9 million in 2024.

b. The global powder coatings market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 15.34 billion by 2030.

b. The consumer goods application segment dominated the powder coating market with a share of 24.11% in 2023. This is attributed to the rising product demand from various applications such as air conditioner cabinets, refrigerators, vacuum cleaners, microwave oven cavities, and others.

b. Some key players operating in the powder coatings market include Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Axalta Coating Systems, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Koninklijke DSM N.V., Bayer AG, and Eisenmann.

b. Key factors that are driving the powder coatings market growth include supportive environmental regulatory, and rising product applications in automotive, consumer goods, and general industrial sectors.

b. The polyester resin type segment accounted for 26.35% of the volume share in the powder coatings market in 2023 on account of beneficial properties of polyester, such as quick-drying, chemical resistance, temperature resistance, abrasion resistance, and surface protection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.