- Home

- »

- Pharmaceuticals

- »

-

Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market 2030GVR Report cover

![Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market Size, Share & Trends Report]()

Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Authentication Packaging Technology, Track & Trace Packaging Technology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-519-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

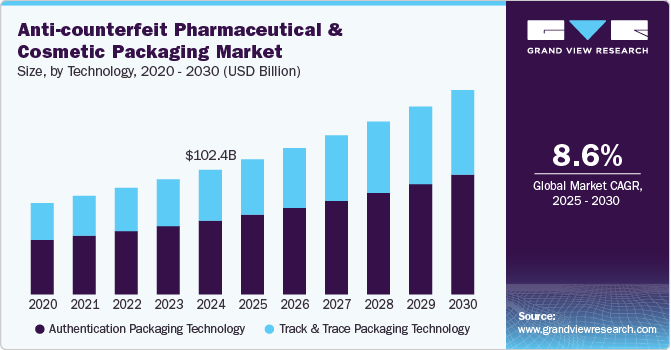

The global anti-counterfeit pharmaceutical and cosmetic packaging market size was estimated at USD 102.45 billion in 2024 and is expected to grow at a CAGR of 8.65% from 2025 to 2030. Consumers are increasingly prioritizing genuine pharmaceutical and cosmetic products due to health and safety concerns. This has pushed brands to adopt secure packaging solutions like tamper-evident seals and digital verification to build trust and protect their reputation.

The anti-counterfeit pharmaceutical and cosmetic packaging industry is experiencing a strong shift towards advanced digital authentication technologies. Companies are integrating blockchain-based serialization, AI-driven tracking systems, and near-field communication (NFC) solutions to enhance product security and traceability. This trend is driven by rising counterfeiting incidents, regulatory enforcement, and growing consumer awareness of product authenticity. The adoption of connected packaging, where QR codes and RFID tags allow real-time verification via smartphones, is expanding rapidly. Brands are leveraging these technologies not only to secure their supply chains but also to build consumer trust, enhance brand engagement, and ensure compliance with stringent regulatory frameworks worldwide.

Drivers, Opportunities & Restraints

Stringent regulatory requirements are a major force propelling the market forward. Governments and regulatory bodies across regions, such as the U.S. FDA, the European Medicines Agency (EMA), and China’s National Medical Products Administration (NMPA), are enforcing strict serialization and track-and-trace mandates to curb counterfeiting in pharmaceuticals and cosmetics. Regulations like the Drug Supply Chain Security Act (DSCSA) in the U.S. and the Falsified Medicines Directive (FMD) in the EU require manufacturers to implement unit-level product authentication, driving demand for anti-counterfeit packaging solutions. Additionally, cosmetic brands are under increased scrutiny due to safety concerns over counterfeit beauty products, further accelerating investments in tamper-evident packaging, holograms, and digital verification systems.

The rise of e-commerce and direct-to-consumer (DTC) sales presents a major growth avenue for anti-counterfeit packaging solutions. Online retail has made it easier for counterfeit products to enter global markets, increasing risks for both consumers and brands. In response, pharmaceutical and cosmetic companies are adopting innovative anti-tampering and authentication measures tailored for e-commerce supply chains. Solutions such as smart labels, digital watermarks, and cloud-based authentication platforms provide secure product verification at every touchpoint. This demand surge is encouraging industry players to develop scalable, cost-effective anti-counterfeit solutions that seamlessly integrate with online retail distribution networks, unlocking new revenue streams and strengthening brand protection strategies.

One of the biggest challenges in the anti-counterfeit pharmaceutical and cosmetic packaging market is the high implementation cost and complexity of advanced anti-counterfeit technologies. The integration of RFID tags, holographic seals, blockchain serialization, and AI-driven tracking requires significant upfront investment in infrastructure, specialized equipment, and IT systems. Small and mid-sized pharmaceutical and cosmetic manufacturers often face budget constraints and technical limitations, making it difficult to adopt these solutions at scale. Additionally, interoperability issues between different authentication technologies across global supply chains create compliance hurdles, further slowing adoption. As a result, while the demand for anti-counterfeit packaging continues to grow, cost and integration challenges remain key barriers, particularly for emerging market players.

Technology Insights

Authentication packaging technology dominated the anti-counterfeit pharmaceutical and cosmetic packaging industry across the product segmentation in terms of revenue, accounting for a market share of 59.28% in 2024 driven by rapid advancement of AI-powered and blockchain-based security solutions. As counterfeiters become more sophisticated, brands are leveraging multi-layered authentication methods, including optical variable devices (OVDs), encrypted QR codes, and smart holograms, to provide real-time product verification. The integration of AI-driven anomaly detection in authentication labels enhances security by identifying tampering attempts and fake products instantly.

Blockchain-based authentication enables immutable, decentralized product verification, allowing consumers and regulators to track product history with full transparency. This shift towards high-tech authentication solutions is gaining traction as industries seek foolproof security measures to combat counterfeiting at scale.

The global enforcement of pharmaceutical serialization laws and evolving e-commerce regulations are driving significant investments in track-and-trace packaging technology. Governments worldwide, including the U.S., Europe, China, and India, have implemented strict track-and-trace mandates requiring unique identification codes on each product unit. This has accelerated the adoption of serialization, RFID tracking, and cloud-based monitoring systems, ensuring real-time visibility across the supply chain. The growth of online marketplaces, where counterfeit pharmaceutical and cosmetic products are prevalent, has further increased the demand for end-to-end tracking solutions. Companies are also integrating IoT-enabled smart packaging to enhance transparency, minimize fraud risks, and provide real-time alerts for any supply chain discrepancies.

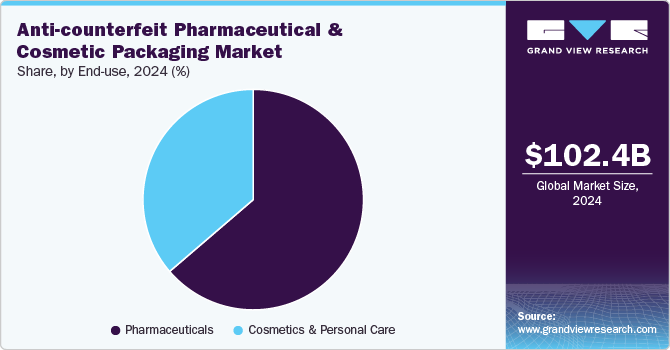

End Use Insights

Pharmaceuticals dominated the anti-counterfeit pharmaceutical and cosmetic packaging industry across the technology segmentation in terms of revenue, accounting to a market share of 63.71% in 2024. The rise in counterfeit drugs and the growing importance of patient safety regulations are major drivers pushing pharmaceutical companies to adopt robust anti-counterfeit packaging technologies. Regulatory bodies such as the U.S. FDA, European Medicines Agency (EMA), and the World Health Organization (WHO) have emphasized the need for tamper-proof, serialized, and digitally authenticated packaging to prevent fake medicines from entering legitimate supply chains.

The expansion of online pharmacy sales, combined with the increasing prevalence of counterfeit vaccines, prescription drugs, and over-the-counter (OTC) medications, has heightened the urgency for secure track-and-trace solutions and biometric-enabled authentication technologies. As a result, pharmaceutical manufacturers are embracing high-security holographic foils, embedded microchips, and real-time product tracking to ensure compliance, protect patient health, and safeguard brand reputation.

The boom in luxury and premium cosmetic brands is driving increased adoption of anti-counterfeit packaging solutions in the cosmetics & personal care industry. High-end beauty brands, particularly in the skincare, fragrance, and makeup segments, face substantial financial and reputational risks from counterfeit products infiltrating global markets. To protect brand equity, companies are investing in customized security features such as NFC-enabled packaging, microtext printing, and color-shifting inks, which allow consumers to verify authenticity instantly.

The rise of social media influencers and direct-to-consumer sales channels has further amplified consumer demand for authenticated, traceable beauty products. As a result, major cosmetic companies are integrating invisible digital watermarks and AI-driven verification platforms to ensure a seamless and secure customer experience.

Regional Insights

North America dominated the global anti-counterfeit pharmaceutical and cosmetic packaging industry and accounted for largest revenue share of 35.42% in 2024. The North American anti-counterfeit pharmaceutical and cosmetic packaging market is witnessing strong growth due to government-backed sustainability policies and bio-based material incentives. The U.S. and Canadian governments have introduced tax credits, subsidies, and funding programs to accelerate the shift away from petroleum-based plastics.

The rising prevalence of counterfeit drugs and cosmetic products in North America is a major driver pushing brands to adopt advanced anti-counterfeit packaging solutions. With a surge in online pharmacy sales and third-party e-commerce beauty retailers, the risk of counterfeit pharmaceuticals and fake cosmetics reaching consumers has significantly increased. This has led to stricter enforcement of serialization, RFID tracking, and digital verification technologies to secure supply chains and ensure product authenticity.

U.S. Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market Trends

The implementation of the Drug Supply Chain Security Act (DSCSA) is a key driver accelerating the demand for anti-counterfeit pharmaceutical packaging in the U.S. The act mandates full serialization and unit-level traceability of prescription drugs by 2024, compelling pharmaceutical companies to adopt track-and-trace technologies, tamper-evident packaging, and digital authentication tools. Additionally, the luxury cosmetics market is expanding rapidly in the U.S., with high-end brands facing increased threats from counterfeit products, particularly through online platforms. As a response, leading cosmetic companies are integrating biometric verification, embedded digital watermarks, and AI-driven authentication to protect brand integrity and enhance consumer confidence in product authenticity.

Europe Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market Trends

Europe’s strict regulatory landscape and strong consumer demand for product safety are major forces driving the adoption of anti-counterfeit packaging in pharmaceuticals and cosmetics. The Falsified Medicines Directive (FMD) requires pharmaceutical manufacturers to implement unique identification barcodes and tamper-proof seals to ensure drug authenticity across EU nations. The cosmetics industry is also witnessing increased regulatory scrutiny, with authorities pushing for enhanced transparency in ingredient labeling and anti-tampering measures to combat counterfeiting. anti-counterfeit pharmaceutical and cosmetic packaging

Asia Pacific Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market Trends

The rapid expansion of pharmaceutical and cosmetic manufacturing hubs in China, India, and South Korea is a key driver fueling the demand for anti-counterfeit packaging in the Asia Pacific region. With rising concerns over counterfeit medications and fake beauty products infiltrating both domestic and international markets, governments are imposing stricter regulations, such as India’s track-and-trace mandate for exported drugs and China’s anti-counterfeit labeling policies for cosmetics.anti-counterfeit pharmaceutical and cosmetic packaging

Key Anti-counterfeit Pharmaceutical And Cosmetic Packaging Company Insights

The anti-counterfeit pharmaceutical and cosmetic packaging industry is highly competitive, with several key players dominating the landscape. Major companies include Impinj Inc.; AlpVision; Authentix; Zebra Technologies Corp.; U-NICA Solutions AG; Alien Technology Corp.; Hague; Prooftag; OpSec; NanoMatriX International Limited; 3M; Avery Denison Corporation; CCL Industries Inc.; SML Group; and Ampacet Corporation. The anti-counterfeit pharmaceutical and cosmetic packaging market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Anti-counterfeit Pharmaceutical And Cosmetic Packaging Companies:

The following are the leading companies in the anti-counterfeit pharmaceutical and cosmetic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Impinj Inc.

- AlpVision

- Authentix

- Zebra Technologies Corp.

- U-NICA Solutions AG

- Alien Technology Corp.

- Hague

- Prooftag

- OpSec

- NanoMatriX International Limited

- 3M

- Avery Denison Corporation

- CCL Industries Inc.

- SML Group

- Ampacet Corporation

Recent Developments

-

In February 2025, the Indian packaging industry announced the assertion of anti-counterfeit measures to combat the fake drug trade. Counterfeit drugs pose a significant threat to public health, brand integrity, and regulatory frameworks. To address this challenge, advanced packaging solutions integrating overt and covert security features have emerged as a critical strategy and have been encouraged to be used.

-

In November 2023, Systech, a brand of Markem-Imaje, launched UniSecure, an anti-counterfeiting product security upgrade. It authenticates products using existing 1D, 2D Data Matrix, or QR codes, converting them into unique digital signatures via Systech's e-Fingerprint technology. This allows brands to verify product distribution using a smartphone, with real-time alerts for counterfeiting and diversion. UniSecure works with existing packaging, offering secure authentication and forensic intelligence for root cause analysis. The product was showcased at the 2023 Healthcare Packaging Expo.

Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 111.01 billion

Revenue forecast in 2030

USD 168.08 billion

Growth rate

CAGR of 8.65% from 2024 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Impinj Inc.; AlpVision; Authentix; Zebra Technologies Corp.; U-NICA Solutions AG; Alien Technology Corp.; Hague; Prooftag; OpSec; NanoMatriX International Limited; 3M; Avery Denison Corporation; CCL Industries Inc.; SML Group; Ampacet Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-counterfeit Pharmaceutical And Cosmetic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global anti-counterfeit pharmaceutical and cosmetic packaging market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Authentication Packaging Technology

-

Track & Trace Packaging Technology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. .The global anti-counterfeit pharmaceutical and cosmetic packaging market size was estimated at USD 102.45 billion in 2024 and is expected to reach USD 111.02 billion in 2025.

b. .The global anti-counterfeit pharmaceutical and cosmetic packaging market is expected to grow at a compound annual growth rate of 8.65% from 2025 to 2030 to reach USD 168.08 billion by 2030.

b. .Pharmaceuticals dominated the anti-counterfeit pharmaceutical and cosmetic packaging market across the technology segmentation in terms of revenue, accounting to a market share of 63.71% in 2024. The rise in counterfeit drugs and the growing importance of patient safety regulations are major drivers pushing pharmaceutical companies to adopt robust anti-counterfeit packaging technologies.

b. .Some key players operating in the anti-counterfeit pharmaceutical and cosmetic packaging market include Impinj Inc., AlpVision, Authentix, Zebra Technologies Corp., U-NICA Solutions AG, Alien Technology Corp., Hague, Prooftag, OpSec, NanoMatriX International Limited, 3M, Avery Denison Corporation, CCL Industries Inc., SML Group, Ampacet Corporation

b. .Consumers are increasingly prioritizing genuine pharmaceutical and cosmetic products due to health and safety concerns. This has pushed brands to adopt secure packaging solutions like tamper-evident seals and digital verification to build trust and protect their reputation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.