- Home

- »

- Beauty & Personal Care

- »

-

Anti-wrinkle Products Market Size & Growth Report, 2030GVR Report cover

![Anti-wrinkle Products Market Size, Share & Trends Report]()

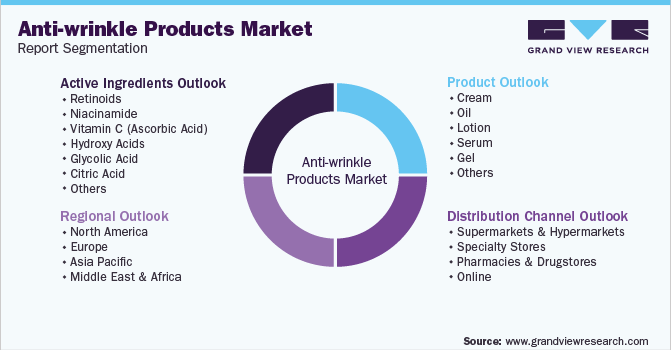

Anti-wrinkle Products Market Size, Share & Trends Analysis Report By Active Ingredients (Vitamin C, Hydroxy Acids), By Product (Cream, Lotion), By Distribution Channel, By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-835-0

- Number of Report Pages: 119

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global anti-wrinkle products market size was valued at USD 10.96 billion in 2022 and is projected to register a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. Rising awareness among consumers about age-related skin problems, such as fine lines, wrinkles, and dullness of skin, coupled with an increasing propensity to spend on products that help retain a youthful appearance, is expected to drive product demand during the forecast period. In addition, the rising elderly population across the globe and technological advancements in the cosmetic industry are expected to be key factors driving the industry’s growth.

Anti-wrinkle products are gaining traction as they contain formulations that help slow down the aging process. Major causes of wrinkles include lack of essential nutrients in the body, exposure to UV light and pollution over a long period, smoking, dehydration, and drugs, as well as genetic predisposition. The growing inclination toward plant-based alternatives has resulted in a recent shift in consumer preference for organic and natural products. In this regard, many brands are providing anti-wrinkle products containing natural ingredients. For instance, Alpyn Beauty, a manufacturer of skin care products, offers a moisturizer with Bakuchiol and Squalane that brightens the skin and minimizes the appearance of wrinkles.

Furthermore, numerous crossover products have emerged under the natural beauty trend. These offer the dual functionality of makeup as well as wrinkle care. For instance, Lancôme, a part of the L’Oréal brand, offers a range of makeup and cosmetics that contains Génifique, an anti-aging serum. The COVID-19 outbreak led to a decline in demand for cosmetics, including anti-wrinkle products, globally. Primarily, some of the most adversely affected countries, such as the U.S., India, Brazil, Russia, and the U.K., witnessed a significant decline in sales in 2020. Many manufacturers previously relied on China for finished products as well as raw materials used in the manufacturing of various types of cosmetics, which disrupted product manufacturing and distribution in 2020.

Active Ingredients Insights

On the basis of active ingredients, the global industry has been further categorized into retinoids, niacinamide, vitamin C (Ascorbic Acid), hydroxy acids, glycolic acid, citric acid, lactic acid, coenzyme Q10, peptides, tea extracts, grape seed extracts, and others. The vitamin C segment dominated the industry in 2022 and accounted for the maximum share of 18.20% of the overall revenue. Vitamin C is a powerful antioxidant, which helps boost collagen production, improves skin firmness, and reduces the appearance of wrinkles. Key players in the industry are using vitamin C as an active ingredient in a variety of anti-wrinkle products.

For example, in March 2020, Kiehl’s announced the launch of Powerful-Strength Dark Circle Reducing Vitamin C Eye serum, which helps improve under-eye circles and reduce signs of aging. On the other hand, the hydroxy acids segment is estimated to register the fastest CAGR during the forecast period. Hydroxy acids primarily work as exfoliants and remove dead skin, thereby promoting the growth of new skin. Hydroxy acids also help improve the appearance of wrinkles and pigmentation on damaged skin. Canada-based CelleX-C International Inc. provides a wide range of exfoliators and anti-aging products that contain AHA & BHA.

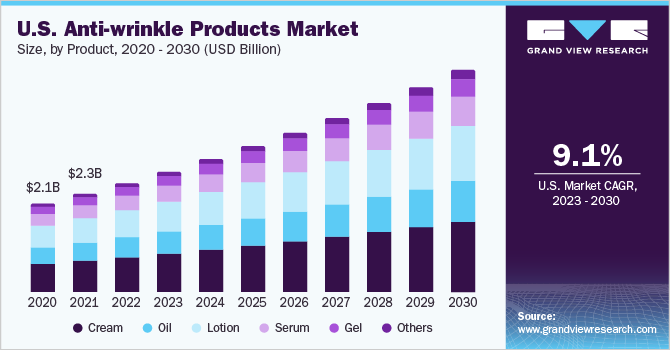

Product Insights

On the basis of products, the global industry has been further categorized into creams, oils, lotions, serums, gels, and others. The anti-wrinkle creams product segment dominated the global industry in 2022 and accounted for the maximum share of more than 31.00% of the overall revenue. The segment is estimated to expand further at a steady growth rate maintaining its leading position in the global industry throughout the forecast period.

Anti-wrinkle creams help in maintaining glow and provide much-needed moisturization to the skin. The demand for anti-wrinkle creams is primarily driven by the growing aging populace across the globe and the rising number of consumers willing to invest in products that help in reducing signs of aging. In addition, various advertising and marketing initiatives undertaken by key manufacturers in the industry are supporting the growth of this segment. The lotion product segment, on the other hand, is estimated to register the fastest growth rate over the forecast period.

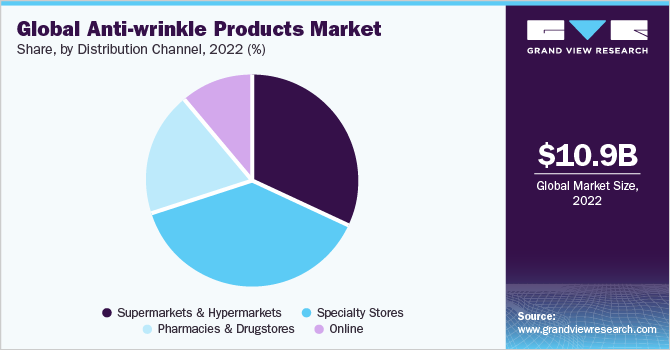

Distribution Channel

The supermarkets & hypermarkets distribution channel segment accounted for the maximum share of more than 31.80% of the overall revenue. These distribution channels offer significant advantages to consumers, such as discounted rates on products, better visibility of product categories, and product variations. According to the Entrepreneur Handbook article, in July 2021, Sainsbury’s, Tesco, Asda, and Morrisons accounted for close to 63% of retail sales in the U.K. Several companies prefer supermarkets and hypermarkets as primary channels to boost product sales. Moreover, younger consumers prefer small retail stores and hypermarkets to purchase skincare products. In addition, the ease of ordering products through websites encourages manufacturers to sell their products online.

Retailers, such as Target, provide a wide range of products from Clinique, Drunk Elephant, and Shiseido. The online segment is projected to register the fastest CAGR during the forecast period due to the rising number of consumers opting for online platforms for shopping. Online platforms offer various benefits, such as easy availability of products of different brands and discounts on product prices. The rising penetration of the internet and social media platforms, such as Instagram and YouTube, is also supporting segment growth. A large population follows social media influencers for recommendations and additional information on skin care products. Moreover, the growing popularity of live shopping will drive the segment’s growth.

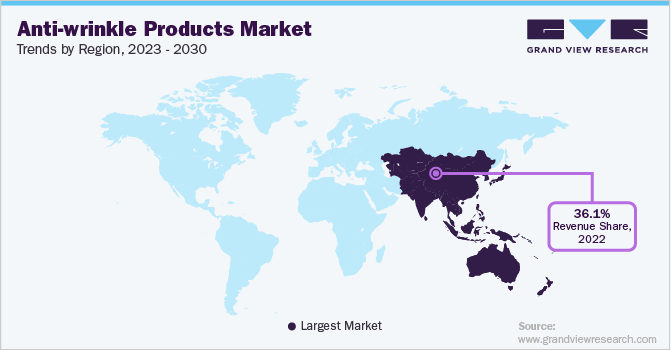

Regional Insights

Asia Pacific led the industry and accounted for the maximum revenue share of more than 36.10% in 2022. The region is estimated to expand further at the fastest growth rate maintaining its leading position throughout the forecast years. North America also emerged as one of the main markets for anti-aging products. High per capita income, better living conditions, and the easy availability of innovative products through online as well as offline distribution channels have boosted product sales in the region. Other factors driving regional expansion include technological advancements, the growing influence of social media, and rising personal appearance consciousness. The increased popularity of non-invasive cosmetic procedures has also fueled product demand in the region.

The demand for anti-wrinkle products in Europe is significant, as consumers are becoming increasingly concerned with their overall appearance. The aging population is a major consumer group driving product demand. Consumers in the region prefer high-quality; effective products that can help reduce the appearance of fine lines and wrinkles. In addition, the growing reluctance for non-invasive cosmetic procedures, such as dermal fillers and botox injections, has further fueled the product demand in Europe. Several European consumers prefer products that will help them achieve a youthful appearance without the use of surgical procedures. Some of the popular anti-wrinkle cream products in Europe include Lancôme Miracle Crème and Olay Regenerist. The easy product availability in retail and drug stores is also supporting the region’s growth.

Key Companies & Market Share Insights

The global industry is highly fragmented with new brands emerging regularly. The industry has a strong presence of several giants as well as medium-sized companies. These companies focus on various strategies, such as M&As and new product launches, to gain a competitive edge over others. For instance, in January 2023, REN Clean Skincare launched Boost+Protect Perfect Canvas Smooth, Prep & Plump Essence. This product includes bioactive that plumps skin with hydration. It also contains polyglutamic and hyaluronic acid for smooth skin and reinforces the skin barrier. In October 2022, No7 Beauty Company launched Menopause Skincare Line. It features creams, serums, and mists that target major signs of aging menopausal skin and helps make it look radiant & reduce the appearance of dark circles as well as wrinkles. Some of the prominent players in the global anti-wrinkle products market include:

-

L’Oréal Groupe

-

Olay

-

CeraVe

-

Neutrogena

-

RoC Skincare

-

POND’S

-

No7 Beauty Company (Walgreens Boots)

-

La Roche-Posay Laboratoire Dermatologique

-

REN Clean Skincare

-

Galderma S.A.

-

Clinique Laboratories

-

LLC, Shiseido Co., Ltd

-

The Estée Lauder Companies Inc.

-

Life Extension

-

Vichy Laboratoires

-

Kiehl’s Since 1851

-

Groupe Clarins

-

Origins Natural Resources, Inc.

Anti-wrinkle Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.10 billion

Revenue forecast in 2030

USD 21.62 billion

Growth rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Active ingredients, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; UAE

Key companies profiled

L’Oréal Groupe; Olay; CeraVe; Neutrogena; RoC Skincare; POND’S; No7 Beauty Company (Walgreens Boots); La Roche-Posay Laboratoire Dermatologique; REN Clean Skincare; Galderma S.A.; Clinique Laboratories, LLC; Shiseido Co., Ltd.; The Estée Lauder Companies Inc.; Life Extension; Vichy Laboratoires; Kiehl’s Since 1851; Groupe Clarins; Origins Natural Resources, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-wrinkle Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global anti-wrinkle products market report based on active ingredients, product, distribution channel, and region:

-

Active Ingredients Outlook (Revenue, USD Million, 2017 - 2030)

-

Retinoids

-

Retinol

-

Retinoic Acid

-

-

Niacinamide

-

Vitamin C (Ascorbic Acid)

-

Hydroxy Acids

-

Glycolic Acid

-

Citric Acid

-

Lactic Acid

-

Coenzyme Q10

-

Peptides

-

Tea Extracts

-

Grape Seed Extracts

-

Others

-

-

Product Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Cream

-

Oil

-

Lotion

-

Serum

-

Gel

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Middle East & Africa

-

U.A.E

-

-

Frequently Asked Questions About This Report

b. The global anti-wrinkle products market size was estimated at USD 10.96 billion in 2022 and is expected to reach USD 12.10 billion in 2023.

b. The global anti-wrinkle products market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 21.61 billion by 2030.

b. Asia Pacific dominated the anti-wrinkle products market with a share of 36% in 2022. The demand for lab-grown jewelry products is driving the regional market.

b. Some key players operating in the anti-wrinkle product market include L’ORÉAL GROUPE, OLAY, CeraVe, Neutrogena, RoC Skincare, POND’S, No7 Beauty Company (Walgreens Boots), La Roche-Posay Laboratoire Dermatologique, REN Clean Skincare, Galderma S.A., Clinique Laboratories, LLC, Shiseido Co., Ltd, The Estée Lauder Companies Inc., Life Extension, Vichy Laboratoires, Kiehl’s Since 1851, Groupe Clarins, Origins Natural Resources, Inc.

b. Key factors that are driving the market growth include rising awareness among consumers related to age-related skin problems such as fine lines, wrinkles, and dullness of skin, coupled with an increasing propensity to spend on products that help retain a youthful appearance, is expected to drive the product demand throughout the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."