- Home

- »

- Food Additives & Nutricosmetics

- »

-

Citric Acid Market Size, Share & Trends Analysis Report 2030GVR Report cover

![Citric Acid Market Size, Share & Trends Report]()

Citric Acid Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Liquid, Powder), By Application (Pharmaceutical, Food & Beverages, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-083-5

- Number of Report Pages: 65

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Citric Acid Market Summary

The global citric acid market size was valued at USD 3.78 billion in 2022 and is projected to reach USD 5.17 billion by 2030, growing at a CAGR of 4.0% from 2023 to 2030. High demand for the product to preserve food is expected to be a key driver for the industry's growth.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 35.0% in 2022.

- The China body scrub market is expected to grow significantly over the forecast period.

- By form, the powder segment accounted for the largest revenue share of 61.5% in 2022.

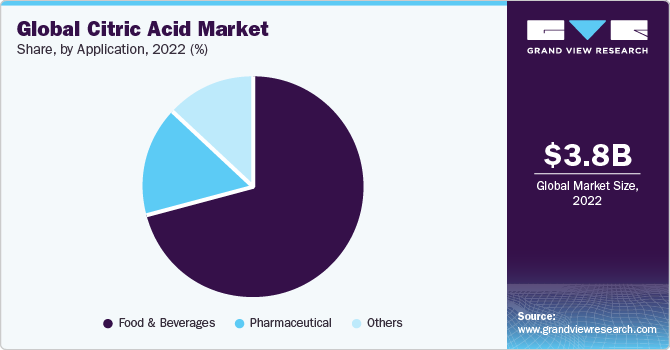

- By application, the food & beverages segment accounted for the largest revenue share of 71.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3.78 Billion

- 2030 Projected Market Size: USD 5.17 Billion

- CAGR (2023-2030): 4.0%

- Asia Pacific: Largest market in 2022

In addition, the growing demand for the compound in the pharmaceutical industry for the manufacturing of digestive medicines is expected to positively drive the market over the forecast period. Citric acid imparts tartness & sourness and enhances flavors. The acid, when used as an additive in food products, is effective in inhibiting microbial growth and, therefore, extends their shelf life. The aforementioned factors are expected to augment product demand over the next eight years.

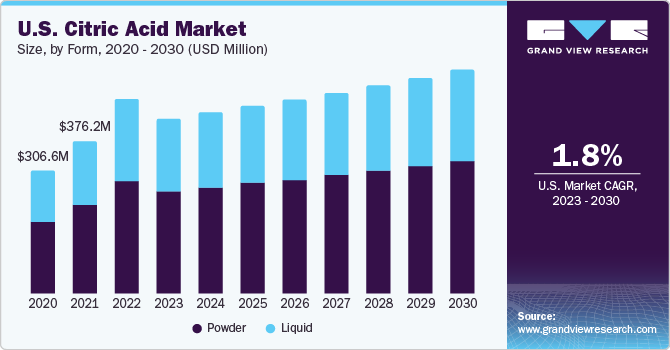

The market in the U.S. is projected to experience steady growth over the next 8 years. Citric acid is largely being used in the regional food processing industry to enhance the shelf life of convenience foods. Well established food processing industry in the region is expected to have a positive impact on the industry trends.

Regulations for the use of citric acid in nutraceuticals, nutricosmetics, and dietary supplements, especially for infant formulas, in North America, are stringent, which are expected to pose a challenge to regional players. This has resulted in stagnancy in terms of innovation in products for infant formulations.

The manufacturers are penetrating into various market segments by introducing citric acid-based products such as confectionery, diabetic baked products, ice creams, low-calorie jellies, low-calorie sugar, dietary beverages & snacks, and low-fat dairy products. The rising demand for these products is expected to boost the demand among consumers.

Form Insights

The powder segment accounted for the largest revenue share of 61.5% in 2022. The powder form is used as an alternative to lemon juice or vinegar in culinary applications. It is employed as a chelating agent to eliminate & prevent the buildup of limescale in evaporators and boilers. In addition, it is also used to treat water to improve the effectiveness of laundry detergents and soaps.

Powder form of the product is extensively used in food & beverage applications for preservation and flavoring. In addition, it is used as an emulsifying agent in ice creams to prevent the fats from separating. It is commonly sold in groceries and markets as sour salt due to its resemblance to table salt.

The liquid segment is expected to grow at a CAGR of 3.6% during the forecast period. Liquid form is used in a variety of food and dairy products due to its beneficial properties such as acidifying agents, texture modification, and flavor enhancement. Liquid form is also used in the oil industry as an iron control additive for chelating and maintaining the pH of acidizing fluids to help reduce the precipitation of iron in oil.

Application Insights

The food & beverages segment accounted for the largest revenue share of 71.4% in 2022. The high market share of the food & beverage segment can be attributed to the extensive usage in ice creams and dietary supplements. It is utilized to control the pH value in medicines and form salt derivatives of minerals and metals in pharmaceuticals. Furthermore, it is employed in conjunction with sodium bicarbonate in effervescent formulae for the manufacturing of personal care and ingestion tablets & powder products.

The pharmaceuticals segment is expected to register a CAGR of 4.2% over the forecast period. Citric acid is predominantly used as an excipient in pharmaceutical formulations, serving multiple functions such as stabilizing pH levels, acting as a chelating agent, and ensuring the stability and efficacy of diverse medications. Furthermore, it plays a crucial role in the production of effervescent tablets, where it is a vital component responsible for creating effervescence, leading to improved patient compliance with the medication regimen.

Others application segments include detergents & cleansers, cosmetics, animal feed, and textiles. The product is used in cleaners, which enables the easy formation of foam and works well without the requirement of water softening when induced with citric acid as a chelating agent. It is also employed for developing photographic films by including it in the stop bath.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 35.0% in 2022. Asia Pacific, being one of the largest and fastest-growing regions in the world, holds a prominent position in the global citric acid market. The region's strong economic growth, rapid industrialization, and increasing urbanization have fueled the demand for processed food and beverages, pharmaceuticals, and personal care products.

Central & South America is expected to grow at a CAGR of 4.7% during the forecast period. Citric acid manufacturers find ample prospects in the region, owing to its varied economies, burgeoning middle-class population, and expanding food and beverage sector. As disposable incomes rise and urbanization accelerates, there is a growing inclination towards convenience foods and ready-to-drink beverages, leading to an increased demand for citric acid as a crucial ingredient in these products. Furthermore, the region's flourishing pharmaceutical and personal care industries also contribute to the consumption of citric acid in the area.

Key Companies & Market Share Insights

Major technological shifts in manufacturing processes and the rising use of advanced machinery are expected to positively affect the growth of citric acid production over the forecast period. The use of advanced machinery has enabled manufacturers to come up with innovative products such as encapsulated citric acid. Companies in the industry are also investing in R&D activities to come up with citric acid products for application in fields such as detergents, food & beverages, pharmaceuticals, and cosmetics.

Key Citric Acid Companies:

- Pfizer, Inc.

- Tate & Lyle PLC

- Danisco A/S

- Cargill

- Kenko Corporation

- ADM

Recent Developments

- In March 2023, Noble Biomaterials, Inc., a company based in Pennsylvania dealing in biotechnology field, announced that it had successfully created a bio based citric acid formula called Ionic + Botanical. The formula would be useful in reducing fabric odour via inhibiting the growth of microbes. The products using this novel technology are expected to be available in the market by 2024.

- In April 2021, Tate & Lyle announced plans to sell its majority stakes in primary products business unit. The unit produces citric acid and other products such as dextrose, corn sweeteners, ethanol and industrial starches. This choice to sell these products fits with the company's main plan to focus more on healthy foods. At the same time, it's also about keeping their main product business separate from food and beverages solutions.

Citric Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,484.0 million

Revenue forecast in 2030

USD 5.17 billion

Growth Rate

CAGR of 4.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Pfizer, Inc.; Tate & Lyle PLC; Danisco A/S; Cargill, Incorporated; Kenko Corporation; ADM

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Citric Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global citric acid market based on form, application, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Food & Beverages

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global citric acid market size was estimated at USD 3,786.9 million in 2022 and is expected to reach USD 3,484.0 million in 2023.

b. The global citric acid market is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 5.17 billion by 2030.

b. Food & beverage dominated the citric acid market with a share of 71.4% in 2022. This is attributable to its extensive usage in ice creams and dietary supplements. It is utilized to control the pH value in medicines and form salt derivatives of minerals and metals in pharmaceuticals.

b. Some key players operating in the citric acid market include Metagenics, Inc.. MP Biomedicals, Tate & Lyle plc, DuPont Danisco, Cargill Incorporated, Kenko Corporation, Pfizer, Inc., Archer Daniels Midland (ADM) Company

b. Key factors that are driving the market growth include increasing demand for preventive healthcare coupled with rising geriatric population which has higher prevalence of nutrition related diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.