- Home

- »

- Organic Chemicals

- »

-

Glycolic Acid Market Size And Share, Industry Report, 2030GVR Report cover

![Glycolic Acid Market Size, Share & Trends Report]()

Glycolic Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (Cosmetic, Technical), By Application (Personal Care, Household, Construction, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-006-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glycolic Acid Market Size & Trends

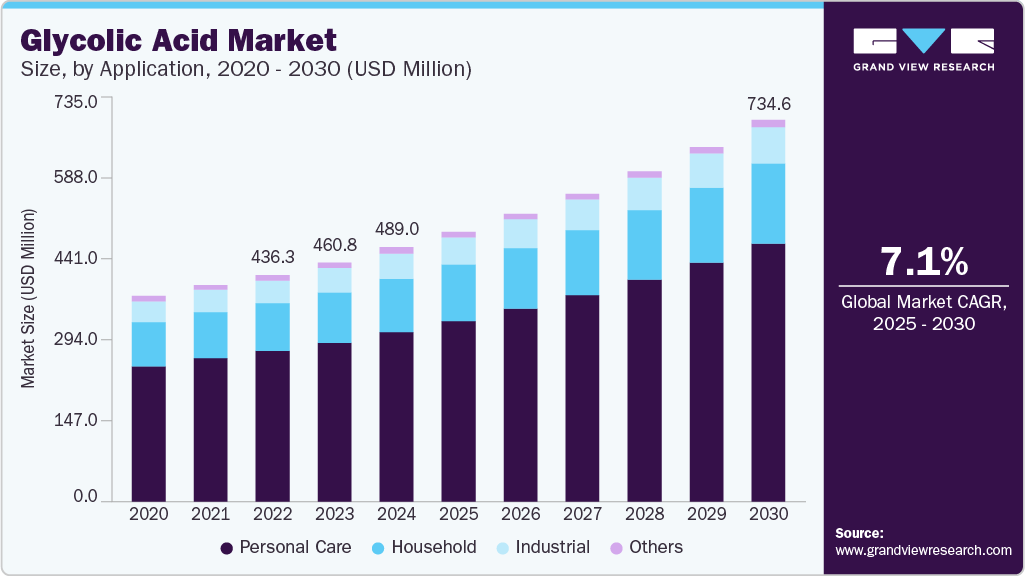

The global glycolic acid market size was estimated at USD 489.0 million in 2024 and is anticipated to grow at a CAGR of 7.1% from 2025 to 2030. Increasing demand of skin and hair care products containing glycolic acid is driving the market.

Key Highlights:

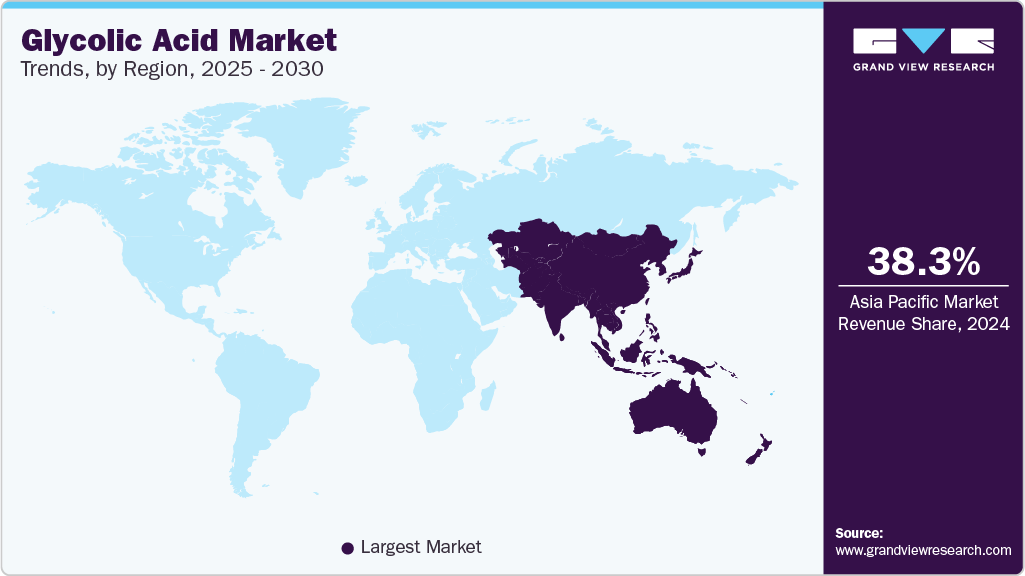

- Asia Pacific glycolic acid market dominated the global industry with the largest revenue share of 38.3% in 2024.

- The glycolic acid market in the U.S. is expected to grow at CAGR of 7.5% over the forecast period.

- By application, the personal care segment dominated the market by capturing 66.7% share in 2024.

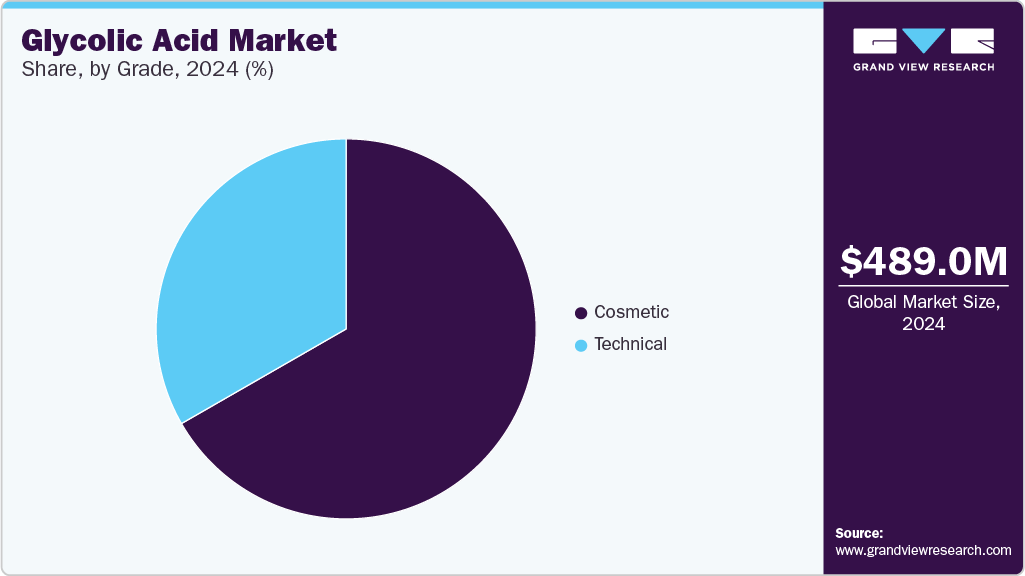

- By grade, the cosmetic segment dominated the industry by capturing 64.7% of share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 489.0 million

- 2030 Projected Market Size: USD 734.6 million

- CAGR (2025-2030): 7.1%

- Asia Pacific: Largest market in 2024

It is also used in emulsion polymers and additives for inks & paints, further expanding the market growth. Glycolic acid is a natural compound primarily obtained from citrus fruits such as oranges and grapes. Kiwi, beets, sugarcane are other rich sources of glycolic acid. Growing production of formaldehyde coupled with technological advancements to optimize the production grade is expected to boost the market growth further.

In addition, rising expenditure on R&D has resulted in an increased scope of application, which is expected to drive product demand over the forecast period. However, high awareness levels about the negative effects of glycolic acid, such as skin allergies, are expected to restrain the market growth to some extent. Stringent regulations imposed by regulatory bodies, such as the European Union, regarding product usage in cosmeceutical formulations, are also likely to hinder growth. On the other hand, the rising popularity of natural cosmetics is likely to positively affect the industry dynamics over the years to come.

The rising need for online cosmetics and personal care products such as moisturizers, body wash, fragrances, scrubs, lipsticks, sunscreens, and others has encouraged many companies or manufacturers to develop a broad sales network, which is anticipated to drive the market. With the advent of the e-commerce sector and the growth of social media, consumer demand for high-end, unique, and novel cosmetics has also emerged. Glycolic acid is a vital element in the manufacturing of the above-mentioned goods, which is anticipated to propel industry growth, coupled with rising consumer healthcare awareness. The rising demand for glucosides in biopolymers usage, due to their harmless and excellent recyclability, represents a significant potential for glycolic acid producers. Hence, it acts as an opportunity for the manufacturers in the market.

However, the excessive use of acids in personal care & cosmetic products can damage the skin. It results in skin irritation, swelling, itching, and skin burning. In addition, chemical peeling frequently can make the skin more sensitive to UV rays and make people more prone to sunburn. If inhaled at high amounts for a prolonged time, it can harm the lungs and liver, and create respiratory ailments. Furthermore, the increasing consumer inclination toward organic products as a substitute can limit market growth.

Drivers, Opportunities & Restraints

The global glycolic acid market is experiencing robust growth, primarily driven by its increasing application in personal care and dermatology products. Glycolic acid's efficacy in treating acne, hyperpigmentation, and signs of aging has made it a favored ingredient in skincare formulations. Its small molecular size allows for deep skin penetration, enhancing its effectiveness in exfoliation and skin rejuvenation. Beyond cosmetics, glycolic acid is utilized in industrial cleaning agents, textile dyeing, and as a precursor in biodegradable polymers like polyglycolic acid (PGA), which are used in medical sutures and drug delivery systems. The demand for biodegradable and sustainable products further propels its market growth.

The glycolic acid market is expanding with the rising consumer preference for natural and eco-friendly products. The shift towards sustainable production methods and the development of bio-based glycolic acid present significant growth avenues. Additionally, the increasing demand for glycolic acid in emerging economies, driven by urbanization and rising disposable incomes, offers potential for market expansion. Innovations in product formulations and the exploration of new applications in pharmaceuticals and agriculture also contribute to the market's positive outlook.

The potential side effects of glycolic acid, such as skin irritation and sensitivity, can limit its usage in cosmetic products. Moreover, stringent regulatory frameworks governing its concentration and application in various industries pose challenges for manufacturers. Compliance with diverse regional regulations requires significant investment in research and development, potentially hindering market growth. Additionally, the high production costs associated with glycolic acid, especially when derived from natural sources, may affect its competitiveness compared to synthetic alternatives.

Application Insights

The personal care segment dominated the market by capturing 66.7% of the market share in 2024. The increasing awareness about self-care and the availability of products aligning with dermatological requirements are driving the segment's growth. Consumers are proactively paying attention to grooming needs, advice from professionals, and social media reviews of various products, due to which scalp & hair treatments are followed.

Polyurethane (PU) coatings are widely used in the wood and furniture industry for their exceptional durability, scratch resistance, and aesthetic appeal. They enhance the longevity of wooden surfaces by providing protection against moisture, stains, and UV exposure, making them ideal for flooring, cabinetry, and high-end furniture. With increasing demand for eco-friendly solutions, water-based PU coatings are gaining popularity as a low-VOC alternative to traditional solvent-based formulations.

The household segment held a notable share of the market in 2024, driven by its widespread use in surface cleaners, descalers, and bathroom and kitchen maintenance products. Growing consumer preference for non-toxic, eco-friendly cleaning solutions and the demand for multifunctional household cleaners further propel segment growth.

Grade Insights

The cosmetic segment dominated the glycolic acid industry by capturing 64.7% of market share in 2024. The cosmetic grade market is driven by its widespread use in skincare products such as chemical peels, anti-aging creams, exfoliants, and acne treatments. Known for its small molecular size and effective skin penetration, glycolic acid helps in removing dead skin cells, improving texture, and promoting collagen production. Rising consumer demand for dermatologist-recommended and premium skincare is fueling the growth of this segment, especially in North America, Europe, and Asia-Pacific.

The technical grade segment is primarily driven by its applications in industrial cleaning, metal surface treatment, and oil & gas descaling. Its strong chelating properties make it effective in removing rust, scale, and mineral deposits without damaging surfaces. This grade is widely used in boiler cleaning agents, electronics manufacturing, and automotive maintenance. Demand is increasing due to its biodegradability and low toxicity, offering a safer alternative to harsher acids.

Regional Insights

The North American glycolic acid market is experiencing growth. High population of working women and increasing awareness among these to maintain grooming standards are driving the market. Increasing influence of social media trends and celebrity endorsements are boosting the growth as well.

U.S. Glycolic Acid Market Trends

The glycolic acid market in the U.S. is expected to grow at CAGR at 7.5% during the forecast period. The presence of key players in the cosmetics sector and continuous R&D activities to offer enhanced products are fostering the market. The growing inclination towards youthful appearance and flawless skin & hair are shaping the market of constituents in cosmetics including glycolic acid.

Europe Glycolic Acid Market Trends

Europe is projected to expand at a CAGR of 7.0% during 2025 to 2030 due to a rapidly evolving skin and hair care industry. Increasing popularity of anti-aging and acne removing creams in European population is expected to drive the market in coming years. Additionally, global fashion hubs such as France and Italy have attracted several cosmetic manufacturers in the region, positively impacting regional growth.

Asia Pacific Glycolic Acid Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 38.3% in 2024. It is expected to grow at a CAGR of 7.4% and retain its dominance during the forecast period. Highly populated and developing countries such as China and India are the major contributors to the segment's growth.

China glycolic acid market held an over 44.2% revenue share of the overall Asia Pacific. The market in China is expected to grow during the forecast period. This growth is attributed to the increasing personal care in the region, which led to increased demand for the product.

Key Glycolic Acid Company Insights

Some of the key participants in the glycolic acid market are PureTech Scientific Inc.,

CABB Chemicals, CrossChem Limited, Nikko Chemicals, Avid Organics Pvt. Ltd. Companies and others.

- PureTech Scientific operates in production of nature-identical and readily biodegradable glycolic acid which is used in variety of industries including personal care products. Its objective is to offer safer and healthier products through innovations, grade and research. Company aims to deliver environmentally sustainable products by reducing carbon emission in the process.

Key Glycolic Acid Companies:

The following are the leading companies in the glycolic acid market. These companies collectively hold the largest market share and dictate industry trends.

- PureTech Scientific Inc.

- CABB Chemicals

- CrossChem Limited

- Nikko Chemicals

- Avid Organics Pvt. Ltd.

- Mehul Dye Chem Industries

- Kanto Chemical Co., Inc.

- Junsei Chemical Co., Ltd.

- Kishida Chemical Co., Ltd.

- Fengchen Group Co., Ltd.

- BASF SE

Recent Developments

-

In December 2024, BASF SE personal care division has launched Symbiocell, a clinically proven active ingredient targeting sensitive skin, formulated with Cestrum latifolium extract which contains glycolic acid in the form of butylene glycol and caprylyl gycol. Recently approved for commercialization in China, Symbiocell addresses the growing demand in Asia-Pacific for glycolic acid.

-

In August 2023, The Chemours Company announced the sale of its Glycolic Acid Business. It is acquired by PureTech Scientific, LLC and backed by a private equity firm, Iron Path Capital.

Glycolic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 520.2 million

Revenue forecast in 2030

USD 734.6 million

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

PureTech Scientific Inc.; CABB Chemicals; CrossChem Limited; Nikko Chemicals; Avid Organics Pvt. Ltd.; Mehul Dye Chem Industries; Kanto Chemical Co., Inc.; Junsei Chemical Co., Ltd.; Kishida Chemical Co., Ltd.; Fengchen Group Co., Ltd.; BASF SE

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glycolic Acid Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global glycolic acid market report on the basis of grade, application, and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Cosmetic

-

Technical

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Personal Care

-

Household

-

Construction

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glycolic acid market size was estimated at USD 489.0 million in 2024 and is expected to reach USD 520.2 million in 2025.

b. The global glycolic acid market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030 to reach USD 734.6 million by 2030.

b. Asia Pacific dominated the glycolic acid market with a share of 38.3% in 2042. This is attributable to increasing product use in industrial, cosmeceutical, and household applications.

b. Some key players operating in the glycolic acid market include Parchem; CrossChem LP; Phibro Animal Health Corporation; DuPont; Griffin International; and Chemsolv, Inc.

b. Key factors that are driving the market growth include growing demand for glycolic acid-based skin and hair care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.