- Home

- »

- Agrochemicals & Fertilizers

- »

-

Anticoagulant Rodenticides Market, Industry Report, 2030GVR Report cover

![Anticoagulant Rodenticides Market Size, Share & Trends Report]()

Anticoagulant Rodenticides Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type, By Form (Pellets, Blocks, Powder), By Application (Agriculture, Pest Control Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-589-7

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anticoagulant Rodenticides Market Trends

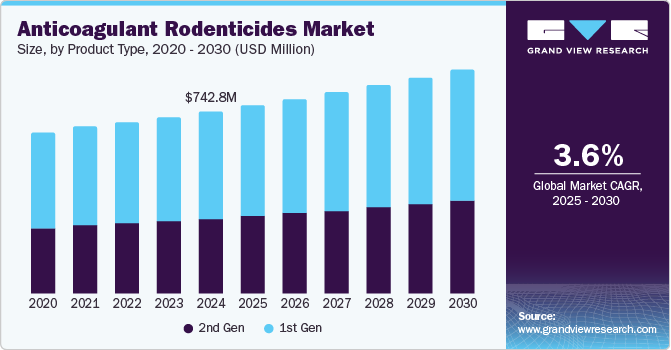

The global anticoagulant rodenticides market size was valued at USD 724.8 million in 2024 and is projected to grow at a CAGR of 3.6% from 2025 to 2030. The market growth is expected to propel due to the increasing frequency of diseases related to rodents, the rising rodent population, and increased demand for rodent control. The market is extremely competitive due to the presence of multiple manufacturing companies coupled with rising demand for products that help in rodent control from key application industries, including household, pest control, agriculture, and others.

Big manufacturers, including BASF, Syngenta, and BAYER AG, are intensifying their product portfolio by developing powders, sprays, and baits with various concentrations of active ingredients. For instance, Neosorexa Plus Blocks are highly palatable rodenticide baits designed for professional pest control. They combine cereals with patented Fortec technology, enhancing their attractiveness and effectiveness against rats and mice. These blocks are suitable for use in various urban, rural, and agricultural environments.

In addition to being employed by warehouses and pest control businesses, these products are used in homes, urban areas, and agriculture. It is projected that factors such as rising rat populations, increased need for rodent control, and the availability of natural rodent control products will propel market expansion. According to North Coast Media LLC, the growing rat population in New York City is estimated at 3 million in 2023, marking a sharp rise from 2 million in 2014. Urban density, improper waste disposal, and climate change contribute to this surge. The city's efforts include deploying Rodent Mitigation Zones and appointing a "rat czar" to oversee control initiatives.

The growing need for effective farming techniques and increased agricultural yields using advanced and new mechanisms result from growing worldwide worries about food security. As a result, the application of chemicals has increased to create efficient rodent control solutions. The creation of such goods has strongly emphasized how competitive they are with current market-available traditional rodent control treatments. The increase in chemical applications for rodent control has focused on creating efficient and targeted solutions.

Product Type Insights

The 2nd generation anticoagulant segment accounted for the largest share of 58.8% in 2024. This can be attributed to the product's ability to be fed once instead of several times with 1st generation anticoagulants. Single-dose anticoagulants are another name for second-generation anticoagulant rodenticides. The active ingredients of 2nd generation anticoagulant rodenticides currently registered are flocoumafen, brodifacoum, bromadiolone, difenacoum, and difethialone. According to the Imperial County Agricultural Commissioner, second-generation anticoagulant rodenticides (SGARs) are significantly more potent than first-generation ones, capable of delivering a lethal dose in a single feeding. They are more toxic due to their strong enzyme binding, longer half-life, and persistence in organs such as the liver.

The 1st generation anticoagulant rodenticides segment is expected to register the fastest CAGR of 3.8% during the forecast period owing to their lower ecological impact than second-generation alternatives. They pose reduced risks to non-target wildlife, aligning with stricter environmental regulations. Regulatory favorability enhances their adoption, particularly in areas emphasizing safety and sustainability. This makes them a preferred choice for broader usage under restricted policies. For instance, California's Poison-Free Wildlife Act (AB 2552), which was expected to take effect on January 1, 2025, restricts second-generation anticoagulant rodenticides to protect wildlife and non-target animals. These products are limited to essential services and require specific packaging criteria for professional or agricultural use. The law aims to reduce the ecological harm and suffering caused by these poisons.

Form Insights

Blocks held the largest market share in 2024, which can be attributed to their capacity to withstand the varying climatic circumstances that make them appropriate for outdoor use. Furthermore, the tendency of rodents to eat solid objects is additionally projected to fuel the need for a block form of anticoagulant rodenticides in the future. Blocks-based bait is specially designed for outdoor use in areas such as sewage systems and waste disposal sites. It offers high moisture resistance and durability, ideal for tropical climates. It includes a bitter agent to prevent accidental poisoning of humans and pets.

Pellets are expected to register the fastest CAGR during the forecast period. The driving factor for pellets in the anticoagulant rodenticides market is their effectiveness in delivering fast, single-dose control for rodents, even in challenging conditions. This makes them ideal for both residential and commercial pest management.

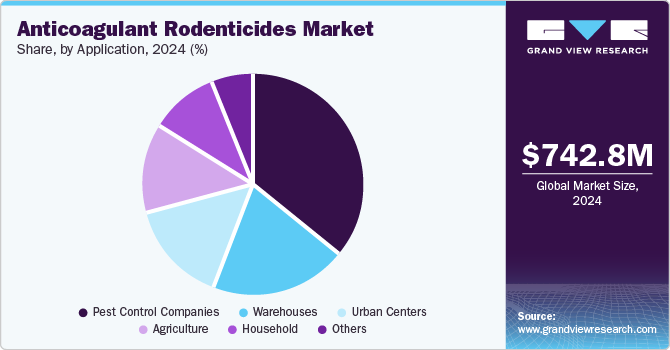

Applications Insights

The pest control companies segment dominated the market in terms of revenue share in 2024, which can be attributed to the expanding rodent populace and increasing mindfulness regarding high cleanliness norms. Pest control firms offer their services and products to various clients, including agriculture, residential, and commercial offices. In addition, numerous pest management services mainly include making preventive moves to limit the increasing population of mice and rats. For instance, BC guidelines restrict the use of anticoagulant rodenticides (ARs) for non-essential services and residential purposes, advocating for integrated pest management to minimize environmental harm. These policies emphasize ecological protection and safer pest control practices. These regulations push pest control companies to innovate and adopt sustainable rodent management strategies.

The household segment is projected to grow at the fastest CAGR over the forecast period. The demand for anticoagulant rodenticides in household applications is driven by rising urbanization, increasing incidences of rodent infestations, and heightened awareness about maintaining hygienic living environments. The shift towards safer, easy-to-use products and advancements in rodenticide formulations further bolster their adoption. In addition, stringent pest control regulations in residential settings contribute to market growth.

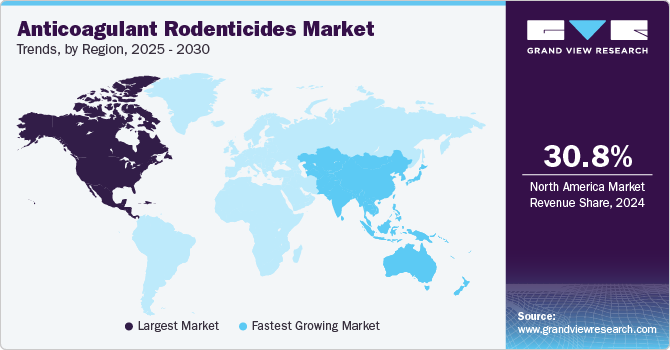

Regional Insights

North America anticoagulant rodenticides market held the largest revenue share in 2024, which can be attributed to growing concerns regarding the increased rodent population and security around warehouses, residential and commercial buildings, and farms. In addition, monitoring rodents in agricultural fields in countries such as Canada, Mexico, and the U.S. is contributing to the demand for rodenticides.

U.S. Anticoagulant Rodenticides Market Trends

The U.S. anticoagulant rodenticides market dominated North America in terms of revenue share in 2024 due to rising urbanization, increased rodent infestations due to climate changes, and growing public health and sanitation concerns. Strict pest control regulations in residential, agricultural, and industrial sectors further propel demand. Additionally, advancements in rodenticide formulations ensure efficacy and compliance with environmental safety standards.

Asia Pacific Anticoagulant Rodenticides Market Trends

The Asia Pacific anticoagulant rodenticides market is anticipated to grow at a CAGR of 4.6% during the forecast period. This growth can be attributed to the increasing need for effective pest control solutions to mitigate economic risks posed by rodent infestations in agricultural sectors.

The Mouse Monitoring Project Update - 30 April 2023 by the Grains Research and Development Corporation (GRDC) employs monitoring methods such as bait cards, field surveys, and community reports to track mouse activity. It highlights the economic risks of mice graining crops and emphasizes the need for proactive management strategies, including reducing residual grain, minimizing shelter, and using baiting programs effectively. The report underscores the importance of integrated pest management (IPM) and collaborative efforts to mitigate the threat of mouse infestations on agricultural productivity.

The China anticoagulant rodenticides market held a substantial market share in 2024. In China, government initiatives on public health, including stringent sanitation regulations and disease prevention campaigns, drive the demand for rodenticides in residential and commercial spaces. Concerns over food security, particularly post-harvest losses and rodent damage to stored food, fuel the need for effective anticoagulant rodenticides. Expanding industrial and warehousing facilities also increases the demand for pest control solutions to meet quality and safety standards.

Key Anticoagulant Rodenticides Company Insights

Some of the key companies in the anticoagulant rodenticides market include BASF, Bayer AG, Syngenta, PelGar International, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

BASF is a chemical company that produces and sells various products, including plastics, crop protection, chemicals, and performance products. Its offerings include solvents, adhesives, surfactants, fuel additives, pigments, paints, and agricultural chemicals. The company collaborates with global customers, scientists, and partners for research and development across various industries, such as agriculture, automotive, electronics, and construction.

-

Bayer AG focuses on discovering, developing, and producing products for human health and agriculture. Its offerings include medicines for various diseases, crop protection solutions, seeds, and non-prescription products. The company markets its healthcare and agricultural products through wholesalers, pharmacies, hospitals, and retailers.

Key Anticoagulant Rodenticides Companies:

The following are the leading companies in the anticoagulant rodenticides market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Bayer AG

- Syngenta

- PelGar International

- Rentokil Initial plc

- UPL

- Bell Labs

- Kalyani Industries Limited

- Heranba Industries Ltd.

- NEOGEN Corporation

- Liphatech, Inc.

Recent Developments

-

In October 2024, BASF relaunched its popular rodenticide, Neosorexa, and introduced the new Neosorexa Plus Blocks with an improved formula. The potent anticoagulant flocoumafen product provides farmers with effective control over rodents, including those resistant to other anticoagulants. The new formulation combines enhanced palatability and durability, making it highly effective even in extreme conditions. It can achieve results in as little as 14 days.

-

In October 2023, Syngenta launched its innovative SecureChoice remote rodent monitoring system in the UK. The technology offers proactive, 24/7 monitoring to detect rodent activity in real time, allowing pest professionals to take timely action to control it. The system was designed to improve efficiency, reduce labor costs, and provide better insights into rodent behavior, ensuring more targeted and effective pest management.

Anticoagulant Rodenticides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 766.9 million

Revenue forecast in 2030

USD 913.6 million

Growth Rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, form, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, Japan, India, South-east Asia, South Korea, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

BASF; Bayer AG; Syngenta; PelGar International; Rentokil Initial plc; UPL; Bell Labs; Kalyani Industries Limited; Heranba Industries Ltd.; NEOGEN Corporation; Liphatech, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anticoagulant Rodenticides Market Report Segmentation

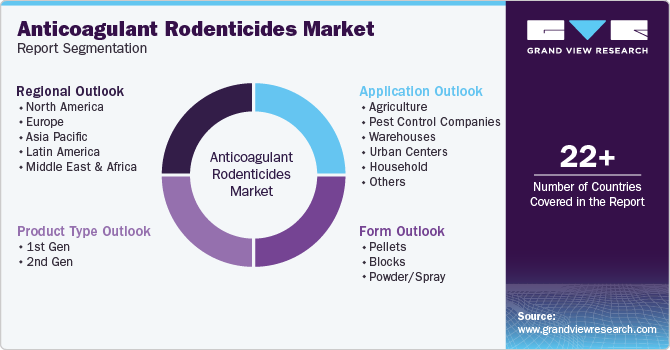

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anticoagulant rodenticides market report based on product type, form, application, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

1st Gen

-

2nd Gen

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Pellets

-

Blocks

-

Powder/Spray

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Pest Control Companies

-

Warehouses

-

Urban Centers

-

Household

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

South-east Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.