- Home

- »

- Next Generation Technologies

- »

-

API Logistics Market Size, Share And Trends Report, 2030GVR Report cover

![API Logistics Market Size, Share & Trends Report]()

API Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (API Management Platform, Services), By Transportation Mode, By Application (Order Management, Visibility), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-319-4

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

API Logistics Market Size & Trends

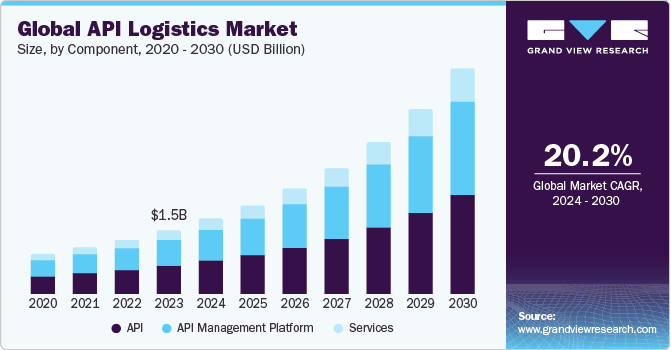

The global API logistics market size was estimated at USD 1.48 billion in 2023 and is projected to grow at a CAGR of 20.2% from 2024 to 2030. Various factors, including e-commerce expansion and the need for real-time tracking and visibility, drive the Application Programming Interface (API) logistics industry. APIs are a collection of protocols that allow software applications to communicate and exchange features, data, and functionalities. Businesses of various sectors are utilizing APIs to improve operations and enhance customer experience. In the logistics sector, application programming interfaces address various use cases, including real-time tracking and order management.

Logistics and transportation companies are under immense pressure to deliver goods efficiently and effectively. These businesses are looking to adopt technological advancements and optimize their operations to remain competitive. Integrating APIs in logistics operations is critical in enhancing reliability and operational efficiency. Transportation and logistics companies utilizing APIs witness significant financial benefits in comparison to businesses not utilizing them. APIs aid in task automation and provide easier access to reliable data, reducing time and improving risk mitigation capabilities.

The rapid growth of the global e-commerce industry is aiding the adoption of APIs among logistics businesses. According to the International Trade Administration (ITA) of the U.S. Department of Commerce, global Business-to-Consumer (B2C) e-commerce revenue is expected to reach USD 5.5 trillion by 2027. With the rise in e-commerce sales, supply chain companies are increasingly looking to use application programming interfaces to connect carriers, suppliers, Software as a Service (SaaS) applications, and cloud providers. Moreover, consumers demand real-time updates on their orders. APIs enable real-time tracking of shipments and provide status updates, enhancing customer satisfaction and transparency in the delivery process.

The growing adoption of advanced technologies, such as the Internet of Things (IoT), is expected to present significant growth opportunities for the market. IoT technology is utilized to track and monitor the movement and condition of shipments and enhance decision-making capabilities by providing a more effective means of obtaining real-time supply chain visibility data. Application programming interface aids in streamlining real-time data exchange of the vast and complex data of IoT solutions.

Market Concentration & Characteristics

The market is in a high growth stage, and the pace of growth is accelerating. The market is competitive, with many APIs and API management platform providers. The market is characterized by a high degree of innovation, with market players investing in Research and Development (R&D) to offer advanced solutions. For instance, in 2023, Axway spent over USD 66 million on R&D.

Numerous product launches by key players also characterize the market. For instance, in March 2024, PTV Logistics GmbH, a Germany-based company, announced the launch of the PTV Developer OptiFlow API, a powerful tool for optimizing routes with up to 100,000 locations, designed to improve transportation efficiency and streamline logistics operations. This API, integrating seamlessly with existing systems, promises significant cost savings, enhanced efficiency, and reduced environmental impact.

Companies operating in the Application Programming Interface (API) logistics industry are subject to a variety of regulations and compliance requirements. These include data protection and privacy laws, such as the General Data Protection Regulation (GDPR) of the European Union (EU) and the California Consumer Privacy Act (CCPA) of California, U.S.

Substitutes for APIs in the logistics industry include Electronic Data Interchange (EDI), which enables the reliable and swift transfer of important data across stakeholders. However, the technology is becoming outdated and is costlier to implement. Application programming interfaces enable faster data transmission than EDI systems.

Many businesses operating in the transportation and logistics sectors, such as e-commerce retailers, shippers, and freight forwarders, utilize application programming interfaces to improve their operations. In April 2024, Emirates SkyCargo, Emirates' airfreight division, announced API integration with DB SCHENKER, a Germany-based logistics company. Emirates SkyCargo aimed to improve customer experience and streamline international trade processes for greater efficiency.

Component Insights

Based on components, the market is classified into API management platform, API, and services, and the API segment dominated the market with the largest revenue share of over 44.0% in 2023. The segment’s growth can be attributed to the rise in e-commerce. The rapid expansion of e-commerce and omnichannel retail models has driven the need for efficient logistics solutions. APIs enable e-commerce platforms to integrate with logistics providers seamlessly, facilitating inventory management, automated order processing, and efficient last-mile delivery.

Moreover, the launch of new API solutions for logistics businesses is expected to drive segment growth. For instance, in March 2023, Senpex, Inc. announced the launch of a new Delivery API aimed at optimizing logistics operations for retail businesses, integrating seamlessly with web and mobile applications. Key benefits include real-time delivery management and tracking and advanced route optimization.

The API management platform segment is expected to register the highest CAGR of 20.9% over the forecast period. The segment’s growth can be attributed to the growing complexity of supply chains driven by various factors, including changes in consumer preferences and market dynamics. This is driving the digitization of the supply chain, driving the use of APIs. API management platforms facilitate the creation, deployment, and management of APIs, which are essential for integrating different technologies and enabling new digital services.

Transportation Mode Insights

Based on transportation mode, the road segment dominated the market with the largest revenue share in 2023. The segment’s growth can be attributed to cost-effectiveness and the flexibility offered by road freight transport. Road transportation modes enable door-to-door delivery as they are well connected. Moreover, the growing complexity of last-mile delivery is driven by a rise in e-commerce sales, driving the need for real-time tracking of road freight. This is having a positive impact on the API logistics market.

The air segment is expected to register the highest CAGR over the forecast period. The segment’s growth is attributed to the growing demand for faster delivery of goods. With continually advancing technologies and virtually unlimited route options, air transportation is the fastest-growing and most time-efficient shipping mode. It is crucial for time-sensitive and high-value shipments as it offers the fastest delivery times. Hence, APIs are likely to witness significant growth in adoption to facilitate real-time tracking and efficient handling of air cargo.

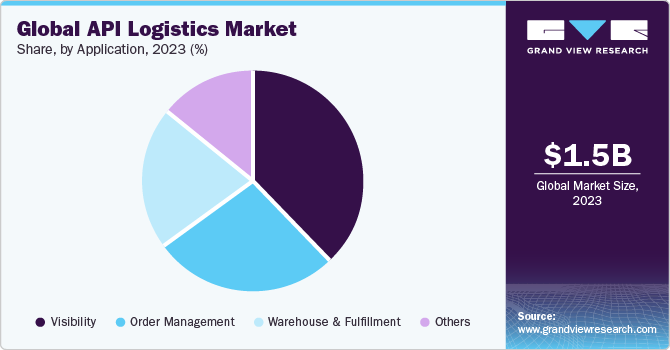

Application Insights

Based on application, the visibility segment dominated the market with the largest revenue share in 2023. The need to gain real-time information to mitigate risks and enhance operational efficiency in the supply chain is driving the segment's growth. Real-time data updates are crucial in logistics software solutions due to the industry's complexity and time-sensitive nature. In logistics, every second matters, and timely information is essential for effective decision-making and seamless operations. Real-time updates enable logistics companies to track shipments, monitor inventory levels, and ensure goods are delivered on time and to the correct locations. APIs provide the necessary integration for real-time data sharing and monitoring, driving the segment's growth.

The warehouse & fulfillment segment is expected to register the fastest CAGR over the forecast period. The growth of this segment is driven by the need for efficient inventory management and to meet the growing shipment volumes led by the growth of e-commerce. APIs can aid businesses in managing fulfillment processes and inventory data. Moreover, the growing adoption of automation technologies in warehouses is likely to drive the use of application programming interfaces to ensure the integration of automation systems.

Regional Insights

North America dominated the API logistics market and accounted for over 34.0% of the revenue share in 2023. The growth of the market in the region is attributed to the region’s developed technological infrastructure. The widespread adoption of advanced technologies such as cloud computing, big data, IoT, and Artificial Intelligence (AI) facilitates the integration of APIs in logistics, enhancing efficiency and innovation. Moreover, the region’s strong transportation and logistics sector drives API adoption in the region.

U.S. API Logistics Market Trends

The API logistics market in the U.S. is projected to grow at a CAGR of 19.0% from 2024 to 2030. The growth of the market in the country can be attributed to the presence of prominent application programming interface logistics companies, such as IBM, EasyPost (Simpler Postage), and Google, among others. Moreover, the growing automation in U.S. warehouses is likely to impact the market in the country positively. According to the International Federation of Robotics (IFR), in 2023, the total installations of industrial robots reached over 44,000 units, growing by 12% from 2022.

Europe API Logistics Market Trends

The API logistics market in Europe was valued at USD 302.9 million in 2023. The market’s growth is driven by government initiatives to improve transportation infrastructure in the region. For instance, in April 2024, the UK government launched a USD 1.6 million Transport Research and Innovation Grant (TRIG) competition to transform the transport sector, grow the economy, and inspire innovation. This competition seeks proposals for nation-specific transport solutions, local transport decarbonization, critical and emerging technologies, and broader transport challenges.

Germany API logistics market is expected to grow at a CAGR of 20.4% from 2024 to 2030. The target market's growth in the country is attributed to the high inland road freight transport, facilitating the need for APIs for the timely and safe movement of goods in the country. According to the Organisation for Economic Co-operation and Development (OECD), in 2022, the freight transport on road in Germany was 303,943 Million tonne-kilometres.

Asia Pacific API Logistics Market Trends

The API logistics market in Asia Pacific is expected to witness the fastest CAGR of 21.3% from 2024 to 2030. The target market’s growth in the region can be attributed to rapid e-commerce expansion in countries such as China, India, and South East Asian countries. Moreover, developing technological and logistics infrastructure is driving the market’s growth in the region. Rapid urbanization and rising consumer expectations for fast and reliable delivery services drive the demand for advanced logistics solutions. APIs help logistics companies meet these expectations by enabling real-time updates and streamlined processes.

China API logistics market is projected to grow at a CAGR of 20.9% from 2024 to 2030. It is driven by the country's complex supply chain and large logistics network. Moreover, government initiatives and policies to support the logistics sector are aiding the growth of the target market in the country, as the adoption of APIs in the logistics sector is expected to grow with its digitization.

Key API Logistics Company Insights

Some of the key companies operating in the market include EasyPost (Simpler Postage), Google, IBM, and Axway, among others.

-

Axway is a U.S.-based company offering software solutions. Its API management platform is Amplify. The company has a global presence with offices across North America, Europe, and Asia Pacific and employs over 1,400 people. It serves various industries, including healthcare, financial services, and transportation and logistics.

-

Google offers various technology solutions and services. Google operates in two business segments, namely, Google Services and Google Cloud. The Google Services segment includes various products and platforms such as YouTube, Chrome, Gmail, and Google Maps. The Google Maps Platform offers various APIs for the logistics sector. The company has a global presence and has offices worldwide.

Vizion and Shippo are some of the emerging companies in the target market.

-

Vizion is a U.S.-based company and developer of Application Programming Interface (API) platform. The company provides API for various applications, such as container tracking and supply chain optimization. It caters to the logistics and supply chain industry, providing data services that aggregate and analyze information from various sources. This enables logistics teams worldwide to manage daily operations and conduct strategic analysis effectively.

-

Shippo, a U.S.-based company, provides shipping software for businesses. It facilitates connectivity between shipping carriers, e-commerce businesses, and diverse logistics infrastructure providers worldwide through a single API and dashboard interface. The company offers application programming interface solutions for the logistics sector.

Key API Logistics Companies:

The following are the leading companies in the API logistics market. These companies collectively hold the largest market share and dictate industry trends.

- EasyPost (Simpler Postage)

- Vizion

- ClickPost

- ShipEngine

- Shippo

- OptimoRoute Inc.

- Routific Solutions Inc.

- Iris Software, Inc.

- ShippyPro

- gravitee.io

- Celigo, Inc.

- IBM

- Axway

Recent Developments

-

In February 2024, Shippo announced the launch of Addresses API, which allows businesses to parse, validate, and store customer shipping addresses, thereby reducing deliverability issues and enhancing the overall shopping experience. This new tool aims to eliminate costly shipping mistakes and improve operational efficiency by validating addresses, parsing address text, and storing customer data, ensuring timely and accurate deliveries.

-

In July 2023, Vizion and TransImpact, a U.S.-based company, announced a strategic partnership to enhance supply chain visibility and optimization for freight-moving organizations. By combining TransImpact's expertise in cost management with Vizion's advanced logistics technology, the collaboration aims to improve operational efficiency, reduce costs, and set new standards in supply chain management.

-

In October 2022, Axway announced the launch of the Amplify Enterprise Marketplace, a solution designed to help companies monetize and accelerate the adoption of API products through a branded storefront, enhancing both internal and external API consumption. Amplify Enterprise Marketplace simplifies API management by centralizing services across various teams, technologies, and vendors, thereby reducing complexities and enhancing digital services.

API Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.74 billion

Revenue forecast in 2030

USD 5.23 billion

Growth rate

CAGR of 20.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, transportation mode, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; and South Africa

Key companies profiled

EasyPost (Simpler Postage); Vizion; ClickPost; ShipEngine; Shippo; OptimoRoute Inc.; Routific Solutions Inc.; Google; Iris Software, Inc.; ShippyPro; gravitee.io; Celigo, Inc.; IBM; and Axway

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

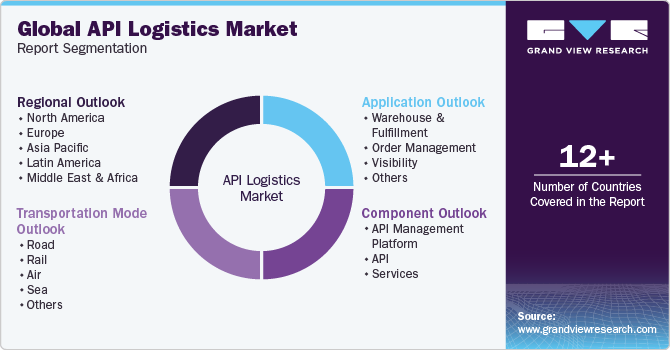

Global API Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global API logistics market report based on component, transportation mode, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

API Management Platform

-

API

-

Services

-

-

Transportation Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Road

-

Full truckload (FTL)

-

Less-than-truckload (LTL)

-

Others

-

-

Rail

-

Air

-

Sea

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Warehouse & Fulfillment

-

Order Management

-

Visibility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global API logistics market size was estimated at USD 1.48 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global API logistics market is expected to grow at a compound annual growth rate of 20.2% from 2024 to 2030 to reach USD 5.23 billion by 2030.

b. North America dominated the API logistics market with a share of over 34.0% in 2023. This is attributable to the developed technological infrastructure and growing adoption of automation technologies in the logistics sector in the region.

b. Some key players operating in the API logistics market include EasyPost (Simpler Postage), Vizion, ClickPost, ShipEngine, Shippo, OptimoRoute Inc., Routific Solutions Inc., Google, Iris Software, Inc., ShippyPro, gravitee.io, Celigo, Inc., IBM, and Axway.

b. Key factors driving market growth include the growing need to monitor the supply chain in real time and the growth of the e-commerce sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.