- Home

- »

- Electronic & Electrical

- »

-

Appliances Market Size And Share, Industry Report, 2030GVR Report cover

![Appliances Market Size, Share & Trends Report]()

Appliances Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances), By Type (Conventional Appliances, Smart Appliances), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-813-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Appliances Market Summary

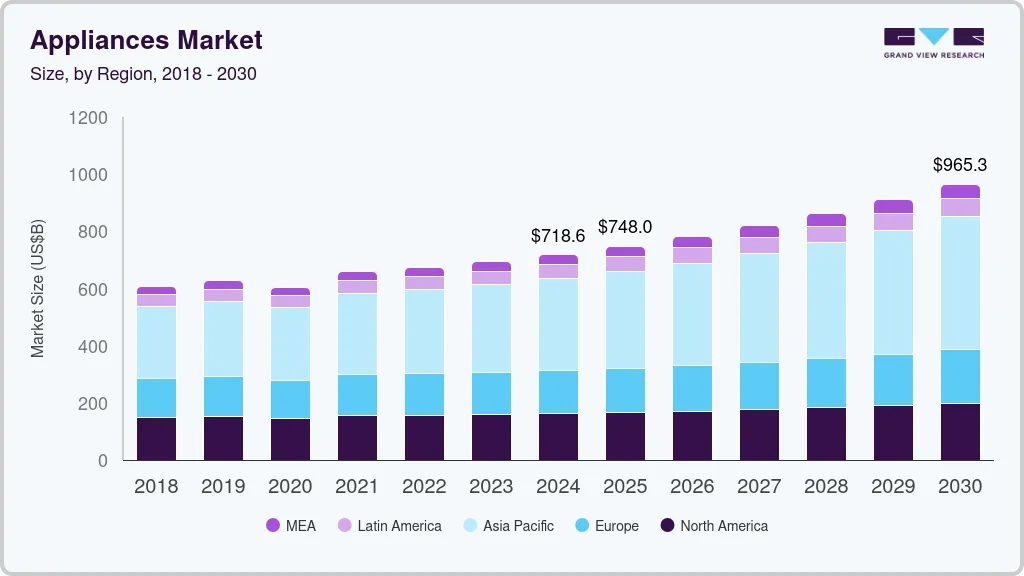

The global appliances market size was estimated at USD 718.6 billion in 2024 and is projected to reach USD 965.32 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. Increasing consumer demand for smart home technologies and connected appliances is a major driver, as these innovations offer greater convenience, energy efficiency, and enhanced functionality.

Key Market Trends & Insights

- Asia Pacific appliances industry dominated the global industry with the largest revenue share of 44.6% in 2024.

- Based on product, major appliances dominated the market, with the largest revenue share of 89.5% in 2024.

- Based on type, conventional appliances dominated the market with the largest revenue share in 2024.

- Based on end-use, the commercial segment is expected to grow at the fastest CAGR of 5.8% from 2025 to 2030.

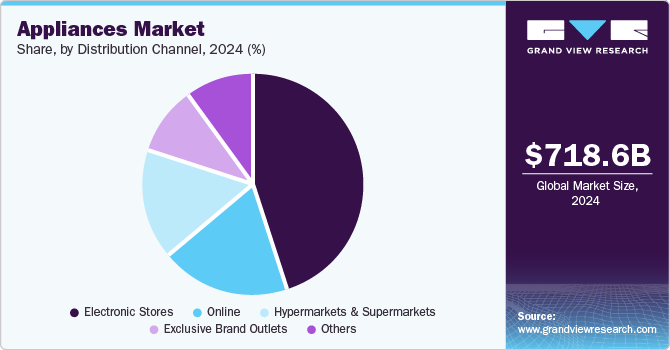

- Based on distribution channel, electronic stores dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 718.6 Billion

- 2030 Projected Market Size: USD 965.32 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

The rise in disposable incomes and improved living standards across emerging economies have also contributed to higher spending on household appliances. Additionally, growing awareness of environmental sustainability and the adoption of energy-efficient appliances are further propelling market expansion. The continuous technological advancements and the introduction of innovative products cater to evolving consumer preferences, supporting the robust growth of the global appliances market.

The growing urbanization and expanding middle class are also contributing to the heightened demand for modern and energy-efficient appliances. Technological advancements, such as smart appliances integrated with artificial intelligence, the Internet of Things (IoT), and automation, are further fueling market growth by offering enhanced convenience and energy savings. Additionally, the increasing awareness about environmental sustainability is driving consumers to opt for energy-efficient and eco-friendly appliances. Government initiatives promoting energy efficiency and the adoption of sustainable practices are also playing a crucial role in shaping the market.

Product Insights

Major appliances dominated the market, with the largest revenue share of 89.5% in 2024. Major appliances, such as refrigerators, washing machines, ovens, and dishwashers, are essential household items that cater to fundamental daily needs. The continuous technological advancements in these appliances, including smart features and energy-efficient technologies, are attracting a wide range of consumers. The growing trend of smart homes, where major appliances can be integrated and controlled through smart devices, is further boosting their demand. Additionally, the increasing disposable income and the rising middle-class population, particularly in emerging economies, contribute to the willingness to invest in high-quality and multifunctional major appliances. The availability of these products through various retail channels, including hypermarkets, supermarkets, specialty stores, and online platforms, ensures easy access for consumers

Small appliances are expected to grow at the fastest CAGR of 6.4% over the forecast period. Increasing urbanization and the rise in smaller living spaces lead consumers to seek compact and efficient appliances that fit into limited areas. Small appliances, such as blenders, coffee makers, toasters, and air fryers, offer convenience and versatility, making them essential for modern lifestyles. The growing trend of healthy living and home cooking is boosting the demand for small kitchen appliances that facilitate healthy meal preparation. Technological advancements and innovative designs are making these appliances more efficient and user-friendly.

Type Insights

Conventional appliances dominated the market with the largest revenue share in 2024. Conventional appliances, such as traditional refrigerators, washing machines, ovens, and air conditioners, are well-established in the market and have a broad consumer base. Many households continue to rely on these appliances due to their proven reliability and performance. Additionally, the affordability of conventional appliances compared to their smart counterparts makes them accessible to a wider range of consumers, especially in regions with lower disposable income levels. The extensive distribution networks for conventional appliances, including physical retail stores and traditional markets, ensure their availability and accessibility to a broad audience.

Smart appliances are expected to grow at the fastest CAGR over the forecast period. Technological advancements in smart appliances, including the integration of artificial intelligence (AI) and the Internet of Things (IoT), are significantly enhancing the functionality and convenience of these products. Smart appliances offer features like remote control, energy efficiency, and automated tasks, which appeal to tech-savvy consumers seeking modern home solutions. The rising demand for connected home ecosystems, where appliances can communicate with each other and be controlled via smartphones or smart home hubs, is a major driver. Additionally, increasing awareness about energy conservation and the benefits of smart appliances in reducing energy consumption are propelling market growth. The continuous innovation and introduction of new smart appliances by major manufacturers are attracting a broader consumer base.

End Use Insights

Residential dominated the market with the largest revenue share in 2024. The continuous demand for household appliances, such as refrigerators, washing machines, air conditioners, and kitchen appliances, remains strong as they are essential for daily living. The trend towards smart homes and the increasing adoption of smart appliances are boosting the residential segment, offering enhanced convenience and efficiency. Additionally, rising disposable incomes and improved living standards, particularly in emerging economies, are driving consumers to upgrade their home appliances to more advanced and multifunctional options. The extensive availability of appliances through various retail channels, including hypermarkets, supermarkets, specialty stores, and online platforms, ensures easy access for consumers.

The commercial segment is expected to grow at the fastest CAGR of 5.8% over the forecast period. Increasing demand for appliances in the hospitality industry, including hotels, restaurants, and catering services, is a significant driver. These establishments require high-performance, durable appliances that can handle heavy usage and ensure efficient operations. The rise of smart commercial appliances, which offer advanced features such as remote monitoring and energy management, is also boosting the market. Additionally, the growing trend of urbanization and the expansion of commercial spaces such as offices, retail stores, and healthcare facilities are driving the demand for commercial appliances. The need for energy-efficient and sustainable solutions in commercial settings is further propelling the market, as businesses seek to reduce operating costs and comply with environmental regulations.

Distribution Channel Insights

Electronic stores dominated the market with the largest revenue share in 2024. Electronic stores offer a wide range of appliances, from major household items to small kitchen gadgets, providing consumers with a one-stop shopping experience. These stores often feature knowledgeable staff who can assist customers in making informed purchasing decisions, enhancing customer satisfaction and trust. Additionally, electronic stores frequently offer competitive pricing, promotions, and financing options, making it easier for consumers to afford high-quality appliances. The ability to physically inspect and compare different models before purchase also contributes to the appeal of electronic stores.

The online shopping channel is projected to experience the fastest CAGR during the forecast period. The convenience and accessibility of online shopping enable consumers to browse and purchase appliances from their homes, saving time and effort. E-commerce platforms provide a wide variety of options, detailed product descriptions, and customer reviews, which help consumers make informed decisions. Additionally, the effectiveness of digital marketing and social media advertising reaches a broader audience, boosting online sales. Exclusive online discounts, promotions, and subscription services further encourage consumers to choose e-commerce channels. The increasing number of tech-savvy consumers who prefer the flexibility and convenience of online shopping, along with the ability to compare prices and products across multiple platforms, also contributes to the growth of this channel.

Regional Insights

Asia Pacific appliances industry dominated the global industry with the largest revenue share of 44.6% in 2024. Rapid urbanization and the increasing disposable income in emerging economies such as China, India, and Southeast Asian countries are major contributors. These factors lead to a higher demand for home appliances as more households seek to improve their living standards. The region's large population and growing middle class further boost the market, with a strong preference for both conventional and smart appliances. Additionally, major manufacturers and suppliers in the Asia Pacific region enhance the availability and variety of appliances, catering to diverse consumer needs. Government initiatives promoting energy-efficient and environmentally friendly appliances are also playing a role in driving market growth.

North America Appliances Market Trends

North America appliances industry held a considerable share in 2024. The emphasis on innovation and the adoption of smart appliances are key drivers, with consumers looking for products that enhance convenience and efficiency in their daily lives. Environmental awareness and the push for sustainability are also influencing purchasing decisions, leading to a higher demand for energy-efficient and eco-friendly appliances. The region's high standard of living and disposable income levels support the market, with consumers willing to invest in premium and multifunctional appliances. Additionally, the strong presence of major global and local manufacturers ensures a continuous supply of advanced and diverse products. The growth of e-commerce and online retail channels further enhances market accessibility and reach.

U.S. Appliances Market Trends

The U.S. appliances industry is expected to grow significantly over the forecast period. The widespread adoption of smart home technology and the integration of IoT in appliances are significant drivers. Consumers are increasingly seeking appliances that offer convenience, connectivity, and energy savings. The U.S. market also benefits from high disposable incomes and a culture that values home improvement and modernization. Additionally, stringent energy efficiency regulations and rebate programs encourage the purchase of energy-saving appliances. The influence of digital marketing and e-commerce platforms is also notable, making it easier for consumers to access and purchase a wide range of appliances.

Europe Appliances Market Trends

Europe appliances industry is expected to grow at a significant CAGR of 3.9% over the forecast period. The increasing demand for energy-efficient and eco-friendly appliances is a major driver, as consumers in Europe are highly conscious of environmental sustainability. Government regulations and initiatives promoting energy-saving technologies further boost the market. Additionally, the rising disposable income and the trend towards smart homes and connected appliances are contributing to market growth. European consumers are also keen on adopting the latest technological advancements in appliances, which enhance convenience and efficiency. The presence of well-established manufacturers and the continuous introduction of innovative products cater to the diverse preferences and needs of consumers in the region.

Key Appliances Company Insights

Some key appliance market companies include Whirlpool Corporation, AB Electrolux, Haier Group, BSH Hausgeräte GmbH, Midea Group, and others.

-

Whirlpool Corporation is a leading global manufacturer and marketer of home appliances. The company offers a wide range of products, including refrigerators, washing machines, dryers, dishwashers, cooking appliances, and small domestic appliances. Whirlpool is known for its innovative and intuitive products, such as the Neo iChill frost-free refrigerators, Icemagic direct cool refrigerators, and WhiteMagic washing machines with advanced 6th Sense technology.

Key Appliances Companies:

The following are the leading companies in the appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- AB Electrolux

- Haier Group

- BSH Hausgeräte GmbH

- Midea Group

- SAMSUNG

- LG Communication Center

- General Electric Company

- Panasonic Corporation

Recent Developments

-

In October 2024, Daewoo, a prominent Korean brand operating in 110 countries, unveiled its plan to launch over 100 consumer appliance products in India, responding to the rising demand among nuclear families and dual-income households.

-

In August 2024, Samsung officially launched four new front-load washing machines in India, tailored to local consumer needs and enhanced by AI technology. These models, part of the company's commitment to expanding its lineup ahead of the festive season, include the WW12DB8B54G, WW12DB7B24G, WW12DG6B24A, and WW12DG6B24A, featuring various customizable options and smart functionalities.

-

In June 2024, LG Electronics launched its 2024 range of microwave ovens in India, featuring nine new models, including seven from the Scan to Cook series and two from the premium Objet series. The new lineup emphasizes convenience, health, and taste, integrating ThinQ connectivity for enhanced functionality.

Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 748.0 billion

Revenue forecast in 2030

USD 965.33 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Whirlpool Corporation; AB Electrolux; Haier Group ; BSH Hausgeräte GmbH; Midea Group; SAMSUNG; LG Communication Center; General Electric Company; Panasonic Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Appliances Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global appliances market report based on product, type, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Major Appliances

-

Small Appliances

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional Appliances

-

Smart Appliances

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.