- Home

- »

- IT Services & Applications

- »

-

Application Hosting Market Size, Share, Industry Report, 2030GVR Report cover

![Application Hosting Market Size, Share, & Trends Report]()

Application Hosting Market (2025 - 2030) Size, Share, & Trends Analysis Report By Hosting (Managed Hosting, Cloud Hosting), By Service, By Application (Mobile-based, Web-based), By Organization Size, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-588-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Application Hosting Market Summary

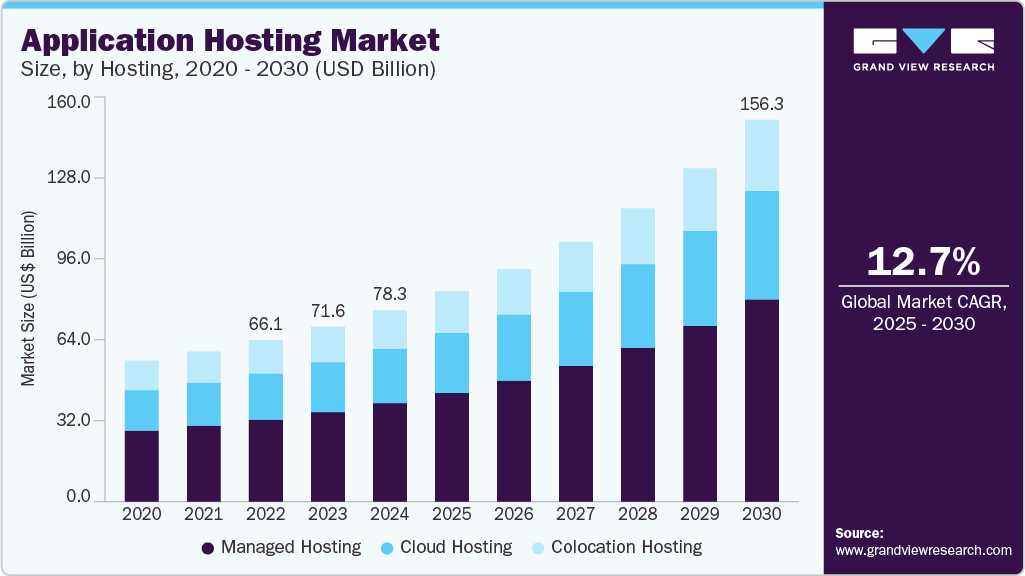

The global application hosting market size was estimated at USD 78.30 billion in 2024 and is projected to reach USD 156.26 billion by 2030, growing at a CAGR of 12.7% from 2025 to 2030. The market represents a dynamic and integral part of the broader IT services landscape, offering businesses the ability to run software applications on remote infrastructure managed by third-party providers.

Key Market Trends & Insights

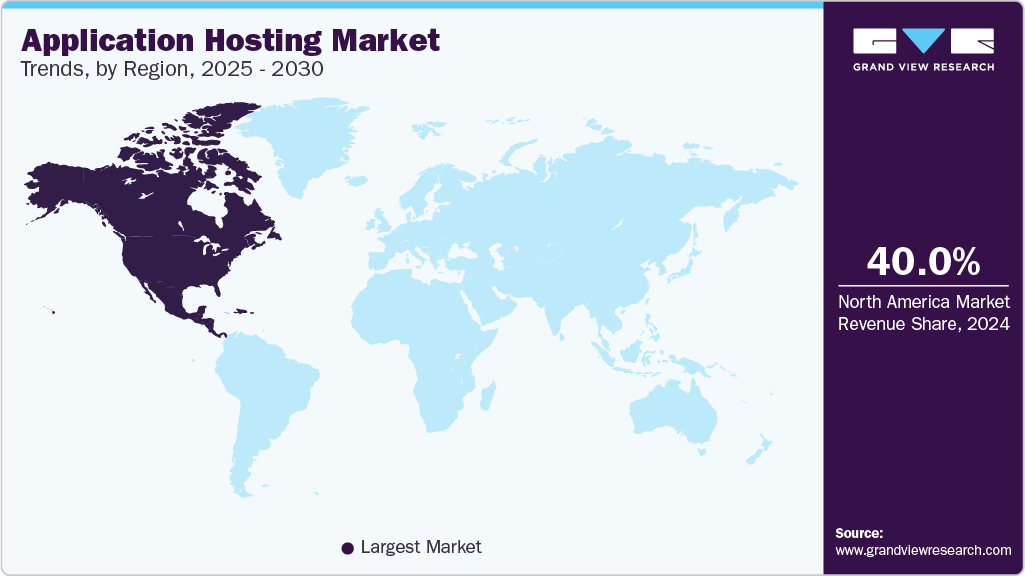

- North America held a significant share of over 40% of the application hosting industry in 2024.

- The application hosting industry in the U.S. is expected to grow significantly from 2025 to 2030.

- By hosting, the managed hosting segment held a market share of over 51.0% in 2024.

- By service, the application security segment is expected to register the fastest CAGR during the forecast period.

- By application, the mobile-based segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 78.30 Billion

- 2030 Projected Market Size: USD 156.26 Billion

- CAGR (2025-2030): 12.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This includes services across cloud, managed, and hybrid hosting environments, allowing organizations to reduce the complexity and cost of managing their own on-premises IT infrastructure. Hosting providers deliver infrastructure, platform, and software-as-a-service (IaaS, PaaS, and SaaS) models, which can be tailored to support diverse business requirements.The rising adoption of cloud computing is a major factor driving the market growth in the coming years. Cloud platforms provide businesses with a flexible, scalable, and cost-effective way to host applications without the need to maintain physical infrastructure. This is particularly advantageous for small and medium-sized enterprises (SMEs), which often lack the resources to invest in on-premises data centers or manage complex IT environments. By leveraging cloud-based hosting, these organizations can access high-performance computing, storage, and security services on a pay-as-you-go basis, reducing upfront capital expenditures. Moreover, cloud solutions enable rapid deployment, seamless updates, and remote accessibility-critical factors for businesses looking to stay agile and competitive in fast-changing markets. The cloud also allows companies to scale resources up or down based on demand, ensuring optimal performance during peak usage while minimizing costs during low-traffic periods. This combination of affordability, convenience, and innovation is fueling widespread migration to cloud-hosted application environments.

Digital transformation initiatives are accelerating across industries, compelling businesses to modernize their application infrastructure. With customer engagement shifting to digital channels, enterprises are investing in hosted applications that can be easily updated, maintained, and scaled to meet fluctuating demand. Sectors such as retail, healthcare, banking, and government are embracing hosted platforms to deliver better digital services, improve agility, and reduce operational burdens.

Vendor lock-in is a significant challenge in the market, especially with large cloud providers. Businesses may become dependent on a specific provider’s proprietary technologies, APIs, or configurations, making it difficult and costly to migrate applications elsewhere. Complex service agreements and integration dependencies further increase switching costs. This lack of interoperability can limit flexibility and hinder a company’s ability to adapt its IT strategy or negotiate better terms. As a result, organizations may be locked into long-term relationships that restrict innovation, cost optimization, and strategic decision-making.

Hosting Insights

The managed hosting segment held a market share of over 51.0% in 2024. As businesses strive to focus on their core competencies, many are choosing to offload the complexities of IT infrastructure and application management to third-party providers. Managed hosting offers a comprehensive solution where providers handle daily operations such as system maintenance, performance monitoring, software updates, and cybersecurity. This not only reduces the need for in-house technical staff but also ensures that systems remain secure, up-to-date, and high performing. For small and mid-sized enterprises (SMEs), managed hosting is especially valuable, as it provides access to enterprise-level IT capabilities without significant capital investment or technical expertise.

The cloud hosting segment is anticipated to grow at a CAGR of 12.6% during the forecast period. Cloud hosting plays a crucial role in enabling DevOps and Agile development practices by supporting rapid application deployment and continuous integration/continuous delivery (CI/CD) pipelines. It provides developers with on-demand resources, allowing them to build, test, and deploy applications quickly and efficiently. Technologies like containerization, APIs, and infrastructure-as-code (IaC) further automate and streamline workflows, reducing manual effort and errors. This accelerates development cycles, improves collaboration between teams, and shortens time-to-market, giving businesses a competitive edge in delivering updates and new features to users with greater speed and consistency.

Service Insights

The infrastructure services segment held the largest market share in 2024. The rising demand for scalable IT infrastructure is a key growth driver in the infrastructure services segment. Modern applications often experience fluctuating workloads that require flexible resource allocation to maintain optimal performance. Infrastructure services enable businesses to dynamically scale computing power, memory, and storage according to real-time usage demands. This flexibility helps organizations efficiently manage peak traffic periods without risking downtime or degraded user experience. By scaling resources up or down as needed, companies avoid the costs and inefficiencies of overprovisioning hardware. This dynamic approach ensures applications run smoothly, supports business continuity, and improves cost management, making scalable infrastructure essential for today’s fast-paced, data-driven environments.

The application security segment is expected to register the fastest CAGR during the forecast period. The migration of applications to cloud and hybrid environments has significantly expanded the attack surface, making security more complex. These environments combine on-premises infrastructure with public or private clouds, creating diverse entry points vulnerable to cyber threats. As a result, specialized application security services are essential to continuously monitor, detect, and respond to risks unique to cloud-hosted applications. Businesses require advanced tools that protect against data breaches, misconfigurations, and unauthorized access, ensuring robust security in dynamic, distributed environments and maintaining trust and compliance in increasingly hybrid IT landscapes.

Application Insights

The mobile-based segment held the largest market share in 2024. The rapid global adoption of smartphones, combined with affordable mobile data plans, has dramatically increased mobile internet access worldwide. This surge enables millions of users to rely heavily on mobile applications for communication, entertainment, shopping, and business. To provide a smooth, uninterrupted experience for this vast user base, mobile apps require hosting on robust, scalable infrastructure capable of handling high traffic volumes and varying usage patterns. As a result, demand for reliable mobile application hosting services has soared, driving growth in the mobile-based segment of the market.

The web-based segment is expected to register the fastest CAGR during the forecast period. The shift toward Software-as-a-Service (SaaS) and cloud-native applications is a major growth driver in the web-based segment. SaaS models deliver software through web interfaces, eliminating the need for local installation and simplifying access for users across devices and locations. This transition allows businesses to reduce IT overhead, accelerate deployment, and scale services on demand. As more organizations embrace SaaS and develop cloud-native apps designed for flexible, distributed environments, the demand for hosting platforms that provide scalability, robust security, high availability, and optimized performance grows significantly. Hosting providers that cater to these needs enable businesses to innovate faster and improve user experiences.

Organization Size Insights

The large enterprises segment held the largest market share in 2024. Large enterprises with global operations require geographically distributed hosting infrastructure to support seamless and reliable service delivery across multiple regions. Applications hosted closer to end users reduce latency, improve response times, and enhance the overall user experience. Moreover, varying data sovereignty regulations in different countries necessitate localized data storage and processing to ensure legal compliance. As a result, hosting solutions that offer region-specific data centers, redundant systems, and global content delivery networks (CDNs) are highly sought after. Enterprises also benefit from standardized security, support, and uptime guarantees across locations. Consequently, providers with expansive global footprints and multi-regional capabilities are increasingly preferred by multinational organizations.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. Application hosting services, especially cloud-based and managed solutions, provide SMEs with cost-effective access to enterprise-grade technology without the need for significant capital investment in hardware or in-house IT teams. These services follow a pay-as-you-go or subscription-based model, allowing businesses to manage costs efficiently while scaling resources as needed. This flexibility helps SMEs compete with larger organizations by leveraging high-performance infrastructure, security, and support. As a result, they can focus on innovation and growth while relying on hosting providers to manage the technical complexities of running modern applications.

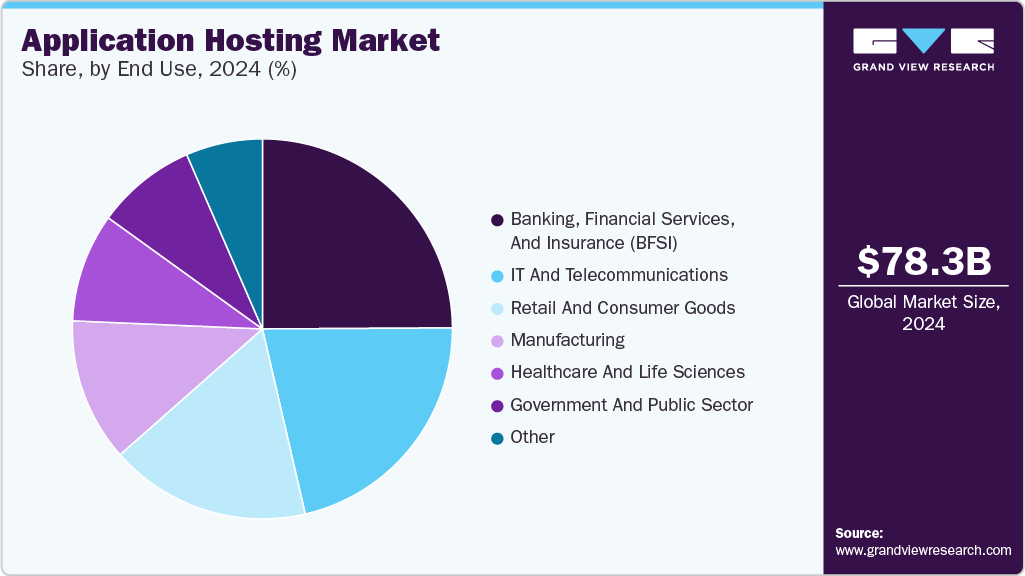

End Use Insights

The BFSI segment held the largest market share in 2024. The emergence of FinTech startups and digital-only banks has significantly accelerated the adoption of hosted applications in the BFSI sector. These companies typically operate with a cloud-native approach from the outset, leveraging flexible, scalable, and cost-efficient hosting environments to launch and update services quickly. Unlike traditional financial institutions, they prioritize rapid innovation and seamless digital experiences, which require agile infrastructure that supports continuous integration and deployment. Secure application hosting is critical for protecting sensitive financial data while maintaining compliance with regulatory standards. As FinTechs and neobanks continue to disrupt the industry, their reliance on advanced hosting solutions is driving strong growth in the application hosting industry.

The IT and telecommunications segment is expected to grow at a significant CAGR during the forecast period. The surge in mobile data traffic, video conferencing, and content streaming has significantly increased the demand for high-performance, low-latency hosting solutions. Telecom providers must ensure that their applications and services operate seamlessly under heavy traffic loads. To meet these real-time service needs, they are increasingly adopting edge computing and distributed hosting models. These approaches bring data processing closer to the end user, reducing latency, improving speed, and enhancing the overall user experience. As a result, robust application hosting has become essential for maintaining performance and reliability in high-demand telecom environments.

Regional Insights

North America held a significant share of over 40% of the application hosting industry in 2024. North America, particularly the United States and Canada, leads in global cloud adoption due to its digitally mature business landscape. Enterprises and SMBs across the region are prioritizing cloud-first strategies to enhance agility, reduce costs, and support innovation. This has significantly increased the demand for scalable, secure, and high-performance application hosting solutions. The region’s advanced IT infrastructure and skilled workforce enable a smooth transition from legacy systems to cloud-hosted applications, fostering improved operational efficiency, faster deployment cycles, and broader adoption of modern technologies across industries.

U.S. Application Hosting Market Trends

The application hosting industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. hosts major cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which continuously invest in expanding data centers, edge computing, and AI-driven hosting solutions. This infrastructure supports diverse application hosting needs, offering scalability, reliability, and cutting-edge technology that attracts businesses nationwide.

Europe Application Hosting Market Trends

The application hosting industry in Europe is expected to grow at a CAGR of 13.0% from 2025 to 2030. European enterprises, from large corporations to SMEs, are rapidly embracing cloud technologies to enhance operational efficiency and innovation. Digital transformation initiatives across sectors such as manufacturing, finance, healthcare, and retail are driving demand for scalable, secure, and flexible application hosting solutions.

The UK application hosting industry is expected to grow rapidly in the coming years. The UK’s leading financial sector demands robust application hosting, prioritizing cloud and hybrid solutions that ensure high availability, strong security, and low latency. These features are critical for trading platforms, risk management systems, and customer-facing applications, enabling seamless, secure, and real-time financial services delivery.

The Germany application hosting industryheld a substantial market share in 2024. Germany’s leadership in manufacturing and industrial sectors fuels demand for application hosting to support Industry 4.0 initiatives, including automation, IoT, and smart factory solutions. Reliable hosting infrastructure is critical for real-time data processing and operational efficiency.

Asia Pacific Application Hosting Industry Trends

The application hosting industry in the Asia Pacific is expected to grow at the fastest CAGR of 13.7% from 2025 to 2030. Businesses in APAC, especially in emerging markets such as India, Indonesia, and Vietnam, are rapidly adopting cloud-based application hosting to drive digital transformation. This shift meets the increasing demand for scalable, flexible, and cost-effective infrastructure needed to support expanding online services and improve operational efficiency.

The China application hosting industry held a substantial market share in 2024. China’s government drives application hosting growth by promoting cloud computing and digital transformation through initiatives like “Digital China.” Significant investments in data centers and 5G infrastructure enhance connectivity and computing power, enabling scalable, reliable, and efficient hosting solutions that support the country’s expanding digital economy.

The Japan application hosting industry held a substantial market share in 2024. Japan’s mature IT ecosystem drives strong adoption of cloud-based and hybrid hosting solutions by enterprises seeking improved operational efficiency, flexibility, and innovation. This well-established technology environment sustains consistent demand for advanced application hosting services that support digital transformation and business agility across various industries.

The application hosting industry in India is growing due to India’s booming startup ecosystem and expanding SME sector, which is increasingly adopting cloud and managed hosting services. These solutions provide cost-effective, scalable IT infrastructure, enabling businesses to innovate rapidly, reduce upfront costs, and efficiently manage growing digital workloads, driving significant demand in the application hosting industry.

Key Application Hosting Company Insights

The key market players in the global application hosting industry include Amazon Application Monitoring Services (AWS), Microsoft Corporation, Google, IBM Corporation, Oracle Corporation, among others. The companies are focusing on various strategic initiatives, including new Managed Hosting development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Liquid Application Monitoring announced the expansion of its London data center to enhance its cloud hosting capabilities across Europe. This expansion aims to provide ultra-low latency, improved performance, and increased reliability for customers throughout the region. The upgraded infrastructure is designed to meet the growing demand for scalable and secure hosting solutions, supporting businesses in delivering high-performance applications and services to their end-users.

-

In April 2025, DigitalOcean launched the DigitalOcean Partner Network Connect, a secure, high-performance connectivity solution designed to simplify multi-cloud and hybrid-cloud networking. This service enables businesses to establish private, secure connections between DigitalOcean and other cloud providers or private clouds, bypassing the public internet for improved security, predictable latency, and optimized network performance.

-

In February 2025, Alibaba Group announced plans to invest around USD 53 billion over the next three years to advance its cloud computing and AI infrastructure. This investment, which exceeds Alibaba’s total AI and cloud spending over the past decade, underscores the company’s focus on AI-driven growth and its role as a leading global cloud provider.

-

In January 2023, Rackspace Technology announced a global expansion of its services and solutions for Google Cloud. This strategic partnership is aimed at accelerating customers' digital transformations by providing enhanced support in areas such as data, artificial intelligence (AI), migrations, application modernization, and industry-specific use cases. Rackspace planned to significantly increase its services capacity by building a dedicated Google Cloud Business Unit worldwide, optimizing spending, and creating differentiated solutions, sales, and delivery experiences to maximize the value of Google Cloud investments.

Key Application Hosting Companies:

The following are the leading companies in the application hosting market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Application Monitoring Services (AWS)

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Alibaba Cloud

- Salesforce

- Rackspace Technology

- DigitalOcean

- GoDaddy

- Liquid Application Monitoring

- Akamai Technologies

- NEC Corporation

- Tencent Cloud

- DXC Technology

Application Hosting Market Report Scope

Report Attribute

Details

Market size in 2025

USD 86.05 billion

Market size forecast in 2030

USD 156.26 billion

Growth rate

CAGR of 12.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Hosting, service, application, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Application Monitoring Services (AWS); Microsoft Corporation; Google; IBM Corporation; Oracle Corporation; Alibaba Cloud; Salesforce; Rackspace Technology; DigitalOcean; GoDaddy; Liquid Application Monitoring; Akamai Technologies; NEC Corporation; Tencent Cloud; DXC Technology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Application Hosting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application hosting marketreport based on hosting, service, application, organization size, end use, and region.

-

Hosting Outlook (Revenue, USD Billion, 2018 - 2030)

-

Managed Hosting

-

Cloud Hosting

-

Infrastructure as a Service

-

Platform as a Service

-

Software as a Service

-

-

Colocation Hosting

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Monitoring

-

Application Programming Interface Management

-

Infrastructure Services

-

Database Administration

-

Backup and Recovery

-

Application Security

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mobile-based

-

Web-based

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government and Public Sector

-

Consumer Goods and Retail

-

Healthcare and Life Sciences

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunications

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application hosting market size was estimated at USD 78.30 billion in 2024 and is expected to reach USD 86.05 billion in 2025.

b. The global application hosting market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 156.26 billion by 2030.

b. The managed hosting segment accounted for a market share of over 51.0% in 2024. As businesses strive to focus on their core competencies, many are choosing to offload the complexities of IT infrastructure and application management to third-party providers.

b. Some of the key companies operating in the application hosting market include Amazon Application Monitoring Services (AWS), Microsoft Corporation, Google, IBM Corporation, Oracle Corporation, Alibaba Cloud, Salesforce, Rackspace Technology, DigitalOcean, GoDaddy, Liquid Application Monitoring, Akamai Technologies, NEC Corporation, Tencent Cloud, DXC Technology.

b. The application hosting market represents a dynamic and integral part of the broader IT services landscape, offering businesses the ability to run software applications on remote infrastructure managed by third-party providers. This includes services across cloud, managed, and hybrid hosting environments, allowing organizations to reduce the complexity and cost of managing their own on-premises IT infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.