- Home

- »

- Network Security

- »

-

Application Security Market Size, Industry Report, 2033GVR Report cover

![Application Security Market Size, Share & Trends Report]()

Application Security Market (2026 - 2033) Size, Share & Trends Analysis By ComponentSolution, Services(Solution, Services), By Solution, By Service, By Testing Type, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-816-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Application Security Market Summary

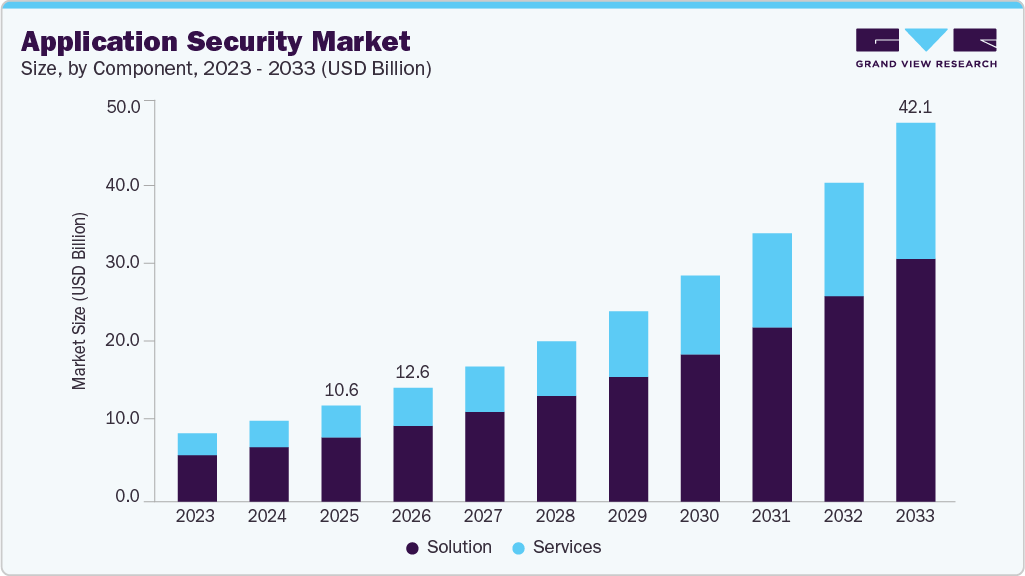

The global application security market size was estimated at USD 10.65 billion in 2025 and is projected to reach USD 42.09 billion by 2033, growing at a CAGR of 18.8% from 2026 to 2033. The growth is driven by the surge in cyberattacks targeting web and mobile applications as organizations increasingly digitize operations.

Key Market Trends & Insights

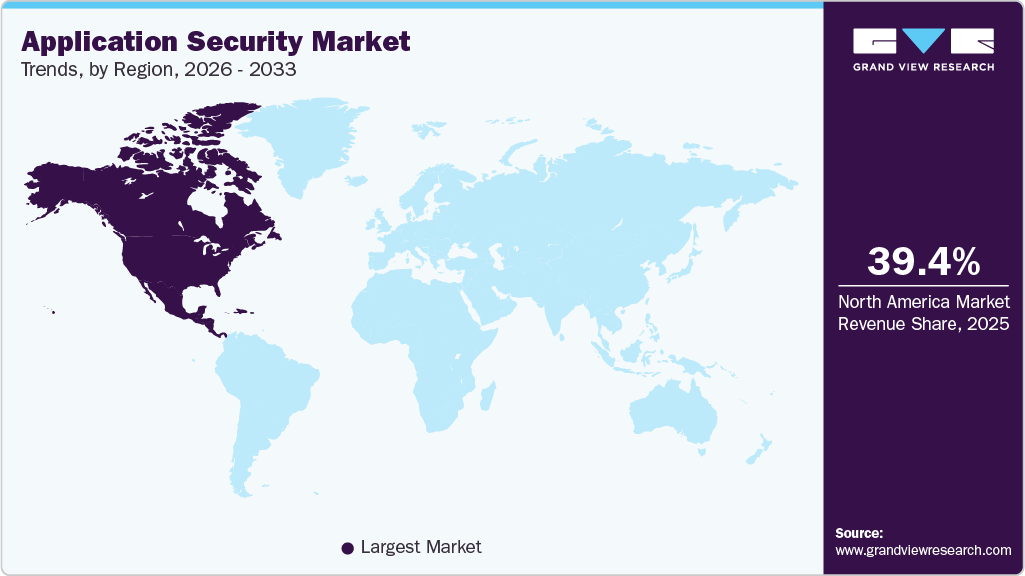

- The North America application security accounted for the largest global revenue share of 39.4% in 2025.

- The application security industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By component, the solution segment held the largest revenue share of 67.2% in 2025.

- By testing type, the SAST segment held the largest revenue share in 2025.

- By end use, the BFSI segment is expected to grow significantly from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 10.65 Billion

- 2033 Projected Market Size: USD 42.09 Billion

- CAGR (2026-2033): 18.8%

- North America: Largest market in 2025

This has heightened the need for robust security solutions that can detect, prevent, and remediate vulnerabilities across development and production environments. The surge in sophisticated cyber threats targeting applications is the most significant growth driver for the application security industry. As organizations increasingly adopt digital platforms, attackers are exploiting vulnerabilities in web and mobile applications to gain unauthorized access and steal sensitive data. This growing threat landscape has prompted enterprises to invest heavily in application security solutions such as web application firewalls, runtime application self-protection (RASP), and static/dynamic application security testing (SAST/DAST).

The accelerated shift toward cloud computing, SaaS-based applications, and microservices architectures has expanded the attack surface for businesses. With applications being deployed across hybrid and multi-cloud environments, ensuring consistent security across these platforms has become critical. Consequently, companies are integrating cloud-native application protection platforms (CNAPPs) and DevSecOps practices to secure their applications throughout the development lifecycle. According to the 2025 State of Cloud Security Report by Orca Security, multi-cloud adoption has become the new standard, with 55% of organizations now utilizing two or more cloud providers. This widespread shift toward hybrid and multi-cloud environments has significantly increased the complexity of maintaining consistent security policies, visibility, and compliance across platforms. The report highlights that as businesses scale their cloud operations, many struggle with misconfigurations, identity management, and vulnerability monitoring.

The exponential rise in mobile and web applications across various industries, including banking, healthcare, and retail, is also fueling market growth. As these applications handle high volumes of financial and personal information, developers are prioritizing secure coding practices and integrating security testing earlier in the development process. This has led to a surge in demand for integrated security testing tools and continuous monitoring solutions.

Component Insights

The solution segment dominated the application security market, accounting for a 67.2% revenue share in 2025. As organizations adopt DevSecOps practices, there is a significant shift toward integrating security tools directly into continuous integration and deployment (CI/CD) pipelines. Application security solutions that integrate seamlessly with DevOps workflows enable real-time scanning, automated testing, and faster remediation of security flaws. The early embedding of security in development has led to an increased demand for automated and developer-friendly application security solutions.

The services segment is anticipated to grow at a significant CAGR during the forecast period. The widespread adoption of multi-cloud and hybrid IT infrastructures has made it difficult for businesses to maintain consistent application security policies across diverse platforms. Professional and consulting services are witnessing rising demand as enterprises seek expert guidance on cloud-native security architecture design, policy integration, and risk assessment. Service providers offering cloud and API security assessments are thus becoming critical partners in securing distributed applications.

Solution Insights

The web application security segment dominated the application security industry, accounting for the largest revenue share in 2025. The rapid surge in web application vulnerabilities and sophisticated cyberattacks, such as SQL injection, cross-site scripting (XSS), and session hijacking, has become a major driver for the web application security solution segment. As businesses increasingly depend on web-based platforms for operations, attackers are exploiting these entry points to access confidential data. This growing threat landscape is pushing enterprises to adopt advanced Web Application Firewalls (WAFs), bot management systems, and runtime protection solutions to safeguard their online assets.

The mobile application security segment is anticipated to grow at a significant CAGR during the forecast period. The exponential increase in mobile app usage across banking, e-commerce, healthcare, and social platforms has made mobile applications a prime target for cybercriminals. Attacks such as malware injection, data leakage, code tampering, and insecure data storage are becoming more common. Moreover, modern mobile application security solutions are increasingly leveraging AI and machine learning to identify behavioral anomalies, detect zero-day vulnerabilities, and automate threat responses.

Service Insights

The professional services segment dominated the application security market, accounting for the largest revenue share in 2025. With the increase in application-layer attacks, organizations are increasingly outsourcing incident response, forensic analysis, and remediation services to professional service providers. These services enable organizations to quickly identify, contain, and mitigate security breaches, thereby reducing the potential business impact. The complexity and criticality of timely response continue to drive the adoption of professional application security services.

The managed services segment is expected to grow at a significant CAGR over the forecast period. The migration of applications to cloud-native and hybrid architectures increases the complexity of security management. Managed services offer centralized monitoring and protection across multiple platforms, ensuring consistent security policies, automated patching, and real-time threat detection. This capability is critical for enterprises with distributed applications, boosting the segment’s growth.

Testing Type Insights

The static application security testing (SAST) segment dominated the market, accounting for the largest revenue share in 2025. SAST solutions enable organizations to identify security flaws during the early stages of software development by analyzing source code, bytecode, or binaries. Early detection reduces the risk of deploying vulnerable applications and lowers remediation costs compared to fixing issues post-production. As enterprises prioritize proactive security measures, the adoption of SAST continues to grow rapidly.

The dynamic application security testing (DAST) segment is expected to grow at a significant CAGR over the forecast period. DAST solutions analyze applications during runtime to identify security flaws that cannot be detected in static code analysis, such as authentication issues, session management flaws, and input/output validation problems. As organizations increasingly deploy complex web and mobile applications, the ability to detect vulnerabilities in a live environment is driving demand for DAST solutions.

Deployment Insights

The on-premise segment dominated the application security industry, with the largest revenue share in 2025. Organizations deploying application security solutions on-premises benefit from full control over configuration, customization, and security policies. Enterprises with complex IT environments or sensitive data often prefer on-premise deployments to tailor security solutions to their unique requirements. This demand for highly customizable and controllable security infrastructure continues to drive growth in the on-premise deployment segment.

The cloud segment is expected to grow at a significant CAGR during the forecast period. Enterprises are increasingly migrating applications to public, private, and hybrid cloud environments to enhance scalability, agility, and operational efficiency. Cloud deployment of application security solutions allows organizations to protect workloads across diverse cloud platforms without the complexity of managing on-premise infrastructure. The surge in cloud adoption is a key driver for this segment.

Enterprise Size Insights

The large enterprises segment dominated the market, accounting for the largest revenue share in 2025. Large enterprises often operate complex IT environments with multiple web, mobile, and cloud applications running across hybrid and multi-cloud architectures. Securing these extensive and interconnected systems requires advanced application security solutions, including SAST, DAST, RASP, and CNAPPs. The complexity and scale of operations drive large enterprises to invest heavily in comprehensive security platforms to protect sensitive data and maintain business continuity.

The small & medium enterprises segment is expected to grow at a significant CAGR during the forecast period. Many SMEs are digitally transforming by adopting e-commerce platforms, cloud applications, and mobile apps to reach customers and streamline operations. The expansion of digital assets increases the attack surface, making application security solutions essential for preventing data breaches, fraud, and service disruptions.

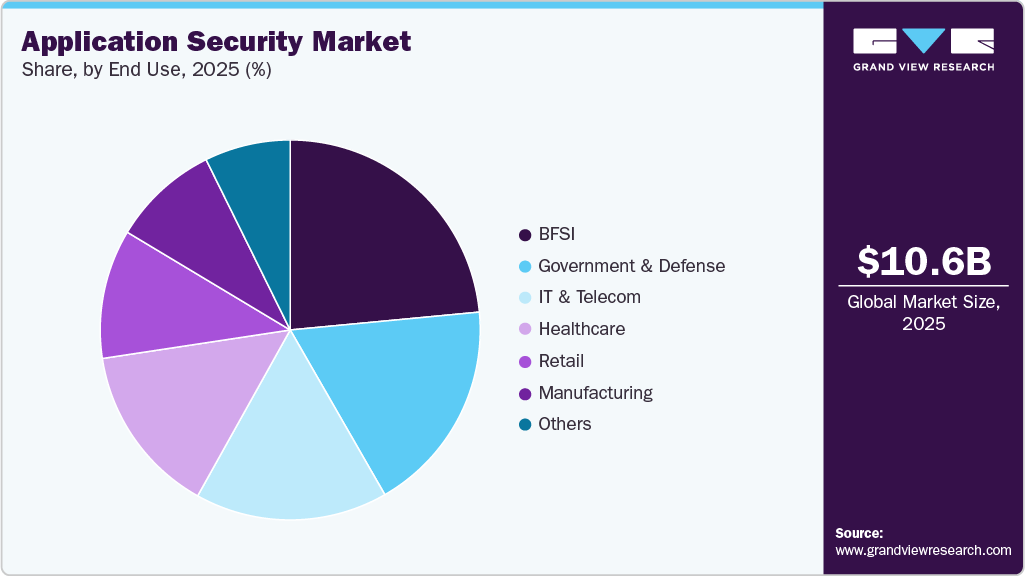

End Use Insights

The BFSI segment dominated the application security market, accounting for a revenue share of over 20.0% in 2025. BFSI organizations are prime targets for cybercriminals due to the high value of financial and personal data. Threats such as account takeover, phishing, API attacks, and ransomware have become increasingly sophisticated and frequent. This has driven BFSI enterprises to adopt advanced application security solutions, including Web Application Firewalls (WAFs), Runtime Application Self-Protection (RASP), and AI-powered threat detection to protect sensitive financial assets.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. Healthcare organizations handle large volumes of personal health information (PHI), making them prime targets for cyberattacks. Threats such as ransomware, data breaches, and unauthorized access can have severe consequences, including patient harm and legal penalties. This drives healthcare providers to adopt advanced application security solutions, including web/mobile security tools, WAFs, and RASP, to protect sensitive patient data.

Regional Insights

The application security market in North America dominated the global market with the largest revenue share of 39.4% in 2025, driven by the high adoption of cloud computing and multi-cloud environments among enterprises. Organizations are increasingly deploying hybrid architectures, which expands the attack surface and creates demand for cloud-native application security solutions and integrated threat intelligence platforms.

U.S. Application Security Market Trends

The application security industry in the U.S. is expected to grow significantly at a CAGR of 16.1% from 2025 to 2033, driven by stringent regulatory compliance and cybersecurity standards. Frameworks such as PCI DSS, HIPAA, and CCPA require robust security for web and mobile applications, encouraging organizations to adopt advanced SAST, DAST, and RASP solutions to maintain compliance and protect sensitive customer data.

Europe Application Security Market Trends

The Europe application security industry is anticipated to register considerable growth from 2026 to 2033 due to the increasing focus on data privacy and GDPR compliance. Enterprises are investing in application security solutions that ensure secure handling of personal data, implement real-time monitoring, and provide audit-ready reports to avoid penalties and reputational damage.

The UK application security market is expected to grow rapidly in the coming years, driven by digital transformation initiatives across the banking, healthcare, and retail sectors, which will increase the adoption of application security solutions. Organizations expanding their web and mobile presence require continuous application monitoring, API security, and vulnerability management to safeguard critical business processes.

The application security market in Germany held a substantial market share in 2025, driven by the strong adoption of Industry 4.0 technologies in the manufacturing and industrial sectors. Industrial applications, IoT-connected systems, and smart manufacturing platforms necessitate robust application security solutions to prevent intellectual property theft, operational disruptions, and cyber espionage.

Asia Pacific Application Security Market Trends

The Asia Pacific held a significant share of the global market in 2025, largely due to the rapid adoption of mobile and digital payment platforms in emerging economies. High smartphone penetration and the expansion of e-commerce have increased the demand for mobile and web application security solutions to protect consumer data and prevent fraud.

The Japan application security market is expected to grow rapidly in the coming years, driven by advanced technological infrastructure and enterprise-level automation drive the market. Organizations are increasingly integrating DevSecOps practices and AI-powered security analytics into their software development lifecycle, accelerating demand for automated SAST, DAST, and runtime protection solutions.

The application security market in China held a substantial revenue share in 2025, due to government initiatives promoting the digital economy and smart city projects. Enterprises and public sector organizations are deploying large-scale web and mobile applications, which require comprehensive security solutions, including cloud-native protection, API security, and continuous threat monitoring, to ensure data integrity and service continuity.

Key Application Security Company Insights

Key players operating in the application security industry are Checkmarx Ltd.; IBM Corporation; Synopsys, Inc.; F5, Inc.; Open Text Corporation; andHCL Technologies. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2025, F5, Inc. announced plans to acquire CalypsoAI, a leading provider of enterprise AI security solutions. CalypsoAI’s platform, known for real-time threat protection, scalable red teaming, and robust data security, will be integrated into F5’s Application Delivery and Security Platform (ADSP), enhancing its ability to secure AI inference and offering enterprises a comprehensive solution for safe deployment of generative and agentic AI.

-

In April 2025, Checkmarx Ltd. launched an application security posture management (ASPM) solution directly within popular integrated development environments (IDEs). The cloud-based Checkmarx One platform enhances developer workflows by simplifying vulnerability prioritization and remediation without disrupting daily tasks. New features include pre-commit secrets scanning in the IDE to reduce redundant fixes and safeguard sensitive data, as well as integration with JFrog Artifactory to ensure secure code delivery and compliance in private registries.

-

In April 2025, Synopsys, Inc. introduced Polaris Assist, an AI-powered application security assistant built into the Synopsys Polaris Software Integrity Platform. By combining cutting-edge Large Language Model (LLM) technology with Synopsys’ security expertise and the extensive open source data from Black Duck, Polaris Assist provides developers and security teams with concise vulnerability summaries, practical recommendations, and AI-suggested code fixes, enabling faster and more secure software development.

Key Application Security Companies:

The following are the leading companies in the application security market. These companies collectively hold the largest market share and dictate industry trends.

- CAST Software

- Checkmarx

- Cisco Systems, Inc.

- F5, Inc.

- GitLab

- HCL Technologies Ltd

- IBM Corporation

- Open Text Corporation

- Onapsis

- Rapid7

- Synopsys, Inc.

- Veracode

- VMware

- WhiteHat Security

Application Security Market Report Scope

Report Attribute

Details

Market size in 2026

USD 12.64 billion

Revenue forecast in 2033

USD 42.09 billion

Growth rate

CAGR of 18.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, service, testing type, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

CAST Software; Checkmarx; Cisco Systems, Inc.; F5, Inc.; GitLab; HCL Technologies Ltd.; IBM Corporation; Open Text Corporation; Onapsis; Rapid7; Synopsys, Inc.; Veracode; VMware; WhiteHat Security

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Application Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the application security market report based on component, solution, service, testing type, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Web Application Security

-

Mobile Application Security

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Professional Services

-

Managed Services

-

-

Testing Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Static Application Security Testing (SAST)

-

Dynamic Application Security Testing (DAST)

-

Interactive Application Security Testing (IAST)

-

Runtime Application Self-Protection (RASP)

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Retail

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global application security market size was estimated at USD 7.57 billion in 2023 and is expected to reach USD 8.98 billion in 2024.

b. The global application security market is expected to grow at a compound annual growth rate of 18.7% from 2024 to 2030 to reach USD 25.10 billion by 2030.

b. Solution offering led the market and accounted for more than 67.0% of the global revenue in 2023. Application security solutions identify and manages open source and third-party component risks in the development and production of application security platforms. Additionally, application security solutions identify and concentrate on the highest-priority issues by aggregating risk scores based on software composition, static, and dynamic analysis when users filter across multiple security tests.

b. Some key players operating in the application security market include Capgemini, CAST Software, Checkmarx, Cisco Systems, Inc., and F5, Inc., GitLab, HCL Technologies Ltd , International Business Machines Corporation, MicroFocus, Onapsis, Rapid7, Synopsys, Inc., Veracode, VMware, and WhiteHat Security.

b. The growing cybersecurity threats are one of the main factors propelling the global application security market. In addition, due to the increasing reliance on the internet and digital technology, applications are now a prime target for cyberattacks. Thus, driving the market demand of the application security market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.