- Home

- »

- Next Generation Technologies

- »

-

Architectural Services Market Size And Share Report, 2030GVR Report cover

![Architectural Services Market Size, Share, & Trends Report]()

Architectural Services Market (2024 - 2030) Size, Share, & Trends Analysis Report By Service Type (Engineering Services, Urban Planning Services), By End-use (Education, Government), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-064-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Architectural Services Market Summary

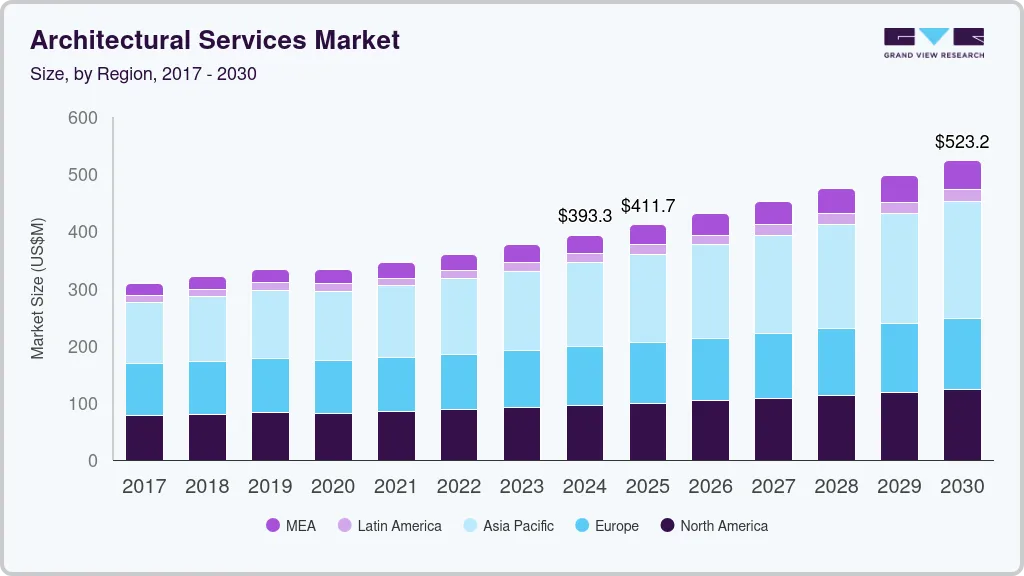

The global architectural services market size was estimated at USD 376.08 billion in 2023 and is projected to reach USD 523.20 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The demand for services can be attributed to the increasing construction activities globally.

Key Market Trends & Insights

- The architectural services market in North America held a significant global share of over 24% of the architectural services market in 2023.

- The architectural services market in the U.S. is growing significantly at a CAGR of 4.2% from 2024 to 2030.

- By service type, the construction and project management services segment held the largest market share of over 32% in 2023.

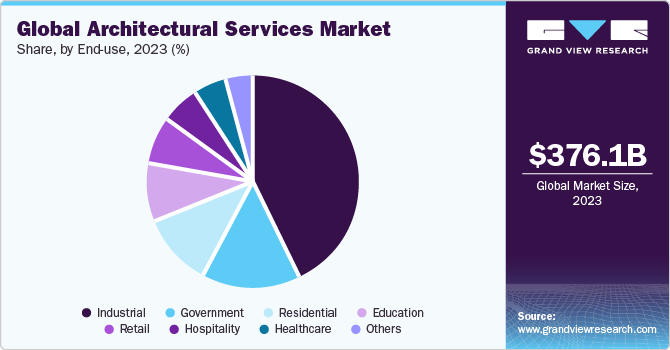

- By end-use, the industrial segment held the largest market share of over 43% in 2023,.

Market Size & Forecast

- 2023 Market Size: USD 376.08 Billion

- 2030 Projected Market Size: USD 523.20 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Rapid urbanization in developing nations like India and Brazil has increased residential and commercial construction projects, thus driving the market's growth. In addition, governments globally are also focusing on introducing affordable housing projects. This rise in construction activities is expected to support the demand for architectural services such as construction and project management services and urban planning, boosting market growth.

The healthcare and hospitality sectors are witnessing rapid growth. In the healthcare sector, hospitals are focused on improving patient care by establishing new facilities and reorganizing existing spaces. This helps them improve patient outcomes, increase patient satisfaction, and optimize the building space to treat patients seamlessly. As a result, services such as construction, project management, and interior design are expected to witness significant demand. The hospitality sector is witnessing increasing tourism in developed and developing countries. Increased tourism has led to the development of new hotels, resorts, and restaurants at tourist locations.

Businesses are opting for architectural services such as interior design, space planning, and schematic designs that help them attract more customers and enhance their stay experience. In addition, the focus of major players on enhancing their businesses and customer base through strategic partnerships is expected to augment market growth.

Architects often encounter challenges in communicating ideas and delivering complex designs. The deployment of VR technology in architectural design enables architects to save time and money while providing high precision in design. The rapid adoption of virtual reality in the architectural service is expected to drive market growth. Although the market is expected to grow, the high costs associated with architectural services are expected to restrain the market's growth.

The number of construction projects being undertaken worldwide shows no signs of abating. As more people migrate from rural to urban areas in search of better opportunities and the rate of urbanization continues to grow, the need for developing civic infrastructure, residential buildings, and commercial complexes will also grow proportionally. In April 2023, the World Bank estimated that around 56% of the world's population, or about 4.4 billion people, live in cities. Looking forward over the next three decades, the World Bank foresaw nearly seven out of ten people living in cities by 2050, more than double its current size. Several construction projects would be undertaken to cater to the growing urban population. Architectural services would play a crucial role in realizing these construction projects.

Governments are pursuing several initiatives to develop adequate infrastructure to support economic growth, particularly in emerging economies. As such, schools, colleges, shopping complexes, transportation hubs, roads, and bridges are aggressively being developed by private companies and public sector agencies. Construction companies increasingly opt for architectural services to streamline their construction projects as construction activities continue to rise. Hence, the continued growth in construction activities is expected to drive the demand for architectural services over the forecast period.

Market Concentration & Characteristics

The technology environment in the market is rapidly evolving. Companies increasingly opt for advanced pre-engineering analysis services to meet complex mechanical and electrical requirements. The preference for 2D and 3D Computer-Aided Design (CAD) design and drafting services is growing. As such, several CAD-based architecture and drafting services are being introduced. For instance, in September 2022, CAD Drafting & Custom Home Design, a provider of home decor services, launched an architecture and drafting service that utilizes CAD software. The CAD architecture and drafting service covers formulating a plan for all stages of construction, including elevations, floor plans, electrical plans, and dimension plans.

Architectural services are increasingly implementing 3D printing technology. 3D printing can allow architects to create different models of the proposed infrastructure. As a new design model, 3D printing can reduce work time and cost by up to 75%. Besides, 3D printing technology can also be seamlessly integrated with in-house CAD applications, enabling newer design options and better perspectives through visually appealing scaled models.

The demand for architectural services depends entirely on the developments in the construction industry. However, the construction industry by itself is complex and dynamic, relying on changing economic conditions. As governments worldwide continue to draft regulations mandating the adoption of environment-friendly construction practices and the construction of sustainable buildings, developing dedicated expertise in developing and drafting sustainable and environment-friendly designs would open new avenues for architectural services companies.

Architectural services providers must also abide by the building codes applicable to their region. However, given that different regions have different building codes and that they change from country to country, architectural services companies, especially those operating internationally, may find it challenging to abide by the different building codes. Failing to adhere to the building codes may lead to legal consequences, monetary fines, and a tarnished reputation. Nevertheless, these companies can overcome this challenge by partnering with local architecture and engineering firms to get better acquainted with the building codes applicable in the respective countries or regions.

Service Type Insights

The construction and project management services segment held the largest market share of over 32% in 2023. Construction and project management are important aspects of a construction project. With the constant rise in construction activities globally, the demand for construction and project management services is increasing for tasks such as project life cycle management, cost control, scheduling, and risk management, thus driving the growth of the segment in the market over the forecast period.

The legal technical requirement compliance counseling services segment is anticipated to grow at a CAGR of 6.9% during the forecast period. The growing complexity of regulations, strong regulatory scrutiny, evolving business environment, focus on risk management, and evolving client needs drive the demand for legal technical requirement compliance counseling services. Non-compliance with legal and technical requirements can lead to significant legal fees, fines, and reputational damage. Consulting services help businesses identify and mitigate these risks by proactively addressing potential compliance issues.

End-use Insights

The industrial segment held the largest market share of over 43% in 2023, the architectural services market. This can be attributed to the rapid global industrialization coupled with increasing acquisitions and new factory establishments by business firms. In addition, the growing environmental concerns and initiatives carried out by business owners to construct green buildings are expected to contribute to the demand for architectural advisory and interior design services.

The education segment is anticipated to grow at a CAGR of 6.8% during the forecast period. Educational facilities need to be designed to facilitate effective teaching and learning. Architectural service providers consider various factors such as classroom size, layout, and natural light to create spaces that promote focus, collaboration, and student engagement. Furthermore, effective architectural services ensure that facilities are accessible and inclusive for students with diverse needs.

Regional Insights

The architectural services market in North America held a significant global share of over 24% of the architectural services market in 2023. A strong and growing economy in North America, especially in the U.S., leads to increased investment in architectural projects across various sectors, such as commercial, residential, and industrial. It fuels the demand for architectural services throughout the project lifecycle.

U.S. Architectural Services Market Trends

The architectural services market in the U.S. is growing significantly at a CAGR of 4.2% from 2024 to 2030. Architectural services users across the U.S. are emphasizing user experience in their construction and architectural projects. This necessitates architects to go beyond traditional designs and incorporate human-centered design principles to create spaces that are functional, comfortable, and cater to users' specific needs.

Europe Architectural Services Market Trends

The architectural services market in Europe is growing significantly at a CAGR of 3.4% from 2024 to 2030. This growth can be attributed to the prosperous construction sector in information technology, which is owing to rising investments and new infrastructure expansion projects. The COVID-19 pandemic temporarily suspended the construction of various data center facilities, but their resumption and new IT projects are expected to revive the market for architectural services.

The UK architectural services market is growing significantly at a CAGR of 3.3% from 2024 to 2030. The UK is experiencing a shortage of residential buildings, which drives the demand for new residential developments. This creates opportunities for architects in various capacities, from designing individual homes to planning large-scale housing projects, thus driving market growth over the forecast period.

The architectural services market in Germany is growing significantly at a CAGR of 3.0% from 2024 to 2030. The German government is implementing various initiatives, including investment programs and tax breaks, to support the construction sector, thus fueling the growth of the country's market.

The France architectural services market is expected to grow significantly from 2024 to 2030. France faces aging infrastructure challenges, including bridges, schools, and hospitals. It necessitates significant investment in upgrades and modernization, creating demand for architectural services in designing, planning, and project management.

Asia Pacific Architectural Services Market Trends

The architectural services market in Asia Pacific dominated the market with a revenue share of 36.73% in 2023 and is growing significantly at a CAGR of 5.8% from 2024 to 2030. The growth can be attributed to rapid urbanization, a growing population, and increasing regional residential and industrial construction projects. Furthermore, the presence of major manufacturers and their increasing efforts to establish new production plants in various developing countries contributes to the growth of the Asia Pacific market.

The China architectural services market is growing significantly at a CAGR of 6.4% from 2024 to 2030. The adoption of Leadership in Energy and Environmental Design (LEED) in China has emphasized green building development. For instance, in February 2024, U.S. Green Building Council, a non-profit green building rating system provider, announced that China secured first rank in its annual list of top 10 countries and regions for Leadership in Energy and Environmental Design (LEED) in 2023.

The architectural services market in Japan is growing significantly at a CAGR of 5.2% from 2024 to 2030. Japanese government implemented fiscal stimulus packages to boost the economy, with a portion of these funds directed toward infrastructure development and construction projects. This government initiative increased the demand for architectural services.

The India architectural services market is growing significantly at a CAGR of 6.9% from 2024 to 2030. As India is witnessing a rapid digital transformation, the amount of digital infrastructure is increasing across various developed and developing cities in the country. Furthermore, technological innovation resulting from the collaboration of public and private companies is expected to increase the demand for architectural services over the forecast period.

Middle East & Africa Architectural Services Market Trends

The architectural services market in the Middle East & Africa is growing significantly at a CAGR of 6.4% from 2024 to 2030. Various countries in the Middle East & Africa region are rich in natural resources, which leads to economic growth and increased investment in construction projects across various sectors, such as residential, commercial, and industrial, thus driving the market growth in the region.

Key Architectural Services Company Insights

Some of the key companies operating in the market include AECOM, Jacob, and Stantec, among others. Some of the leading participants in the architectural services industry are.

-

AECOM is one of the leading firms positioned to design, build, finance, and operate infrastructure assets for governments, businesses, and organizations worldwide. The company operates through three business segments: Americas, International, and AECOM Capital (ACAP). Under the International segment, the company provides services to various end-use markets, such as government, transportation, environment, and energy in Europe, the Middle East, India, and Africa.

-

Jacobs provides professional services such as technical, consulting, project delivery, and scientific for the government and private sectors. The company primarily offers three solutions: Climate Response, Data Solutions, and Consulting and advisory services. Climate response is focused on end-to-end solutions in decarbonization, energy transition, and regenerative and environmentally friendly climate solutions.

Perkins Eastman, Arcadis, and Perkins and Will are some of the emerging market participants in the architectural services industry.

-

Perkins Eastman is a global architecture firm offering services across different industries and sectors, such as healthcare, education, and transit-oriented developments. The company offers a wide range of specialized project types, such as healthcare, civil, higher education, office & retail, hospitality, planning & urban design, residential, science & technology, and transportation & infrastructure.

-

IBI Group is a technology design firm driven by planners, architects, engineers, technology professionals, and designers who offer professional services in urban development and transportation planning and design. The company provides Architectural Engineering, Interiors, Landscape Architecture, Planning, and Urban Design.

Key Architectural Services Companies:

The following are the leading companies in the architectural services market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- CannonDesign

- Foster + Partners

- Gensler

- HDR, Inc.

- HKS Inc

- HOK

- IBI Group

- Jacobs

- NBBJ

- Nikken Sekkei Ltd.

- Perkins and Will

- Perkins Eastman

- Stantec

- Zaha Hadid Architects

Recent Developments

-

In December 2023, HDR, Inc. acquired City Point Partners, a construction services provider based in Massachusetts, U.S. The two firms collaborated on various projects, such as the Massachusetts Bay Transportation Authority. The acquired firm is a program management company specializing in public outreach, construction services, project controls, and project management.

-

In November 2023, AECOM signed a MoU with Boryspil International Airport to work as a reconstruction partner. AECOM partnered with the Boryspil Airport reconstruction project to provide infrastructure consulting services encompassing capability assessment and asset condition, planning, design, program management, and construction management. In addition, the company helped develop program management capabilities for the broader reconstruction of the country's aviation industry.

-

In May 2024, Gensler, an architecture and design firm, opened a sports venue design practice in Kansas City, Missouri. This expansion marks a significant milestone for the company, which has grown its sports and entertainment practice over the past 15 years. The firm aims to leverage the local talent pool and expertise to create innovative and human-centric sports and entertainment districts that cater to the growing demand for in-person experiences.

Architectural Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 373.30 billion

Revenue forecast in 2030

USD 523.20 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Historical data

2018 - 2022

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AECOM; CannonDesign; Foster + Partners; Gensler; HDR, Inc.; HKS Inc; HOK; IBI Group; Jacobs; NBBJ; Nikken Sekkei Ltd.; Perkins and Will; Perkins Eastman; Stantec; Zaha Hadid Architects

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

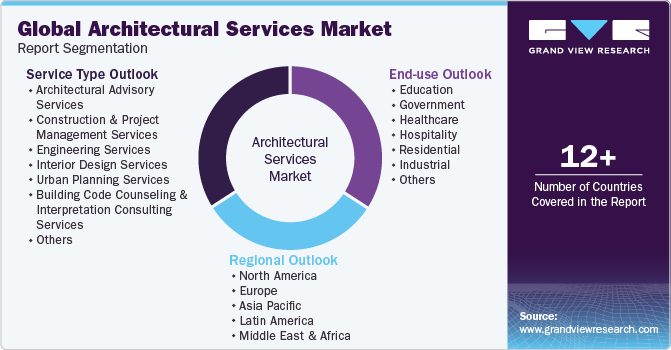

Global Architectural Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global architectural services market report based on service type, end-use, and region.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architectural Advisory Services

-

Construction And Project Management Services

-

Engineering Services

-

Interior Design Services

-

Urban Planning Services

-

Building Code Counseling And Interpretation Consulting Services

-

Legal Technical Requirement Compliance Counseling Services

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Education

-

Government

-

Healthcare

-

Hospitality

-

Residential

-

Industrial

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global architectural services market size was estimated at USD 376.08 billion in 2023 and is expected to reach USD 393.30 billion in 2024.

b. The global architectural services market is expected to reach USD 523.20 by 2030, at a compound annual growth rate of 4.9%

b. The Asia Pacific region held the largest revenue share of more than 36.73% in 2023 in the architectural services market. Growth in the investment for smart city projects and rapid industrialization across the countries are some of the factors expected to favor regional growth.

b. Some key players operating in the architectural services market include AECOM, CannonDesign, Foster + Partners, Gensler, HKS Inc.; HDR, Inc.; HOK, and IBI Group.

b. Key factors that are driving the architectural services market growth include increasing investments in the construction market and a substantial increase in demand for design services, project management, and consultancy service.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.