- Home

- »

- Medical Devices

- »

-

Argentina Interventional Peripheral Devices Market Report, 2030GVR Report cover

![Argentina Interventional Peripheral Devices Market Size, Share & Trends Report]()

Argentina Interventional Peripheral Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Microcatheters, Sheath, Peripheral Stents), By Application (Peripheral Artery Disease, Venous Thromboembolism), And Segment Forecasts

- Report ID: GVR-4-68040-549-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

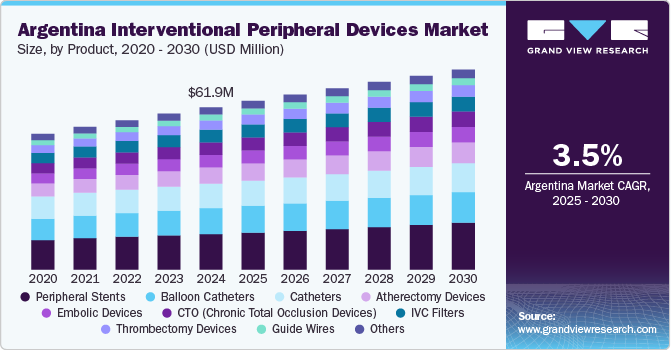

The Argentina interventional peripheral devices market size was valued at USD 61.92 million in 2024 and is projected to grow at a CAGR of 3.5% from 2025 to 2030 due to the rising prevalence of Peripheral Arterial Diseases (PAD) and related conditions. An aging population has contributed to a higher incidence of vascular disorders, creating a consistent demand for advanced treatment solutions. The increasing burden of diabetes and hypertension has further escalated the need for peripheral interventions. Healthcare institutions are adopting minimally invasive techniques that promote quicker recovery times and reduced hospital stays. This shift toward interventional procedures has increased the usage of devices such as stents, catheters, and angioplasty balloons. In addition, technological innovations in device design and performance have supported clinical outcomes, encouraging their wider application. The growing awareness among patients and clinicians regarding early diagnosis and treatment has also influenced market growth.

Private healthcare infrastructure in Argentina is expanding, increasing access to advanced medical technologies. Private hospitals and diagnostic centers are investing in high-precision interventional systems to improve service quality. Multinational medical device companies are entering the market through partnerships and distribution channels, which enhances product availability. These collaborations have allowed the introduction of high-end devices that meet international standards. Clinical professionals are also receiving specialized training, which contributes to the efficient use of peripheral devices. Rising disposable incomes among a population segment have increased out-of-pocket spending on elective procedures. These economic and structural shifts have boosted the adoption rate of interventional peripheral treatments across urban areas.

Peripheral Artery Disease (PAD) is becoming increasingly common in Argentina, primarily due to an aging population and the prevalence of risk factors such as diabetes, smoking, and sedentary lifestyles. As more patients are diagnosed with PAD, there is a growing need for effective treatment options, boosting demand for interventional peripheral devices. These devices are critical in restoring blood flow in blocked or narrowed arteries, improving patient outcomes. Healthcare providers prioritize early diagnosis and intervention, leading to increased procedure volumes. Consequently, this trend is a major driver of market growth in Argentina.

The aging population is a major driver of growth in Argentina’s interventional peripheral devices industry. According to the Pan American Health Organization article published in October 2024, individuals aged 65 and above constituted approximately 12.4% of the total population in 2024, marking a 2.8% point increase from 9.6% in 2000. This demographic shift is leading to a higher prevalence of vascular diseases such as peripheral artery disease (PAD) and deep vein thrombosis (DVT), which require interventional treatments. As a result, the demand for peripheral stents, catheters, and thrombectomy devices is rising to address the increasing burden of vascular disorders among older adults.

Aged Population in Argentina in 2024

Age Group

Female Population

Male Population

60-64

1,043,735

981,116

65-69

938,705

832,317

70-74

810,480

655,481

75-79

644,547

461,093

80-84

446,579

267,419

85-89

264,287

127,285

90-94

122,924

44,921

95+

45,319

12,311

Source: Pan American Health Organization & GVR

Advances in medical technology have significantly improved the quality and outcomes of interventional procedures. Devices such as drug-eluting balloons, bioresorbable stents, and improved catheter systems offer less invasive treatment with shorter recovery times. These innovations are particularly attractive to patients and healthcare professionals, increasing their adoption nationwide. Improved device performance and patient safety profiles have further supported the shift toward minimally invasive techniques. As a result, technological innovation continues to propel market expansion in Argentina’s interventional peripheral devices industry.

Market Concentration & Characteristics

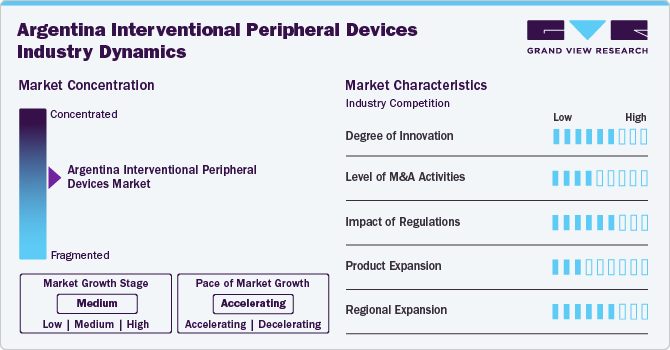

The market growth stage is moderate, and its growth is accelerating. Argentina’s interventional peripheral devices industry is driven by rising healthcare investments and technological advancements. The increasing prevalence of peripheral artery disease, fueled by aging populations and lifestyle-related risk factors, is boosting demand for interventional procedures. There is a growing preference for minimally invasive techniques due to their reduced recovery time and improved patient outcomes. In addition, greater awareness among healthcare providers and expanding access to advanced medical devices support market expansion.

The degree of innovation in Argentina’s interventional peripheral devices industry is moderate but steadily increasing. Local distributors and multinational companies are introducing newer-generation devices with enhanced precision, safety, and efficacy. Technological advancements such as drug-eluting balloons, atherectomy devices, and imaging-guided interventions are gradually entering the market. However, innovation is often limited by cost constraints and delayed regulatory approvals. Collaborations with international manufacturers are helping bridge this gap and introduce advanced solutions.

Mergers and acquisitions (M&A) activity in Argentina’s interventional peripheral devices industry is relatively low compared to global trends but shows signs of growing interest. Larger multinational firms are exploring partnerships or acquiring local distributors to strengthen their regional footprint. Economic uncertainties and regulatory complexity have traditionally limited M&A activity. However, the need for market access and the desire to leverage established distribution networks are encouraging more strategic deals. As market confidence improves, M&A activities are expected to increase.

Regulations play a significant role in shaping market entry and product approval timelines in Argentina’s interventional peripheral devices industry. The regulatory environment, managed by ANMAT, is becoming more structured but can still present delays and bureaucratic hurdles. Import restrictions and compliance requirements can increase time-to-market for new devices. While the government is working toward harmonizing standards with international norms, challenges remain for faster innovation adoption. Despite this, stricter regulations have helped ensure product safety and quality.

Product expansion is a key focus in Argentina’s interventional peripheral devices industry, particularly in response to evolving clinical needs. Companies are diversifying their offerings to include devices for complex lesions, chronic total occlusions, and drug-eluting technologies. The expansion is driven by physician demand for more specialized tools and patient preferences for less invasive solutions. However, product adoption can be limited by pricing pressures and reimbursement challenges. Over time, increasing awareness and training are expected to support broader adoption of advanced products.

Companies operating in the Argentina Interventional Peripheral Devices Market are increasingly expanding beyond the metropolitan area of Buenos Aires into secondary cities and underserved provinces such as Córdoba, Mendoza, and Santa Fe. This regional push is driven by the growing demand for advanced vascular treatments outside the capital and efforts to decentralize healthcare services. Firms are establishing local partnerships, distributor networks, and regional training programs to strengthen their presence and support product adoption. Infrastructure improvements and government initiatives to enhance healthcare access in remote areas also encourage company investment. As a result, the market is seeing more balanced growth across the country.

Product Insights

The peripheral stents segment dominated the market with the largest revenue share of 21.93% in 2024. Driven by the growing need for effective treatments for peripheral artery disease (PAD), peripheral stents have become essential tools in restoring blood flow through blocked or narrowed arteries outside the heart. These small mesh tubes are especially useful in arteries like the superficial femoral, iliac, and popliteal. Several leading global companies in Argentina provide advanced stent technologies designed for challenging vascular areas. For instance, Cook Medical’s Zilver PTX Drug-Eluting Peripheral Stent is suitable for 4 mm to 7 mm in diameter arteries and can treat lesions up to 300 mm long. It combines mechanical support with drug delivery to help keep arteries open over time.

The sheath segment is projected to grow at a significant CAGR over the forecast period. Fueled by the rising demand for safer and more efficient vascular access in minimally invasive procedures, introducer sheaths have become essential tools in modern interventional care. These devices provide a stable entry point into blood vessels, allowing doctors to insert, guide, and exchange catheters or other instruments with less trauma and greater control. In Argentina, global medical device companies with local operations offer advanced introducer sheath solutions tailored for peripheral vascular procedures. For instance, Terumo Argentina offers the RADIFOCUS Introducer II, which is inserted percutaneously to support the entire procedure. A more advanced version, the RADIFOCUS Introducer II Mcoat, features a hydrophilic coating that reduces friction during insertion and removal, smoothing the process and minimizing vessel damage.

Application Insights

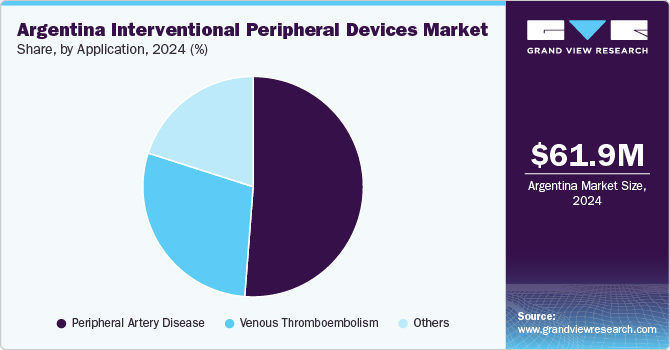

The peripheral artery disease segment dominated the market with the largest revenue share of 51.22% in 2024. Peripheral Arterial Disease (PAD) is becoming more common in Argentina. PAD occurs when arteries, especially in the legs, become narrowed or blocked due to atherosclerosis, the buildup of fatty deposits on artery walls. This rising health concern is leading to greater demand for minimally invasive treatments like balloon angioplasty and peripheral stent placement, which help restore blood flow, relieve symptoms, and reduce the risk of limb loss. These procedures are especially important for older adults and people living with diabetes or high blood pressure who are at higher risk of PAD complications.

Smoking is one of the biggest preventable risk factors for PAD. Harmful substances in tobacco smoke damage the inner lining of blood vessels, trigger inflammation and increase the risk of plaque buildup. Smoking also lowers oxygen levels in the blood while raising carbon monoxide, further weakening cardiovascular health. A study published in PLoS One in April 2024 confirmed that current smokers, regardless of gender, face a significantly higher risk of developing PAD than non-smokers. Alongside rising awareness, research efforts are expanding. In March 2024, medical tech company BD launched the AGILITY study, enrolling its first participant in a clinical trial for its Vascular Covered Stent, a self-expanding nitinol device coated with Polytetrafluoroethylene (PTFE). The study aims to evaluate its safety and effectiveness in PAD treatment, marking a major step forward in improving care and outcomes for PAD patients.

The venous thromboembolism segment is projected to grow at a significant CAGR over the forecast period, driven by unhealthy lifestyle trends and rising cardiovascular risks, Venous Thromboembolism (VTE), which includes Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE) is becoming a major health concern in Argentina. VTE occurs when blood clots form in the veins, most often in the legs, and can travel to the lungs, causing a potentially deadly blockage. According to a Pan American Health Organization report published in October 2024, the burden of VTE is rising due to factors like tobacco use, which affected 23.3% of people aged 15 and older in 2023, and obesity, which impacted 68.4% of the adult population in 2022. Smoking leads to inflammation in blood vessels, while excess body weight slows blood flow, increasing the risk of clot formation. These statistics show a growing need for improved vascular care and advanced treatment options.

Key Argentina Interventional Peripheral Devices Company Insights

BIOTRONIK Argentina S.A., B. Braun Melsungen AG, MicroPort, Medtronic Argentina, Abbott Laboratories Argentina, Boston Scientific Argentina, Terumo Argentina, and Cook Group are some of the prominent players in the Argentina interventional peripheral devices market. The market has witnessed considerable growth in recent years, driven by increasing incidences of PAD, advancements in minimally invasive procedures, and growing healthcare infrastructure in the country.

Key Argentina Interventional Peripheral Devices Companies:

- BIOTRONIK Argentina S.A.

- B. Braun Melsungen AG

- MicroPort

- Medtronic Argentina

- Abbott Laboratories Argentina

- Boston Scientific Argentina

- Terumo Argentina

- Cook Group

Recent Developments

-

In December 2024, Terumo Interventional Systems (TIS), a unit of Terumo Corporation, introduced its R2P NaviCross peripheral support catheter in the U.S. market. Now offered in 200 cm length, this new version expands Terumo’s radial-to-peripheral (R2P) portfolio. Designed for peripheral vascular procedures, the catheter features a double-braided stainless-steel build that enhances its trackability and torque control, supporting effective navigation through challenging lesions.

-

In June 2024, B. Braun Interventional Systems Inc. (BIS), part of the B. Braun Group, introduced its Biliary Drainage Catheters and ACCEL All-Purpose featuring TrueGlide Hydrophilic Coating. These catheters are designed to support percutaneous drainage procedures, focusing on enhancing patient comfort and clinical efficiency. Key features include large oval holes to promote greater fluid drainage and a hydrophilic coating that enables smoother insertion during use.

-

In April 2024, The U.S. FDA approved Abbott's groundbreaking Esprit BTK System, a treatment designed for chronic limb-threatening ischemia (CLTI) below the knee. This system features a resorbable scaffold that releases everolimus, offering a novel approach to managing the condition.

-

In January 2024, Cook Group launched its Slip-Cath Beacon Tip Hydrophilic Selective Catheter in the U.S. and Canada. It is designed for vascular and nonvascular procedures, making it a versatile option for medical professionals.

Argentina Interventional Peripheral Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 64.36 million

Revenue forecast in 2030

USD 76.28 million

Growth rate

CAGR of 3.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, application

Key companies profiled

BIOTRONIK Argentina S.A.; B. Braun Melsungen AG; MicroPort; Medtronic Argentina; Abbott Laboratories Argentina; Boston Scientific Argentina; Terumo Argentina; Cook Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Argentina Interventional Peripheral Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Argentina interventional peripheral devices market report based on product and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Catheters

-

Microcatheters

-

Sheath

-

Peripheral Stents

-

Self-expanding

-

Balloon-expandable

-

Drug-eluting stents

-

-

Guide Wires

-

Peripheral Vascular Microguidewires

-

Atherectomy Devices

-

Embolic Devices

-

Thrombectomy Devices

-

IVC Filters

-

CTO (Chronic Total Occlusion Devices)

-

Balloon Catheters

-

High-Pressure Balloons

-

RX PTA (Rapid Exchange Percutaneous Transluminal Angioplasty)

-

OTW PTA (Over-the-Wire Percutaneous Transluminal Angioplasty)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Artery Disease

-

Venous Thromboembolism

-

Others

-

Frequently Asked Questions About This Report

b. The Argentina interventional peripheral devices market size was estimated at USD 61.92 million in 2024 and is expected to reach USD 64.36 mllion in 2025.

b. The Argentina interventional peripheral devices market is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 76.28 million by 2030.

b. Peripheral Stents dominated the Argentina interventional peripheral devices market with a share of 21.93% in 2024. This is attributable to the rise in peripheral artery disease (PAD) cases and the increase in demand for these products.

b. Some of the players operating in this market are Medtronic Argentina, Abbott Laboratories Argentina, Terumo Argentina, B. Braun Melsungen AG, MicroPort, and Boston Scientific Argentina.

b. Key factors that are driving the Argentina interventional peripheral devices market growth include the increase in prevalence of PAD, rise in geriatric population, and favorable government initiatives for interventional peripheral devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.