- Home

- »

- Consumer F&B

- »

-

Argentina Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Argentina Nutraceuticals Market Size, Share & Trends Report]()

Argentina Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-808-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Argentina Nutraceuticals Market Summary

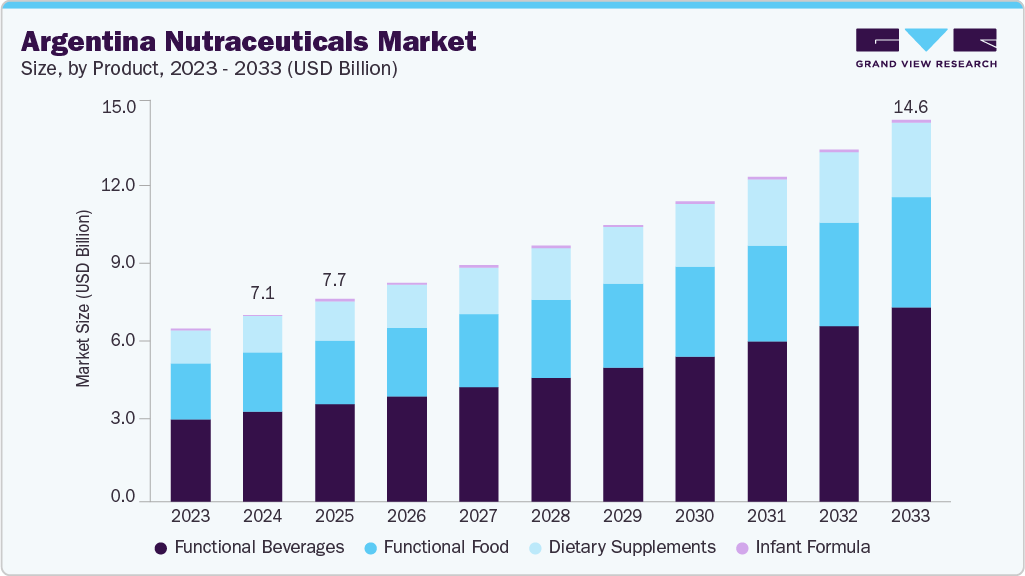

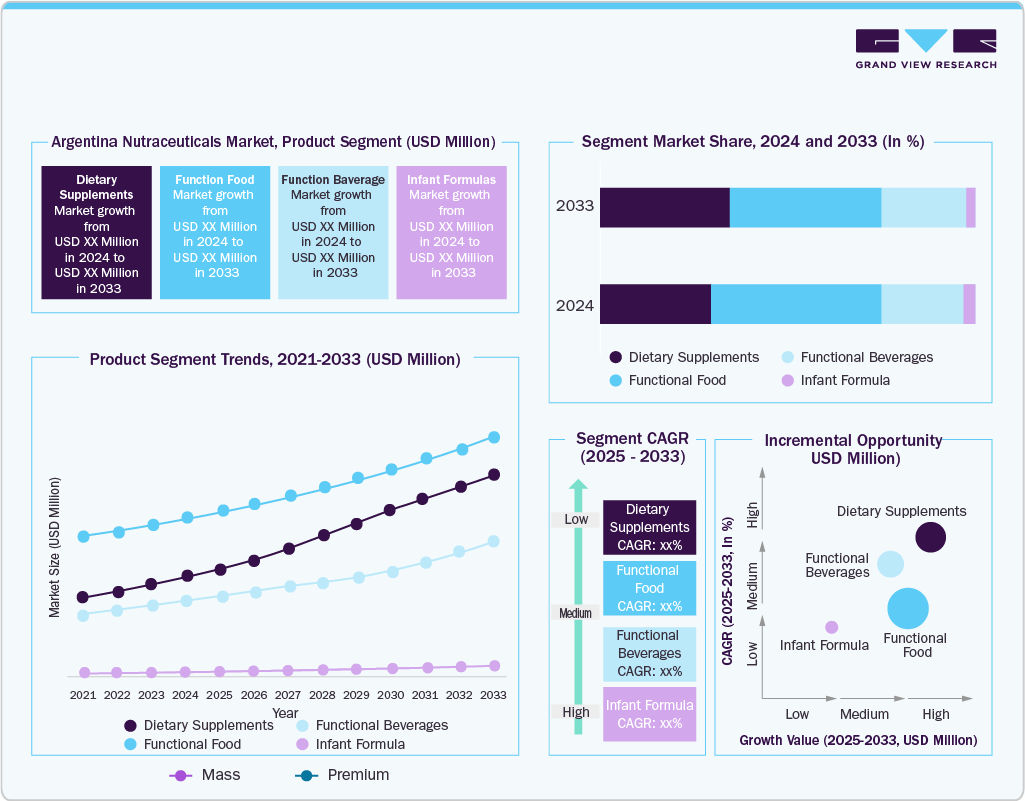

The Argentina nutraceuticals market size was estimated at USD 7.13 billion in 2024 and is projected to reach USD 14.55 billion by 2033, growing at a CAGR of 8.3% from 2025 to 2033. This market is primarily driven by increasing consumption of functional beverages among active urban consumers, rising demand for immunity-boosting supplements among young adults, and the growing use of nutraceuticals in managing chronic health conditions across all age groups.

Key Market Trends & Insights

- By product, the functional beverages segment held the largest market share of 47.9% in 2024.

- The dietary supplements product segment is expected to grow at a CAGR of 8.3% over the forecast period.

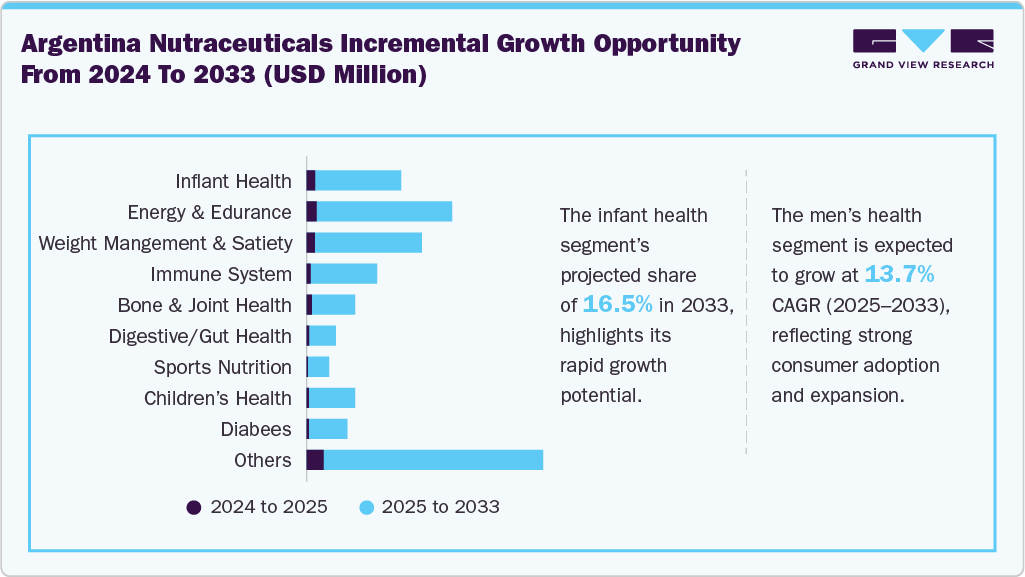

- Based on applications, the weight management & satiety segment held the largest market share of 16.6% in 2024.

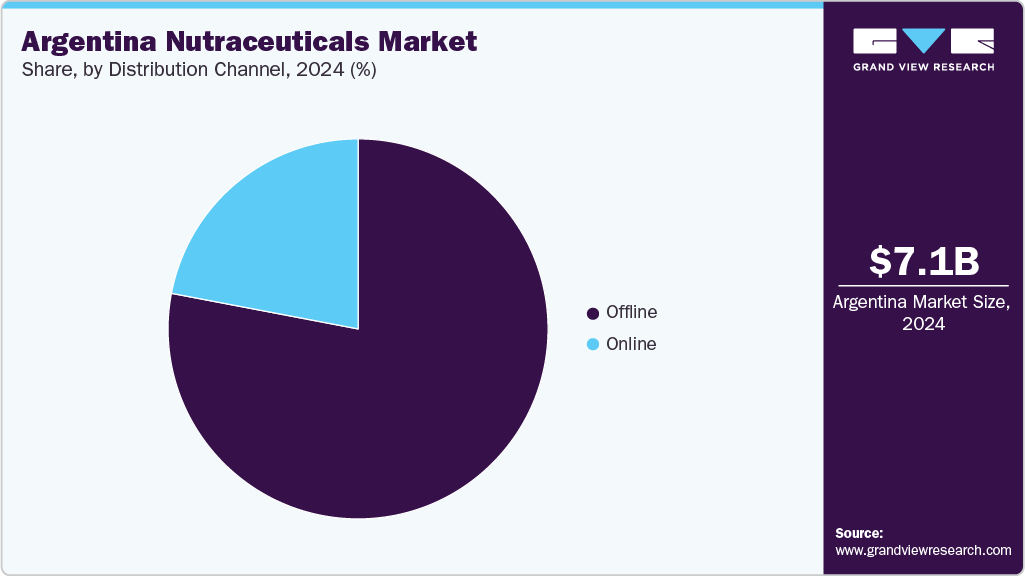

- By distribution channel, the offline segment held the largest market share of 78.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.13 Billion

- 2033 Projected Market Size: USD 14.55 Billion

- CAGR (2025-2033): 8.3%

Argentina is one of the largest economies in Latin America, with a diverse and urbanized population that is increasingly attentive to health and nutrition. The population is characterized by a significant share of working-age adults and health-conscious youth, contributing to the rising demand for nutraceuticals and functional foods in urban centers.

The government of Argentina has implemented a series of strong public health and nutrition policies to address changing dietary needs and improve population health. In 2022, Law No. 27,642 on the Promotion of Healthy Eating was enacted. This law brought in front-of-package warning labels, stricter rules on advertising, and controls on marketing unhealthy foods to children. The Ministry of Health has been updating national dietary guidelines in collaboration with nutrition professionals and public agencies. These measures are expected to increase consumer awareness, encourage healthier choices, and foster trust in nutraceuticals and functional foods as part of daily diets.

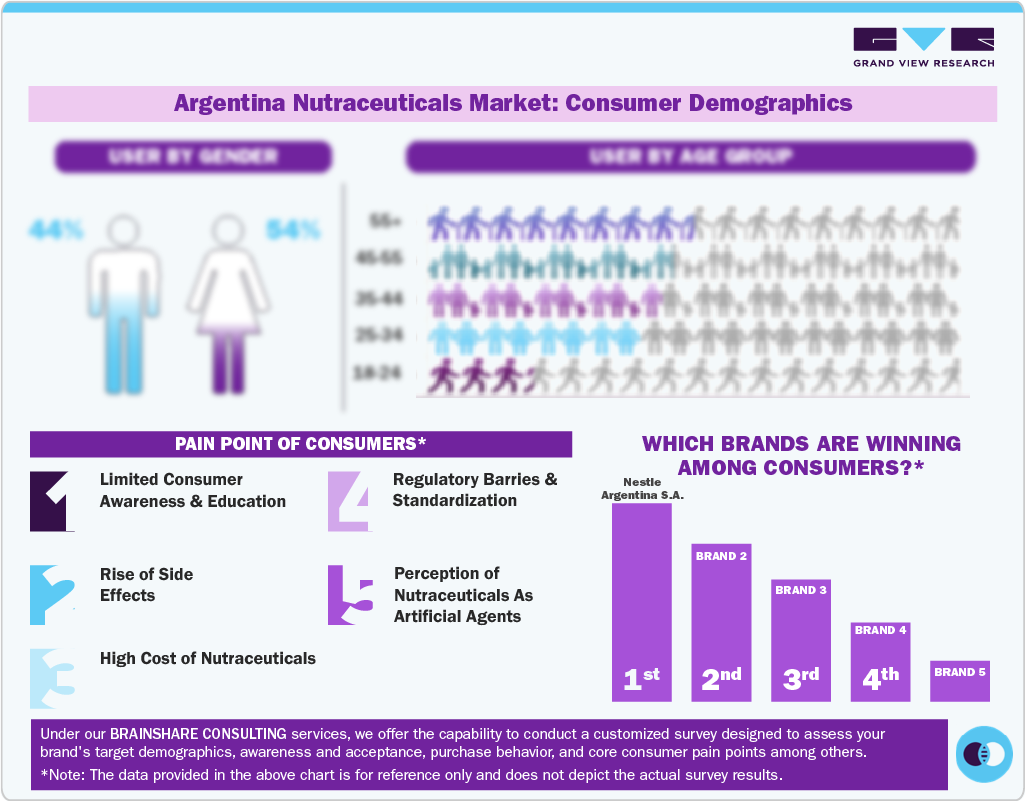

Consumer Insights

Consumer behavior in Argentina’s nutraceutical market is increasingly influenced by health and wellness trends and the strong reputation of leading brands. Leading companies have established significant trust and loyalty among consumers, which guides many purchasing decisions. At the same time, the rising popularity of plant-based diets and trends like veganism and clean-label products are reshaping preferences, particularly among younger and urban populations. As sports and fitness activities become more common across the country, a growing number of Argentines are turning to supplements and functional foods to support their active lifestyles and overall well-being.

The demand for nutraceuticals is particularly strong among adults aged 25 to 55, who prioritize preventive healthcare and maintaining their vitality. The market for prenatal supplements and infant nutrition products is also growing, particularly in urban centers with higher health awareness. Although more consumers are turning to online shopping due to its convenience and access to a wider range of products, offline channels, such as pharmacies, supermarkets, and specialty health stores, remain the dominant distribution segment. The growth of e-commerce and online pharmacies is expected to continue, but physical retail outlets currently hold the largest market share and are likely to remain critical over the coming years.

Product Insights

The functional beverages segment dominated the market, accounting for a 47.9% revenue share in 2024, and is expected to record the fastest CAGR over the forecast period. The increasing health awareness and a preference for convenient, on-the-go nutrition are key factors contributing to the dominance of this segment. Energy drinks and sports drinks are the most popular types, especially in urban areas like Buenos Aires, where busy lifestyles drive demand for drinks that provide hydration, energy, and immune system support. Young adults and working professionals are the primary consumers seeking healthier alternatives to sugary sodas and traditional beverages. The rise in fitness activities and increase in the number of people going to gyms have also increased the use of sports and energy drinks. Leading brands respond by introducing new products with natural ingredients and added vitamins, which appeal to health-conscious buyers.

The dietary supplements segment is expected to record the second-fastest CAGR of 8.3% over the forecast period. The projected growth of this segment can be attributed to increasing awareness of preventive healthcare and the desire to address nutritional gaps. Adults and the elderly population are the key drivers, motivated by the need for immune support, bone health, and overall wellness. The market is also experiencing a surge in demand from younger consumers who are interested in fitness and personalized nutrition. The expansion of e-commerce and the availability of supplements through pharmacies and health stores have enhanced the accessibility of these products.

Application Insights

The weight management & satiety segment held the largest revenue share of 16.6% in 2024, primarily due to increasing obesity rates and heightened public awareness of metabolic health. Consumers across all age groups, especially adults and middle-aged individuals, seek products that help control appetite and support healthy weight loss. The popularity of nutraceuticals is increasing, with many products formulated to induce satiety and reduce calorie intake.

The men’s health segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing awareness of male-specific health needs and proactive health management. Middle-aged and older men are the primary consumers, focusing on products that support vitality, prostate health, and muscle development. The reduction of stigma around men’s health issues has encouraged more men to invest in specialized nutraceuticals. The introduction of tailored formulations and increased availability of such products through offline and online channels are expected to accelerate growth in this segment over the coming years.

Distribution Channel Insights

The offline distribution channel segment dominated the market with a share of 78.0% in 2024. Pharmacies, supermarkets, and specialty health stores are the primary points of sale, offering consumers immediate access to a wide variety of products and personalized services. A notable example is Farmacity, one of the largest pharmacy chains in Argentina, which operates over 330 stores and five distribution centers across the country. Farmacity partnered with Slimstock in 2023 to strengthen its supply chain and ensure optimal product availability in stores and distribution centers. This strategic collaboration is focused on optimizing inventory management, improving service levels, and enhancing the overall customer experience. Such strategic initiatives by market players in the country significantly contribute to the segment growth.

The online segment is expected to grow at the fastest CAGR over the forecast period, as consumers turn to digital platforms for convenience and access to a broader selection of products. Many leading nutraceutical brands and pharmacy chains have expanded their e-commerce offerings, enabling consumers to shop for dietary supplements and wellness products from home.

Key Companies & Market Share Insights

Some of the key players in the Argentina nutraceuticals market include Nestlé Argentina S.A., Danone, and Amway Argentina.

- Amway Argentina S.A. provides a broad range of products across nutrition, beauty, and personal care. Its nutrition portfolio includes dietary supplements, weight management solutions, sports nutrition products, and wellness offerings designed to promote a healthy lifestyle.

Key Argentina Nutraceuticals Companies:

- Nestlé Argentina S.A.

- Danone

- Amway Argentina

Recent Developments

- In July 2023, Danone launched Almimama, a science-based probiotic supplement designed to support breastfeeding mothers by reducing the incidence of mastitis. This synbiotic supplement combines the probiotic strain Lactobacillus salivarius PS2 with fructo-oligosaccharides (FOS), leveraging Danone’s expertise in breastmilk research to improve maternal health.

Argentina Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.72 billion

Revenue forecast in 2033

USD 14.55 billion

Growth rate

CAGR of 8.3% from 2025 to 2033

Historical data

2021 - 2023

Base year for estimation

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Nestlé Argentina S.A.; Danone; Amway Argentina;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Argentina Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Argentina nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.