- Home

- »

- Medical Devices

- »

-

Arrhythmia Monitoring Devices Market Size Report, 2030GVR Report cover

![Arrhythmia Monitoring Devices Market Size, Share & Trends Report]()

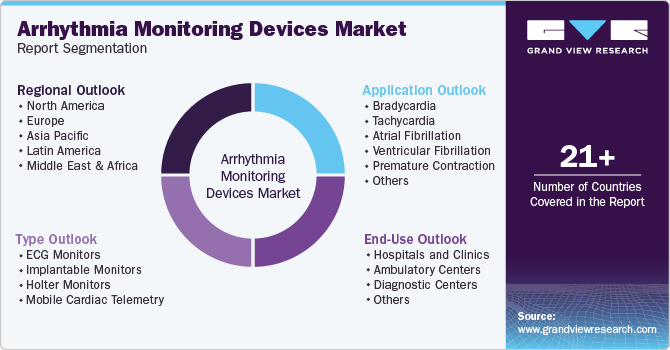

Arrhythmia Monitoring Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (ECG Monitors, Implantable Monitors, Holter Monitors, Mobile Cardiac Telemetry), By Application (Bradycardia, Tachycardia), By End-use, And Segment Forecasts

- Report ID: GVR-2-68038-631-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Arrhythmia Monitoring Devices Market Summary

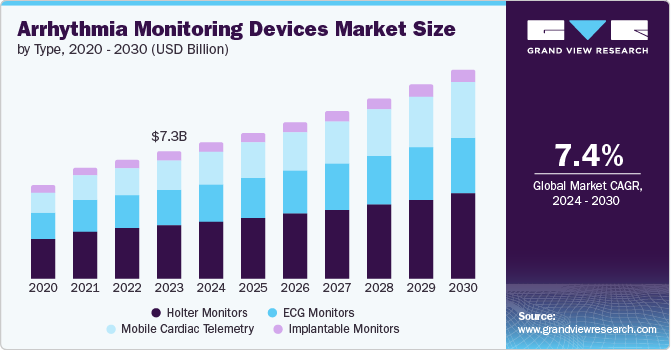

The global arrhythmia monitoring devices market size was valued at USD 7.34 billion in 2023 and is projected to reach USD 12.03 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The arrhythmia monitoring device market is expected to surge due to several factors.

Key Market Trends & Insights

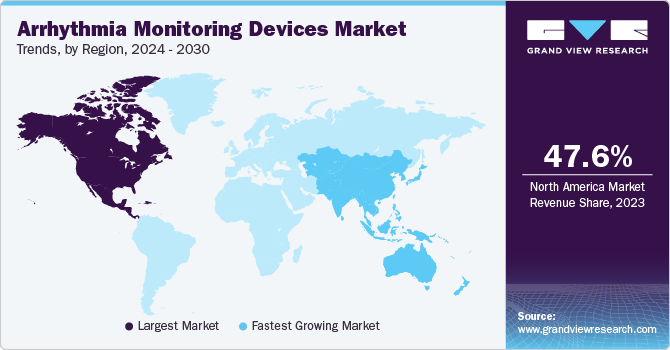

- The arrhythmia monitoring devices market in North America held the share of 47.6% in 2023.

- Based on type, holter monitors dominated the market and accounted for a share of 42.0% in 2023.

- Based on end-use, the hospitals segment dominated the market with a 60.3% revenue share in 2023.

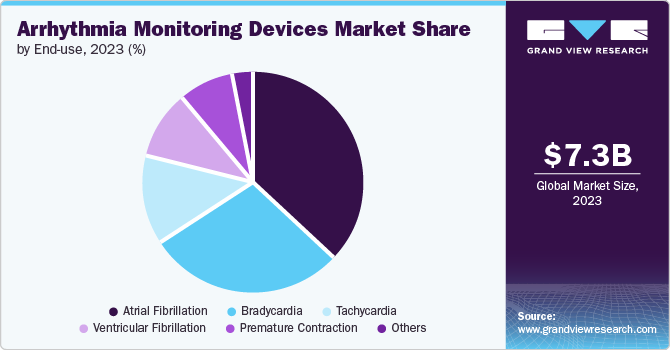

- Based on application, Atrial Fibrillation (AF) accounted for the largest market revenue share of 36.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.34 Billion

- 2030 Projected Market Size: USD 12.03 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

These include growing heart rhythm irregularity cases, new AI-powered devices, wider use of remote cardiac monitoring, user-friendly designs, and increasing adoption by medical professionals. Advancements in technology and investment in new devices fuel this exponential market growth. According to Johnson & Johnson Services, Inc., atrial fibrillation, a common irregular heartbeat, affects over 37.5 million people globally and is expected to rise by 60% by 2050.

Arrhythmia monitoring devices are expected to grow rapidly due to the increasing prevalence of cardiac arrhythmia worldwide. The rise in the number of arrhythmic patients is being observed because COVID-19-associated cardiac morbidities are reported in patients. For instance, according to a study published in Sage Journals in January 2020 on atrial fibrillation, the most prevalent form of cardiac arrhythmia. The study estimated that 6 to 12 million individuals globally are expected to suffer cardiac arrhythmia in the U.S. by 2050 and 17.9 million individuals in Europe by 2060. Atrial fibrillation is a significant risk factor for ischemic stroke and leads to a considerable economic burden along with high morbidity and mortality.

Integration of AI in arrhythmia monitoring devices is expected to drive the market in the forecast period because of its highly efficient and precise cardiac monitoring. For instance, in April 2024, BiotroniK. announced that its newest insertable cardiac monitor (ICM) received CE approval and was approved in Europe for the first time. The BIOMONITOR IV utilizes artificial intelligence (AI) to decrease false positives. The BIOMONITOR IV can distinguish between premature ventricular and atrial contractions (PVC and PAC), superior signal quality, and successful transmission for dependable remote patient monitoring.

Technological advancements in arrhythmia monitoring devices are driving the market. Novel implantable devices have overcome the limitations of traditional arrhythmia monitoring devices. For instance, in May 2024, the Heart Rhythm Society (HRS) announced new results from various clinical trials demonstrating advancements in cardiac implantable electronic device (CIED) technology and medication to address the challenges with traditional devices or meet unmet therapeutic needs. The researchers showcased the studies as cutting-edge clinical science at Heart Rhythm 2024. Technological advancements in pacemakers, subcutaneous implantable cardioverter defibrillators (S-ICDs), and cardiac resynchronization therapy, along with the development of sophisticated stimulation systems, have accelerated rapid innovations in the cardiac pacing sector.

Type Insights

Holter monitors dominated the market and accounted for a share of 42.0% in 2023. Holter monitor ECG is utilized for identifying possible cardiac arrhythmias, such as atrial fibrillation, in patients showing symptoms such as chest pain, breathlessness, or palpitations. Holter monitoring is a preferred choice for cardiac monitoring, offering ECG recording and monitoring for 24 to 48 hours. Holter monitors can be used for extended periods to diagnose sporadic symptoms in patients, providing faster and more convenient monitoring to improve patient compliance and treatment results.

The mobile cardiac telemetry segment is expected to grow at the fastest CAGR of 9.4% over the forecast period. Mobile cardiac telemetry is gaining traction due to its ability to capture long-term heart rhythms. Some systems use traditional metal sensors, while newer options explore phone cameras and light technology for atrial fibrillation detection. For instance, in May 2024, VivaLNK, Inc. launched a new solution for ambulatory cardiac monitoring. It combines remote patient monitoring tech with advanced arrhythmia detection to improve patient care and streamline deployment for Mobile Cardiac Telemetry (MCT) and Holter monitoring. This caters to the rising demand for efficient ECG monitoring outside of hospitals.

End-use Insights

The hospitals segment dominated the market with a 60.3% revenue share in 2023. Significant research and technological progress in the field, combined with an increasing population of elderly individuals with heart conditions, are boosting the segment growth. For instance, a January 2023 Journal of American Heart Association article found a high prevalence of multimorbidity (two or more chronic diseases) in older adults: 55% to 98% of those over 60 have it, with cardiovascular diseases such as ischemic heart disease being most common.

The diagnostic centers segment is expected to grow at the fastest CAGR of 8.2% over the forecast period. The growth of diagnostic centers for arrhythmia is fueled by patient acceptance of their advanced testing options. These centers offer a wide array of cutting-edge devices for monitoring heart rhythm irregularities.

Application Insights

Atrial Fibrillation (AF) accounted for the largest market revenue share of 36.9% in 2023. It is a prevalent form of arrhythmia associated with stroke risk and blood clot formation. In many cases, it becomes unnoticeable in clinical practices with traditional observation methods, leading to insufficient treatment when needed. Hence, improved technological devices are needed to diagnose atrial fibrillation and address the limited capability of conventional methods.

The bradycardia segment is expected to register the fastest CAGR of 8.1% over the forecast period. Factors such as inadequate physical activity, smoking, and heavy drinking contribute to heart rhythm disorders (tachycardia, bradycardia). For instance, according to the National Center for Biotechnology Information (NCBI), a study found that over 70% of severe COVID-19 patients in Chiang Mai, Thailand, had bradycardia (slow heart rate) in 2021. This highlights a potential need for advanced pacemakers to regulate heartbeat in such cases.

Regional Insights

North America arrhythmia monitoring devices market dominated the market in 2023 owing to the increasing prevalence of arrhythmia cases in the region. For instance, a study published in February 2024 revealed a high prevalence of atrial fibrillation (AF), and affecting roughly 1 in 3-5 people over 45. Globally, diagnosed AF cases surged from 33.5 million in 2010 to 59 million in 2019, with the U.S. expected to reach 15.9 million by 2050.

U.S. Arrhythmia Monitoring Devices Market Trends

The arrhythmia monitoring devices market in the U.S. dominated the market with a substantial share in 2023 due to the high demand for arrhythmia monitoring devices in the region and the availability of cost-effective arrhythmia monitoring devices. For instance, in February 2024, Medtronic published a study that shows continuous monitoring with their Reveal LINQ ICM is significantly more cost-effective than standard care for ischemic stroke patients, regardless of vessel size.

Europe Arrhythmia Monitoring Devices Market Trends

Europe arrhythmia monitoring devices market was identified as a lucrative region in this industry. The market is expected to grow rapidly in the forecast period due to rising investment in developing novel arrhythmia monitoring devices. For instance, in June 2022, Idoven, a health tech company focused on early diagnosis of heart disease, secured USD 19.8 million to develop its AI platform for detecting arrhythmias and other heart abnormalities.

The UK arrhythmia monitoring devices market is expected to grow rapidly in the coming years due to recent technological advancements in cardiac monitoring. The development of a novel AI algorithm for the automated detection of atrial fibrillation is expected to drive the market in the region. For instance, a May 2023 Heart Rhythm study showed that PulseAI's ECG algorithm significantly improved Apple Watch arrhythmia detection, boosting sensitivity by 17% and specificity by 11%. Inconclusive results dropped from 32% to just 1%.

Arrhythmia monitoring devices market in Germany held a substantial market share in 2023 owing to increased demand for arrhythmia monitoring devices in the region. The market is expected to grow rapidly due to the high prevalence of atrial fibrillation in Germany. For instance, according to Deutsches Zentrum für Herz-Kreislauf-Forschung e.V, Atrial Fibrillation is the most common arrhythmia affecting about 1% of the German population (about 800,000 people).

Asia Pacific Arrhythmia Monitoring Devices Market Trends

Asia Pacific arrhythmia monitoring devices market is anticipated to witness significant growth in the forecast period owing to the significantly increasing investments in device development across the region.

Japan arrhythmia monitoring devices market is expected to grow rapidly in the coming years due to recent discoveries in ECG monitoring with smart wears. For instance, in March 2023, Toray Industries, Inc., and the University of Tsukuba announced a study conducted by the University of Tsukuba Faculty of Medicine, confirming the effectiveness of two-week ECG monitoring with medical smart wear in detecting recurring atrial fibrillation after catheter ablation treatment.

Arrhythmia monitoring devices market in China held a substantial market share in 2023 owing to the continuous increase in the prevalence of atrial fibrillation in the country. For instance, a study in China published in April 2022 found a high prevalence of atrial fibrillation (AF) - 1.6% in adults surveyed between 2020-2021.

Latin America Arrhythmia Monitoring Devices Market Trends

The increasing population and technological advancements, such as wearables such as fitness monitors, mobile monitoring systems, and fabric monitoring systems, are expected to contribute to the highest growth in the Latin American market. Additionally, portable and home-based arrhythmia monitors are a major medical advancement.

The market for arrhythmia monitoring devices in Brazil is driven by the rising prevalence of cardiovascular diseases fueled by lifestyle changes, poor diet, lack of exercise, and an aging population. This growing incidence of heart-related conditions underscores the need for effective monitoring solutions. According to the American Heart Association, Inc., in Brazil, 72% of deaths are due to non-communicable diseases, with cardiovascular diseases (CVDs) leading the way to nearly 400,000 deaths in 2019. Heart attack (23.9%), stroke (14.1%) and heart failure (8.9%) are the top CVD killers.

Middle East & Africa Arrhythmia Monitoring Devices Market Trends

The Middle East and Africa are anticipated to witness significant growth in the arrhythmia monitoring devices market. Advancements in developing novel devices and techniques integrated with artificial intelligence have increased market engagement within the region.

The market for arrhythmia monitoring devices in South Africa, the rising awareness among arrhythmia patients about the various arrhythmia monitoring devices is expected to drive the market growth. Owing to the region's approval of AI-based cardiac monitoring devices, the market is also expected to experience rapid growth in the forecast period.

Key Arrhythmia Monitoring Devices Company Insights

Some of the key companies operating in the arrhythmia monitoring devices market include Abbott, ACS Diagnostics, Inc., GE HeathCare. and Biotronik. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Abbott discovers, develops, produces, and markets a wide range of healthcare products, such as branded generic drugs, diagnostic tools and tests, and nutraceutical products for children and adults. The company also provides a range of medical devices, such as rhythm management, electrophysiology, heart failure, vascular and structural heart devices, and neuromodulation devices.

-

ACS Diagnostics is a medical device company operating in outpatient heart monitoring and innovative telemedicine. The company designs, builds and produces outpatient cardiac monitoring devices. Its ECG monitor combines all types of ECG into a single device through integrated cell phone transmission, removing the need for a separate gateway device and allowing for more accurate diagnoses.

Key Arrhythmia Monitoring Devices Companies:

The following are the leading companies in the arrhythmia monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- ACS Diagnostics

- GE HeathCare

- Biotronik

- iRhythm Technologies, Inc.

- Medtronic

- Koninklijke Philips N.V.

- FUKUDA DENSHI

- Spacelabs Healthcare

- AliveCor, Inc.

Recent Developments

-

In July 2024, Octagos Health, an AI-powered cardiac device monitoring company, secured a funding worth USD 43 million led by Morgan Stanley. This investment was expected to fuel its mission to revolutionize cardiac care with advanced patient monitoring powered by AI.

-

In January 2024, iRhythm Technologies, Inc. announced CE mark approval for its Zio monitor ECG system. This certification by BSI Group under the EU MDR signifies that the device meets strict European Union standards for performance, quality, safety, and effectiveness in detecting potential heart arrhythmias.

-

In July 2021, Medtronic announced two AccuRhythm AI algorithms were approved by the U.S. Food and Drug Administration (FDA) for use with the LINQ II insertable cardiac monitor (ICM). AccuRhythm AI utilizes AI on LINQ II-collected heart rhythm event data to enhance the precision of information provided to physicians for improved diagnosis and treatment of abnormal heart rhythms.

Arrhythmia Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.85 billion

Revenue forecast in 2030

USD 12.03 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; ACS Diagnostics; GE HeathCare; Biotronik; iRhythm Technologies, Inc.; Medtronic; Koninklijke Philips N.V.; FUKUDA DENSHI; Spacelabs Healthcare; AliveCor, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arrhythmia Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global arrhythmia monitoring devices market report based on type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ECG Monitors

-

Implantable Monitors

-

Holter Monitors

-

Mobile Cardiac Telemetry

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bradycardia

-

Tachycardia

-

Atrial Fibrillation

-

Ventricular Fibrillation

-

Premature Contraction

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Centers

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.