- Home

- »

- Medical Devices

- »

-

Arterial Filter Market Size And Share, Industry Report, 2030GVR Report cover

![Arterial Filter Market Size, Share & Trends Report]()

Arterial Filter Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Age Category (Adult, Neonatal/Pediatric), By End-use (Hospitals, Ambulatory Surgical Centers, Others), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-580-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Arterial Filter Market Summary

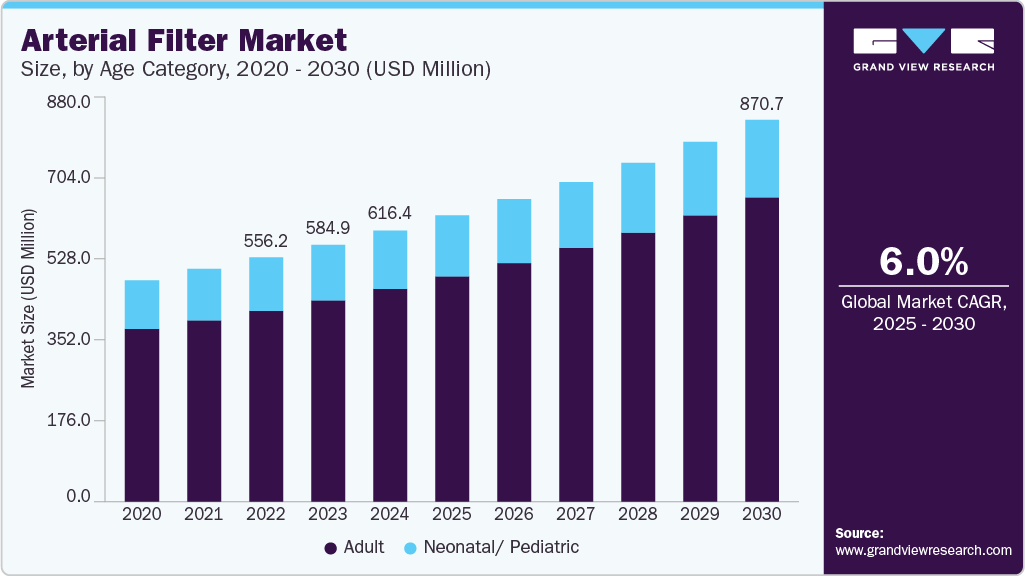

The global arterial filter market size was estimated at USD 616.4 million in 2024 and is projected to reach USD 870.7 million by 2030, growing at a CAGR of 6.0% from 2025 to 2030. This market growth can be attributed to the rising incidence of Cardiovascular Diseases (CVDs) worldwide, increasing demand for cardiac surgeries, and advancements in cardiopulmonary bypass technologies.

Key Market Trends & Insights

- North America arterial filter market held the largest share of 40.52% of the global industry.

- The arterial filter market in Asia Pacific is expected to grow at the fastest CAGR of 6.7%.

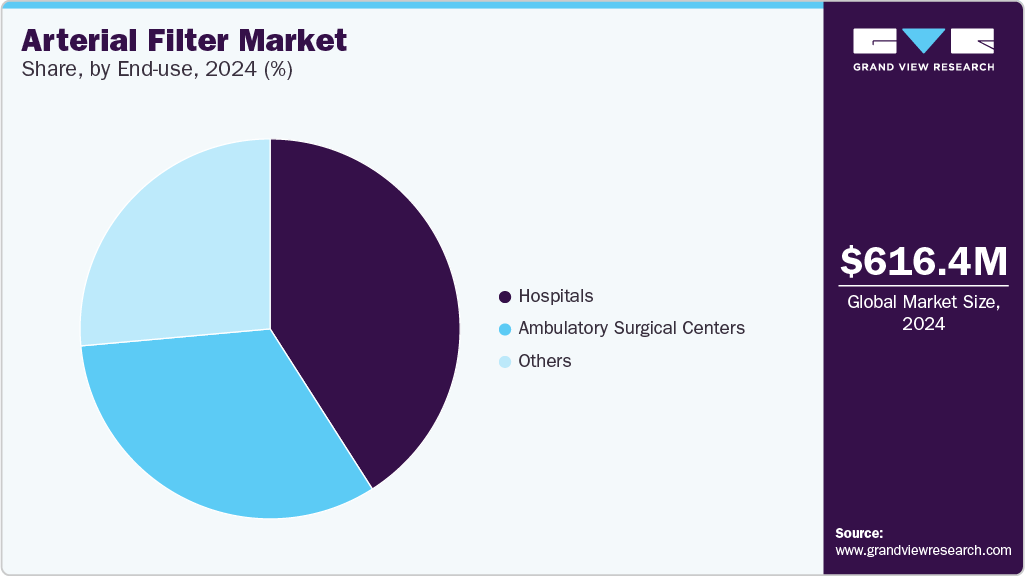

- Based on end-use, the hospitals segment dominated the market with a 40.95% share.

- In terms of age category, the adult segment led the market with a 78.61% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 616.4 Million

- 2030 Projected Market Size: USD 870.7 Million

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the growing geriatric population, which is more susceptible to heart conditions, and improved access to healthcare in emerging economies, fuel the need for safer and more efficient surgical interventions, boosting the demand for the arterial filter industry. One of the primary market drivers is the rising global burden of CVDs. For instance, in October 2024, the European Journal of Preventive Cardiology highlighted that CVDs are the primary cause of death and illness around the world. Modifiable lifestyle factors, such as poor diet, lack of exercise, smoking, and aging, mostly drive them. Since 1990, the number of people with heart disease has almost doubled, raising the healthcare burden and increasing medical costs. In 2019, more than 500 million people had heart disease. That year, Europe and the U.S. spent over 280 billion euros and USD 400 billion on the disease.

Experts say that by 2050, the U.S. alone might spend around USD 1,344 billion each year on heart disease. This emphasizes the need for urgent preventive policies. Arterial filters are an essential component of these surgeries, as they help prevent the introduction of an emboli (air bubbles, clots, or tissue debris) into the bloodstream during cardiopulmonary bypass, improving patient safety and surgical outcomes. The increasing number of such surgical procedures, driven by the growing incidence of heart conditions, directly contributes to market expansion.

Rapidly growing global geriatric population is expected to drive further market growth, which is more vulnerable to CVDs and often requires surgical interventions. As people age, the likelihood of developing conditions such as Coronary Artery Disease (CAD), valvular heart disease, and arrhythmias increases significantly. According to Our World in Data, in November 2024, globally, there are about 830 million people 65 years or older. According to the latest United Nations data, this number is expected to grow to 1.7 billion by 2054. Hence, the geriatric population will more than double in the next few decades. Asia, with the largest population of all continents, is expected to experience a significant shift.

The number of older people in Asia is also expected to more than double by 2050. This demographic shift has led to a higher demand for cardiac procedures like Coronary Artery Bypass Grafting (CABG), valve replacements, and surgeries where arterial filters are used to protect patients from embolic events during cardiopulmonary bypass. Thus, the growing geriatric population directly contributes to the increasing usage of arterial filters in surgical settings, expanding the arterial filter industry.

Market Concentration & Characteristics

The arterial filter industry exhibits a moderate degree of innovation, driven by continuous advancements in materials, filtration efficiency, and biocompatibility. Manufacturers are integrating cutting-edge membrane technologies and ergonomic designs to enhance blood flow management during cardiovascular surgeries. Emphasis on minimizing embolic events and improving patient outcomes encourages the development of smarter, more precise filters. In addition, innovation is supported by rising investments in R&D and regulatory support for medical device advancements.

Mergers and acquisitions (M&A) in the arterial filter industry remain moderate, largely driven by strategic consolidation among key players in the broader cardiopulmonary and cardiovascular device sectors. While the arterial filter segment is highly specialized, companies increasingly seek to integrate it within comprehensive product portfolios through targeted acquisitions. Notable trends include large medical device firms acquiring niche filter manufacturers to gain a technological edge, expanding surgical product lines, and enhancing global distribution capabilities.

The impact of regulations is considerably high in the arterial filter industry. Strict regulatory approvals from authorities such as the FDA and European Medicines Agency (EMA) ensure high safety, efficacy, and biocompatibility standards. Rigorous clinical evaluation and post-market surveillance obligations have increased compliance costs and extended product approval timelines, especially for new filter technologies involving novel materials or smart integration features. However, these regulations have also improved patient safety and clinical outcomes, reinforcing market trust.

Product expansion in the arterial filter industry has been steadily advancing, driven by technological innovation and the growing demand for safer, more efficient cardiopulmonary bypass procedures. Manufacturers are increasingly developing next-generation arterial filters with enhanced microemboli removal, integrated air elimination chambers, and improved hemocompatibility. Recent expansions have included pediatric arterial filters, addressing a previously underserved segment.

The arterial filter industry is witnessing notable regional expansion, particularly in emerging economies across Asia Pacific, Latin America, and the Middle East, owing to factors such as improvement in cardiac care infrastructure and an increase in advanced surgical procedures, driving demand beyond traditionally dominant markets like North America and Europe.

Age Category Insights

The adult segment led the market with a 78.61% share in 2024, driven by factors such as the high prevalence of CVDs among adults, an increasing rate of lifestyle-related disorders like hypertension, obesity, diabetes, and the growing volume of adult open-heart surgeries globally. Adults are more susceptible to CAD, aortic valve disorders, and myocardial infarction, which often require cardiopulmonary bypass procedures where arterial filters are critical for removing microemboli and ensuring safe perfusion. As per the U.S. Centers for Disease Control and Prevention, in October 2024, around 1 in 20 adults aged 20 and older had CAD in 2022. This demographic shift and expansion in surgical infrastructure in emerging economies drive the dominance of the adult segment in the market.

The neonatal/pediatric segment is projected to expand at a CAGR of 5.00% over the forecast period, driven by the rising incidence of Congenital Heart Defects (CHDs), advancements in pediatric cardiac care, and increasing availability of specialized equipment for infant and child surgeries. For instance, in March 2025, the U.S. CDC stated that nearly 1% of births in the U.S., or about 40,000 babies, have heart defects each year. Almost 1 in 4 babies with a heart defect has a critical heart defect.

End-use Insights

The hospitals segment dominated the market with a 40.95% share, owing to factors such as the high number of Cardiopulmonary Bypass (CPB) procedures performed in hospital settings, the availability of advanced surgical infrastructure, and a growing focus on patient safety during open-heart surgeries. In addition, hospitals also have the advantages of offering complete care after surgery and using advanced medical devices, which help enhance recovery and make surgeries more successful. Hospitals buy medical devices in bulk, attend to a high volume of patients, and often receive better financial support through insurance and reimbursements.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to expand at a CAGR of 6.6% over the forecast period, driven by the increasing shift toward minimally invasive cardiac procedures, growing cost-efficiency of outpatient surgical care, and rising demand for faster patient turnaround times. ASCs are gaining popularity due to their lower operational costs, shorter hospital stays, and improved scheduling flexibility compared to traditional hospitals. These centers are now increasingly equipped to perform certain cardiac interventions that may involve short-term extracorporeal support, where compact arterial filters are used to ensure safety during perfusion.

Regional Insights

North America arterial filter market held the largest share of 40.52% of the global industry. It is driven by expanding cardiac care infrastructure, rising healthcare investment, public sector initiatives to improve surgical outcomes, and ongoing technology reinvestment. Widespread adoption of best-practice guidelines for extracorporeal circulation and strong ties between clinical centers and device innovators foster rapid adoption of next-generation filters. In addition, regional emphasis on procedural efficiency and patient safety encourages hospitals to standardize the use of advanced arterial filtration in adult and pediatric bypass programs.

U.S. Arterial Filter Market Trends

Thearterial filter market in the U.S. held the highest share of North American market in 2024. The country has the highest global volume of cardiac bypass surgeries, supportive Centers for Medicare & Medicaid Services (CMS) reimbursement policies, and a dynamic ecosystem of medical device R&D. Stringent FDA requirements for device safety and efficacy drive manufacturers to continuously improve filter materials and designs. In addition, expanding ambulatory surgical centers performing select cardiac procedures, driving the demand for compact, high-performance arterial filters tailored to outpatient settings.

Europe Arterial Filter Market Trends

The arterial filter market in Europe is expected to grow significantly, fueled by rising investments by public healthcare systems in modernizing cardiac surgery suites and a large geriatric population requiring surgical treatments. The region’s focus on cost-effectiveness and centralized tendering processes also compels suppliers to offer filters combining high performance with competitive pricing.

The UK arterial filter market is driven by a large geriatric population with a high burden of CVDs, extensive public healthcare funding for cardiac surgery, and harmonized regulatory standards under the EU Medical Device Regulation. In addition, Europe's emphasis on value-based healthcare encourages hospitals to standardize high-efficiency arterial filters with low priming volumes and proven biocompatibility, driving the market.

The arterial filter market in Germanyis expected to grow at the fastest CAGR over the forecast period, driven by the growing geriatric population, a strong prevalence of CVDs, and the highest per capita rate of cardiac surgeries. The country’s decentralized hospital financing model and Diagnosis-Related Group reimbursement framework allow hospitals to invest in advanced perfusion technologies. At the same time, early health-technology assessment pathways facilitate rapid adoption of innovative devices.

Asia Pacific Arterial Filter Market Trends

The arterial filter market in Asia Pacific is expected to grow at the fastest CAGR of 6.7%, driven by rising CVD prevalence, expanding tertiary care infrastructure, and increasing healthcare spending across emerging economies. Governments prioritize cardiac surgery capacity through public-private partnerships and insurance reforms. The growing middle-class patient population and improving access to advanced surgical tools support strong adoption of arterial filters designed for varied clinical settings.

China arterial filter marketis driven by the large-scale expansion of healthcare infrastructure and strong government initiatives to improve cardiac care across urban and rural regions. Growing cardiovascular health awareness, with strategic public funding for hospitals and specialty cardiac centers, is creating sustained demand for reliable perfusion consumables, further driving the arterial market in the country.

The arterial filter market in Japan is expected to grow significantly over the forecast period. The high elderly population, the rise in demand for cardiac interventions, and the country’s comprehensive public health insurance system aid growth. A well-developed medical device sector and supportive regulatory framework enable rapid adoption of new filtration technologies. Emphasis on patient safety and procedural efficiency drives manufacturers to develop compact filters that are easy to integrate into existing perfusion setups and are designed with features that align with the country’s focus on innovation and quality of care.

Latin America Arterial Filter Market Trends

The arterial filter market in Latin America is driven by rapidly growing surgical capacity as countries expand tertiary hospitals and specialized heart centers to address rising CVD burdens. Public–private partnerships further boost the growth, with joint ventures equipping new facilities with modern Cardiopulmonary Bypass (CPB) suites that incorporate up-to-date arterial filtration technology.

Middle East and Africa Arterial Filter Market Trends

The arterial filter market in the Middle East and Africa is growing due to the rising prevalence of CVDs, the growing number of cardiac surgeries, and expanding healthcare infrastructure. In addition, improved access to healthcare, government health initiatives, medical tourism, a high incidence of CHDs, the region's reliance on imports, and the emerging local manufacturing efforts drive the market further.

Key Arterial Filter Company Insights

Some of the leading companies in the arterial filter industry are Medtronic, Pall Corporation, Fresenius Medical Care AG, and Terumo Corporation. These companies prioritize new product development, Research & Development (R&D) investments, and strategic M&As to strengthen their market positions.

Key Arterial Filter Companies:

The following are the leading companies in the arterial filter market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Pall Corporation

- Fresenius Medical Care AG

- Terumo Corporation

- NIPRO

- Haemonetics Corporation

- ICU Medical, Inc.

- Braile Biomédica

- LivaNova, Inc.

- EUROSETS

Arterial Filter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 651.3 million

Revenue forecast in 2030

USD 870.7 million

Growth rate

CAGR of 6.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and product outlook

Segments covered

Age category, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Pall Corporation; Fresenius Medical Care AG; Terumo Corporation; NIPRO; Haemonetics Corporation; ICU Medical, Inc.; Braile Biomédica; LivaNova, Inc.; EUROSETS

Customization scope Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arterial Filter Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global arterial filter market report based on age category, end-use, and region:

-

Age Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Neonatal/ Pediatric

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global arterial filter market size was estimated at USD 616.4 million in 2024 and is expected to reach USD 651.3 million in 2025.

b. The global arterial filter market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 870.7 million by 2030.

b. North America arterial filter market held the largest share of 40.52% of the global arterial filter industry. It is driven by expanding cardiac care infrastructure, rising healthcare investment, public sector initiatives to improve surgical outcomes, and ongoing technology reinvestment.

b. Some prominent players in the arterial filter market include Medtronic; Pall Corporation; Fresenius Medical Care AG; Terumo Corporation; NIPRO; Haemonetics Corporation; ICU Medical, Inc.; Braile Biomédica; LivaNova, Inc.; EUROSETS

b. Growth in the arterial filter market can be attributed to the rising incidence of Cardiovascular Diseases (CVDs) worldwide, increasing demand for cardiac surgeries, and advancements in cardiopulmonary bypass technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.