- Home

- »

- Healthcare IT

- »

-

AI In Medical Coding Market Size, Industry Report, 2033GVR Report cover

![AI In Medical Coding Market Size, Share & Trends Report]()

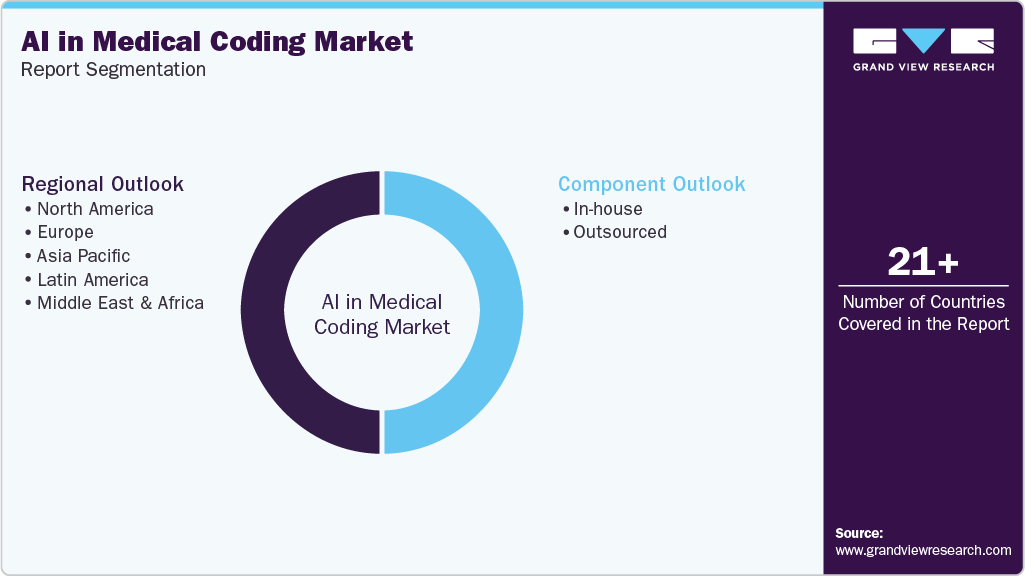

AI In Medical Coding Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (In-house, Outsourced), By Region (North America, Europe, APAC, Latin America, MEA), Key Companies, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-098-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Medical Coding Market Summary

The global AI in medical coding market size was estimated at USD 2.86 billion in 2025 and is projected to reach USD 8.62 billion by 2033, growing at a CAGR of 14.19% from 2026 to 2033. Rising administrative burdens and coding complexity, workforce shortages and productivity constraints, as well as cost containment and revenue cycle optimization, are significant factors contributing to market growth.

Key Market Trends & Insights

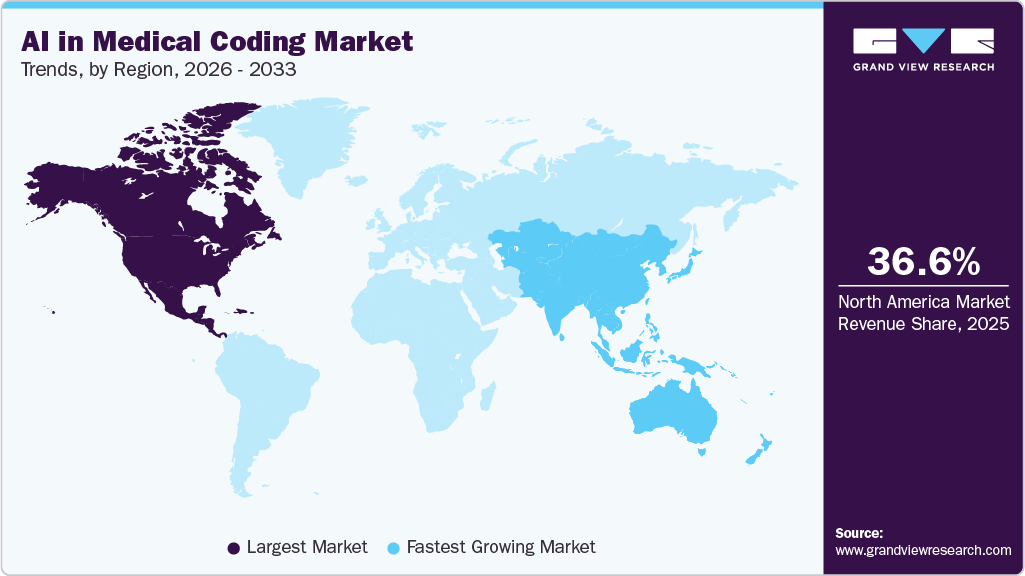

- North America dominated the global AI in medical coding market with the largest revenue share of 36.63% in 2025.

- The AI in medical coding industry in the U.S. accounted for the largest market revenue share in North America in 2025

- Based on component, the outsourced segment led the market with the largest revenue share of 68.25% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.86 Billion

- 2033 Projected Market Size: USD 8.62 Billion

- CAGR (2026-2033): 14.19%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Healthcare organizations face strict billing timelines and reimbursement cycles. Delays in coding affect cash flow and operational planning. AI-assisted coding accelerates chart review and code assignment. Automation supports near-real-time coding workflows. Faster turnaround improves first-pass claim acceptance. Reduced rework lowers administrative overhead. Efficiency requirements strengthen market demand. For instance, in April 2025, Cleveland Clinic implemented generative AI for medical coding to automate code assignment from clinical documentation. The initiative aims to improve accuracy, reduce administrative workload, and accelerate billing processes.

Moreover, the increasing complexity of clinical documentation and coding systems is a significant driver of the AI in medical coding industry. There is a growing demand for a more streamlined and convenient coding and billing solution. Medical coding plays a crucial role in ensuring consistent documentation across various medical facilities. Medical coding companies enable healthcare administrators to analyze the frequency and effectiveness of treatments within their facilities, important for large medical establishments, such as tertiary-care hospitals.

Integration with revenue cycle systems enhances financial control and oversight. Organizations prioritize risk mitigation. Compliance-driven financial protection fuels market growth. For instance, in April 2025, RamSoft and Maverick Medical AI partnered to integrate AI-powered medical coding into RamSoft’s radiology workflow. The solution delivers real-time coding at the point of care, improving accuracy, reducing administrative burden, and accelerating revenue cycle processes for imaging providers through automated, compliant code generation.

"We're thrilled to partner with RamSoft to bring Maverick AI to a wider audience of imaging providers. Together, we're delivering a smarter, more scalable approach to revenue integrity-one that starts at the point of care, right within the radiologist's reporting environment."

- Michael Brozino, Co-Founder and Chief Commercial Officer of Maverick Medical AI

Recent Developments in the AI in Medical Coding Market

Company

Year

Month

Description

Matic

2025

November

Matic (formerly Scribematic), a physician-founded AI company, launched Codematic to extend automation into medical coding and billing.

Arintra

2025

August

Arintra raised $21 million in Series A funding led by Peak XV Partners, with participation from Endeavor Health Ventures, Y Combinator, and others. The GenAI platform automates medical coding, clinical documentation improvement, and denial prevention, integrating with Epic and Athena EHRs.

Aptarro and aiHealth

2025

August

Aptarro and aiHealth partnered to integrate aiH.Automate's autonomous medical coding with RevCycle Engine's real-time charge corrections, targeting revenue cycle gaps.

Maverick AI

2025

August

Infinx announced a strategic investment in Maverick AI to integrate real-time autonomous medical coding into revenue cycle management.

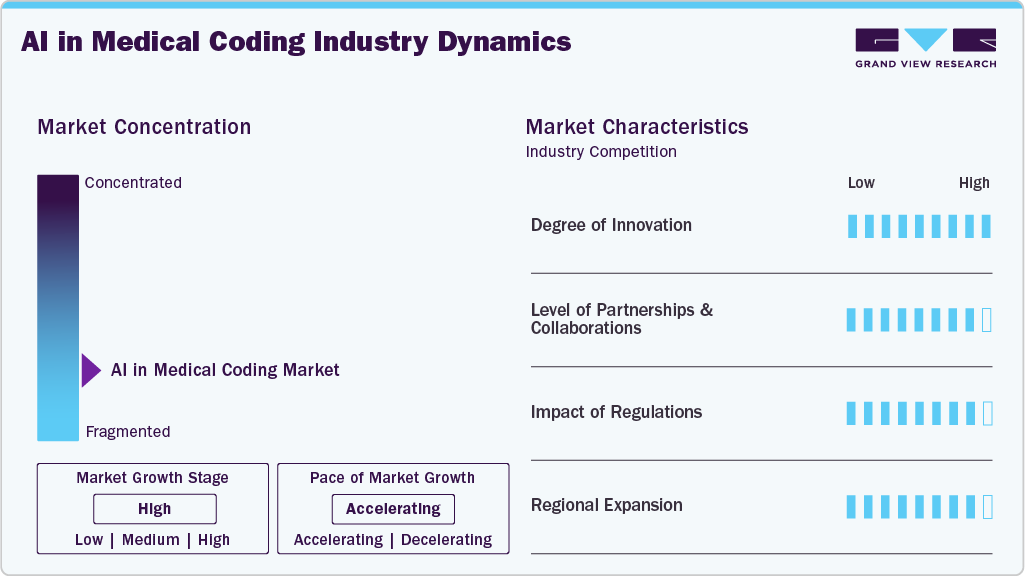

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations, degree of innovation, impact of regulations, and regional expansion. The AI in medical coding industry is fragmented. Several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation, the level of partnerships & collaborations, the impact of regulations, and the regional expansion of industry is high.

The AI in medical coding industry is characterized by constant innovation. For instance, in October 2025, Suki AI, Inc. enhanced its ambient AI platform to automate clinical coding, generating ICD-10, HCC, CPT, and E/M codes directly from patient encounters with transparent rationale and audit trails. The expansion integrates codes into EHRs like Epic, reducing amended encounters by 48% and accelerating reimbursements.

The AI in medical coding industry is experiencing a high level of partnerships & collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in November 2025, XpertDox partnered with CHP Berkshires, a Massachusetts FQHC serving 30,000+ residents, to deploy XpertCoding AI across all facilities for enhanced medical coding and revenue cycle performance.

"We've successfully implemented XpertDox's AI, and the results have been transformative. We've seen increased collections per claim, higher quality scores through automated Category II coding, and our coding team is now able to focus on value-based care initiatives and auditing. The dashboards for provider documentation improvement and HCC recapture have been especially impactful. The XpertDox team has been great to work with."

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the AI in medical coding industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in June 2025, HIMAA released a principle-based guideline for clinical coding AI adoption in Australia/New Zealand, targeting health organizations, coders, vendors, and educators.

Component Insights

The outsourced segment led the market with the largest revenue share of 68.25% in 2025. In addition, this segment is expected to grow at the fastest CAGR over the forecast period. Healthcare providers are outsourcing medical coding to reduce administrative costs, save time, and enhance workflow efficiency. This enables them to focus on delivering high-quality patient care and improving patient engagement. The growing trend of offshoring and onshoring revenue cycle management, including medical coding, is driving market growth.

Outsourced AI solutions offer scalability, flexibility, and cost-effectiveness, as organizations are able to access advanced technologies without investing in their development and maintenance. In addition, outsourcing reduces the burden of hiring, training, and managing an in-house team, allowing healthcare organizations to focus on core healthcare operations while relying on trusted AI partners to deliver accurate and efficient coding solutions.

Regional Insights

North America dominated the global AI in medical coding market with the largest revenue share of 36.63% in 2025, driven by advanced healthcare infrastructure and high chronic disease prevalence, which necessitates precise billing. Complex reimbursement systems and federal EHR mandates create administrative burdens, thereby increasing the adoption of AI to reduce claim denials.

U.S. AI in Medical Coding Market Trends

The AI in medical coding market in U.S. accounted for the largest market revenue share in North America in 2025. The U.S. leads with complex insurance frameworks that demand AI for claim optimization and denial prevention. The increasing prevalence of chronic diseases escalates coding needs. In addition, EHR mandates and value-based care increase administrative efficiency requirements.Moreover, CMS regulations enforce precise ICD-10/CPT usage. For instance, in November 2025, Netsmart launched AlphaCoding, an AI-powered clinical coding tool with real-time, evidence-based recommendations to improve compliance, accuracy, and efficiency. Integrated with an AI assistant “Benny,” it automates ICD-10 code suggestions, supports coder verification, and enhances workflow productivity for healthcare organizations.

"AlphaCoding has already made a measurable impact on our coding accuracy and efficiency. It’s intuitive and enhances our clinicians’ expertise by surfacing the appropriate details and helping align with CMS guidelines, allowing us to code faster and more confidently than ever before."

- Melissa Ward, R.N., Post-Acute Care Executive, Adventist Health

Europe AI in Medical Coding Market Trends

The AI in medical coding market in Europe is expected to witness at a significant CAGR during the forecast period. The region’s medical coding market is growing through stringent regulatory frameworks, such as GDPR and EHDS, which mandate data accuracy and interoperability. Rising chronic illness burdens and aging populations are increasing coding demands, with Germany and the UK leading the adoption.

The UK AI in medical coding market is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies. The UK's NHS Digital and reimbursement complexities drive the adoption of AI for reducing backlogs and improving accuracy. Moreover, EHDS compliance mandates interoperable solutions, coupled with public health initiatives prioritizing efficiency.

The AI in medical coding market in Germany held the largest revenue share in 2025 in the European market, attributed to increasing investments in healthcare technology and robust healthcare infrastructure. In addition, favorable government initiatives, coupled with the country’s focus on integrating AI into nationwide healthcare, environmental, and agriculture systems, propel market growth further. For instance, the Euro 5.5 billion (USD 6.5 billion) national AI investments under the High-Tech Strategy fund healthcare AI hubs, prioritizing data sovereignty via GAIA-X and enabling secure coding analytics.

Asia Pacific AI in Medical Coding Market Trends

The AI in medical coding market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Rapid improvements in healthcare infrastructure, rising prevalence of chronic diseases, and government programs accelerating AI integration are key drivers of growth. Outsourcing opportunities and rising healthcare costs propel adoption in China, India, and Japan. Moreover, digitalization in India and Japan modernizes coding for universal coverage schemes.

The India AI in medical coding marketis expanding rapidly. Rising prevalence of chronic diseases, demand for enhanced healthcare operations, and investments in healthcare infrastructure are key drivers of market expansion. India's digitalization and Ayushman Bharat expand coverage, necessitating AI coding efficiency.

The AI in medical coding market in Japan is driven by the country’s advanced digital infrastructure and rapidly aging population, creating demand for advanced healthcare solutions.

Latin America AI in Medical Coding Market Trends

The AI in medical coding market in Latin America is anticipated to grow at a significant CAGR over the forecast period. Latin America's AI medical coding market is driven by healthcare modernization in Brazil and Argentina, with a focus on chronic disease management. Expanding coverage and digital infrastructure drive the need for efficiency.

Middle East and Africa AI in Medical Coding Market Trends

The AI in medical coding market in Middle East and Africa is expected to grow at a significant CAGR over the forecast period. The market is propelled by Vision 2030 investments in Saudi Arabia and the UAE totaling USD 65 billion for digital health infrastructure. Medical tourism hubs, such as the Dubai Health Authority, process millions of annual visitors, necessitating the adoption of ICD-10/CPT standards, thereby increasing the use of AI to deliver seamless solutions. For instance, in December 2025, PMBAUSA LLC launched CAIMC Certified AI Medical Coder training in Dubai, UAE, via Medesun Medical Coding Academy, addressing AI literacy gaps for coders amid digital health adoption.

Key AI in Medical Coding Company Insights

Key players operating in the AI in medical coding industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI In Medical Coding Companies:

The following are the leading companies in the AI in medical coding market. These companies collectively hold the largest Market share and dictate industry trends.

- Oracle

- CodaMetrix

- IBM

- Fathom, Inc.

- Clinion

- BUDDI.AI

- aidéo technologies, LLC

- Diagnoss

- Suki AI, Inc.

- Netsmart Technologies, Inc.

- Arintra

Recent Developments

-

In September 2025, Oracle Health unveiled AI-powered applications to enhance payer-provider collaboration, targeting an annual reduction of USD 200 billion in administrative costs through automation in prior authorizations, claims denials, medical coding, and care coordination.

-

In August 2025, HOV Services (now HandsOn Global Management) acquired a 100% stake in Aidéo Technologies LLC, a U.S.-based AI-powered autonomous medical coding platform, through its subsidiary Healthcare Capital Holdings LLC via Class B Preferred Stock issuance. Aidéo specializes in AI-driven revenue cycle management solutions that utilize NLP, real-time analytics, and LLMs, serving surgical, emergency, anesthesia, and radiology specialties with HL7 EHR interoperability.

-

In August 2025, Infinx invested in Maverick AI to integrate real-time, autonomous medical coding into revenue cycle management, achieving direct-to-bill rates of over 85% and 95% accuracy without human intervention.

-

In June 2025, Ambience Healthcare unveiled an AI model outperforming board-certified physicians by 27% in ICD-10 coding accuracy, validated against 18 experts on complex cases. Trained via OpenAI's Reinforcement Fine-Tuning, it generates real-time clinical notes with precise codes during consultations.

AI in Medical Coding Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.26 billion

Revenue forecast in 2033

USD 8.62 billion

Growth rate

CAGR of 14.19% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle; CodaMetrix; IBM; Fathom, Inc.; Clinion; BUDDI.AI; aidéo technologies, LLC; Diagnoss; Suki AI, Inc; Netsmart Technologies, Inc.; Arintra

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI in Medical Coding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in medical coding market report based on component and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

In-house

-

Outsourced

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.