- Home

- »

- Healthcare IT

- »

-

AI In Radiology Market Size & Share, Industry Report, 2033GVR Report cover

![AI In Radiology Market Size, Share & Trends Report]()

AI In Radiology Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (AI-enabled Devices, Software & Platform), By Technology (Machine Learning Algorithms), By Modality (Computed Tomography (CT), Ultrasound), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-753-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI in Radiology Market Summary

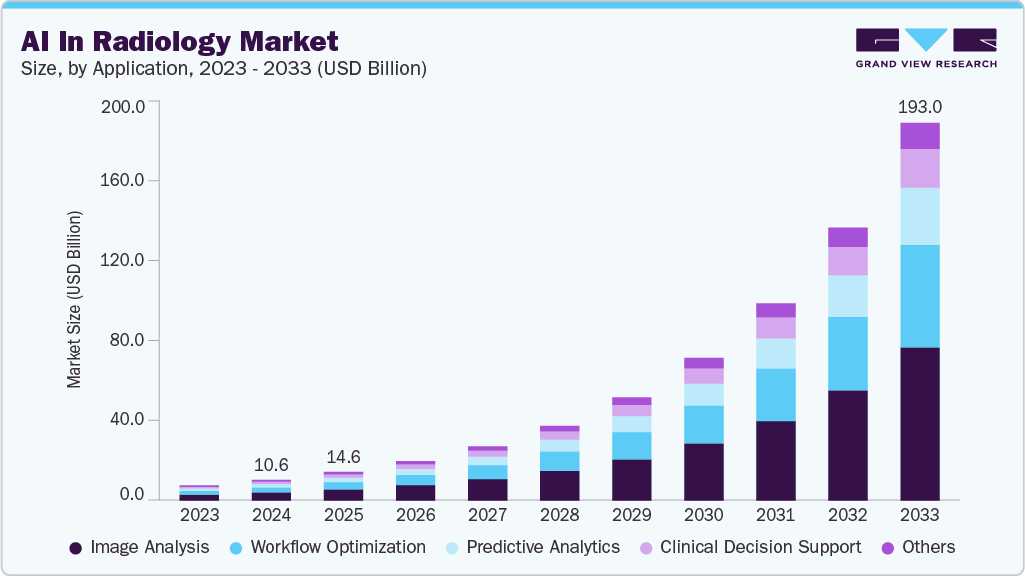

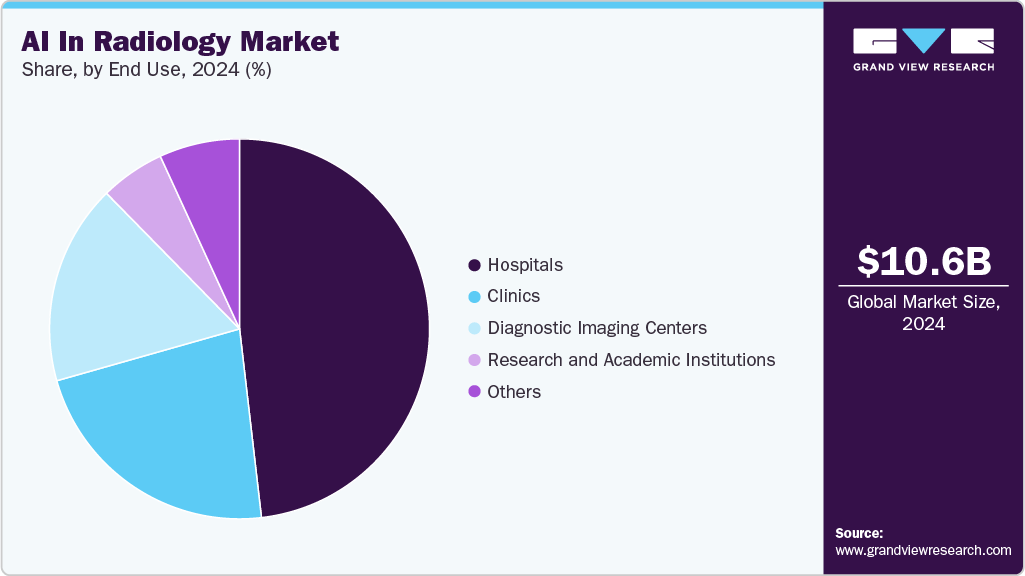

The global AI in radiology market size was estimated at USD 10.57 billion in 2024 and is projected to reach USD 193.02 billion by 2033, growing at a CAGR of 38.12% from 2025 to 2033. Rising demand for accurate and early disease detection, rapid growth in imaging volumes, and government initiatives and regulatory support are significant factors contributing to market growth.

Key Market Trends & Insights

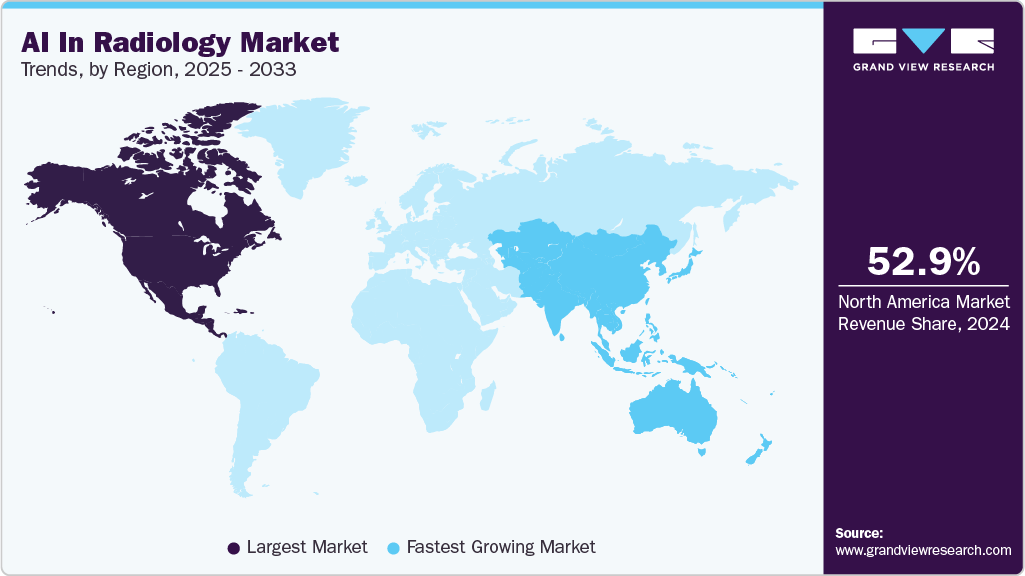

- The North America AI in radiology market accounted for the largest revenue share of 52.86% in 2024.

- The U.S. AI in radiology industry held the largest revenue share in 2024.

- By components, the AI-enabled devices segment held the largest market share of 41.85% in 2024.

- By technology, the machine learning segment led the AI in radiology market with the largest revenue share of 35.75% in 2024.

- By modality, the computed tomography (CT) segment held the largest revenue share of 29.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.57 Billion

- 2033 Projected Market Size: USD 193.02 Billion

- CAGR (2025-2033): 38.12%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, growing emphasis on cost-efficiency in healthcare delivery and technological advancements in machine learning, natural language processing, and computer vision are some other factors fueling market growth further. The rising demand for accurate and early disease detection is a primary driver of the AI in radiology market. Chronic conditions such as cancer, cardiovascular diseases, and neurological disorders are increasing globally, necessitating advanced imaging tools for early intervention. AI-enabled image analysis enhances diagnostic accuracy by detecting subtle abnormalities that might be missed by human interpretation. Automated quantification and risk stratification further improve diagnostic confidence. These capabilities reduce variability across radiologists and support personalized treatment planning. For instance, in April 2024, Exo launched FDA-cleared AI applications for heart failure diagnosis and lung assessment on its Exo Iris handheld ultrasound device. Thus, as healthcare systems focus on value-based care, the adoption of AI in radiology is becoming essential.

Technological advancements in machine learning, natural language processing, and computer vision fuel the growth of the AI in radiology industry. Deep learning algorithms are improving in accuracy, enabling more reliable interpretation of complex imaging modalities such as CT, MRI, and PET scans. For instance, iPETcertum, developed by Claritas NucMed Technologies, received FDA 510(k) clearance in August 2025. It is an AI-powered software device that enhances PET, PET-CT, and PET-MRI scans by automating the segmentation and quantification of tumors and lesions.

Integration of large language models and generative AI supports advanced clinical decision-making and structured reporting. For instance, in February 2025, RapidAI secured FDA 510(k) clearance for Lumina 3D, an AI-powered, automated 3D imaging reconstruction solution for head and neck CTA. Lumina 3D enables near real-time, high-quality 3D vascular images, reducing manual workflow burdens and improving diagnostic speed, accuracy, and procedural planning for neuroradiologists and neuro-interventionalists. Furthermore, AI tools are increasingly designed to integrate seamlessly with PACS and electronic health record systems. These innovations provide radiologists with actionable insights, creating a more connected and efficient diagnostic ecosystem.

Government initiatives and regulatory support are significantly accelerating AI adoption in radiology. Authorities in regions such as the U.S., Europe, and Asia are introducing frameworks to ensure AI's safe and ethical use in clinical practice. Reimbursement policies for AI-enabled diagnostic tools are gradually being implemented, enhancing their accessibility.

Governments are also funding research collaborations between academic institutions and technology providers. This ecosystem encourages innovation and fosters trust among healthcare providers. For instance, in May 2025, South Korean AI imaging company Coreline Soft secured multiple supply contracts with major organizations, including the UK NHS, Boehringer Ingelheim Taiwan, and the French National Cancer Institute. The NHS contract serves 12 hospitals in East England, including Cambridge University Hospital. As regulations mature, adoption rates are expected to rise across developed and emerging markets.

List of a few FDA-approved AI-enabled radiology medical devices/software-as-a-medical device

Date of Final Decision

Submission Number

Device

Company

05/30/2025

K251406

BriefCase-Triage

Aidoc Medical, Ltd.

05/30/2025

K243863

Opulus Lymphoma Precision

Roche Molecular Systems, Inc.

05/29/2025

K250543

Voluson Performance 16; VolusonPerformance 18

GE Medical Systems Ultrasound and Primary Care Diagnostics

05/21/2025

K243793

EPIQ Series Diagnostic Ultrasound System; Affiniti Series Diagnostic Ultrasound System

Philips Ultrasound LLC

05/21/2025

K243762

Synapse 3D Base Tools (V7.0)

FUJIFILM Corporation

05/21/2025

K243122

uMR Omega

Shanghai United Imaging Healthcare Co., Ltd.

05/20/2025

K250370

SCENARIA View Phase 5.0

FUJIFILM Corporation

05/16/2025

K243617

uCT ATLAS Astound with uWS-CT-Dual Energy Analysis; uCT ATLAS with uWS-CT-Dual Energy Analysis

Shanghai United Imaging Healthcare Co., Ltd.

05/16/2025

K241671

6450 Ultrasound System (MyLabE80); 6450 Ultrasound System (MyLabE85)

Esaote S.p.A.

05/16/2025

K240554

InferRead Lung CT.AI

Infervision Medical Technology Co., Ltd.

05/09/2025

K251110

EPIQ Series Diagnostic Ultrasound Systems; Affiniti Series Diagnostic Ultrasound Systems

Philips Ultrasound LLC

05/08/2025

K250226

Clarius Median Nerve AI

Clarius Mobile Health Corp.

05/01/2025

K250087

Vscan Air

GE Medical Systems Ultrasound and Primary Care Diagnostics

04/30/2025

K250328

UltraExtend NX CUW-U001S V2.0 Ultrasound Image Analysis Program

Canon Medical Systems Corporation

Upgrade the report license to gain a complete analysis

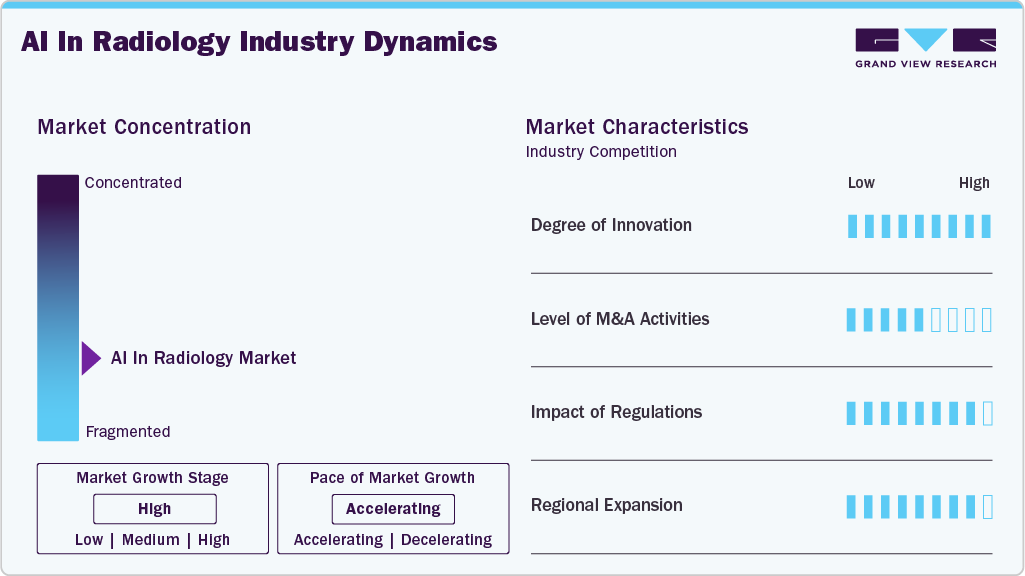

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The degree of innovation is high. The level of merger & acquisition activities is moderate. Moreover, the impact of regulations and the regional expansion of industry is high.

The AI in radiology market is characterized by constant innovation, with a strong focus on launching new platforms and devices to leverage administrative tasks, improve diagnostic accuracy, and enhance care delivery. Prominent players are launching advanced solutions to sustain a competitive advantage. In addition, growing regulatory approvals propel market growth further. For instance, in July 2025, Philips received FDA 510(k) clearance for SmartSpeed Precise, a deep learning MRI reconstruction software. This dual AI solution delivers up to 3x faster scans and 80% sharper images across Philips’ 1.5T and 3.0T MRI systems. It integrates AI denoising, image sharpening, and the Compressed SENSE engine to enhance image quality and workflow efficiency.

“This FDA clearance is a powerful validation of Philips’ leadership in AI-powered MRI innovation. “SmartSpeed Precise reflects our commitment to continuous innovation that addresses clinicians' real-world pressures. By integrating dual AI with our proven Compressed SENSE engine, we are enabling faster, sharper, and smarter MR scans-making high-quality imaging more accessible and efficient than ever before.”

-Ioannis Panagiotelis, PhD, Business Leader MR at Philips

The AI in radiology industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in May 2025, Australia-based Kailo Medical, a leader in structured reporting for medical imaging, acquired REI AI, a generative AI company. This acquisition expands Kailo’s offerings with generative AI-powered reporting tools that streamline workflows by converting dictation into structured reports, detecting errors in real-time, and generating personalized, clinically aligned impressions.

Regulations, such as the HIPAA in the U.S. and the GDPR in Europe, establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the AI in radiology industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions. For instance, in May 2025, Lunit entered a five-year strategic partnership with Starvision Service GmbH, Germany's largest private radiology network, covering 79 locations across seven federal states. The agreement facilitates the phased rollout of Lunit's AI imaging suite, including chest X-ray and mammography, tomosynthesis, and fracture detection.

"Partnering with Starvision accelerates our vision of bringing AI-powered precision diagnostics into everyday clinical practice.”

-Brandon Suh, CEO of Lunit.

Component Insights

The AI-enabled devices segment held the largest market share of 41.85% in 2024. These devices support real-time image acquisition, automated analysis, and faster reporting, reducing reliance on post-processing software. Integration of AI improves accuracy in detecting abnormalities, enhances image quality, and minimizes operator variability. For instance, in January 2025, Philips launched the AI-enabled CT 5300. The system features advanced AI reconstruction, cardiac motion correction, and smart workflows that enhance diagnostic accuracy, speed, and workflow efficiency. Moreover, the increasing adoption of smart imaging systems by hospitals and diagnostic centers is fueling this segment’s market growth.

The software and platform segment is expected to grow at the fastest CAGR during the forecast period. These solutions include advanced image recognition software, workflow management platforms, and cloud-based AI services integrated with PACS and RIS systems. By providing automated detection of abnormalities and risk stratification, they enhance diagnostic accuracy and efficiency. Cloud-based AI platforms facilitate remote collaboration, second opinions, and access to advanced analytics for smaller healthcare providers.

Technology Insights

The machine learning segment led the AI in radiology market with the largest revenue share of 35.75% in 2024. Machine learning algorithms identify patterns and anomalies in imaging data with high accuracy. They support applications such as tumor detection, lesion classification, and image segmentation, improving diagnostic precision and clinical outcomes. Machine learning also aids in predictive analytics, helping clinicians anticipate disease progression. Its adaptability across modalities like CT, MRI, and X-ray further fuels market growth.

The context-aware computing segment is anticipated to register the fastest CAGR from 2025 to 2033. Context-aware computing leverages patient-specific information, clinical history, and environmental factors to enhance radiological interpretations. In addition, context-aware computing optimizes workflow by tailoring imaging recommendations and follow-up actions to individual patient needs.

Modality Insights

The computed tomography (CT) segment held the largest revenue share of 29.81% in 2024 due to its ability to enhance image reconstruction, improve detection accuracy, and reduce radiation exposure. Advanced applications include low-dose imaging, lesion tracking across longitudinal scans, and predictive analytics for disease progression. For instance, in March 2025, GE HealthCare launched Revolution Vibe, a next-generation cardiac CT scanner with advanced AI capabilities, focused on coronary CT angiography (CCTA) and structural heart exams.

“The system is designed to encourage the broader adoption of and access to cardiac imaging, combining advanced technology with AI-powered solutions to deliver fast, accurate diagnoses and a more comfortable patient experience. It is designed to empower healthcare providers to offer the highest quality care, even in the most challenging cases."

-Jean-Luc Procaccini, president and CEO of molecular imaging and CT at GE HealthCare

The ultrasound segment is anticipated to grow at the fastest CAGR from 2025 to 2033. AI algorithms assist clinicians in identifying anatomical structures, detecting abnormalities, and reducing operator dependency. Automated measurements, such as fetal growth tracking and cardiac function analysis, improve consistency and minimize manual variability. In addition, AI-powered ultrasound solutions optimize workflows by automating reporting, guiding probe placement, and enabling remote interpretation through telemedicine platforms.

Application Insights

The image analysis segment led the AI in radiology industry with the largest revenue share of 39.12% in 2024. AI in image analysis helps radiologists prioritize critical cases through automated triaging and flagging high-risk findings. Advanced deep learning models enable predictive insights, linking imaging data with clinical outcomes for more personalized treatment planning. Cloud-based and PACS-integrated AI solutions streamline workflow by embedding analysis into existing radiology systems. Moreover, collaborations between AI startups and established imaging vendors are accelerating innovation and deployment across hospitals and diagnostic centers.

The workflow optimization segment is anticipated to grow at the fastest CAGR from 2025 to 2033. AI-powered solutions streamline the management of imaging studies by automating scheduling, worklist prioritization, and case routing. In addition, workflow optimization solutions integrate seamlessly with PACS, RIS, and EMR systems, ensuring smooth data exchange and reducing administrative burden, thus contributing to market growth further.

End Use Insights

The hospitals segment held the largest market share of 48.16% in 2024, driven by their need to manage large patient volumes and diverse imaging modalities. Hospitals are adopting AI solutions to support diagnostic accuracy, reduce reporting backlogs, and streamline clinical decision-making. Integrating AI into radiology departments helps standardize image interpretations, lowering the chances of diagnostic errors.

The diagnostic imaging centers segment is anticipated to grow at the fastest CAGR from 2025 to 2033. Diagnostic imaging centers are increasingly adopting AI solutions to enhance efficiency, accuracy, and competitiveness. These centers handle high imaging volumes daily, making automation and advanced analytics essential for optimizing turnaround times. AI-driven tools assist radiologists by detecting anomalies, flagging urgent cases, automating routine measurements, and reducing workload pressure. In addition, diagnostic imaging centers benefit from AI integration into scheduling, workflow, and reporting processes, enabling seamless patient management.

Regional Insights

The North America AI in radiology market accounted for the largest revenue share of 52.86% in 2024. This is attributed to the high prevalence of chronic diseases, strong reimbursement frameworks, and rapid integration of AI into digital health ecosystems. The U.S. leads with significant FDA clearances for AI-powered diagnostic and therapeutic devices, ensuring regulatory support for innovation. Moreover, rising collaborations between technology companies and healthcare providers further fuel innovation.

U.S. AI In Radiology Market Trends

The U.S. AI in radiology industry held the largest revenue share in 2024. The country has witnessed a surge in approvals for AI-powered imaging devices, reflecting robust innovation in healthcare technology. For instance, in September 2025, Tempus AI received FDA 510(k) clearance for its updated Tempus Pixel, an AI-powered cardiac imaging platform. The upgrade enables the generation of T1 and T2 inline maps, enhancing cardiac MR image analysis.

“With inline maps generated by Tempus Pixel, cardiologists and radiologists gain a comprehensive view of heart tissue, enabling deeper insights into cardiac health and helping them deliver more precise, personalized care to their patients.”

-Chris Scotto DiVetta, Senior Vice President of AI Applications at Tempus.

Europe AI In Radiology Market Trends

The Europe AI in radiology industry is expected to witness significant growth during the forecast period. This is attributed to the widespread adoption of AI technologies in healthcare and increasing investments by government and private organizations. Moreover, integrating 5G with healthcare drives Europe's market by enabling faster, more reliable connectivity for advanced medical technologies. For instance, in February 2025, Philips launched SmartSpeed Precise, a next-generation MRI technology powered by dual AI engines, debuting at the European Congress of Radiology (ECR) 2025. It enables up to three times faster scans with 80% sharper images, improving diagnostic confidence and patient outcomes.

The UK AI in radiology market is expected to grow over the forecast period, owing to the robust healthcare infrastructure and increasing investments in AI technologies to enhance medical diagnosis and patient care. For instance, in December 2023, DeepTek.AI partnered with AI One to enhance medical imaging analysis in the UK. The collaboration focuses on deploying DeepTek’s AI-driven radiology solutions across healthcare providers, enabling faster and more accurate image interpretation.

“We are excited to partner with AiOne to bring our cutting-edge AI solutions to the UK market. The UK has a world-class healthcare system, and we believe that our AI solutions can help to improve patient care further.”

- Dr. Amit Kharat, CEO of DeepTek and Co-founder

The AI in radiology market in Germany held the largest revenue share in 2024 in the European market, attributed to increasing investments in healthcare technology and robust healthcare infrastructure. In addition, favorable government initiatives and insurance coverage, coupled with the country’s focus on integrating AI into nationwide healthcare systems, propel market growth further. In May 2025, Korean medical imaging AI companies- Lunit and Coreline Soft- secured significant supply contracts in Germany. Lunit signed a five-year agreement with Germany’s largest private radiology network, Starvision, to deploy AI solutions across 79 sites, covering chest X-ray, mammography, tomosynthesis, and fracture detection.

"While Germany, which leads the medical field in Europe, is active in the introduction of AI technology, our products are constantly expanding to key hospitals…"

-Coreline Soft CEO Kim Jin-kook.

Asia Pacific AI In Radiology Market Trends

The Asia Pacific AI in radiology industry is expected to grow at the fastest CAGR in the coming years. This growth is attributed to the rising healthcare expenditure, increasing adoption of AI in healthcare, and growing prevalence of chronic diseases. Countries such as China, Japan, South Korea, and India are leading innovation through government-backed AI healthcare policies. Moreover, collaborations between key market players expedite market growth. In February 2025, South Korea’s Coreline Soft signed an MoU with China’s Jiangsu Suhai Information Technology to jointly advance the development of AI-powered imaging technologies. The collaboration aims to enhance clinical innovation and expand commercial partnerships across the Asian healthcare market.

The India AI in radiology market is expanding rapidly, driven by the high prevalence of hypertension, government health initiatives, and technological innovation. Furthermore, the market is experiencing a growing adoption of AI technologies by healthcare providers in the country. For instance, in December 2023, Indian startup DeepTek.ai launched Augmento X-Ray, a U.S. FDA-cleared CADe Chest X-Ray AI solution designed to reduce radiologist workload and improve chest X-ray reporting quality.

The AI in radiology market in Japan is expected to grow rapidly, owing to technological advancements, a growing geriatric population, increasing healthcare expenditure, and rapid adoption of artificial intelligence in healthcare. Moreover, increasing public and private funding, coupled with the rapid adoption of telehealth solutions, is expected to propel market growth further.

Latin America AI In Radiology Market Trends

The Latin America AI in radiology industry is anticipated to grow at a significant CAGR over the forecast period. This is attributed to the growing awareness about AI technologies, increasing government spending, and growing advancements in healthcare infrastructure.

Middle East & Africa AI In Radiology Market Trends

The Middle East and Africa AI in radiology industry is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by the growing adoption of technologically advanced medical devices, increasing healthcare expenditures, and supportive government policies. Significant integration of AI in healthcare technology across the region contributes to market growth further. Countries such as Saudi Arabia and the UAE are integrating AI into healthcare infrastructure under strategic visions such as Saudi Vision 2033 and the UAE National Strategy for Artificial Intelligence 2031.

Key AI In Radiology Company Insights

Key players operating in the AI in radiology market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI In Radiology Companies:

The following are the leading companies in the AI in radiology market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers AG

- GE HealthCare

- Koninklijke Philips N.V.

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Aidoc

- Tempus AI

- Lunit

- Viz.ai

- Riverain Technologies

- Qure.ai

- Infervision

Recent Developments

-

In August 2025, Philips launched Transcend Plus for its EPIQ CVx and Affiniti CVx cardiovascular ultrasound systems, featuring major advancements in image quality and AI.

"Transcend Plus represents a bold leap forward in the evolution of echocardiography, reinforcing our commitment to continuous innovation, empowering clinicians with AI-driven tools that enhance confidence, accelerate decision-making, and elevate care at every stage of the cardiac journey.”

-David Handler, Business Leader, Cardiology Ultrasound at Philips

-

In May 2025, Philips partnered with NVIDIA to develop a foundational AI model for MRI, leveraging NVIDIA’s advanced AI computing platform.

-

In March 2025, Nawaloka Hospitals in Sri Lanka introduced South Asia’s first AI-powered Canon Vantage Orian MRI scanner. The scanner enhances imaging precision and speed using deep learning algorithms, enabling early detection of neurological, cardiovascular, musculoskeletal, abdominal, pelvic, pediatric, and cancer-related conditions.

-

In March 2025, NVIDIA and GE HealthCare announced a collaboration to advance autonomous diagnostic imaging using physical AI. The partnership integrates NVIDIA’s AI computing with GE HealthCare’s imaging expertise to develop next-generation tools.

-

In November 2024, Subtle Medical and 626 announced a strategic partnership to provide AI-powered imaging upgrades for MRI systems.

-

In May 2023, Annalise.ai, an Australia-based AI radiology startup, opened its first office in Chennai, India, as part of its global expansion.

AI In Radiology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.58 billion

Revenue forecast in 2033

USD 193.02 billion

Growth rate

CAGR of 38.12% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, modality, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthineers AG; GE HealthCare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Aidoc; Tempus AI; Lunit; Viz.ai; Riverain Technologies; Qure.ai; Infervision

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Radiology Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in radiology market report based on component, technology, modality, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

AI-enabled Devices

-

Software & Platform

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning Algorithms

-

Deep learning

-

Supervised

-

Unsupervised

-

Others

-

-

Natural Language Processing (NLP)

-

Computer Vision Techniques

-

Context-aware Computing

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

X-ray / Radiography

-

Computed Tomography (CT)

-

Magnetic Resonance Imaging (MRI)

-

Ultrasound

-

Mammography / Tomosynthesis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Image Analysis

-

Workflow Optimization

-

Predictive Analytics

-

Clinical Decision Support

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinics

-

Diagnostic Imaging Centers

-

Research and Academic Institutions

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.