- Home

- »

- Medical Devices

- »

-

Artificial Organs And Bionics Market Size, Share Report 2030GVR Report cover

![Artificial Organs And Bionics Market Size, Share & Trends Report]()

Artificial Organs And Bionics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Artificial Organ, Artificial Bionics), By Technology (Mechanical, Electronic), By Region, And Segment Forecasts

- Report ID: 978-1-68038-147-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Organs And Bionics Market Summary

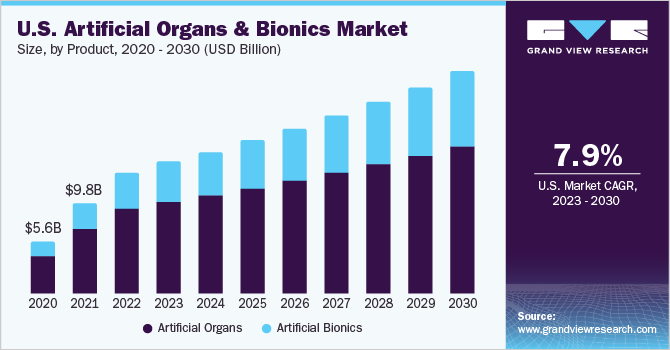

The global artificial organs and bionics market size was valued at USD 34.30 billion in 2022 and is projected to reach USD 70.09 billion by 2030, growing at a CAGR of 9.3% from 2023 to 2030. The key drivers of the market for artificial organs and bionics are the increasing number of transplants, coupled with the rising number of people waiting for donors.

Key Market Trends & Insights

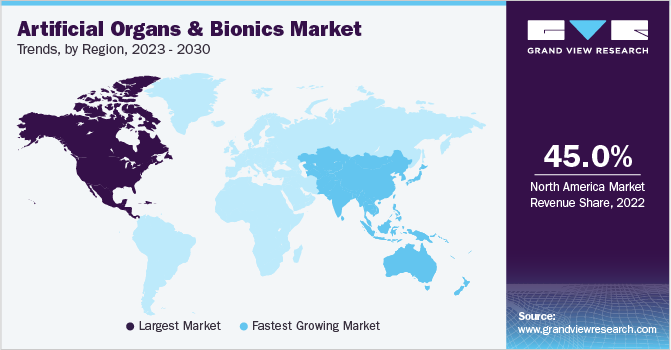

- North America dominated the market and accounted for the largest revenue share of 45.0% in 2022.

- Based on product, the artificial organs segment dominated the market with the largest revenue share of 70.4% in 2022.

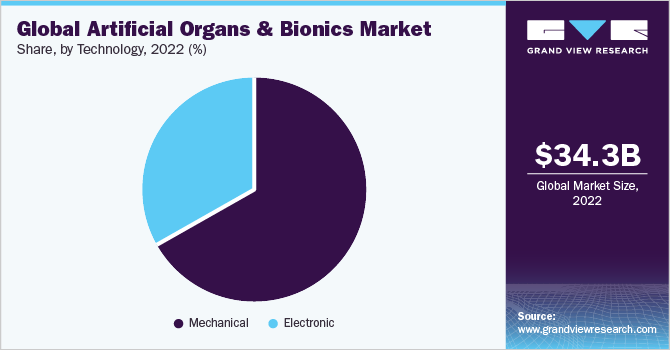

- Based on technology, the mechanical segment dominated the market with the largest revenue share of 66.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 34.30 Billion

- 2030 Projected Market Size: USD 70.09 Billion

- CAGR (2023-2030): 9.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to the Human Resource and Services Administration (HRSA), there are more than 104,234 people on the national waiting list in 2023 in the U.S. Additionally, every ten minutes, a person is added to the transplant waiting list in the U.S., resulting in greater demand for artificial medical devices.

The COVID-19 pandemic arose as an unprecedented health crisis, adversely affecting the artificial organs and bionics market. The coronavirus pandemic affected millions of people worldwide, resulting in significant deaths, disease burden, and financial instability. The healthcare system and facilities were under extreme strain as a result of the massive patient influx. The delay in other medical procedures was caused by prioritizing patients afflicted by COVID-19, affecting the market growth. This delay impacted many elective procedures, further reducing product adoption. Orthopedic bionic devices were widely used after amputation surgery to help partially or completely restore movement in limbs or arms. However, the decreased number of amputation procedures during the pandemic hampered industry growth by lowering device acceptance rates. However, due to the ease of lockdowns and several restrictions, the market is expected to flourish during the forecast period.

Primary factors for organ failure are loss of blood, drug abuse, serious trauma, and other acute diseases. Furthermore, lifestyle disorders such as unhealthy dietary habits, smoking, excessive alcohol consumption, and lack of exercise negatively impact organ function. In addition, development in healthcare facilities and the availability of advanced artificial support systems are expected to boost the demand for artificial organs and bionics.

The rising global geriatric population is primarily creating demand for organ implants. The number of people aged over 65 years of age receiving and seeking organ transplants is on the rise. Demand for artificial devices in the older population is highest, as they are more susceptible to post-transplant malignancies. According to the HRSA, in 2022, there were 8,895 organ transplant procedures performed on the population aged over 65 in the U.S. In 2022, 42,887 organ transplants were performed in the U.S., an increase of 3.7 percent over 2021. Thus, increasing life expectancy and rising demand for organ donors are boosting the demand for artificial devices.

According to a new study, the wait list for organ transplants is expected to rise in the coming years as more patients need organ transplants. In March 2023, HRSA announced the OPTN Modernization Initiative with the goal of improving system fairness, accountability, and performance through the modernization of OPTN technology, data transparency and analytics, governance, operations, and quality improvement and innovation.

Advancements in the field of 3D bioprinting have proven to be crucial in organ transplanting as it is used for developing artificial organs. 3D bioprinting is relatively popular since it minimizes the risk of organ rejection. Furthermore, artificial intelligence is poised to transform the global trends for artificial devices. Currently, many countries are focusing on a tool that provides a customized assessment of organ and donor suitability. This tool would be very helpful in making effective decisions about organ retrieval and will also help patients in deciding if they should accept donor organs or wait for better options.

Product Insights

The artificial organs segment dominated the market with the largest revenue share of 70.4% in 2022. Demand for kidney, heart, lung, and liver transplants is contributing to the growth of the segment. The average median waiting time to transplant a kidney in the U.S. is 5 years. Many factors are considered while on the waiting list, such as body size, blood type, distance from a donor, and severity of illness. Thus, the challenge of fulfilling unmet demand has compelled the manufacturers to develop bio-lungs, artificial pancreas, and wearable artificial kidneys.

The artificial bionics segment is expected to grow at the fastest CAGR of 10.7% during the forecast period from 2023 to 2030. Primary factors contributing to the segment's growth are the increasing demand for cochlear implants, vision, exoskeleton, limbs, and brain bionics. Furthermore, favorable reimbursement policies and fast-track FDA approval for implants are strengthening the growth of the market for artificial organs and bionics. For instance, in January 2022, the Cochlear Nucleus Implants of Cochlear Limited received clearance from the U.S. Food and Drug Administration to treat unilateral hearing loss and single-sided deafness.

Technology Insights

The mechanical segment dominated the market with the largest revenue share of 66.9% in 2022. This is primarily attributed to the rising incidence of organ failure and the low cost of mechanical bionics. A mechanical artificial heart valve lasts much longer as compared to the other options, creating a robust demand. Other factors contributing to the growth are speedy FDA approvals and reimbursement policies. For instance, in September 2021, the FDA approved Abbott's Portico with FlexNav TAVR system to treat individuals with symptomatic and aortic stenosis who may be at high or very high risk for open-heart surgery.

The electronic segment is expected to grow at the fastest CAGR of 9.9% during the forecast period. According to Bionics Queensland, approximately 1.0 billion people are living with a physical disability, and 190.0 million adults have primary functional difficulty. In most developing countries, the logistical and financial barriers remain high. The only option for many who are disabled is to obtain prosthetics such as artificial hands, arms, and legs. These prosthetics are battery and electronic systems that are myoelectric-controlled and can create nerve movement through sensors. These sensory electric technologies enable mobility in artificial organs. Machine learning, smart wearables, and element modeling are used to achieve mobility. In addition, an increasing number of road accidents, the rising prevalence of amputees, and individuals born without limbs are expected to create a demand for electronic bionics.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 45.0% in 2022. The reason for this growth is the increase in transplant surgeries and the need for artificial organs due to the high incidence of organ failure. Furthermore, the presence of well-developed healthcare facilities and the local presence of many large biotechnology and medical device companies, such as Zimmer Biomet, Arthrex, Inc., Medtronic, Novartis AG, and Stryker, contribute to its dominance. For instance, in March 2022, Zimmer Biomet Holdings, Inc. announced the launch of WalkAI, an evolving AI design that recognizes patients who are expected to have a lesser gait speed outcome, ninety days after hip or knee surgical intervention. WalkAI augments ZBEdge, a suite of integrated smart, robotic technologies digitally designed to offer transformative data-powered clinical insights to boost patient outcomes, with strong predictive analytic capabilities. The number of donors in the U.S. has increased significantly in the last 5 years. According to the U.S. Department of Health and Human Services, there was a 27.7% increase in the number of organ donors from 2015 to 2019. The growing demand for kidney transplantation is one of the major drivers of the market for artificial organs and bionics. Kidney transplantation witnessed an exponential growth from 16,186 transplants in 2011 to 23,401 transplants in 2019 and 24,670 in 2021.

Asia Pacific is expected to grow at the fastest CAGR of 11.1% during the forecast period from 2023 to 2030, owing to emerging economies like Japan, China, and India. These countries have a large population base with a high incidence of chronic diseases. An increase in the number of chronic diseases that lead to organ failure is expected to boost artificial organ and bionics device growth. In February 2022, Warburg Pincus invested USD 210 million in Micro Life Sciences Pvt Ltd., the parent organization of the Indian medical device company, Meril group of companies. This investment will promote domestic medical devices at a high level of legitimacy in the global context, allowing them to expand their overseas footprint, attract international talent, and scale up clinical research programs. The countries are technologically advanced and offer various advanced surgical procedures with booming medical tourism. The low cost of surgical procedures in the region allows many patients to visit for medical reasons. Thus, an increase in the number of chronic diseases leading to organ failure and a rise in medical tourism has contributed significantly to the growth of the market in the region.

Key Companies & Market Share Insights

The artificial organ and bionics market market is highly fragmented with the presence of many large, small, and medium-scale vendors. Market players are engaged in the development of innovative products and regional expansion to gain maximum revenue share in the industry. Mergers and acquisitions support prominent leaders in expanding their existing product portfolio and increasing their geographical footprints. For instance, in March 2022, Edwards Lifesciences announced that it obtained approval from the U.S. Food and Drug Administration (FDA) for the MITRIS RESILIA valve, a specialized tissue valve replacement intended for the mitral position of the heart. This innovative therapy represents the company's latest innovation, featuring advanced RESILIA tissue accompanied by anti-calcification technology. The technology enables the valve to be stored under dry packaging conditions, enhancing its usability and convenience. This achievement underscores Edwards Lifesciences' commitment to delivering cutting-edge solutions in the field of cardiac care.

Rising regulatory approvals for artificial organs and other materials along with the development of innovative products, such as 3D bioprinting have led to high demand for transplant products. This 3D bioprinting can be used to regenerate tissues and organs. For instance, in June 2021, Readily3D announced the development of a 3D-printed living model of the human pancreas to facilitate the testing of diabetes medicines, as part of the EU-funded Enlight project. Leveraging their innovative technology, Readily3D achieved a significant milestone by enabling the rapid 3D printing of biological tissue comprising human stem cells in a mere 30 seconds. This breakthrough highlights the potential of innovative approaches and paves the way for advanced research and development in the field of diabetes treatment.

Additionally, in February 2022, HUMOTECH, a U.S.-based research services firm with a focus on artificial organs, announced a partnership with the University of Michigan. This partnership aims to speed up the creation of software that would allow prosthetic users to walk naturally and with the power of a human leg. Some of the prominent companies operating in the global artificial organs and bionics market are:

-

ABIOMED

-

Berlin Heart

-

Zimmer Biomet

-

Boston Scientific Corporation

-

Cochlear Ltd.

-

Edwards Lifesciences Corporation

-

Ekso Bionics

-

Medtronic

-

Jarvik Heart, Inc

-

SynCardia Systems, LLC

Artificial Organs and Bionics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.61 billion

Revenue forecast in 2030

USD 70.09 billion

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

ABIOMED; Berlin Heart; Zimmer Biomet; Boston Scientific Corporation; Cochlear Ltd.; Edwards Lifesciences Corporation; Ekso Bionics; Medtronic; Jarvik Heart, Inc; SynCardia Systems, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Organs And Bionics Market Report Segmentation

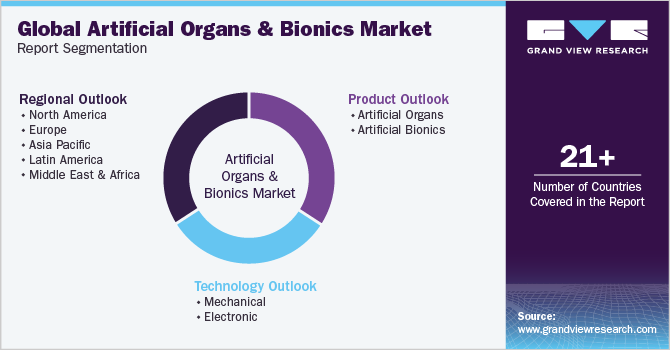

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial organs and bionics market report based on product, technology, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Artificial Organs

-

Kidney

-

Heart

-

Lungs

-

Liver

-

Pancreas

-

-

Artificial Bionics

-

Cochlear implant

-

Exoskeleton

-

Bionic limbs

-

Vision bionics

-

Brain bionics

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical bionics

-

Electronic bionics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial organs and bionics market size was estimated at USD 34.3 billion in 2022 and is expected to reach USD 37.61 billion in 2023.

b. The global artificial organs and bionics market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 70.09 billion by 2030.

b. North America dominated the artificial organs and bionics market with a share of 45.0% in 2022. This is attributable to rising artificial intelligence techniques, acceptance of cloud-based technologies, and constant research and development initiatives.

b. Some key players operating in the artificial organs and bionics market include Syncardia, Berlin Heart Gmbh, Ekso Bionics, Edwards Lifesciences Corporation, ABIOMED, and Medtronic.

b. Key factors that are driving the artificial organs and bionics market growth include an increasing number of transplants coupled with the rising number of people waiting for donors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.