- Home

- »

- Medical Devices

- »

-

Artificial Urinary Sphincter Market Size & Share Report, 2030GVR Report cover

![Artificial Urinary Sphincter Market Size, Share & Trends Report]()

Artificial Urinary Sphincter Market (2023 - 2030) Size, Share & Trends Analysis Report By Brand (AMS 800, Others), By End-user (Male, Female), By Region (North America, Asia Pacific, Europe, Latin America), And Segment Forecasts

- Report ID: GVR-3-68038-912-8

- Number of Report Pages: 116

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global artificial urinary sphincter market size was estimated at USD 494.33 million in 2022 and is anticipated to grow a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. The increasing prevalence of urge, stress Urinary Incontinence (UI), rising healthcare expenditure in emerging countries, and increasing number of clinical trials are major factors driving the market growth. For instance, in November 2022, UroMems initiated a groundbreaking clinical trial for its innovative smart automated artificial urinary sphincter (AUS), called UroActive. This cutting-edge device aims to enhance the treatment of stress urinary incontinence by eliminating the requirement for manual adjustments. Positioned around the urethral duct, UroActive operates automatically, responding to the patient's activities for optimal control and management.

Thus, due to such initiatives, the market is expected to grow in the near future. Furthermore, the AUS plays a significant role in urinary incontinence patient treatment. It is considered an effective and reliable treatment option for men experiencing UI, particularly those undergoing prostate surgery or who have sphincter dysfunction. The growing prevalence of prostate cancer, benign prostatic hyperplasia (BPH), and other urological disorders are major contributors to the rise in prostate surgeries. According to the National Center for Biotechnology Information (NCBI) study published in January 2022, the estimated prevalence of BPH ranged from 23.79% in the Gulf cluster, 23.76% in Egypt, and 13.84% in Turkey and Middle Eastern Countries.

Thus, the increasing prevalence of these diseases is projected to fuel demand for AUS during the forecast period. Stress and urgent urinary incontinence (UUI) are one of the most high-risk complications of surgery for prostate cancer. The AUS has been considered a gold standard for treating most severe UUI cases. According to Cleveland Clinic Statistics, around 90,000 prostatectomies are performed yearly in the U.S. It is the second most common cancer that affects men and assigned males at birth (AMAB). Thus, increasing prostatectomies will fuel demand for AUS in the coming years, consequently driving market growth.

Moreover, patients with spinal cord injury (SCI) are at a high risk of developing neurogenic bladder dysfunction characterized by poorly contractile bladder and urinary incontinence. According to the National Spinal Cord Injury Statistical Center, the estimated incidence of spinal cord injury (SCI) is approximately 54 cases per one million people in the U.S. annually. Artificial urinary sphincters can often provide a less invasive and effective continence treatment than urinary diversion in SCI patients before and after the procedure. Thus, rising cases of SCI and hospitalizations will spur the demand for AUS during the forecast period.

The favorable reimbursement policies and insurance coverage for AUS procedures encourage healthcare providers and patients to opt for this treatment option. Surgical therapy with an AUS is the standard treatment in men with SUI who fail and do not prefer conservative management. As per the NCBI study published in February 2023, in the U.S., forty-eight states of 49 U.S. states reported coverage for inserting an AUS and tandem cuff. The reimbursement for each AUS-associated procedure was USD 665.54 for AUS insertion, USD 528.03 for AUS removal, USD 630.29 for AUS revision, and USD 624 for a tandem cuff insertion. Thus, reimbursement policies and high claim settlements drive the adoption of AUS in hospitals and other healthcare settings, thereby driving the growth of the market.

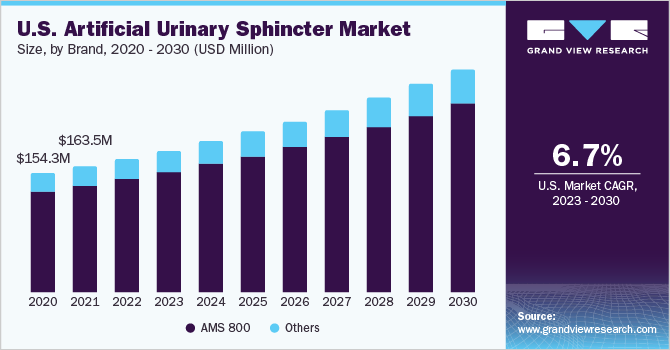

Brand Insights

Based on type, the market has been segmented into AMS 800 and others. The AMS 800 segment accounted for the largest revenue share of 85.25% in 2022. This can be attributed to the high demand for the AUS worldwide, and it is considered effective for treating stress urinary incontinence (SUI) in males. As per the Boston Scientific Corporation data, over 250,000 AUS have been sold since the product's launch. Furthermore, high patient satisfaction rates & high effectiveness and durability offer safe surgical options for SUI treatment and contribute to segment growth.

The other segment is also expected to witness significant growth during the forecast period due to the introduction of new brands, such as ZSI 375, ATOMS, ARTUS, FEMSOFT, and Relief. Zephyr Surgical Implants is the developer and manufacturer of the ZSI 375 implants, an AUS made from medical-grade silicon rubber to treat patients with urinary incontinence problems, and is considered an effective alternative to AUS 800. Factors, such as adjustable to patient’s continence needs, minimal risk of mechanical failure, and ease of implant, are attributed to the increasing demand for another artificial urinary sphincter over AMS 800.

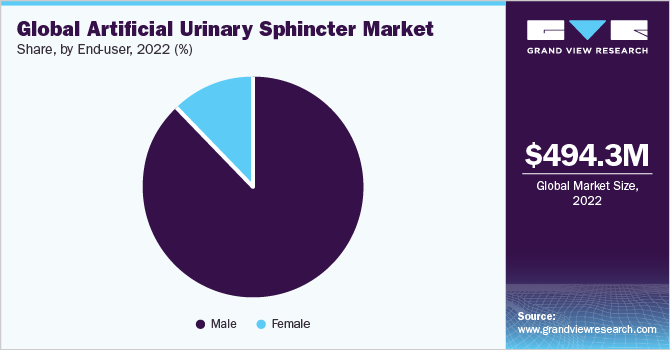

End-user Insights

Based on end-users, the market has been segmented into male and female. The male segment accounted for the largest share of 87.56% in 2022. This can be attributed to the high adoption of AUS in males due to the unmet need for continence care treatment. According to an article published by ICUROLOGY in January 2022, the prevalence of incontinence in men is lower (3% to 11%) compared to women. Urge incontinence accounts for around 40% - 80% of males with urinary incontinence. In addition, stress UI represents less than 10% of cases and is typically caused by trauma, prostate surgery, or nerve injury. Thus, the increasing prevalence of incontinence in men is anticipated to drive the segment growth.

The female segment is anticipated to witness the fastest growth over the forecast period. This can be attributed to the rising prevalence of hypertension, and diabetes is one of the major factors causing UI, which is driving the demand for incontinence and stoma care products. According to a report released by the CDC in 2020, approximately 39.7% of females worldwide suffered from hypertension during 2017-2018. Consequently, the increasing number of patients suffering from associated diseases is expected to boost the demand for incontinence and stoma care products, such as artificial urinary sphincter implants, in the coming years.

Regional Insights

Based on region, North America accounted for the largest share of 42.81% in 2022. This can be attributed to initiatives undertaken by the government to support continence care. For instance, the Canadian government's focus on improving healthcare infrastructure and increasing healthcare expenditure has resulted in improved access to healthcare services, including diagnosis and treatment for urinary incontinence. This has further boosted the market growth. Europe is also the largest market, followed by North America owing to technological advancements and medical innovations, which have led to better diagnostic tools, treatment options, and management strategies for UI. These advancements increased the potential for positive outcomes and improved quality of life for individuals with the condition. The recommended treatment for male incontinence, according to the National Institute for Health and Care Excellence (NICE), is the Artificial Urinary Sphincter (AUS).

This advanced treatment option is also provided by Manchester Urology, ensuring that patients have access to the gold-standard treatment for their condition. Asia Pacific is expected to witness the fastest growth rate during the forecast period. This can be attributed to the growing prevalence of prostate-related issues, and the rising geriatric population, which has contributed to a rise in demand for AUS and improving the lifestyle of patients suffering from bladder leakage problems. Several companies are implementing strategies to remain competitive in the market. With technological advancements in the healthcare industry and treatment options, more effective and minimally invasive interventions or AUS are now available for patients with UI. This encourages individuals to seek AUS-based treatment, contributing to regional market growth.

Key Companies & Market Share Insights

The development of new products, major R&D investments, and merger & acquisition are among the key strategies market players adopt to gain a competitive edge. In January 2022, ICU Medical, Inc. acquired Smith’s Medical, a medical device company. This helped the company gain a strong position on a global level in the medical industry & technology sector. Some of the prominent players in the global artificial urinary sphincter market include:

-

Boston Scientific Corporation

-

Creo Medical Ltd.

-

Zephyr Surgical Implants

-

Rules-Based Medicine

-

GT Urological (GTU)

Artificial Urinary Sphincter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 527.08 million

Revenue forecast in 2030

USD 853.30 million

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Brand, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corp.; Creo Medical Ltd.; Zephyr Surgical Implants; Rules-Based Medicine; GT Urological (GTU)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Urinary Sphincter Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the artificial urinary sphincter market report on the basis of brand, end-user, and region:

-

Brand Outlook (Revenue, USD Million, 2018 - 2030)

-

AMS 800

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial urinary sphincter market was estimated at USD 494.33 million in 2022 and is expected to reach USD 527.08 million in 2023.

b. The global artificial urinary sphincter market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 853.30 million by 2030.

b. North America dominated the artificial urinary sphincters market with a share of 42.81% in 2022. This is attributable to the increasing incidence of urinary incontinence, supportive government initiatives, favorable reimbursement framework, rising awareness in the region.

b. Some key players operating in the artificial urinary sphincter market includes Boston Scientific Corporation; Creo Medical Ltd.; Zephyr Surgical Implants; Rules-Based Medicine; GT Urological (GTU), and others.

b. Key factors that are driving the market growth include increase owing to increasing prevalence of urinary incontinence, technological advancements, increasing number of patients suffering from overactive bladder, and rising demand for artificial urinary sphincter device.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.