- Home

- »

- Advanced Interior Materials

- »

-

Asia And Europe Steel Rebar Market, Industry Report, 2030GVR Report cover

![Asia And Europe Steel Rebar Market Size, Share & Trend Report]()

Asia And Europe Steel Rebar Market Size, Share & Trend Analysis Report By Application (Construction, Infrastructure, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-911-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

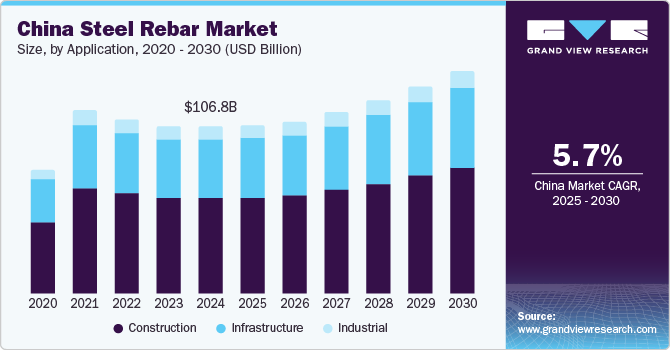

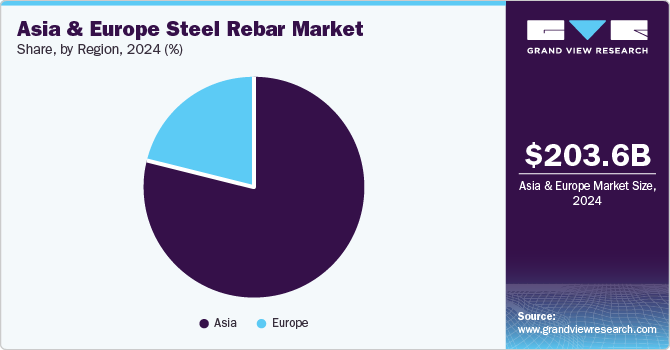

The Asia and Europe steel rebar market was estimated at USD 203.56 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. Governments in various countries are focusing of expanding infrastructure through the development of bridges, highways, and tunnels, which is projected to provide new opportunities for steel rebar vendors over the coming years. For instance, in October 2024, the Indian government approved a new road bridge in Varanasi, Uttar Pradesh, India. This bridge is likely to have six-lane highway and four railway lines with a lifespan of around 150 years. It is expected to take four years to construct this bridge.

Similar projects are underway across Asia and Europe, which are projected to fuel market growth over the coming years. Chinese government is trying to revive its real estate industry and to support this, the Chinese government is setting up new initiatives. For instance, in February 2023, China launched a pilot program for real estate private equity investment funds. The China Securities Regulatory Commission has allowed private equity funds to invest in projects under construction, rental projects, affordable homes, and residential housing, on a trial basis.

Investments in the residential sector are anticipated to boost the steel rebar demand over the coming years. For instance, in 2023, the Singapore government allocated a budget of USD 6.52 billion to the National Development Ministry. A portion of approximately USD 900 million will be reserved for housing development spending. Specifically, USD 341.17 million will be allocated for upgrading public residential areas, USD 220.70 million for retrofitting homes for the elderly, USD 69.08 million for elevator upgrades, and USD 51.37 million for neighborhood rejuvenation projects.

Drivers, Opportunities & Restraints

The rapidly growing construction industry is a key driver for the market, with urbanization and infrastructure projects driving demand. Countries like China and India lead in consumption due to large-scale developments in infrastructure and residential housing. The Asia steel rebar market is projected to witness robust growth, supported by government infrastructure and urban development investments. In Europe, the rebar market is anticipated to grow due to an increased focus on renewable energy projects and green buildings. The market in Europe is expected to benefit from the expansion of industrial applications, such as the construction of manufacturing facilities and warehouses.

The Asia region offers substantial opportunities, particularly with ongoing investments in transportation, residential, and energy sectors. For instance, India is expected to see an increase in demand for steel rebars as part of its infrastructure push under the “Make in India” initiative, along with China’s Belt and Road projects. For the Europe steel rebar market, opportunities lie in the increasing adoption of high-strength rebars and advanced materials like thermo-strengthened steel, which improve durability and reduce costs.

The availability of substitutes for steel rebar, such as fiber-reinforced polymers, which offer advantages like corrosion resistance is expected to have a critical impact on the market. Additionally, the steel rebar industry is capital-intensive, with high initial costs, which can limit smaller players from entering the market. Furthermore, environmental regulations in Europe that promote the reduction of carbon emissions may hamper growth in the region, as the steel industry is a significant contributor to greenhouse gases.

Price Trend Analysis

Steel rebar prices in the European market remained stable in September 2024. In Europe, buyers are adopting a cautious approach to purchasing rebar, opting to utilize their existing stockpiles. Infrastructural developments are expected to increase in the coming weeks, which is anticipated to drive the demand for rebar. This cautious purchasing behavior, combined with expectations of growing infrastructure projects, suggests a potential shift in market dynamics, with upward pressure on prices.

Steel rebar producers in Europe have undertaken capacity maintenance shutdowns to manage operational efficiency and maintain production quality. These planned shutdowns typically occur during periods of slower demand, allowing producers to perform necessary maintenance without significantly impacting the market.

Application Insights

Rebar products are widely utilized in commercial and residential buildings owing to their high strength and low weight, which reduces the load on the building foundations and improves economic savings. Investments in commercial and residential buildings are expected to drive the steel rebar demand over the coming years. For instance, the Singapore government’s Government Land Sales (GLS) Program is expected to provide 11,110 private residential units in the second half of 2024.

The investments are being supported by ongoing structural shifts in both demographics and lifestyles. Thus, growing investments in residential construction across different parts of the world are anticipated to propel the market growth over the next eight years. Emerging economies of Asia such as India and ASEAN are witnessing increasing investments in the infrastructure sector owing to increasing urbanization, rising income per capita, and growing population. In September 2024, the Government of Indonesia and Millennium Challenge Corporation launched USD 649 million Indonesia Infrastructure and Finance Compact, a grant to improve the quality of infrastructure and finance small and medium enterprises.

Regional Insights

The region is also anticipated to register the fastest growth rate from 2024 to 2030. Rising construction activities in the region, along with increasing penetration of steel rebar in residential and non-residential applications are likely to further fuel the product demand, especially in emerging economies of the region. Increasing investments by the government of developing countries such as China and India in massive infrastructure projects are driving the market in the region.

The demand for steel rebar in India is expected to increase with the government's focus on developing infrastructure in the coming years. The Indian government's decision to increase its capital expenditure allocation to USD 133.86 billion (3.4% of GDP) in the 2024 Budget has provided a significant boost to infrastructure projects across the country. This substantial investment, aimed at enhancing transportation networks, urban development, and public utilities, is likely to boost the steel rebar demand.

Thailand steel rebar market is driven by its demand in the construction sector. The substantial investments by the government in infrastructure projects, coupled with the rising need for residential and commercial buildings, are mainly driving the demand for structural steel. As Thailand's construction industry continues to expand, the demand for high-quality steel rebar products remains robust. The versatility and strength of structural steel make it a favored material for various construction applications, including bridges, high-rise buildings, and industrial infrastructure.

Europe Steel Rebar Market Trends

Steel rebar prices in the European market witnessed a slight decline in August 2024 due to a lack of strong demand from various end-use industries. Steel rebar prices have declined in most countries in the region, such as Italy, France, Poland, Romania, and Albania. Geopolitical tensions between Eastern European nations have led to a slump in prices and further cheap steel rebar imports from China owing to a lack of domestic demand and high inventories in the Chinese market.

Germany steel rebar market is anticipated to grow due to the country’s focus on green infrastructure and industrial expansion. Recent forecasts project a steady demand increase for rebar, particularly in manufacturing plants and renewable energy projects. Germany's construction sector, which accounted for 3.4% of its GDP in 2023, is expected to drive rebar consumption further through increased industrial building activities.

The steel rebar market in the UK is likely to see moderate growth driven by investments in housing and commercial infrastructure. The UK's government push for new housing construction, alongside major infrastructure projects such as the High-Speed 2 (HS2) railway, is projected to elevate demand for steel rebar in the coming years.

Key Asia And Europe Steel Rebar Company Insights

Some key players operating in the market include JFE Corporation, Tata Steel, and JSW among others.

-

JFE Corporation is one of Japan's leading steel manufacturers and a key player in the global steel market. JFE specializes in producing high-quality steel products, including steel plates, pipes, and tubes. The company serves sectors such as construction, automotive, and shipbuilding.

-

Tata Steel, part of the Tata Group, is one of the leading steel producers around the world. The company is headquartered in India and was established in 1907. It operates in more than 50 countries and has manufacturing units in India, Europe, and Southeast Asia.

Key Asia And Europe Steel Rebar Companies:

- ArcellorMittal

- Celsa Group

- Evraz Plc

- HBIS Group

- JFE Corporation

- Jiangsu Shagang Group

- NLMK

- SAIL

- Tata Steel

Recent Developments

-

In October 2024, Shyam Metallics and Energy Ltd. started stainless steel rebar production targeting coastal regions of India. This strategy is in line with the Indian government’s ‘Make In India’ program and vision for coastal infrastructure.

-

In October 2024, the European Commission announced its decision to block the proposed merger between Thyssenkrupp and Tata Steel in Europe. The planned merger between these two companies was the strategic solution to increasing pressure on the European steel industry with rising global competition, especially in China.

Asia And Europe Steel Rebar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 203.56 billion

Revenue forecast in 2030

USD 272.71 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

Europe; Asia

Country scope

Germany; France; Italy; Russia; China; Japan; India; Indonesia

Key companies profiled

ArcellorMittal; Celsa Group; Evraz Plc; HBIS Group; JFE Corporation; Jiangsu Shagang Group; NLMK; SAIL; Tata Steel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia And Europe Steel Rebar Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia and Europe steel rebar market report based on the application and region.

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia

-

China

-

Japan

-

India

-

Indonesia

-

-

Frequently Asked Questions About This Report

b. The Asia and Europe steel rebar market size was estimated at USD 203.56 billion in 2024.

b. The Asia and Europe steel rebar market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 272.71 billion by 2030.

b. Based on application segment, construction held the largest revenue share of more than 57% in 2023 owing to growing construction activities in emerging countries such as India and ASEAN region

b. Some of the key vendors of the Asia and Europe steel rebar market are ArcelorMittal, Celsa Group, Evraz Plc, HBIS Group, JFE Corporation, Jiangsu Shagang Group, NLMK, SAIL and Tata Steel

b. The growing investments in infrastructure through public and private platforms is the key driving factor for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."