- Home

- »

- Automotive & Transportation

- »

-

Asia Pacific Automotive Suspension Systems Market Report, 2030GVR Report cover

![Asia Pacific Automotive Suspension Systems Market Size, Share & Trends Report]()

Asia Pacific Automotive Suspension Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (Passenger Vehicles, Commercial Vehicles), By Component, By System, By Application, By Country, And Segment Forecasts

- Report ID: GVR-2-68038-153-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

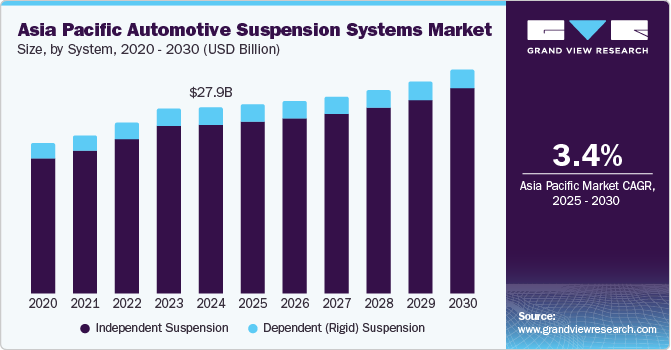

The Asia Pacific automotive suspension system market size was valued at USD 27.89 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2025 to 2030. Growing demand for car refurbishments, increased spending on vehicle maintenance, and a large number of customers seeking performance enhancement products are primarily driving the growth of this market.

Growing urbanization plays a vital role in the growing demand for passenger cars in multiple countries in Asia Pacific. Car ownership is increasing rapidly in urban areas of countries such as China and India. Approximately 54.0% of the global urban population, approximately 2.2 billion individuals, live in Asia. Increasing purchase power of the urban population, availability of advanced passenger vehicles equipped with modern technologies, and enhanced focus of manufacturing companies on the Asia Pacific market are expected to drive the growth of this market during the forecast period.

Automotive suspension holds a major role in the well-being of vehicles and overall performance. Advanced suspension system incorporated by manufacturers enables vehicles to absorb unexpected road shocks formed by road bumps, changes in surface levels, and more. It also assists in maintaining continuous contact between tires and the road surface. A fully-functioning suspension system provides an improved driving experience. It is vital in giving vehicle stability through curves, slopes, and more.

Advancements in technology are also adding to the growth experienced by the Asia Pacific automotive suspension system industry. For instance, in April 2024, Mahindra&Mahindra Ltd., one of the globally applauded brands in the XUVs market in the region, launched the XUV 3XO. The newly introduced vehicle offered by the company is equipped with twist-beam semi-independent rear suspension. It incorporates MacPherson Strut fully independent suspension at the front.

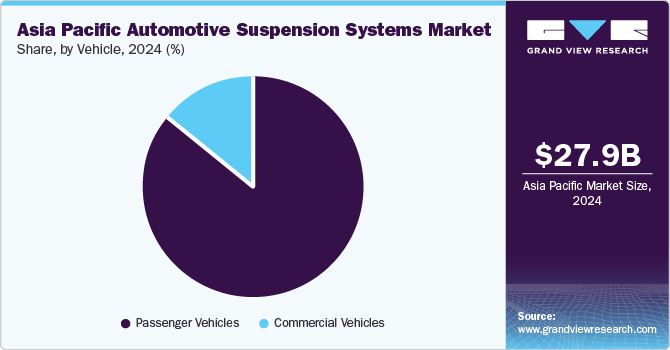

Vehicle Insights

The passenger vehicles segment dominated the Asia Pacific automotive suspension system industry with a revenue share of 86.3% in 2024. Highly populated countries such as China and India account for a higher regional industry share. Increasing demand for products by urban passenger car owners, rising disposable income levels, and significant spending on maintenance and performance management by replacing parts such as suspension systems add to the growth opportunities. Growth in overall vehicle production and the adoption of advanced technologies by manufacturers also contribute to the development of this segment. Asia Pacific is home to multiple passenger car manufacturers, including Mahindra & Mahindra, Honda, SAIC, Daimler, Toyota, Nissan, Maruti Suzuki, Tata Motors, Hyundai, and others.

The commercial vehicles segment is expected to experience significant growth during the forecast period. This is attributed to the increasing demand for commercial vehicles in the country driven by industrial development, technology adoption by businesses, and the focus of multiple manufacturers and service providers on embracing advanced cars to reduce costs. Large-scale operators purchase commercial vehicles to ensure the smooth flow of the supply chain and transportation. Small businesses deploy commercial vehicles to ensure operational excellence. Commercial vehicles are widely used in retail, agriculture, food and beverages, food processing, healthcare, etc. Growing demand for processed food in urbanized areas of the region, significant growth in domestic trade activities in countries such as India, and availability of enhanced infrastructure are adding to the growth opportunities for this market.

System Insights

The independent suspension segment held the largest revenue share of the Asia Pacific automotive suspension system industry in 2024. This is attributed to enhanced ride quality provided by the independent systems and improved stability and handling. Each wheel with an independent suspension system can absorb bumps independently, significantly influencing the experience. Every wheel adjusts with the road surface individually, which ensures enhanced handling and a stable driving experience. An independent suspension system also minimizes the leaning on curves, which adds safety and security.

The dependent (rigid) suspension system segment is expected to experience significant growth during the forecast period. It connects wheels and axles while ensuring the vehicle's flow. These systems were largely used in vehicles in earlier years. Refurbishment, maintenance of the existing systems, and use in heavy commercial vehicles primarily influence this segment. These systems were incorporated for the factors such as cost-effectiveness, durability and higher load bearing capabilities.

Damping Insights

The hydraulic damping segment dominated the Asia Pacific automotive suspension system industry in 2024. The growth of this segment is mainly driven by highly controlled and adjustable damping force. Hydraulic damping ensures control over motion while enabling various applications, including shock absorbing, reduced vibrations, and more. Hydraulic damping can absorb large amounts of kinetic energy, making it preferred by manufacturers and car owners.

The electromagnetic damping segment is anticipated to experience the highest growth during the forecast period. This is attributed to the smooth, contact-less, and highly adjustable damping mechanism provided by the system. Control over current in electromagnetic coils assists in adjusting damping force precisely, which can suit multiple operations. Lower response time makes these systems suitable for higher motion.

Component Insights

The shock absorber/dampener segment held a significant revenue share of the Asia Pacific automotive suspension system industry in 2024. Shock absorbers/dampeners play a vital role in the suspension system's primary function, which is to offer stability and control over the vehicle in bouncing motion. They absorb excessive energy with the help of springs and improve handling while ensuring a smoother ride. Oscillations caused by uneven road surfaces and bumps make it harder for cars to maintain motion flow and controlled lines. Shock absorbers/dampeners offer enhanced tire contact with the road surface to ensure safety during bumps.

The ball joints segment is projected to experience highest growth over the forecast period. Ball joints enable multi-directional movements during bumps and uneven surfaces, ensuring enhanced steering control and comfortable riding. Multi-planar movement holds a significant role in fully functioning steering maneuvers. Ball joints act as connecting parts among steering and control arms, which assist in the absorption of unexpected shocks and surface changes.

Country Insights

China Automotive Suspension Systems Market Trends

China dominated the Asia Pacific automotive suspension systems industry with a revenue share of 60.8% in 2024. The shock absorber/dampener segment held the largest revenue share of the Asia Pacific automotive suspension system industry in 2024. Shock absorbers/dampeners play a vital role in the primary function of the suspension system, which is to offer stability and control over the vehicle in bouncing motion. It absorbs excessive energy with the help of springs and improves handling while ensuring a smoother ride. Oscillations caused by uneven road surfaces and bumps make it harder for cars to maintain motion flow and controlled lines. Shock absorbers/dampeners offer enhanced tire contact with the road surface to ensure safety during bumps.

India Automotive Suspension Systems Market Trends

India automotive suspension system market is expected to experience highest growth from 2025 to 2030. This market is driven by the growing disposable income levels and increasing urbanization in the country. Significant enhancements in infrastructure, ease of availability associated with financial support by BFSI organizations, and accessibility to global brands are adding to the growth.

Key Automotive Suspension Systems Company Insights

Some of the key companies operating in the Asia Pacific automotive suspension system industry include ContiTech Deutschland GmbH, KYB Corporation, Marelli Holdings Co., Ltd., ZF Friedrichshafen AG, Rassini, and others. To address changing demand from manufacturers and increasing focus on advanced technology-assisted products, key manufacturers have been embracing strategies such as process automation, innovation, and more.

-

KYB Corporation is a global company that offers a wide range of products for automotive, motorcycles, railroad equipment, special purpose vehicles, construction machinery, agricultural machinery, industrial vehicles, industrial machinery, theater equipment, marine products, sports, welfare, and more. Its automotive portfolio features shock absorbers of various sorts, including hydraulic rebound stop, adjustable damping, frequency sensitive, prosmooth, and swing valves.

-

NHK SPRING Co., Ltd. is a spring manufacturer that offers various products. This includes coil springs, leaf springs, tapered leaf springs, mono leaf springs, hollow stabilizers, solid stabilizers, bush bonding, stabilizer links, torsion bars, tab linkers, valve springs, and others.

Key Asia Pacific Automotive Suspension System Companies:

- ContiTech Deutschland GmbH

- KYB Corporation

- Tenneco Inc.

- HL Mando Corp.

- F-TECH INC.

- ZF Friedrichshafen AG

- Marelli Holdings Co., Ltd.

- thyssenkrupp AG

- Rassini

- Sogefi SpA

- NHK SPRING Co., Ltd.

- Multimatic Inc.

Asia Pacific Automotive Suspension Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.25 billion

Revenue forecast in 2030

USD 33.47 billion

Growth Rate

CAGR of 3.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, damping, system, component, region

Country scope

China, Japan, India, South Kore, Malaysia

Key companies profiled

ContiTech Deutschland GmbH; KYB Corporation; Tenneco Inc.; HL Mando Corp.; F-TECH INC.; ZF Friedrichshafen AG; Marelli Holdings Co., Ltd.; thyssenkrupp AG; Rassini; Sogefi SpA; NHK SPRING Co., Ltd.; Multimatic Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Automotive Suspension Systems Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the Asia Pacific automotive suspension system industry report based on vehicle, system, damping, component, and region.

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Independent Suspension

-

Dependent (Rigid) Suspension

-

-

Damping Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydraulic Damping

-

Air Suspension

-

Electromagnetic Damping

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Springs

-

Control Arms

-

Shock Absorber/Dampener

-

Ball Joints

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.