- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Ceramic Tiles Market Size, Industry Report 2030GVR Report cover

![Asia Pacific Ceramic Tiles Market Size, Share & Trends Report]()

Asia Pacific Ceramic Tiles Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch Free Ceramic Tiles, Other Tiles), By Application, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-244-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Ceramic Tiles Market Trends

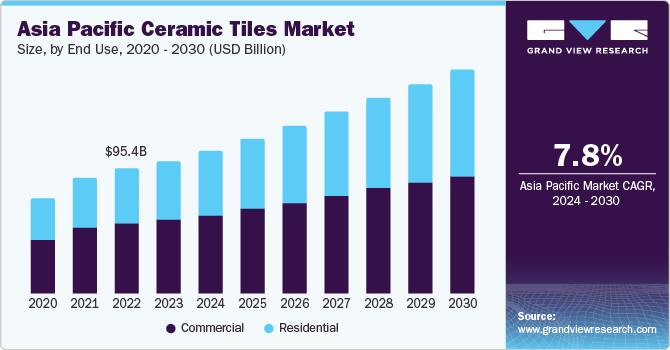

The Asia Pacific ceramic tiles market size was estimated at USD 101.07 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. The Asia Pacific is expected to witness an increase in construction spending over the forecast period owing to rapid urbanization coupled with an expanding population. According to a report published by the Asian Development Bank, the region’s construction market is anticipated to witness significant growth over the next decade. Government initiatives to increase foreign direct investments in India and strong economic growth are expected to spur the growth of the construction industry over the forecast period. Rapid urbanization, rising population, and strong economic growth in the Philippines, India, and Malaysia are expected to provide lucrative growth opportunities to the construction sector in Asia Pacific.

South Korea is predicted to register a significant growth rate over the forecast period in the construction industry owing to private and public investments in commercial and industrial projects. Malaysia is expected to witness strong growth in residential construction on account of project implementations under the government’s economic transformation program. Therefore, the growth of the construction industry in the Asia Pacific is expected to be a major driving factor triggering the demand for flooring, thereby driving the market for ceramic tiles.

Several companies worldwide have established their manufacturing facilities in China owing to the increasing urban population, rapid industrialization, increasing foreign investments, rising disposable income, favourable government regulations, and inexpensive labor, which is expected to boost construction spending. Rapid population growth in cities including Beijing, Shanghai, Chongqing, Guangzhou, and Shenzen is expected to fuel non-residential construction investments in the country. China surpassed the U.S., in terms of construction market size, in 2010. The government launched the Sha Tin to Central Link’s Hung Hom-Admiralty east rail line in May 2022 and Kai Tak-Hung Hom in June 2021. The growth of the construction industry in China is expected to result in a high demand for flooring solutions in residential, commercial as well as industrial applications.

Market Concentration & Characteristics

The market growth is medium and is accelerating at a significant pace owing to a moderately fragmented market. Asia Pacific ceramic tiles manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, innovation, and production expansion, among others.

The degree of innovation is moderate level. The development of technologies such as Building Information Modeling (BIM), smart city solutions, green building, and artificial intelligence applications play a crucial role in driving the development of new products.

The level of mergers and acquisitions in the Asia Pacific ceramic tiles market is moderate to high as these strategies are being adopted by industry players to stay ahead of the competition. For instance, in May 2021, Phomiholdings and Dongpeng Holdings entered into a cooperation agreement to drive the sustainable development of the ceramic tiles industry. This strategic initiative was intended to support the development of construction materials, such as ceramic tiles.

Product Insights

The glazed ceramic segment accounted for a revenue of USD 101.07 billion in 2023. Glazed tiles have a glossy, which is produced by adding a liquid to the clay during the manufacturing process and then firing in the kiln. They are often used in laundry rooms, kitchens, and bathrooms owing to their water resistance and high durability properties.

Porcelain tiles is expected to expand the fastest CAGR during the forecast period. This segment is driven by its widespread adoption in wet and dry areas such as kitchen splashbacks and bathrooms. Porcelain tiles are made from highly refined clay and is fired at high temperatures.

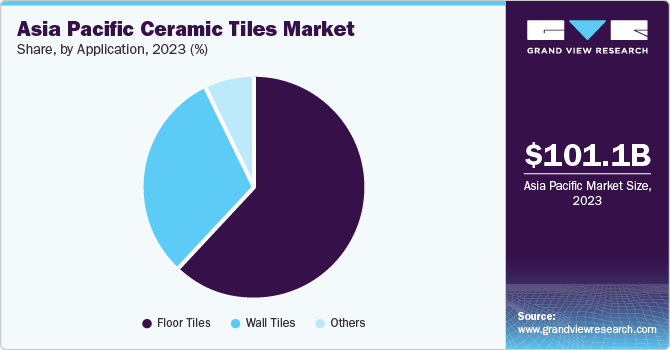

Application Insights

Floor tiles held the largest revenue share of 62.2% in 2023. Ceramic floor tiles are water-resistant and suitable for heavy foot traffic areas. They foster green economy as they have zero Volatile organic compounds (VOC) as manufacturing byproducts as they are made from naturally occurring minerals and clay. Furthermore, floor tiles are available in a wide variety of colors, textures, and patterns, which caters to a larger customer base.

Wall tiles are projected to grow at a significant rate during the forecast period. The evolving trends such as modern organic and cabin interior décor styles are fuelling the demand for marble and wood textured wall tiles. The rising disposable income in China and India is fostering redevelopment projects, thereby driving segment growth.

End use Insights

The commercial sector accounted for the largest revenue share of 55.8% in 2023 owing to the ongoing construction activities in developing countries such as India and China. Changing lifestyles and the demand for high-rise luxury buildings & hotels to develop the tourism sector are expected to continue supporting construction spending in Asia Pacific countries.

The residential sector is projected to register the fastest CAGR from 2024 to 2030. Developing countries like Malaysia are expected to witness strong growth in residential construction on account of project implementations under the government’s economic transformation program. Therefore, the growth of the construction industry in the Asia Pacific is expected to be a major driving factor triggering the demand for flooring, thereby driving the market for ceramic tiles over the coming years.

Country Insights

Asia Pacific ceramic tiles market are expected to witness significant demand from the new residential and commercial construction projects. Rising number of renovation projects in the region owing to structural damage of old buildings, particularly in India, is expected to drive the demand for ceramic tiles in residential replacement applications. Increasing population coupled with rising spending capability of consumers is expected to drive the market for ceramic tiles in new residential and commercial infrastructure projects in the region over the forecast period.

China Ceramic Tiles Market Trends

China ceramic tiles market, accounting for a revenue share of 31.0% in 2023. According to data published by International Trade Association (ITA) report in March 2023, China has the world’s largest construction industry. China’s 14th Five-Year Plan emphasizes the development of infrastructure projects in energy, transportation, water systems, etc. According to ITA’s estimates, the total investment in infrastructure development during the 14th Five-Year Plan period (2021-2025) will account for USD 4.2 trillion. Major municipalities, such as Beijing, Shanghai, and Shenzhen, plan to transform the real estate sector to sustainable or green infrastructure. This also includes plans to renovate hospitals, schools, and public buildings and make them more energy efficient.

India Ceramic Tiles Market Trends

Ceramic tiles market in India is projected to register the fastest CAGR during the forecast period. United Nations projects India’s population to reach 1.64 billion by 2047 and over 50% of the country’s population is likely to be living in urban cities. According to Invest India, cities in India are expected to be responsible for more than 70% of the GDP owing to rapid industrialization and migration of the population from smaller cities. By 2030, 600 million people are projected to live in cities and this would create a demand for USD 25 million for additional residential projects.

Key Asia Pacific Ceramic Tiles Company Insights

The key players are increasing investments and are focused on continuous R&D in ceramic tile products. This has led to the introduction of flooring materials with enhanced durability and strength. Moreover, availability of tiles in various color, texture, and finishing has further driven ceramic tiles demand in flooring market. Market players have been adopting various strategies such as new product developments, partnerships, joint ventures, agreements, contracts, and collaborations to maximize their market penetration and to cater to the changing technological requirements of end use industries.

Key Asia Pacific Ceramic Tiles Companies:

- Siam Cement group

- Phomi soft porcelain

- Somany Ceramics

- Atlas Concorde

- H & R Johnson

- Foshan Hanse Industrial Co. Ltd

- China Ceramics Co. Ltd

- Shanghai Cimic Tiles Co. Ltd

- Guangdong Sanfi Ceramics Group Co. Ltd

- Orient Tiles

- CERA

- Parryware

Recent Developments

-

In 2023, India’sPM Awas Yojana budget was increased by 66%, with a 33% increase in capital investment outlay. The foreign direct investment (FDI) for the construction development sector was USD 32.00 billion by September 2023, fostering the real estate and urban development segments.

-

In August 2022, Orientbell Tiles launched Sahara Double Body tilescatering tocommercial spaces such as hospitals, airports, and pathways, and residential spaces such as bathrooms and kitchens. Sahara Double Body tiles require low maintenance and are highly durable.

-

In July 2022, Orientbell Tiles launched Serenity Tiles for walls and floors. The strategic launch caters to the growing trend of interior renovation amongst modern consumers.

Asia Pacific Ceramic Tiles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 108.42 billion

Revenue forecast in 2030

USD 170.33 billion

Growth Rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Million Square Meters

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, country

Regional scope

Asia Pacific

Country scope

China, India, South Korea, Japan

Key companies profiled

Siam Cement group; Phomi soft porcelain; Somany Ceramics; Atlas Concorde; H & R Johnson; Foshan Hanse Industrial Co. Ltd.; China Ceramics Co. Ltd; Shanghai Cimic Tiles Co. Ltd; Guangdong Sanfi Ceramics Group Co. Ltd; Orient Tiles; CERA; Parryware

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Ceramic Tiles Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific ceramic tiles market report based on product, application, end use, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Glazed Ceramic Tiles

-

Porcelain Tiles

-

Scratch-free Ceramic Tiles

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Wall Tiles

-

Floor Tiles

-

Others

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Rest of APAC

-

Frequently Asked Questions About This Report

b. The Asia Pacific ceramic tiles market was valued at USD 101.07 billion in the year 2023 and is expected to reach USD 108.42 billion in 2024.

b. The Asia Pacific ceramic tiles market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 170.33 billion by 2030.

b. Based on end use, commercial segment emerged as a dominating segment in the market with a share of 55.0% in 2023 due to the ongoing redevelopment of public infrastructure.

b. The key market players in the Asia Pacific ceramic tiles market include Siam Cement group; Phomi soft porcelain; Somany Ceramics; Atlas Concorde; H & R Johnson; Foshan Hanse Industrial Co. Ltd.; China Ceramics Co. Ltd; Shanghai Cimic Tiles Co. Ltd; Guangdong Sanfi Ceramics Group Co. Ltd; Orient Tiles; CERA; Parryware.

b. The key factors that are driving the Asia Pacific ceramic tiles market include, growing application in residential construction industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.