- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Disposable Gloves Market, Industry Report, 2030GVR Report cover

![Asia Pacific Disposable Gloves Market Size, Share & Trends Report]()

Asia Pacific Disposable Gloves Market Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene), By Product (Powdered, Powder-free), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-225-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

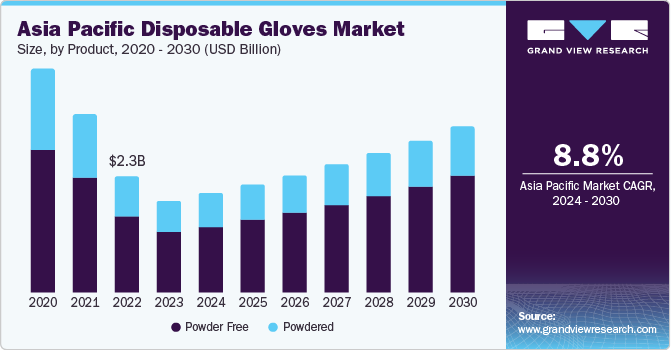

The Asia Pacific disposable gloves market size was estimated at USD 1.83 billion in 2023 and is projected to grow at a CAGR of 8.8% from 2024 to 2030. This growth is attributed to the expansion of healthcare facilities, such as hospitals and clinics, as well as the rise in people preferring home care services. In addition, medical tourism in the region is on the rise, and the increasing population, along with an aging demographic, is anticipated to boost healthcare service demands. Consequently, this is predicted to drive the need for disposable gloves over the forecast period.

Disposable gloves are the type of personal protective gear utilized during medical procedures to prevent the spread of infections and contamination. They act as a shield, offering protection from bacterial and fungal infections, as well as hazardous chemicals. These gloves find extensive use in various areas such as cleaning, healthcare, food, and chemical industries.

There is an increasing recognition of the role of raw materials in imparting desirable properties such as heat resistance, comfort, elasticity, and lightness to disposable gloves. This realization is expected to drive research and development initiatives among key market players, to improve the functionality of disposable gloves and broaden their use through innovative design improvements. The manufacturing process of disposable gloves is capital-intensive, owing to the high cost of raw materials and intricate production techniques. To enhance competitiveness, major suppliers of raw materials in the market have integrated into the value chain to produce disposable gloves.

The growth of the disposable glove industry is significantly influenced by occupational safety regulations. Mandates by agencies for businesses to maintain worker safety in various sectors are projected to drive market demand in the future. As per a report by OSHA, most hand injuries in the construction industry occur among workers who do not wear gloves, while about 30% of injuries result from the use of damaged or inappropriate gloves.

Market Concentration & Characteristics

The Asia Pacific disposable gloves market is marked by a moderate level of innovation. Gloves are important protective equipment that are used in various industries, including healthcare, food processing, and manufacturing. Although companies may make changes to the design of these gloves to improve their features and meet customer requirements, the fundamental structure and function of disposable gloves have mostly remained unchanged over time. In addition, while there have been some improvements in the materials and manufacturing techniques used to produce these gloves, the basic structure and functionality of disposable gloves have remained constant.

The market witnesses a moderate level of merger and acquisition activities, with a blend of large global corporations and smaller local entities. For instance, in February 2023, Ansell Limited (ASX: ANN), a worldwide leader in safety solutions for personal protection, announced the acquisition of a 50% stake in Careplus (M) Sdn Bhd (Careplus) from Careplus Group for a total of RM 37.5 million (approximately USD 9 million). This acquisition, funded from existing cash reserves and subject to standard closing conditions, will give Ansell full operational control and a 100% stake. Previously, in May 2020, Ansell acquired a 50 percent stake in Careplus to access additional surgical glove capacity to meet the high market demand.

Maintaining safety and hygiene makes disposable gloves crucial in the market, where regulatory compliance plays an important role. Regulatory standards and requirements strictly govern product quality, manufacturing practices, and material safety. Adherence to these regulations is essential for market entry and retaining consumer confidence.

Disposable gloves have limited substitutes, especially in industries where their use is mandatory for safety and hygiene. Although reusable gloves or automation may be alternatives in some applications, they may not always be practical, especially in healthcare settings where single-use disposable gloves are the norm.

The market experiences a moderate level of product expansion, with manufacturers introducing variations in materials, textures, and sizes to cater to specific user needs or target niche markets. However, the primary product offerings remain relatively stable, emphasizing meeting regulatory standards and ensuring product reliability and performance.

Product Insights

The powder-free product segment accounted for the highest market share in 2023. Powder-free gloves are subjected to a chlorination process, which makes them less form-fitting, eliminating the need for powder to facilitate easy donning and removal. This process involves treating the gloves with a chlorine solution, followed by a rinse with water, and then drying to remove most of the powdered residue, dirt, and proteins. This process results in gloves that are stronger than their powdered counterparts. Powder-free gloves are expected to continue their dominance in the market in the forecast period due to their increasing preference in various industries, including medical, chemical, and food processing, among others.

On the other hand, powdered gloves also held a substantial market share in 2023. Cornstarch powder is used in latex gloves as it can conform closely to the hand and provide protection against harmful chemicals or physical contaminants. However, individuals with allergies or sensitivities may experience aggravated symptoms when cornstarch powder is present in latex gloves. This issue does not arise with vinyl or nitrile gloves. Despite the advantages of powder-free gloves, powdered gloves have their own set of benefits. They can fit snugly and provide a shield against dangerous chemicals or physical impurities.

End-use Insights

The healthcare end-use segment led the market with the largest revenue share in 2023. Disposable gloves are a staple in this industry, serving as a protective barrier for doctors and patients alike, preventing the spread of pathogens during medical procedures and examinations. They offer protection against the transmission of germs, blood-borne pathogens, and other environmental contaminants in the workplace. Moreover, these gloves are designed for single use, further minimizing the risk of contamination. There are various types of disposable gloves available, including nitrile, neoprene, natural rubber, and vinyl, each offering unique advantages over traditional gloves.

The food industry also held a significant revenue share in 2023, driven by the growing demand for disposable gloves. These gloves are commonly used to minimize direct hand contact with food, making them a prevalent personal protection item in the food industry. Virtually every food service or food manufacturing facility has a stock of gloves on hand. Many of these gloves are single use, designed to prevent direct hand contact with food or surfaces that come into contact with food. The use of disposable gloves helps prevent cross-contamination and maintain hand hygiene. By wearing these gloves, the likelihood of bacteria on your hands contaminating the food is greatly reduced.

Material Insights

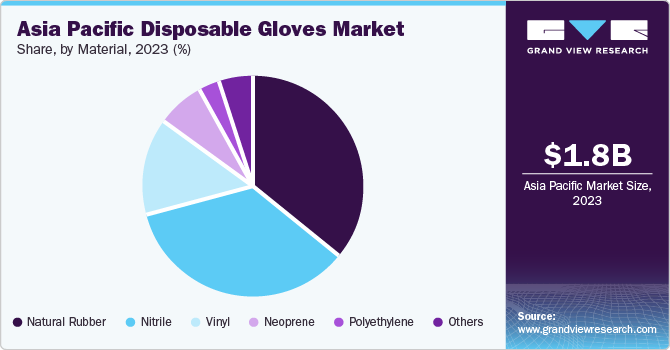

The natural rubber segment accounted for the largest market share in 2023. The growth in the market is largely due to the exceptional performance and protection provided by disposable gloves made of natural rubber. These gloves find extensive use in various sectors such as medical & dental, food service & processing, janitorial & sanitation, pharmaceutical, and automotive. The rising demand for disposable natural rubber gloves in diverse environments, including medical, surgical, and laboratory settings, is expected to boost market growth and drive the growth of this segment.

The Nitrile glove segment accounted for a significant revenue share in 2023, due to its superior puncture and chemical resistance compared to vinyl and latex gloves. The increasing need for infection control is expected to spur the demand for nitrile gloves in the coming years. In the disposable gloves industry, nitrile gloves are largely replacing latex gloves. This is because disposable nitrile gloves offer barrier protection, can withstand heat up to 500 °F, resist chemicals, and eliminate the risk of latex allergies.

Country Insights

China Disposable Gloves Market Trends

The China disposable gloves market accounted for the highest market share of 35.94% owing to several factors such as urbanization, the development of healthcare infrastructure, improved standard of living, and an aging population. The growth of the healthcare sector is expected to be fueled by increased healthcare spending. These elements are predicted to positively influence the expansion of the disposable gloves market in the future. In addition, increased investment in the construction, manufacturing, and food & beverage industries is expected to stimulate demand for these products.

India Disposable Gloves Market Trends

The disposable gloves market inIndia saw substantial growth in 2023. This growth is attributed to the expanding healthcare industry in the country, which is driven by a growing population, increased disposable income, broader insurance coverage, heightened health awareness, and increased spending by both public and private entities in the sector. Moreover, the progress of the manufacturing sector in India is expected to propel market growth in the forecast period.

Japan Disposable Gloves Market Trends

The Japan disposable gloves market also experienced significant growth in 2023, due to strict regulations on medical drug development and workplace environments in the healthcare and pharmaceutical sectors. Furthermore, the demand for outpatient care is expected to rise due to the increasing aging population. These factors contribute to the growth of the healthcare sector, which in turn is expected to boost the demand for various personal protective equipment, including disposable gloves.

Key Asia Pacific Disposable Gloves Company Insights

The Asia Pacific disposable gloves market consists of various manufacturers and suppliers serving several industry sectors and geographical areas. The market is a mix of large multinational corporations with a significant presence and smaller regional competitors competing on aspects such as price, quality, and service.

Key players in the market include Ansell Ltd.; Supermax Corporation Berhad; and Hartalega Holdings Berhad.

-

Ansell Ltd. is a provider of protective equipment and solutions, operating through three segments: industrial, medical, and single-use solutions. The company also offers high-quality protective solutions tailored for specific roles such as guardians and care centers. Its products are marketed under several brand names, including AlphaTec, Activarmr, Projex, Microflex, Encore, Gammex, Sandel, Micro-Touch, and Viking.

-

Hartalega Holdings Berhad stands as one of the world's leading manufacturers of nitrile gloves. The company's operations are centered around the production and distribution of gloves, with a product range that includes nitrile and latex gloves. It caters to a variety of industries, including food, healthcare, and semiconductors.

The Glove Company; Kossan Rubber Industries Bhd; and Dahanu Rubber Gloves Mfg. Co. are other participants operating in the Asia Pacific disposable gloves market.

-

Kossan Rubber Industries Bhd is a producer and distributor of rubber products. Its product range encompasses molded rubber, polyurethane products, extruded rubber, and gloves. The company manufactures disposable gloves under the brand names Pureshield, Intouch, Chemax, and 7th Sense, which are used in various sectors such as medical, dental, tattoo, EMS, salon, and automotive industries.

Key Asia Pacific Disposable Gloves Companies:

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- The Glove Company

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd

- Everpro Gloves

- Wuxi Fbyl Leather Corporation Ltd.

- Dahanu Rubber Gloves Mfg. Co.

- Sri Trang gloves

Recent Development

-

In February 2024, Ansell is pleased to introduce a new ultra-textured glove to the market: MICROFLEX® Mega Texture 93-256. This nitrile disposable orange glove offers a confident grip and durable protection to industrial workers. It is especially suitable for auto shop workers who require a robust glove with tear resistance, high visibility, and strong grip properties. MICROFLEX® 93-256 provides an important barrier between automotive workers and everyday hazards, which range from oils and grime to chemicals and carcinogens.

-

In October 2023, Hartalega Holdings Berhad launched a 360-degree virtual plant tour, the Hartalega Next Generation Experience (NGX), in collaboration with global professional services firm Accenture. The digitally enabled platform was created to orchestrate a unique and personalized experience for the glovemaker's audiences and facilitate informative customer purchase journeys. The Hartalega NGX platform will enable key stakeholders, including customers and partners across the globe, to virtually explore the world-class operations and production processes at Hartalega's Next Generation Integrated Glove Manufacturing Complex (NGC), along with the company's innovative product range available for global users.

Asia Pacific Disposable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.99 billion

Revenue forecast in 2030

USD 3.31 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use.

Regional scope

Asia Pacific

Country scope

China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia

Key companies profiled

Ansell Ltd.; Top Glove Corporation Bhd; Hartalega Holdings Berhad; The Glove Company; Supermax Corporation Berhad; Kossan Rubber Industries Bhd; Everpro Gloves; Wuxi Fbyl Leather Corporation Ltd.; Dahanu Rubber Gloves Mfg. Co,; Sri Trang gloves.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Disposable Gloves Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific disposable gloves market report based on material, product, and end-use:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powdered

-

Powder Free

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific disposable gloves market was valued at USD 1.83 billion in the year 2023 and is expected to reach USD 1.99 billion in 2024.

b. The Asia Pacific disposable gloves market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 3.31 billion by 2030.

b. The powder free segment accounted for the highest market share of 65.85% in 2023 due to the growing need in a variety of industries, such as the food processing, chemical, and medical sectors, for powder-free gloves.

b. The key market player in the Asia Pacific disposable gloves market includes Ansell Ltd.; Top Glove Corporation Bhd; Hartalega Holdings Berhad; The Glove Company; Supermax Corporation Berhad; Kossan Rubber Industries Bhd; Everpro Gloves; Wuxi Fbyl Leather Corporation Ltd.; Dahanu Rubber Gloves Mfg. Co,; Sri Trang gloves.

b. The key factors that are driving the Asia Pacific disposable gloves market include, the expansion of healthcare facilities, such as hospitals and clinics, as well as the rise in people preferring home care services. In addition, medical tourism in the region is on the rise, and the increasing population, along with an aging demographic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."