- Home

- »

- Advanced Interior Materials

- »

-

Nitrile Gloves Market Size & Share, Industry Report, 2030GVR Report cover

![Nitrile Gloves Market Size, Share & Trends Report]()

Nitrile Gloves Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Powdered, Powder Free), By Product (Disposable, Durable), By End Use (Medical & Healthcare, Automotive), By Region And Segment Forecasts

- Report ID: GVR-4-68039-104-2

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nitrile Gloves Market Summary

The global nitrile gloves market size was valued at USD 4.71 billion in 2024 and is projected to reach USD 7.92 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. Increasing awareness among industry participants about the importance of worker safety and security in the workplace, coupled with stringent regulations and high costs associated with workplace hazards, is expected to drive industry growth.

Key Market Trends & Insights

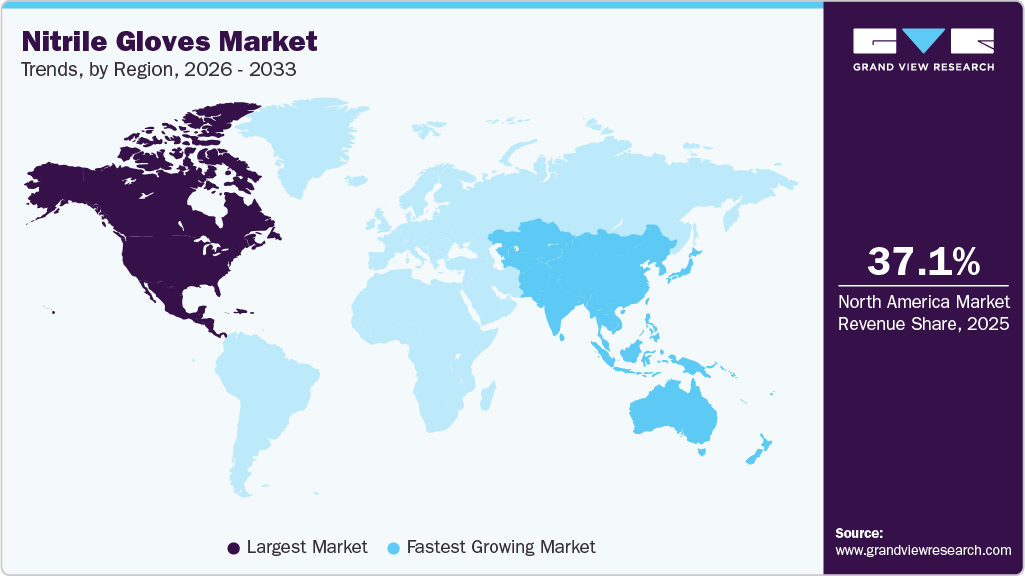

- North America nitrile gloves dominated the market with the largest revenue share of 35.7% in 2024.

- The U.S. nitrile gloves market held the largest country share in 2024.

- By type, the powder free segment dominated the market with the largest share of 73.9% in 2024.

- By end use, the medical & healthcare segment held the largest revenue share in 2024.

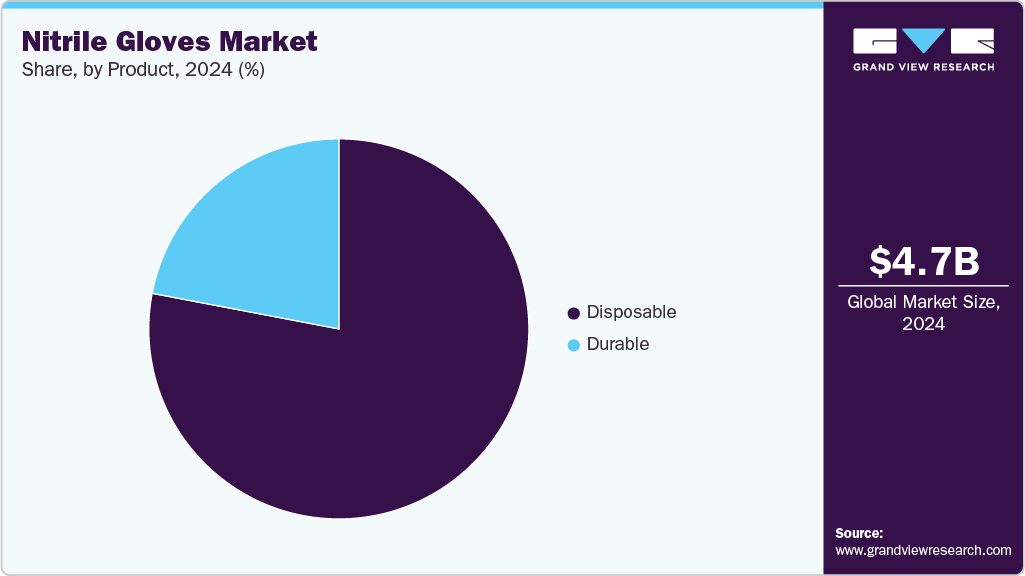

- By product, the disposable segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.71 Billion

- 2030 Projected Market Size: USD 7.92 Billion

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The significance of worker safety has risen significantly due to the growing employment across industries globally. The rising awareness of safety and health measures in emergency response situations is expected to impel the demand for nitrile gloves in the healthcare sector. Furthermore, concerns about on-the-job transmission of blood-borne pathogens and germs have led to higher product adoption in medical and healthcare facilities.In the U.S., a large geriatric population, advanced healthcare infrastructure, and relatively high disposable incomes among patients are key drivers of the healthcare industry. In addition, the country has the highest healthcare spending globally. These factors are projected to positively impact product demand within the healthcare sector. Ongoing innovations and advancements in surgery, such as standardized procedures, technical improvements, and high-reliability organizing (HRO), are expected to drive hospital sector growth and increase demand for medical-grade gloves.

Stringent government regulations concerning the safety of patients, medical staff, and other hospital employees, along with substantial penalties for non-compliance, have encouraged the use of gloves to protect workers from infections and health hazards. Hence, growth in the medical and healthcare sectors is expected to further fuel product demand in the U.S.

In middle- and low-income economies, rising healthcare spending is largely driven by increased public funding rather than out-of-pocket expenditure. Factors such as expanding public healthcare systems, greater economic capacity, and population growth are expected to contribute to this trend. Moreover, an aging population, a growing number of individuals with chronic and long-term conditions, rising labor costs, staff shortages, and the demand for broader healthcare services are projected to boost global healthcare spending. This increased demand for healthcare services has led to greater use of personal protective equipment, including nitrile gloves. The expanding geriatric population is also expected to increase healthcare expenditure further, positively impacting the nitrile gloves industry.

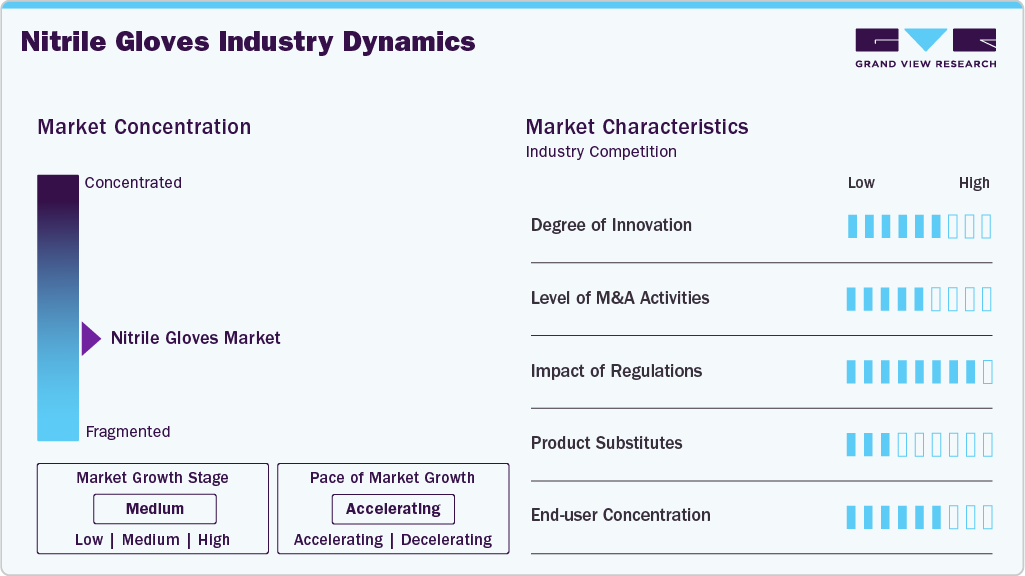

Market Concentration & Characteristics

The market growth stage is medium, and the pace of its growth is accelerating. The market is characterized by a high degree of competition owing to the various cost-efficient technologies used for the manufacturing of nitrile gloves. The market is fragmented due to the presence of a large number of manufacturers at the global level.

The market is also characterized by a high degree of product innovation, leading to the development of high-quality nitrile gloves. The demand for sustainable and eco-friendly nitrile gloves is increasing, which is expected to drive higher R&D spending by market players. Furthermore, the global market is significantly influenced by growing regulatory compliance worldwide.

The industry focuses on R&D activities to develop new technologies for manufacturing nitrile gloves and integrates across various stages of the value chain to gain a competitive edge in the market. Market players strive to develop applications that offer a competitive advantage. The presence of local players in Asia Pacific poses a substantial threat to large multinational companies, particularly in terms of product quality and pricing offered to customers.

New product launches significantly shape the nitrile gloves market by driving innovation and addressing evolving consumer demands. Manufacturers continuously introduce advanced nitrile gloves with enhanced features such as improved puncture resistance, comfort, and eco-friendliness. These innovations attract more customers and cater to specific industries, especially food processing, healthcare, and manufacturing, requiring specialized gloves. New product introductions often impel competitors to upgrade their offerings, resulting in increased market competition and the overall growth of the nitrile gloves industry. For instance, in October 2024, Unigloves and KluraLabs introduced the CrossGuard antimicrobial nitrile glove, eliminating 99.99% of selected bacteria within 60 seconds.

Type Insights

The powder free segment dominated the market with the largest share of 73.9% in 2024, driven by growing demand across healthcare, food, and cleanroom applications. These gloves significantly reduce the risk of allergic reactions, making them ideal for sensitive users and environments. Their ability to minimize contamination has made them the preferred choice in laboratories, food processing, and medical settings. As industries prioritize safety and hygiene standards, the demand for powder-free nitrile gloves is growing steadily, reinforcing their leading market position. In November 2024, Sybron launched a new range of biodegradable nitrile gloves for the hospitality, healthcare, and education sectors. These gloves biodegrade 81% in 491 days, are powder free, food-approved, and available in blue or black with improved grip.

The powdered segment is anticipated to grow significant CAGR over the forecast period, attributed to its ease of use and cost-effectiveness, especially in industrial and non-medical settings. Powdered gloves are easier to don and remove, making them suitable for environments requiring frequent glove changes. They also help reduce sweating and improve comfort during extended use.

Product Insights

The disposable segment accounted for the largest revenue share in 2024, fueled by the critical need for hygiene in healthcare, food processing, and food service industries. In these sectors, strict cleanliness standards prohibit reusable gloves due to contamination risks. Disposable gloves offer a reliable solution, allowing workers to frequently change gloves without compromising hygiene. Their convenience, safety, and cost-effectiveness make them the preferred choice in environments where infection control and cleanliness are paramount, thereby fueling strong demand and ensuring continued growth in this segment. For instance, in February 2024, Ansell launched the MICROFLEX Mega Texture 93-256 glove, an ultra-textured nitrile disposable glove designed for automotive workers and industrial use.

The durable segment is projected to witness significant growth in the nitrile gloves industry from 2025 to 2030, propelled by growing demand from sectors that operate in harsh and high-risk environments. These gloves, known for their strength and extended usability, are ideal for oil & gas, chemical & petrochemical, automotive, and metal & machinery sectors. Their ability to be reused multiple times significantly reduces waste and offers environmental and cost-saving benefits. As industries increasingly seek long-lasting protective solutions, the durable nitrile glove segment is set to experience substantial growth in the years ahead.

End Use Insights

The medical & healthcare segment held the largest revenue share in 2024, driven by its vital role in preventing cross-contamination and the transmission of pathogens during medical procedures. These gloves offer superior protection against bloodborne pathogens, germs, and other contaminants, making them essential in healthcare environments. With high puncture resistance, excellent barrier protection, and durability, nitrile gloves are favored for medical examinations and surgeries. The growing need for hygiene and safety in healthcare settings continues to fuel strong demand, reinforcing the segment’s dominant market position. For instance, in January 2024, Kimberly-Clark Professional introduced Kimtech Polaris Nitrile Gloves, designed to provide safety and comfort to scientists in demanding environments. Examination gloves are used by doctors, nurses, caregivers, and other healthcare professionals for non-invasive physical examinations. The pharmaceutical segment is expected to witness lucrative growth from 2025 to 2030, as these gloves protect the employees working in the industry against biological agents, chemical substances, and drugs. Nitrile gloves exhibit good puncture resistance and offer higher chemical resistance, most notably for solvents widely used in the pharmaceutical industry. Moreover, nitrile dissipates and does not cause allergic reactions, which is why they are preferred in the pharmaceutical industry. Thus, product adoption is increasing in the pharmaceutical application segment.

The pharmaceutical segment is expected to be the fastest-growing segment over the forecast period, owing to the increasing need for protective gear against biological agents, chemicals, and drugs. Nitrile gloves are highly valued for their superior puncture resistance and chemical resistance, particularly to solvents commonly used in pharmaceutical production. Moreover, their non-allergenic properties make them ideal for use in environments where worker safety is critical. As the pharmaceutical industry continues to expand, the demand for nitrile gloves is set to rise, further boosting market growth.

Regional Insights

North America nitrile gloves dominated the market with the largest revenue share of 35.7% in 2024, fueled by increasing healthcare expenditure, an aging population, and heightened awareness of healthcare-acquired infections (HAIs) among healthcare workers. The rise in chronic illnesses, including obesity, further contributes to higher healthcare costs, creating a greater demand for nitrile gloves. In addition, the region’s significant number of major glove manufacturers ensures a reliable supply of gloves, supporting the growing demand in both healthcare and industrial sectors.

U.S. Nitrile Gloves Market Trends

The U.S. nitrile gloves market held the largest country share in 2024, propelled by its advanced healthcare infrastructure and a large geriatric population. With the highest healthcare spending globally, the demand for medical-grade nitrile gloves is substantial, particularly in the healthcare sector.

Europe Nitrile Gloves Market Trends

Europe nitrile gloves market is set to experience significant expansion over the forecast period, attributed to increasing awareness of hygiene and safety regulations, especially in healthcare and food processing sectors. The rising emphasis on worker safety across various industries and stringent regulations has led to a growing demand for disposable gloves.

Asia Pacific Nitrile Gloves Market Trends

Asia Pacific nitrile gloves market is expected to grow at the fastest CAGR of 10.3% from 2025 to 2030, owing to the growing demand for nitrile gloves across various industries, including healthcare, manufacturing, and construction. Increased healthcare spending and enhanced infrastructure in emerging economies are boosting the adoption of nitrile gloves for medical and infection control purposes. Moreover, the region’s prominent glove manufacturing hubs, particularly in Thailand and Malaysia, are improving production capabilities and supply chain efficiency.

India is projected to grow at the fastest CAGR over the forecast period, fueled by increasing demand across the healthcare and industrial sectors. The expansion of the healthcare infrastructure, particularly in clinics, hospitals, and laboratories, is fueling the need for high-quality protective gloves. Furthermore, as India’s industrial and automotive sectors grow, the need for nitrile gloves to ensure worker safety and meet health standards is rising.

Latin America Nitrile Gloves Market Trends

The CSA nitrile gloves market growth is driven by the high product demand in hospitals, labs, and clinics due to the increased awareness of hygiene practices and safety regulations. In addition to maintain food safety and hygiene, nitrile gloves have become increasingly popular as the region's food processing and handling sector has grown. Furthermore, strict occupational safety laws and government programs to upgrade the region's healthcare system contributed to regional market growth.

The nitrile gloves market in Brazil is expected to witness lucrative growth due to the growing geriatric population, coupled with the increasing burden of non-communicable chronic diseases, which is expected to drive the demand for healthcare services. Moreover, rapid growth in the secondary sector has driven the product demand in industries such as automotive, pharmaceutical, food processing, and chemical.

Middle East & Africa Nitrile Gloves Market Trends

The Middle East & Africa nitrile gloves market growth is driven by the emphasis on worker safety in the region's massive infrastructure project and growing construction industry, which necessitates using premium personal protective equipment (PPE), such as nitrile gloves. The product usage for infection prevention, fueled by the rising incidence of infectious disease and strict hygiene standards, especially in the food handling and healthcare industry, will also drive market expansion. Moreover, the market is expected to grow due to the rising importance of occupational safety regulations and the expansion of healthcare facilities in the region.

The nitrile gloves market in Saudi Arabia is expected to grow at a lucrative rate in the coming years, owing to the development of the manufacturing sector. Rising demand for crude oil & gas in various industrial sectors, such as power and transport, is expected to drive the production of oil & gas in the country. Concerns regarding employee health & safety in various industries, including petrochemicals, aluminum production, and food processing, are also expected to drive the demand for nitrile gloves significantly.

Key Nitrile Gloves Company Insights

Some of the key companies in the nitrile gloves industry include Ansell Ltd; Top Glove Corporation Bhd; Hartalega Holdings Berhad; Unigloves (UK) Limited; and Kossan Rubber Industries Bhd.

-

Ansell Ltd. offers a wide range of protective solutions, including gloves, personal protective equipment (PPE), and clothing. It serves the healthcare, manufacturing, and automotive industries and offers brands such as MICROFLEX, HyFlex, and GAMMEX.

-

Kossan Rubber Industries Bhd specializes in manufacturing rubber products, including disposable gloves, technical rubber components, and cleanroom equipment. It provides innovative, high-quality solutions for healthcare, automotive, and industrial sectors worldwide.

Key Nitrile Gloves Companies:

The following are the leading companies in the nitrile gloves market. These companies collectively hold the largest market share and dictate industry trends.

- Ansell Ltd

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Unigloves (UK) Limited

- Adenna LLC (hospeco brands group)

- Kossan Rubber Industries Bhd

- Superior Glove

- MCR Safety

- Supermax Corporation Berhad

- Ammex Corporation

- Cardinal Health

- Medline Industries, LP

- Globus

- Atlantic Safety Products

- MAPA Professional (Newell Co.)

Recent Developments

-

Ansell Ltd. is likely to finish constructing its new plant in Tamil Nadu, India, in 2024. This plant is constructed with an investment of USD 80 million. Apart from manufacturing surgical gloves, this new facility is designed to manufacture different categories of products. This expansion initiative is likely to help Ansell Ltd. penetrate the regional market.

-

In January 2023, Unigloves (UK) Ltd. acquired the Derma Shield business. This acquisition is likely to help Unigloves (UK) Ltd. expand its product portfolio of hand and arm protection products.

Nitrile Gloves Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.09 billion

Revenue forecast in 2030

USD 7.92 billion

Growth Rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; Italy; Spain; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Ansell Ltd; Top Glove Corporation Bhd; Hartalega Holdings Berhad; Unigloves (UK) Limited; Adenna LLC; Kossan Rubber Industries Bhd; Superior Glove; MCR Safety; Supermax Corporation Berhad; Ammex Corporation; Cardinal Health; Medline Industries, LP; Globus; Atlantic Safety Products; and MAPA Professional

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitrile Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nitrile gloves market report based on type, product, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Powdered

-

Powder Free

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Durable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical & Healthcare

-

Examination

-

Surgical

-

-

Automotive

-

Oil & Gas

-

Food & Beverage

-

Metal & Machinery

-

Chemical & Petrochemical

-

Pharmaceutical

-

Cleanroom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.