- Home

- »

- Advanced Interior Materials

- »

-

Disposable Gloves Market Size, Share, Industry Report, 2030GVR Report cover

![Disposable Gloves Market Size, Share & Trends Report]()

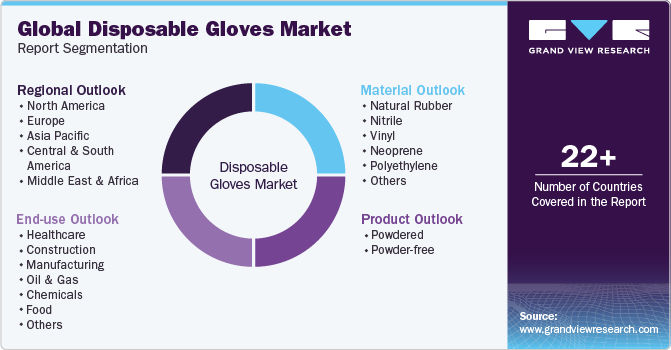

Disposable Gloves Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene), By Product (Powdered, Powder-free), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-574-8

- Number of Report Pages: 212

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Gloves Market Summary

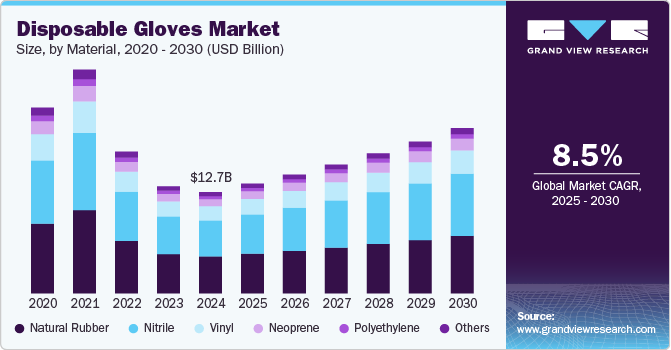

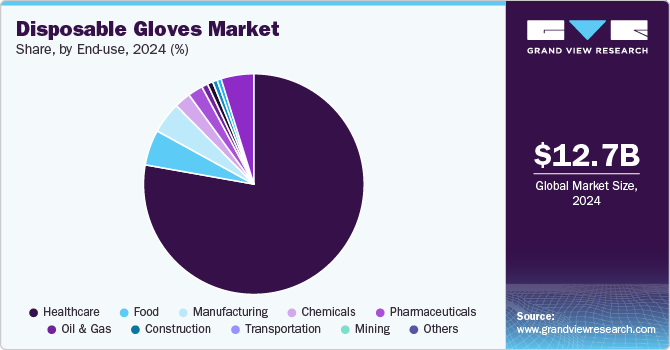

The global disposable gloves market size was estimated at USD 12.71 billion in 2024 and is projected to reach USD 20.71 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The global disposable gloves industry is anticipated to grow over the coming years on account of several factors including favorable occupational safety regulations, increasing importance of safety and security at workplaces, and rising healthcare expenditure.

Key Market Trends & Insights

- North America disposable gloves market dominated globally and accounted for 36.7% of the global market share in 2024.

- The disposable gloves industry in the U.S. is expected to grow at a CAGR of 8.8% from 2025 to 2030.

- By material, natural rubber led the market and accounted for 36.4% of the global revenue demand in 2024.

- By product, the powder-free product segment dominated the market with the largest revenue share in 2024.

- By end use, the healthcare segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.71 Billion

- 2030 Projected Market Size: 20.71 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

The healthcare industry in major developing economies is anticipated to witness substantial growth on account of several factors, such as increasing investments in both private and public sectors along with rising population, the high influx of migrants, and the growing geriatric population. Furthermore, rising healthcare expenditure is projected to drive the growth of the healthcare sector, which, in turn, is estimated to augment the demand for disposable gloves.

The disposable gloves industry is driven by factors such as advanced healthcare infrastructure, higher patient disposable income, and a significant geriatric population. Moreover, in various industries such as healthcare, medical, and mining, exposure to harmful chemicals poses a significant risk to workers' health, leading to issues such as skin diseases, rashes, hand cuts, amputation, and exposure to bloodborne pathogens. The implementation of safety regulations is expected to play a crucial role in driving market growth.

There is a growing awareness of the importance of raw materials in providing disposable gloves with high heat resistance, comfort, elasticity, and lightweight properties. This awareness is anticipated to fuel research and development activities among major players in the market, aiming to enhance the functionality of disposable gloves and expand their application through innovative design enhancements.

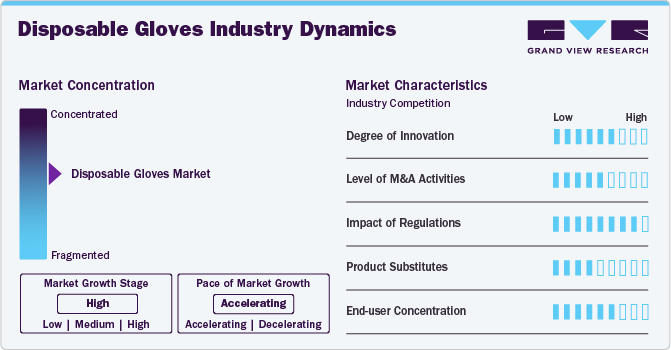

Market Concentration & Characteristics

Market growth stage is medium, with an accelerating pace. The disposable gloves industry is characterized by a high degree of competition, with a few key players dominating the industry. Major players in the disposable gloves industry often have a global presence, supplying products to various regions and industries. Companies in this sector usually offer a diverse range of disposable gloves, catering to different industries such as healthcare, food, pharmaceuticals, and industrial sectors.

Due to the critical nature of applications, especially in healthcare, companies adhere to strict quality standards and certifications to ensure the safety and efficacy of their products. Research and development initiatives are common among leading players, focusing on technological innovations to improve the functionality, durability, and safety features of disposable gloves.

Major players in the disposable gloves industry often integrate vertically along the supply chain. This integration includes activities ranging from raw material sourcing to manufacturing and distribution. Vertical integration helps companies control costs, ensure a steady supply of high-quality materials, and maintain a competitive edge in the market.

In response to growing environmental concerns, some industry players are increasingly focusing on sustainability initiatives. This includes efforts to develop eco-friendly materials, reduce waste in production processes, and implement environmentally responsible practices. These sustainability efforts align with broader global trends and consumer preferences for environmentally friendly products, contributing to the long-term viability of companies in the disposable gloves industry.

Drivers, Opportunities & Restraints

The disposable gloves industry is primarily driven by increasing health and safety concerns across various industries, such as healthcare, food processing, and pharmaceuticals. The growing awareness regarding hygiene, particularly in the wake of the COVID-19 pandemic, has significantly boosted demand for gloves. In addition, stringent government regulations and guidelines mandating the use of personal protective equipment (PPE) in workplaces further fuel market growth.

One of the key restraints for the disposable gloves industry is the environmental impact associated with single-use gloves. The increasing awareness about plastic waste and the strain on landfills due to disposable items has led to growing concerns. Additionally, the rising costs of raw materials like latex, nitrile, and PVC may hinder market growth, particularly for manufacturers relying on imported materials.

The market presents significant opportunities for innovation in eco-friendly and biodegradable glove options, catering to the rising demand for sustainable products. As more industries prioritize environmental responsibility, the development of gloves made from alternative materials, such as plant-based or recycled content, is a growing market opportunity. Furthermore, expanding healthcare and industrial sectors in emerging economies presents new growth avenues for disposable glove manufacturers.

Material Insights

Natural rubber led the market and accounted for 36.4% of the global revenue demand in 2024. Natural rubber disposable gloves offer superior performance and protection in various applications such as medical & dental, food processing & service, janitorial & sanitation, pharmaceutical, and automotive. However, allergy caused by natural latex acts as a significant restraint, limiting the penetration of natural rubber gloves in the medical and food industries. Nitrile emerged as the fastest growing material used for disposable owing to the latex-free, chemical resistance, and long shelf life offered by nitrile gloves. Disposable examination gloves have witnessed significant growth in medical & healthcare sectors on account of higher demand products in hospital, veterinary, and dental applications.

Vinyl disposable gloves are latex-free and are made from polyvinyl chloride and plasticizers. These gloves offer high comfort and tactile sensitivity as compared to neoprene gloves. Vinyl gloves are suitable in an environment where frequent change of gloves is required, such as food preparation. Vinyl gloves are used in manufacturing, food processing, print shops, assembly, and medical industries. Polyethylene (PE) emerges as the most cost-effective material for gloves. Renowned for their affordability, PE gloves boast a loose fit and lightweight nature. Engineered for swift and effortless donning and removal, these gloves are latex- and powder-free. Primarily employed in light-duty applications demanding regular glove changes, PE gloves are ideal for tasks like food processing and serving, salad preparation, and various other food-related applications.

Product Insights

The powder-free product segment dominated the market with the largest revenue share in 2024. Stringent regulations on the use of powdered gloves by several governments worldwide are expected to have a positive impact on the powder-free gloves market over the forecast period. Powder-free gloves are treated with chlorination, which makes them less form-fitting to eliminate the use of powder for easy donning and removal. Rising preference for powder-free gloves across several industries, including chemical, medical, and food processing, among others, is projected to drive the market over the forecast period.

The advantages of using powdered gloves compared to powder-free gloves include their ability to fit tightly and offer protection against hazardous chemicals or physical contaminants. Cornstarch powder used in latex gloves is likely to contribute towards allergies or sensitivity, although it is not a concern in the case of vinyl or nitrile gloves. On January 19, 2017, the U.S. Food and Drug Administration (FDA) banned the manufacturing, sales, and distribution of all powdered patient examination gloves, powdered surgeon gloves, and absorbable powder used to lubricate surgeon's gloves, which, in turn, anticipated to hamper the growth of powdered gloves market over the forecast period.

End Use Insights

The healthcare end use segment dominated the market in 2024. Regions with advanced healthcare systems and a large geriatric population tend to exhibit higher demand for disposable gloves. In addition, global events that heighten awareness of hygiene, such as pandemics, can significantly boost market demand, especially in the healthcare sector. Disposable gloves are often classified based on application as surgical gloves and examination gloves. Disposable examination gloves have witnessed substantial growth in the medical sector on account of higher demand in hospital, veterinary, and dental applications. Surgical disposable gloves have high-quality standards compared to examination gloves and are commonly used by surgeons and operating room nurses.

Disposable gloves are essential to protect employees against hand injuries that are common across numerous industries, including food processing, construction, automotive, oil & gas, and metal fabrication. These gloves protect hands from hot objects, splinters, bodily fluids, sharp edges, excessive vibrations, electricity, and extreme cold. The demand for disposable gloves in the chemical & petrochemical industries is anticipated to witness substantial growth from 2025 to 2030 owing to the rising adoption of the product for handling volatile chemicals in laboratories and chemical industries. Furthermore, rising concerns pertaining to employee safety and initiatives to reduce injury rates in manufacturing facilities are anticipated to augment the demand for protective gloves over the forecast period.

Regional Insights

North America disposable gloves market dominated globally and accounted for 36.7% of the global market share in 2024. The disposable gloves industry in North America has experienced strong growth, driven primarily by increasing awareness of hygiene, especially in healthcare settings due to the COVID-19 pandemic. Demand from the food and manufacturing industries, as well as government regulations requiring PPE use, have also contributed to the market's expansion. North America’s preference for high-quality nitrile gloves, due to their durability and chemical resistance, is also a key trend, with manufacturers investing in local production to address supply chain challenges.

U.S. Disposable Gloves Market Trends

The disposable gloves industry in the U.S. is expected to grow at a CAGR of 8.8% from 2025 to 2030. The U.S. remains a dominant market for disposable gloves, especially driven by the healthcare sector’s need for infection control and PPE. Additionally, the food and automotive industries’ growing demand for gloves in everyday operations supports market growth. The trend towards eco-friendly and sustainable glove materials, such as biodegradable gloves, is also gaining traction as the U.S. becomes more conscious of environmental issues.

Canada disposable gloves market is expected to grow at a CAGR of 7.9% from 2025 to 2030. In Canada, the demand for disposable gloves has surged across healthcare, food, and industrial sectors, with significant growth in the pharmaceutical and biotechnology industries. Canadian regulations on safety standards and hygiene in healthcare settings have further fueled market growth. The trend toward sustainable and eco-conscious products, as well as a push for local manufacturing to reduce reliance on imports, is shaping the Canadian market.

Europe Disposable Gloves Market Trends

The disposable gloves industry in Europe is driven by stringent regulatory requirements in the healthcare and food industries, where hygiene and safety are critical. The rise of the elderly population and the expanding healthcare infrastructure contribute to increasing glove usage. Furthermore, the shift towards eco-friendly materials and recyclable gloves is a growing trend, aligning with Europe’s broader sustainability goals.

Germany disposable gloves industry held a 25.1% share of the European market. Germany has emerged as a key player in the European market, with its well-established healthcare and pharmaceutical industries driving the demand. The country’s strict hygiene standards and increasing focus on infection control in hospitals and clinics are boosting market growth. In addition, the shift toward biodegradable and sustainable gloves is aligned with Germany’s environmental policies, encouraging innovation in the glove manufacturing sector.

France disposable gloves industry is expanding, fueled by heightened hygiene awareness, particularly within the healthcare and food industries. The market is also driven by government regulations requiring the use of PPE in public health sectors. With a growing preference for high-quality gloves and increasing awareness of environmental concerns, there is a rising demand for gloves made from sustainable materials, such as latex alternatives and biodegradable options.

Asia Pacific Disposable Gloves Market Trends

Asia Pacific disposable gloves industry is experiencing rapid growth due to the region’s expanding healthcare sector, increased industrial activities, and heightened awareness of hygiene practices. The market is particularly booming in countries like China and India, where healthcare infrastructure development and rising healthcare expenditures drive demand for gloves. The region is also seeing increased adoption of nitrile gloves due to their superior properties compared to latex gloves.

China disposable gloves industry held a 35.8% share in the Asia Pacific market. China is a major hub for the production and consumption of disposable gloves, driven by its booming healthcare industry, food industry, and growing industrial sectors. The country’s push for increased safety standards, coupled with an expanding middle class and heightened awareness of hygiene, has significantly boosted demand for gloves. Additionally, the growing trend towards domestic manufacturing to reduce dependency on imports is reshaping the market.

The disposable gloves industry in India is expected to grow at a CAGR of 10.1% from 2025 to 2030. The market in India is expanding rapidly, fueled by the country’s growing healthcare sector, increasing prevalence of infectious diseases, and rising awareness of hygiene practices. The adoption of gloves is on the rise in both healthcare and food industries. Furthermore, government initiatives aimed at improving healthcare infrastructure and sanitation are likely to drive continued market growth, with an increasing demand for affordable yet high-quality gloves.

Middle East & Africa Disposable Gloves Market Trends

The Middle East and Africa disposable gloves industry is witnessing growth due to a rising awareness of hygiene and safety standards, particularly in healthcare, food handling, and personal care industries. Increasing government regulations on infection control, particularly in hospitals and clinics, are driving the demand for gloves. Additionally, the region's growing population and the healthcare industry's expansion provide significant growth opportunities for glove manufacturers.

Saudi Arabia's disposable gloves industry is expanding due to increased healthcare investments, rising hygiene awareness, and the implementation of stringent infection control measures. The government's focus on improving healthcare services and infrastructure, along with growth in food safety regulations, is propelling market demand. Furthermore, Saudi Arabia’s efforts toward sustainability and the introduction of eco-friendly glove alternatives are emerging as key trends.

Latin America Disposable Gloves Market Trends

The disposable gloves industry in Latin America is expanding, driven by increasing healthcare investments and the demand for personal protective equipment in the wake of the pandemic. Countries such as Mexico and Brazil are seeing heightened demand for gloves in hospitals, clinics, and food processing industries. Moreover, as environmental concerns rise in the region, there is an emerging trend towards sustainable glove alternatives, creating opportunities for manufacturers.

The disposable gloves industry in Brazil is seeing growth due to increasing healthcare requirements, including the expansion of medical facilities and heightened hygiene awareness. The rise in the food processing and manufacturing industries is also contributing to glove demand. Additionally, Brazil’s growing focus on sustainable products and eco-friendly alternatives in healthcare and industry is expected to drive future market trends.

Key Disposable Gloves Company Insights

Some key players in the disposable gloves industry include: Top Glove Corporation Bhd, Hartalega Holdings Berhad, Ansell Ltd, and Kossan Rubber Industries Bhd.

-

Top Glove is one of the largest manufacturers of rubber gloves globally. The company produces a wide range of disposable gloves, including latex, nitrile, and vinyl gloves. It serves various industries, such as healthcare, food, and industrial sectors.

-

Hartalega specializes in the production of nitrile gloves. Known for its focus on innovation and technology, Hartalega is a key player in the disposable gloves industry, supplying gloves to healthcare and laboratory settings.

Supermax Corporation Berhad, Kossan Rubber Industries, and Bhd Kimberly-Clark Corporation are some of the emerging market participants in the disposable gloves industry.

-

Kossan Rubber Industries, based in Malaysia, is engaged in the manufacturing of various rubber products, including disposable gloves. The company produces gloves for medical and non-medical applications, emphasizing quality and technological advancements.

-

Kimberly-Clark, a U.S.-based multinational corporation, is known for its consumer and professional healthcare products. The company produces disposable gloves under various brands for use in healthcare and industrial settings.

Key Disposable Gloves Companies:

The following are the leading companies in the disposable gloves market. These companies collectively hold the largest market share and dictate industry trends.

- Ansell Ltd

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd

- Ammex Corporation

- Kimberly-Clark Corporation

- Sempermed USA, Inc

- MCR Safety

Recent Developments

-

In February 2024, Ansell Ltd. announced the full acquisition of Careplus (M) Sdn Bhd (Careplus). This acquisition increased Ansell’s production capacity of surgical gloves to meet the growing global demand and strengthen its supply chain, and ensure greater control over the quality of its products.

-

In August 2022, Supermax Corp Bhd's subsidiary, Supermax Healthcare Canada, unveiled a strategic partnership with Minco Wholesale & Supply Inc. through a formal agreement. This collaboration entails distributing Canadian manufacturer Supermax's products throughout North America. These offerings encompass rubber gloves, masks, and non-woven cotton medical products.

Disposable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.76 billion

Revenue forecast in 2030

USD 20.71 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2025

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East, and Africa

Country scope

U.S., Canada, Mexico, Germany, France, Italy, Russia, Spain, UK, China, India, Japan, South Korea, Indonesia, Australia, Thailand, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, and South Africa

Key companies profiled

Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, Unigloves (UK) Limited, The Glove Company, Superior Gloves, MAPA Professional, Adenna LLC, MCR Safety, Atlantic Safety Products, Inc, Globus (Shetland) Ltd., Supermax Corporation Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, Kimberly-Clark Corporation, Sempermed USA, Inc, Halyard Health, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global disposable gloves market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Powdered

-

Powder-free

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global disposable gloves market size was estimated at USD 12.71 billion in 2024 and is expected to reach USD 13.76 billion in 2025.

b. The global disposable gloves market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 20.71 billion by 2030.

b. Natural rubber led the market and accounted for 36.4% of the global revenue demand in 2024. Natural rubber disposable gloves offer superior performance and protection in various applications such as medical & dental, food processing & service, janitorial & sanitation, pharmaceutical, and automotive.

b. Some of the key players operating in the disposable gloves market include Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, The Glove Company, Superior Gloves, Adenna LLCSupermax Corporation Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, and Kimberly-Clark Corporation.

b. The key factors that are driving the disposable gloves market include the increasing product demand from numerous end-use industries including medical & healthcare, pharmaceutical, automotive finishing, chemical, and oil & gas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.