Market Size & Trends

The Asia Pacific drug development market size was valued at USD 49.10 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. Market growth is driven by a synergy of factors, including the region’s unique healthcare landscape, demographic trends, and technological advancements. The growing prevalence of chronic diseases is driving the development of innovative therapies and personalized medicine, necessitating the creation of targeted drug delivery systems that enhance treatment outcomes and patient compliance.

The region’s technological advancements are also playing a crucial role in driving the growth of the market. Innovations in drug delivery technologies, including nanotechnology, microencapsulation, and 3D printing, are revolutionizing the pharmaceutical landscape. These advancements are leading to the creation of novel drug delivery systems that improve drug stability, bioavailability, and controlled release, making them more effective for patients.

Government support and regulatory reforms are catalyzing drug development in the Asia Pacific region. Notable initiatives include Japan’s subsidy programs, designed to enhance local production capabilities, and China’s regulatory reforms, aimed at streamlining the drug approval process and promoting innovation. Key government agencies, such as METI, JETRO, JFC, and MEXT, are leading the way in offering incentives to drive growth and development in the region’s pharmaceutical sector.

Industry growth is driven by the growing demand for personalized medicine, exemplified by South Korea’s focus on targeted therapies based on genetic profiles. The region’s robust healthcare infrastructure and increasing R&D investments support innovation in drug delivery systems. Rising healthcare expenditure in China and India, driven by public and private investments, also fuels growth. The combination of factors, including disease prevalence, technological advancements, and supportive government policies, drives industry growth.

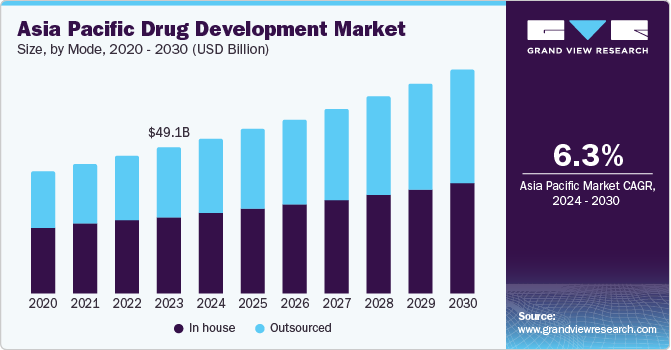

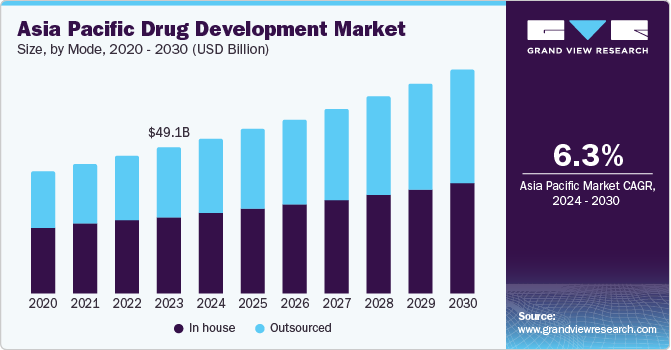

Mode Insights

In house drug development dominated the market and accounted for a share of 52.8% in 2023. Developing drugs in-house offers greater control over the process and accelerated timelines, making it a crucial strategy for companies creating innovative or niche treatments. As the Asia Pacific pharmaceutical industry advances, companies are investing in training and development initiatives to build a skilled workforce for in-house projects. In-house development also enables greater control over sensitive intellectual property data.

Outsourced drug development is expected to register the fastest CAGR of 7.4% during the forecast period. Pharmaceutical companies have leveraged outsourcing to gain a competitive edge, particularly in countries with lower costs such as India. Patent expiries, generic competition, and stringent regulations have also driven the adoption of CMO services. Western companies and local players, such as Eisai, outsource manufacturing processes, including generics, in Asia, contributing to the outsourced drug development model’s significant impact on market revenue.

Process Steps Insights

Process research development accounted for the largest market revenue share of 19.6% in 2023. The Asia Pacific region is emerging as a hub for groundbreaking drug discovery. To deliver innovative treatments, robust research and development processes are crucial for efficient manufacturing of new medications. Scalable manufacturing methods are vital for timely and cost-effective market entry. CROs in the region specialize in process R&D, enabling pharmaceutical companies to tap into this expertise without investing in their own capabilities.

The DMPK (Drug Metabolism and Pharmacokinetics) segment is expected to register the fastest CAGR of 7.7% during the forecast period. Asia Pacific countries offer cost-effective DMPK investigations, attracting pharmaceutical companies seeking to optimize their research and development spending. The region’s focus on biologics platforms underscores the importance of DMPK knowledge, particularly for biologics drugs that may exhibit unique metabolites and pathways. Global pharmaceutical firms are increasingly outsourcing DMPK studies to Asian CROs due to lower costs and specialized expertise.

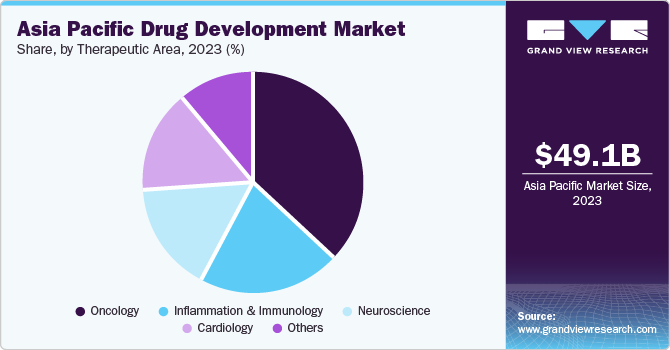

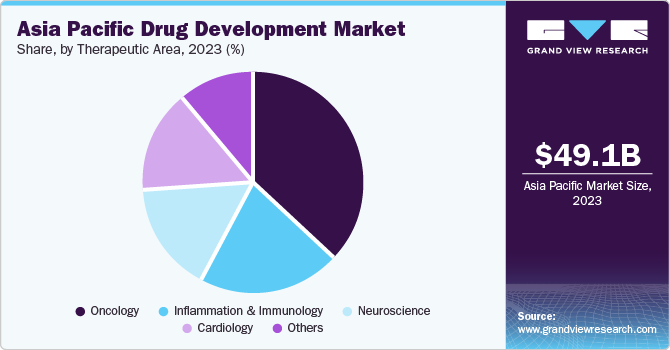

Therapeutic Area Insights

Oncology dominated the market and accounted for a share of 37.0% in 2023. The region is grappling with rising cancer mortality rates, driven by aging populations and lifestyle changes. To address this, innovative and efficient therapies are needed. Public health campaigns have increased awareness and led to earlier detections, creating a larger pool of potential clinical trial participants. As a result, the Asia Pacific has become a hub for oncology clinical trials, with its large patient population, efficient regulatory framework, and focus on prevalent regional cancers.

Inflammation & immunology are projected to grow at the fastest CAGR of 7.5% over the forecast period. The demographic includes a large population of individuals suffering from chronic inflammatory and immunological conditions, including rheumatoid arthritis, psoriasis, and inflammatory bowel disease. This presents a significant market opportunity for novel treatments. Public health initiatives and improved access to information have increased awareness, leading to earlier diagnoses and a growing patient pool seeking treatment.

Regional Insights

China dominated the Asia Pacific drug development market with as share of 32.5% in 2023. The country’s rapidly expanding population and growing prevalence of chronic diseases, such as cancer, diabetes, and heart disease, have created a substantial patient pool and market opportunity for new medications. The Chinese government is actively supporting the development of a domestic pharmaceutical sector through policies that finance research and development, streamline regulatory procedures, and promote innovation, creating a favorable environment for both local and foreign companies to invest in pharmaceutical R&D.

Key Asia Pacific Drug Development Company Insights

Some key companies in Asia Pacific drug development market include Samsung Biologics; WuXi Biologics; CELLTRION INC; and others. Manufacturers are prioritizing expanding their customer base in order to outperform competitors in the market. Hence, major stakeholders are implementing various strategic actions, such as mergers and acquisitions, and collaborations with other significant firms.

-

Samsung Biologics is a CDMO that provides a comprehensive range of services from cell line development to clinical and commercial manufacturing. The company specializes in biopharmaceuticals and offers advanced technologies, including its S-CHOice and S-DUAL platforms for high-performing cell lines and bispecific antibodies.

-

Parexel International (MA) Corporation offers a comprehensive range of drug development and regulatory consulting services. With a strong presence in the Asia Pacific region, Parexel provides expertise in clinical trials, regulatory affairs, and market access strategies, helping clients navigate complex regulations and accelerate new therapy development.

Key Asia Pacific Drug Development Companies:

- Samsung Biologics

- WuXi Biologics

- CELLTRION INC

- PT Kalbe Farma Tbk.

- Eurofins Advinus

- Laboratory Corporation of America Holdings

- Celerion

- Parexel International (MA) Corporation

Recent Developments

-

In June 2024, Kalbe Farma Tbk launched a new dyslipidemia drug, combining rosuvastatin and ezetimibe, through its subsidiary Kalventis. The drug aimed to address disrupted blood fat levels, reducing the risk of cardiovascular conditions such as coronary heart disease.

-

In March 2024, WuXi Biologics broke ground on its new 13.5-hectare CRDMO center in Singapore, marking a USD 1.4 billion investment in the country, adding 120,000L of manufacturing capacity and expected to employ 1,500 staff.

-

In March 2024, Parexel announced Jamie Macdonald’s retirement as CEO, effective May 15, 2024. Peyton Howell, Chief Operating & Growth Officer, succeeded Macdonald as CEO and joined the Board of Directors.

Asia Pacific Drug Development Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 52.01 billion

|

|

Revenue forecast in 2030

|

USD 75.06 billion

|

|

Growth rate

|

CAGR of 6.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Mode, process step, therapeutic area, region

|

|

Regional scope

|

Asia Pacific

|

|

Country scope

|

China, Japan, India, Australia, South Korea, Thailand

|

|

Key companies profiled

|

Samsung Biologics; WuXi Biologics; CELLTRION INC; PT Kalbe Farma Tbk.; Eurofins Advinus; Laboratory Corporation of America; Celerion; Parexel International (MA) Corporation

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Asia Pacific Drug Development Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific drug development market report based on mode, process step, therapeutic area, and region.

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Step Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Research Development

-

Formulation

-

Analytical & Stability Studies

-

DMPK

-

Safety Assessment (Toxicology)

-

Regulatory Compliance

-

Packaging

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand