Market Size & Trends

The Asia Pacific e-cigarette and vape market size was estimated at USD 6.5 billion in 2023 and is anticipated to grow at a CAGR of 34.6% from 2024 to 2030. The region is expected to experience significant growth in the coming years, driven by a combination of factors such as rising consumer awareness, government initiatives, high prevalence of tobacco and drug abuse, e-commerce growth, product innovation, and disposable and rechargeable cig-a-like products.

The Asia Pacific e-cigarette and vape market accounted for a 23.1% share of the global e-cigarette and vape market in 2023. One of the primary drivers is rising consumer awareness regarding the effects of traditional tobacco products. Governments in the region, such as China and Japan, have launched campaigns promoting e-cigarettes as a safer alternative.

Proactive government initiatives, such as South Korea’s strict regulations on tobacco products, have also fueled growth. Moreover, the high prevalence of tobacco and drug abuse in the region has led to an increase in demand for e-cigarettes as a safer alternative. This has resulted in a surge in the demand for e-cigarettes, particularly among adults.

Disposable and rechargeable cig-a-like e-cigarettes are driving market growth in Asia Pacific due to their affordability and availability. Open tank vaporizers are expected to experience higher growth, driven by consumer popularity. The large population of smokers in countries like China and Japan is projected to drive demand for e-cigarettes as a safer alternative.

Thus, the rapid expansion of e-commerce in Asia Pacific is making e-cigarettes more accessible to consumers. Alibaba and Rakuten have launched initiatives to promote online sales, while manufacturers have developed innovative products, such as the “Vape Pen” and “E-Cig,” offering portable and discreet devices.

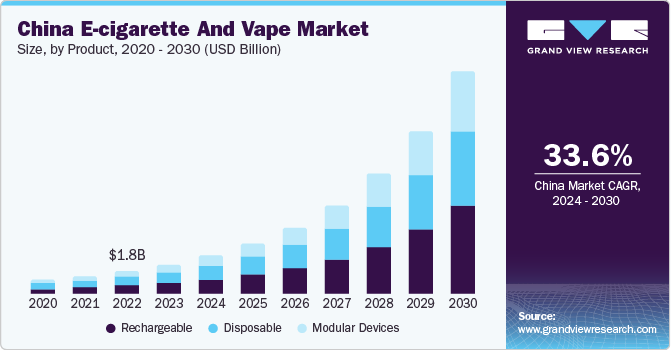

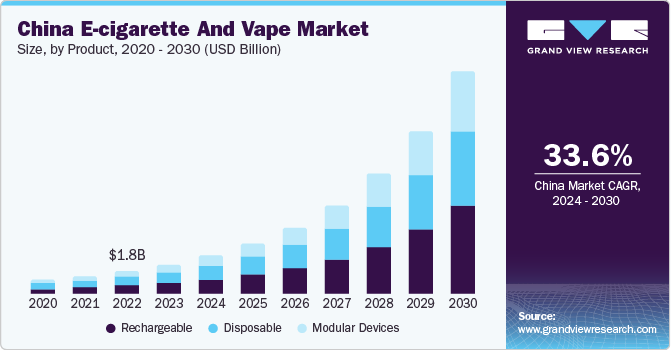

Product Insights

The rechargeable product segment led the market, generating over 35% of the total revenue in 2023. Factors driving its adoption include growing awareness of smoking’s health risks, increased availability of rechargeable batteries and e-cigarettes online, and youth interest in vaping.

The modular devices segment is projected to witness the fastest CAGR of 36.5% from 2024 to 2030. This is due to the innovative design, which allows for customization and flexibility. Modular devices consist of interchangeable parts, such as atomizers and batteries, which can be tailored to individual preferences. The temperature control feature also enables users to precisely adjust the vapor or nicotine levels, making it a popular choice among enthusiasts. Notably, modular devices are often used by professionals in the vaping community, particularly those participating in competitive ape competitions.

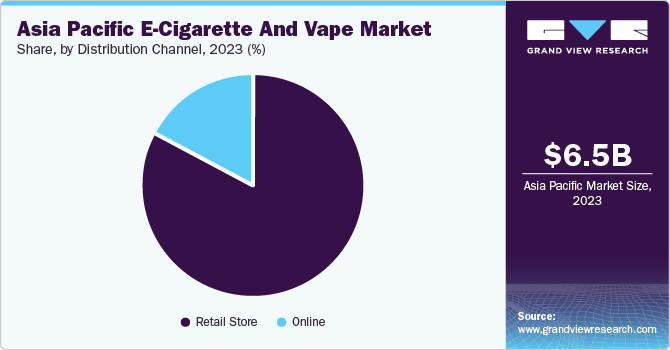

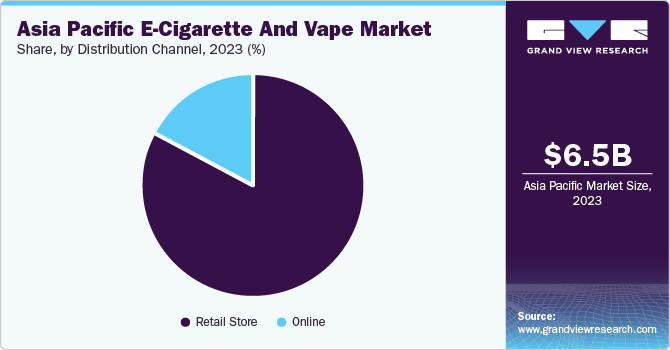

Distribution Channel Insights

Based on distribution channels, retail stores held the largest market share in 2023, with approximately 83.0% share of the total revenue. E-cigarette brands and manufacturers promoted their products across retail shops, convenience stores, gas stations, pharmacies, and supermarkets, driving significant retail sales.

Online distribution channels are expected to grow at the fastest CAGR of 39.4% over the forecast period. Online vape shops have gained popularity, offering customers convenience and a wide range of e-cigarette products. Emerging economies in the Asia Pacific region are driving significant traffic on online marketplaces, providing opportunities for stakeholders.

Country Insights

China E-cigarette And Vape Market Trends

China e-cigarette and vape market held the largest share in 2023, accounting for 35.0% of the total revenue. The market’s rapid growth can be attributed to the surge in vape production volumes and increasing international demand.

Philippines E-cigarette And Vape Market Trends

The e-cigarette and vape market in the Philippines is growing due to the perception of vaping as a safer alternative to traditional smoking in the country. Advancements in pod systems, temperature control, and intelligent features enhance e-cigarette safety, and are aiding the market expansion in the country.

Japan E-cigarette And Vape Market Trends

Japan e-cigarette and vape market is poised for significant growth, with a CAGR of 34.6% from 2024 to 2030. The popularity of e-cigarettes among young adults and the growing demand for premium e-liquids are fueling expansion. Leading market players in Japan are contributing to growth through their extensive product offerings and distribution networks.

Key Asia Pacific E-cigarette And Vape Company Insights

The Asia-Pacific e-cigarette and vape industry is highly competitive, with numerous players competing for market share. These companies have diverse product offerings and distribution channels, including offline retail stores and online platforms. Some key players operating in this market include Philip Morris Products S.A.; JUUL Labs, Inc.; Altria Group, Inc.; and British American Tobacco plc.

-

Philip Morris Products S.A. is a global tobacco company offering nicotine products worldwide. Its diverse portfolio includes iconic brands like Marlboro, one of the world’s best-selling cigarette brands.

-

JUUL Labs, Inc. is a prominent player in the Asia-Pacific region, recognized for its innovative products and strong brand recognition. Its flagship product, JUUL, is a popular e-cigarette device that uses nicotine salts and comes in various flavors. With a strong distribution network and a wide range of online and offline products, JUUL Labs has maintained a significant market share in the region through its focus on product innovation and marketing strategies.

Key Asia Pacific E-cigarette And Vape Companies:

- Philip Morris Products S.A.

- JUUL Labs, Inc.

- Altria Group, Inc.

- British American Tobacco plc

- Smoore International Holdings Ltd

- Japan Tobacco International

- Imperial Brands PLC

- Vaping Gadget Limited

Recent Developments

-

In March 2024, Smoore announced its 2023 annual performance, reporting a total revenue. The company is focused on global expansion, strengthening its localized layout in overseas markets, and improving management efficiency.

-

In December 2023, Japan Tobacco announced the launch of its new tobacco device “With 2” with a “Mevius Gold Purple Mint” pod, scheduled for January 22, 2024. The product features cutting-edge technology and a unique flavor profile, meeting market demand for flavored tobacco products, which have seen a significant increase in sales in Japan.

-

In January 2023, JUUL Labs Inc. conducted preliminary discussions with three major tobacco companies, Philip Morris International, Japan Tobacco Group, and Altria Group Inc., regarding a potential sale, strategic investment, or licensing agreement.

Asia Pacific E-cigarette And Vape Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2023

|

USD 6.5 billion

|

|

Revenue forecast in 2030

|

USD 52.0 billion

|

|

Growth rate

|

CAGR of 34.6% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical Data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel, country

|

|

Country scope

|

Japan, China, South Korea, Philippines

|

|

Key companies profiled

|

Philip Morris Products S.A.; JUUL Labs, Inc.; Altria Group, Inc.; British American Tobacco plc; Smoore International Holdings Ltd; Japan Tobacco International; Imperial Brands PLC; Vaping Gadget Limited

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options.

|

Asia Pacific E-cigarette And Vape Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific e-cigarette and vape market report based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Rechargeable

-

Modular Devices

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

South Korea

-

Philippines

-

RoAP