- Home

- »

- Clinical Diagnostics

- »

-

Asia Pacific In Vitro Diagnostics Market Size Report, 2024GVR Report cover

![Asia Pacific In Vitro Diagnostics Market Size, Share & Trends Report]()

Asia Pacific In Vitro Diagnostics Market Size, Share & Trends Analysis Report By Product (Reagents, Instruments), By Technology (Immunoassays), By Application, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-975-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The Asia Pacific In Vitro Diagnostics (IVD) market size was estimated at USD 18.0 billion in 2023 and is projected to expand at a CAGR of 6.2% from 2024 to 2030. The region’s aging population is increasing the demand for diagnostic tests as older individuals are more prone to chronic diseases. In addition, there is a growing awareness of the importance of early disease detection, boosting the adoption of IVD technologies. The rise in point-of-care diagnostics, which offer quick and accurate results, also contributes to market expansion. Furthermore, improvements in healthcare infrastructure and increased healthcare spending in countries such as China and India support market growth.

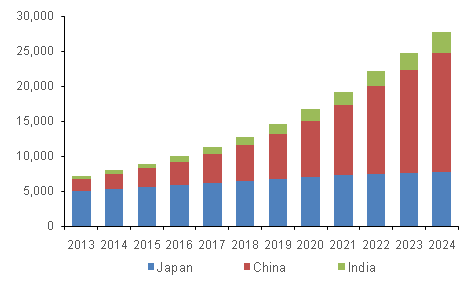

Asia Pacific IVD Market, by Country, 2013 - 2024 (USD Million)

Various regulations and initiatives have significantly influenced the Asia Pacific IVD market to ensure the safety, efficacy, and quality of diagnostic products. For instance, the implementation of the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) in Europe has set high standards that impact global markets, including Asia Pacific. In China, the National Medical Products Administration (NMPA) has introduced stringent requirements for registering and approving IVD devices, which has heightened the regulatory burden and improved market standards.

Similarly, India's Medical Device Rules and the recent draft of the National Medical Devices Policy 2023 are expected to streamline regulatory processes and foster innovation while ensuring device safety and effectiveness. In addition, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has rigorous protocols for IVD approvals, impacting market entry and operational strategies.

Product Insights

The reagents segment accounted for 66.1% of the revenue share in 2023 attributed to recurring use in laboratory and point-of-care settings, ensuring a steady and robust demand. Moreover, continuous advancements in reagent formulations have enhanced their efficiency and accuracy, making them more reliable for diagnostic purposes. The increasing prevalence of chronic and infectious diseases in the Asia Pacific region has further fueled the demand for diagnostic tests, thereby driving the consumption of reagents.

The instruments segment is projected to grow at a CAGR of 5.8% from 2024 to 2030. Technological innovations in diagnostic instruments, such as automation, integration of artificial intelligence, and enhancements in sensitivity and specificity, are making these instruments more efficient and user-friendly. The expansion and modernization of healthcare facilities in countries such as China, India, and Japan are driving the adoption of advanced diagnostic instruments. Furthermore, the increasing preference for point-of-care testing, which requires portable and easy-to-use diagnostic instruments, is contributing to the growth of this segment.

Technology Insights

The immunoassay segment held largest revenue share in 2023, primarily due to their widespread application in various diagnostic fields, including infectious diseases, oncology, cardiology, and endocrinology. Immunoassays are highly valued for their specificity, sensitivity, and ability to provide rapid results, making them indispensable in clinical and research settings.

The coagulation segment is expected to grow at a CAGR of 7.9% over the forecast period driven by several factors, including the increasing incidence of cardiovascular diseases and the rising awareness of the importance of coagulation testing in managing these conditions. Coagulation tests are crucial for diagnosing and monitoring bleeding disorders, guiding anticoagulant therapy, and assessing the risk of thrombosis.

Application Insights

The infectious diseases segment dominated the market in 2023 largely due to the high prevalence of infectious diseases such as tuberculosis, HIV, hepatitis, and respiratory infections in the region. The COVID-19 pandemic further underscored the critical need for robust diagnostic capabilities, driving significant investments in IVD technologies. Governments and healthcare organizations have prioritized developing and deploying diagnostic tests to manage and control the spread of infectious diseases.

The oncology segment is projected to witness the fastest growth in the Asia Pacific IVD market from 2024 to 2030, driven by the rising incidence of cancer in the region, coupled with the growing emphasis on early detection and personalized medicine, fueling the demand for advanced diagnostic solutions. Innovations in molecular diagnostics, such as next-generation sequencing (NGS) and liquid biopsy, enable more precise and less invasive cancer detection and monitoring. The expansion of healthcare infrastructure and increased healthcare spending in countries such as China, India, and Japan further support the adoption of cutting-edge oncology diagnostics.

End Use Insights

The hospital segment accounted for the largest market share in 2023. The extensive infrastructure and availability of advanced diagnostic equipment in hospitals enable comprehensive testing and accurate results, which are crucial for effective patient management. In addition, hospitals often serve as referral centers for complex diagnostic procedures that require sophisticated technologies and specialized expertise. The integration of advanced IVD technologies in hospital laboratories, such as automated analyzers and molecular diagnostic tools, has further enhanced the efficiency and accuracy of diagnostic services. As a result, hospitals remain the dominant end use segment, driving significant revenue in the in vitro diagnostics market.

The home-care segment is anticipated to grow the fastest over the forecast period, driven by the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, leading to a growing demand for home-based diagnostic solutions that enable patients to monitor their health conveniently and regularly. Technological advancements in portable and user-friendly diagnostic devices, such as glucose meters, home pregnancy tests, and portable coagulation monitors, have made it easier for patients to conduct tests at home with minimal training.

Country Insights

China In Vitro Diagnostics Market

The China in vitro diagnostics market, which holds 30.5% of Asia Pacific's total revenue, is driven by the increasing prevalence of chronic diseases such as diabetes and cancer, which necessitate advanced diagnostic solutions. The COVID-19 pandemic further highlighted the importance of IVD, boosting demand for diagnostic kits and reagents. China’s focus on healthcare innovation and developing novel diagnostic technologies also contribute to market growth.

Singapore In Vitro Diagnostics Market

The Singapore in vitro diagnostics market is projected to grow at a CAGR of 7.9% from 2024 to 2030, which is attributed to the country’s advanced healthcare system and the increasing adoption of innovative diagnostic technologies. The rising prevalence of chronic diseases and the growing demand for personalized medicine drive the market. Furthermore, the emphasis on preventive healthcare and early diagnosis is expected to boost the adoption of IVD in Singapore.

Japan In Vitro Diagnostics Market

Japan in vitro diagnostics (IVD) market is one of the largest in the Asia Pacific region, driven by the aging population and the high prevalence of chronic diseases. Japan’s healthcare system is known for its high standards and extensive use of cutting-edge medical technologies, which support the growth of the IVD market. Moreover, government initiatives to promote healthcare innovation and the increasing demand for point-of-care testing are key factors contributing to the market expansion.

Key Companies & Market Share Insights

Some of the key players operating in the market include Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, and Bio-Rad Laboratories, among others:

-

Sysmex Corporation offers a comprehensive range of diagnostic solutions, including hematology, urinalysis, and hemostasis analyzers.

-

bioMérieux specializes in in vitro diagnostics for infectious diseases, cancer, and cardiovascular diseases. The company offers a variety of diagnostic solutions, including microbiology, immunoassays, and molecular diagnostics, helping healthcare providers in Asia Pacific to detect and manage diseases more effectively.

Key Asia Pacific In Vitro Diagnostics Companies:

- Abbott

- bioMérieux SA

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Qiagen

- Sysmex Corporation

- Charles River Laboratories

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

- Danaher Corporation

- BD

- F. Hoffmann-La Roche Ltd.

Recent Developments In The Asia Pacific In Vitro Diagnostics Market

-

In March 2024, Everlife Holdings Pte Ltd announced the acquisition of Hausen-Bernstein Co. Ltd., a prominent IVD provider in Thailand. Hausen’s extensive market presence and technical capabilities will enable Everlife to introduce innovative products, expand its product portfolio, and deliver enhanced solutions and services to the Thai market.

-

In September 2023, Asia Healthcare Holdings (AHH) announced the acquisition of a controlling interest in the Asian Institute of Nephrology and Urology (AINU). AINU is India's premier specialized hospital network dedicated to urology and nephrology care, operating in four cities. Renowned for its pioneering advancements in robotic urology surgery, AINU represents a strategic addition to AHH's healthcare portfolio.

Asia Pacific In Vitro Diagnostics Market Scope

Report Attribute

Details

Market size value in 2024

USD 18.5 million

Revenue forecast in 2030

USD 26.5 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Volume in million square meters; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, technology, application, end use, country

Key companies profiled

Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Qiagen, Sysmex Corporation, Charles River Laboratories, Quest Diagnostics Incorporated, Agilent Technologies, Inc., Danaher Corporation, BD, F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific In Vitro Diagnostics Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific in vitro diagnostics market report based on product, technology, application, end use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Hematology

-

Clinical Chemistry

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology/Cancer

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratory

-

Home Care

-

Others

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Singapore

-

Indonesia

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."