- Home

- »

- Clinical Diagnostics

- »

-

In Vitro Diagnostics Market Size, Share, Industry Report, 2030GVR Report cover

![In Vitro Diagnostics Market Size, Share & Trends Report]()

In Vitro Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents), By Test Location, By End Use (Hospitals, Laboratory), By Application, By Technology (Molecular Diagnostics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-080-4

- Number of Report Pages: 320

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In Vitro Diagnostics Market Summary

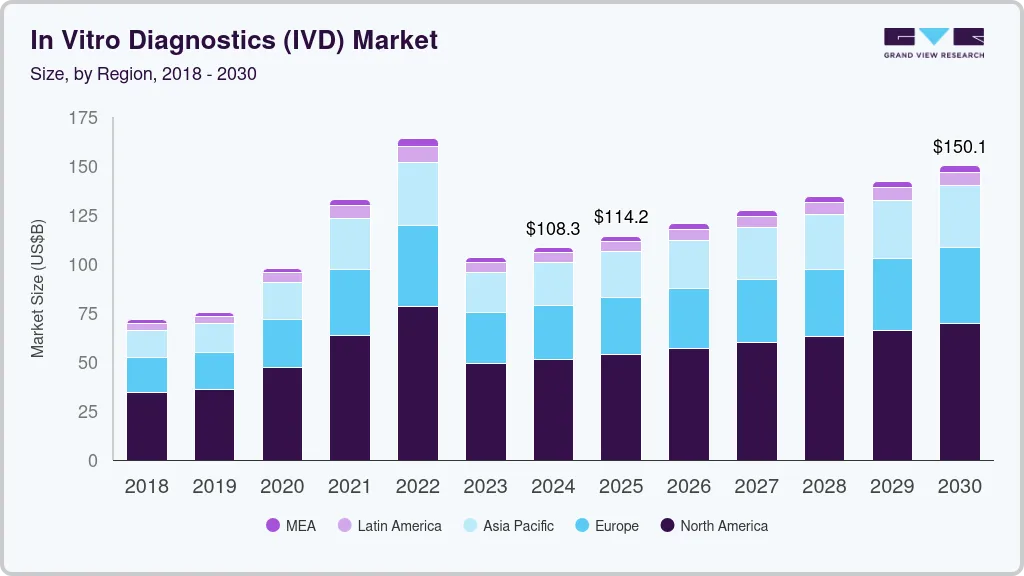

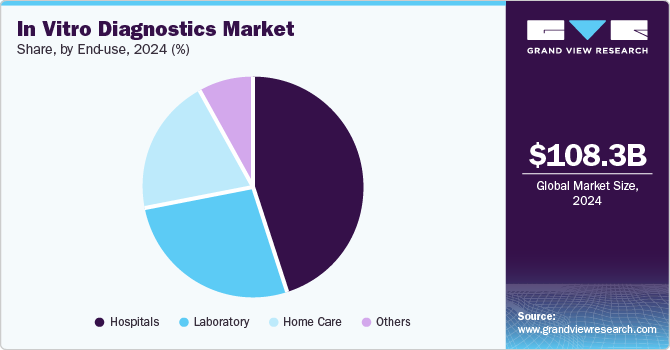

The global in vitro diagnostics market size was estimated at USD 108.30 billion in 2024 and is projected to reach USD 150.13 billion by 2030, growing at a CAGR of 5.62% from 2025 to 2030. The growth of the market is attributed to the rising global demand for accurate, rapid, and personalized diagnostic solutions.

Key Market Trends & Insights

- North America dominated the in vitro diagnostics industry and accounted for a 47.43% share in 2024.

- The Asia Pacific region is emerging as the fastest-growing in-vitro diagnostics industry, with a CAGR of 6.57% over the forecast period.

- Based on product, the reagents segment held the largest share of 65.54% of the in vitro diagnostics market in 2024.

- Based on technology, the immunoassay segment accounted for the largest revenue share of the in vitro diagnostics market in 2024.

- Based on application, the infectious diseases segment dominated the in vitro diagnostics industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 108.30 Billion

- 2030 Projected Market Size: USD 150.13 Billion

- CAGR (2025-2030): 5.62%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Some of the key growth factors driving the market growth include the increasing prevalence of chronic and infectious diseases, advancements in diagnostic technologies, and the shift toward value-based healthcare emphasizing early detection and preventive care. The integration of digital health, AI, and data analytics into diagnostic platforms enhancing test accuracy and clinical decision-making. Additionally, the expansion of point-of-care testing, personalized medicine, and emerging markets, coupled with heightened pandemic preparedness, continues to drive market penetration, creating significant opportunities for industry stakeholders.

The increase in the prevalence of chronic & infectious diseases and genetic disorders, such as Alzheimer’s disease, Turner syndrome, & Parkinson’s disease, is expected to boost the market demand during the forecast period. According to CDC, chronic diseases such as cancer & diabetes and chronic kidney & respiratory diseases, such as asthma, are responsible for 7 in 10 deaths in the U.S. each year. Around 6 out of 10 adults are likely to suffer from a chronic disease in the U.S. These chronic diseases account for USD 4.1 trillion in annual healthcare costs in the U.S. In 2024, 620,000 cases and 213 deaths were detected, primarily in the Americas, with Brazil, Paraguay, and Argentina reporting the highest burdens. Asia saw significant cases, particularly in India and Pakistan, while Senegal was the only affected African country. Europe recorded one locally acquired case in France and 118 cases in La Réunion.

Technological advancements in terms of accuracy, cost-effectiveness, and portability are expected to be among the high-impact rendering drivers for this market. Leading market participants are updating their range of testing options by undertaking R&D initiatives for the development of kits that target life-threatening conditions or by entering into collaborations with other kit manufacturing players. Innovative product launches in the market are also a result of the rising number of R&D and partnership programs by players. Advancements in miniaturization, nanotechnology, microfluidics, and cloud-connected POC diagnostics are making molecular-level diagnostics more affordable, user-friendly, and sensitive. Smartphone-integrated readers with diverse biosensing platforms enable onsite and on-time diagnoses. 3D printing enhances POC device fabrication and performance, while flexible sensors with wireless communication allow real-time patient monitoring for preventative healthcare and disease outbreaks. These innovations signify significant progress in POC molecular diagnostics and its potential impact on healthcare.

The increase in external funding for clinical studies in infectious disease molecular diagnostics is expected to drive market growth, as funding is crucial in advancing product development. For example, in January 2025, Rhode Island Hospital received a USD 1 million grant from CARB-X to support the development of a direct-from-blood PCR test for pneumonia-causing bacteria, aiming to improve diagnostics for lower respiratory tract infections (LRTIs). This advancement addresses the urgent need for rapid, accurate diagnostics to combat antibiotic resistance and enhance patient care in the infectious disease molecular diagnostics market.

However, high prices associated with molecular tests are one of the major factors impeding this market. Lack of comparable products is another reason for hiked prices. The significant price variations for different applications of each molecular diagnostic product further compound this problem. Moreover, the high cost of molecular diagnostic instruments remains a key challenge for market growth. For example, Bio-Rad Laboratories' CFX Connect PCR Detection System is priced at approximately USD 17,995, while Thermo Fisher Scientific's 7900 HT qPCR system ranges between USD 20,000 and USD 30,000. Digital PCR (dPCR) instruments offer greater accuracy and sensitivity and are even more expensive than real-time PCR systems. Manual dPCR instruments typically cost between USD 65,000 and USD 70,000, whereas automated dPCR systems can exceed USD 100,000.

Market Opportunities

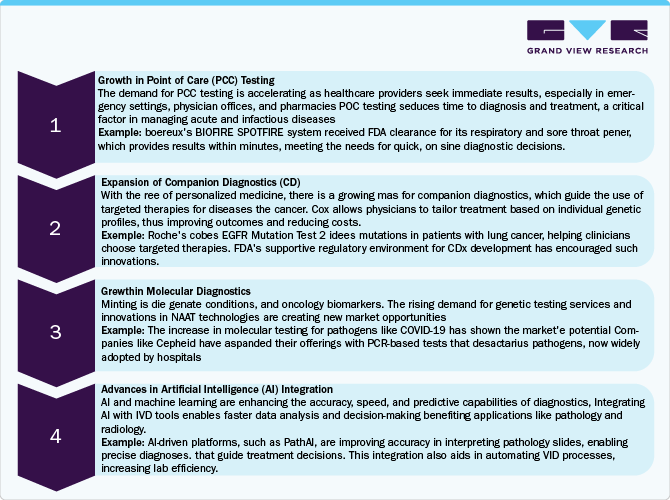

The in vitro diagnostics (IVD) market is experiencing substantial growth and offers multiple opportunities, driven by technological advancements, an increasing emphasis on personalized medicine, and a demand for rapid diagnostics. Here is a detailed opportunity analysis for IVD along with examples:

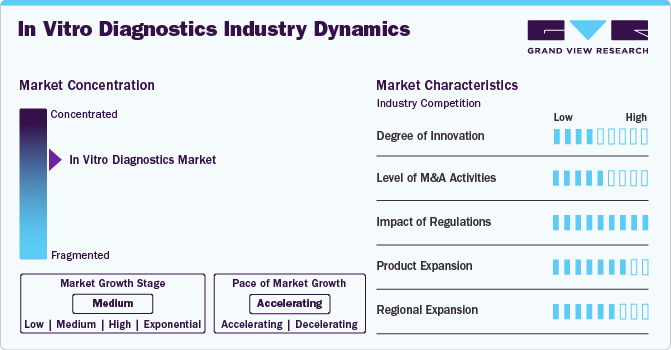

Market Concentration & Characteristics

The IVD market demonstrates a high degree of innovation, driven by advancements in molecular diagnostics, next-generation sequencing (NGS), and point-of-care testing. Continuous R&D efforts focus on improving test accuracy, speed, and ease of use, particularly in personalized medicine and early disease detection. Emerging technologies like AI and machine learning are also being integrated into diagnostic platforms, enabling predictive analytics and enhanced data interpretation. Additionally, the demand for rapid diagnostic tests and non-invasive methods has led to significant breakthroughs, especially highlighted during the COVID-19 pandemic, further accelerating innovation within the market.

The IVD market experiences a high level of mergers and acquisitions (M&A), as companies pursue strategic partnerships and acquisitions to expand product portfolios, enter new market segments, and strengthen their global presence. Large players often acquire smaller, innovative firms to integrate advanced technologies, such as molecular diagnostics and digital health solutions, into their offerings. M&A activities also help companies consolidate market share, diversify geographically, and enhance their competitive positioning. Notable deals, such as Thermo Fisher Scientific’s acquisition of Qiagen, underscore the industry's dynamic nature and the importance of M&A in driving growth and innovation.

The IVD market operates under high regulatory scrutiny, given the critical role diagnostics play in patient care. Regulatory bodies like the FDA (U.S.) and the European Medicines Agency (EMA) enforce stringent standards to ensure product safety, accuracy, and efficacy. The introduction of the EU In Vitro Diagnostic Regulation (IVDR) has significantly raised compliance requirements, impacting product development timelines and market entry strategies. While these regulations aim to enhance patient safety, they also increase the complexity and cost of bringing new products to market. Companies must invest heavily in quality control, clinical validation, and regulatory affairs to meet these evolving standards.

Product expansion in the IVD market is at a high level, driven by the growing demand for comprehensive diagnostic solutions across multiple disease areas. Manufacturers are consistently developing new assays, expanding test menus, and integrating multiplex testing capabilities to meet evolving clinical needs. The rise of personalized medicine has further accelerated product diversification, with a focus on companion diagnostics and biomarker-based tests. Additionally, companies are expanding into emerging sectors like liquid biopsy, microbiome analysis, and infectious disease testing, broadening their portfolios to capture new market opportunities and address unmet clinical needs.

The IVD market is witnessing a medium to high level of regional expansion as companies aim to tap into growth opportunities in emerging markets while solidifying their presence in established regions. Asia-Pacific, Latin America, and the Middle East are becoming key targets due to rising healthcare investments, increasing awareness of diagnostic testing, and expanding healthcare infrastructures. Market leaders are setting up local manufacturing units, establishing partnerships with regional distributors, and customizing product offerings to meet specific market requirements. However, regional expansion efforts are often challenged by varying regulatory landscapes and market access barriers, requiring tailored strategies for each geography.

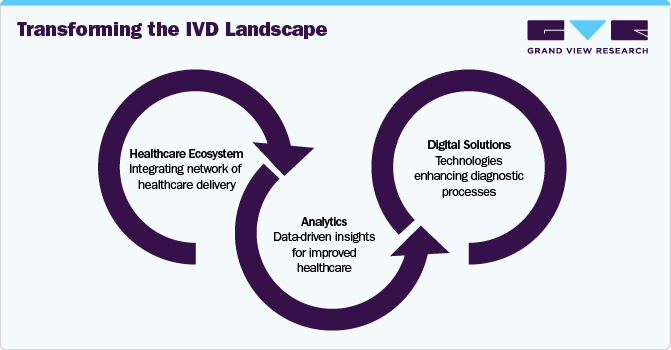

The Evolving Role of In Vitro Diagnostics in Healthcare Delivery

The in vitro diagnostics (IVD) industry is transitioning from its traditional role as a back-office, pay-for-service function to a central stakeholder within the healthcare delivery ecosystem. This shift is driven by three key trends, creating significant opportunities for digital solutions and analytics to reshape the IVD landscape.

Enhancing Diagnostic Tests: Healthcare systems are increasingly seeking improvements in diagnostic capabilities. One major expectation is for diagnostics to provide meaningful metrics that support outcome-based healthcare. Rather than delivering isolated results—such as a high hemoglobin A1c level—tests are now expected to link these findings to patient outcomes (e.g., a reduction in HbA1c correlating with a lower risk of complications). Another critical development is the transformation of test results into actionable insights. By incorporating local context, patient history, and trend analysis, diagnostic tools can offer clinicians deeper, more personalized insights, enhancing their decision-making process.

Revolutionizing Care Delivery: As a cornerstone of clinical decision-making, diagnostics plays a vital role in shaping the future of care delivery. Three significant shifts are influencing this evolution. First, the rise of new care models, including home-based and virtual care, demands innovative diagnostic workflows and tests that support remote care without compromising accuracy or quality. Second, the growing emphasis on preventive care highlights the need for advanced screening tools. Cost-effective, high-accuracy tests, such as molecular colon-cancer screenings enhanced by algorithms, can enable earlier detection and better outcomes. Finally, the move toward personalized medicine is reshaping how treatments are selected. IVD companies must develop new diagnostic panels that help clinicians tailor therapies to individual patients, improving efficacy and patient outcomes.

Expanding Diagnostics Role in Healthcare: The scope of diagnostics is broadening beyond traditional disease detection, creating new value for both the healthcare system and IVD companies. A clear example of this expanded remit is the role diagnostics can play in pandemic preparedness and response, serving as a frontline defense against future global health threats. Additionally, diagnostics are becoming integral to drug development, enhancing efficiency and precision. Companion diagnostics, for example, help identify patients most likely to benefit from specific treatments or those at risk of adverse effects, enabling more targeted and effective therapies.

Supply Chain Analysis

The In Vitro Diagnostics (IVD) supply chain is structured to deliver diagnostic products efficiently from manufacturers to healthcare providers. Given the high demand for diagnostic tests, especially post-COVID-19, this supply chain is critical to ensuring quick and accurate testing, particularly in settings that require rapid diagnostics, such as emergency departments and urgent care clinics. The IVD supply chain begins with the production of diagnostic products by manufacturers, followed by distribution to wholesalers or directly to healthcare providers. This chain includes various stages: manufacturing, warehousing, distribution, transportation, and End Use application. Each stage is influenced by regulatory requirements, market demands, and the need for high-quality diagnostic outcomes.

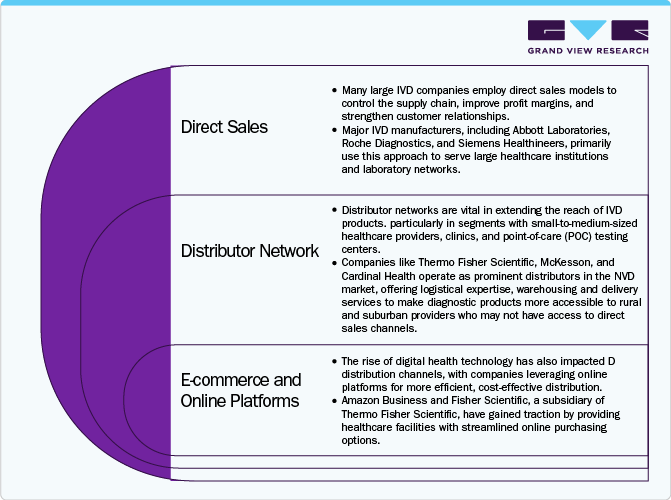

Distribution Channel

The distribution channels for in vitro diagnostics (ivd) market play a critical role in how products reach healthcare facilities, laboratories, and End Users, impacting market reach and operational efficiency. IVD products include reagents, instruments, and systems used in disease diagnosis and monitoring, and their distribution is largely handled through three primary channels: direct sales, distributors, and e-commerce.

Direct sales are commonly used by large IVD manufacturers like Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers to maintain control over the supply chain, improve profit margins, and strengthen customer relationships. This approach is particularly effective for high-value, complex diagnostic equipment that requires installation, customization, and technical support. Direct engagement allows manufacturers to offer comprehensive training, maintenance, and personalized customer service, fostering brand loyalty and enhancing the overall user experience.

Distributor networks play a vital role in reaching smaller healthcare providers, clinics, and point-of-care testing centers, especially in geographically diverse areas. Companies like Thermo Fisher Scientific, McKesson, and Cardinal Health extend IVD product access by offering logistical support, warehousing, and delivery services. These distributors often represent multiple manufacturers, providing healthcare facilities with diverse product options and value-added services such as inventory management. Meanwhile, the growing adoption of e-commerce platforms, such as Amazon Business and Fisher Scientific, is transforming IVD distribution by offering streamlined purchasing, transparent pricing, and just-in-time delivery, particularly for consumables and low-complexity devices.

Pricing Analysis

The pricing of In Vitro Diagnostics (IVD) products varies significantly based on product type, complexity, and application. Instruments, such as automated analyzers and molecular diagnostic platforms, generally involve high upfront costs due to advanced technologies and integration capabilities, often complemented by service and maintenance contracts. Reagents, on the other hand, follow a recurring revenue model, with pricing influenced by test complexity, sensitivity, and volume requirements. High-precision reagents for molecular diagnostics or immunoassays typically command premium pricing, while routine reagents for clinical chemistry or hematology are more cost-competitive. The following table outlines typical pricing ranges for IVD instruments and reagents:

Product Type

Category

Price Range (USD)

Pricing Notes

Instruments

Clinical Chemistry Analyzers

USD 15,000 - USD 200,000

Pricing varies based on throughput and automation levels.

Immunoassay Analyzers

USD 19,500 - USD 250,000

Higher-end models offer multiplexing and enhanced sensitivity.

Molecular Diagnostics Platforms

USD 50,000 - USD 500,000

Premium pricing due to advanced technology and versatility.

Hematology Analyzers

USD 5,000 - USD 360,000

Costs depend on throughput and parameters analyzed.

Reagents

Clinical Chemistry Reagents

USD 1 - USD 20 per test

High-volume, lower-margin consumables.

Immunoassay Reagents

USD 5 - USD 100+ per test

Priced higher due to assay complexity and specificity.

Molecular Diagnostic Reagents

USD 20 - USD 100+ per test

High pricing reflects complex assays (e.g., PCR, NGS).

Hematology Reagents

USD 0.50 - USD 5 per test

Lower-cost consumables for routine blood analysis.

Product Insights

Reagents held the largest share of 65.54% of the in vitro diagnostics market in 2024, driven by significant R&D efforts from leading market players aiming to develop innovative biomarker kits. The ongoing introduction and commercialization of new reagents are expected to propel this growth. For example, in October 2022, Thermo Fisher Scientific introduced the TaqPath Enteric Bacterial Select Panel Test, designed to detect gastrointestinal bacterial infections within a short two-hour timeframe. In November 2021, Applied BioCode launched 28 Fungal Analyte Specific Reagents (ASRs), available to clinical laboratories and IVD manufacturers, while Promega Corporation released XpressAmp Direct Amplification Reagents in March 2021 to support COVID-19 testing needs.

Instruments held the second-largest market share in 2024. The growth of the segment is fueled by advancements in technology and partnerships among major players. For instance, in October 2024, Illumina, Inc. introduced the MiSeq i100 Series, a new generation of benchtop sequencing systems designed to enhance next-generation sequencing (NGS) accessibility. This series, featuring MiSeq i100 and MiSeq i100 Plus, enables efficient, same-day sample-to-analysis processes, with user-friendly operation aimed at professionals with varying NGS expertise. The devices offer room-temperature storage and shipping, eliminating the need for lengthy thawing periods, allowing laboratories to perform on-demand sequencing.

Technology Insights

Immunoassay accounted for the largest revenue share of the in vitro diagnostics market in 2024. The rising incidence of chronic and communicable diseases and the demand for early diagnosis are boosting the need for immunological methods like Enzyme-linked Immunosorbent Assays (ELISAs). Leading companies are investing in R&D for innovative immunological diagnostic instruments aimed at immune deficiency assessment. For instance, Roche introduced the Elecsys HCV Duo immunoassay in July 2022, which uses both antigen and antibody markers for early-stage hepatitis C diagnosis. Similarly, Ortho Clinical Diagnostics launched an advanced Anti-T. cruzi assay in 2018 for Chagas disease, approved for the VITROS series of diagnostic instruments, including the high-throughput VITROS XT 7600 Integrated System.

Coagulation is expected to grow at the fastest rate over the forecast period, driven by increasing demand for precise diagnostics to assess hemostasis, a process that prevents excessive bleeding by enabling blood clot formation. Coagulation tests are essential in detecting abnormalities in blood clotting components, making them vital for patients with cardiovascular conditions, blood disorders, and autoimmune diseases. Major companies, including Abbott, Siemens Healthcare GmbH, and Beckman Coulter, Inc., are actively innovating in this field, creating advanced IVD instruments that streamline and improve coagulation testing. The COVID-19 pandemic also brought significant attention to coagulation diagnostics.

Application Insights

Infectious diseases segment dominated the in vitro diagnostics industry in 2024. One major trend is the shift toward multiplex tests that detect multiple respiratory pathogens like Flu A/B, COVID-19, and RSV in a single panel. While the expansion into multiplex respiratory testing initially met market needs, the space has quickly become saturated with similar products. As a result, companies need to avoid "me-too" products and instead emphasize unique product features to secure a foothold in labs and clinics that may be consolidating equipment after pandemic-driven over-purchasing. To differentiate their portfolios, many IVD companies are exploring expansion opportunities in infectious disease diagnostics beyond the traditional respiratory scope. Integrating tests for high-impact conditions such as lower respiratory infections, strep throat, and tuberculosis could attract both high-income and developing markets.

Oncology segment is anticipated to grow at the fastest CAGR over the forecast period, driven by the increasing prevalence of cancer and the demand for advanced diagnostic solutions. Cancer remains a significant health burden, as it is the second leading cause of death in the U.S., with common types including colorectal, prostate, breast, and lung cancer. The rising importance of early cancer detection is likely to propel the demand for cancer-related IVD tests, especially as AI and digital pathology streamline workflows and improve diagnostic accuracy. The adoption of comprehensive, multi-biomarker profiling tests and non-invasive liquid biopsies will continue to grow, meeting the demand for precise and patient-friendly cancer diagnostics.

Test Location Insights

Point-of-care accounted for the largest revenue share of the in vitro diagnostics market in 2024, driven by advancements in portable diagnostic technologies and the growing need for immediate, patient-centered care. POC testing enables healthcare providers to perform diagnostics at or near the patient, delivering timely results without requiring samples to be sent to a central laboratory. This reduces waiting times and enhances clinical decision-making, particularly in emergency and critical care settings. Key market players are investing in R&D and forming partnerships to enhance their POC offerings, ensuring they meet stringent regulatory standards. As a result, the POC IVD market is anticipated to continue growing, fueled by an aging population, a rising prevalence of chronic diseases, and an ongoing shift toward value-based care that emphasizes convenience, accessibility, and efficiency in diagnostics.

Homecare segment is expected to grow at the fastest CAGR during the forecast period. The In Vitro Diagnostics (IVD) industry has seen a marked increase in the adoption of homecare testing, driven by the need for accessible and reliable testing solutions. Homecare testing offers patients a convenient and safe alternative to traditional healthcare settings, helping to reduce the burden on healthcare facilities. This trend accelerated significantly during the COVID-19 pandemic, as home tests for SARS-CoV-2 became essential in containing virus spread, especially during peak infection periods. The need for frequent testing encouraged government and public health agencies to provide large-scale support for home testing initiatives, making it easier for Americans to access testing kits.

End Use Insights

The hospitals segment held the largest market share in 2024, owing to increased hospitalization, as doctors require diagnostic interpretation for further treatment. Most often, diagnostic centers operate in collaboration with hospitals; hence, hospitals have their own diagnostic set up. Furthermore, ongoing development of healthcare infrastructure is anticipated to enhance the existing hospital facilities. Thus, the demand for hospital-based IVD tests is increasing. Most of the IVD devices are purchased by hospitals and are used in significant volumes. In 2022, there are over 6,093 hospitals in the U.S. that require constant aid from IVD for critical decision-making, as IVD tests provide faster and accurate results. Furthermore, increasing number of MRSA cases in hospitalized patients is expected to boost market growth. According to CDC, around 5% of hospitalized patients suffer from MRSA infections and carry the bacteria.

The homecare segment is expected to grow at the fastest CAGR over the forecast period due increasing demand for molecular diagnosis, there is a growing need for molecular diagnostic platforms that can assist patients in conducting self-tests. Few of the home diagnostics tests are Home Access Hepatitis C Test (Home Access Health Corp), ADEXUSDx HIV 1/2 Test, and Home Access Express HIV-1 Test (Home Access Health Corp).Increasing development of at-home tests to help healthcare workers and patients fight against crisis of COVID-19 is anticipated to fuel market growth. For instance, in April 2020, Laboratory Corporation of America Holdings received EUA for COVID-19 At-Home Test Kit. The nasal swabs are collected easily and safely using Pixel by LabCorp COVID-19 test home collection kit.

Regional Insights

North America dominated the in vitro diagnostics industry and accounted for a 47.43% share in 2024. The growth of the market in the region is attributed to the rising prevalence of chronic diseases, increasing demand for genetic testing, and advancements in molecular diagnostics. According to the Centers for Disease Control and Prevention (CDC), approximately 129 million individuals in the U.S. live with at least one major chronic condition, including heart disease, cancer, diabetes, obesity, or hypertension. Notably, 42% of Americans manage two or more chronic conditions, while 12% contend with five or more. The growing emphasis on personalized medicine is propelling the adoption of genetic testing, particularly for conditions such as cancer and diabetes. Strategic collaborations between pharmaceutical firms and molecular diagnostic companies are accelerating innovation in this space. A notable example is Fluxergy’s partnership with the National Institute of Allergy and Infectious Diseases (NIAID) in November 2024. This initiative aims to enhance molecular testing and sample preparation on the Fluxergy platform through advanced nucleic acid extraction and purification techniques. Furthermore, leading industry players, including Bio-Rad, Thermo Fisher, and Danaher, are actively launching innovative products to meet evolving consumer demands.

U.S. In Vitro Diagnostics Market Trends

The U.S. leads the in vitro diagnostics industry, driven by major industry players such as Roche Diagnostics, Abbott, and Danaher. Their dominance is reinforced by strong R&D investments and favorable reimbursement policies that support innovation and the adoption of advanced diagnostic technologies. According to the American Cancer Society, over 2 million new cancer cases are projected to be diagnosed in the U.S. in 2024, excluding basal and squamous cell skin cancers and noninvasive carcinoma in situ, except for urinary bladder cases. This rising disease burden is expected to sustain the country's leadership in the market.

Europe In Vitro Diagnostics Market Trends

The Europe In Vitro Diagnostics (IVD) industry is rapidly evolving, driven by technological advancements and growing demand for precision medicine. Next-Generation Sequencing (NGS) and PCR-based tests are at the forefront, particularly in genomics, oncology, and infectious disease diagnostics. These technologies are integral to personalized medicine, targeted therapies, and rapid disease detection, with leading companies like Illumina Inc., Roche, and Thermo Fisher Scientific Inc. continuously innovating to enhance diagnostic accuracy and efficiency.

The uk in vitro diagnostics market is experiencing significant growth, driven by a robust healthcare infrastructure, high disposable income, and increasing awareness of early disease detection. The rising demand for molecular diagnostics is further supported by government initiatives aimed at improving accessibility to diagnostic services and reducing NHS waiting times. In July 2023, Virax Biolabs Group Limited, a company specializing in immune response detection and viral disease diagnostics, announced plans to launch two new research and laboratory facilities in the UK.

The in vitro diagnostics market in France is evolving rapidly, driven by technological advancements, increasing disease prevalence, and government initiatives aimed at strengthening healthcare infrastructure. Major global players, including Roche, Thermo Fisher Scientific, Qiagen, Danaher, and Hologic, have established a strong presence in France, continuously expanding their molecular diagnostics portfolios with real-time PCR systems and high-throughput sequencing tools. Furthermore, the French molecular diagnostic market would thus be directly impacted by this acquisition, as companies expands its capabilities and presence in this growing sector. In January 2025, bioMérieux acquired SpinChip Diagnostics ASA (SpinChip). This small benchtop analyzer is designed for near-patient testing, delivering high-sensitivity results from whole blood samples within 10 minutes—a level of performance previously available only in laboratory settings.

Germany in vitro diagnostics market is growing largely fueled by technological innovations, particularly in Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and Isothermal Nucleic Acid Amplification Technology (INAAT). These cutting-edge technologies have expanded diagnostic capabilities, allowing for the early detection of diseases such as cancer, cardiovascular conditions, and infectious diseases, all of which are prevalent in the region.

Asia Pacific In Vitro Diagnostics Market Trends

The Asia Pacific region is emerging as the fastest-growing in-vitro diagnostics industry, with a CAGR of 6.57% over the forecast period driven by a high burden of tuberculosis (TB), increasing adoption of molecular diagnostics, and evolving reimbursement policies. According to the WHO Global TB Report 2023, the South-East Asia (SEA) Region, home to nearly one-fourth of the global population, accounts for over 45% of global TB cases. In 2022, more than 4.8 million people in the region developed TB, and over 600,000 deaths were recorded, excluding HIV-related TB mortality. This represents more than half of all global TB-related deaths. Additionally, the treatment success rate for new and relapse TB cases in the 2021 cohort stood at 88%.Innovations and new product launches by local players are further accelerating the growth of the Asia Pacific IVD market. For instance, in February 2023, Redcliffe Labs introduced a molecular diagnostic test in India to detect multidrug-resistant TB (MDR-TB). This test offers faster and more accurate detection, addressing the rising need for advanced TB diagnostics and improving disease control efforts in the region.

China in vitro diagnostics market is expanding rapidly, driven by increasing healthcare spending, a rising geriatric population, and advancements in molecular diagnostics. China is heavily investing in R&D and novel diagnostic technologies to improve healthcare outcomes. A major focus is on early disease detection to reduce treatment costs and improve survival rates. Key molecular diagnostic tests available in China include FISH-based breast cancer screening and Human Papillomavirus (HPV) testing. In November 2022, the cervical cancer screening test GynTect was launched in China, marking a significant advancement in HPV-positive patient management. Developed by oncgnostics (Germany), GynTect is the first methylation assay approved by China’s National Medical Products Administration (NMPA) for triaging HPV-positive cases, enabling more precise detection of high-risk individuals and improving early diagnosis and treatment.

In vitro diagnostics market in Japan is expanding rapidly, fueled by its growing geriatric population, increasing cancer prevalence, and advancements in molecular diagnostics. With a high life expectancy and per capita income among individuals aged 80 and above, the country faces a rising burden of chronic and age-related diseases, particularly cancer. According to Japan’s Ministry of Health, Labor and Welfare, cancer accounts for approximately 30% of total deaths, making it a leading cause of mortality. The integration of real-world data (RWD) in cancer research and treatment is accelerating the growth of Japan’s molecular diagnostics sector. In October 2024, Flatiron Health and Lifebit Biotech expanded their collaboration into Japan, aiming to improve cancer care by providing secure access to real-world patient data. This initiative is expected to enhance cancer treatment, drive innovative research, and promote personalized medicine through molecular diagnostics.

Latin America In Vitro Diagnostics Market Trends

Latin America’s in vitro diagnostics (ivd) market is growing due to technological advancements in the healthcare sector. Key factors contributing to this growth include increasing government expenditure on Research & Development (R&D), the rising focus of multinational medical device companies on the molecular diagnostics segment and growing patient awareness about infectious diseases. Additionally, the rising prevalence of chronic diseases, the expanding geriatric population, and increased healthcare spending in developing countries are further propelling the market.

The Brazil in vitro diagnostic market is witnessing substantial growth, fueled by technological advancements, rising healthcare demands, and supportive government policies. Brazil faces a significant burden of infectious diseases such as dengue, Zika, HIV, and tuberculosis, as well as a high prevalence of chronic conditions like cancer and diabetes. These health challenges are driving the demand for accurate, rapid, and reliable diagnostic solutions, with molecular diagnostics emerging as a preferred choice due to their superior sensitivity and specificity.

Middle East & Africa In Vitro Diagnostics Market Trends

The Middle East and Africa (MEA) In Vitro Diagnostics (IVD) industry is poised for growth, driven by the increasing prevalence of chronic conditions such as cancer and cardiovascular diseases, as well as the high burden of infectious diseases. According to the World Health Organization (WHO), cancer incidence in the Middle East is expected to double by 2030, with 9 out of 22 countries in the region lacking optimal operational facilities to manage cancer effectively. This unmet need for early diagnosis and treatment, coupled with economic development in emerging markets like South Africa, is creating substantial opportunities for the IVD market.

The Saudi Arabia in vitro diagnostics market is experiencing robust growth, fueled by the increasing prevalence of both communicable and noncommunicable diseases (NCDs), as well as rising awareness and government initiatives to improve healthcare outcomes. The country faces a growing burden of NCDs, such as cardiovascular diseases (CVDs) and diabetes, largely attributed to sedentary lifestyles. Additionally, cancers such as lung, colorectal, stomach, breast, and prostate are major causes of cancer-related deaths. According to ScienceDirect, the prevalence of CVDs in Saudi Arabia is projected to reach 479,500 cases by 2035, while over 31,000 new cancer cases were anticipated to be diagnosed in 2023.

Key In Vitro Diagnostics Company Insights

Some of the key players operating in the in vitro diagnostics market include Abbott; bioMérieux; F. Hoffmann-La Roche Ltd.; Siemens Healthineers AG; Thermo Fisher Scientific, Inc.; and Bio-Rad Laboratories, Inc. Mature players heavily invest in state-of-the-art technology and infrastructure, allowing them to efficiently process & analyze a large volume of data. Market players in the IVD market are adopting various market strategies such as new product launches, mergers & acquisitions, and partnerships to strengthen their product portfolios, offer diverse technologically advanced & innovative products, expand their product portfolios, and improve competency.

ARUP Laboratories; RayBiotech, Inc.; Randox Laboratories Ltd.; Everlywell; Orreco, and Biostarks are some of the emerging participants in the in vitro diagnostics industry. Emerging players put greater focus on gaining market penetration through product differentiation. These comapnies are actively involved in developing novel and accurate IVD testing products to improve overall health services. Moreover, these companies are collaborating with research institutes, government bodies, and global leaders to increase the range of their products in potential markets.

Key In Vitro Diagnostics Companies:

The following are the leading companies in the in vitro diagnostics Market. These companies collectively hold the largest market share and dictate industry trends:

- Abbott

- Bio-Rad Laboratories, Inc

- Siemens Healthineers AG

- BIOMÉRIEUX

- BD

- QIAGEN

- Quidel Corporation

- F. Hoffmann-La Roche Ltd.

- Danaher

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

Recent Developments

-

In February 2025, ABL Diagnostics will manufacture and commercialize a full range of UltraGene PCR tests acquired from its parent company, Advanced Biological Laboratories. These tests cover over 100 pathogens, supporting infectious disease diagnostics across multiple conditions. The company aims to integrate PCR with its DeepChek sequencing products, expanding its presence in precision medicine.

-

In January 2025, QIAGEN secured U.S. FDA clearance for its QIAstat-Dx Gastrointestinal Panel 2 Mini B&V, a targeted syndromic test for bacterial and viral gastrointestinal infections. The company is planning a product launch to expand QIAGEN's syndromic testing portfolio, offering comprehensive and targeted options to improve inpatient and outpatient diagnostics.

-

In October 2024, Becton, Dickinson and Company (BD) achieved Health Canada approval for its Onclarity HPV Assay to be used with self-collected vaginal samples for human papillomavirus (HPV) testing at home.

-

In June 2024, bioMérieux announced that its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel Mini received FDA Special 510(k) clearance and a CLIA waiver. This POC multiplex PCR test can detect five common respiratory and sore throat pathogens in about 15 minutes, using samples from nasopharyngeal or throat swabs, depending on the suspected infection.

In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.25 billion

Revenue forecast in 2030

USD 150.13 billion

Growth rate

CAGR of 5.62% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, volume (number of units installed and reagents sold), and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, technology, application, test location, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Russia; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; BIOMÉRIEUX; BD; QIAGEN; Quidel Corporation; F. Hoffmann-La Roche Ltd.; Danaher; Quest Diagnostics Incorporated; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Vitro Diagnostics Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in vitro diagnostics market report based on products, technology, application, test location, end use, and region.

-

Product Outlook (Volume, Number of Instruments, in Thousands; Volume, Reagents, Number of Tests in Million; Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (Volume, Number of Instruments, in Thousands; Volume, Reagents, Number of Tests in Million; Revenue, USD Billion, 2018 - 2030)

-

Immunoassay

-

Instruments

-

Reagents

-

Others

-

-

Hematology

-

Instruments

-

Reagents

-

Others

-

-

Clinical Chemistry

-

Instruments

-

Reagents

-

Others

-

-

Molecular Diagnostics

-

Instruments

-

Reagents

-

Others

-

-

Coagulation

-

Instruments

-

Reagents

-

Others

-

-

Microbiology

-

Instruments

-

Reagents

-

Others

-

-

Others

-

Instruments

-

Reagents

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Other applications

-

-

Test Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Point of Care

-

Home-care

-

Others

-

-

End Use Outlook (Volume, Number of Instruments, in Thousands; Volume, Reagents, Number of Tests in Million; Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Laboratory

-

Home Care

-

Others

-

-

Regional Outlook (Volume, Number of Instruments, in Thousands; Volume, Reagents, Number of Tests in Million; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in vitro diagnostics market size was valued at USD 108.30 billion in 2024 and is expected to reach USD 114.25 billion in 2025.

b. The global in vitro diagnostics market is expected to grow at a compound annual growth rate of 5.62% from 2025 to 2030 to reach USD 150.13 billion in by 2030.

b. Reagents dominated the in vitro diagnostics market with a market share of 65.54% in 2024 driven by significant R&D efforts from leading market players aiming to develop innovative biomarker kits.

b. Major players in the IVD market are Abbott, Bio-Rad Laboratories, Inc, Siemens Healthineers AG, BIOMÉRIEUX, BD, QIAGEN, Quidel Corporation, F. Hoffmann-La Roche Ltd., Danaher, Quest Diagnostics Incorporated, Agilent Technologies, Inc.

b. Key factors that are driving the IVD market growth include the increasing prevalence of chronic and infectious diseases, advancements in diagnostic technologies, and the shift toward value-based healthcare emphasizing early detection and preventive care.

b. The coronavirus pandemic led to many pharmaceutical companies launching novel rapid diagnostic kits for the detection of the virus, with federal agencies around the globe enabling their early launch, which accelerated the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.