- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Intermediate Bulk Container Liner Market, 2030GVR Report cover

![Asia Pacific Intermediate Bulk Container Liner Market Size, Share & Trends Report]()

Asia Pacific Intermediate Bulk Container Liner Market Size, Share & Trends Analysis Report By Capacity (Above 1000 Liter, Upto 1000 Liter), By Application (Food & Beverage, Industrial Liquids), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-057-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Asia Pacific IBC Liner Market Size & Trends

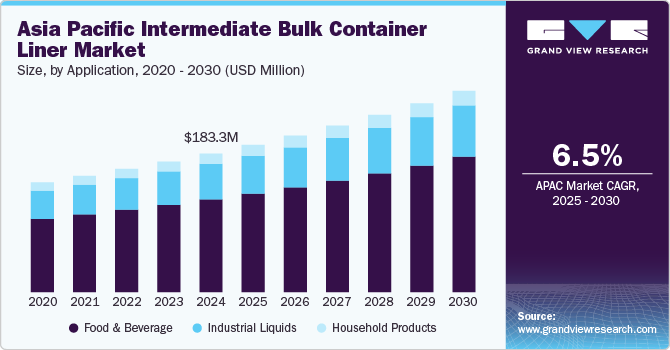

The Asia Pacific intermediate bulk container liner market size was estimated at USD 183.3 million in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The growth in urbanization and rising manufacturing activities across the region are expected to fuel the intermediate bulk container (IBC) liner market demand over the forecast period. Container liner are a form of bulk packaging designed mainly for moving bulk cargo inside a container.

Furthermore, their ability to reduce the need for container cleaning, reusable nature, cost-effectiveness, and avoid product contamination drive market demand. In addition, the growing transportation, international trade, and shipment activities in developing countries such as China, India, and Japan are expected to create demand for bulk packaging in the automotive industry, resulting in the growth of the market in the coming years.

The rise in the import and export of vegetable oils in the country is expected to drive the intermediate bulk container liner industry over the forecast period. The increasing usage of bulk container liner packaging in various industries, such as barrels, tank containers, and drums, owing to their high efficiency and low cost, is propelling the demand for the market in the country.

Logistics and cross-border commerce offer promising growth opportunities. Many infrastructure projects are being launched to integrate the overall system and link the global economy through transportation, energy, and telecommunications efforts. During the projected period, the market is expected to generate lucrative opportunities for the global industrial packaging market, thereby assisting the growth of the regional intermediate bulk container liner industry.

Furthermore, many manufacturers such as Shanghai Metal Corporation, China International Marine Containers (Group) Co., Ltd, and COSCO SHIPPING Lines Co., Ltd. use plastic as a raw material in the development of a favorable product to enhance the durability and reliability of the product. There is an increase in demand for plastic-based containers to transport dangerous goods such as explosive, toxic, flammable, and hazardous products, which is also anticipated to drive the intermediate bulk container liner industry growth in the coming years.

Application Insights

The food & beverage segment dominated the market and held the largest revenue share of over 66.9% in 2024. As the Asia Pacific region continues to experience rapid urbanization and a growing middle class, consumer demand for processed food and beverages has increased. This, in turn, is fueling the need for more advanced packaging solutions that can safely transport a wide range of liquid and solid food products.

Industrial liquids are anticipated to grow at a CAGR of 6.3% over the forecast period. IBC liners are essential for transporting and storing liquids, particularly in industries such as chemicals, food and beverage, pharmaceuticals, and agriculture. The increasing demand for efficient and safe transportation solutions for bulk liquids is a primary driver of this segment’s growth. As industries expand and global trade increases, reliable packaging solutions that maintain product integrity during transit become paramount.

Household products emerged as another major segment owing to the introduction of eco-cleaning household products. The household products packed in the IBC liner include liquid detergent, floor cleaners, surfactants, and liquid soaps & hand wash, among others. Liquid detergents are gaining popularity over powder detergents due to their ability to be applied directly on clothes without the need to be mixed with water, thus driving their demand. This, in turn can fuel the requirement of IBC liner for packaging quantities of liquid detergents for transportation to the packaging sites.

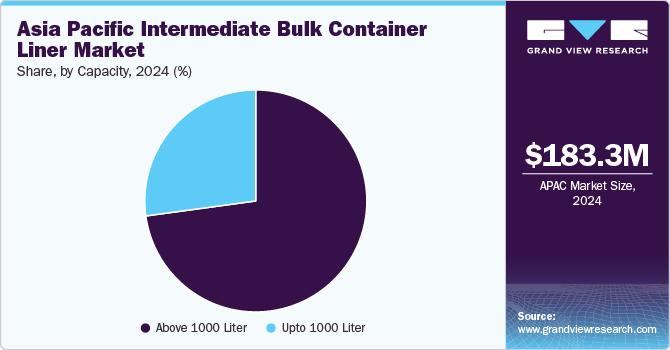

Capacity Insights

Above 1,000 liters capacity dominated the market and accounted for the largest revenue share of over 72.8% in 2024. Larger IBC liners, with a capacity of above 1,000 liters, can transport a larger volume of product in one trip, making them ideal for companies seeking to optimize supply chain efficiency, reduce shipping costs, and minimize packaging waste.

Up to 1,000 liters capacity is anticipated to grow at a CAGR of 6.2% over the forecast period. IBC liners, particularly those in the 1,000-liter capacity range, are often designed to be reusable and recyclable, offering a more sustainable alternative to single-use packaging. As environmental regulations become stricter across the Asia Pacific region, companies are increasingly adopting more eco-friendly solutions to comply with these regulations.

Country Insights

China Intermediate Bulk Container Liner Market Trends

China IBC liner market dominated the Asia Pacific region and is expected to grow at the fastest CAGR over the forecast period. The growing food and beverage market in the country is expected to have a positive impact on the Asia Pacific market growth over the forecast period. Increasing industrialization in the country, coupled with the rising adoption and transportation of packaged food and beverage products in large amounts in the region, is expected to propel demand over the forecast period.

India Intermediate Bulk Container Liner Market Trends

The intermediate bulk container (IBC) liner market in India is expected to grow owing to the increasing demand for product in the agriculture and food and beverage industry. Changing consumption patterns of the consumers, high levels of urbanization coupled with the increasing popularity of such packaging are expected to increase market growth over the forecast period. Increasing investments in R&D by the packaging manufacturers to enable the incorporation of new features, including shape and size are likely to increase the demand for the intermediate bulk container liner in this region over the forecast period.

Key Asia Pacific Intermediate Bulk Container Liner Company Insights

The competitive environment of the Asia Pacific IBC liner industry is marked by the presence of several major players, including Steripac Asia, Bycom Industries Pte: Ltd, and others who dominate the global market with their extensive product portfolios and advanced technologies.

In February 2022, SIG announced its decision to acquire Scholle IPN for USD 1.54 billion (EUR 1.36 billion). Scholle IPN and SIG have many similarities in terms of product offerings, including bag in box and IBC liner, among others; this acquisition will strengthen SIG's presence in the Asia Pacific IBC liner industry.

Key Asia Pacific Intermediate Bulk Container Liner Companies:

- Steripac Asia

- Bycom Industries Pte. Ltd

- Mulitpac Systems

- SBH Solutions

- ILC Dover LP

- Flexbo (TianJin) Logistic System Hi-Tech Co., Ltd.

- Qingdao LAF Packaging Co. Ltd

- Qingdao Jierong Packaging Co., Ltd.

- CHEP

- Changzhou Hailida Packaging Co., LTD

Asia Pacific Intermediate Bulk Container Liner Market Report Scope

Report Attribute

Details

Market size in 2025

USD 194.7 million

Revenue forecast in 2030

USD 266.3 million

Growth rate

CAGR of 6.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Capacity, application, country

Regional scope

Asia Pacific

Country Scope

China; India; Japan; Australia; Malaysia; Thailand

Key companies profiled

Steripac Asia; Bycom Industries Pte. Ltd; Mulitpac Systems; SBH Solutions; ILC Dover LP; Flexbo (TianJin) Logistic System Hi-Tech Co., Ltd.; Qingdao LAF Packaging Co. Ltd; Qingdao Jierong Packaging Co., Ltd.; CHEP; and Changzhou Hailida Packaging Co., LTD

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Intermediate Bulk Container Liner Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific intermediate bulk container liner market report based on capacity, application, and country:

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Upto 1,000 liters

-

Above 1000 liters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Alcoholic Beverages

-

Non-alcoholic Beverages

-

Others

-

-

Industrial Liquids

-

Household Products

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

Malaysia

-

Thailand

-

Frequently Asked Questions About This Report

b. The Asia Pacific intermediate bulk container liner market size was estimated at USD 183.3 million in 2024 and is expected to reach USD 194.67 million in 2025.

b. The Asia Pacific intermediate bulk container liner market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 266.3 million by 2030.

b. The food & beverage segment dominated the Asia Pacific intermediate bulk container liner market with a share of over 66.9% in 2024. Improved lifestyle, growing awareness, and higher disposable income about healthier products have resulted in a heightened demand for food and beverage products.

b. Some key players operating in the Asia Pacific intermediate bulk container liner market include ILC Dover LP, Flexbo (TianJin) Logistic System Hi-Tech Co.,Ltd. , Qingdao LAF Packaging Co. Ltd, Qingdao Jierong Packaging Co., Ltd., and others.

b. Key factors that are driving the Asia Pacific intermediate bulk container liner market growth include increasing industrialization in the country coupled with the rising adoption and transportation of packaged food and beverage products in large amounts in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."