- Home

- »

- Food Additives & Nutricosmetics

- »

-

Asia Pacific, Middle East And Africa Emulsifiers Market Report, 2030GVR Report cover

![Asia Pacific, Middle East And Africa Emulsifiers Market Size, Share & Trends Report]()

Asia Pacific, Middle East And Africa Emulsifiers Market Size, Share & Trends Analysis Report By Product, By Product By Application, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-978-4

- Number of Report Pages: 225

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

Report Highlights

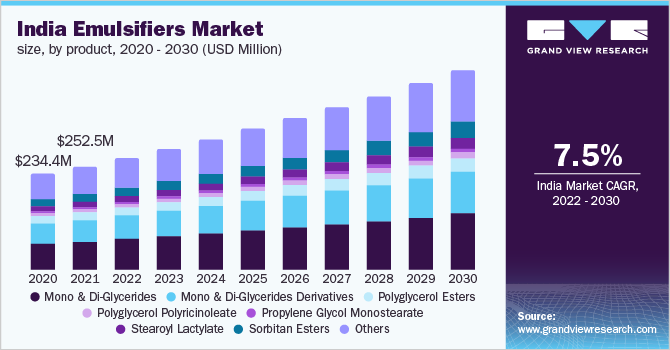

The Asia Pacific, Middle East And Africa emulsifiers market size was valued at USD 2.37 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2022 to 2030. The market growth is attributed to the increasing consumption of food and beverage products. Globally, the increasing population has caused a rapid rise in the demand for food and beverages in the Asia Pacific and the Middle East. An emulsifier is an additive that helps two liquids mix by stabilizing the emulsion. It is naturally found in candelilla wax, beeswax, rice bran wax, and carnauba wax among others. Mustard, soy, lecithin, mono and di-glycerides, and polysorbates are the most commonly used emulsifiers in food and non-food applications. In 2021, India held a prominent market share. Factors such as the availability of feedstock, adoption of novel bio-based value chains, government policies, and business sustainability programs are expected to influence the demand for the product in the region.

The market in the country is expected to grow at a considerable rate owing to robust demand from the food industry. The demand from the food industry is expected to grow exponentially owing to an increase in population, which is likely to impact the market growth positively.

Thus, the food and beverage industry is driving the market for emulsifiers in the country. The demand in these regions is driven by growth in the end-use industries such as bakery and the presence of end-use manufacturers.

Product Insights

Mono and Di-Glycerides (MDG) dominated the market with a revenue share of over 25.0% in 2021. Mono and diglycerides are produced commercially from plant and animal lipids by catalytic transesterification of glycerol, and they are the most widely used emulsifiers in baked products.

There are three types of mono and di-glycerides: 40%, 60%, and 90%. These are primarily used in baked products and beverages and for texture purposes. Lactam as a product has features like emulsification, wetting, viscosity reduction, control of oil crystals, delaying starch aging, and solubilization in dairy and non-dairy products.

Other major emulsifiers include sorbitan esters, polyglycerol polyricinoleate, and polyglycol monosterate. These are more commonly used in the food, pharmaceutical, and cosmetics industries due to their amphiphilic properties.

Product by Application Insights

Mono and di-glycerides dominated the market with a revenue share of over 25.0% in 2021. This is attributed to the increasing demand for food products with longer shelf life and improved food quality. Mono- and diglycerides help water and oil to blend. As a result, they are commonly used as food additives.

In some Asian countries such as China, Malaysia, and Australia, there has been exponential growth in the bakery industry due to changing lifestyles, dietary patterns, and an increase in the disposable income of the people. This will, consequently, lead to increased demand for mono and di-glyceride emulsifiers in this region. In terms of revenue, the market for mono and di-glycerides derivatives in the Asia Pacific is anticipated to witness the fastest growth during the forecast period.

Although the consumption of bakery products remained low in 2021 as compared to mature markets such as Europe and North America, the rising population and shifting consumer preferences are likely to drive the demand for bakery products in APAC and the MEA. For instance, in 2021, China and India witnessed a growth of 7% to 8% in the baking industry, which is anticipated to drive the demand for stearoyl lactylate over the forecast period.

The rapid industrialization of key food processing sectors, including bakery and confectionery and dairy, in the Asia Pacific, is estimated to present a strong scope for market growth shortly. This scenario is likely to be reflected in major Asia Pacific countries including India and China.

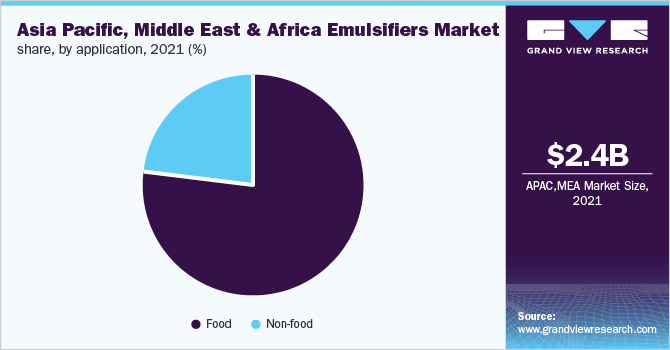

Application Insights

The food application segment dominated the market with a revenue share of over 75.0% in 2021. This is attributed to the high rate of utilization of emulsifiers in the food industry. The significant demand for the product in the food industry is from the bakery industry. The rise in the consumption of baked products has positively impacted the market for emulsifiers and is likely to increase at a high rate over the forecast period.

Food ingredient companies including Danisco, Palsgaard, ADM, and Lonza Group have integrated their business from manufacturing raw materials to the production and distribution of emulsifiers to the end-use industries. The strong foothold of the abovementioned companies in the food ingredients industry as a result of extensive brand networks and established partnerships with food processing companies operating in the bakery, confectionery, dairy goods, and meat sectors is expected to remain a favorable factor for sustaining their growth.

People consume a wide variety of bakery products including cakes, desserts, pancakes, bread, and cookies. Over recent years, there has been a growing awareness regarding using safe ingredients to manufacture bakery products. Owing to the use of emulsifiers derived from bio-based sources, such as soybeans, papaya, and other vegetable oils, this trend is estimated to offer significant scope for the consumption of food emulsifiers in the bakery and confectionery industry over the years ahead.

Regional Insights

Asia Pacific dominated the market in 2021 with a revenue share of over 80.0%. This is attributed to the presence of a large processed food industry in this region. Rising foreign investments in the food-processing sector, the availability of abundant raw material sources, and a broad consumer base are a few of the major growth factors. Favorable regulations promoting foreign investments in the domestic food and beverage industry in India are expected to be a favorable factor for market growth in the Asia Pacific.

Asia Pacific is the largest producer and consumer of emulsifiers in the world. In this region, the food and beverages industry is the largest consumer of the product owing to its increased usage in baked food manufacturing. Mono-di glyceride is the most commonly used emulsifier. Significant consumption of food emulsifiers in application markets, including bakery and confectionery and convenience foods, is expected to propel their demand in the Asia Pacific region in the coming years.

Key Companies & Market Share Insights

The market is competitive and consolidated with the presence of numerous players. It has been characterized by the presence of multiple multinational players that are involved in premeditated mergers & acquisitions, product developments, regional expansion, and inventions to increase profits, strengthen their position, and at the same time find innovative and sustainable solutions.

The market in the Asia Pacific and the Middle East and Africa is established with major applications in food, beverages, pharmaceuticals, and personal care and cosmetic products. The market growth also depends upon various factors such as the availability of raw materials, production cost, and extraction processes.

Consequently, the focus on emulsifier production has increased owing to rising environmental concerns arising from the utilization of harmful chemical products. The Asia Pacific market has witnessed several consolidations such as new product developments, joint ventures, and mergers & acquisitions due to increasing demand for emulsifiers. Some prominent players in the Asia Pacific, Middle East, And Africa Emulsifiers market include:

-

Kerry Group plc.

-

Vantage Specialty Chemicals

-

Corbion N.V.

-

Nexira

-

Cargill Inc.

-

Estelle Chemicals Pvt. Ltd.

-

Plasgaard A/S

-

BASF SE

-

ADM (Archer Daniel Midland)

-

International Flavors and Fragrances

-

Ingredion Inc.

Asia Pacific, Middle East And Africa Emulsifiers Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.54 billion

Revenue forecast in 2030

USD 4.24 billion

Growth rate

CAGR of 6.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, product by application, application, region

Regional scope

Asia Pacific; Middle East & Africa

Country scope

India; Saudi Arabia; Egypt; UAE; Nigeria; Turkey; South Africa; Qatar; Israel; Iran

Key companies profiled

Kerry Group plc.; Vantage Specialty Chemicals; Corbion N.V.; Nexira; Cargill Inc.; Estelle Chemicals Pvt. Ltd.; Plasgaard A/S; BASF SE; ADM (Archer Daniel Midland); International Flavors and Fragrances; Ingredion Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific, Middle East And Africa Emulsifiers Market Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific, Middle East, And Africa Emulsifiers market report based on product, product by application, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Mono & Di-Glycerides

-

40%

-

60%

-

90%

-

-

Mono & Di-Glycerides Derivatives (MDG)

-

Lactem (Lactic acid esters of MDG)

-

Citrem (Citric acid esters of MDG)

-

-

Polyglycerol Esters (PGE)

-

Polyglycerol Polyricinoleate (PGPR)

-

Propylene Glycol Monostearate (PGMS)

-

Stearoyl Lactylate

-

Sodium Stearoyl Lactylate (SSL)

-

Calcium Stearoyl-2-lactylate (CSL)

-

-

Sorbitan Esters

-

Sorbitan Monostearate (SMS)

-

Sorbitan Tristearate (STS)

-

-

Others

-

-

Product by Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Mono & Di-Glycerides

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Personal Care

-

Home Care

-

Others

-

-

-

Mono & Di-Glycerides Derivatives (MDG)

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Personal Care

-

Home Care

-

Others

-

-

-

Polyglycerol Esters(PGE)

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Plastics/Polymers

-

Personal Care

-

Home Care

-

Others

-

-

-

Polyglycerol Polyricinoleate (PGPR)

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Personal Care

-

Others

-

-

-

Propylene Glycol Monostearate (PGMS)

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Personal Care

-

Others

-

-

-

Stearoyl Lactylate

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Personal Care

-

Home Care

-

Others

-

-

-

Sorbitan Esters

-

Food

-

Bakery

-

Confectionery

-

Chocolate Confectionary

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Ice Cream

-

Others

-

-

Non-food

-

Personal Care

-

Home Care

-

Agrochemicals

-

Others

-

-

-

Others

-

Food

-

Bakery

-

Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Non-food

-

Plastics/Polymers

-

Personal Care

-

Home Care

-

Agrochemicals

-

Others

-

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Food

-

Bakery

-

Confectionery

-

Chocolate Confectionary

-

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Ice Cream

-

-

Others

-

-

Non-Food

-

Plastics/Polymers

-

Personal Care

-

Home Care

-

Agrochemicals

-

Others

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2030)

-

Asia Pacific

-

India

-

-

Middle East and Africa

-

Saudi Arabia

-

Egypt

-

UAE

-

Nigeria

-

Turkey

-

South Africa

-

Qatar

-

Israel

-

Iran

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific, Middle East And Africa emulsifiers market size was estimated at USD 2.37 billion in 2021 and is expected to reach USD 2.54 billion in 2022.

b. The Asia Pacific, Middle East And Africa emulsifiers market is estimated to advance with a moderate growth rate at a CAGR of 6.7% from 2022 to 2030 to reach USD 4.24 billion by 2030.

b. Mono & Di-Glycerides emerged as the dominating product segment in 2021. The growth of this segment can be attributed to the mounting consumption of numerous dairy products including cheese, margarine, creams, ice creams, and yogurt.

b. Some prominent players in the Asia Pacific, Middle East And Africa emulsifiers market include: Kerry Group plc. ,Vantage Specialty Chemicals, Corbion N.V., Nexira, Cargill Inc.

b. The Asia Pacific, Middle East And Africa emulsifiers market is anticipated to be driven by demand for emulsifiers in food & beverage products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."