- Home

- »

- Personal Care & Cosmetics

- »

-

Polyglycerol Market Size And Share, Industry Report, 2033GVR Report cover

![Polyglycerol Market Size, Share & Trends Report]()

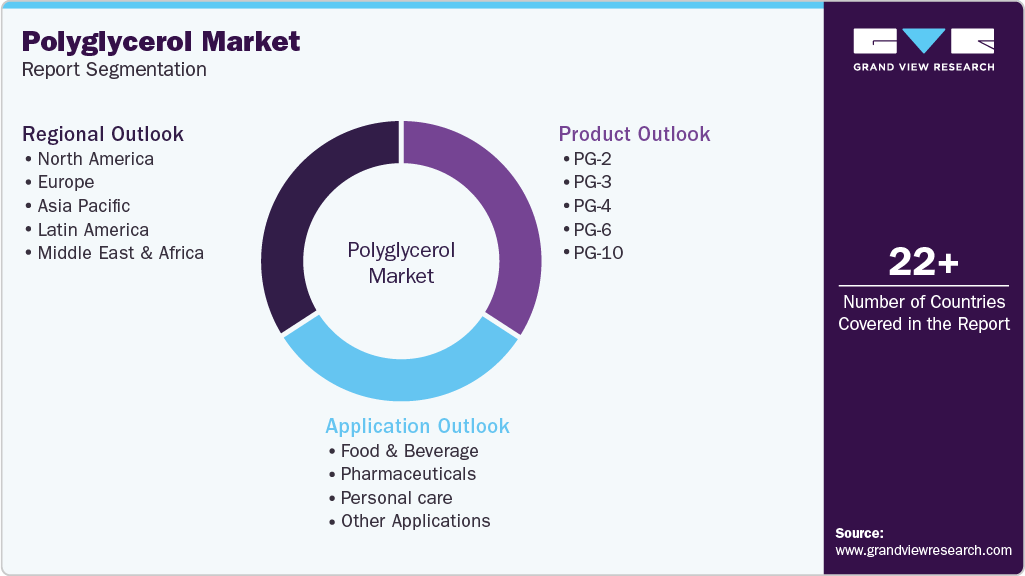

Polyglycerol Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (PG-2, PG-3, PG-4), By Application (Food & Beverage, Pharmaceuticals, Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-026-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyglycerol Market Summary

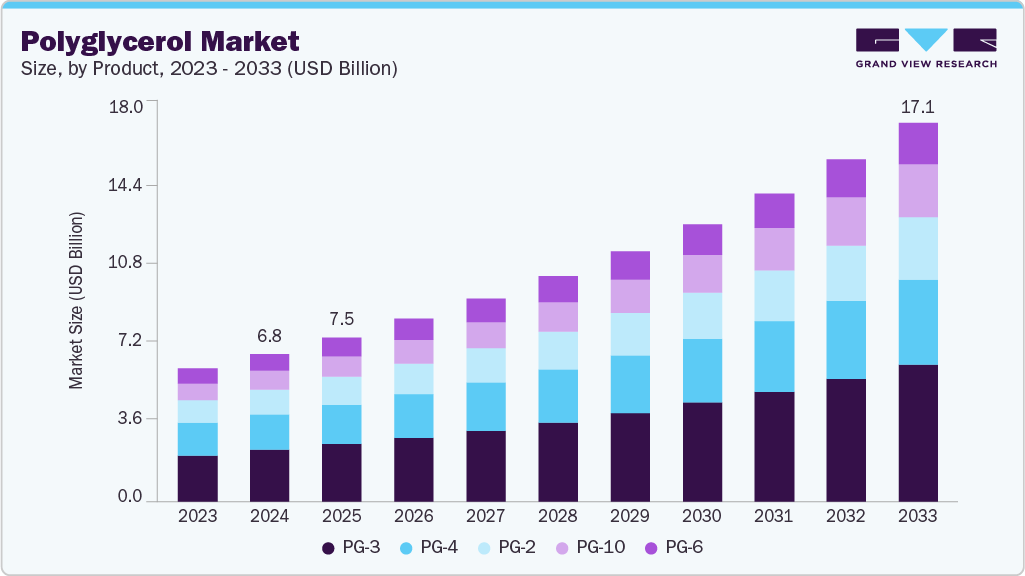

The global polyglycerol market size was estimated at USD 6.77 billion in 2024 and is projected to reach USD 17.06 billion by 2033, growing at a CAGR of 10.8% from 2025 to 2033. The market is primarily driven by the rising demand for biodegradable and non-toxic emulsifiers across the food, pharmaceutical, and personal care industries.

Key Market Trends & Insights

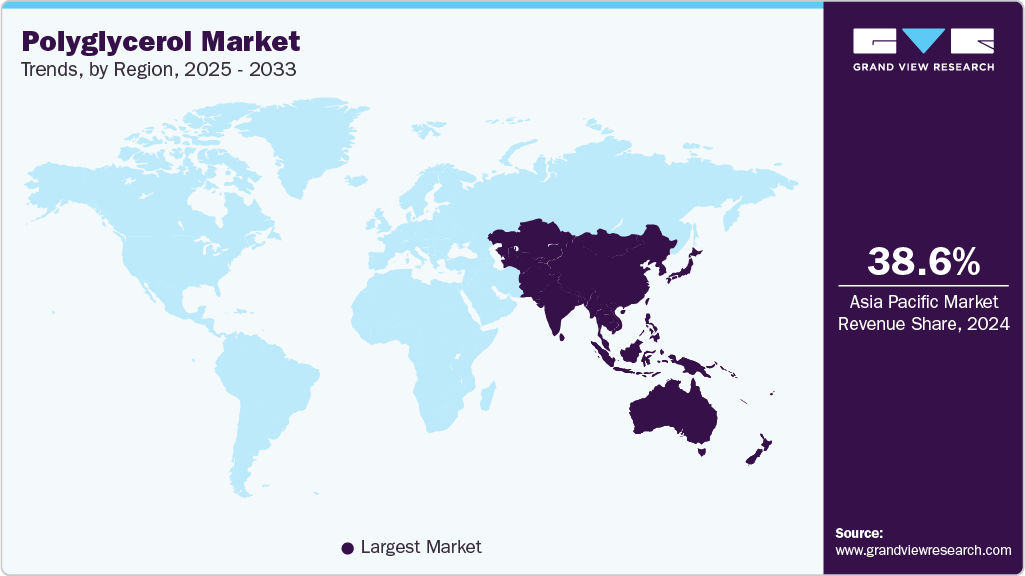

- Asia Pacific dominated the polyglycerol market with the largest revenue share of 38.6% in 2024.

- The market in China is expected to grow at a significant CAGR of 12.0% from 2025 to 2033.

- By product, the PG-10 segment is expected to grow at a CAGR of 12.8% from 2025 to 2033 in terms of revenue.

- By application, the personal care segment held the largest revenue share of 46.3% in 2024 in terms of value.

- By product, PG-3 segment held the largest revenue share of 34.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 6.77 Billion

- 2033 Projected Market Size: USD 17.06 Billion

- CAGR (2025-2033): 10.8%

- Asia Pacific: Largest market in 2024

In addition, growing consumer preference for clean-label and plant-based ingredients is accelerating the adoption of polyglycerol-based formulations. The market presents significant growth opportunities driven by increasing demand for sustainable and multifunctional ingredients across various industries. Expanding applications in bio-based lubricants, biodegradable plastics, and cosmeceuticals are opening new avenues for innovation. Moreover, the rising focus on natural and plant-derived excipients in pharmaceuticals and the growing popularity of vegan and organic personal care products further enhance the market potential, especially in emerging markets across Asia Pacific and Latin America.

Despite its growth prospects, the market faces challenges related to high production costs and limited scalability compared to conventional synthetic alternatives. Raw material dependency, particularly on plant-based glycerol sources such as palm or soybean oil, raises concerns regarding price volatility and supply chain sustainability. Furthermore, compliance with varying international regulatory standards for food and pharmaceutical applications may pose entry barriers for new players and delay product commercialization.

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Cargill, Incorporated, Sakamoto Yakuhin kogyo Co., Ltd., Solvay, and Spiga Nord S.p.A. dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global market are adopting strategies such as strategic partnerships, product innovation, and capacity expansion to strengthen their market position. Companies invest in R&D to develop high-purity, multifunctional polyglycerol grades tailored for specialized food, pharmaceuticals, and personal care applications. Moreover, several players are focusing on sustainable sourcing of raw materials and introducing bio-based formulations to align with evolving consumer preferences and regulatory standards.

Product Insights

The PG-3 segment accounted for the largest revenue share of 34.3% in 2024, primarily driven by its widespread use in food and personal care applications. PG-3 offers an optimal balance between hydrophilicity and emulsifying performance. It is a key ingredient in food-grade emulsifiers such as polyglycerol esters of fatty acids (PGEFs), commonly used in bakery, confectionery, and dairy products. Its non-toxic and biodegradable nature aligns well with the growing demand for clean-label and sustainable additives. In addition, PG-3’s compatibility with a wide range of formulations has made it a preferred choice in personal care products such as lotions, creams, and cleansers.

Meanwhile, PG-6 and PG-10 segments are expected to witness the fastest growth over the forecast period, driven by increasing demand from pharmaceutical and high-performance personal care applications. These higher polymerized forms offer superior emulsification, moisture retention, and film-forming capabilities, making them ideal for advanced formulations such as drug delivery systems, anti-aging skincare, and cosmeceuticals. PG-4 also holds a steady share, bridging low and high polymerized grades, especially in multiphase formulations. Product innovation and customization across these grades enhance their relevance across diverse end-use industries, contributing to sustained segmental growth.

Application Insights

The personal care segment held the largest revenue share of 46.3% in 2024, driven by the increasing demand for safe, multifunctional, and biodegradable ingredients. In personal care, polyglycerol is used as a humectant, emulsifier, and solubilizer in products such as moisturizers, sunscreens, and facial cleansers, with PG-6 and PG-10 gaining popularity in premium skincare lines. In pharmaceuticals, polyglycerol is valued for its non-toxic, non-irritating characteristics and is used in topical formulations, ointments, and drug delivery systems. The PG-10 segment, which includes industrial applications such as lubricants, surfactants, and biodegradable packaging materials, represents a niche but expanding area, offering potential for future innovation as industries increasingly shift toward greener alternatives.

The food and beverage segment held a significant revenue share of 30.6% in 2024, owing to its extensive use as an emulsifier, stabilizer, and texture enhancer in a variety of processed food products. Polyglycerol, particularly in polyglycerol esters of fatty acids (PGEFs), is widely approved for use in bakery, dairy, confectionery, and margarine applications due to its excellent emulsification properties and safety profile. Growing consumer demand for clean-label and plant-based ingredients has further propelled their adoption in natural and organic food formulations. Regulatory approvals across major economies and the expanding global processed food industry are expected to support sustained growth in this segment.

Regional Insights

Asia Pacific held the largest revenue share of 38.6% in 2024, driven by the region's strong industrial base, expanding food processing sector, and growing demand for personal care and pharmaceutical products. Rapid urbanization, increasing consumer awareness toward clean-label and sustainable ingredients, and supportive regulatory frameworks in countries such as Japan, South Korea, and India have further fueled market growth.

China Polyglycerol Market Trends

The polyglycerol market in China, as the leading contributor within Asia Pacific, has emerged as a key manufacturing and consumption hub for polyglycerol, supported by its massive food and beverage industry, growing cosmetic sector, and increasing pharmaceutical production. The country’s push for domestic production of biodegradable and bio-based chemicals, coupled with government initiatives promoting green chemistry and clean technologies, has accelerated the adoption of polyglycerol across multiple end-use sectors.

North America Polyglycerol Market Trends

The polyglycerol market in North America accounted for a significant share of 20.8% in 2024, supported by a mature personal care industry, strong demand for functional food ingredients, and ongoing innovations in pharmaceutical formulations. The region’s emphasis on sustainable and non-toxic ingredients across consumer and industrial applications has driven the adoption of polyglycerol, particularly in clean-label food products and bio-based skincare solutions.

The U.S. polyglycerol market, as the dominant market in North America, continues to lead in terms of consumption and innovation in the polyglycerol space. The U.S. benefits from well-established food processing and personal care sectors and a strong focus on health-conscious and eco-friendly products. The rising preference for plant-based emulsifiers and excipients in pharmaceutical and nutraceutical applications further bolsters demand for polyglycerol.

Europe Polyglycerol Market Trends

The polyglycerol market in Europe is prominent, driven by stringent environmental regulations, strong consumer demand for sustainable ingredients, and a well-developed personal care and pharmaceutical industry. The region's regulatory emphasis on eco-friendly, non-toxic additives has accelerated the adoption of polyglycerol across food, cosmetics, and healthcare sectors.

Germany polyglycerol market, as one of the leading contributors within the European market, plays a critical role due to its advanced manufacturing capabilities and robust end-user industries. The country’s strong presence in pharmaceuticals, cosmetics, and specialty chemicals has driven consistent demand for high-purity polyglycerol variants.

Latin America Polyglycerol Market Trends

The polyglycerol market in Latin America is emerging as a growing market for polyglycerol, supported by the expanding food processing and personal care industries across Brazil, Mexico, and Argentina. Rising consumer awareness regarding the benefits of natural and sustainable ingredients and increasing adoption of clean-label food products is driving demand for polyglycerol-based emulsifiers and stabilizers.

Middle East & Africa Polyglycerol Market Trends

The polyglycerol market in the Middle East and Africa represents a nascent but developing market, driven by growing urbanization, increasing disposable incomes, and a gradual shift toward sustainable and health-conscious consumer products. Countries such as the UAE and South Africa are witnessing rising demand for personal care and pharmaceutical products incorporating biodegradable ingredients like polyglycerol.

Key Polyglycerol Company Insights

Key players such as Cargill, Incorporated, Sakamoto Yakuhin kogyo Co., Ltd., Solvay, Spiga Nord S.p.A., The Good Scents Company, and Lonza dominate the market.

-

Cargill, Incorporated is a privately held American multinational conglomerate. The company operates across multiple sectors, including agricultural commodities trading, food ingredient production (notably starches, glycerin, vegetable oils, and fats), industrial bio-chemicals, and risk management services. Leveraging its extensive global footprint, operating in over 70 countries with around 160,000 employees, Cargill serves markets spanning ultra-processed foods, animal feed, biodiesel, pharmaceuticals, and industrial glycerin derivatives like polyglycerol. Cargill’s strategic initiatives include investing in developing polyglycerol-based polyols (e.g., Oxi-Cure 500 and 510), aligning with rising demand for sustainable, multifunctional ingredients in personal care, food & beverage, and industrial formulations.

Key Polyglycerol Companies:

The following are the leading companies in the polyglycerol market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- Sakamoto Yakuhin kogyo Co., Ltd.

- Solvay

- Spiga Nord S.p.A.

- The Good Scents Company

- Lonza

- Stepan Company

- Savannah Surfactants

- Palsgaard

- NIKKO CHEMICALS CO., LTD.

- Procter & Gamble

- Croda International Plc

Global Polyglycerol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.50 billion

Revenue forecast in 2033

USD 17.06 billion

Growth rate

CAGR of 10.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Cargill, Incorporated; Sakamoto Yakuhin kogyo Co., Ltd.; Solvay, Spiga Nord S.p.A.; The Good Scents Company; Lonza; Stepan Company; Savannah Surfactants; Palsgaard; NIKKO CHEMICALS CO., LTD.; Procter & Gamble; Croda International Plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyglycerol Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global polyglycerol market report based on application, product, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Pharmaceuticals

-

Personal care

-

Other Applications

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

PG-2

-

PG-3

-

PG-4

-

PG-6

-

PG-10

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.