- Home

- »

- Healthcare IT

- »

-

Asia Pacific Predictive Disease Analytics Market Size ReportGVR Report cover

![Asia Pacific Predictive Disease Analytics Market Size, Share & Trends Report]()

Asia Pacific Predictive Disease Analytics Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud-based), By End-use (Healthcare Providers, Healthcare Payers), By Component, And Segment Forecasts

- Report ID: GVR-4-68040-082-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

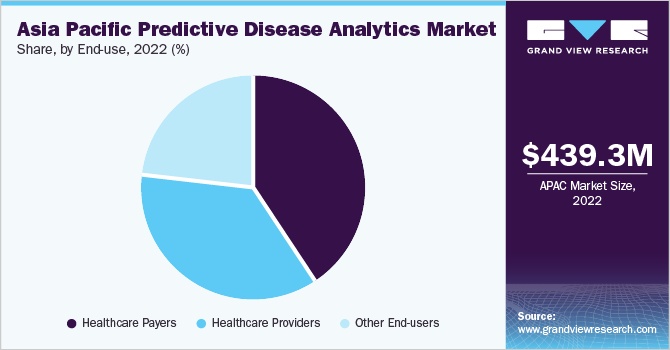

The Asia Pacific predictive disease analytics market size was valued at USD 439.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 24.0% from 2023 to 2030. The market growth is attributed to the rising awareness regarding benefits associated with the adoption of predictive disease analytics, such as enhanced operating capabilities and improved patient care. Moreover, significant advancements in technology and rising government support for the development of healthcare infrastructure in the form of favorable policies and funding is driving the market growth. Predictive analytics assists in decision-making and predictions with the help of various techniques such as data mining, modeling, Artificial Intelligence (AI), and statistics.

Predictive analytics and big data are capable of improving operations in healthcare organizations and enhancing the accuracy of treatment and diagnosis in personalized medicine. Increasing healthcare costs, reduced patient engagement and retention, coupled with a lack of patient care, are encouraging healthcare providers to adopt predictive disease analytics to address these issues. According to Philips Future Health Index (FHI) 2022, around 80% of the healthcare leaders in the region see predictive disease analytics as having a positive impact on staff and patient experience, health outcomes, health inequalities, and cost of care. Moreover, rising investment by prominent players in the market for the development of healthcare solutions coupled with technological advancements in the field of predictive analytics is leading to the digitalization of the healthcare industry.

According to Philips FHI 2022, around 55% of the healthcare leaders in Asia have already invested in AI, of which 35% consider AI for clinical decision support, 34% use it for predicting outcomes, and 33% use AI for integrating diagnostics. The rising government support in the form of policies and funding is driving the adoption of predictive analytical tools in the healthcare industry. For instance, in April 2023, Congress announced funding of USD 10 million to the Department of Defense (DoD) for the advancement in AI-driven disease prediction under its Accelerate the Procurement and Fielding of Innovation Technologies initiative. The DoD has successfully demonstrated the use of AI in leveraging data from wearables and predicting various infections 2–3 days before the diagnostic testing. Philips is responsible for the algorithm development and is expected to accelerate scaling and commercialization.

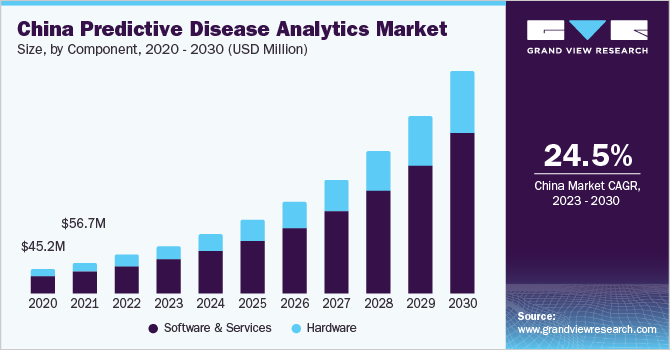

Component Insights

On the basis of components, the industry has been further segmented into software & services and hardware. The software & services segment accounted for the largest share of 70.8% of the overall revenue in 2022. The segment is anticipated to expand further at the fastest CAGR of 24.4% retaining its dominant position throughout the forecast period. The rising patient load on healthcare facilities, coupled with the rising prevalence of diseases, is contributing to the market growth in this segment.

In addition, the growing pressure to offer better patient care at a low cost is creating opportunities for this segment to grow. Moreover, the development of data analytics and platforms is drawing investments into the IT sector in the healthcare industry. As the majority of healthcare systems don’t have dedicated data analytics divisions, they tend to outsource it to IT companies. This is propelling the growth of data analytics firms, which, in turn, is driving the segment growth.

Deployment Insights

On the basis of deployments, the market has been segmented into on-premise and cloud-based. The on-premise deployment segment accounted for the largest share of 65.2% of the overall revenue in 2022. The segment growth is attributed to the benefits associated with the adoption of on-premise solutions, such as reduced costs, low power consumption, and low maintenance. Moreover, this type of deployment also offers security and convenience of access, which is motivating various healthcare institutions to install instruments and software at their premises.

The cloud-based segment is anticipated to grow at the fastest CAGR of 25.1% over the forecast period. The growth is attributed to the low capital requirement, ease of storage, and enhanced efficiency. The cloud-based solutions are capable of increasing user engagement and providing remote access to medical information at any time and from anywhere, which is expected to drive the growth of this segment over the forecast period.

End-use Insights

On the basis of end-uses, the industry has been segmented into healthcare payers, healthcare providers, and others. The healthcare payers end-use segment dominated the market in 2022 and accounted for the largest share of 40.8% of the overall revenue. The healthcare payers segment includes health plan sponsors, insurance companies, third-party payers, and government agencies. Payers are adopting predictive disease analytics tools to evaluate insurance claims and reduce risks arising from fraud.

The healthcare providers segment is anticipated to register the fastest growth rate of 24.3% from 2023 to 2030 owing to the increasing healthcare expenditure and rising investment for the development of healthcare infrastructure in the region. Furthermore, the growing geriatric population coupled with the rising incidences of chronic disease is creating an opportunity for predictive disease analytics to grow as it assists in clinical decision-making, treatment, and resource allocation as per future needs.

Country Insights

India dominated the regional market in 2022 and accounted for the largest share of 23.6% of the overall revenue. The market in the country is projected to expand further at the fastest growth rate of 24.9% and retain its dominance throughout the forecast period. The growth of the market is attributed to the strong presence of companies, such as IBM Corp. and Oracle Corp., in the country. These players are adopting strategies to strengthen their market position, which, in turn, is driving market growth.

For instance, in 2022, Google and Apollo Hospitals announced a collaboration for the use of deep learning models in diagnostic purposes, such as x-rays. Moreover, the presence of government support in the form of initiatives and funding for the development of the healthcare sector in the country is driving the growth. According to India Today, public funding was increased by 67% in FY 2022-23 for the Digital India Mission, which encourages the use of AI-based tools for enhanced healthcare outcomes and agricultural productivity.

Key Companies & Market Share Insights

Prominent companies are engaging in various strategies, such as acquisitions, partnerships, collaborations, expansions, and new product launches, to strengthen their position in the market. For instance, in June 2022, Oracle Corp. completed the acquisition of Cerner Corp. and gained a stake of 69.2% in the company. Both companies focus on co-developing advanced healthcare analytics solutions and expanding their product portfolio & business footprint.

In October 2022, MedeAnalytics, Inc. partnered with Pendo to introduce MedeAdopt, enabling users to maximize real-time utilization metrics for clients. Similarly, in January 2023, SwitchPoint Ventures and Ardent Health Service collaborated to establish an innovation center, which aimed to create & implement data-driven solutions. In addition, Polaris, SwitchPoint’s groundbreaking method for precisely forecasting the number of patients in any clinical setting, was adopted by Ardent. Some of the prominent players in the Asia Pacific predictive disease analytics market include:

-

IBM Corp.

-

Verisk Analytics, Inc.

-

McKesson Corp.

-

SAS Institute, Inc.

-

Cotiviti, Inc.

-

Optum, Inc.

-

MedeAnalytics, Inc.

-

Oracle

Asia Pacific Predictive Disease Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 543.6 million

Revenue forecast in 2030

USD 2448.46 million

Growth rate

CAGR of 24.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Component, Deployment, End-use, Country

Country scope

China; Japan; India; Australia; Singapore; Malaysia; Indonesia; Vietnam

Key companies profiled

IBM Corp.; Verisk Analytics, Inc.; McKesson Corp.; SAS Institute, Inc.; Cotiviti, Inc.; Optum, Inc.; MedeAnalytics, Inc.; Oracle

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Predictive Disease Analytics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Asia Pacific predictive disease analytics market based on component, deployment, end-use, and country:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Payers

-

Healthcare Providers

-

Other End-users

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

Malaysia

-

Indonesia

-

Vietnam

-

Frequently Asked Questions About This Report

b. Some of the prominent players in the Asia Pacific predictive disease analytics market include: • IBM Corporation • Verisk Analytics, Inc. • McKesson Corporation • SAS Institute, Inc. • Cotiviti, Inc. • Optum, Inc. • MedeAnalytics, Inc. • Oracle

b. The market growth is attributed to the rising awareness regarding benefits associated with the adoption of predictive disease analytics, such as enhanced operating capabilities and improved patient care

b. The Asia Pacific predictive disease analytics market size was valued at USD 439.3 million in 2022 and is expected to reach USD 543.6 million in 2023.

b. The Asia Pacific predictive disease analytics market is anticipated to grow at a compound annual growth rate of 24.0% over the forecast period to reach USD 2448.46 million by 2030.

b. Based on component, the market is segmented into software & services and hardware. The software & services segment accounted for the largest share of 70.8% in 2022 and is anticipated to show the fastest growth at a CAGR of 24.4% over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.