- Home

- »

- Healthcare IT

- »

-

Predictive Disease Analytics Market, Industry Report, 2030GVR Report cover

![Predictive Disease Analytics Market Size, Share & Trends Report]()

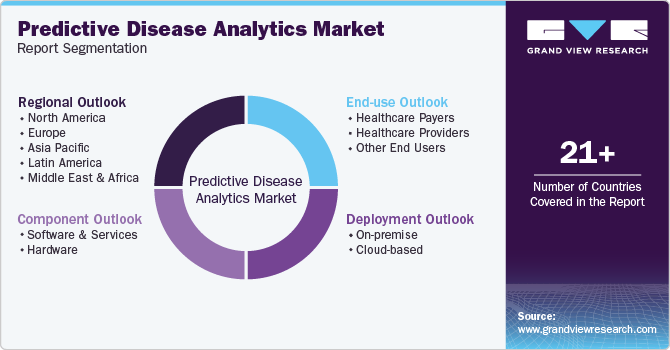

Predictive Disease Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software & Services), By Deployment (On-premise, Cloud-based), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-043-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Predictive Disease Analytics Market Trends

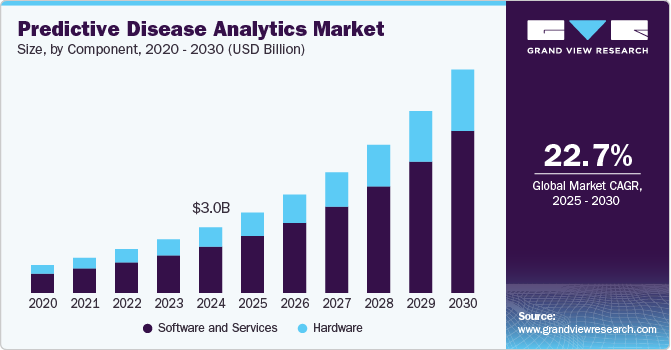

The global predictive disease analytics market size was estimated at USD 3.0 billion in 2024 and is projected to grow at a CAGR of 22.7% from 2025 to 2030. The growth is driven by the rising emphasis on personalized medicine and the rising prevalence of chronic diseases, along with the rising healthcare expenditure and continuous technological advancements in AI and machine learning. According to a World Health Organization (WHO) report published in December 2024, approximately 43 million deaths were attributed to non-communicable diseases in 2021, representing nearly 75% of all global non-pandemic-related mortalities. This significant disease burden highlights the critical need for predictive disease analytics, as healthcare systems increasingly rely on advanced analytical tools, such as AI, data mining, and statistical modeling, to enable early disease detection, improve clinical decision-making, and enhance patient outcomes.

The healthcare industry has been challenged with issues like skyrocketing treatment costs, lack of better patient care, and less patient retention and engagement. Thus, predictive disease analytics are being adopted throughout the industry to provide better care to patients and improve operations. These factors are the primary reasons for the growth of the healthcare analytics industry. For instance, in November 2022, Hartford HealthCare and Google Cloud announced their long-term partnership to improve their healthcare system's digital transformation to improve data analytics and enhance patient care.

Moreover, the rapid advancement in technology and huge investment by the healthcare industry have helped the rapid digitization of the healthcare sector. These analytical platforms are deployed throughout the globe to help manage patient and their retention. Deploying healthcare analytics increases staff productivity, improves patient management, and reduces caregivers' burden. In March 2022, Databricks introduced the Lakehouse paradigm for the Healthcare and Life Science industry to deliver innovation in research and care. The single platform can be used for analytics, data management, and advanced AI for disease prediction, medical image classification, and biomarker discovery.

COVID-19 boosted the growth of the predictive disease analytics industry due to the rising need for digital solutions and advanced analytical tools for managing the patient population. A considerable amount of clinical data was generated during the pandemic that required proper management with the help of analytics solutions; this will help researchers and caregivers derive more significant outcomes, predict trends, and understand the dynamics of the spread of disease. For instance, in June 2020, NIH introduced a healthcare data analytics platform to collect patient data for actionable insights on COVID-19. However, factors such as privacy issues, lack of regulations, and algorithm bias are projected to hamper the market growth.

The 10 high-value use cases for predictive disease analytics in healthcare, highlighting their core value propositions:

Use Case

Value Propositions

Real Time Insights

Care Coordination

- Forecasting patient deterioration, readmissions, and length of stay.

- Real-time ICU risk prediction.

- Streamlined patient flow and resource allocation.

- According to a December 2023 NEJM Catalyst study, predictive models deployed at Corewell Health have seen similar success, keeping 200 patients from being readmitted and resulting in a USD 5 million cost savings.

Early Disease Detection

- Identify disease risk.

- Predict disease progression.

- Enable early, targeted interventions.

- In a study published in PLOS One in February 2024, researchers from the University of Virginia introduced an online big data dashboard designed to monitor the burden of enteric infectious diseases in low- and middle-income countries.

- This dashboard is a key component of the Planetary Child Health & Enterics Observatory (Plan-EO) initiative, which seeks to generate data-driven insights to geographically tailor child health interventions more effectively.

Patient Engagement

- Predicting appointment no-shows.

- Tailored outreach post-discharge.

- Medication adherence monitoring.

- Machine learning models have demonstrated strong capabilities in predicting medication adherence. A 2020 study published in Psychiatry Research found that such models could accurately forecast adherence rates of 80% or higher throughout a clinical trial, as well as predict adherence behavior on a daily and weekly basis across a diverse participant population.

- Similarly, a study featured in the March 2020 issue of BMJ Open Diabetes Research & Care showed that a machine learning model effectively identified individuals with type 2 diabetes who were at high risk of non-adherence to their prescribed medications, achieving notable accuracy and sensitivity.

Use cases related to other key applications, such as payer forecasting, precision medicine, and additional relevant areas, will be thoroughly covered in the final report.

Case Study & Insights

WellSky published a case study titled "Improving home health outcomes using predictive analytics" in June 2023. This research shows lowered rehospitalization rates and fewer year-on-year visits.

Challenge:

Home healthcare providers struggled to address the high rehospitalization rate, rising complexity of patient needs, and inefficient care delivery. The lack of predictive tools made it difficult to prioritize interventions, leading to higher operational costs and suboptimal patient outcomes.

Solution:

CareInsights is a predictive analytics platform that improves clinical outcomes and operational efficiency in healthcare settings, particularly in home health and hospice care. The integration of machine learning algorithms and data analytics enables the prediction of patient needs and outcomes. Thus, WellSky implemented CareInsights to help providers leverage data to anticipate patient needs. With machine learning algorithms and predictive models, healthcare teams could proactively manage care, tailor interventions, and reduce unnecessary visits.

Outcome:

After a 12-month period, predictive analytics implementation resulted in a 12% reduction in hospitalization rates and an 8% decrease in visits per admission. After three years of implementation, around a 26% reduction in hospitalization rates and a 45% decrease in visits per admission were observed. Further, for large agencies, admission was 32% lower than non-users, and for top users, admission was 45% lower than non-users. Thus, CareInsights enhanced clinical outcomes and optimized operational workflows with reduced costs.

“Ultimately, providers are not aiming for fewer visits but better episode management. This, coupled with lower hospitalization rates and improved patient outcomes, becomes a meaningful measure of efficiency,”

- Tim Ashe, chief clinical officer at WellSky

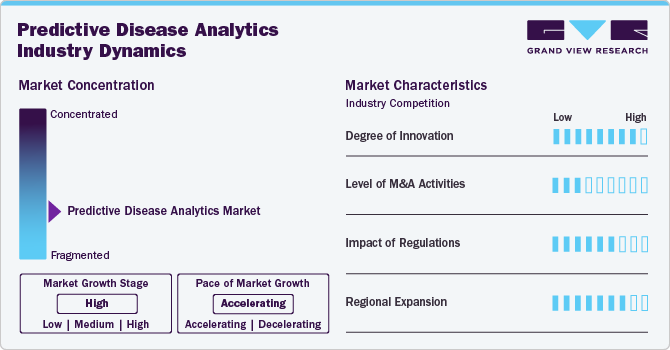

Market Concentration & Characteristics

Degree of Innovation: The degree of innovation in the market is high, characterized by rapid advancements in technologies such as artificial intelligence, machine learning algorithms, and big data. Companies increasingly focus on predictive disease analytics product innovations for various diseases, including cardiovascular diseases, diabetes, and cancers, enhancing accuracy and efficiency. For instance, in May 2024, mPulse launched predictive analytics and engagement solutions for modeling optimal digital interventions across diverse populations.

“The healthcare ecosystem continues to seek ways to better personalize the consumer experience while lowering costs and improving health outcomes”.

-Bob Farrell, CEO of mPulse.

Level of M&A Activities: The level of mergers and acquisitions (M&A) activities is moderate, as major companies seek to strengthen their technological capabilities, expand their market reach, and enhance their offerings in predictive analytics, AI, and machine learning within healthcare. For instance, in October 2021, SonderMind acquired Qntfy, a machine learning company, to integrate a predictive analytics platform for mental healthcare.

“Qntfy was always rooted in making data work for the individual,” said, in a statement. “I am thrilled to be working with SonderMind to improve how data can also be used to create a more personalized, effective mental health system.”

-Glen Coppersmith, Ph.D., founder of Qntfy

Impact of Regulations: The impact of regulations on the market is medium, as compliance with strict healthcare standards is essential for product development and market entry. Regulatory bodies like the FDA in the U.S. and the EMA in Europe impose rigorous guidelines on healthcare hardware and software, affecting the pace of innovation.

Regional Expansion: Various factors across key geographies drive regional expansion in the Predictive disease analytics market. In North America, advanced healthcare infrastructure, early adoption of cutting-edge technologies, and strong regulatory frameworks are accelerating growth. Europe is witnessing increased investments in a new project focusing on developing AI-based platforms for improving operational efficiency and patient care. In the Asia-Pacific region, rapid urbanization, expanding healthcare access, and rising demand for high-quality care promote the adoption of Predictive disease analytics technologies.

Component Type Insights

The software and services segment held the largest market share of 70.57% in 2024, and is also projected to grow at the fastest CAGR over the forecast period. The development of platforms and the digitalization of data for analytics have drawn significant investments from the healthcare sector into the IT sector. Because most businesses do not have a data analytics division, they outsource the data analytics portion of their IT. Because of this, the number of data analytics firms is growing and providing a full range of services to businesses. Expanding the services provided by data analytics further boosts the segment’s growth.

Increasing patient load on the healthcare system, rising disease prevalence, and other factors lead to large data generation. Growing pressure on the healthcare industry to provide better patient care at lower costs further opens new opportunities for the market.

Deployment Insights

The on-premise segment dominated the market in 2024. The growth is attributed to the convenience of access and security; most institutions are currently installing software and instruments to store data at their premises, leading to segment growth. The current technologies are helpful in small businesses, but when scaled up, they can make data management challenging and laborious if the firm works with a sizable dataset; this may need significant financial investment for data security and storage.

Cloud-based solutions are expected to grow at the fastest CAGR over the forecast period. The growth is attributed to its ease of storage, low capital requirements, enhanced flexibility, and efficiency. Cloud-based solutions help increase user engagement and provide access to medical information anywhere and anytime. Key players are highly focusing on various strategic initiatives to boost the segment's growth, which positively impacts the market; for instance, after the acquisition of Cerner, Oracle's Q2 of 2022 revenue grew by 18% y-o-y, which would have been just 9% excluding Cerner. The overall growth is highly boosted by their infrastructure and applications cloud businesses, which grew by 59% and 45%, respectively. Its total cloud revenue, including Cerner, grew by 48%, up 25% without Cerner.

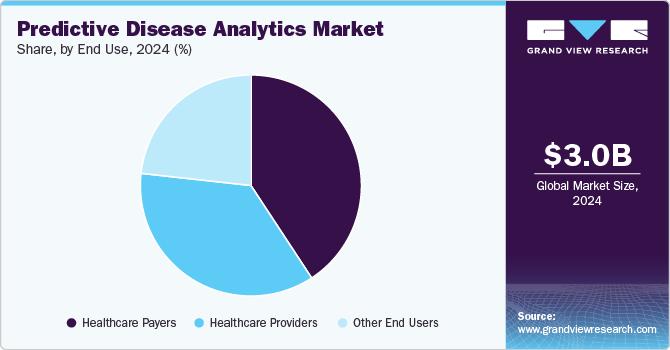

End Use Insights

The payer segment dominated the predictive disease analytics industry in 2024 based on end users. Payers include insurance companies, health plan sponsors (employers and unions), government agencies, and third-party payers. Payers adopt predictive disease analytics tools for evaluating insurance claims before payment settlement, disease risk assessment, and preventing and detecting fraudulent claims. Payers use historical and current data as a predictor of the future.

The provider segment is projected to witness the fastest CAGR over the forthcoming years. Growing healthcare expenditure and rising investment in healthcare infrastructure are two major factors that boost the segment's growth. An increasing percentage of the geriatric population and increasing cases of chronic conditions also boost the market growth. Predictive disease analytics help providers identify trends and patterns, make better decisions about treatments and allocation of resources, and provide insights that predict demand for healthcare services and plan for future needs. In October 2022, a research team from the University of Florida (UF) Health and the University Of Pennsylvania Perelman School of Medicine (Penn Medicine) proclaimed that they would develop a set of predictive analytics algorithms to forecast which patients appear likely to develop any rare diseases.

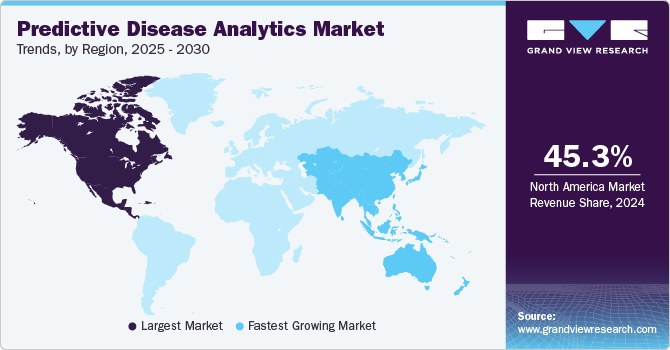

Regional Insights

North America dominated the predictive disease analytics industry with the largest revenue share of 45.3% in 2024. The region has the most advanced healthcare facilities, boosting platform adoption rates. The increasing burden of chronic diseases and the rising geriatric population have also increased the demand for hospitals and other organizations to adopt analytics tools. For instance, according to the CDC, as of October 2024 states that six in 10 Americans have at least one chronic disease, while 4 in 10 have two or more chronic diseases. Further, the presence of major players in the market has also contributed to the large share of the revenue.

U.S. Predictive Disease Analytics Market Trends

Predictive disease analytics industry in the U.S. is expected to grow significantly owing to the shift towards personalized medicine and precision healthcare characterizes. As a vast amount of healthcare data is generated, predictive analytics help tailor treatment plans and predict patient outcomes based on individual health profiles. Key market players in the U.S. are focusing on various strategic developments such as partnerships, collaborations, and funding, contributing to the adoption of predictive disease analytics. For instance, in August 2023, Healthmap Solutions, Inc., a U.S.-based company focused on kidney disease, raised funding of USD 100 million for expanding its kidney health management platform. Further, this funding will support the development of predictive analytics for kidney disease management.

Europe Predictive Disease Analytics Market Trends

Europe predictive disease analytics industry is experiencing significant expansion fueled by technological innovations and a growing need for effective healthcare solutions. The rise in government initiatives and an increasing amount of money invested in the healthcare industry are two key reasons for the rising adoption of predictive analytical tools in the healthcare sector. For instance, in February 2023, the European Commission invested USD 7.2 million for a new project that focuses on developing an AI-based platform to collect and analyze clinical data on new oncology medicines to support their assessment through regulators and health technology assessment (HTA) agencies.

The predictive disease analytics market in the UK is experiencing significant growth, driven by several key factors, including government initiatives and funding focused on modernizing healthcare infrastructure and fostering increasing adoption of AI-driven technologies. For instance, in January 2025, the government of UK launched a tender of USD 185 million, aiming to drive the integration of AI solutions that NHS can utilize in areas like predictive analytics, medical imaging, and R&D.

Germany's predictive disease analytics market is expected to grow significantly over the forecast period. The increasing elderly population drives this growth, shift from volume to value-based care, and increasing adoption of analytics by healthcare companies, health insurers, healthcare providers, healthcare payers, biopharmaceuticals, and pharmaceuticals. Further, according to Eurostat, in 2022, Germany accounted for the largest healthcare expenditure among all other countries in Europe that is around 12.6%, which is USD 516.71 Billion (Euro 489) of the country's total GDP

Germany's healthcare market is rapidly adopting digitalization and creating significant new opportunities for established companies & emerging startups. The country's geriatric population has significantly increased, and hence, it is highly susceptible to various diseases. Therefore, changes in lifestyle and demographics demand new standards for healthcare facilities and services. The increasing prevalence of chronic diseases, coupled with high healthcare costs, is increasing the demand for analytics in the healthcare market, further driving the market.

Asia Pacific Predictive Disease Analytics Market Trends

Asia Pacific predictive disease analytics industry is anticipated to register the fastest CAGR over the forthcoming years. The market growth is attributed to increasing favorable government initiatives & support. Furthermore, a rise in healthcare spending further boosts the market growth and opens new opportunities for the market over the coming years. The growing geriatric population and rising incidences of chronic conditions are two significant factors contributing to the regional expansion. According to the United Nations ESCAP, the number of older persons in Asia Pacific is estimated to double from 630 million in 2020 to 1.3 billion by 2050.

Predictive disease analytics market in Japan is expected to grow significantly over the forecast period. Government policies promoting the adoption of digital technologies in hospitals and healthcare facilities support the country's focus on healthcare innovation. Further, the country's advancements in healthcare technologies, such as integrating AI algorithms and big data to improve healthcare organizations' operational management, drive market growth.

China predictive disease analytics market is witnessing substantial growth fueled by rapid technological advancements and increasing healthcare expenditure. Growing chronic diseases cases like cancer and cardiovascular diseases, for instance, according to NIH, in 2024, China reported around 3.2 million new cancer cases and 1.6 million cancer deaths, which drives the need for the adoption of predictive disease analytics in the country for early diagnosis of diseases.

Latin America Predictive Disease Analytics Market Trends

The predictive disease analytics industry in Latin America is experiencing significant growth driven by increasing healthcare investments and rising demand for efficiency in medical facilities. Countries, including Brazil and Argentina, focus on digital health innovations, such as telemedicine and mobile health services, to manage the growing burden of chronic diseases. For instance, in 2023, the Ministry of Health of Brazil invested USD 200 million to digitalize the public basic healthcare system.

Middle East and Africa Predictive Disease Analytics Market Trends

MEA predictive disease analytics industry is characterized by increasing healthcare infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries, which are driving the adoption of advanced healthcare technologies. Governments across the region are focusing on modernizing healthcare services, which include integrating data analytics for improved efficiency and patient care. The rising burden of chronic diseases, such as diabetes and cardiovascular conditions, further pushes the demand for predictive disease analytics.

Key Predictive Disease Analytics Company Insights

Key players are focusing on developing new tools and solutions to meet the growing demand for predictive disease analytics in the healthcare and life science industry. Furthermore, regional expansions and mergers & acquisitions are key strategic undertakings these players adopt. For instance, in January 2023, Ardent Health Services partnered with SwitchPoint Ventures to launch an innovation studio. The studio will focus on developing and deploying data-driven solutions. Ardent has also adopted Polaris, SwitchPoint's novel solution for accurately predicting patient volume in any clinical setting. Rising investment in healthcare further boosts startups' entry into the industry, increasing market competition. Some of the emerging players of predictive disease analytics include Airfinity, Owkin, and Merative.

Key Predictive Disease Analytics Companies:

The following are the leading companies in the predictive disease analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle,

- Cerner Corporation

- IBM

- SAS

- Allscripts Healthcare Solutions Inc.

- MedeAnalytics, Inc.

- Health Catalyst.

- Apixio Inc

- GE Healthcare (a division of General Electric Company)

- Siemens Healthineers

Recent Developments

-

In March 2024, UMass Memorial Health partnered with Google Cloud to enhance predictive analytics for advancements of cardio metabolic therapies.

“Our mission is to provide the best possible care to our patients, and this partnership with Google Cloud is a significant step forward,”

-Michael Hyder, M.D., MPH, Executive Director of the UMass Memorial Center for Digital Health Solutions and Associate Professor of Cardiovascular Medicine.

-

In April 2023, Certis launched CertisAI a predictive analytics platform for elevating personalized cancer treatment This platform utilizes statistical algorithms, machine learning and big data for predicting efficiency of drugs based on gene expression biomarkers.

“When it comes to understanding how to treat a person’s cancer, identifying oncogenic DNA mutations is just scratching the surface.,”

-Peter Ellman, Certis President and CEO.

-

In October 2024, Clarify Health partnered with Prealize Health for enhancing predictive analytics for health plans and providers. With this partnership Clarify integrates MetisAI, AI model for healthcare, with the healthcare data source available.

“Prealize powers proactive healthcare. Our predictive technology, MetisAI, offers the most advanced predictive analytics in healthcare, setting the industry benchmark for accuracy, confidence, and impact.”

-Kyle Raffaniello, Prealize CEO.

Predictive Disease Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.7 billion

Revenue forecast in 2030

USD 10.2 billion

Growth rate

CAGR of 22.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report Updated

April 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden, Norway, China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle; Cerner Corporation; IBM; SAS; Allscripts Healthcare Solutions Inc.; MedeAnalytics, Inc.; Health Catalyst; Apixio Inc.; GE Healthcare (a division of General Electric Company), and Siemens Healthineers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Predictive Disease Analytics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global predictive disease analytics market report based on application type, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software & Services

-

Hardware

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Payers

-

Healthcare Providers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global predictive disease analytics market size was estimated at USD 3.0 billion in 2024 and is expected to reach USD 3.7 billion in 2025.

b. The global predictive disease analytics market is expected to grow at a compound annual growth rate of 22.7% from 2025 to 2030 to reach USD 10.2 billion by 2030.

b. North America had the largest market share of 45.3% as of 2024 driven by increasing healthcare digitization, growing adoption of AI-driven tools, rising chronic disease burden, and supportive government initiatives promoting precision medicine and data-driven care.

b. Key players operating in the predictive disease analytics market include Oracle, Cerner Corporation, IBM, SAS, Allscripts Healthcare Solutions Inc., MedeAnalytics, Inc., Health Catalyst, Apixio Inc, GE Healthcare (a division of General Electric Company), and Siemens Healthineers

b. Key factors that are driving the market growth include the rising chronic disease prevalence, advancements in AI and big data, growing demand for personalized medicine, and increased healthcare digitization. These factors enhance early diagnosis, optimize treatment plans, and improve overall patient outcomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.