- Home

- »

- Medical Devices

- »

-

APAC Therapeutic Respiratory Devices Market, Industry Report 2030GVR Report cover

![Asia Pacific Therapeutic Respiratory Devices Market Size, Share & Trends Report]()

Asia Pacific Therapeutic Respiratory Devices Market Size, Share & Trends Analysis Report By Product Type (Nebulizer, Humidifiers), By Technology (Electrostatic, Hollow Fiber), By Filters, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-209-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

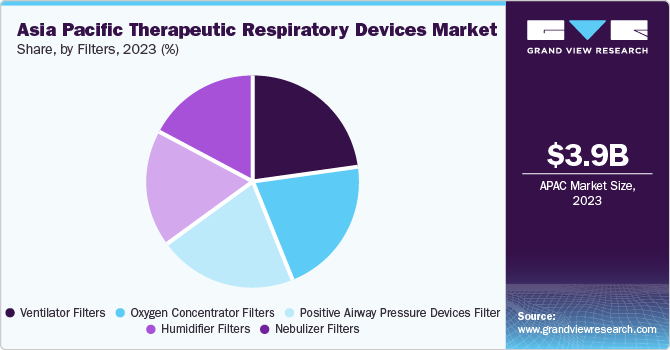

The Asia Pacific therapeutic respiratory devices market size was estimated at USD 3.9 billion in 2023 and is expected to witness a compound annual growth rate (CAGR) of 7.22% from 2024 to 2030.The rising geriatric population and the widespread occurrence of respiratory diseases, coupled with the introduction of advanced products, are the primary drivers of market expansion. In addition, numerous supportive measures taken by both government and private organizations are further propelling the market growth. For instance, in July 2022, OMRON Healthcare, a division of OMRON, unveiled its medical molecular sieve-based oxygen concentrator, a state-of-the-art oxygen delivery system. This compact device employs Pressure Swing Adsorption (PSA) technology to supply high-purity (>90%) oxygen at a flow rate of 5 liters per minute, simultaneously eliminating unwanted ambient air molecules such as nitrogen and argon.

The COVID-19 pandemic had a positive effect on the sales of therapeutic respiratory devices in the market. Non-essential operations, such as routine patient-doctor consultations, elective surgeries, and screenings, were postponed or cancelled when various regional and national governments initially imposed stay-at-home orders. However, connected care businesses saw a significant surge due to the sudden spike in demand. This certainly benefited leading market firms. For instance, Philips N.V., a significant player in the market, mentioned in its 2020 annual report that the pandemic influenced every aspect of its operations in the first half of 2020.

Nevertheless, the connected care businesses, including the ventilator portfolio, experienced remarkable growth driven by COVID-19-related demands, resulting in the company reporting a 3% comparable sales growth with a strong cash flow. Moreover, an important element expected to propel the market’s expansion soon is the increasing need for therapeutic respiratory devices in home healthcare settings. Home healthcare equipment has been gaining popularity and market presence in the past few years. Furthermore, the launch of therapeutic respiratory devices for home healthcare is an additional focus area for both well-established producers and other budding suppliers.

Market Concentration & Characteristics

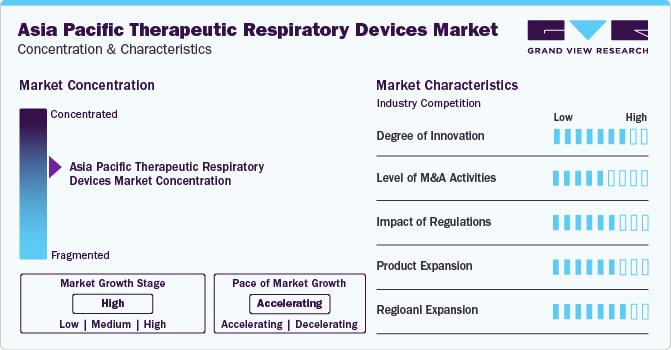

The rising prevalence of chronic respiratory diseases such as asthma and COPD is leading to significant changes in the healthcare industry. Key players are adopting growth strategies such as mergers and acquisitions, geographic expansions, product expansion, and launching new products to increase their market share. Mergers and acquisitions allow companies to combine resources and expertise, accelerating the development of innovative treatments. New product launches, resulting from R&D investments, introduce novel therapies to the market, offering improved patient outcomes and giving companies a competitive edge. These strategic actions aim to deliver better patient care and increase market share.

Driven by the escalating adoption of digital technology and advancements in products, the industry is witnessing intense competition, necessitating a constant need for innovation. Currently, numerous market players are pioneering inventive systems to fight future pandemics. For instance, in May 2022, Alkem Laboratories launched its new Innohaler, a DPI device intended to improve the lives of asthmatic and COPD patients. Alkem is planning to fill the gap in access to respiratory disease treatment in India, and the launch of Innohaler represents a big step forward in the pulmonology vertical.

To maintain market share, major firms frequently engage in mergers and acquisitions as well as new product launches. By combining resources, expertise, and market reach, these companies can accelerate the development and distribution of innovative treatments. This approach allows them to expand their patient base, increase their operational efficiency, and ultimately, enhance their position in the market.

The regulatory frameworks significantly influence market growth. The implementation of digital health regulations is anticipated to standardize and streamline regulatory review processes. This is likely to pave the way for deployment of innovative, secure, and efficient digital health solutions for healthcare providers and patients. Furthermore, governmental actions and policies, coupled with companies’ strategic advancements to address deficiencies, have had a substantial effect on the market, particularly during the COVID-19 pandemic. These regulatory actions are vital in guaranteeing the efficacy and safety of respiratory devices, thereby driving market growth.

Companies introduce new or improved products to meet the healthcare sector’s needs, stay competitive, and reach new market segments. The rise in respiratory diseases has increased the demand for advanced devices. Companies respond by innovating and expanding their product lines, such as portable and wireless devices, enhancing patient care and market growth. Continuous product evolution, fueled by technological advancements and research, further boosts this growth. For instance, in November 2021, Cipla Limited launched Spirofy, India’s first pneumotach-based portable, wireless Spirometer. This product launch is an example of how companies are innovating and expanding their product offerings to meet the growing demand in the market.

Companies look for diverse regional dynamics, focus on affordability and innovation, and navigate regulatory hurdles to position themselves in the growing market. Asian countries are witnessing rapid growth due to large populations, rising healthcare awareness, and government support. Moreover, densely populated cities with higher pollution levels drive demand for respiratory devices. Furthermore, e-commerce and telemedicine platforms increase access to devices in remote areas. Companies are adapting products and marketing strategies to suit local needs and preferences through expansion, thus fueling market growth.

Product Type Insights

Oxygen concentrators market accounted for the largest revenue share of 56.23% in 2023. This can be attributed to the rising prevalence of respiratory illnesses, rapidly growing geriatric population, high rate of tobacco usage, preference for at-home oxygen therapy, and technological improvements. Moreover, due to the rising demand for oxygen concentrators, market players from various industries are entering the market to meet the growing demand for oxygen concentrators. In addition, government organizations are partnering with manufacturers to supply oxygen concentrators to hospitals and healthcare facilities, supporting further growth of the segment. Furthermore, the COVID-19 pandemic led to an increase in demand for respiratory care products, including concentrators.

Capnograph market is anticipated to witness a rapid growth of over 10.7% during the forecast period, owing to the technological advancements, incidence of respiratory disorders, and favorable initiatives.Capnography’s use in the treatment of respiratory disorders, is anticipated to increase the medical effectiveness of these devices for patient monitoring because of their increased dependability and effectiveness. Furthermore, the market is anticipated to see fierce rivalry due to the huge number of startups looking for opportunities in this sector. For instance, in May 2020, Koninklijke Philips and Masimo reached an agreement to license Masimo's measuring technologies, including as NomoLine capnography and O3 regional oximetry, for use in a subset of Philips' IntelliVue MX-series multi-parameter monitors.

Technology Insights

HEPA filter dominated the market with the largest revenue share of 35.84% in 2023. The use of high-efficiency particulate air (HEPA) filters is crucial. These filters play a significant role in removing and retaining particles, a requirement set by the Centers for Disease Control and Prevention (CDC) for all therapeutic equipment. The demand for HEPA filters is driven by the widespread occurrence of respiratory disorders and their rapid transmission rate. The incorporation of HEPA filters in various therapeutic respiratory devices underscores the importance of this technology and hints at the potential for market expansion during the research period. Factors such as the prevalence of respiratory diseases and their modes of transmission further emphasize the necessity for HEPA filter technology.

Microsphere separation is anticipated to grow at the fastest CAGR of over 8.8% during the forecast period. Increase in the number of health conditions owing to sedentary lifestyle, smoking, pollution, and obesity is projected to generate demand for respiratory devices over the forecast period. This, in addition to the investment by governments around the globe to improve the healthcare industry, is expected to drive the demand during the forecast period.

Filters Insights

Ventilator filters accounted for the largest revenue share of 23.2% in 2023. The increase in prevalence of respiratory disorders is expected to significantly impact the market and drive the demand for ventilators. This, in turn, opens opportunities for the ventilator filters market. Over the projected period, there is an anticipated rise in the adoption of long-term home ventilation for chronic respiratory failure cases due to conditions like thoracic disease, COPDs, and neuromuscular diseases. The most common respiratory diseases in Asia Pacific region are COPDs and asthma. In November 2020, Philips introduced a noninvasive ventilator for COPD patients, the Ventilator BiPAP A40 Expiratory Flow Limitation (EFL). This allows physicians to provide accurate homecare therapy to hypercapnic COPD patients by detecting EFL at the point of care. The growing demand for home healthcare in the coming years is expected to positively impact the homecare ventilators market.

Humidifier filters is expected to witness the fastest CAGR of 8.6% over the forecast period. The growing demand for humidifiers is primarily driven by their increasing necessity for various therapeutic purposes. Humidifier filters play a crucial role in preventing the proliferation of fungus and bacteria in the air, leading to a surge in their usage across households, healthcare facilities, hospitals, and educational institutions. This rise in demand is expected to propel the expansion of the humidifier filter market. The need for filters in humidifiers is also driven by the rise in the prevalence of airborne illnesses like TB, which is a key factor fostering market growth. Using a humidifier increases air humidity and offers protection against environmental dryness. As awareness among consumers regarding conditions like sinusitis, asthma, and specific allergies grows, the demand for humidifier devices is projected to increase. Consequently, this trend stimulates growth in the humidifier filters market.

Country Insights

Asia Pacific is anticipated to witness the fastest growth over the forecast period, owing to a surge in hospital admissions and the growing number of respiratory diseases and the causes leading to them. The need for medical oxygen concentrators is not just confined to hospitals and ambulatory surgical centers, but also extends to home healthcare settings. As a result, the market for therapeutic devices has seen significant growth since the COVID-19 pandemic began. Furthermore, the market for respiratory devices is also expected to expand, driven by an increase in product launches by major players in the region. For example, Max Ventilator launched versatile noninvasive ventilators equipped with built-in humidifiers and oxygen treatment in India in May 2022. The ongoing emphasis on creating innovative respiratory devices is anticipated to further stimulate the market for therapeutic respiratory devices in the future.

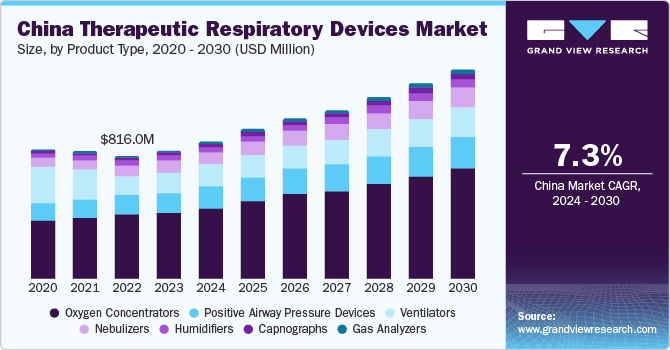

China Therapeutic Respiratory Devices Market Trends

Therapeutic respiratory devices market in China dominated the market with the largest revenue share of 22.67% in 2023. Several key factors are driving the growth of the market, including the high incidence of respiratory diseases in China, the expanding use in home care settings, ongoing demographic and economic trends, and advancements in technology. Chronic respiratory conditions rank as the second most common cause of death in China. A 2018 study by Tulane University revealed that nearly 100 million adults in China suffer from COPD, primarily due to cigarette smoking and air pollution. The World Health Organization (WHO) reports that more than half of Chinese men are smokers, a factor that increases the risk of respiratory diseases and, consequently, fueling the market.

Japan Therapeutic Respiratory Devices Market Trends

Japan therapeutic respiratory devices market showed the second largest revenue share in 2023. Increasing number of respiratory diseases such as COPD and hay fever are major factors propelling market growth in Japan. The growing incidence of respiratory syncytial virus infections among children in Japan is another key driver of market expansion. A study published in the National Library of Medicine in February 2022 revealed that respiratory syncytial virus is a leading cause of lower respiratory tract infections in children aged 5 and above in Japan. This virus is linked to long-term respiratory issues such as asthma, recurrent wheezing, allergic sensitization, and reduced lung function. The increasing cases of respiratory syncytial virus are placing a considerable strain on the Japanese healthcare system. This situation is expected to increase the demand for respiratory devices in Japan, thereby stimulating market growth.

India Therapeutic Respiratory Devices Market Trends

Therapeutic respiratory devices market in India is anticipated to grow at the fastest CAGR of 8.43% during the forecast period. The COVID-19 pandemic has led to a surge in the need for respiratory devices in India, particularly for home healthcare. The scarcity of oxygen cylinders and ventilators in hospitals has driven patients to opt for home-based oxygen therapy and ventilators, thereby boosting the demand for home respiratory care services, even amidst the lockdown caused by the pandemic. The healthcare industry was heavily strained due to the escalating number of COVID-19 cases, especially during the initial two waves of the pandemic. In response, key market players resorted to strategic partnerships, acquisitions, and product launches to devise effective medical devices for treating COVID-19 patients. For example, Max Ventilator and Amptron Medical Healthcare collaborated to develop a high-performance High Flow Oxygen Therapy device specifically for COVID-19 patients.

Key Asia Pacific Therapeutic Respiratory Devices Market Company Insights

Companies in the Asia Pacific therapeutic respiratory devices market is implementing strategies such as mergers and acquisitions as well as new product launches to expand their market share. The increasing number of COVID-19 cases overburdened the healthcare industry, particularly during the first and second waves of the pandemic; as a result, some of the major market players adopted strategic partnerships, acquisitions, and product launches to develop effective medical devices to treat COVID-19 patients.

Key Asia Pacific Therapeutic Respiratory Devices Companies:

- GE Healthcare

- Koninklijke Philips N.V.

- ICU Medical (Smiths Medical)

- Invacare Corporation

- Medtronic

- Fisher & Paykel Healthcare

- ResMed

- Linde

- Mindray

- Chart Industries

- Drägerwerk AG & Co. KGaA

- DeVilbiss Healthcare

Recent Developments

-

In April 2021, ResMed increased the availability of AirView for Ventilation, its cloud-based remote monitoring and management technology for patients receiving respiratory treatment in India.

-

In April 2020, Linde signed a new agreement with the Indian Oil Corporation. Under this agreement, Praxair India Private Limited, an owned subsidiary of Linde, will build and operate an air separation unit.

-

In September 2020, Drive DeVilbiss Healthcare partnered with Amazon to deliver ventilation products in response to covid-19. This partnership will help the company’s ventilation portfolio sale.

Therapeutic Respiratory Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.1 billion

Revenue forecast in 2030

USD 6.3 billion

Growth rate

CAGR of 7.22% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, filter, region

Regional Scope

Asia Pacific

Country Scope

Japan; China; India

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; Medtronic; Fisher & Paykel Healthcare; ResMed; Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; DeVilbiss Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Therapeutic Respiratory Devices Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific therapeutic respiratory devices market based on product type, technology, filter, and Country:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizers

-

Compressor-based Nebulizers

-

Piston based handheld nebulizer

-

Ultrasonic Nebulizer

-

-

Humidifiers

-

Heated Humidifiers

-

Passover Humidifiers

-

Integrated Humidifiers

-

Built-In Humidifiers

-

Stand-alone Humidifiers

-

-

Oxygen Concentrators

-

Fixed Oxygen Concentrators

-

Portable Oxygen Concentrators

-

-

Positive Airway Pressure Devices

-

Continuous Positive Airway Pressure Devices

-

Auto-titrating Positive Airway Pressure Devices

-

Bi-level Positive Airway Pressure Devices

-

-

Ventilators

-

Adult Ventilators

-

Neonatal Ventilators

-

-

Capnographs

-

Gas Analyzers

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrostatic Filtration

-

HEPA Filter Technology

-

Hollow Fiber Filtration

-

Microsphere Separation

-

-

Filter Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizer filters

-

Inlet filter

-

Replacement filter

-

Cabinet filter

-

-

Humidifier filters

-

Wick filters

-

Permanent cleanable filters

-

Mineral absorption pads

-

Demineralization cartridges

-

-

Positive airway pressure devices filter

-

Ultra-fine foam inlet filters

-

Polyester non-woven fiber filters

-

Acrylic & Polypropylene fiber filters

-

-

Oxygen concentrator filters

-

HEPA Filter

-

Cabinet Filter

-

Pre-Inlet Filter

-

Inlet Filter

-

Micro Disk Filter

-

Felt Intake Filter

-

Bacterial Filter

-

Hollow-membrane Filter

-

-

Ventilator filters

-

Mechanical filters

-

HEPA Filters

-

ULPA Filters

-

Activated Carbon Filters

-

-

Electrostatic filters

-

Tribocharged Filters

-

Fibrillated Filters

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific therapeutic respiratory devices market is expected to grow at a compound annual growth rate of 7.22% from 2024 to 2030 to reach USD 6.3 billion by 2030.

b. China dominated the Asia Pacific therapeutic respiratory devices market with a share of 22.67% in 2023. This is attributable to the presence of a large geriatric population base and the rising prevalence of chronic respiratory diseases.

b. Some key players operating in the therapeutic respiratory devices market include GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; Medtronic; Fisher & Paykel Healthcare; ResMed; Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; DeVilbiss Healthcare

b. Key factors that are driving the Asia Pacific therapeutic respiratory devices market growth include the rising prevalence of respiratory diseases & growing geriatric population, the launch of new-generation products, and supportive initiatives by government and private organizations

b. The Asia Pacific therapeutic respiratory devices market size was estimated at USD 3.9 billion in 2023 and is expected to reach USD 4.1 billion in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."