- Home

- »

- Pharmaceuticals

- »

-

Asthma Therapeutics Market Size And Share Report, 2030GVR Report cover

![Asthma Therapeutics Market Size, Share & Trends Report]()

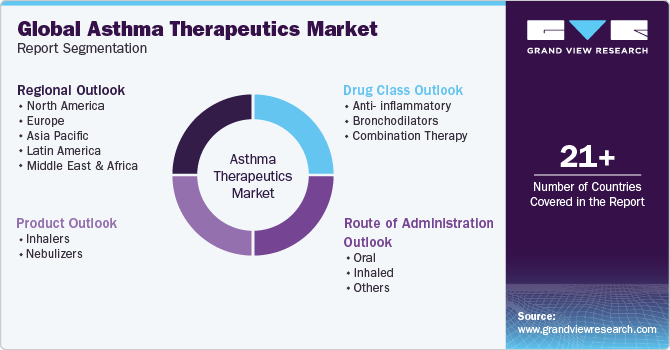

Asthma Therapeutics Market (2024 - 2030) Size, Share & Trends Analysis Report By Drug Class (Anti- inflammatory, Bronchodilators), By Product (Inhalers, Nebulizers), By Routeof Administration (Oral, Inhaled), By Region, And Segment Forecasts

- Report ID: 978-1-68038-936-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Asthma Therapeutics Market Summary

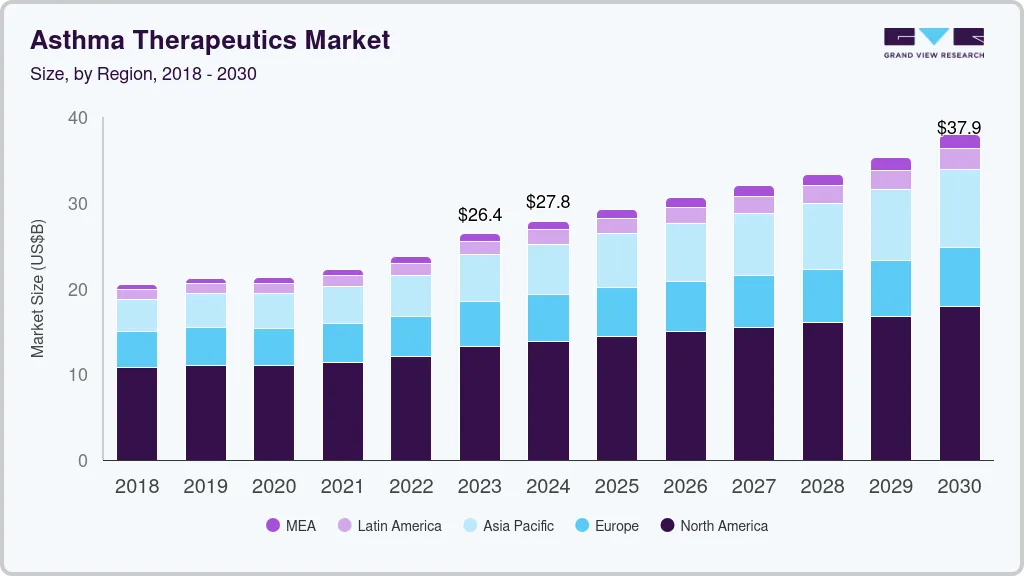

The global asthma therapeutics market size was estimated at USD 26,409.9 million in 2023 and is projected to reach USD 37,910.5 million by 2030, growing at a CAGR of 5.3% from 2024 to 2030. The global increase in the prevalence of asthma has significantly raised the demand for therapeutics, including the most promising asthma treatment choices.

Key Market Trends & Insights

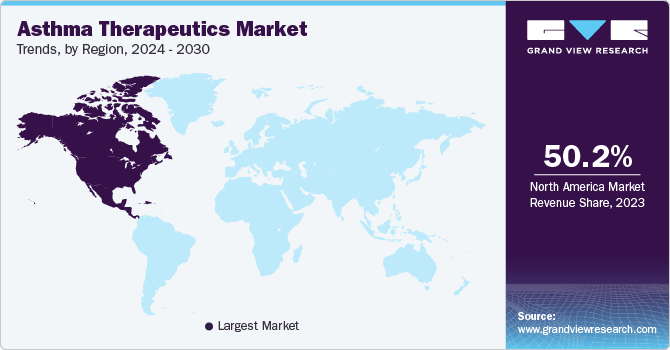

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Norway is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, anti- inflammatories accounted for a revenue of USD 16,470.9 million in 2023.

- Combination therapy is the most lucrative drug class segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 26,409.9 million Million

- 2030 Projected Market Size: USD 37,910.5 Million

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2023

In addition, new therapies, including anti-immunoglobulin E (IgE) antibodies, cytokine modulators, and DNA vaccinations, are now utilized for uncontrolled asthma. The anti-IgE monoclonal antibody (ibalizumab) effectively treats severe allergic asthma. The introduction or approval of these newly developed biologics is anticipated to reshape the treatment landscape, boosting the market growth from 2024 to 2030.

Despite the availability of suitable treatment offerings, the rising incidence of uncontrolled asthma has driven the demand for several & effective treatments. Existing medications fall short of addressing the frequency of asthma attacks. Consequently, key companies are developing novel, effective biological-based therapies with target-specific mechanisms.In February 2023, Pulmatrix initiated a Phase 2b trial, dosing the first patient with PUR1900 for Allergic Bronchopulmonary Aspergillosis (ABPA) and asthma. The global study will assess safety, tolerability, and efficacy over 16 weeks, supporting Pulmatrix's collaboration with Cipla to bring therapy to patients with asthma, with proof-of-concept data expected by mid-2024.

Positive trial results enhance Pulmatrix's market standing and contribute to market growth. Furthermore, the Asthma and Allergy Foundation of America (AAFA) offers an online community for patients, fostering connections and providing EXHALE strategies. Initiatives include promoting NAEPP EPR-4 guidelines, enhancing patient knowledge, forming partnerships with health departments, and launching national programs on respiratory illnesses & inhaler usage. These programs contribute to ongoing efforts to raise awareness, educate the public, and support individuals affected by asthma. Thus, the rising number of awareness programs is a key factor positively impacting market growth.

Market Concentration & Characteristics

Market growth stage is high, and the growth pace is accelerating. Asthma therapeutics market is characterized by a high degree of innovation owing to rapid technological advancements and launch of novel products by key players. For instance, in September 2023, AstraZeneca's Tezspire (tezepelumab) received approval in the EU for severe asthma in patients aged 12 years and older, inadequately controlled with high-dose inhaled corticosteroids.

The market is also characterized by a high level of strategic initiatives, such as collaborations and partnerships, by leading players. For instance, in March 2023, Teva Pharmaceuticals and Rimidi collaborated to implement a respiratory patient monitoring program at California’s Desert Oasis Healthcare using data from Teva’s Digihaler System. The Digihaler, a smart inhaler system, offers objective data for disease management.

The threat of internal substitutes, specifically novel biologics, such as monoclonal antibodies, pose a challenge. Ongoing technological advancements in devices and continuous R&D efforts are expected to replace conventional products with newer alternatives. However, absence of external substitutes in current market scenario contributes to an overall low threat of substitutes.

The concentration of end-users plays a crucial role in this market. Global adoption of therapeutics is on the rise, driven by increasing availability and accessibility of healthcare facilities and services. The market is further propelled by enhanced affordability of therapeutics and rising number of government initiatives & awareness programs.

Drug Class Insights

The anti-inflammatory segment led the market and accounted for a revenue share of 62.37% in 2023 owing to the introduction of affordable and innovative anti-inflammatory biologics to treat severe asthmatic patients.For instance, in April 2021, the FDA approved Xolair, a biologic, to treat moderate to severe persistent allergic asthma, Chronic Idiopathic Urticaria (CIU), and nasal polyps. It is specifically designed to target and block IgE. Furthermore, collaborations between pharmaceutical companies, research institutions, and healthcare organizations are driving R&D efforts in the market. These partnerships facilitate the discovery and commercialization of novel anti-inflammatory drugs, further propelling segment growth. For instance, in March 2023, Propeller Health and UC Davis Health announced a partnership to provide personalized medicine for patients at high risk of Chronic Obstructive Pulmonary Disease (COPD) and asthma.

The combination therapy segment is expected to register the fastest CAGR from 2024 to 2030. Combination therapy involves using two medications that target inflammation and bronchoconstriction, two key components of asthma pathophysiology. Adoption of combination therapy is driven by its efficacy compared to other drug combinations, ease of use, and improved patient compliance. In addition, the availability of several fixed-dose combination inhalers has made combination therapy more convenient for patients, further contributing to its higher adoption. For instance, in June 2022, Glenmark Pharmaceuticals Limited introduced a new fixed-dose combination drug, Indamet, in India for uncontrolled asthma. As a result of these factors, combination therapy is expected to dominate the market in the coming years.

Product Insights

The inhalers segment accounted for the largest revenue share in 2023. This can be attributed to several factors, such as their reliability, versatility, portability, and cost-effectiveness. Moreover, increasing prevalence of asthma & COPD and growing need for emergency treatment alternatives against sudden attacks have contributed to a significant market share of inhalers. The inhalers segment is expected to grow further due to the development of advanced products. For instance, in September 2020, GSK Plc. and Innoviva's triple therapy inhaler, Trelegy Ellipta, was approved in the U.S. for treating asthma and COPD. The nebulizers segment is expected to register the fastest CAGR from 2024 to 2030.

One of the primary drivers is ease of use, making nebulizers particularly suitable for children, elderly patients, and severe asthmatic patients who struggle with inhaler techniques. Moreover, an increase in the adoption of nebulizers in home healthcare and emergency medicine due to associated benefits, such as greater comfort, administration of large dosages facilitating sustained results, and favorable reimbursement scenarios, is expected to drive market growth. Furthermore, continuous advancements in nebulizer technology, such as portable and handheld devices, increase patient compliance and convenience. For instance, in July 2020, OMRON Corporation launched OMRON NE C106, a compressor nebulizer designed to deliver medication directly to the lungs in the form of a mist.

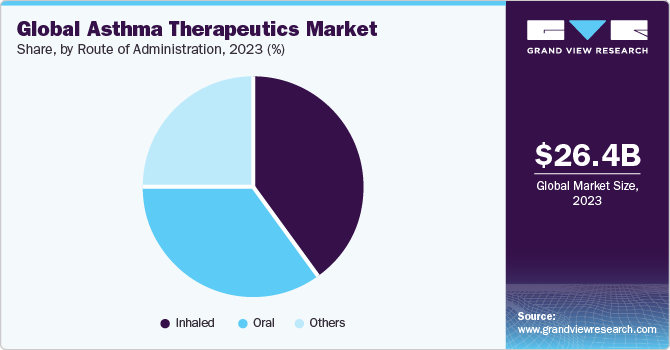

Route of Administration Insights

The inhaled route of administration segment led the industry in 2023. The inhaled route of administration is considered to be most effective way of treatment as it allows for targeted delivery of medication to the site of inflammation in the airways. The inhaled route of administration is preferred over oral or injectable routes as it minimizes adverse effects and maximizes therapeutic outcomes. In addition, new product launches and approvals are expected to play a significant role in driving the segment growth. For instance, in July 2023, Viatris, Inc. launched Breyna Inhalation Aerosol, an FDA-approved generic version of Symbicort for asthmatic and COPD patients in the United States.

The oral segment is projected to witness the highest growth rate from 2024 to 2030. The oral route of administration is the most common and convenient method of drug delivery for therapeutics. Oral medications are taken by mouth and absorbed into the bloodstream through the digestive system. This route of administration is well-tolerated and easy to use, making it a popular choice for patients and healthcare providers. Oral medications are easy to take and can be administered at home without requiring specialized equipment or training. The convenience, efficacy, and versatility of oral medications make them a valuable tool for managing asthma, which is expected to boost segment growth.

Regional Insights

North America dominated the market and accounted for a share of 50.22% in 2023. This is due to the strong presence of major key players, well-established infrastructure, and increasing prevalence of diseases in the region. For instance, asthma affects more adult women than adult men in the U.S. According to the CDC’s 2020 report, approximately 25 million people in the U.S. were reported to have asthma. In addition, according to the Asthma and Allergy Foundation of America (AAFA), around 5 million children in the U.S. are asthmatic. Furthermore, rising air pollution, increasing geriatric population, and growing demand for fast-acting & high efficacy drugs are a few other factors propelling market growth in North America.

Asia Pacific is anticipated to witness significant growth due to improving healthcare reforms.Other factors contributing to market growth include rising geriatric population, entry of new players, growing healthcare expenditure, and high awareness about lung diseases. In Southeast Asia, asthma is reported as one of the most common non-communicable diseases and is responsible for nearly 73% of the visits to outpatient clinics. This creates a wide target population pool for effective therapeutics.

Key Asthma Therapeutics Company Insights

Some of the key players operating in market include Teva Pharmaceutical Industries Ltd, GSK plc, Merck & Co., Inc. and Koninklijke Philips N.V.

-

In March 2023, Teva Pharmaceuticals and Rimidi collaborated to implement a respiratory patient monitoring program at California’s Desert Oasis Healthcare using data from Teva’s Digihaler System. The Digihaler, a smart inhaler system, offers objective data for asthma management

-

In January 2023, AstraZeneca's Tezspire (tezepelumab) received CHMP's positive opinion for self-administration in a prefilled pen for severe asthma in patients aged 12 years & older, offering increased flexibility and convenience

CHIESI USA, Inc. and Areteia Therapeutics are some of the emerging market participants in the asthma therapeutics market.

-

In August 2023, Areteia Therapeutics announced results from Phase 2 EXHALE-1 study which demonstrated that the drug could reduce the count of blood eosinophil. In addition, In July 2022, Areteia Therapeutics raised USD 350 million funding to create oral asthma treatment for eosinophilic asthma patients

-

In October 2022, CHIESI USA, Inc. and Aptar Digital Health announced a strategic partnership to offer asthma and COPD patients a disease management platform. The platform developed by Aptar Digital Health aims to improve the quality of life of patients with respiratory diseases. The initiative would lead to high adoption and demand for therapeutic regimes

Key Asthma Therapeutics Companies:

The following are the leading companies in the asthma therapeutics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these asthma therapeutics companies are analyzed to map the supply network.

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Sanofi.

- Koninklijke Philips N.V.

- BD

- Covis Pharma

Recent Developments

-

In September 2023, AstraZeneca's Fasenra (benralizumab) showed significant remission rates compared to mepolizumab in patients with Eosinophilic Granulomatosis with Polyangiitis (EGPA) in the MANDARA Phase III trial, indicating a potential treatment option

-

In July 2023, Teva Pharmaceuticals and Alvotech strengthened their partnership, enabling Teva's exclusive commercialization of new biosimilars in the U.S. Teva would acquire USD 40 million in convertible bonds to support Alvotech's pipeline development

-

In January 2023, AstraZeneca's Tezspire (tezepelumab) received CHMP's positive opinion for self-administration in a prefilled pen for severe asthma in patients aged 12 years & older, offering increased flexibility and convenience

Asthma Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.81 billion

Revenue forecast in 2030

USD 37.91 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, product, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; GSK plc; Merck & Co., Inc.; F. Hoffmann-La Roche Ltd.; AstraZeneca; Boehringer Ingelheim International GmbH; Sanofi; Koninklijke Philips N.V., BD; Covis Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asthma Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global asthma therapeutics market report based on drug class, product, route of administration, and region:

-

Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Anti- inflammatory

-

Bronchodilators

-

Combination Therapy

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inhalers

-

Dry Powder

-

Metered Dose

-

Soft Mist

-

-

Nebulizers

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Inhaled

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global asthma therapeutics market size was estimated at USD 26.41 billion in 2023 and is expected to reach USD 27.81 billion in 2024.

b. The global asthma therapeutics market is expected to grow at a compound annual growth rate of 5.30% from 2024 to 2030 to reach USD 37.91 billion by 2030.

b. North America dominated the global asthma therapeutics market with a share of 50.22% in 2023. This is attributable to the high prevalence of asthma, increasing R&D initiatives by key players, and rising awareness among people about early diagnosis and treatment of asthma.

b. Some key players operating in the global asthma therapeutics market include Novartis AG; GlaxoSmithKline plc, Merck & Co., Inc.; F. Hoffmann-La Roche Ltd.; AstraZeneca plc; Boehringer Ingelheim GmbH; Teva Pharmaceuticals Industries Ltd.; Sunovion Pharmaceuticals; Inc.; Sanofi S.A.; and Cipla Ltd.

b. Key factors that are driving the market growth include robust product pipeline, rising government initiatives, and increasing awareness regarding asthma therapeutics and its available therapeutic options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.