- Home

- »

- Clinical Diagnostics

- »

-

ATP Assays Market Size And Share, Industry Report, 2030GVR Report cover

![ATP Assays Market Size, Share & Trends Report]()

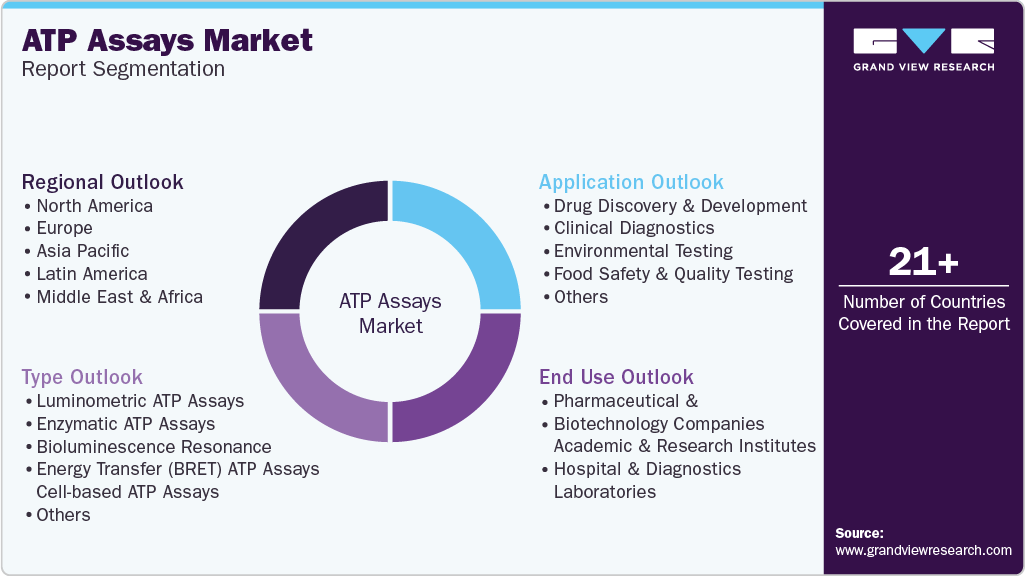

ATP Assays Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Luminometric ATP Assays, Enzymatic ATP Assays), By Application (Drug Discovery & Development, Clinical Diagnostics), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-390-2

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ATP Assays Market Size & Trends

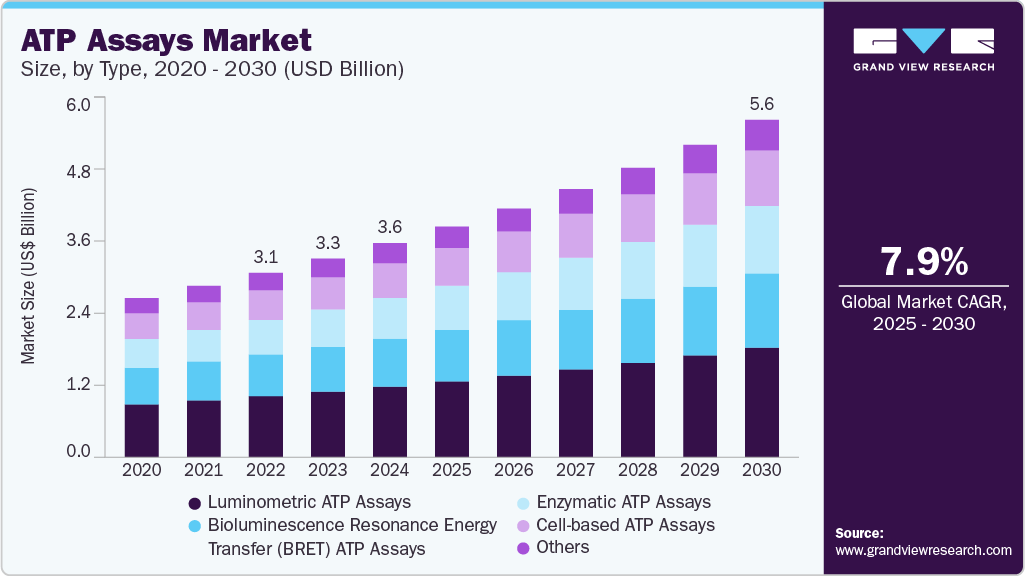

The global ATP assays market size was estimated at USD 3.56 billion in 2024 and is projected to grow at a CAGR of 7.91% from 2025 to 2030. This is attributed to the demand for rapid and sensitive detection methods, expanding applications in pharmaceutical and biotechnology research, regulatory approvals, and the rising burden of chronic diseases.

Key Highlights:

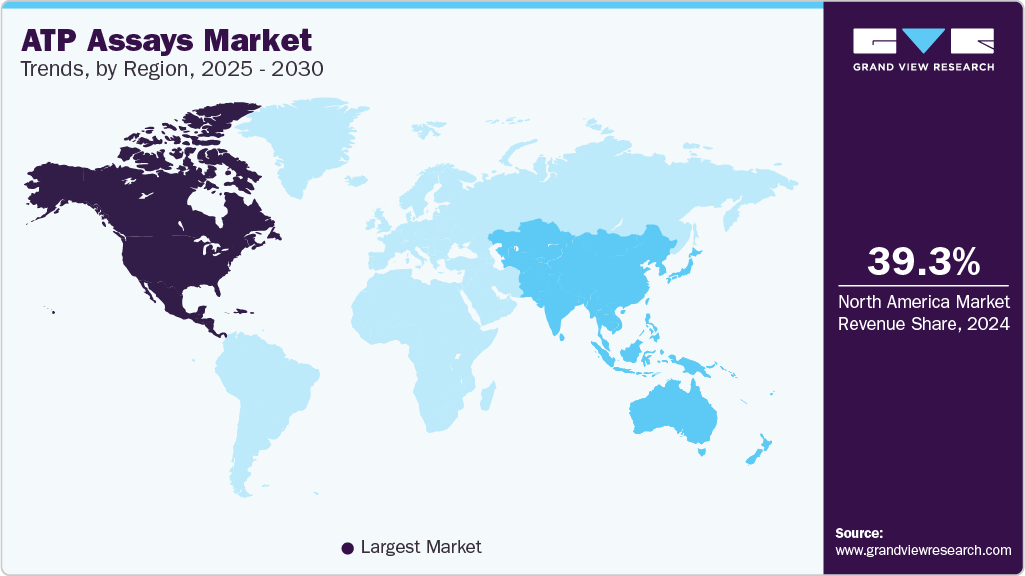

- North America ATP assays industry dominated globally with a revenue share of over 39.35% in 2024.

- The U.S. ATP assays industry leads North America in terms of revenue share, propelled by the increasing emphasis on rapid microbial detection methods in pharmaceutical quality control and food processing

- Based on type, luminometric ATP Assays held the largest market share of 32.95% in 2024 due to their sensitivity, broad application spectrum, rapid detection capabilities, technological advancements, and compliance with regulatory standards.

- By application, the drug discovery and development segment held the largest share of 32.25% in 2024.

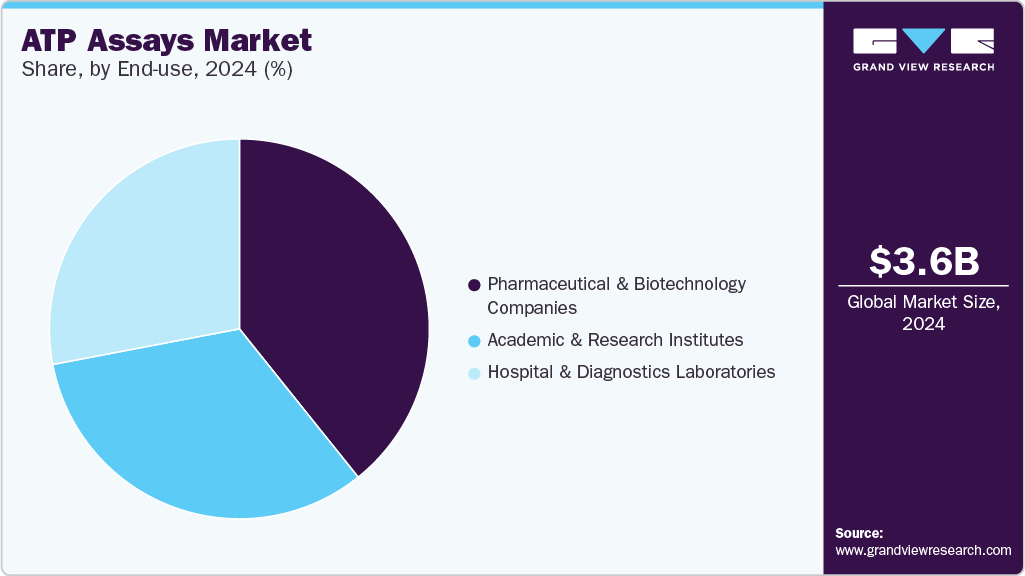

- By end use, the pharmaceutical and biotechnology companies segment held the largest share of 39.25% in 2024 and is also expected to grow at the fastest CAGR during the forecast period.

These drivers underscore the critical role of ATP assays in healthcare, research, and industrial sectors, facilitating advancements in personalized medicine, drug discovery, environmental monitoring, food safety and quality testing, and disease management. The 2022 WHO report highlights that food contamination affects about 600 million people globally, leading to over 200 diseases annually, including severe conditions such as diarrhea, resulting in 420,000 deaths and 33 million healthy life years lost.

The increasing prevalence of chronic diseases, such as cancer, diabetes, cardiovascular disorders, and infectious diseases, drives the demand for ATP assays in diagnostic testing and disease management. According to the report published by World Health Organization (WHO) in July 2023, 116 million people live with hepatitis B and 10 million with hepatitis C, leading to cancer, liver cirrhosis, and viral hepatitis-related deaths, and around 3 million new infections occur annually, with most going undetected in the Western Pacific Region. ATP levels are indicative of cellular dysfunction and disease progression, making these assays valuable tools for disease diagnosis, prognosis, and monitoring therapeutic responses. As healthcare systems worldwide face the challenge of managing chronic conditions, assays contribute to improving patient outcomes through early detection and personalized treatment strategies.

Contaminated food contains harmful pathogens such as bacteria, viruses, parasites, and chemical substances, posing significant health risks. ATP assays are pivotal in combating food contamination by swiftly and sensitively detecting microbial presence. These assays measure adenosine triphosphate, a universal indicator of microbial activity found in all living cells. ATP levels serve as reliable markers for assessing cleanliness in food surfaces, equipment, and processing areas. They enable prompt identification of contamination sources, empowering food manufacturers, processors, and regulators to take immediate corrective actions to prevent foodborne illnesses. In food processing, these products monitor hygiene practices, validate cleaning procedures, ensure compliance with safety standards, and enable real-time microbial monitoring to uphold food quality and safety across supply chains.

Technological innovations play a pivotal role in driving the ATP assays industry forward. Advances in assay sensitivity, accuracy, and automation have enhanced the performance and reliability of AP detection methods. Manufacturers are developing novel platforms that integrate cutting-edge technologies such as bioluminescence, fluorescence, and chemiluminescence to provide rapid and precise measurements. For instance, The RealTime-Glo Extracellular ATP Assay by Promega Corporation is a bioluminescent method designed to detect ATP released from cells undergoing stress, activation, or apoptosis. It serves as a pivotal biomarker for assessing treatments that may induce immunogenic cell death, a significant aspect of immune response modulation. These advancements cater to the growing demand for high-throughput screening and automated workflows in research laboratories and diagnostic settings.

The ATP assays industry is witnessing notable product innovation and expansion, with recent developments aimed at enhancing assay sensitivity, convenience, and affordability. A key example is Biotium’s launch of the Steady-ATP HTS Viability Assay Kit in March 2025, which reflects the industry’s focus on supporting high-throughput screening (HTS) applications in pharmaceutical and biotech research. The newly launched assay offers ultra-high sensitivity, detecting as few as 16 cells per well in a 384-well format, and delivers a stable luminescent signal with an extended half-life of over 5 hours. Its single-step, homogeneous workflow is designed to simplify assay protocols, making it highly compatible with automation and HTS systems. Importantly, the assay delivers performance comparable to premium market alternatives, such as CellTiter-Glo, while being positioned at a more accessible price point. This development is expected to drive broader adoption of luminescent ATP assays, particularly in budget-sensitive research laboratories and emerging biotech companies, supporting the overall growth trajectory of the ATP assays industry. Furthermore, the focus on user-friendly and cost-effective assays aligns with the market’s shift toward enabling real-time, scalable, and high-efficiency cell viability and metabolic studies across various research and quality testing domains.

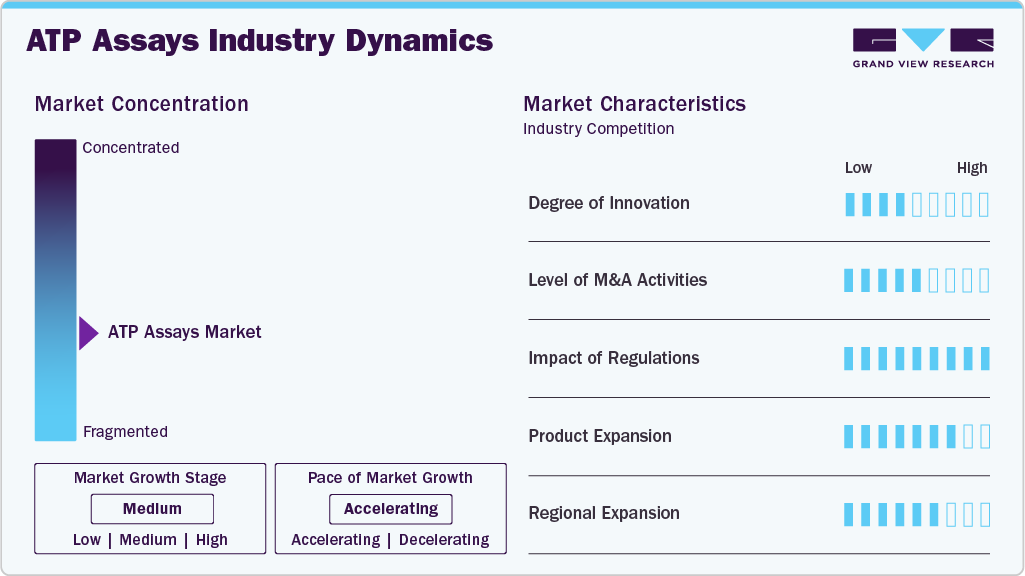

Market Characteristics & Concentration

The ATP assays industry demonstrates a high degree of innovation, driven by a focus on enhancing the precision and speed of ATP detection, particularly in drug discovery, environmental testing, and food safety applications. Companies like Promega Corporation and Thermo Fisher Scientific are continuously launching advanced luminescent and bioluminescence resonance energy transfer (BRET) assays, enabling more accurate quantification of cellular ATP under diverse experimental conditions. Furthermore, innovations in cell-based ATP assays are supporting live-cell monitoring and dynamic metabolic studies, reflecting the market’s focus on bridging the gap between traditional endpoint assays and real-time cellular analysis.

The ATP assays industry experiences a high level of mergers and acquisitions (M&A), as major players seek to broaden their technological capabilities, enhance their product portfolios, and enter new regional markets. Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. Key players engage in this growth strategy.

Regulatory frameworks play a pivotal role in shaping the market. Regulatory authorities, including the U.S. FDA, EMA, and regional bodies, mandate stringent validation protocols, accuracy benchmarks, and quality standards for assays used in regulated environments. As ATP assays are increasingly applied in clinical settings and food safety testing, compliance with ISO certifications, Good Laboratory Practices (GLP), and pharmacopoeial standards has become critical.

Product expansion is at a high level in the ATP assays industry, with companies diversifying their offerings by introducing next-generation ATP assay kits with improved chemistries, such as enhanced luminescent and BRET-based assays, offering superior performance in complex biological matrices. In addition, the integration of ATP assays with multimode plate readers and automation platforms has broadened their appeal in high-throughput drug screening and microbial contamination detection. Key players are also diversifying their ATP assay product lines to cater to niche applications such as personalized medicine, cancer metabolism analysis, and rapid antimicrobial susceptibility testing

The ATP assays industry is witnessing a medium to high level of regional expansion as companies aim to tap into growth opportunities in emerging markets while solidifying their presence in established regions. Asia Pacific, led by China, Japan, and India, is experiencing accelerated growth due to rising investments in biotechnology, expanding pharmaceutical manufacturing capabilities, and government support for life science research.

Type Insights

Based on type, luminometric ATP Assays held the largest market share of 32.95% in 2024 due to their sensitivity, broad application spectrum, rapid detection capabilities, technological advancements, and compliance with regulatory standards. As industries prioritize enhanced quality control and safety measures, luminometric ATP assays are pivotal in ensuring product integrity, environmental health, and public safety across various sectors globally. For instance, the Luminescent ATP Detection Assay Kit by Abcam plc measures cellular ATP levels by lysing cell samples, adding luciferase enzyme and luciferin, and measuring the emitted light with a luminometer. It is significantly used in assessing cell viability, monitoring cellular metabolic activity, evaluating cytotoxicity in drug testing, and conducting research in cancer, microbiology, and biochemistry.

Enzymatic ATP Assays are expected to grow at the fastest CAGR during the forecast period. These assays leverage the enzyme luciferase, which catalyzes the reaction between ATP and luciferin, producing light that can be quantitatively measured. This bioluminescent reaction is highly specific to ATP, allowing for precise detection and quantification even at very low concentrations. This precision makes enzymatic assays particularly valuable in numerous fields such as clinical diagnostics, pharmaceutical research, and environmental monitoring. In healthcare, these assays are used for monitoring microbial contamination, assessing hygiene in clinical settings, and diagnosing infectious diseases. Key players contribute to the advancement of enzymatic ATP assays, supporting researchers in their efforts to develop targeted therapeutics. Companies such as Eurofins Discovery offer the MEK1 Human STE Kinase Enzymatic Radiometric Km ATP KinaseProfiler LeadHunter Assay, a radiometric assay designed for profiling kinase activity and inhibitor selectivity. This assay utilizes recombinant full-length human MEK1 kinase and measures ATP consumption through radiolabeled phosphate incorporation, providing quantitative insights into kinase activity.

Application Insights

The drug discovery and development segment held the largest share of 32.25% in 2024. This dominance is driven by the critical role in evaluating cellular responses to drug candidates, assessing cytotoxicity, and screening for potential therapeutic compounds. The ability to measure cellular ATP levels provides insights into cell viability and metabolic activity, which are essential for identifying and optimizing effective drugs. The increasing investment in pharmaceutical research, growing prevalence of chronic diseases, and the need for efficient high-throughput screening methods further fuel the demand for assays in this segment. In April 2024, Reaction Biology, a leading provider of drug discovery and development services, announced the launch of its HotSpot ATP-Max KinomeScreen assay platform at the American Association for Cancer Research (AACR) Annual Meeting 2024. This innovative assay enables kinase profiling at physiologically relevant ATP concentrations (1 mM) across the industry's largest portfolio of kinase targets, utilizing a gold-standard filter binding radiometric assay. The ATP-Max KinomeScreen is designed to provide researchers with more accurate and physiologically relevant data, facilitating the identification of potent and specific kinase inhibitors in drug discovery programs. This development underscores Reaction Biology's commitment to advancing kinase testing technologies and supporting the discovery of targeted therapeutics.

Clinical diagnostics is expected to grow at the fastest CAGR during the forecast period. In clinical diagnostics, the ability to quickly determine the presence of pathogenic bacteria, viruses, and other microorganisms is crucial for timely and effective treatment. For instance, ATP assays are widely used in hospitals and clinics to monitor hygiene and sterility, reducing the risk of healthcare-associated infections (HAIs). The integration of assays with advanced diagnostic technologies, such as molecular diagnostics and point-of-care testing, enhances their utility in clinical settings. The combination of ATP assays with techniques like polymerase chain reaction (PCR) and next-generation sequencing (NGS) allows for comprehensive analysis of microbial presence and activity, improving diagnostic accuracy and patient outcomes.

End Use Insights

The pharmaceutical and biotechnology companies segment held the largest share of 39.25% in 2024 and is also expected to grow at the fastest CAGR during the forecast period due to its indispensable role in drug discovery, technological advancements in high-throughput screening, the shift towards personalized medicine, regulatory compliance, and diverse applications across industries. Pharmaceutical and biotechnology companies rely heavily on these products to assess drug candidates' efficacy and safety during various stages of drug discovery and development. These assays measure cellular ATP levels, providing insights into cellular metabolism, viability, and response to drug treatments. For instance, ATP assays are used to evaluate how potential therapies affect cancer cell proliferation or microbial growth, crucial steps in identifying promising drug candidates.

In diagnostics laboratories, these products contribute significantly to research and development efforts across various fields. Pharmaceutical laboratories utilize these assays extensively in drug discovery processes to screen for cytotoxic effects and evaluate drug efficacy. The high sensitivity of enzymatic ATP assays allows researchers to conduct large-scale screenings efficiently, accelerating the identification of potential therapeutic compounds.

Regional Insights

North America ATP assays industry dominated globally with a revenue share of over 39.35% in 2024. The region boasts a well-developed healthcare infrastructure and advanced research facilities, particularly in the pharmaceutical and biotechnology sectors. The region is home to numerous leading pharmaceutical companies, biotech firms, and academic research institutions conducting extensive research and development activities. These entities heavily rely on assays for drug discovery, toxicity testing, and clinical diagnostics, driving the demand for ATP assay products and technologies.

U.S. ATP Assays Market Trends

The U.S. ATP assays industry leads North America in terms of revenue share, propelled by the increasing emphasis on rapid microbial detection methods in pharmaceutical quality control and food processing, which acts as a significant driver for ATP assays adoption. Moreover, strict regulatory oversight by the FDA and EPA regarding contamination control further amplifies the demand for ATP-based hygiene monitoring. In recent developments, companies like Thermo Fisher Scientific and 3M have been expanding their ATP hygiene monitoring product lines, integrating digital analytics to enhance data accuracy and compliance reporting. The growing preference for point-of-use ATP assay kits in healthcare settings to monitor biofilm formation on medical devices is opening new avenues. In addition, rising biopharmaceutical R&D activities in the U.S. are creating opportunities for ATP assays in cell viability and cytotoxicity applications.

Europe ATP Assays Market Trends

The Europe ATP assays industry is rapidly evolving. The European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) are promoting rigorous cleanliness protocols, which have accelerated the uptake of ATP-based contamination detection systems. In countries such as France, Germany, and the Netherlands, ATP assays are increasingly used in water quality testing, especially in light of the region’s heightened environmental regulations. Recent collaborations between key players such as Merck KGaA and regional biotech firms are introducing advanced ATP assay platforms with improved sensitivity and faster turnaround times. Moreover, demand for ATP assays in pharmaceutical sterility assurance is growing, particularly for biologics and advanced therapies, creating niche opportunities.

The UK ATP assays industry is experiencing significant growth. Companies such as Hygiena and Promega have been actively marketing ATP hygiene monitoring systems tailored to the UK market, including cloud-based platforms for remote audit compliance. In addition, the UK’s growing focus on sustainability and water reuse is fostering ATP assay application in water treatment and industrial hygiene programs. The rise of local start-ups offering rapid microbial detection services is also fueling market expansion. With increasing investments in biomanufacturing, there are opportunities for ATP assays to support cleanroom validation and sterility assurance.

The Germany ATP assays industry is growing, driven by the growing demand for rapid, reliable microbial contamination detection tools, with ATP assays playing a crucial role in sterility monitoring and process validation. German pharmaceutical companies are increasingly integrating ATP assays into their quality control systems to comply with stringent European Union GMP standards. Key players such as Merck KGaA and BioControl Systems are actively expanding their ATP assay product portfolios to serve industrial and clinical sectors.

Asia Pacific ATP Assays Market Trends

The Asia Pacific ATP assays industry is anticipated to witness significant growth at a CAGR of 9.09% over the forecast period. Asia Pacific countries face significant challenges related to infectious diseases and public health threats. The 2021 report from the National Health Commission in China disclosed a total of 2,711,785 reported cases of 27 Class A and B notifiable infectious diseases. These products offer rapid and sensitive detection methods for pathogens, supporting timely diagnosis and containment of infectious outbreaks. Governments and healthcare authorities in the region prioritize disease surveillance and management, driving the demand for ATP assays in epidemiological studies and healthcare settings. The Asia Pacific region is home to a burgeoning biotechnology and pharmaceutical industry, with rapid growth in research and development activities. They play a crucial role in drug discovery, toxicity testing, and bioprocessing applications. Pharmaceutical companies across countries such as China, India, Japan, and South Korea utilize these assays to evaluate drug candidates, ensuring safety and efficacy before market introduction.

China ATP assays industry held a substantial share in the Asia Pacific region in 2024. The market is advancing steadily due to the recent innovations in the Chinese market that include integrated ATP assay devices with AI-enabled data analytics for predictive hygiene monitoring, providing new value propositions for manufacturers. Emerging opportunities lie in applying ATP assays for cell viability studies in the booming biologics and vaccine manufacturing segments. Overall, China’s ATP assays industry is benefiting from regulatory push, industrial modernization, and technological adoption.

Japan’s ATP assays industry is progressing steadily, and ATP assays are increasingly adopted by Japanese pharmaceutical manufacturers to comply with strict PMDA regulations for sterility and environmental monitoring. In the food sector, the Ministry of Health, Labour and Welfare (MHLW) encourages the use of ATP-based hygiene monitoring to ensure food safety, particularly in convenience food production, which is a large market in Japan. Key players such as Kikkoman Biochemifa and Lumitester have introduced ATP assay products tailored for local industries, focusing on compact, high-sensitivity devices with user-friendly interfaces.

Latin America ATP Assays Market Trends

The Latin American ATP assays industry is witnessing steady growth. Opportunities are emerging in the healthcare sector, where ATP assays are being introduced to monitor hospital hygiene and prevent healthcare-associated infections (HAIs). In addition, as the region faces water contamination challenges, the use of ATP assays for water quality testing is gaining interest among environmental agencies and industries. Overall, Latin America’s ATP assays industry is poised for consistent growth, supported by regulatory developments, industrial modernization, and growing awareness of hygiene control.

The Brazil ATP assays industry is growing, as Brazil is emerging as a key market for ATP assays within Latin America, driven by its large food and beverage industry, expanding pharmaceutical production, and strengthening regulatory framework. The National Health Surveillance Agency (ANVISA) has been promoting higher quality and hygiene standards in both food processing and pharmaceutical manufacturing sectors, leading to increased adoption of ATP assays as a fast and reliable method for contamination monitoring.

Middle East & Africa ATP Assays Market Trends

The Middle East and Africa (MEA) ATP assays industry is poised for growth. In the Gulf Cooperation Council (GCC) countries, especially the UAE and Kuwait, ATP assays are increasingly adopted for hygiene monitoring in food processing, hospitality, and healthcare facilities, aligning with the region’s emphasis on high cleanliness standards. In Africa, countries like South Africa are seeing rising adoption of ATP assays in food production and pharmaceutical sectors, supported by growing awareness of contamination control.

Key ATP Assays Company Insights

Key players operating in the ATP assays industry aim to drive innovation, expand market reach, and strengthen their competitive position. The players are seeking regulatory approvals, such as FDA and CE-IVD, for their products to ensure compliance and expand their market access.

Key ATP Assays Companies:

The following are the leading companies in the ATP assays market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Promega Corporation

- PerkinElmer Inc.

- Becton, Dickinson and Company (BD)

- Lonza Group Ltd.

- Danaher Corporation

- Abcam plc

- Quest Diagnostics Incorporated

- Biomerieux SA

- 3M Company

Recent Developments

-

In March 2025, Biotium announced the launch of its Steady-ATP HTS Viability Assay Kit, a luminescent assay designed for high-throughput screening (HTS) applications. This assay offers exceptional sensitivity, capable of detecting as few as 16 cells per well in a 384-well plate, and provides a stable luminescent signal with a half-life exceeding 5 hours. The single-step, homogeneous assay format simplifies workflows, making it particularly suitable for automated HTS platforms. By offering performance comparable to existing assays like CellTiter-Glo at a more affordable price point, the Steady-ATP HTS Viability Assay Kit is poised to drive growth in the ATP assays industry by enhancing accessibility and efficiency in cell viability assessments across pharmaceutical, biotechnology, and academic research settings.

-

In April 2024, Reaction Biology, a leading provider of drug discovery and development services, announced the launch of its HotSpot ATP-Max KinomeScreen assay platform at the American Association for Cancer Research (AACR) Annual Meeting 2024. This innovative assay enables kinase profiling at physiologically relevant ATP concentrations (1 mM) across the industry's largest portfolio of kinase targets, utilizing a gold-standard filter binding radiometric assay.

-

In January 2022, Agilent Technologies, Inc., announced the launch of Seahorse XF Pro Analyzer. The analyzer allows understanding of the cellular function, fate, and fitness by providing access to the most advanced cellular metabolism analysis technology.

-

In May 2021, Neogen Corp. launched an improved version of AccuPoint Advanced sanitation monitoring system. The system uses a flat tip sampler for maximum recovery of ATP.

ATP Assays Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.84 billion

Revenue forecast in 2030

USD 5.62 billion

Growth Rate

CAGR of 7.91% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; Promega Corporation; PerkinElmer Inc.; Becton, Dickinson and Company (BD); Lonza Group Ltd.; Danaher Corporation; Abcam plc; Quest Diagnostics Incorporated; Biomerieux SA; 3M Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ATP Assays Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global ATP assays market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Luminometric ATP Assays

-

Enzymatic ATP Assays

-

Bioluminescence Resonance Energy Transfer (BRET) ATP Assays

-

Cell-based ATP Assays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Clinical Diagnostics

-

Environmental Testing

-

Food Safety & Quality Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Hospital & Diagnostics Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Sweden

-

Denmark

-

Spain

-

Italy

-

France

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ATP assays market was valued at USD 3.56 billion in 2024 and is expected to reach USD 3.84 billion in 2025

b. The global ATP assays market is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2025 to 2030 to reach USD 5.62 billion by 2030.

b. Luminometric ATP Assays held the largest share of 32.95% of the ATP assays market in 2024 due to their sensitivity, broad application spectrum, rapid detection capabilities, technological advancements, and compliance with regulatory standards

b. Some key players operating in the ATP assays market include Thermo Fisher Scientific; Promega Corporation; PerkinElmer Inc.; Becton, Dickinson and Company (BD); Lonza Group Ltd.; Danaher Corporation; Abcam plc; Quest Diagnostics Incorporated; Biomerieux SA; 3M Company

b. Key factors that are driving the market growth include demand for rapid and sensitive detection methods, expanding applications in pharmaceutical and biotechnology research, regulatory approvals, and rising burden of chronic diseases

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.