- Home

- »

- Digital Media

- »

-

Audience Intelligence Market Size, Industry Report, 2033GVR Report cover

![Audience Intelligence Market Size, Share & Trends Report]()

Audience Intelligence Market (2026 - 2033) Size, Share & Trends Analysis Report By Platform (Integrated Audience Intelligence Platform, Social Media Listening Tools), By Enterprise Size, By Deployment (On-Premises, Cloud), By End-use (IT & Telecommunication, BFSI, Travel & Hospitality), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-859-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Audience Intelligence Market Summary

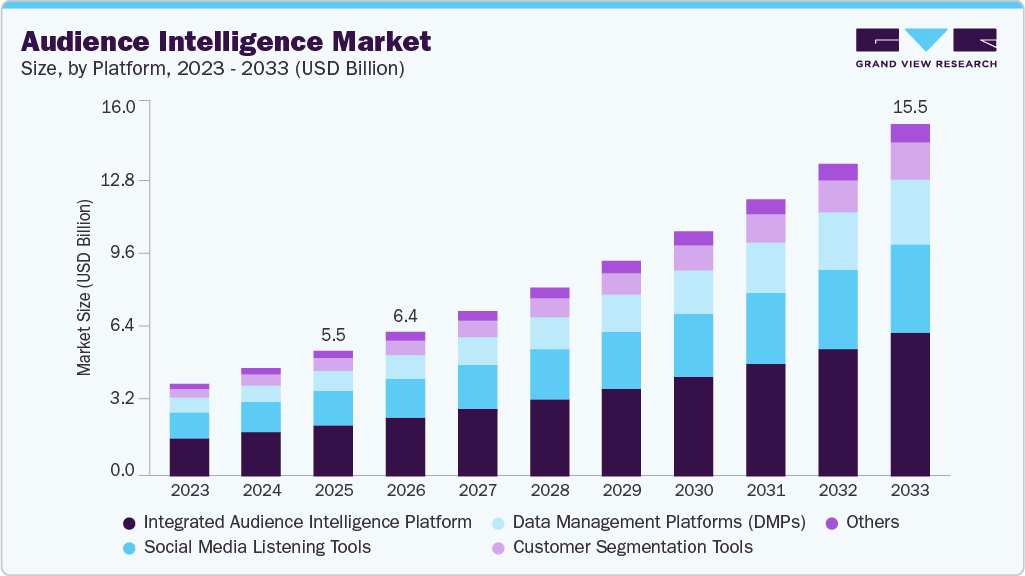

The global audience intelligence market size was estimated at USD 5.52 billion in 2025 and is projected to reach USD 15.54 billion by 2033, growing at a CAGR of 13.6% from 2026 to 2033. The market growth is primarily driven by the rapid expansion of digital channels and the fragmentation of consumer attention across platforms.

Key Market Trends & Insights

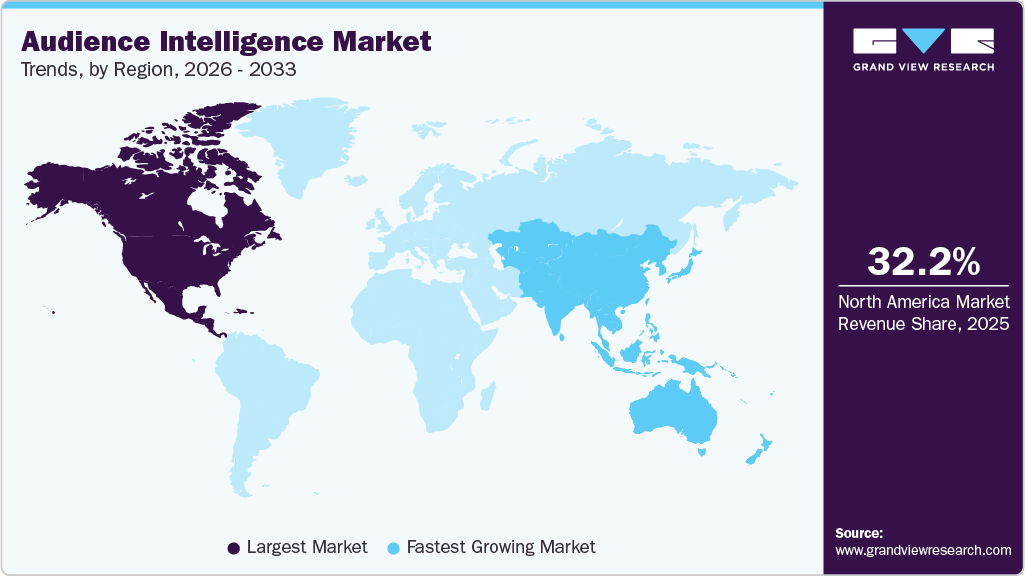

- North America audience intelligence market held the largest share of 32.2% the audience intelligence industry in 2025.

- The audience intelligence industry in the U.S. is expected to grow significantly over the forecast period.

- By platform, the integrated audience intelligence platform segment accounted for the largest revenue share of 40.7% in 2025.

- By enterprise size, the large enterprises segment accounted for the largest share in 2025.

- By deployment, the cloud segment accounted for the largest share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.52 Billion

- 2033 Projected Market Size: USD 15.54 Billion

- CAGR (2026 - 2033): 13.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rise of social media and user-generated content as influential sources of consumer insight is another critical driver of the audience intelligence market. Social platforms generate enormous volumes of unstructured data in the form of posts, comments, reviews, and discussions that reflect authentic consumer opinions and emotions. Audience intelligence tools equipped with natural language processing and sentiment analysis can extract meaningful insights from this data, revealing emerging trends, brand perceptions, and unmet needs. These insights allow organizations to respond proactively to shifts in sentiment, manage brand reputation, and identify opportunities for innovation. Social listening capabilities also help businesses understand competitor performance and industry dynamics in real time. As social media continues to shape consumer attitudes and purchasing behavior, organizations increasingly rely on audience intelligence to convert social data into strategic value. This growing dependence on social insight significantly drives market adoption.Another important driver shaping the audience intelligence market is the increasing complexity of consumer journeys and the need to understand intent rather than just behavior. Traditional analytics often focus on what consumers did, but modern strategies require understanding why they acted and what they are likely to do next. Audience intelligence platforms incorporate predictive analytics and intent modeling to move beyond descriptive insights. These capabilities enable organizations anticipate future needs, identify high-propensity segments, and align offerings with evolving consumer expectations. Understanding intent is particularly valuable in competitive markets where timing and relevance determine success. By enabling proactive engagement rather than reactive responses, audience intelligence solutions enhance strategic agility. As organizations seek deeper, forward-looking insights into audience motivations, the demand for intent-driven intelligence continues to rise.

The increasing emphasis on customer experience optimization across industries is a strong driver of the audience intelligence market. Businesses increasingly recognize that superior customer experience is a key differentiator and a driver of long-term loyalty. Audience intelligence platforms provide insights into pain points, satisfaction drivers, and emotional responses throughout the customer lifecycle. These insights allow organizations to refine touchpoints, improve messaging, and design experiences that resonate with specific audience segments. By identifying gaps between customer expectations and actual experiences, companies can prioritize improvements that deliver the greatest impact. Audience intelligence also supports experience measurement across channels, helping organizations maintain consistency and relevance. As customer experience becomes central to competitive strategy, investment in audience intelligence platforms continues to grow.

Furthermore, the growing adoption of advanced analytics, artificial intelligence, and machine learning technologies is accelerating the evolution and uptake of audience intelligence solutions. Modern platforms leverage AI and machine learning to process massive datasets quickly and uncover insights that would be impossible to identify manually. These technologies enable automated segmentation, anomaly detection, trend forecasting, and real-time insight generation. As analytical sophistication increases, audience intelligence tools become more accessible and valuable to a broader range of organizations, not just large enterprises. Automation also reduces reliance on specialized data science teams, making insights more actionable across business units. The integration of AI-driven capabilities transforms audience intelligence from a reporting tool into a strategic decision engine. As organizations increasingly embrace intelligent analytics to stay competitive, this technological advancement continues to drive sustained growth in the audience intelligence market.

Platform Insights

The integrated audience intelligence platform segment accounted for the largest revenue share of 40.7% in 2025. The rising complexity of privacy management and responsible data use is driving the adoption of integrated audience intelligence platforms. Organizations must manage audience data carefully while balancing insight generation with ethical and compliant data practices. Integrated platforms provide centralized governance, consistent data handling policies, and unified controls over access and usage. This reduces the risk of mismanagement that can occur when data is spread across multiple disconnected tools. Centralized oversight also improves transparency and auditability of how audience data is analyzed and shared. As organizations become more conscious of data stewardship and long-term trust, integrated platforms offer a structured and controlled approach to audience intelligence. This combination of insight depth and governance capability further accelerates adoption within the audience intelligence market.

The data management platforms (DMPs) segment is expected to grow at the fastest CAGR from 2026 to 2033. The increasing integration of data-driven advertising and omnichannel activation strategies is a key driver of the DMP segment in the audience intelligence market. Organizations seek to activate audience insights across digital advertising, email marketing, mobile messaging, and on-site personalization efforts. DMPs act as a central hub that connects audience data to execution platforms, ensuring consistent targeting and messaging across channels. This integration reduces silos between data analysis and campaign execution, improving efficiency and effectiveness. Without DMPs, organizations risk inconsistent audience definitions and fragmented activation strategies. As omnichannel engagement becomes the norm, DMPs become critical for coordinating data-driven actions across multiple touchpoints. This growing reliance on unified activation capabilities reinforces the importance of DMPs in the audience intelligence ecosystem.

Enterprise Size Insights

The large enterprises segment dominated the audience intelligence market in 2025. The integration of audience intelligence with broader enterprise technology stacks is a major growth driver. Large enterprises typically operate extensive ecosystems of ERP, CRM, marketing automation, data warehouses, and business intelligence tools. Audience intelligence platforms serve as a connecting layer, enriching these systems with behavioral and contextual insights. Seamless integration enables insights to flow directly into operational systems, enabling faster, more informed actions. This interoperability enhances the return on existing technology investments by making data more actionable. Enterprises increasingly prioritize platforms that can embed intelligence across workflows rather than operate in isolation. As technology stacks become more interconnected, the adoption of audience intelligence within large organizations strengthens.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2026 to 2033. The rise of digital and social media channels as primary growth engines for SMEs is another critical driver. Many SMEs rely heavily on online platforms to reach customers, especially in markets where physical presence is limited. Audience intelligence tools analyze social listening data, engagement metrics, and content performance to reveal what resonates with target audiences. This insight helps SMEs refine messaging, content timing, and platform selection. Without such intelligence, SMEs risk being drowned out in crowded digital spaces. Audience intelligence enables smarter participation rather than higher spending. As digital engagement deepens, demand from SMEs continues to grow.

Deployment Insights

The cloud segment held the largest revenue share in 2025. The growing role of advanced analytics, artificial intelligence, and machine learning in audience intelligence is strengthening the cloud segment. Cloud platforms are well-suited to support compute-intensive AI workloads required for predictive modeling, sentiment analysis, and behavioral forecasting. They provide access to powerful processing resources and integrated analytics services that are difficult to replicate in on-premises environments. This enables audience intelligence platforms to deliver deeper, more sophisticated insights at scale. Cloud-native architectures also support continuous learning models that adapt as new data is ingested. As organizations move toward predictive and prescriptive analytics, cloud environments become essential enablers of innovation. This alignment between cloud infrastructure and advanced analytics drives sustained growth in the cloud segment.

The on-premises segment is expected to grow at a significant CAGR over the forecast period. The demand for predictable performance and low-latency analytics drives the on-premises segment growth. Organizations that rely on high-frequency data processing or near-real-time analytics often require consistent performance without depending on internet connectivity or shared cloud resources. On-premises deployments enable direct access to computing resources, reducing latency and ensuring stable processing speeds. This can be particularly important for real-time monitoring, operational decision-making, or mission-critical analytics use cases. By avoiding potential network congestion or service disruptions associated with external platforms, organizations gain greater reliability in analytics delivery. Predictable performance also supports internal service-level agreements and operational planning.

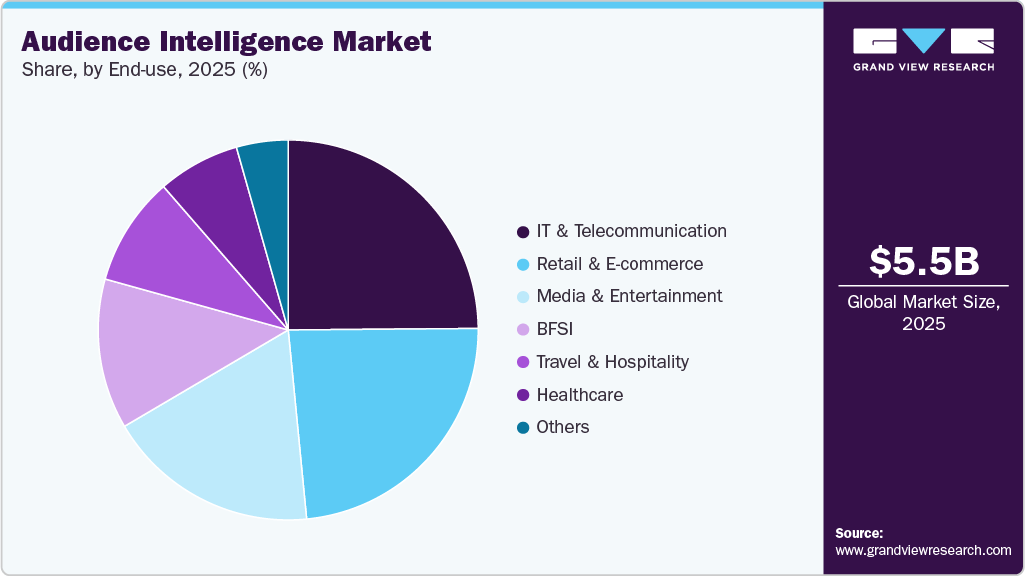

End-use Insights

The IT & telecommunication segment accounted for the largest revenue share in 2025.The expansion of digital service portfolios beyond traditional connectivity drives this segment growth. Telecom and IT companies increasingly offer cloud services, cybersecurity solutions, IoT connectivity, streaming platforms, and enterprise digital services. Each service category attracts different audience profiles with distinct behaviors and expectations. Audience intelligence platforms help organizations understand cross-service adoption patterns and identify opportunities for bundling and upselling. This insight supports revenue diversification strategies while improving customer lifetime value. Managing such complex portfolios without audience intelligence leads to fragmented decision-making. As service ecosystems grow broader, audience intelligence becomes a strategic coordination tool.

The retail & e-commerce segment is expected to grow at the fastest CAGR during the forecast period. The growing demand for hyper-personalized shopping experiences to increase conversion rates is driving segment adoption. Retail and e-commerce companies operate in highly competitive environments where customers can switch brands with minimal effort. Audience intelligence enables granular segmentation based on browsing history, purchase frequency, price sensitivity, and lifestyle indicators. These insights support personalized product recommendations, dynamic pricing strategies, and tailored promotional offers. Personalization driven by audience intelligence improves relevance, reduces decision fatigue, and increases average order value. Generic campaigns, in contrast, often fail to engage today’s digitally savvy shoppers. As personalization directly impacts revenue performance, retailers increasingly invest in audience intelligence solutions.

Regional Insights

North America audience intelligence market held the largest share of 32.2% the audience intelligence industry in 2025. The increasing pressure to measure and optimize marketing ROI drives the audience intelligence market in North America. As marketing budgets face scrutiny from executives and boards, CMOs and digital strategists are under growing pressure to demonstrate measurable impact and justify spending. Traditional marketing metrics, while useful, often lack the depth required to link campaign investments directly to audience behavior and long-term outcomes. Audience intelligence platforms help bridge this gap by providing insights into which segments drive conversions and long-term value, which channels perform most effectively, and which messages resonate best with target audiences. These insights allow marketers to refine budget allocation, optimize channel mix, and continually improve campaign performance. Enterprises that adopt audience intelligence frameworks gain a data-driven foundation for budget decisions, reducing waste and increasing strategic clarity. As fiscal accountability becomes more central to marketing operations, demand for audience intelligence solutions grows.

U.S. Audience Intelligence Market Trends

The audience intelligence industry in the U.S. is expected to grow significantly from 2026 to 2033. The widespread adoption of digital commerce and on-demand services is another driver in the U.S. audience intelligence market. Consumers increasingly expect seamless, fast, and personalized experiences across e-commerce, food delivery, streaming, and service platforms. Audience intelligence helps organizations analyze browsing behavior, purchase journeys, and usage patterns to optimize these experiences. Insights derived from audience data support improvements in user experience design, pricing strategies, and service delivery models. Without audience intelligence, it becomes difficult to understand friction points or drop-off behaviors in complex digital journeys. As digital consumption continues to grow, audience intelligence remains central to experience optimization.

Asia Pacific Audience Intelligence Market Trends

The audience intelligence industry in the Asia Pacific is growing at the fastest CAGR of 15.9% from 2026 to 2033. The rise of data-driven marketing and performance accountability across Asia Pacific enterprises acts as a major driver. Marketing teams across the region are under increasing pressure to justify spend and demonstrate measurable outcomes. Audience intelligence platforms provide clear visibility into which segments respond to campaigns, which channels drive engagement, and which messages influence conversion. These insights enable more precise targeting and continuous campaign optimization. For organizations operating with limited budgets in price-sensitive markets, efficiency is critical. As marketing accountability becomes standard practice, audience intelligence adoption strengthens across industries.

China audience intelligence market held a significant share in 2025. The use of audience intelligence to support hyper-localized and city-level targeting strategies drives market growth in China. Consumer behavior can vary significantly between tier-one cities, lower-tier cities, and rural areas. Audience intelligence enables segmentation by geography, lifestyle, income level, and local consumption patterns. This allows brands to tailor pricing, messaging, and distribution strategies to specific regions. Without such insight, national-level strategies often fail to resonate at the local level. Hyper-local understanding improves both engagement and operational efficiency. As regional diversity continues to shape demand, audience intelligence is crucial to localization.

Europe Audience Intelligence Market Trends

The Europe audience intelligence industry is growing at a significant CAGR from 2026 to 2033. The need to manage and interpret increasingly complex media and content ecosystems drives market growth in Europe. Consumers across the region engage with a wide mix of traditional media, digital platforms, social networks, and streaming services. Audience intelligence helps organizations understand how different audience segments consume content and respond to media across these channels. These insights inform media planning, content creation, and channel prioritization decisions. By aligning content strategies with audience preferences, companies can improve engagement and brand recall. As media fragmentation continues, audience intelligence becomes essential for maintaining relevance and efficiency.

The audience intelligence market in the UK is growing at a significant CAGR from 2026 to 2033. The increasing role of audience intelligence in content strategy and media planning also drives market growth in the UK Consumers in the country are exposed to a wide range of content across traditional media, digital platforms, and social networks. Audience intelligence helps organizations understand content consumption habits, preferred formats, and engagement drivers across segments. These insights support smarter content creation and more effective media placement. Without audience intelligence, content strategies risk being misaligned with audience interests. As content competition intensifies, insight-led planning becomes increasingly important.

Key Audience Intelligence Company Insights

Some of the key companies operating in the market, include The Nielsen Company (US), LLC, Pulsar Group, among others are some of the leading participants in the audience intelligence market.

-

The Nielsen Company (US), LLC is a global measurement and data analytics company. Nielsen’s portfolio includes advanced analytics and identity-based measurement capabilities that link exposure data with demographic, behavioral, and geographic attributes. This allows clients to build detailed audience profiles, compare audience performance across channels, and identify high-value segments for targeted advertising and content personalization. By integrating panel-based measurement with big data sources, Nielsen provides scalable and privacy-conscious audience insights that balance depth, accuracy, and comparability. These capabilities are particularly valuable for media planning, ad pricing, attribution modeling, and competitive benchmarking.

-

Pulsar Group is an audience intelligence company focused on helping brands, media owners, and agencies understand how people think, feel, and behave across digital and social ecosystems. Pulsar’s product portfolio centers on platforms that analyze consumer behavior across social media, forums, blogs, news, and search data. Its core solutions enable organizations to identify audience segments based on shared interests, attitudes, and behaviors rather than solely on age or location. By mapping how audiences interact with topics, brands, and cultural narratives, Pulsar helps clients understand what drives engagement and how conversations evolve over time. These insights inform brand strategy, campaign development, media planning, and product innovation, particularly in industries where cultural relevance and timing are critical.

Key Audience Intelligence Companies:

The following key companies have been profiled for this study on the audience intelligence market.

- AlikeAudience

- Audience.io

- Audiense

- Ipsos

- NumberEight Technologies Ltd.

- Parrot Analytics Limited

- Pulsar Group

- Qrious Insight LLC

- Rise, a Quad agency

- Solsten, Inc.,

- Sprinklr Inc.

- Talkwalker

- The Nielsen Company (US), LLC

Recent Developments

-

In February 2026, Parrot Analytics Limited partnered with Maria Farinha Filmes to integrate robust audience intelligence into the development and distribution of purpose-driven storytelling. The partnership exemplifies a wider transformation across the entertainment landscape, where capturing attention has become increasingly challenging. In this environment, production companies that successfully merge creative vision with data-informed audience insight are emerging as industry leaders.

-

In January 2026, Super League signed an exclusive strategic partnership with Solsten, Inc. This collaboration enhances Super League’s capabilities by enabling it to go beyond conventional demographic targeting and leverage predictive audience intelligence for more precise, insights-driven campaign strategies. Under the agreement, Super League receives select exclusivity to embed Solsten’s proprietary psychographic datasets and predictive modeling tools directly into its campaign planning, creative execution, and performance optimization processes.

-

In November 2025, DoohClick announced a new integration with Quividi, designed to deliver granular first-party audience insights directly within the DoohClick platform. This collaboration enables media owners to plan, optimize, and validate campaigns with greater accuracy and confidence. By incorporating Quividi’s high-quality audience data, DoohClick users can enhance every stage of the campaign lifecycle, from precise forecasting and real-time attention measurement to comprehensive post-campaign verification. The partnership represents another milestone in DoohClick’s commitment to helping media owners worldwide simplify operations, improve transparency, and drive smarter, data-driven growth.

Audience Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.36 billion

Revenue forecast in 2033

USD 15.54 billion

Growth rate

CAGR of 13.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Platform, enterprise size, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AlikeAudience; Audience.io; Audiense; Ipsos; NumberEight Technologies Ltd.; Parrot Analytics Limited; Pulsar Group; Qrious Insight LLC; Rise a Quad agency; Solsten Inc.; Sprinklr Inc.; Talkwalker; The Nielsen Company (US), LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Audience Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the audience intelligence market report based on platform, enterprise size, deployment, end-use, and region.

-

Platform Outlook (Revenue, USD Billion, 2021 - 2033)

-

Integrated Audience Intelligence Platform

-

Social Media Listening Tools

-

Data Management Platforms (DMPs)

-

Customer Segmentation Tools

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecommunication

-

BFSI

-

Travel & Hospitality

-

Healthcare

-

Retail & E-commerce

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global audience intelligence market size was estimated at USD 5.52 billion in 2025 and is expected to reach USD 6.36 billion in 2026.

b. The global audience intelligence market is expected to grow at a compound annual growth rate of 13.6% from 2026 to 2033 to reach USD 15.54 billion by 2033.

b. The integrated audience intelligence platform segment accounted for the largest revenue share of 40.7% in 2025. The rising complexity of privacy management and responsible data use is driving the adoption of integrated audience intelligence platforms.

b. Some key players operating in the market include AlikeAudience, Audience.io, Audiense, Ipsos, NumberEight Technologies Ltd., Parrot Analytics Limited, Pulsar Group, Qrious Insight LLC, Rise, a Quad agency, Solsten, Inc. Sprinklr Inc., Talkwalker, The Nielsen Company (US), LLC.

b. Factors such as the rapid expansion of digital channels and the fragmentation of consumer attention across platforms and The rise of social media and user-generated content as influential sources of consumer insight are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.